Indonesia Internet Retailer Market Outlook to 2030

Region:Asia

Author(s):Sanjna

Product Code:KROD10359

December 2024

97

About the Report

Indonesia Internet Retailer Market Overview

- Indonesia Internet Retailer Market is valued at USD 72 billion, driven by the nations expanding digital ecosystem and an increase in consumer reliance on online shopping platforms. This growth is supported by extensive mobile internet access, particularly within urban populations, alongside increased payment security for digital transactions, fostering greater consumer confidence.

- Java and Sumatra emerge as dominant regions in Indonesias internet retail sector. Java leads the market due to its dense urban population, strong technological infrastructure, and high concentration of digital consumers, with major cities like Jakarta and Surabaya playing pivotal roles. Sumatra follows, benefiting from an expanding logistics infrastructure and growing e-commerce adoption in semi-urban areas, which supports broader market accessibility.

- The Indonesian government implemented stricter e-commerce regulations in 2024, mandating data privacy standards and enforcing taxation on online transactions to foster a more secure e-commerce environment. This legal framework requires online platforms to safeguard consumer data and ensure fair tax practices, supporting trust within the digital economy. These regulatory measures aim to strengthen the countrys e-commerce infrastructure by creating a more equitable playing field for domestic and international players.

Indonesia Internet Retailer Market Segmentation

By Platform Type: The Indonesia Internet Retailer market is segmented by platform type into mobile commerce and web-based commerce. Mobile commerce currently holds a dominant market share within this segment due to widespread smartphone use, driven by affordable internet services and a young, tech-savvy population. The flexibility and convenience of mobile commerce make it a preferred shopping platform, particularly for younger consumers who favor accessibility and on-the-go shopping experiences.

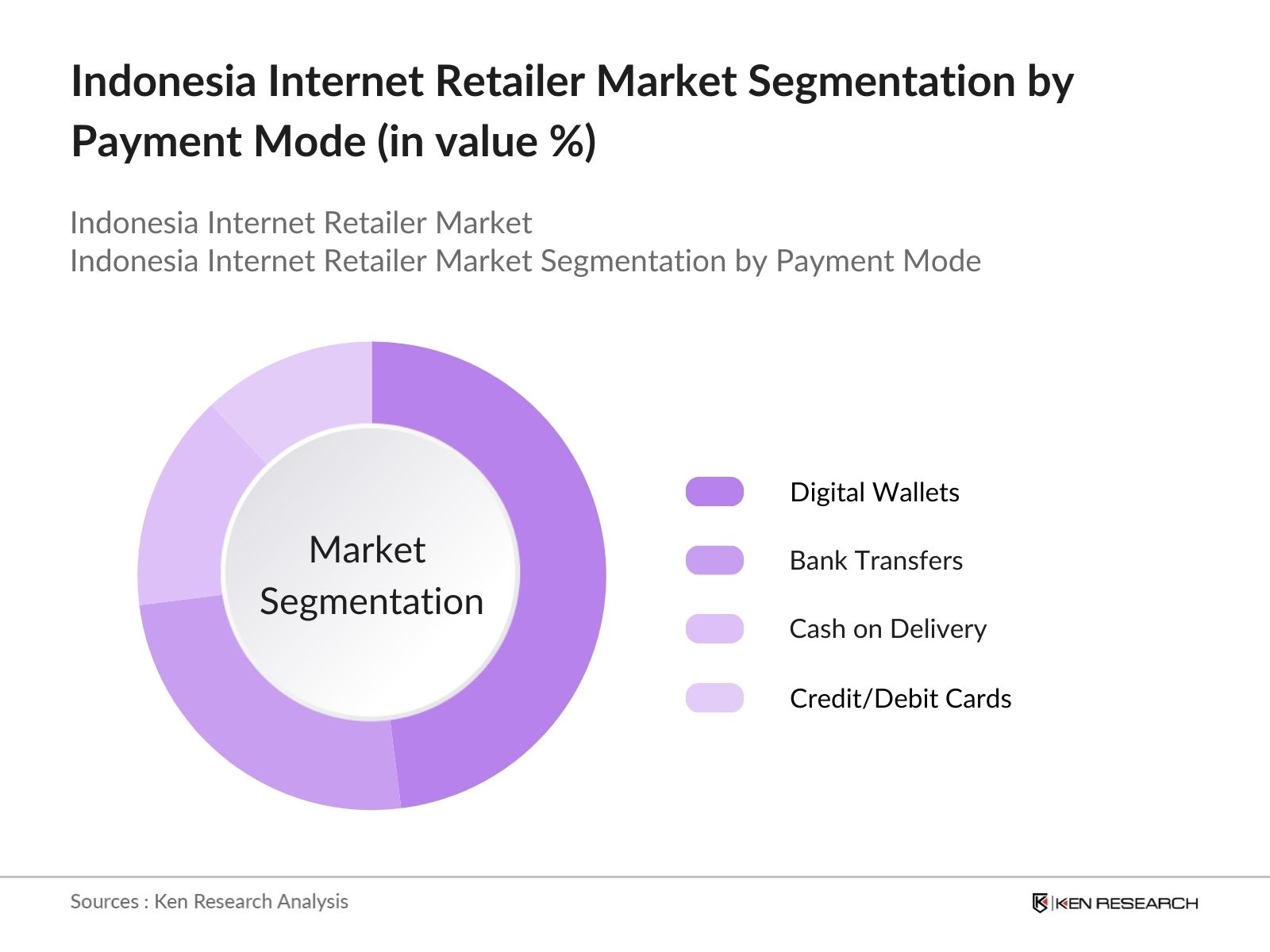

By Payment Mode The market is segmented by payment mode into digital wallets, bank transfers, cash on delivery, and credit/debit cards. Digital wallets dominate this segment due to their convenience and compatibility with Indonesias mobile-centric consumer base. Digital wallets such as GoPay and OVO have achieved high user adoption through strategic partnerships with major e-commerce platforms, creating a seamless checkout experience and furthering consumer trust in digital payments.

Indonesia Internet Retailer Market Competitive Landscape

The Indonesia Internet Retailer Market is characterized by the dominance of both local and international players, indicating significant industry consolidation. Key market leaders, such as Tokopedia and Shopee Indonesia, leverage extensive distribution networks and strong brand presence, while competitors like Lazada Indonesia and Blibli tap into local partnerships and customized marketing approaches to cater to Indonesian consumers' preferences.

Indonesia Internet Retailer Market Analysis

Growth Drivers

- Urban Population Growth: Indonesias urban population is estimated to reach around 160 million in 2024, representing nearly 57% of the total population. This demographic shift is fostering a surge in digital shopping behaviors, particularly among urban millennials who prioritize online convenience and a wider product selection. With over 200 million internet users in 2024, Indonesias urban regions are becoming prime markets for e-commerce platforms, as accessibility to online services grows through widespread urban infrastructure enhancements.

- Increased Smartphone Adoption: In 2024, Indonesia is projected to have approximately 300 million active mobile connections, showing how mobile device penetration is central to the rise in digital retail engagement. The countrys internet users are primarily mobile-based, with nearly 90% accessing e-commerce platforms via smartphones. The proliferation of affordable smartphones and mobile data packages has further encouraged mobile internet use, transforming Indonesia into one of the worlds leading mobile-driven e-commerce markets.

- Government Digital Economy Initiatives: The Indonesian governments "100 Smart Cities" initiative is part of a broader effort to develop a digital economy, aiming to integrate smart technologies that enhance e-commerce operations across the nation. As of 2024, the government has allocated significant funding toward digital infrastructure, targeting improved internet connectivity and digital literacy. The impact of such initiatives has been substantial, with digital economy contributions expected to support nearly 15% of Indonesias GDP by year-end, directly benefiting the internet retail sector by facilitating easier market access and transaction flow.

Challenges

- Logistics and Last-Mile Delivery Challenges: Despite advancements, Indonesias logistics infrastructure faces challenges in efficiently reaching the countrys geographically dispersed islands, which total over 17,000. In 2024, transportation logistics costs in Indonesia are among the highest in Southeast Asia, averaging approximately 24% of GDP. This inefficiency complicates last-mile delivery, a critical component for e-commerce success, especially in rural regions where infrastructure limitations persist.

- Competition from Traditional Retail Channels: Indonesias retail sector is heavily influenced by traditional markets, which account for over 60% of retail transactions in 2024. Cultural preferences for in-store shopping experiences, coupled with the widespread presence of local markets and small retail shops, pose stiff competition to digital retailers. The preference for cash transactions and a tangible shopping experience presents a barrier for e-commerce platforms attempting to penetrate deeper into local markets, especially outside urban areas.

Indonesia Internet Retailer Market Future Outlook

The Indonesia Internet Retailer market is projected to experience strong growth over the next five years, supported by expanding internet penetration, advanced payment technologies, and consumer preferences for digital platforms. This growth is likely to extend beyond urban centers, spurred by digital initiatives and infrastructure developments that enable e-commerce penetration in suburban and rural regions, creating new market opportunities.

Market Opportunities

- Emerging Rural E-commerce Markets: With urban e-commerce markets nearing maturity, rural areas present significant untapped potential. The Indonesian governments commitment to enhancing rural internet access, targeting nearly 75% rural internet penetration by end of 2024, is expanding digital access in these regions. This shift is expected to unlock new consumer bases for e-commerce retailers, offering an opportunity to serve previously underserved demographics and drive growth in non-urban markets.

- Integration of AI in Personalized Shopping: AI technology integration in Indonesian e-commerce is increasingly prominent, particularly in personalized shopping. As of 2024, major online retailers have begun using AI algorithms for targeted product recommendations, leading to increased customer engagement and satisfaction. The AI-driven approach allows platforms to analyze vast data sets to tailor shopping experiences to individual preferences, enhancing customer loyalty. This development represents a strategic opportunity for e-commerce companies to differentiate their offerings and improve customer retention.

Scope of the Report

|

Segment |

Sub-Segments |

|

By Platform Type |

Mobile Commerce Web-based Commerce |

|

By Payment Mode |

Digital Wallets Bank Transfers Cash on Delivery Credit and Debit Cards |

|

By Product Type |

Electronics and Appliances Fashion and Apparel Health and Beauty Groceries and Essentials Others |

|

By Customer Demographics |

Age Group Income Group Urban vs. Rural Segmentation |

|

By Region |

Java Sumatra Kalimantan Sulawesi Eastern Indonesia |

Products

Key Target Audience

Digital Payment Solution Providers

Retail and E-commerce Companies

Logistics and Delivery Services

Mobile Network Operators

Marketing and Advertising Agencies

Local Manufacturing and Consumer Goods Brands

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (Ministry of Communication and Informatics, Financial Services Authority)

Companies

Players Mentioned in the Report

Tokopedia

Shopee Indonesia

Bukalapak

Lazada Indonesia

Blibli

JD.id

Zalora Indonesia

Orami

Sociolla

Ralali

Table of Contents

1. Indonesia Internet Retailer Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Dynamics Overview

1.4. Market Segmentation Overview

2. Indonesia Internet Retailer Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Developments and Milestones

3. Indonesia Internet Retailer Market Analysis

3.1. Growth Drivers

3.1.1. Urban Population Growth (Digital Shopping Demographics)

3.1.2. Increased Smartphone Adoption (Mobile Internet Users)

3.1.3. Government Digital Economy Initiatives

3.1.4. Expanding Payment Infrastructure (Digital Payment Adoption)

3.2. Market Challenges

3.2.1. Logistics and Last-Mile Delivery Challenges

3.2.2. Trust Deficit in Online Shopping (Fraud and Security Concerns)

3.2.3. Competition from Traditional Retail Channels

3.3. Opportunities

3.3.1. Emerging Rural E-commerce Markets

3.3.2. Integration of AI in Personalized Shopping

3.3.3. International Brand Expansion in Indonesian E-commerce

3.4. Trends

3.4.1. Social Commerce Integration (Social Media Shopping)

3.4.2. Omnichannel Retailing Strategies

3.4.3. Rise in Subscription-Based Retail Services

3.5. Government Regulation

3.5.1. E-commerce Law Compliance (Data Privacy, Taxation)

3.5.2. Cross-Border E-commerce Policies

3.5.3. National Payment Gateway Mandates

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competitive Landscape

4. Indonesia Internet Retailer Market Segmentation

4.1. By Platform Type (In Value %)

4.1.1. Mobile Commerce

4.1.2. Web-based Commerce

4.2. By Payment Mode (In Value %)

4.2.1. Digital Wallets

4.2.2. Bank Transfers

4.2.3. Cash on Delivery

4.2.4. Credit and Debit Cards

4.3. By Product Type (In Value %)

4.3.1. Electronics and Appliances

4.3.2. Fashion and Apparel

4.3.3. Health and Beauty

4.3.4. Groceries and Essentials

4.3.5. Others

4.4. By Customer Demographics (In Value %)

4.4.1. Age Group

4.4.2. Income Group

4.4.3. Urban vs. Rural Segmentation

4.5. By Region (In Value %)

4.5.1. Java

4.5.2. Sumatra

4.5.3. Kalimantan

4.5.4. Sulawesi

4.5.5. Eastern Indonesia

5. Indonesia Internet Retailer Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Tokopedia

5.1.2. Shopee Indonesia

5.1.3. Bukalapak

5.1.4. Lazada Indonesia

5.1.5. Blibli

5.1.6. JD.id

5.1.7. Zalora Indonesia

5.1.8. Orami

5.1.9. Sociolla

5.1.10. Ralali

5.2. Cross Comparison Parameters

Employee Count, Headquarters, Inception Year, Revenue, Active User Base, Product Variety, Customer Ratings, Average Delivery Time

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital and Private Equity Influx

5.8. Government Support and Grants for E-commerce Expansion

6. Indonesia Internet Retailer Market Regulatory Framework

6.1. E-commerce and Trade Regulations

6.2. Data Privacy and Protection Guidelines

6.3. Digital Payment Compliance Standards

6.4. Taxation and Customs on E-commerce Imports

7. Indonesia Internet Retailer Future Market Size (In USD Mn)

7.1. Projections of Future Market Size

7.2. Key Factors Shaping Future Market Dynamics

8. Indonesia Internet Retailer Future Market Segmentation

8.1. By Platform Type (In Value %)

8.2. By Payment Mode (In Value %)

8.3. By Product Type (In Value %)

8.4. By Customer Demographics (In Value %)

8.5. By Region (In Value %)

9. Indonesia Internet Retailer Market Analysts Recommendations

9.1. Market Potential Analysis (TAM/SAM/SOM)

9.2. Customer Behavior Analysis

9.3. Strategic Marketing Initiatives

9.4. Opportunity Analysis for New Entrants

Research Methodology

Step 1: Identification of Key Variables

This step involves mapping essential stakeholders in the Indonesia Internet Retailer market and conducting secondary research from verified databases to identify critical variables, such as digital infrastructure and payment technology advancements.

Step 2: Market Analysis and Construction

Historical data analysis is undertaken to assess market penetration across e-commerce platforms and payment types, focusing on digital transaction volumes and user growth rates to forecast revenue trends.

Step 3: Hypothesis Validation and Expert Consultation

Market insights are validated through structured interviews with representatives from e-commerce and digital payment firms, enhancing data accuracy with industry expert perspectives.

Step 4: Research Synthesis and Final Output

This phase consolidates insights from stakeholders, refining the data to ensure a comprehensive, reliable market analysis for publication.

Frequently Asked Questions

01. How big is the Indonesia Internet Retailer Market?

The Indonesia Internet Retailer Market is valued at USD 72 billion, driven by a dynamic digital economy, widespread internet adoption, and a consumer base that increasingly prefers online shopping.

02. What are the challenges in the Indonesia Internet Retailer Market?

Challenges in Indonesia Internet Retailer Market include reaching remote areas due to logistics limitations, intense competition among major players, and consumer security concerns related to digital payments.

03. Who are the major players in the Indonesia Internet Retailer Market?

Key players in Indonesia Internet Retailer Market include Tokopedia, Shopee Indonesia, Bukalapak, and Lazada Indonesia, who dominate due to their expansive infrastructure, strategic partnerships, and localized marketing strategies.

04. What are the growth drivers of the Indonesia Internet Retailer Market?

Growth in Indonesia Internet Retailer Market is fueled by high mobile internet penetration, government digitalization programs, and widespread use of digital payments, which enhance consumer access to e-commerce platforms.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.