Indonesia Home Healthcare Market Outlook to 2030

Region:Asia

Author(s):Sanjna

Product Code:KROD3324

December 2024

97

About the Report

Indonesia Home Healthcare Market Overview

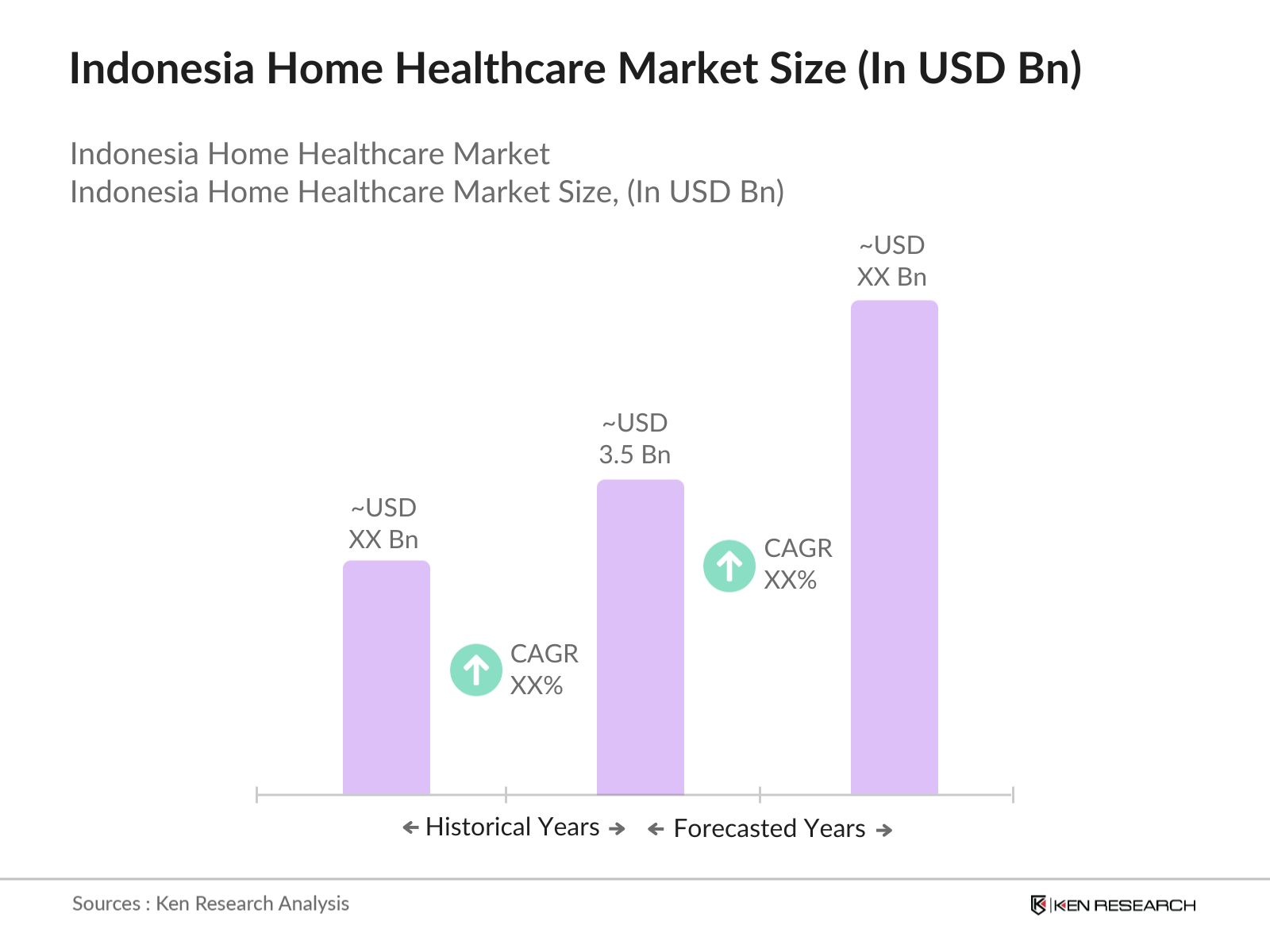

- The Indonesia home healthcare market is valued at USD 3.5 billion, based on a five-year historical analysis. This valuation is driven by the increasing demand for home-based care solutions, a result of Indonesia's aging population, rising healthcare costs, and the growing prevalence of chronic diseases. The need for cost-effective, personalized healthcare solutions has propelled the market forward. Advances in technology, such as telehealth and remote monitoring devices, are further accelerating this growth.

- In Indonesia, major cities like Jakarta, Surabaya, and Medan dominate the home healthcare market. These cities account for the highest demand due to their high population density, greater access to healthcare infrastructure, and higher disposable incomes. Jakarta, being the capital, has witnessed rapid adoption of telemedicine and remote monitoring services, while Surabaya and Medan are fast catching up due to increasing urbanization and healthcare accessibility.

- The Indonesian government has introduced stricter licensing and certification requirements for home healthcare providers to ensure quality and safety. By 2023, over 75% of home healthcare providers in major cities like Jakarta and Bandung had secured government certifications, compared to only 50% in 2021. These certifications ensure that providers meet national healthcare standards, making it safer and more reliable for patients to opt for home healthcare services. Government regulations are helping to standardize the sector and build consumer confidence.

Indonesia Home Healthcare Market Segmentation

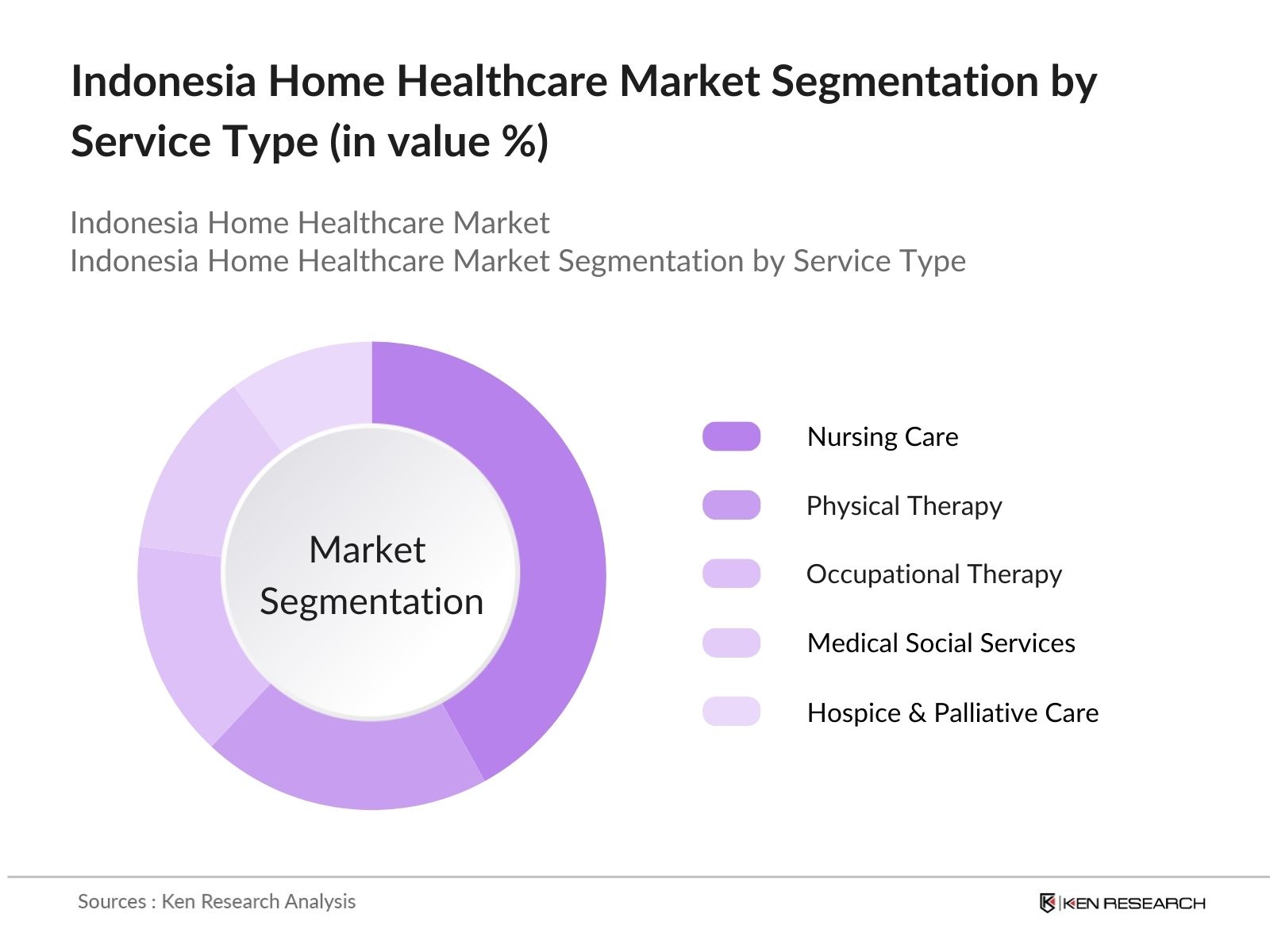

By Service Type: Indonesia's home healthcare market is segmented by service type into Nursing Care, Physical Therapy, Occupational Therapy, Medical Social Services, and Hospice and Palliative Care. Among these, Nursing Care dominates the market due to its essential role in managing chronic diseases, post-operative care, and elderly care. The rising elderly population in Indonesia and the preference for home-based care for managing long-term illnesses have driven the demand for professional nursing services at home. This trend is supported by the government's push towards reducing hospital overcrowding and promoting home care as an alternative solution.

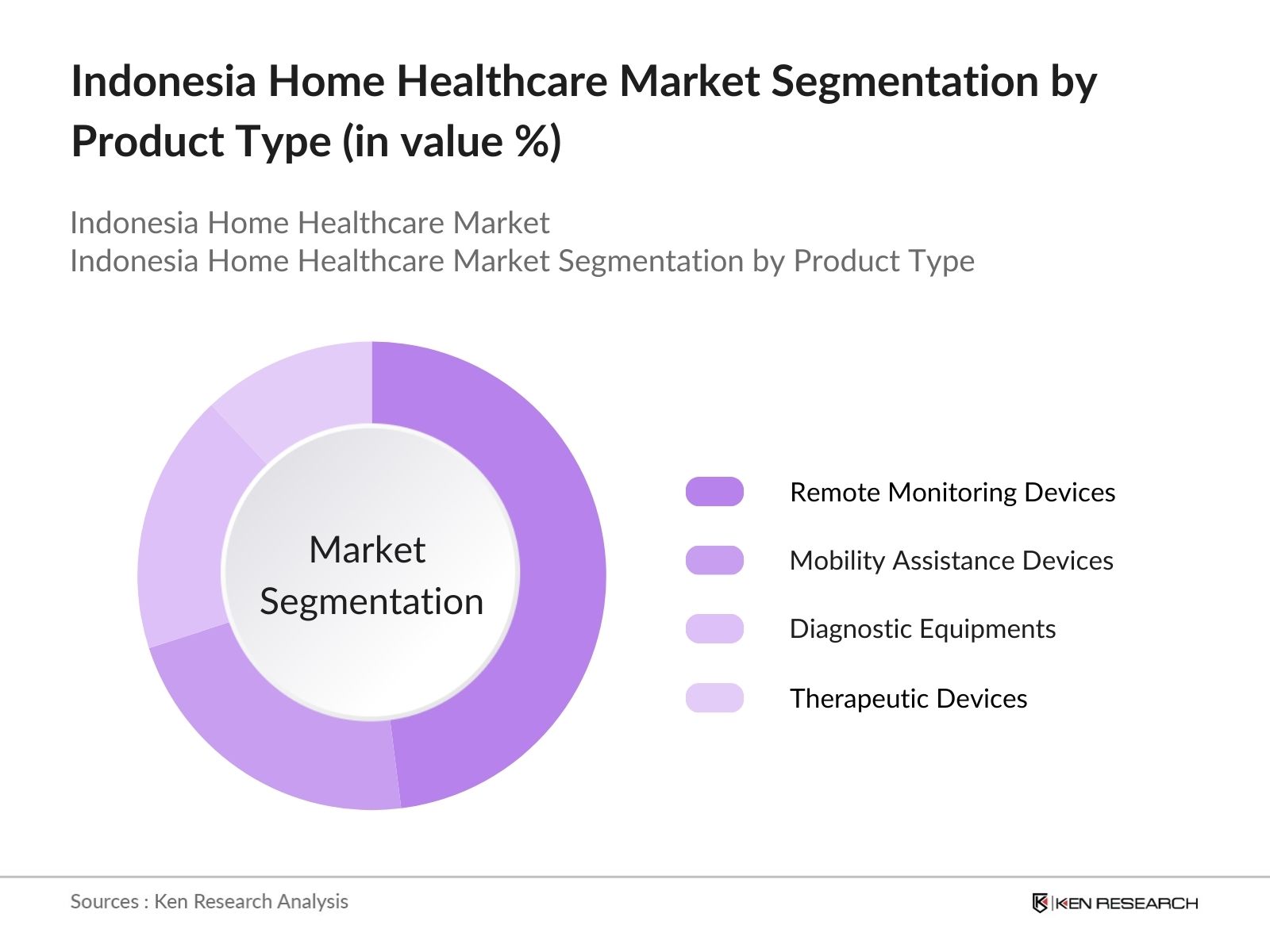

By Product Type: The home healthcare market is also segmented by product type, including Remote Monitoring Devices, Mobility Assistance Devices, Diagnostic Equipment, and Therapeutic Devices. Remote Monitoring Devices lead this segment due to their critical role in tracking patients health remotely, especially during the COVID-19 pandemic. These devices allow healthcare professionals to monitor patients' vitals, such as blood pressure, glucose levels, and oxygen saturation, reducing the need for frequent hospital visits. The increasing integration of IoT and AI technologies in these devices further enhances their functionality and adoption in urban centers.

Indonesia Home Healthcare Market Competitive Landscape

The Indonesia home healthcare market is dominated by both local and international players, creating a competitive environment characterized by technological advancements and service diversification. Companies in the market are increasingly focusing on telehealth integration, strategic partnerships, and expanding service portfolios to gain a competitive edge.

|

Company |

Establishment Year |

Headquarters |

Product Portfolio |

Service Diversification |

Market Presence |

Number of Employees |

Strategic Partnerships |

|

PT Prodia Widyahusada Tbk |

1973 |

Jakarta |

- |

- |

- |

- |

- |

|

Siloam International Hospitals |

1996 |

Tangerang |

- |

- |

- |

- |

- |

|

Halodoc |

2016 |

Jakarta |

- |

- |

- |

- |

- |

|

PT Kimia Farma Tbk |

1817 |

Jakarta |

- |

- |

- |

- |

- |

|

Lifepack |

2019 |

Jakarta |

- |

- |

- |

- |

- |

Indonesia Home Healthcare Market Analysis

Growth Drivers

- Rising Aging Population: As of 2024, it is reported that there are approximately32.42 million elderly citizensaged 60 and above, which constitutes about11.5%of the total population. The elderly population is more prone to chronic diseases like hypertension and diabetes, which require ongoing management, making home healthcare a preferable option. The Indonesian government is focusing on healthcare infrastructure to accommodate the aging population but home healthcare is emerging as a practical solution for immediate needs.

- Increasing Chronic Diseases Prevalence: Non-communicable diseases (NCDs), including hypertension, are a growing concern in Indonesia, with projections indicating that the total number of individuals suffering from various NCDs could reach about92 million by 2024. Chronic illnesses require constant monitoring and care, which has been driving demand for home healthcare services. Healthcare professionals in Indonesia are increasingly focusing on home-based management to reduce the burden on hospitals and clinics.

- Shift Toward Home-Based Care: Due to the growing pressure on hospitals, particularly in major cities like Jakarta, there is a significant shift towards home-based healthcare. Indonesia's healthcare facilities were operating at over 85% capacity in 2023,. With hospital overcrowding and increasing healthcare costs, many Indonesians are opting for home-based care solutions. Home healthcare allows for personalized, continuous care, which reduces the strain on public health facilities and offers patients the comfort of staying in familiar environments while managing their health.

Market Challenges

- High Initial Investment in Medical Devices for Home Use: The cost of setting up home healthcare, particularly the purchase of essential medical devices, remains prohibitively high for many Indonesian households. A home monitoring system can range from 5 to 20 million IDR depending on the complexity of the equipment. This high initial investment is a significant barrier for broader adoption, particularly in middle-income and lower-income households. As healthcare insurance coverage does not always extend to home devices, the upfront costs remain a challenge. (Source: Indonesian Ministry of Industry, Medical Devices Pricing)

- Regulatory Compliance and Insurance Reimbursement Challenges: Indonesias healthcare system is still evolving in terms of regulatory compliance and insurance reimbursement for home healthcare services. Many patients are forced to pay out of pocket for these services, which limits access. Additionally, home healthcare providers are often subjected to complex licensing processes, making it difficult for new players to enter the market and scale their operations.

Indonesia Home Healthcare Future Market Outlook

Over the next five years, the Indonesia home healthcare market is expected to show significant growth driven by advancements in healthcare technology, government initiatives, and increasing consumer demand for convenient, home-based medical services. Telehealth and remote monitoring are projected to become integral to the country's healthcare infrastructure, offering cost-effective and efficient solutions to Indonesias growing healthcare challenges.

Market Opportunities

- Expansion in Telehealth Solutions: Telehealth is rapidly growing in Indonesia, especially in the home healthcare sector. As of 2024, over 50% of healthcare consultations in urban areas are conducted via telehealth platforms. This increase is driven by Indonesia's improving internet infrastructure, with more than 200 million internet users, facilitating telemedicine in remote and rural areas.

- Government Initiatives Promoting Homecare: The Indonesian government is increasingly investing in policies that support home healthcare services. In 2023, the Ministry of Health launched a program aimed at improving home healthcare access by providing subsidies for home-based medical services to low-income families. Approximately 2.5 million households have benefited from these subsidies. Additionally, the government is pushing forward with initiatives to streamline the certification and regulation of home healthcare providers, making it easier for companies to operate within this sector.

Scope of the Report

|

By Service Type |

Nursing Care Physical Therapy Occupational Therapy Medical Social Services Hospice and Palliative Care |

|

By Product Type |

Remote Monitoring Devices Mobility Assistance Devices Diagnostic Equipment Therapeutic Devices |

|

By End User |

Geriatric Population Chronically Ill Patients Post-Surgical Patients Pediatrics |

|

By Mode of Payment |

Out-of-Pocket Payment Insurance Government Programs |

|

By Region |

Java Sumatra Kalimantan Sulawesi Bali |

Products

Key Target Audience

Home Healthcare Providers

Telemedicine Companies

Medical Device Manufacturers

Health Insurance Companies

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (Ministry of Health, BPJS Kesehatan)

Private Hospitals and Clinics

Pharmaceutical Companies

Companies

Major Players in the Market

PT Prodia Widyahusada Tbk

Siloam International Hospitals

PT Kalbe Farma Tbk

PT Kimia Farma Tbk

PT Mitra Keluarga Karyasehat Tbk

Telkomedika

PT Medikaloka Hermina Tbk

Lifepack

Halodoc

KlikDokter

Alodokter

Mandiri Inhealth

Bio Farma

Docquity

Rumah Sakit Pusat Pertamina

Table of Contents

1. Indonesia Home Healthcare Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Indonesia Home Healthcare Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Indonesia Home Healthcare Market Analysis

3.1. Growth Drivers

3.1.1. Rising Aging Population

3.1.2. Increasing Chronic Diseases Prevalence

3.1.3. Shift Toward Home-Based Care (Consumer Demand, Healthcare Burden)

3.1.4. Technological Advancements in Remote Monitoring Devices

3.2. Market Challenges

3.2.1. Lack of Skilled Workforce (Nurses, Caretakers)

3.2.2. High Initial Investment in Medical Devices for Home Use

3.2.3. Regulatory Compliance and Insurance Reimbursement Challenges

3.3. Opportunities

3.3.1. Expansion in Telehealth Solutions

3.3.2. Government Initiatives Promoting Homecare

3.3.3. Strategic Partnerships with Healthcare Providers

3.4. Trends

3.4.1. Integration of AI and IoT in Home Healthcare Devices

3.4.2. Adoption of Wearable Monitoring Devices

3.4.3. Increasing Use of Mobile Healthcare Apps

3.5. Government Regulation

3.5.1. Licensing and Certification for Home Healthcare Providers

3.5.2. Healthcare Policies Supporting Home Treatment

3.5.3. Reimbursement Policies for Home Health Services

3.5.4. Data Privacy and Security Regulations for Telehealth

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. Indonesia Home Healthcare Market Segmentation

4.1. By Service Type (In Value %)

4.1.1. Nursing Care

4.1.2. Physical Therapy

4.1.3. Occupational Therapy

4.1.4. Medical Social Services

4.1.5. Hospice and Palliative Care

4.2. By Product Type (In Value %)

4.2.1. Remote Monitoring Devices

4.2.2. Mobility Assistance Devices

4.2.3. Diagnostic Equipment

4.2.4. Therapeutic Devices

4.3. By End User (In Value %)

4.3.1. Geriatric Population

4.3.2. Chronically Ill Patients

4.3.3. Post-Surgical Patients

4.3.4. Pediatrics

4.4. By Mode of Payment (In Value %)

4.4.1. Out-of-Pocket Payment

4.4.2. Insurance

4.4.3. Government Programs

4.5. By Region (In Value %)

4.5.1. Java

4.5.2. Sumatra

4.5.3. Kalimantan

4.5.4. Sulawesi

4.5.5. Bali

5. Indonesia Home Healthcare Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. PT Prodia Widyahusada Tbk

5.1.2. Siloam International Hospitals

5.1.3. PT Kalbe Farma Tbk

5.1.4. PT Kimia Farma Tbk

5.1.5. PT Mitra Keluarga Karyasehat Tbk

5.1.6. Telkomedika

5.1.7. PT Medikaloka Hermina Tbk

5.1.8. Lifepack

5.1.9. Halodoc

5.1.10. KlikDokter

5.1.11. Alodokter

5.1.12. Mandiri Inhealth

5.1.13. Bio Farma

5.1.14. Docquity

5.1.15. Rumah Sakit Pusat Pertamina

5.2. Cross Comparison Parameters (No. of Employees, Revenue, Product Portfolio, Service Diversification, R&D Spending, Market Presence, Strategic Partnerships, Customer Base)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Indonesia Home Healthcare Market Regulatory Framework

6.1. Licensing Requirements

6.2. Compliance Standards for Home Healthcare Providers

6.3. Medical Device Approval Processes

6.4. Insurance and Reimbursement Policies

7. Indonesia Home Healthcare Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Indonesia Home Healthcare Future Market Segmentation

8.1. By Service Type (In Value %)

8.2. By Product Type (In Value %)

8.3. By End User (In Value %)

8.4. By Mode of Payment (In Value %)

8.5. By Region (In Value %)

9. Indonesia Home Healthcare Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involved constructing an ecosystem map encompassing all major stakeholders within the Indonesia Home Healthcare Market. Extensive desk research, along with secondary and proprietary databases, was used to gather relevant industry information. The objective was to identify key variables influencing market dynamics, such as technology adoption rates, healthcare policies, and consumer behavior.

Step 2: Market Analysis and Construction

We analyzed historical data on home healthcare service adoption and healthcare device penetration in Indonesia. This involved assessing the growth of remote monitoring services, the ratio of healthcare providers to service users, and the resulting revenue generation in major urban areas.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses were developed based on collected data and validated through interviews with industry experts, including healthcare providers, device manufacturers, and telemedicine companies. These consultations provided operational insights, refining the data collected through desk research.

Step 4: Research Synthesis and Final Output

We conducted detailed discussions with multiple home healthcare providers to gain insights into product segments, market performance, and consumer preferences. This engagement helped verify data gathered through the bottom-up approach, ensuring comprehensive, validated market insights.

Frequently Asked Questions

01. How big is the Indonesia Home Healthcare Market?

The Indonesia home healthcare market is valued at USD 3.5 billion, driven by a rising aging population, increasing chronic illnesses, and technological advancements like telemedicine and remote patient monitoring.

02. What are the challenges in the Indonesia Home Healthcare Market?

Key challenges include a lack of skilled home healthcare workers, high initial investments in technology, and regulatory hurdles, particularly regarding insurance reimbursement for home-based services.

03. Who are the major players in the Indonesia Home Healthcare Market?

Major players include PT Prodia Widyahusada Tbk, Siloam International Hospitals, Halodoc, PT Kalbe Farma Tbk, and Lifepack. These companies dominate due to their strong service portfolios, partnerships, and extensive market presence..

04. What are the growth drivers of the Indonesia Home Healthcare Market?

The market is driven by the increasing aging population, rising healthcare costs, government support for home care services, and advancements in telemedicine technologies.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.