Indonesia Juice Market Outlook to 2030

Region:Asia

Author(s):Vijay Kumar

Product Code:KROD3841

December 2024

99

About the Report

Indonesia Juice Market Overview

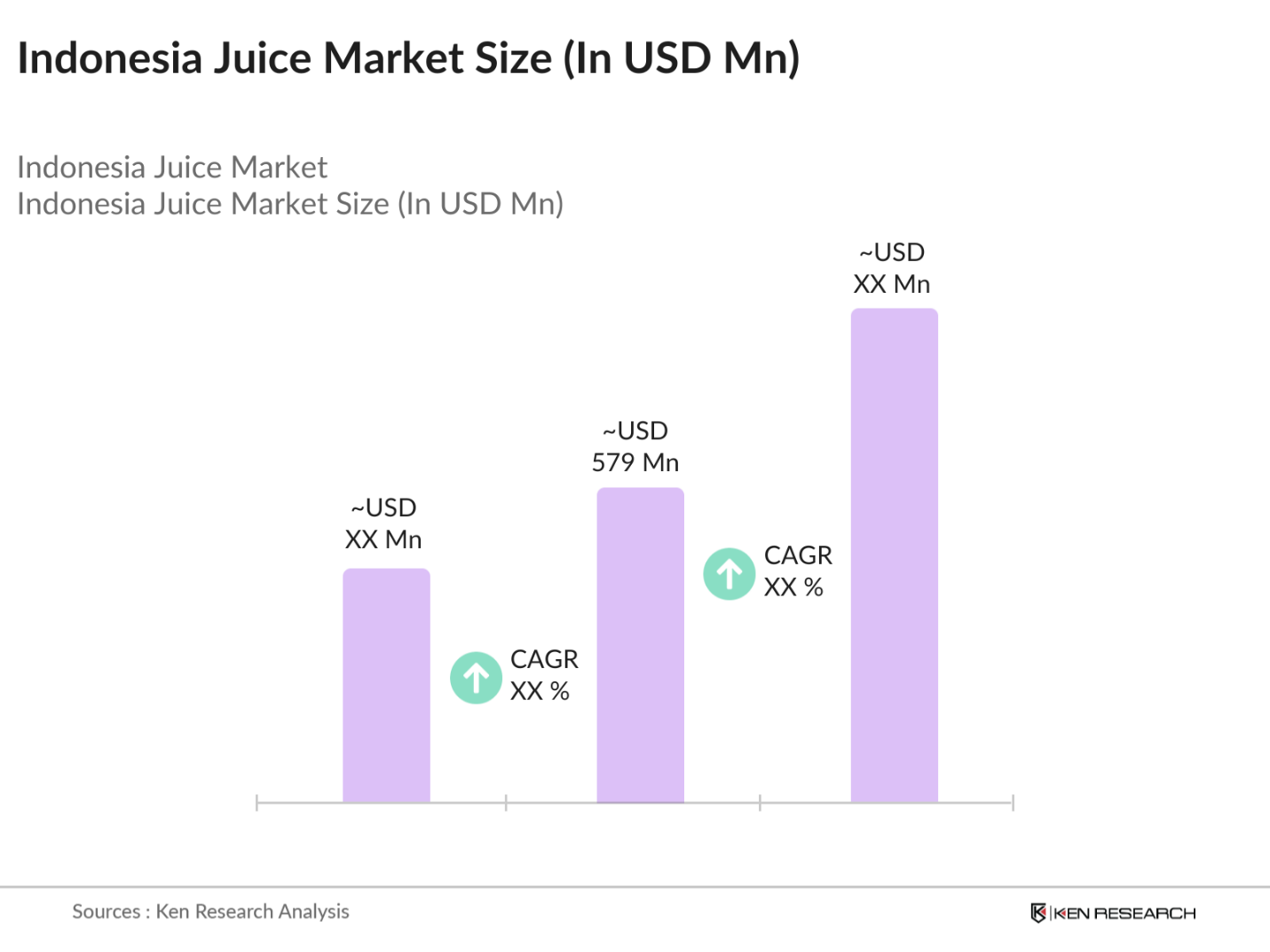

- The Indonesia Juice Market is valued at USD 579 million, based on a comprehensive five-year historical analysis. The market is primarily driven by the increasing health consciousness among consumers and a preference for natural and organic beverages. Urbanization, coupled with the growing middle-class population, has led to a higher disposable income, enabling consumers to spend more on healthier beverage options. Additionally, the shift towards functional juices, which offer added health benefits such as immunity-boosting and detoxification, has further propelled the market's growth.

- Java and Sumatra dominate the Indonesia Juice Market due to their large population bases and high urbanization rates. The presence of well-established distribution channels, including supermarkets and hypermarkets, has made these regions the leading markets. Moreover, the high concentration of premium juice consumers in metropolitan cities like Jakarta and Surabaya has contributed significantly to the markets dominance in these areas. The consumer preference for branded juices with innovative flavors and functional properties is more pronounced in these urban centers.

- The government has implemented stringent food safety standards for all juice products sold in Indonesia. These regulations are part of broader reforms aimed at improving public health, which has seen a marked improvement in health-related expenditures and infrastructure Compliance with these standards is essential for market entry and continued operation.

Indonesia Juice Market Segmentation

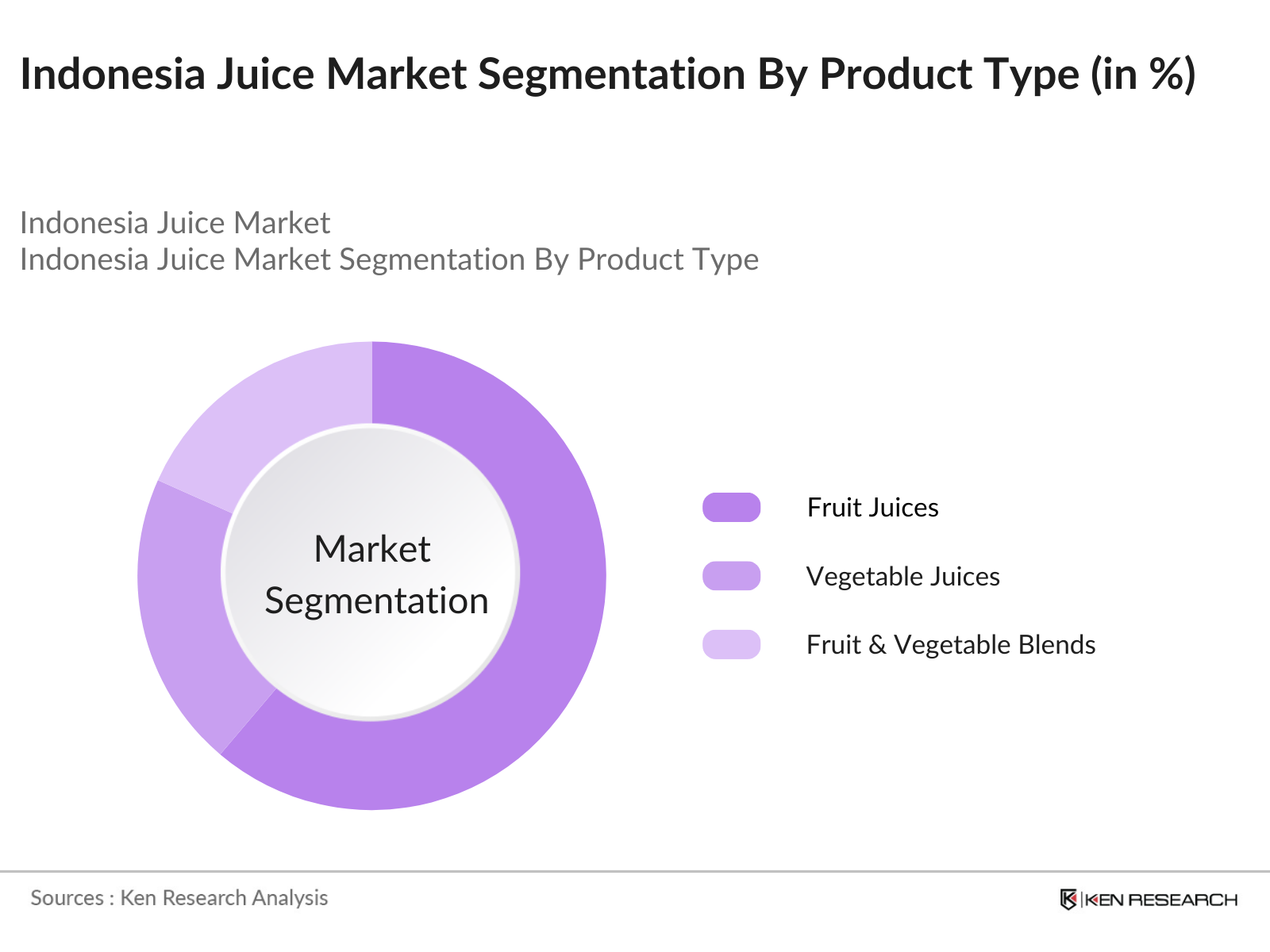

By Product Type: The market is segmented by product type into fruit juices, vegetable juices, and fruit & vegetable blends. Recently, fruit juices have captured the largest market share under the segmentation by product type due to their engrained consumption as a breakfast staple and their perceived nutritional value. Popular sub-segments include orange and apple juices, which are considered healthier alternatives to sugary carbonated beverages. The introduction of various fruit juice flavors catering to local preferences, such as tropical fruit blends, has also driven the segment's growth. Vegetable juices are gaining traction but still lag behind due to their limited flavor profile and consumer awareness.

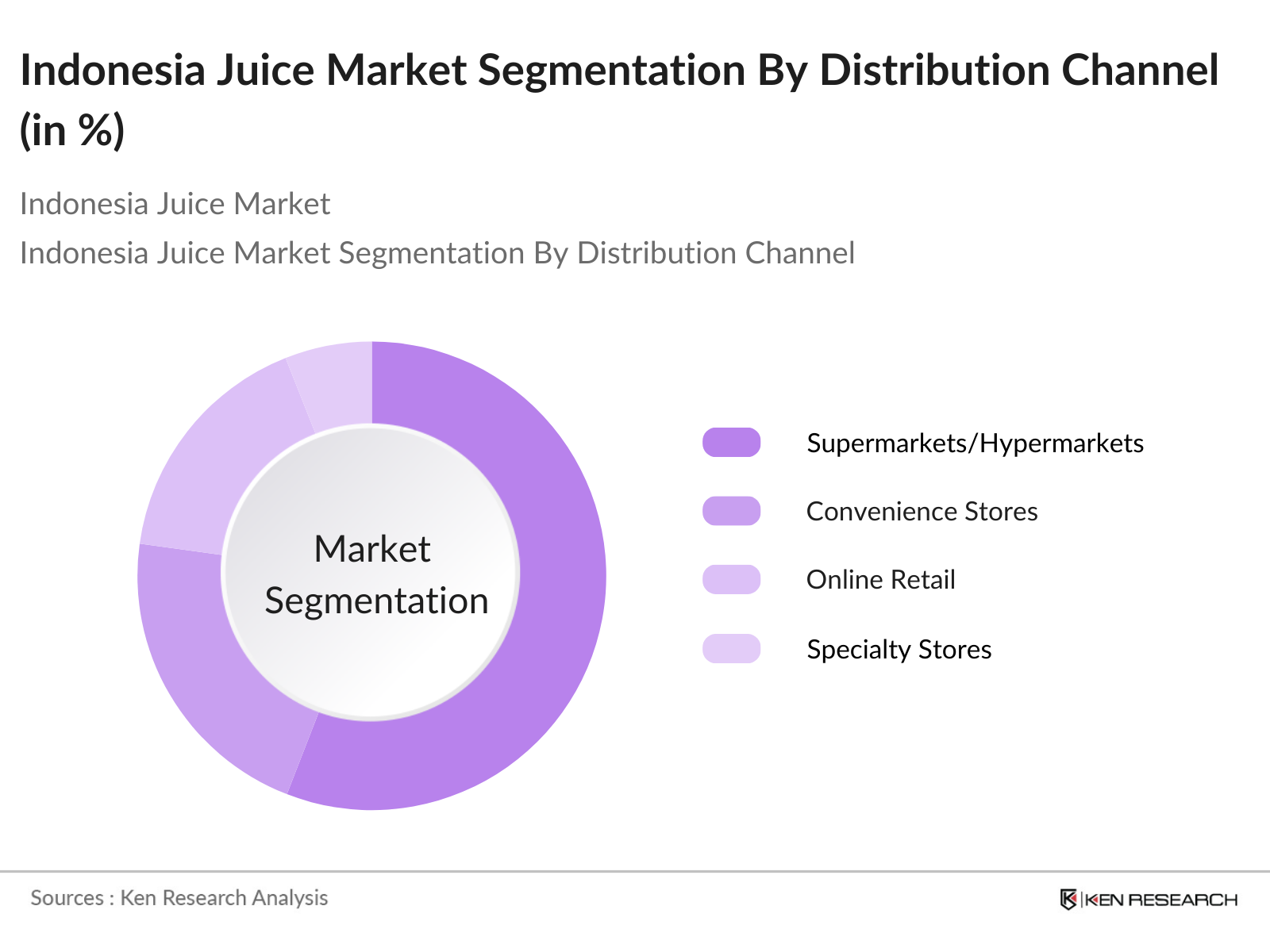

By Distribution Channel: The market is segmented by distribution channel into supermarkets/hypermarkets, convenience stores, online retail, and specialty stores. Supermarkets/hypermarkets dominate the distribution channel due to their expansive reach, offering consumers a variety of products and attractive promotions. These outlets have become the go-to for families looking to purchase household essentials, including beverages like juice.

Indonesia Juice Market Competitive Landscape

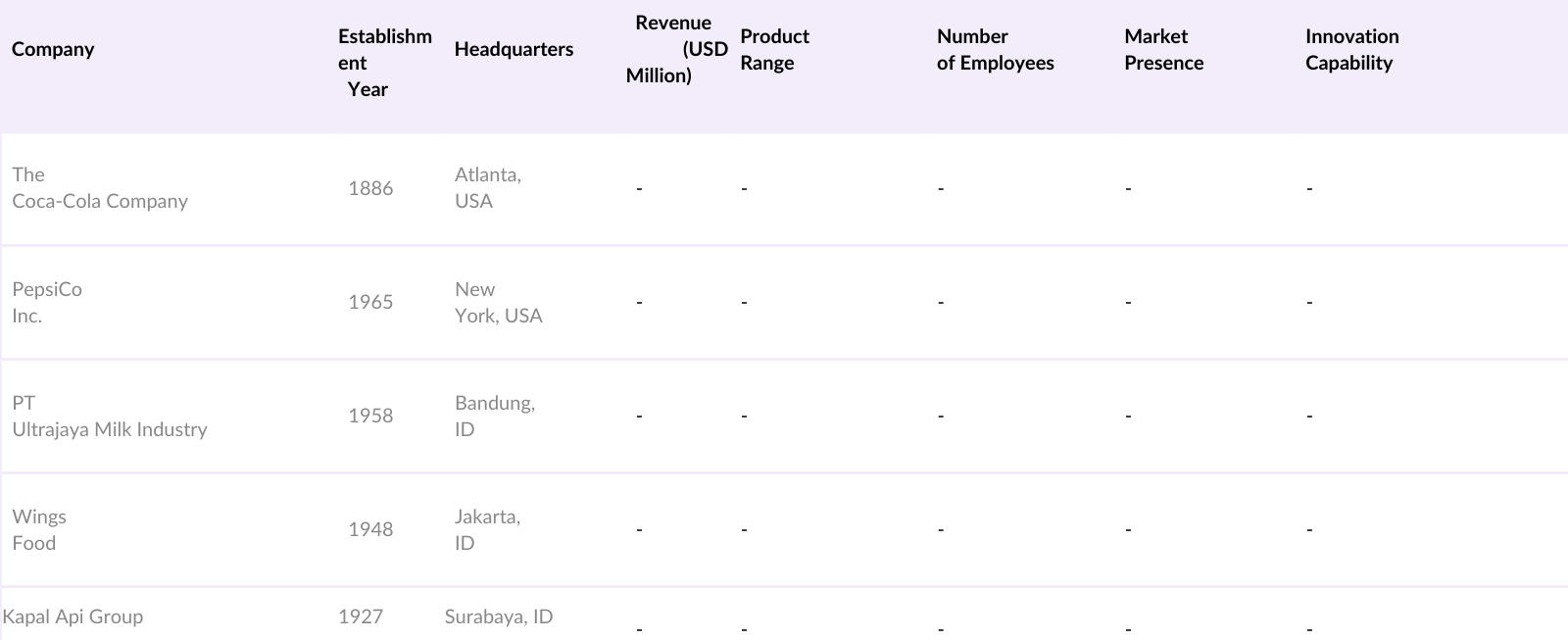

The Indonesia Juice Market is characterized by intense competition, with global giants like The Coca-Cola Company and PepsiCo Inc. vying for market share alongside strong local players like PT Ultrajaya Milk Industry and Wings Food. This competition has led to continuous product innovation and aggressive marketing strategies. The presence of these key players highlights the fragmented nature of the market, as international brands focus on premium and niche segments, while local players leverage price competitiveness and local flavors.

Indonesia Juice Industry Analysis

Growth Drivers

- Rising Health Consciousness: The demand for juice products in Indonesia is largely driven by increased health awareness among consumers, particularly in urban areas. With a population of over 270 million, the number of health-conscious individuals is growing. According to the IMF, the increase in health spending as a percentage of GDP reached 2.9 trillion Rupiah in 2023, reflecting higher consumer prioritization on healthier food options like natural and organic juices.

- Increasing Disposable Incomes: Indonesias nominal GDP reached 25,048 trillion Rupiah in 2024, up from 23,229 trillion Rupiah in 2023, reflecting improved economic conditions and higher disposable incomes. This economic growth has led to greater purchasing power, enabling more consumers to afford premium juice products. Rising incomes, particularly in the middle-class demographic, support the trend towards consuming higher-quality juices, further boosting the sectors growth.

- Adoption of Organic and Natural Juices: With the expansion of retail and online distribution channels, organic and natural juices are becoming more accessible to a larger audience. The increased demand for these products is aligned with the rise in the number of urban health-focused individuals. Indonesia's gross reserves stood at 158.6 billion USD in 2024, providing a stable economic backdrop for investment in the organic and natural food sectors.

Market Challenges

- Fluctuating Raw Material Prices: The price volatility of fruits, a primary raw material for juice production, poses a significant challenge. The IMFs 2023 report highlighted fluctuations in commodity prices impacting the agriculture sector, which in turn affects the juice industry. This instability makes it difficult for producers to maintain consistent pricing, affecting profitability and pricing strategies in the market.

- High Production Costs: Production costs remain high due to Indonesias reliance on imported machinery and packaging materials. Total external debt stood at 441.4 billion USD in 2024, reflecting higher input costs for industries relying on imports. These elevated costs make it challenging for producers to maintain competitive pricing, especially against lower-cost local producers.

Indonesia Juice Market Future Outlook

Over the next five years, the Indonesia Juice Market is expected to witness robust growth, driven by increasing consumer preference for healthy and natural beverages. The market is likely to see an influx of new product launches catering to local tastes, including fruit and vegetable blends that align with the country's health trends. Government support for local manufacturers and the growing popularity of e-commerce channels are also expected to contribute to market expansion.

Market Opportunities

- Expansion in Rural Markets: Rural markets in Indonesia present untapped opportunities due to increasing disposable incomes and improved infrastructure. The governments infrastructure spending has grown, with allocations surpassing 300 trillion Rupiah annually in recent years, promoting better access to rural areas. The expansion of rural retail networks and the introduction of affordable juice products can drive significant market growth.

- Product Diversification and Innovation: Product diversification through the introduction of functional juices enriched with vitamins and probiotics is gaining traction. Investment in product innovation is supported by the strong fiscal position of the country, with a fiscal deficit well within the 3% ceiling of GDP, which allows for subsidies and incentives for innovation. This focus on diversification is critical for capturing various consumer segments.

Scope of the Report

|

By Product Type |

Fruit Juices Vegetable Juices Fruit & Vegetable Blends |

|

By Distribution Channel |

Supermarkets/Hypermarkets Convenience Stores Online Retail Specialty Stores |

|

By Packaging Type |

Cartons Plastic Bottles Glass Bottles Cans |

|

By Flavor |

Orange Apple Mixed Berry Exotic Fruits |

|

By Region |

Java Sumatra Kalimantan Sulawesi Papua |

Products

Key Target Audience

Juice Manufacturers and Producers

Retail Chains and Supermarkets

Health and Wellness Product Distributors

Government and Regulatory Bodies (Indonesia Food and Drug Authority, Ministry of Trade)

Online Retail Platforms

Beverage Importers and Exporters

Investment and Venture Capitalist Firms

Marketing and Distribution Companies

Companies

Players Mentioned in the Report

The Coca-Cola Company

PepsiCo Inc.

Tropicana Products Inc.

Minute Maid

Suntory Holdings Ltd.

Dabur India Ltd.

Real Activ

Pran Beverages

Marigold

NutriAsia Inc.

Table of Contents

1. Indonesia Juice Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Indonesia Juice Market Size (In USD Billion)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Indonesia Juice Market Analysis

3.1. Growth Drivers

3.1.1. Rising Health Consciousness

3.1.2. Increasing Disposable Incomes

3.1.3. Adoption of Organic and Natural Juices

3.1.4. Expansion of Retail Channels

3.2. Market Challenges

3.2.1. Fluctuating Raw Material Prices

3.2.2. High Production Costs

3.2.3. Competition from Local Producers

3.3. Opportunities

3.3.1. Expansion in Rural Markets

3.3.2. Product Diversification and Innovation

3.3.3. Strategic Partnerships and Acquisitions

3.4. Trends

3.4.1. Growing Popularity of Cold-Pressed Juices

3.4.2. Increasing Use of Functional Ingredients

3.4.3. Rise in Private Label Juice Offerings

3.5. Government Regulations

3.5.1. Food Safety and Standards

3.5.2. Import and Export Regulations

3.5.3. Labeling Requirements

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competitive Landscape Analysis

4. Indonesia Juice Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Fruit Juices

4.1.2. Vegetable Juices

4.1.3. Fruit & Vegetable Blends

4.2. By Distribution Channel (In Value %)

4.2.1. Supermarkets/Hypermarkets

4.2.2. Convenience Stores

4.2.3. Online Retail

4.2.4. Specialty Stores

4.3. By Packaging Type (In Value %)

4.3.1. Cartons

4.3.2. Plastic Bottles

4.3.3. Glass Bottles

4.3.4. Cans

4.4. By Flavor (In Value %)

4.4.1. Orange

4.4.2. Apple

4.4.3. Mixed Berry

4.4.4. Exotic Fruits

4.5. By Region (In Value %)

4.5.1. Java

4.5.2. Sumatra

4.5.3. Kalimantan

4.5.4. Sulawesi

4.5.5. Papua

5. Indonesia Juice Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. The Coca-Cola Company

5.1.2. PepsiCo Inc.

5.1.3. Tropicana Products Inc.

5.1.4. Minute Maid

5.1.5. Suntory Holdings Ltd.

5.1.6. Dabur India Ltd.

5.1.7. Real Activ

5.1.8. Pran Beverages

5.1.9. Marigold

5.1.10. NutriAsia Inc.

5.1.11. PT Ultrajaya Milk Industry

5.1.12. PT Kalbe Farma

5.1.13. Wings Food

5.1.14. Indofood CBP Sukses Makmur

5.1.15. Kapal Api Group

5.2. Cross Comparison Parameters

(Revenue, Headquarters, Product Range, Market Presence, Innovation Capabilities, Supply Chain Strength, Marketing Strategies, Brand Equity)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Indonesia Juice Market Regulatory Framework

6.1. Health and Safety Standards

6.2. Packaging and Labeling Regulations

6.3. Import and Export Policies

7. Indonesia Juice Market Future Market Size (In USD Billion)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Indonesia Juice Market Future Segmentation

8.1. By Product Type (In Value %)

8.2. By Distribution Channel (In Value %)

8.3. By Packaging Type (In Value %)

8.4. By Flavor (In Value %)

8.5. By Region (In Value %)

9. Indonesia Juice Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Indonesia Juice Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the Indonesia Juice Market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple juice manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the Indonesia Juice Market.

Frequently Asked Questions

01. How big is the Indonesia Juice Market?

The Indonesia Juice Market is valued at approximately USD 579 million, based on a comprehensive five-year historical analysis. The market is primarily driven by the increasing health consciousness among consumers and a preference for natural and organic beverages.

02. What are the challenges in the Indonesia Juice Market?

The Indonesia Juice Market challenges include fluctuating raw material prices, competition from local producers, and high production costs, all of which impact profitability.

03. Who are the major players in the Indonesia Juice Market?

The Indonesia Juice Market key players include The Coca-Cola Company, PepsiCo Inc., PT Ultrajaya Milk Industry, Wings Food, and Kapal Api Group.

04. What are the growth drivers of the Indonesia Juice Market?

The Indonesia Juice market is propelled by rising health consciousness, increasing disposable incomes, and the expansion of retail channels.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.