Indonesia In-App Advertising Market Outlook to 2030

Region:Asia

Author(s):Yogita Sahu

Product Code:KROD8338

December 2024

80

About the Report

Indonesia In-App Advertising Market Overview

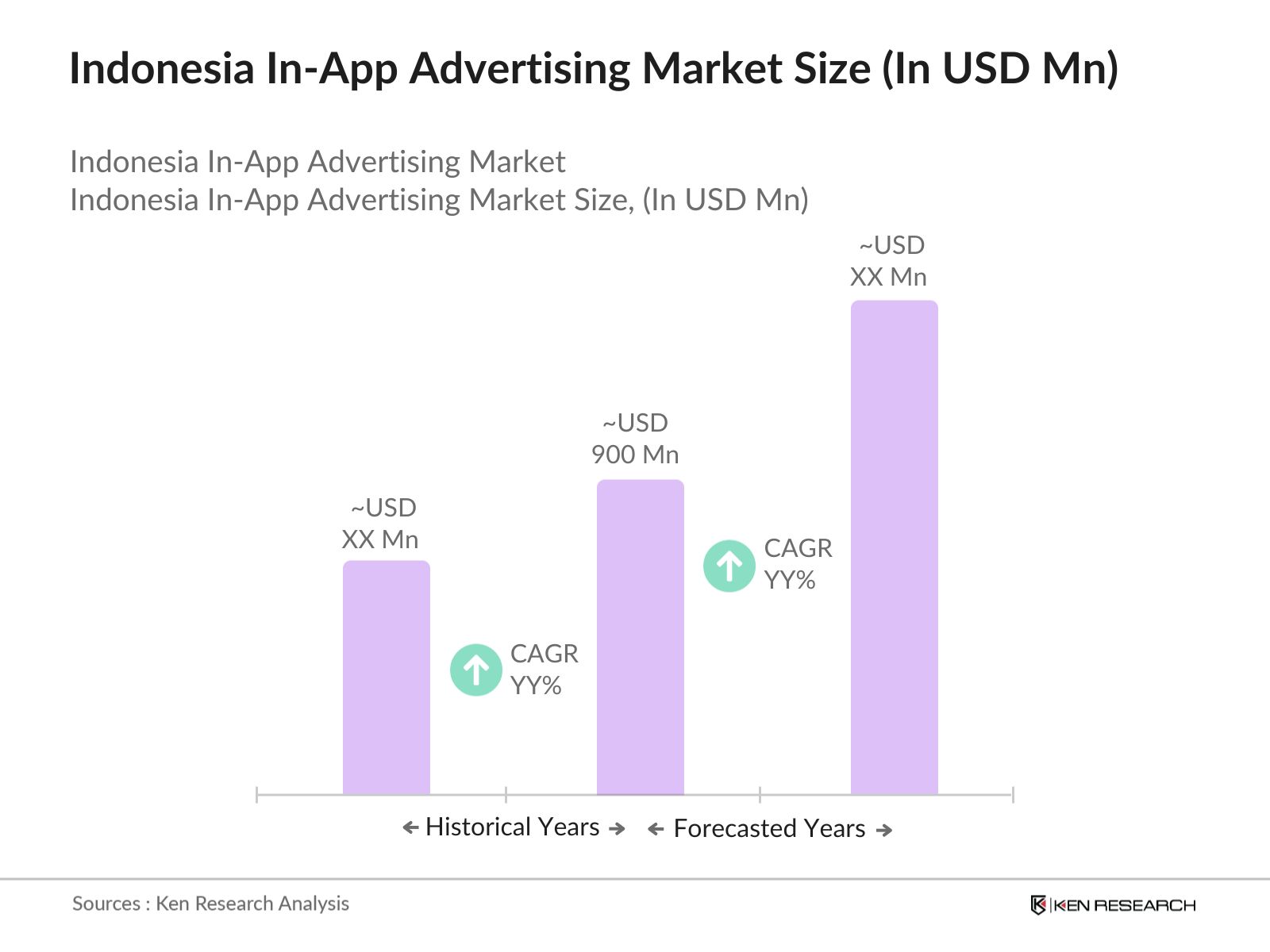

- The Indonesia In-App Advertising market is valued at USD 900 million based on a five-year historical analysis. This market has grown significantly due to the rapid adoption of mobile technologies and increased smartphone penetration. The continuous shift in consumer behavior towards mobile applications for entertainment, e-commerce, and social media has been a significant growth driver.

- Java and Sumatra dominate the market in Indonesia due to their high population density and robust mobile internet penetration. These regions, being the most urbanized and economically advanced, house the majority of the target audience for digital advertisements. Java, in particular, serves as a hub for major companies and tech firms, making it a strategic location for advertisers aiming to reach a large, diverse audience with varying demographics and purchasing power.

- The Indonesian government is heavily investing in boosting the countrys digital economy, which is projected to reach USD 146 billion by 2024. This includes funding initiatives to support digital advertising platforms and e-commerce infrastructure, both of which will indirectly support the growth of in-app advertising. The governments support for digital startups, combined with incentives for digital marketing innovations, is likely to drive more businesses to adopt in-app advertising solutions.

Indonesia In-App Advertising Market Segmentation

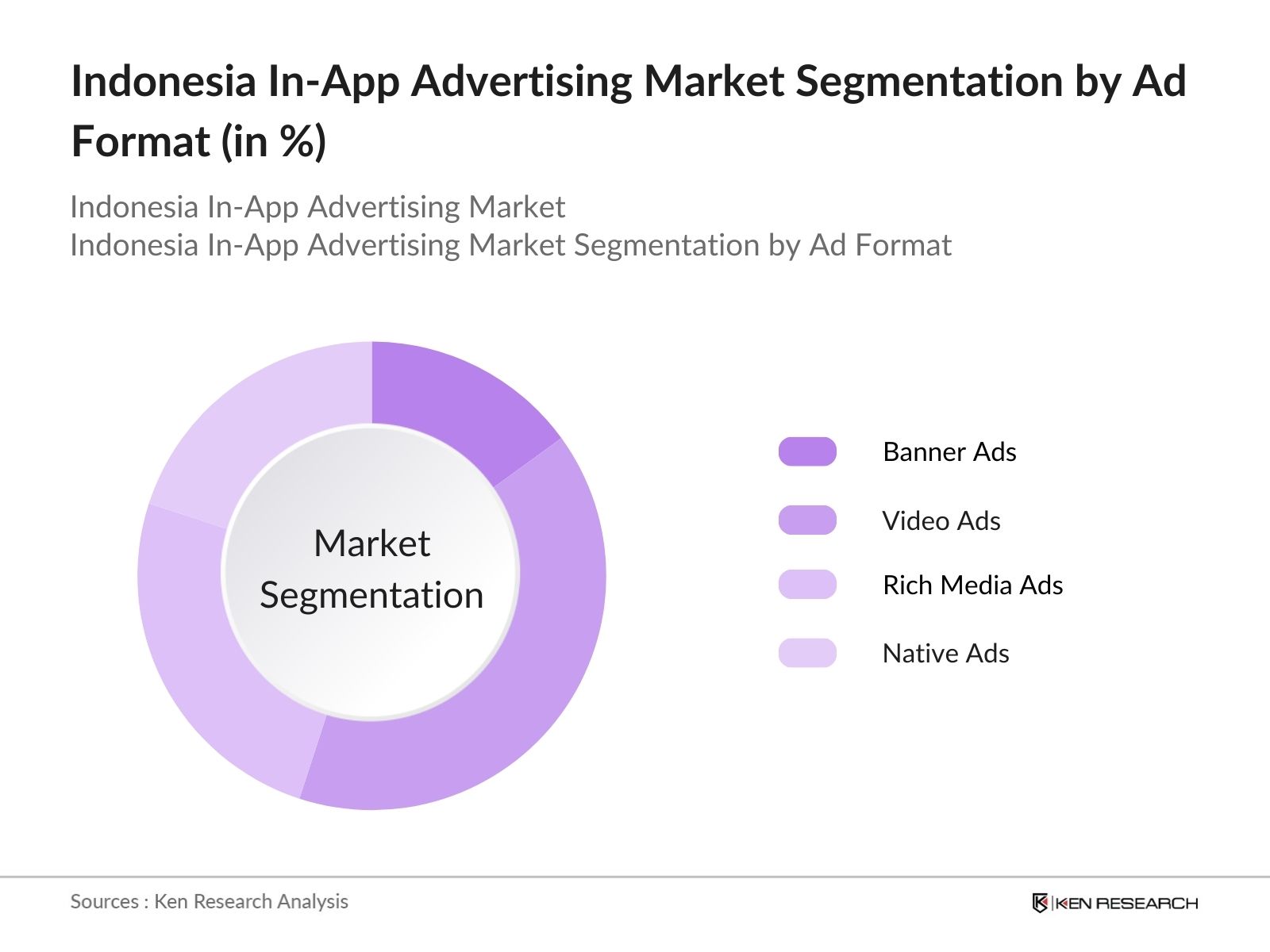

By Ad Format: market is segmented by ad format into banner ads, video ads, rich media ads, and native ads. Recently, video ads have taken a dominant market share in Indonesia due to the high engagement rates they offer. With the increasing consumption of video content, particularly among mobile users, in-app video advertising has become an attractive option for brands seeking immersive, interactive, and engaging ad experiences.

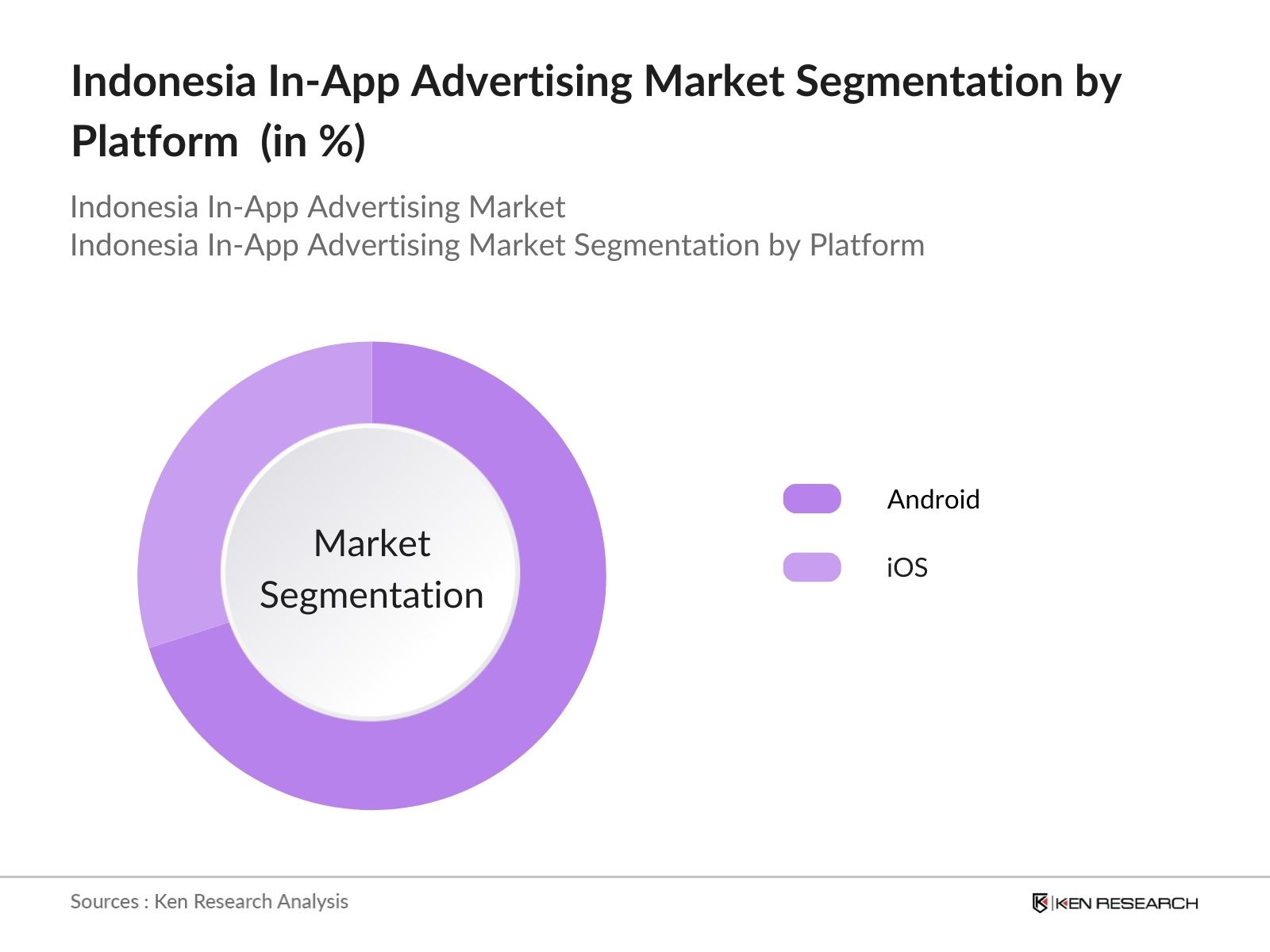

By Platform: The market is also segmented by platform into Android and iOS. Android holds a larger market share due to the widespread availability of affordable Android smartphones, which cater to the majority of Indonesia's population. The open-source nature of Android allows more developers to create localized apps, contributing to a broader range of apps that utilize in-app advertising. iOS, while popular among high-income users, still holds a smaller share in comparison.

Indonesia In-App Advertising Market Competitive Landscape

The market is shaped by several global and local players who offer varying degrees of ad solutions. While Google and Meta dominate globally with their programmatic ad services, regional players like Gojek and Bukalapak also play roles in offering in-app ad services that are more localized to the Indonesian market.

|

Company |

Establishment Year |

Headquarters |

In-App Ad Specialization |

Revenue (USD Bn) |

Market Position |

Key Clients |

Technological Advancements |

|

|

1998 |

California, USA |

|||||

|

Meta (Facebook) |

2004 |

California, USA |

|||||

|

AppLovin |

2012 |

California, USA |

|||||

|

Gojek |

2010 |

Jakarta, Indonesia |

|||||

|

InMobi |

2007 |

Bengaluru, India |

Indonesia In-App Advertising Market Analysis

Market Growth Drivers

- Increase in Smartphone Penetration: Indonesia has seen a rise in smartphone users, with over 190 million people expected to use smartphones by the end of 2024, up from 175 million in 2023, according to credible sources. This rise in smartphone usage is driving the in-app advertising market, as companies seek to reach users directly through mobile applications. The growing accessibility to mobile phones, even in remote areas of Indonesia, has broadened the target audience for in-app advertising, making it a crucial driver for growth.

- Rising Internet Users and Digital Engagement: Indonesias internet user base is growing rapidly, with over 225 million internet users expected by 2024. With digital engagement increasing across all demographics, consumers are spending more time on mobile apps for everything from e-commerce to entertainment. The increasing digital footprint provides a fertile ground for in-app advertisements to thrive, as companies are increasingly allocating ad budgets to mobile platforms to capture the attention of this growing online audience.

- Growing Mobile Gaming Industry: The mobile gaming industry in Indonesia is booming, with over 100 million mobile gamers expected by 2024. As mobile games account for a large share of app usage in Indonesia, advertisers are taking advantage of in-app advertising opportunities within games. In-app advertisements in gaming apps, such as reward-based ads or pop-ups, are becoming a critical advertising channel, attracting major brands targeting younger audiences who dominate the gaming space.

Market Challenges

- High Competition Among Apps: With thousands of apps available to Indonesian consumers, the sheer volume of choices has created a highly competitive app marketplace. Many apps struggle to retain users, making it difficult for in-app advertisements to reach their intended audience.

- Ad-blocking and Consumer Fatigue: A growing challenge for in-app advertising in Indonesia is ad-blocking and increasing user fatigue towards advertisements. With more than 25 million Indonesian users expected to use ad-blockers by 2024, advertisers face challenges in reaching their target audience.

Indonesia In-App Advertising Market Future Outlook

Over the next five years, the Indonesia In-App Advertising industry is expected to witness growth, driven by the expansion of mobile internet services, rising app usage, and advancements in programmatic advertising technology.

Future Market Opportunities

- Growth of AI-Powered Ad Targeting: In the next five years, AI and machine learning will play a pivotal role in shaping Indonesias in-app advertising landscape. By 2029, AI-powered ad targeting solutions are expected to dominate the market, allowing advertisers to deliver highly personalized and context-aware ads based on real-time user behavior. AI algorithms will help improve ad relevance, leading to higher engagement rates and better return on investment for advertisers.

- Increased Adoption of Augmented Reality (AR) Ads: AR-based in-app ads are projected to become a trend in Indonesia by 2029. Major brands, especially in retail and automotive sectors, will increasingly use AR technologies to create interactive, immersive ad experiences. For example, users may be able to virtually try on clothes or visualize how furniture fits in their homes using AR ads, which will boost customer engagement and lead to higher conversion rates.

Scope of the Report

|

Ad Format |

Banner Ads Video Ads Rich Media Ads Native Ads |

|

Platform |

Android iOS |

|

Industry Vertical |

Retail & E-commerce FMCG Telecom Entertainment Financial Services |

|

Application Type |

Social Media Apps Gaming Apps Utility Apps OTT Platforms |

|

Region |

North East West South |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Banks and Financial Institution

Private Equity Firms

E-commerce Companies

Telecommunication Providers

Media & Entertainment Firms

Government & Regulatory Bodies (Kominfo)

Investor and Venture Capitalist Firms

FMCG Brands

Companies

Players Mentioned in the Report:

Google

Meta (Facebook)

AppLovin

Gojek

InMobi

Vungle

MoPub (Twitter)

Unity Ads

Chartboost

AdColony

Table of Contents

1. Indonesia In-App Advertising Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Dynamics

1.4 Market Segmentation Overview

2. Indonesia In-App Advertising Market Size (in USD Mn)

2.1 Historical Market Size

2.2 Year-on-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. Indonesia In-App Advertising Market Analysis

3.1 Growth Drivers (e.g., Rising Mobile App Usage, Targeted Advertising Capabilities, High Smartphone Penetration)

3.2 Market Challenges (e.g., Ad Blocking Technologies, Privacy Concerns, Regulatory Compliance)

3.3 Opportunities (e.g., Programmatic Advertising Growth, In-App Video Ads, Localized Content Strategies)

3.4 Trends (e.g., Integration with Social Media Apps, Expansion of Gamified Ads, Growing Role of AI in Ad Targeting)

4. Government Regulations in Indonesia's Digital Advertising Sector

4.1 Data Privacy Regulations (e.g., PDPA, GDPR Impacts)

4.2 Advertising Guidelines

4.3 Regulatory Challenges and Implications for Market Players

5. Indonesia In-App Advertising Market Segmentation

5.1 By Ad Format (In Value %)

5.1.1 Banner Ads

5.1.2 Video Ads

5.1.3 Rich Media Ads

5.1.4 Native Ads

5.2 By Platform (In Value %)

5.2.1 Android

5.2.2 iOS

5.3 By Industry Vertical (In Value %)

5.3.1 Retail & E-commerce

5.3.2 FMCG

5.3.3 Telecom

5.3.4 Entertainment

5.3.5 Financial Services

5.4 By Application Type (In Value %)

5.4.1 Social Media Apps

5.4.2 Gaming Apps

5.4.3 Utility Apps

5.4.4 OTT Platforms

5.5 By Region (In Value %)

5.5.1 North

5.5.2 West

5.5.3 East

5.5.4 South

6. Competitive Landscape: Indonesia In-App Advertising Market

6.1 Detailed Profiles of Major Companies

6.1.1 Google

6.1.2 Meta (Facebook)

6.1.3 TikTok (Bytedance)

6.1.4 AppLovin

6.1.5 Unity Ads

6.1.6 AdColony

6.1.7 Chartboost

6.1.8 InMobi

6.1.9 IronSource

6.1.10 MoPub (Twitter)

6.1.11 Vungle

6.1.12 Tapjoy

6.1.13 Verizon Media

6.1.14 Smaato

6.1.15 Digital Turbine

6.2 Cross Comparison Parameters (Headquarters, Revenue, Market Share, In-App Ad Specialization)

6.3 Market Share Analysis

6.4 Strategic Initiatives

6.5 Mergers and Acquisitions

7. Indonesia In-App Advertising Future Market Size (in USD Mn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. Indonesia In-App Advertising Future Market Segmentation

8.1 By Ad Format (In Value %)

8.2 By Platform (In Value %)

8.3 By Industry Vertical (In Value %)

8.4 By Application Type (In Value %)

8.5 By Region (In Value %)

9. Indonesia In-App Advertising Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Strategic Marketing Initiatives

9.3 Audience Targeting Strategies

9.4 White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial stage involves constructing a comprehensive ecosystem of all major stakeholders within the Indonesia In-App Advertising market. This is achieved through detailed desk research, incorporating proprietary databases to gather extensive industry-level data. The goal is to identify the critical factors influencing market trends and behavior.

Step 2: Market Analysis and Construction

In this step, historical data on market penetration, advertising spending, and user engagement within in-app environments is compiled. A thorough analysis is conducted to assess the quality of advertising services and the efficiency of revenue models within the Indonesian digital landscape.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses based on preliminary data will be validated through interviews with industry experts and executives from leading in-app advertising companies. Insights from these consultations provide real-time feedback and contribute to refining our market analysis.

Step 4: Research Synthesis and Final Output

The final step involves consolidating findings from all data points into a coherent market report. This includes validation through engagement with developers, ad platforms, and agencies to ensure accuracy, consistency, and completeness in market projections.

Frequently Asked Questions

01. How big is Indonesias In-App Advertising Market?

The Indonesia In-App Advertising market is valued at USD 900 million, driven by increased mobile app usage, growing digital consumption, and the rapid adoption of smartphones.

02. What are the challenges in Indonesias In-App Advertising Market?

Challenges in the Indonesia In-App Advertising market include ad fraud, privacy concerns, and regulatory hurdles related to digital advertising standards. The growing use of ad-blocking technologies also threatens market growth.

03. Who are the major players in Indonesias In-App Advertising Market?

Key players in the Indonesia In-App Advertising market include Google, Meta, AppLovin, Gojek, and InMobi. These companies dominate due to their advanced ad targeting capabilities, programmatic solutions, and localized content strategies.

04. What are the growth drivers of Indonesias In-App Advertising Market?

Growth in the Indonesia In-App Advertising market is driven by the rising penetration of smartphones, increasing consumption of mobile apps, and the surge in mobile commerce. Furthermore, video ad formats are gaining popularity due to high engagement rates.

05. What future trends can be expected in Indonesias In-App Advertising Market?

The Indonesia In-App Advertising market is expected to benefit from advancements in programmatic advertising and AI-driven targeting, as well as the expansion of 5G technology, which will enhance mobile ad delivery and user experiences.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.