Indonesia Internet-of-Things (IOT) Market Outlook to 2030

Region:Asia

Author(s):Naman Rohilla

Product Code:KROD2454

November 2024

91

About the Report

Indonesia IoT Market Overview

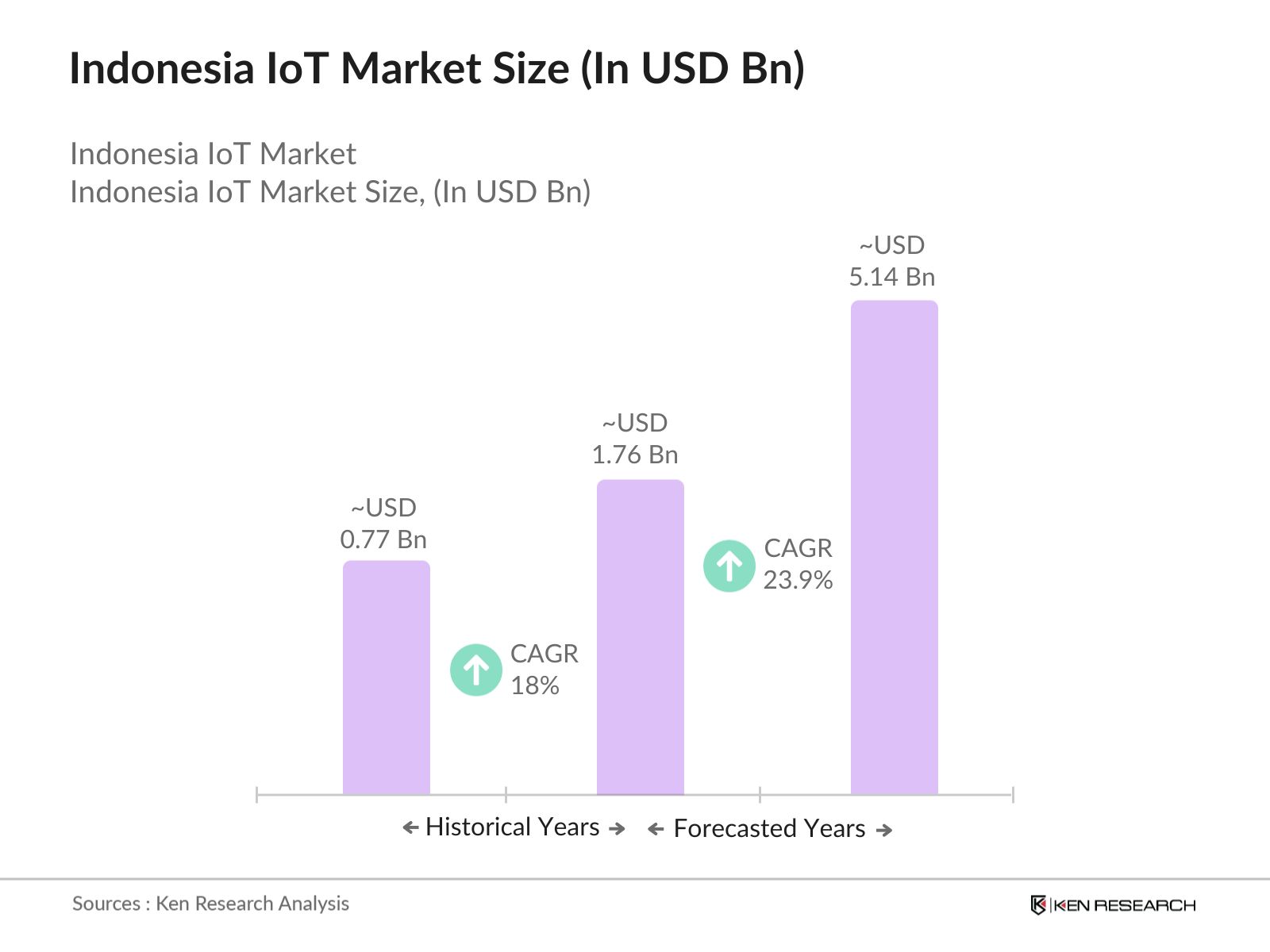

- The Indonesia IoT (Internet of Things) market was valued at USD 1.76 billion. This growth is driven by increasing digitalization across industries, expanding urban infrastructure, and government initiatives promoting smart city projects. The market is further supported by the adoption of 5G technology and the rise in connected devices.

- Key players in the Indonesia IoT market include Telkom Indonesia, XL Axiata, Huawei Technologies, Ericsson, and Cisco Systems. These companies are leveraging the growing demand for smart solutions across sectors like manufacturing, healthcare, and energy.

- Telkom Indonesia and Cisco have partnered to enhance IoT services in ASEAN, launching the Cisco IoT Control Center at NeutraDC's data center. This facility will support 5 million connections, aiming to accelerate digitalization and meet rising demand for smart solutions across various sectors.

- Jakarta emerged as the leading region in the Indonesia IoT market, driven by rapid urbanization, the development of smart cities, and an increasing number of connected devices aimed at improving infrastructure and public services.

Indonesia IoT Market Segmentation

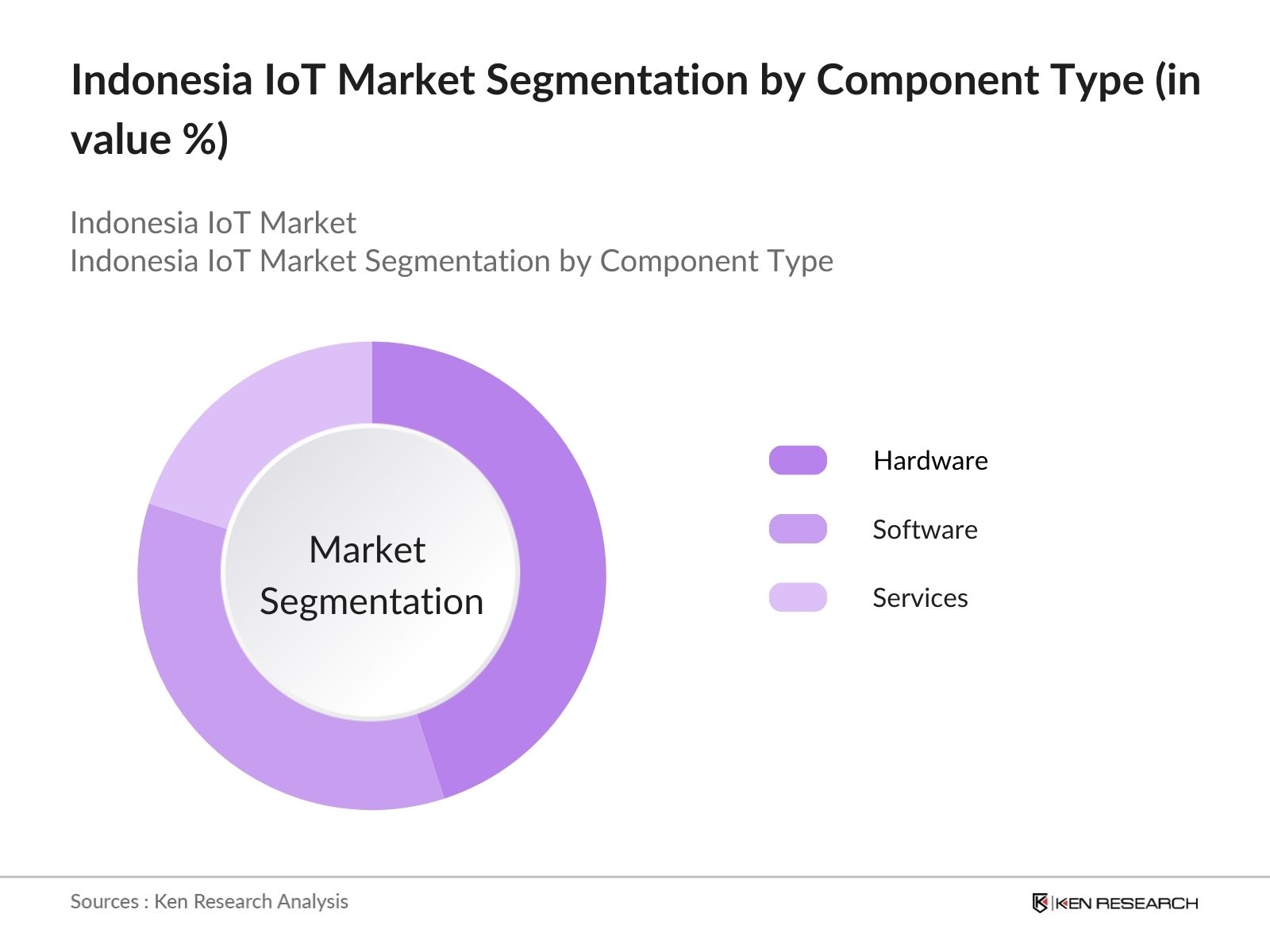

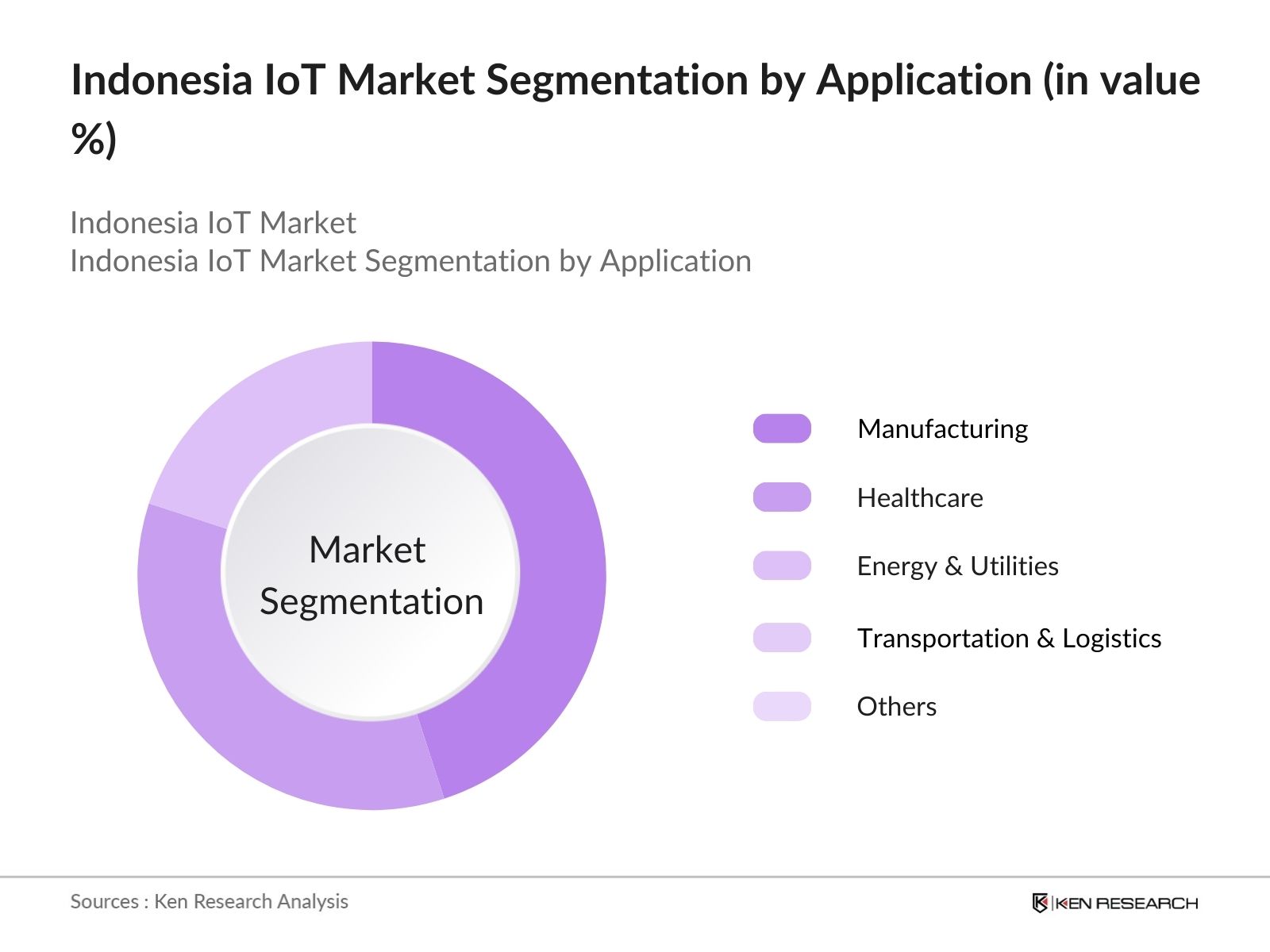

The Indonesia IoT market is segmented by component type, application, and region.

- By Component Type: The market is segmented into hardware, software, and services. Hardware dominated the market due to the large-scale adoption of IoT sensors and devices.

- By Application: The market is segmented by applications such as manufacturing, healthcare, energy & utilities, transportation & logistics, and others (agriculture, smart homes). Manufacturing held the largest market share due to its extensive use of IoT for automation and operational efficiency.

- By Region: The market is segmented by region into North, South, East, and West Indonesia. The western region led the market due to the concentration of industries and advanced infrastructure in cities like Jakarta and Surabaya.

Indonesia IoT Market Competitive Landscape

|

Company Name |

Establishment Year |

Headquarters |

|

Telkom Indonesia |

1965 |

Jakarta, Indonesia |

|

XL Axiata |

1989 |

Jakarta, Indonesia |

|

Huawei Technologies |

1987 |

Shenzhen, China |

|

Ericsson |

1876 |

Stockholm, Sweden |

|

Cisco Systems |

1984 |

San Jose, USA |

- XL Axiata: XL Axiata, an Indonesian mobile operator, is collaborating with TIBCO to provide data scientists with advanced analytics tools, including TIBCO Data Science. The project aims to equip 50 data scientists with tools to embrace cloud technology and enhance data analysis capabilities.

- Huawei Technologies: Huawei and EDMI, a leading smart metering solutions provider, have signed a global IoT licensing agreement, enabling EDMI to develop and sell IoT products using Huawei's LiteOS and Huawei Mobile Services (HMS) Core.

Indonesia IoT Market Analysis

Indonesia IoT Market Growth Drivers:

- 5G Adoption: The deployment of 5G networks is accelerating in Indonesia. As of 2023, Indosat's 5G network has reached eight major cities, while Telkomsel had 1,500 5G base stations by the end of 2021. 5G technology enables faster data speeds, with average download speeds reaching 300 Mbps in Indonesia as of October 2023.

- Industrial Automation: Indonesia's manufacturing sector is embracing IoT to optimize operations. For example, the country's first 5G-powered smart warehouse, launched in 2022, utilizes autonomous guided vehicles (AGVs), IoT sensors, and real-time data processing to streamline logistics.

- Data Analytics and AI Integration: The Indonesian government's AI readiness index reached 52.5 out of 100 in 2022, with the highest scores in data and infrastructure. Businesses are leveraging AI and data analytics to extract insights from IoT data. According to Ericsson, 5G will empower Indonesia to unlock the potential of Industry 4.0.

Indonesia IoT Market Challenges:

- Infrastructure Gaps: Regions outside Java face major challenges due to insufficient digital infrastructure, which hampers IoT adoption. Around 60% of Indonesia's internet users are concentrated in Java, leaving other areas with limited connectivity and access to IoT solutions that require reliable internet services for effective implementation.

- Cybersecurity Concerns: As IoT adoption increases, so do cybersecurity risks. Indonesia experiences about 42,000 cyber-attacks daily, with 361 million reported in 2023 alone. The countrys cybersecurity spending is only 0.02% of GDP, making it crucial to enhance data security measures to protect sensitive information in the digital economy.

Indonesia IoT Market Government Initiatives:

- Smart City Nusantara Program: The Smart City Nusantara Program aims to enhance urban living through IoT integration. As of 2023, Jakarta's smart city initiatives have led to a 30% improvement in public service efficiency. Additionally, over 50 smart city projects are underway across various Indonesian cities, focusing on transportation, safety, and public services.

- Making Indonesia 4.0: The "Making Indonesia 4.0" initiative seeks to transform the manufacturing sector by 2030. By 2023, the Indonesian government reported that 40% of manufacturers are adopting IoT technologies. This initiative is expected to contribute to a 15% increase in productivity within the manufacturing sector, positioning Indonesia as a competitive player in the global market.

Indonesia IoT Market Future Market Outlook

The Indonesia IoT market is expected to grow over the next five years, driven by the increasing need for automation, government-backed initiatives for smart cities, and the deployment of 5G networks.

Future Market Trends:

- Increased Focus on Smart Cities: Over the next five years, smart city projects are expected to dominate IoT investments, particularly in urban areas like Jakarta, Bandung, and Surabaya. The Indonesian government is prioritizing the improvement of public infrastructure, which will lead to increased funding and development of smart city initiatives aimed at enhancing urban living and services.

- IoT in Agriculture: IoT solutions in precision agriculture are anticipated to gain traction, enabling farmers to monitor crops and optimize irrigation systems. This trend will drive growth in rural regions, as the adoption of IoT technologies helps improve agricultural efficiency, productivity, and sustainability, ultimately benefiting the agricultural sector and local economies.

Scope of the Report

|

By Component Type |

Hardware Software Services |

|

By Application |

Manufacturing Healthcare Energy & Utilities Transportation & Logistics Others |

|

By Region |

North South East West |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Government and Regulatory Bodies

Banks and Financial Institutes

Investors and Venture Capitalists

IoT Hardware and Software Companies

Manufacturing Companies

Agricultural Technology Firms

Energy & Utility Companies

Logistics and Transportation Companies

Time Period Captured in the Report

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Table of Contents

1. Indonesia IoT Market Overview

1.1. Definition and Scope (clarifying market coverage and specific IoT parameters)

1.2. Market Taxonomy (segmenting IoT market players and components)

1.3. Market Growth Rate (CAGR and growth trajectory explanation)

1.4. Market Segmentation Overview (component type, application, and region)

2. Indonesia IoT Market Size (in USD Billion)

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis (detailing growth metrics and trends)

2.3. Key Market Developments and Milestones (IoT adoption milestones, 5G integration)

3. Indonesia IoT Market Analysis

3.1. Growth Drivers

3.1.1. Expansion of 5G technology

3.1.2. Government initiatives for smart city development (Smart City Nusantara, Making Indonesia 4.0)

3.1.3. Increased demand for automation in manufacturing, healthcare, and logistics

3.1.4. Rise in connected devices and data analytics integration

3.2. Restraints

3.2.1. Infrastructure gaps in non-urban regions (mention regions like Kalimantan and Sulawesi)

3.2.2. Cybersecurity threats and insufficient cybersecurity spending

3.2.3. Limited access to high-speed internet outside Java

3.3. Opportunities

3.3.1. Expansion into rural areas through IoT-based agriculture (precision farming)

3.3.2. IoT-driven industrial automation and optimization

3.3.3. Increasing foreign investments and partnerships in IoT

3.4. Trends

3.4.1. Increased focus on smart city projects in Jakarta, Bandung, and Surabaya

3.4.2. Adoption of IoT for public services and urban infrastructure

3.4.3. Growth of IoT solutions in agriculture and sustainability

3.5. Government Initiatives

3.5.1. Smart City Nusantara Program

3.5.2. Making Indonesia 4.0 (IoT in manufacturing)

3.5.3. Government push for 5G deployment and smart infrastructure

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (mapping key stakeholders and their role in IoT development)

3.8. Competitive Ecosystem (analysis of IoT vendors, service providers, and integrators)

4. Indonesia IoT Market Segmentation

4.1. By Component Type (in value %)

4.1.1. Hardware

4.1.2. Software

4.1.3. Services

4.2. By Application (in value %)

4.2.1. Manufacturing

4.2.2. Healthcare

4.2.3. Energy & Utilities

4.2.4. Transportation & Logistics

4.2.5. Others (Agriculture, Smart Homes)

4.3. By Region (in value %)

4.3.1. North Indonesia

4.3.2. South Indonesia

4.3.3. East Indonesia

4.3.4. West Indonesia (Jakarta, Surabaya dominance)

5. Indonesia IoT Market Competitive Landscape

5.1. Company Profiles (including key metrics: year of establishment, headquarters, revenue, market share)

5.1.1. Telkom Indonesia

5.1.2. XL Axiata

5.1.3. Huawei Technologies

5.1.4. Ericsson

5.1.5. Cisco Systems

5.1.6. Nokia

5.1.7. IBM Corporation

5.1.8. SAP SE

5.1.9. ZTE Corporation

5.1.10. Qualcomm

5.1.11. Schneider Electric

5.1.12. Siemens AG

5.1.13. Bosch Software Innovations

5.1.14. Samsung Electronics

5.1.15. Microsoft Corporation

5.2. Market Share Analysis (mention market leadership for hardware, software, and service segments)

5.3. Strategic Initiatives (partnerships, collaborations, and acquisitions)

5.4. Investment Analysis

5.4.1. Venture Capital and Private Equity Investments

5.4.2. Foreign Direct Investment (FDI) in IoT and tech startups

5.4.3. Government Funding for IoT projects

6. Indonesia IoT Market Regulatory Framework

6.1. National IoT and Telecom Regulations (impacts of IoT on policy and regulation)

6.2. Compliance Requirements (standards for IoT devices and data protection laws)

6.3. IoT Device Certification Processes (mandatory testing for smart devices)

6.4. Cybersecurity Legislation (initiatives to enhance cybersecurity for IoT)

7. Indonesia IoT Market Future Outlook

7.1. Future Market Size Projections (forecast period 2023-2028)

7.2. Key Factors Driving Future Growth (growth drivers by component, application, and region)

7.3. Adoption Rate of Emerging Technologies (AI, 5G, big data in IoT)

7.4. Public and Private Sector Collaboration

8. Indonesia IoT Market Future Segmentation

8.1. By Component Type (hardware, software, services)

8.2. By Application (manufacturing, healthcare, energy, transportation)

8.3. By Region (North, South, East, West Indonesia)

9. Indonesia IoT Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis (Total Addressable Market, Serviceable Addressable Market)

9.2. Investment Opportunities (emerging IoT sectors: agriculture, transportation, energy)

9.3. White Space Opportunity Analysis (gaps in market readiness for smart city solutions)

9.4. Technology Integration Strategies (leveraging AI, cloud computing for IoT)

10. Indonesia IoT Market Cross Comparison

10.1. Detailed Profiles of Major Competitors (15 competitors cross-compared: year of establishment, revenue, market share)

10.2. Product Offering and Service Differentiation (analyzing competitive advantages and product features)

10.3. Strategic Initiatives (notable collaborations, acquisitions, partnerships in the IoT space)

11. Indonesia IoT Market Competitive Landscape and SWOT Analysis

11.1. Market Share Analysis (vendor rankings and market penetration)

11.2. SWOT Analysis of Major Players

11.3. Strategic Initiatives (joint ventures, product launches)

11.4. Key Success Factors (factors contributing to competitive advantages)

Contact Us DisclaimerResearch Methodology

Step: 1 Identifying Key Variables

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around the market to collate market-level information.

Step: 2 Market Building

Collating statistics on the Indonesia IoT market over the years and analyzing the penetration of products as well as the ratio of suppliers to compute the revenue generated for the market. We will also review product quality statistics to ensure accuracy behind the data points shared.

Step: 3 Validating and Finalizing

Building market hypothesis and conducting CATIs with market experts from different companies to validate statistics and seek operational and financial information from company representatives.

Step: 4 Research Output

Our research team approaches multiple IoT software developers and solution providers to understand product segments, sales trends, consumer preferences, and other parameters. This approach supports us in validating the statistics derived from the bottom-up approach of these IoT software developers and solution providers.

Frequently Asked Questions

01. How big is the Indonesia IoT Market?

The Indonesia IoT market was valued at USD 1.76 billion in 2023, driven by rising digitalization, smart city initiatives, and the adoption of 5G technology in various sectors.

02. Who are the major players in the Indonesia IoT market?

Key players in the Indonesia IoT market include Telkom Indonesia, XL Axiata, Huawei Technologies, Ericsson, Cisco Systems, and Nokia, which are leading IoT deployments in the manufacturing, healthcare, and transportation sectors.

03. What are the growth drivers of the Indonesia IoT market?

Growth drivers of the Indonesia IoT market include government initiatives for smart cities, the increasing deployment of 5G technology, and the rising demand for automation in the manufacturing, energy, and transportation sectors.

04. What are the Indonesia IoT market challenges?

Indonesia's IoT market challenges include limited digital infrastructure in regions outside urban centres and rising cybersecurity concerns due to the increased connectivity of IoT devices and systems.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.