Indonesia Hospitality Market Outlook to 2030

Region:Asia

Author(s):Paribhasha Tiwari

Product Code:KROD10379

November 2024

96

About the Report

Indonesia Hospitality Market Overview

- The Indonesia hospitality market, valued at USD 16.5 billion, is primarily driven by robust growth in international tourism, domestic travel, and government-led initiatives aimed at expanding the sector. This market has experienced significant growth due to infrastructure development, the opening of new international travel routes, and the rise in the number of hotels and resorts catering to business and leisure travelers. Major drivers also include Indonesia's strategic efforts to increase foreign tourist arrivals, particularly in key destinations like Bali, Jakarta, and Yogyakarta.

- Key cities such as Bali, Jakarta, and Yogyakarta dominate the hospitality market in Indonesia. Bali remains a top destination due to its well-established tourism infrastructure and global appeal, attracting millions of tourists annually. Jakarta, as a business hub, drives substantial demand for hospitality services from business travelers, while Yogyakartas cultural significance and emerging popularity among international tourists contribute to its prominence. These cities benefit from a combination of strong branding, accessibility, and government support for tourism initiatives.

- The Indonesian governments Tourism Recovery Program aims to restore the countrys tourism sector following the impacts of the COVID-19 pandemic. In 2024, IDR 15 trillion has been allocated to support tourism infrastructure, promotional campaigns, and investment incentives. The program focuses on reviving international tourist arrivals, providing subsidies to tourism operators, and developing new tourist destinations. The government expects tourism to return to pre-pandemic levels by the end of 2025, strengthening the hospitality sector's growth trajectory.

Indonesia Hospitality Market Segmentation

By Service Type: Indonesia's hospitality market is segmented into Accommodation Services, Food & Beverage Services, and Travel & Transport. Within the Accommodation Services category, hotels and resorts command the majority of the market share due to the consistent influx of international tourists and the rise of luxury tourism in Bali and Jakarta. The presence of international hotel chains and resorts offering premium experiences reinforces the dominance of this segment, particularly in highly visited areas. Boutique hotels have also gained popularity in niche markets.

By Food & Beverages Services: In the Food & Beverage Services segment, restaurants maintain a dominant market share. This is driven by the diverse culinary offerings catering to both international tourists and local consumers. With Indonesia being recognized for its rich food culture, fine dining and street food both play a crucial role in enhancing the hospitality experience for visitors. The rise of trendy cafes and dining experiences, particularly in urban centers like Jakarta and Bali, further contributes to the growth of this segment.

Indonesia Hospitality Market Competitive Landscape

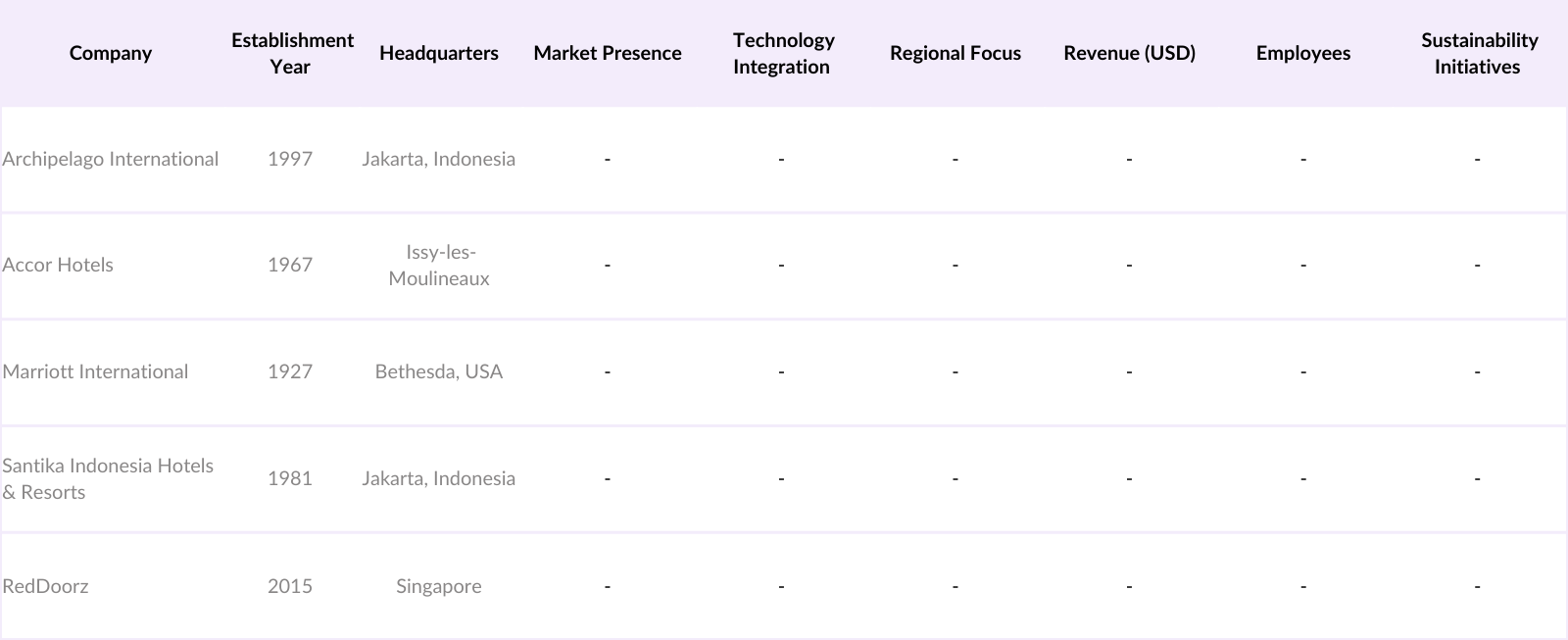

The Indonesian hospitality market is highly competitive, with both local players and international hotel chains striving to capitalize on the country's booming tourism industry. The market is dominated by several well-established players that have a strong presence in key tourist areas and offer a broad range of services catering to both luxury and budget travelers. The competition is characterized by companies focusing on expanding their portfolios, enhancing guest experiences through technology integration, and investing in sustainable and eco-friendly practices.

Indonesia Hospitality Market Analysis

Growth Drivers

- Rising Domestic and International Tourism: Indonesia's hospitality market is experiencing a surge in domestic and international tourist arrivals, supported by over 17 million international visitors annually before the pandemic. In 2024, with improved post-pandemic recovery, tourist numbers are expected to rise significantly. This recovery is bolstered by easing visa restrictions and a projected increase in flight frequencies. Data from Indonesia's Ministry of Tourism and Creative Economy shows a rise in domestic tourists by approximately 2 million in 2024, reflecting a strong travel demand within the country, with Bali, Jakarta, and Yogyakarta being key destinations.

- Expansion of Business Travel and MICE Industry: The Meetings, Incentives, Conferences, and Exhibitions (MICE) industry is growing rapidly in Indonesia due to its strategic location and competitive infrastructure. Business travel contributes significantly to the hospitality sector, with major international events being hosted in Jakarta, Bali, and Surabaya. In 2024, the government has allocated IDR 1.2 trillion for the development of MICE-related infrastructure. The rise in corporate events and conferences continues to drive occupancy rates in key hospitality hubs, enhancing Indonesias profile as a premier destination for business events.

- Increased Investment in Infrastructure (Hotels, Resorts, Restaurants): Investment in hospitality infrastructure is a key growth driver, with significant hotel construction and resort expansions underway. According to Bank Indonesia, the country will witness over IDR 20 trillion in direct investments toward tourism infrastructure in 2024. New hotel chains, resorts, and high-end restaurants are being developed, particularly in emerging tourist destinations like Lombok, Labuan Bajo, and Lake Toba. This increase in hospitality assets aims to accommodate the growing tourist influx and enhance Indonesias competitiveness in the global tourism market.

Market Challenges

- Regulatory Complexity and Licensing Delays: The hospitality industry faces significant regulatory hurdles, including complex licensing procedures and bureaucratic delays. In 2024, it is estimated that the average approval time for hotel and restaurant licenses exceeds 180 days, causing investment delays and limiting market expansion. Businesses often face issues navigating local regulations, which can differ significantly between provinces, leading to slower growth in less-developed regions such as Kalimantan and Sulawesi.

- Shortage of Skilled Hospitality Workforce: Despite the rapid growth in tourism, Indonesia faces a shortage of skilled workers in the hospitality industry. The Ministry of Tourism estimates that by 2024, the industry will require an additional 500,000 trained hospitality professionals to meet demand, but training facilities are limited. This workforce gap threatens the quality of service across hotels and resorts, particularly in emerging tourist destinations, limiting the sectors ability to compete with neighboring markets like Thailand and Malaysia.

Indonesia Hospitality Market Future Outlook

Over the next five years, the Indonesia hospitality market is expected to see significant growth driven by the continuous recovery of international tourism post-pandemic, government-backed tourism initiatives, and the expansion of luxury hotels and resorts in key regions. The government's focus on developing new tourist destinations, such as the "10 New Balis" initiative, and infrastructure improvements will likely drive growth in previously underdeveloped areas. Moreover, the rising trend of eco-tourism and the growing preference for sustainable travel will push hospitality providers to adopt more environmentally friendly practices.

Market Opportunities

- Growth in Eco-Tourism and Sustainable Hospitality: Indonesias rich biodiversity and commitment to sustainable development have positioned the country as a growing eco-tourism destination. In 2024, the government will allocate over IDR 5 trillion to develop eco-friendly tourism projects, particularly in regions like Raja Ampat and Sumatra. This push for eco-tourism is aligned with global trends toward sustainable travel, creating opportunities for the development of eco-lodges, green hotels, and environmentally conscious travel experiences.

- Digital Transformation and Hotel Management Technologies: The adoption of digital technologies in hotel management is transforming Indonesias hospitality sector, with cloud-based management systems, AI-driven guest services, and automated booking platforms seeing increasing adoption. In 2024, the digital transformation in the hospitality industry is expected to receive IDR 2 trillion in investment for upgrading digital infrastructure in hotels and resorts, enhancing guest experiences and operational efficiency. These advancements create opportunities for businesses to streamline operations and cater to tech-savvy travelers.

Scope of the Report

|

By Service Type |

Accommodation Services F&B Services Travel & Transport Event Management MICE Services |

|

By Target Customer |

Business Travelers Leisure Tourists Backpackers Family Vacationers |

|

By Ownership |

Independent Hotels International Chains Domestic Chains |

|

By Booking Channel |

OTAs Direct Bookings Travel Agencies |

|

By Region |

Bali Jakarta Yogyakarta Lombok Other Islands (Flores, Sumba, Sulawesi) |

Products

Key Target Audience

Investors and Venture Capital Firms

Government and Regulatory Bodies (Ministry of Tourism, Ministry of Public Works)

Hospitality and Hotel Operators

Food and Beverage Providers

Real Estate Developers

Sustainability Consultants

Technology Solution Providers

Travel Agencies and Tour Operators

Companies

Players Mentioned in the Report:

Archipelago International

Accor Hotels

Marriott International

Tauzia Hotel Management

Santika Indonesia Hotels & Resorts

RedDoorz

Swiss-Belhotel International

OYO Rooms

The Mulia, Mulia Resort & Villas

Hyatt Hotels Corporation

Table of Contents

1. Indonesia Hospitality Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Evolution and Growth Trends

1.4 Market Segmentation Overview

2. Indonesia Hospitality Market Size (In USD Bn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones (New Hotel Launches, International Arrivals, and Infrastructure Investments)

3. Indonesia Hospitality Market Dynamics

3.1 Growth Drivers

3.1.1. Rising Domestic and International Tourism

3.1.2. Expansion of Business Travel and MICE Industry

3.1.3. Increased Investment in Infrastructure (Hotels, Resorts, Restaurants)

3.1.4. Government Initiatives for Tourism Development (e.g., "10 New Balis")

3.2 Challenges

3.2.1. Regulatory Complexity and Licensing Delays

3.2.2. Shortage of Skilled Hospitality Workforce

3.2.3. High Operating Costs (Labor, Utilities, Real Estate)

3.3 Opportunities

3.3.1. Growth in Eco-Tourism and Sustainable Hospitality

3.3.2. Digital Transformation and Hotel Management Technologies

3.3.3. Partnership with International Hotel Chains

3.3.4. Untapped Markets in Lesser-Known Islands (Lombok, Flores)

3.4 Trends

3.4.1. Integration of AI and Smart Technologies in Hospitality

3.4.2. Rise of Boutique and Lifestyle Hotels

3.4.3. Growth in Long-Term Stay Options (Serviced Apartments, Co-Living Spaces)

3.5 Government Regulations

3.5.1. Ministry of Tourism Regulations

3.5.2. Taxation Policies Affecting Hospitality Businesses

3.5.3. Environmental and Building Codes for New Hotels

4. Indonesia Hospitality Market Segmentation (In Value %)

4.1 By Service Type

4.1.1. Accommodation Services (Hotels, Resorts, Villas)

4.1.2. Food and Beverage Services (Restaurants, Cafes, Bars)

4.1.3. Travel and Transport (Tour Operators, Vehicle Rentals)

4.1.4. Event Management and MICE Services

4.2 By Target Customer

4.2.1. Business Travelers

4.2.2. Leisure Tourists

4.2.3. Backpackers and Budget Tourists

4.2.4. Family Vacationers

4.3 By Ownership

4.3.1. Independent Hotels

4.3.2. International Chains

4.3.3. Domestic Chains

4.4 By Booking Channel

4.4.1. Online Travel Agencies (OTAs)

4.4.2. Direct Bookings (Website, Phone)

4.4.3. Travel Agencies

4.5 By Region (In Value %)

4.5.1. Bali

4.5.2. Jakarta

4.5.3. Yogyakarta

4.5.4. Lombok

4.5.5. Other Islands (Flores, Sumba, Sulawesi)

5. Indonesia Hospitality Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1. Archipelago International

5.1.2. Accor Hotels

5.1.3. Marriott International

5.1.4. Tauzia Hotel Management

5.1.5. Santika Indonesia Hotels & Resorts

5.1.6. RedDoorz

5.1.7. OYO Rooms

5.1.8. AirAsia Group Berhad (AirAsia Super App for Travel and Hospitality)

5.1.9. Swiss-Belhotel International

5.1.10. InterContinental Hotels Group (IHG)

5.1.11. Hotel Ciputra

5.1.12. The Mulia, Mulia Resort & Villas

5.1.13. Hyatt Hotels Corporation

5.1.14. PT. Puri Asih (Hotels and Resorts)

5.1.15. Ayana Resort & Spa

5.2 Cross Comparison Parameters (No. of Properties, Revenue, International vs Domestic Ownership, Expansion Strategy, MICE Capabilities, Sustainability Initiatives, Occupancy Rate, Loyalty Programs)

5.3 Market Share Analysis

5.4 Strategic Initiatives (Brand Partnerships, Digital Innovation, New Hotel Openings)

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Government Incentives for Hotel Investments

6. Indonesia Hospitality Market Regulatory Framework

6.1 Tourism Law and Guidelines (Indonesia Tourism Act)

6.2 Licensing and Permitting for Hotels and Restaurants

6.3 Employment Regulations (Labor Law in Hospitality Sector)

6.4 Health, Safety, and Environmental Standards

6.5 Digital Booking Regulations (Compliance with Data Privacy Laws)

7. Future Market Size of Indonesia Hospitality Market (In USD Bn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Growth (Tourism Recovery Post-COVID, New International Flight Routes, Focus on Eco-Tourism)

8. Indonesia Hospitality Market Analysts Recommendations

8.1 TAM/SAM/SOM Analysis

8.2 Customer Cohort Analysis (Luxury vs Budget Segments)

8.3 Marketing Initiatives (Destination Marketing, Influencer Partnerships)

8.4 White Space Opportunity Analysis (New Untapped Regions, Niche Tourism)

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase of the research process focused on identifying key market variables through desk research and the analysis of secondary data sources. This step involved mapping key stakeholders in the Indonesia hospitality market and determining the primary factors influencing market growth.

Step 2: Market Analysis and Construction

This phase involved compiling and analyzing historical data on the hospitality market, focusing on key indicators such as revenue generation from hotels, occupancy rates, and the segmentation of service types. An emphasis was placed on evaluating tourism arrivals and infrastructure development in key regions like Bali and Jakarta.

Step 3: Hypothesis Validation and Expert Consultation

The hypotheses were validated by consulting with industry experts through interviews. These consultations provided insights into market operations, growth strategies, and trends that are influencing the Indonesian hospitality landscape.

Step 4: Research Synthesis and Final Output

In the final stage, data from all previous steps were synthesized and verified with feedback from multiple hospitality operators. This process ensured the accuracy of the market forecasts and produced a comprehensive report on the Indonesian hospitality market.

Frequently Asked Questions

01. How big is the Indonesia Hospitality Market?

The Indonesia hospitality market is valued at USD 16.5 billion, driven by the influx of international tourists and government investments in tourism infrastructure.

02. What are the challenges in the Indonesia Hospitality Market?

Challenges in the Indonesia hospitality market include high operational costs, regulatory complexity, and a shortage of skilled hospitality workers, all of which affect profitability and market expansion.

03. Who are the major players in the Indonesia Hospitality Market?

Key players in the Indonesia hospitality market include Archipelago International, Accor Hotels, Marriott International, and Santika Indonesia Hotels & Resorts. These companies dominate through extensive property portfolios and strategic locations in top tourist areas.

04. What are the growth drivers of the Indonesia Hospitality Market?

The Indonesia hospitality market is primarily driven by government initiatives aimed at boosting tourism, the expansion of infrastructure, and a growing middle class with increasing disposable incomes.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.