Indonesia Hospitality Real Estate Market Outlook to 2030

Region:Asia

Author(s):Abhinav kumar

Product Code:KROD9336

November 2024

93

About the Report

Indonesia Hospitality Real Estate Market Overview

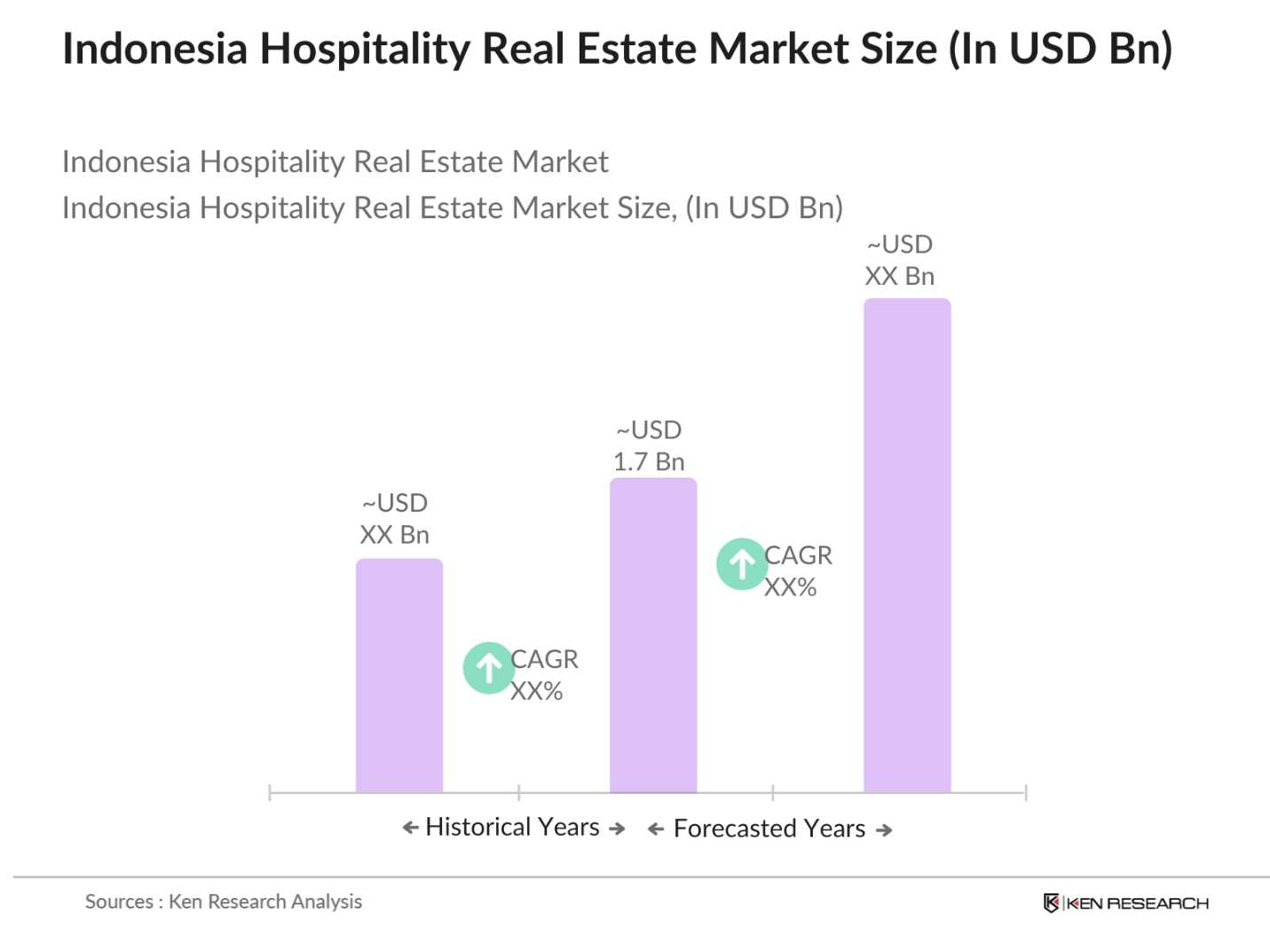

- The Indonesia Hospitality Real Estate Market is valued at USD 1.7 billion, based on a five-year historical analysis. This market size reflects the steady growth driven by an increase in both international and domestic tourism, supported by government infrastructure investments. Indonesias thriving tourism sector, with strong demand in urban centers and emerging travel destinations, continues to fuel the need for diversified hospitality real estate offerings across the country.

- Jakarta, Bali, and Surabaya are the dominant cities in the hospitality real estate market due to their status as key business and tourism hubs. Jakarta is the economic center of Indonesia, attracting both leisure and business travelers, while Bali is renowned globally as a premier tourist destination. Surabayas strategic location and economic growth also make it a favored location for real estate investment, contributing to its significant market share.

- Environmental compliance is mandatory for hospitality developments, requiring adherence to standards related to waste management, energy efficiency, and conservation. Meeting these standards is essential for project approval and operation.

Indonesia Hospitality Real Estate Market Segmentation

By Property Type: The Indonesia Hospitality Real Estate Market is segmented by property type into hotels, resorts, serviced apartments, and eco-lodges. Recently, hotels have maintained a dominant market share in Indonesia under the segmentation of property type, largely due to the steady inflow of international and domestic travelers. Major brands like Marriott and Hilton have established a strong presence, boosting the dominance of the hotel segment.

By Investment Type: The Indonesia Hospitality Real Estate Market is segmented by investment type into new developments, renovations, joint ventures, and private equity. New developments have a leading market share in Indonesias hospitality real estate investment, fueled by the increasing demand for unique and modern accommodations. The governments incentives for new projects and the demand for high-quality facilities contribute significantly to the growth of this segment.

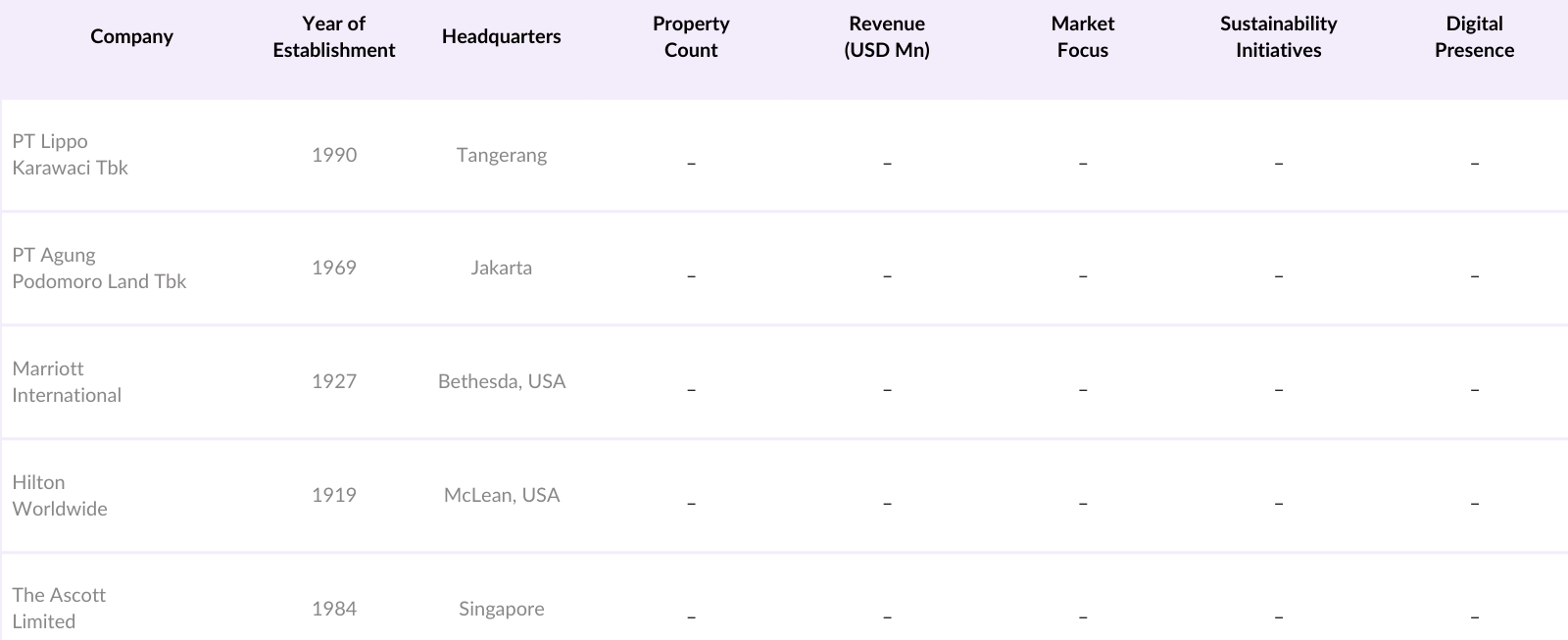

Indonesia Hospitality Real Estate Market Competitive Landscape

The Indonesia Hospitality Real Estate Market is dominated by both local and international players, such as PT Lippo Karawaci Tbk, PT Agung Podomoro Land Tbk, and international brands like Marriott and Hilton. This consolidation indicates a strong influence from key industry leaders in shaping the market's trends and strategies.

Indonesia Hospitality Real Estate Industry Analysis

Growth Drivers

- Surge in International Tourism: In 2024, Indonesia experienced a significant increase in international tourist arrivals, with 1,339,946 visitors recorded in August alone. This surge reflects a growing global interest in Indonesia's diverse attractions, directly boosting the hospitality real estate sector.

- Government Infrastructure Support: The Indonesian government has been actively investing in infrastructure to support tourism growth. Notably, plans for a new international airport in northern Bali, estimated at 2.5 billion, aim to accommodate 20 million passengers annually, enhancing accessibility and stimulating hospitality real estate development.

- Rise in Domestic Travel and Staycations: Domestic tourism has seen a notable uptick, with 77.24 million domestic trips recorded in July 2024. This increase in local travel has led to higher occupancy rates in hotels and resorts, encouraging further investment in hospitality properties.

Market Challenges

- Regulatory and Licensing Constraints: Navigating Indonesia's complex regulatory environment poses challenges for hospitality real estate developers. Strict zoning laws and licensing requirements can delay projects, impacting market growth.

- Environmental and Sustainability Compliance: Developers face increasing pressure to adhere to environmental regulations, including sustainable building practices and waste management standards. Compliance can lead to higher costs and extended project timelines.

Indonesia Hospitality Real Estate Market Future Outlook

Over the next five years, the Indonesia Hospitality Real Estate Market is expected to experience significant growth, supported by government initiatives, increased foreign investment, and the expansion of tourism in emerging regions. With a focus on sustainable developments and the integration of digital services, the market will continue to attract both local and international investors.

Opportunities

- Development of Emerging Tourist Destinations: Regions like North Bali are gaining attention as emerging tourist hotspots. The planned new international airport aims to boost tourism in areas such as Lovina Beach, known for its unique attractions, presenting opportunities for hospitality real estate development.

- Adoption of Smart and Green Hospitality Solutions: The integration of smart technologies and eco-friendly designs in hospitality properties is becoming increasingly important. Implementing energy-efficient systems and sustainable materials can attract environmentally conscious travelers and reduce operational costs.

Scope of the Report

|

Property Type |

Hotels and Accommodations Resorts and Spas Serviced Apartments Boutique Hotels, Eco-lodges |

|

Investment Type |

New Developments Renovations Partnerships and Joint Ventures Private Equity Real Estate Investment Trusts (REITs) |

|

End-User Type |

Leisure Business and MICE Medical Tourism Cultural and Eco-tourism |

|

Service Type |

Property Management Hospitality Consulting Marketing and Branding Facility Operations Financing and Investment Services |

|

Region |

Java, Bali Sumatra Sulawesi Kalimantan |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Real Estate Investor Companies

Hospitality Property Development Companies

Government and Regulatory Bodies (e.g., Ministry of Tourism and Creative Economy)

Investor and Venture Capitalist Firms

Property Management Companies

Hotel Chains and Brands

Infrastructure Development Companies

Sustainable Development Companies

Companies

Players Mentioned in the Report

PT Lippo Karawaci Tbk

PT Agung Podomoro Land Tbk

Ciputra Development

Pakuwon Jati Tbk

PT Surya Semesta Internusa Tbk

AccorHotels Indonesia

Marriott International

Hilton Worldwide

The Ascott Limited

RedDoorz Indonesia

Table of Contents

1. Indonesia Hospitality Real Estate Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. Indonesia Hospitality Real Estate Market Size (In USD Mn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. Indonesia Hospitality Real Estate Market Analysis

3.1 Growth Drivers

3.1.1 Surge in International Tourism

3.1.2 Government Infrastructure Support

3.1.3 Rise in Domestic Travel and Staycations

3.1.4 Expansion of Business Travel and MICE Activities

3.2 Market Challenges

3.2.1 Regulatory and Licensing Constraints

3.2.2 Environmental and Sustainability Compliance

3.2.3 Competition from Alternative Accommodation Options

3.3 Opportunities

3.3.1 Development of Emerging Tourist Destinations

3.3.2 Adoption of Smart and Green Hospitality Solutions

3.3.3 Increased Investment in Eco-friendly Properties

3.4 Trends

3.4.1 Digital Solutions Integration in Guest Services

3.4.2 Rise in Boutique and Lifestyle Hotels

3.4.3 Focus on Health and Wellness Amenities

3.5 Government Regulations

3.5.1 Foreign Investment Policies

3.5.2 Tax Incentives for Hospitality Projects

3.5.3 Zoning and Land Use Regulations

3.5.4 Environmental Compliance Standards

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces Analysis

3.9 Competitive Landscape

4. Indonesia Hospitality Real Estate Market Segmentation

4.1 By Property Type (In Value %)

4.1.1 Hotels and Accommodations

4.1.2 Resorts and Spas

4.1.3 Serviced Apartments

4.1.4 Boutique Hotels

4.1.5 Eco-lodges

4.2 By Investment Type (In Value %)

4.2.1 New Developments

4.2.2 Renovations

4.2.3 Partnerships and Joint Ventures

4.2.4 Private Equity

4.2.5 Real Estate Investment Trusts (REITs)

4.3 By End-User Type (In Value %)

4.3.1 Leisure

4.3.2 Business and MICE

4.3.3 Medical Tourism

4.3.4 Cultural and Eco-tourism

4.4 By Service Type (In Value %)

4.4.1 Property Management

4.4.2 Hospitality Consulting

4.4.3 Marketing and Branding

4.4.4 Facility Operations

4.4.5 Financing and Investment Services

4.5 By Region (In Value %)

4.5.1 Java

4.5.2 Bali

4.5.3 Sumatra

4.5.4 Sulawesi

4.5.5 Kalimantan

5. Indonesia Hospitality Real Estate Market Competitive Analysis

5.1 Detailed Profiles of Major Competitors

5.1.1 PT Lippo Karawaci Tbk

5.1.2 PT Agung Podomoro Land Tbk

5.1.3 Ciputra Development

5.1.4 Pakuwon Jati Tbk

5.1.5 PT Surya Semesta Internusa Tbk

5.1.6 AccorHotels Indonesia

5.1.7 Marriott International

5.1.8 Hilton Worldwide

5.1.9 The Ascott Limited

5.1.10 RedDoorz Indonesia

5.1.11 OYO Rooms Indonesia

5.1.12 Aryaduta Hotels

5.1.13 Santika Indonesia Hotels & Resorts

5.1.14 Archipelago International

5.1.15 Swiss-Belhotel International

5.2 Cross Comparison Parameters (Revenue, Portfolio Size, Headquarters, Year of Establishment, Number of Properties, Market Presence, Customer Base, Sustainability Practices)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Private Equity and Venture Capital Investments

5.8 Government Grants

6. Indonesia Hospitality Real Estate Market Regulatory Framework

6.1 Product Approval Process

6.2 Compliance Standards

6.3 Certification and Licensing Requirements

6.4 Import Tariffs and Tax Regulations

7. Indonesia Hospitality Real Estate Future Market Size (In USD Mn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. Indonesia Hospitality Real Estate Future Market Segmentation

8.1 By Property Type (In Value %)

8.2 By Investment Type (In Value %)

8.3 By End-User Type (In Value %)

8.4 By Service Type (In Value %)

8.5 By Region (In Value %)

9. Indonesia Hospitality Real Estate Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Targeted Marketing Strategies

9.4 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase focuses on mapping the entire ecosystem of stakeholders in the Indonesia Hospitality Real Estate Market. This includes a thorough analysis of key players, market dynamics, and influential variables. Extensive desk research was conducted using secondary databases to form an accurate picture of the market structure.

Step 2: Market Analysis and Construction

In this stage, historical data was compiled and analyzed to understand market growth trends, penetration rates, and the revenue generation process. An evaluation of consumer behavior and property development cycles was undertaken to ensure the reliability of revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market assumptions were developed and validated through structured interviews with industry experts. These consultations provided essential insights into the operational and financial aspects of the hospitality real estate sector in Indonesia, refining the initial market data.

Step 4: Research Synthesis and Final Output

The final phase involved direct engagement with real estate developers and hospitality managers to gain deeper insights into occupancy rates, investment trends, and customer preferences. This interaction allowed for a comprehensive and validated analysis of the Indonesia Hospitality Real Estate Market.

Frequently Asked Questions

1. How big is the Indonesia Hospitality Real Estate Market?

The Indonesia Hospitality Real Estate Market is valued at USD 1.7 billion, driven by high tourism demand, government incentives, and rising consumer interest in eco-friendly accommodations.

2. What are the main challenges in the Indonesia Hospitality Real Estate Market?

The market faces regulatory hurdles, environmental compliance requirements, and strong competition from alternative accommodations. Additionally, challenges in sustainable development add to market complexity.

3. Who are the major players in the Indonesia Hospitality Real Estate Market?

Key players include PT Lippo Karawaci Tbk, PT Agung Podomoro Land Tbk, Marriott International, Hilton Worldwide, and The Ascott Limited, which lead the market due to their strong brand presence and property portfolio.

4. What are the growth drivers of the Indonesia Hospitality Real Estate Market?

Growth is driven by an increase in international tourism, government infrastructure initiatives, the rise of domestic travel, and the popularity of business travel and MICE activities.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.