Indonesia In Vitro Diagnostics (IVD) Market Outlook to 2030

Region:Asia

Author(s):Naman Rohilla

Product Code:KROD4333

December 2024

90

About the Report

Indonesia In Vitro Diagnostics (IVD) Market Overview

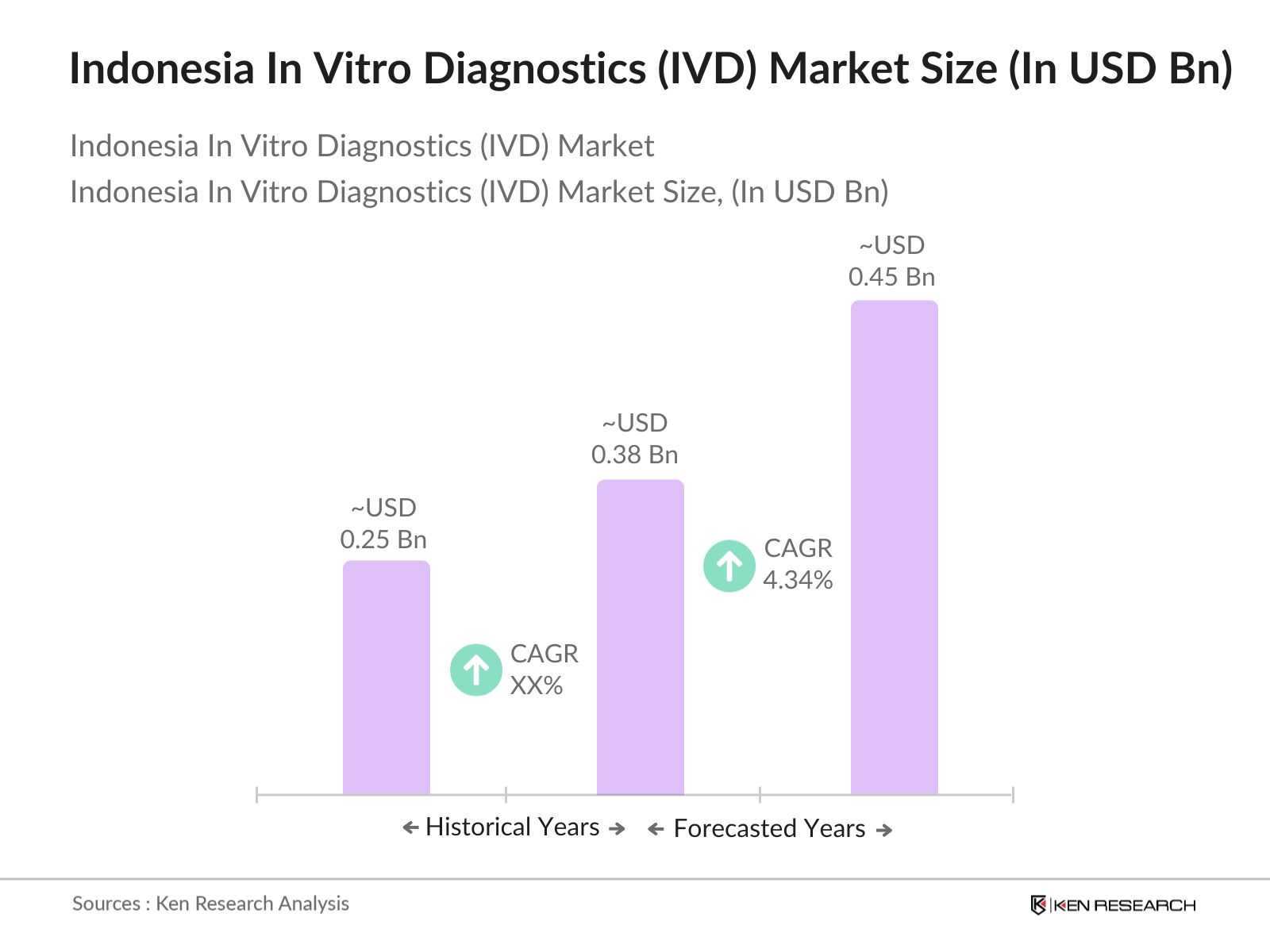

- The Indonesia In Vitro Diagnostics (IVD) market is valued at USD 0.38 billion, driven by a combination of increasing healthcare expenditures, advancements in diagnostic technologies, and rising demand for early disease detection. Based on a five-year historical analysis, growth has been observed due to a higher focus on preventive healthcare, facilitated by government support and a growing prevalence of chronic diseases like diabetes and cancer. The adoption of point-of-care diagnostics and molecular testing technologies further drives market growth.

- Indonesia's most dominant regions in the IVD market include Java and Sumatra, owing to their advanced healthcare infrastructure, higher population densities, and concentration of leading healthcare facilities. Java, in particular, benefits from its position as an economic hub, providing access to sophisticated diagnostic tools and resources. These regions' prominence stems from higher investments in healthcare, coupled with a well-established supply chain for medical devices and diagnostics.

- In 2023, Indonesia updated its medical device regulations to enhance the approval process for diagnostic tools. The Ministry of Health's new regulations introduced mandatory in-country post-market testing for devices, which aims to ensure ongoing safety and quality. While these updates are intended to improve the country's diagnostic capabilities, they may also increase costs for manufacturers and distributors, potentially complicating access to new technologies. The changes are designed to provide clearer guidelines for international diagnostic companies looking to enter the Indonesian market.

Indonesia In Vitro Diagnostics Market Segmentation

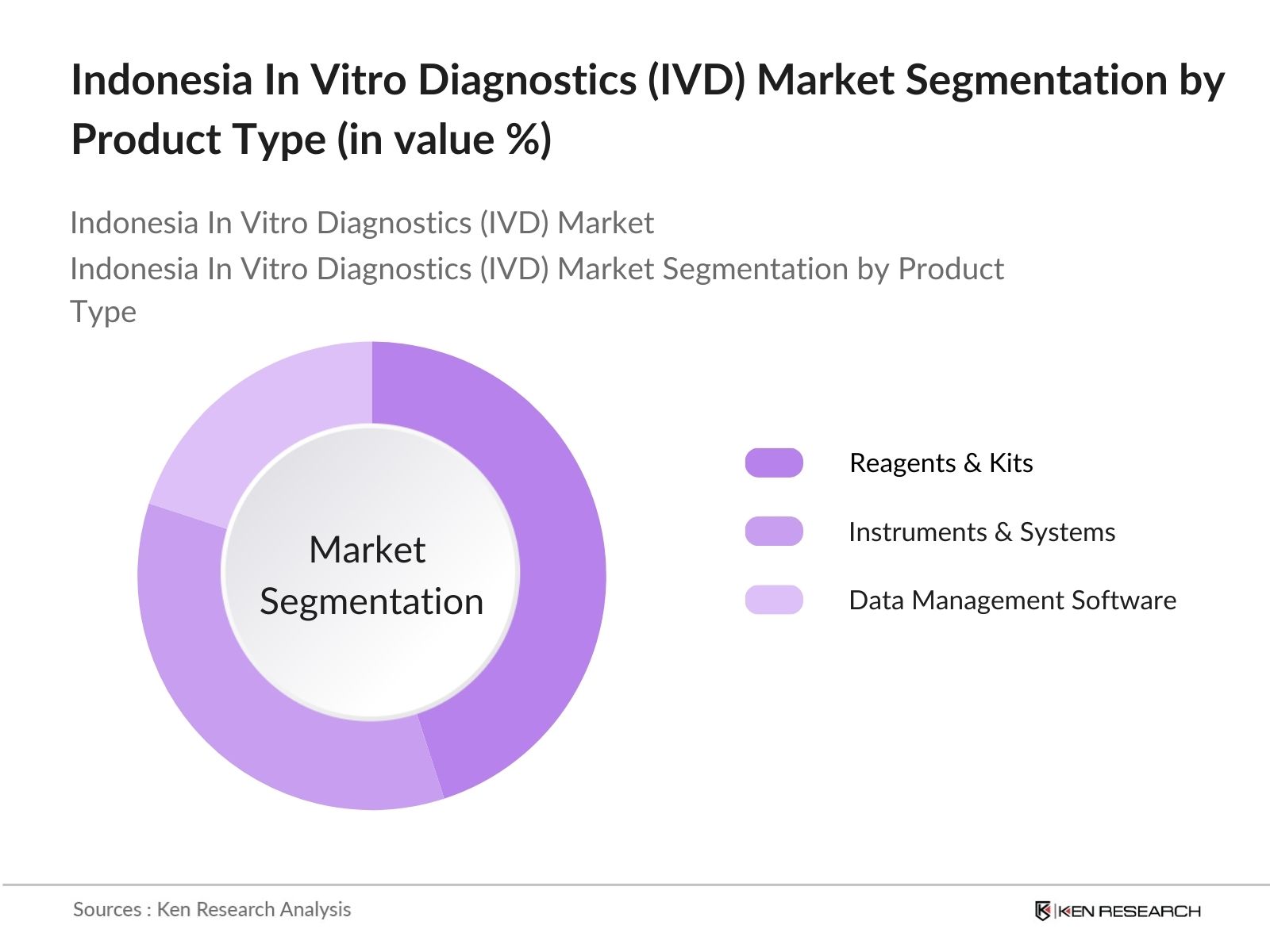

- By Product Type: Indonesia's IVD market is segmented by product type into Reagents & Kits, Instruments & Systems, and Data Management Software. Recently, Reagents & Kits have been dominating the market share due to their high usage frequency in diagnostic procedures. The demand for reagents in infectious disease testing, particularly post-COVID-19, has surged, contributing to the dominance of this segment. Furthermore, the increasing frequency of chronic disease testing requires constant reagent supplies, which ensures their consistent market presence.

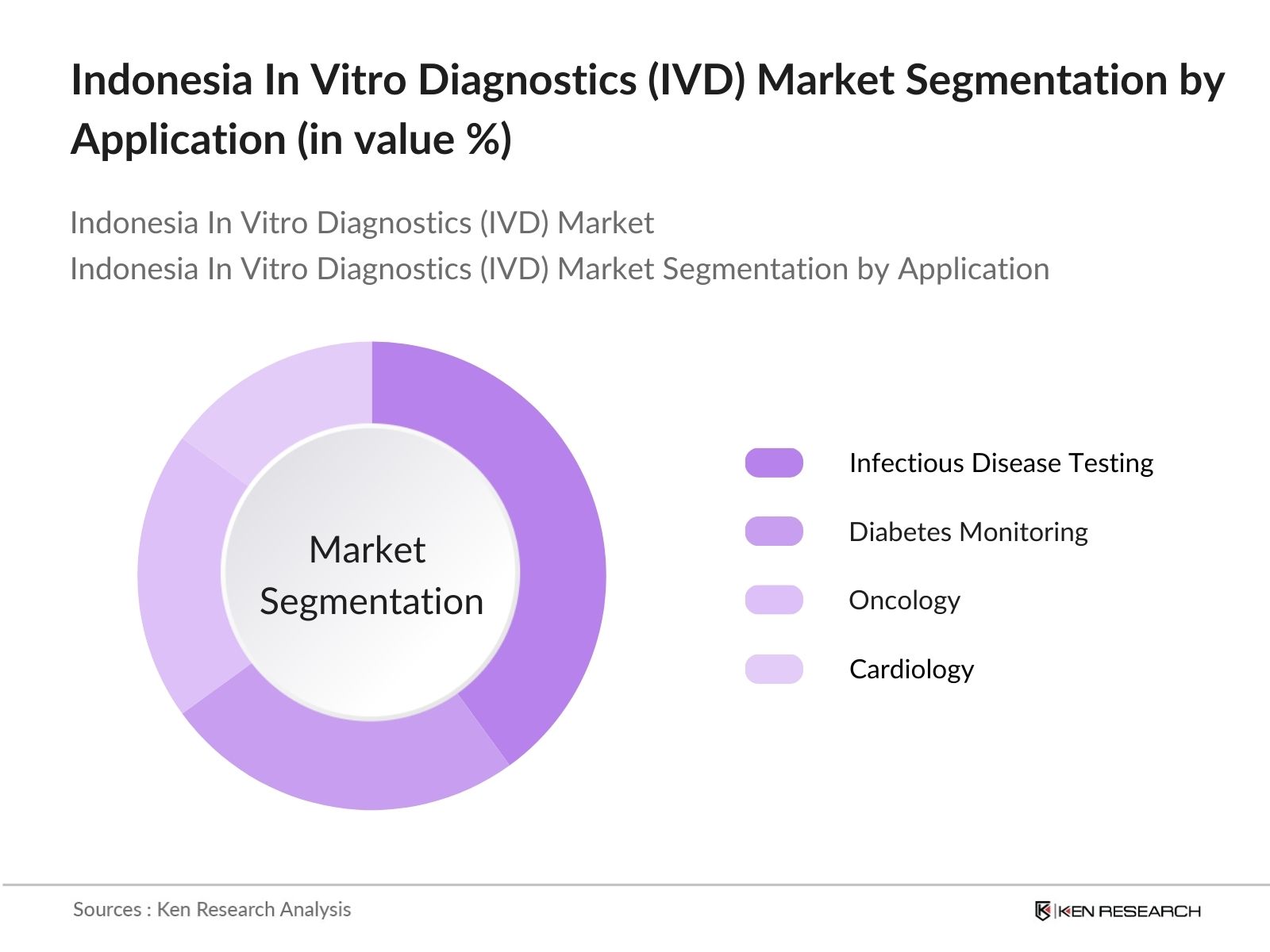

- By Application: The market is also segmented by application into Infectious Disease Testing, Diabetes Monitoring, Oncology, and Cardiology. Infectious Disease Testing leads the market due to Indonesias heightened focus on preventing diseases like tuberculosis and dengue fever. With frequent outbreaks, this segment commands a dominant position in the market, supported by government efforts to enhance disease surveillance. The growing accessibility to diagnostic tools has made it easier to detect and manage infectious diseases early, further boosting this segment.

Indonesia In Vitro Diagnostics (IVD) Market Competitive Landscape

The Indonesia In Vitro Diagnostics (IVD) market is dominated by both local and international players, focusing on technological advancements and expanding their distribution channels across the country. Major players include Abbott Laboratories and Roche Diagnostics, whose strong product portfolios and continuous innovations ensure their market leadership. Companies are increasingly adopting mergers and collaborations to enhance their competitive position in the evolving IVD space.

|

Company Name |

Establishment Year |

Headquarters |

Revenue (USD Bn) |

Product Portfolio |

R&D Expenditure |

Global vs Local Presence |

Growth Strategy |

Technological Innovations |

|

Abbott Laboratories |

1888 |

Chicago, USA |

- |

- |

- |

- |

- |

- |

|

Roche Diagnostics |

1896 |

Basel, Switzerland |

- |

- |

- |

- |

- |

- |

|

Siemens Healthineers |

1847 |

Erlangen, Germany |

- |

- |

- |

- |

- |

- |

|

Thermo Fisher Scientific |

1956 |

Waltham, USA |

- |

- |

- |

- |

- |

- |

|

Sysmex Corporation |

1968 |

Kobe, Japan |

- |

- |

- |

- |

- |

- |

Indonesia In Vitro Diagnostics (IVD) Market Analysis

Indonesia In Vitro Diagnostics (IVD) Market Growth Drivers

- Healthcare Infrastructure Development: Indonesia's healthcare infrastructure has improved due to government investments in hospitals and healthcare centers. As of 2023, there were over 3,042 hospitals in the country, with ongoing projects aimed at increasing capacity, particularly in rural areas. This expansion is crucial for achieving Universal Health Coverage (UHC) goals, which target coverage for approximately 270 million citizens. Such developments are expected to enhance diagnostic testing capabilities and increase demand for in vitro diagnostics (IVD) nationwide.

- Rising Chronic Diseases: The prevalence of chronic diseases such as diabetes, cancer, and cardiovascular diseases is sharply increasing in Indonesia. The International Diabetes Federation estimated over 19 million cases of diabetes in 2023. Additionally, the Ministry of Health reported that cancer incidences reached approximately 136,000, while cardiovascular diseases accounted for over 1.2 million deaths annually. This rise in chronic conditions highlights the growing need for advanced diagnostic tools, particularly IVD devices that can facilitate early detection and improve patient outcomes.

- Increased Adoption of Point-of-Care Diagnostics: Point-of-care (POC) diagnostics have gained traction in Indonesia, driven by the need for rapid and accurate diagnosis in rural and underserved areas. In 2023, POC diagnostics were reported to be deployed in over 35% of public healthcare facilities. This increase reflects a growing reliance on POC systems that enable healthcare providers to conduct tests and deliver results quickly, particularly for prevalent diseases like malaria, dengue, and COVID-19.

Indonesia In Vitro Diagnostics (IVD) Market Challenges

- High Cost of Advanced Diagnostic Devices: One of the major hurdles in the Indonesian IVD market is the high cost associated with advanced diagnostic devices. In 2023, the average cost of molecular diagnostic machines was noted to be upwards of IDR 700 million, according to the Ministry of Finance. Such high costs often limit the procurement of these devices, particularly in smaller healthcare facilities. Additionally, imported equipment faces added costs due to tariffs and taxes, increasing the financial burden on healthcare providers.

- Regulatory Compliance for Imported Equipment: Indonesia has stringent regulations when it comes to importing medical devices, including IVD tools. In 2023, the Ministry of Health implemented updated regulations that require imported devices to undergo rigorous compliance checks before they can be used in healthcare settings. These regulatory hurdles can delay the introduction of advanced diagnostic technologies into the market, thereby affecting the availability of cutting-edge diagnostic solutions for healthcare providers across the country.

Indonesia In Vitro Diagnostics (IVD) Market Future Outlook

Over the next five years, the Indonesia In Vitro Diagnostics market is expected to witness substantial growth. This surge will be driven by continued investments in healthcare infrastructure, government support for local production of diagnostic tools, and a shift toward personalized medicine. The growing importance of early disease detection and the increasing use of molecular diagnostics will also be key growth drivers, as these technologies enable more precise and timely diagnoses.

Indonesia In Vitro Diagnostics (IVD) Market Opportunities

- Expansion of Telemedicine and Digital Diagnostics: The integration of telemedicine into Indonesia's healthcare system presents a major opportunity for the IVD market. In 2023, over 20 million Indonesians accessed healthcare services through telemedicine platforms, according to the Ministry of Health. This surge in digital healthcare has fueled demand for remote diagnostic solutions, including IVD tests that can be conducted and monitored virtually. As telemedicine continues to expand, it will drive the adoption of digital diagnostic tools across the country, especially in underserved areas

- Collaborations with International Diagnostic Firms: Indonesia's IVD market is poised for growth through collaborations with international diagnostic firms. In 2023, the Indonesian government signed over 10 agreements with global diagnostic companies to promote technology transfer and local manufacturing of diagnostic tools. These collaborations will help Indonesia reduce its reliance on imported equipment, increase local production, and enhance the availability of cutting-edge diagnostics, creating a more sustainable healthcare system in the long run.

Scope of the Report

|

Product Type |

Reagents & Kits Instruments & Systems Data Management Software |

|

Technology |

Immunoassays Molecular Diagnostics Clinical Chemistry Hematology |

|

Application |

Infectious Disease Testing Diabetes Monitoring Oncology Cardiology |

|

End User |

Hospitals Diagnostic Laboratories Point-of-Care Testing Centers |

|

Region |

Java, Sumatra Kalimantan Sulawesi Bali & Nusa Tenggara |

Products

Key Target Audience

Hospitals and Diagnostic Laboratories

Point-of-Care Testing Centers

IVD Device Manufacturers

Healthcare Providers and Physicians

Medical Technology Companies

Banks and Financial Institutions

Investments and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., Ministry of Health, BPOM)

Pharmaceutical Companies

Companies

Indonesia In Vitro Diagnostics (IVD) Market Major Players

Abbott Laboratories

Roche Diagnostics

Siemens Healthineers

Thermo Fisher Scientific

Sysmex Corporation

Bio-Rad Laboratories

Danaher Corporation

Beckman Coulter

Mindray Medical International

Ortho Clinical Diagnostics

Becton Dickinson

Cepheid

bioMrieux

Illumina

Agilent Technologies

Table of Contents

1. Indonesia In Vitro Diagnostics (IVD) Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Indonesia In Vitro Diagnostics Market Size (in USD Bn)

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Indonesia In Vitro Diagnostics Market Analysis

3.1. Growth Drivers (Regulatory Support, Aging Population, Technological Advancements)

3.1.1. Healthcare Infrastructure Development

3.1.2. Rising Chronic Diseases (Diabetes, Cancer, Cardiovascular Diseases)

3.1.3. Government Healthcare Initiatives (Universal Health Coverage, Local Production Incentives)

3.1.4. Increased Adoption of Point-of-Care Diagnostics

3.2. Market Challenges (Reimbursement Constraints, Regulatory Hurdles)

3.2.1. High Cost of Advanced Diagnostic Devices

3.2.2. Regulatory Compliance for Imported Equipment

3.2.3. Limited Access to Advanced Diagnostic Tools in Rural Areas

3.2.4. Skilled Workforce Shortage in Diagnostics

3.3. Opportunities (Local Manufacturing, Technological Integration)

3.3.1. Expansion of Telemedicine and Digital Diagnostics

3.3.2. Collaborations with International Diagnostic Firms

3.3.3. Integration of Artificial Intelligence in Diagnostics

3.4. Trends (Digital Transformation, AI Integration)

3.4.1. Automation in Laboratory Testing

3.4.2. Shift to Personalized Medicine

3.4.3. Growth in Molecular Diagnostics

3.4.4. Focus on Infectious Disease Testing

3.5. Government Regulations (Compliance, Standards)

3.5.1. Medical Device Regulation Updates

3.5.2. Indonesias National Health Insurance Program (BPJS)

3.5.3. Tax Exemptions for Medical Equipment

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competition Ecosystem

4. Indonesia In Vitro Diagnostics Market Segmentation

4.1. By Product Type (in Value %)

4.1.1. Reagents & Kits

4.1.2. Instruments & Systems

4.1.3. Data Management Software

4.2. By Technology (in Value %)

4.2.1. Immunoassays

4.2.2. Molecular Diagnostics

4.2.3. Clinical Chemistry

4.2.4. Hematology

4.3. By Application (in Value %)

4.3.1. Infectious Disease Testing

4.3.2. Diabetes Monitoring

4.3.3. Oncology

4.3.4. Cardiology

4.4. By End User (in Value %)

4.4.1. Hospitals

4.4.2. Diagnostic Laboratories

4.4.3. Point-of-Care Testing Centers

4.5. By Region (in Value %)

4.5.1. Java

4.5.2. Sumatra

4.5.3. Kalimantan

4.5.4. Sulawesi

4.5.5. Bali & Nusa Tenggara

5. Indonesia In Vitro Diagnostics Market Competitive Analysis

5.1. Detailed Profiles of Major Competitors

5.1.1. Abbott Laboratories

5.1.2. Roche Diagnostics

5.1.3. Siemens Healthineers

5.1.4. Thermo Fisher Scientific

5.1.5. Sysmex Corporation

5.1.6. Bio-Rad Laboratories

5.1.7. Danaher Corporation

5.1.8. Ortho Clinical Diagnostics

5.1.9. Beckman Coulter

5.1.10. Mindray Medical International

5.1.11. Becton Dickinson

5.1.12. Cepheid

5.1.13. bioMrieux

5.1.14. Illumina

5.1.15. Agilent Technologies

5.2. Cross Comparison Parameters (Revenue, Product Portfolio, R&D Expenditure, Market Penetration, Product Innovation, Global vs Local Presence, Collaborations, Growth Strategy)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers & Acquisitions

5.6. Investment Analysis (Private Equity, Venture Capital)

5.7. Government Grants

5.8. Technological Partnerships

6. Indonesia In Vitro Diagnostics Market Regulatory Framework

6.1. Medical Device Regulations (MoH, BPOM)

6.2. Import Tariffs and Tax Regulations

6.3. Certification Processes

6.4. Compliance Requirements for IVD Devices

7. Indonesia In Vitro Diagnostics Future Market Size (in USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Indonesia In Vitro Diagnostics Future Market Segmentation

8.1. By Product Type (in Value %)

8.2. By Technology (in Value %)

8.3. By Application (in Value %)

8.4. By End User (in Value %)

8.5. By Region (in Value %)

9. Indonesia In Vitro Diagnostics Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. White Space Opportunity Analysis

9.4. Strategic Marketing Initiatives

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The first stage involves mapping all key stakeholders in the Indonesia In Vitro Diagnostics market. This is achieved through extensive desk research using secondary databases and proprietary sources to gather relevant industry-level data. The aim is to identify the factors influencing market growth and dynamics.

Step 2: Market Analysis and Construction

Historical data related to market performance and product penetration are collected. Data is analyzed to understand revenue growth, product adoption rates, and diagnostic trends across various regions. This phase ensures the accurate estimation of current and future market dynamics.

Step 3: Hypothesis Validation and Expert Consultation

Through consultations with industry experts and practitioners, the hypotheses generated from market data are validated. These discussions provide insights into market operations, technological advancements, and potential barriers to growth.

Step 4: Research Synthesis and Final Output

Direct engagement with diagnostic device manufacturers and healthcare providers ensures the accuracy of the market insights. This final step involves integrating feedback from industry experts to refine and validate the final market report.

Frequently Asked Questions

01. How big is the Indonesia In Vitro Diagnostics Market?

The Indonesia In Vitro Diagnostics (IVD) market is valued at USD 0.3 billion, driven by increasing healthcare expenditures and technological advancements in diagnostics.

02. What are the key growth drivers of the Indonesia IVD Market?

Key growth drivers in the Indonesia In Vitro Diagnostics (IVD) market include rising demand for early disease detection, government healthcare initiatives, and the increasing prevalence of chronic diseases such as diabetes and cancer.

03. Who are the major players in the Indonesia IVD Market?

Major players in the Indonesia In Vitro Diagnostics (IVD) market include Abbott Laboratories, Roche Diagnostics, Siemens Healthineers, Thermo Fisher Scientific, and Sysmex Corporation.

04. What are the challenges in the Indonesia IVD Market?

The Indonesia In Vitro Diagnostics (IVD) market faces challenges such as high costs of advanced diagnostic devices, regulatory hurdles, and a lack of skilled professionals in rural areas.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.