Indonesia Landing Gear Market Outlook to 2030

Region:Asia

Author(s):Shreya Garg

Product Code:KROD750

July 2024

100

About the Report

Indonesia Landing Gear Market Overview

- The Indonesia landing gear market has experienced notable growth, this is reflected by global landing gear market reaching a valuation of USD 7.3 billion in 2023. The growth in its market size is driven by the increase in air travel and the expansion of both commercial and military aircraft fleets. The rising demand for modern, efficient, and lightweight landing gear systems has also propelled the market forward.

- Key players in the Indonesia Landing Gear Market include Collins Aerospace, Safran Landing Systems, Liebherr-Aerospace, Heroux-Devtek, and CIRCOR Aerospace. These companies dominate the market through their extensive product offerings, technological innovations, and strategic partnerships with major aircraft manufacturers.

- In 2023, Safran Landing Systems announced the opening of a new manufacturing facility in Indonesia to cater to the growing demand for landing gear systems in the Asia-Pacific region. This facility is expected to increase the company’s production capacity, enabling them to better serve the regional market.

Indonesia Landing Gear Current Market Analysis

- The growth in the Indonesia Landing Gear Market has a significant positive impact on the local economy, creating numerous job opportunities and fostering technological advancements. The increased demand for landing gear systems has led to the establishment of new manufacturing facilities and the expansion of existing ones, contributing to economic growth.

- One of the primary growth drivers for the Indonesia Landing Gear Market is the rapid expansion of the aviation sector. In 2023, Indonesia witnessed a massive increase in domestic air travel, with over 50 million passengers. Additionally, the Indonesian government aims to increase the country's aviation capacity by 2024, further boosting demand for landing gear systems.

- The island of Java dominates the Indonesia Landing Gear Market, accounting for over one third of the market share in 2023. This dominance is due to the presence of major airports and aerospace manufacturing hubs in cities like Jakarta and Surabaya. Java’s well-developed infrastructure and strategic location make it a central hub for the aviation industry in Indonesia.

Indonesia Landing Gear Market Segmentation

By Product Type: Indonesia Landing Gear Market is segmented by product type into main landing gear, nose landing gear, and tail landing gear. In 2023, main landing gear held the dominant market share due to its crucial role in aircraft operations and higher production volume compared to other types. Main landing gear is essential for the stability and safety of aircraft during landing and takeoff, making it a critical component in the aviation industry.

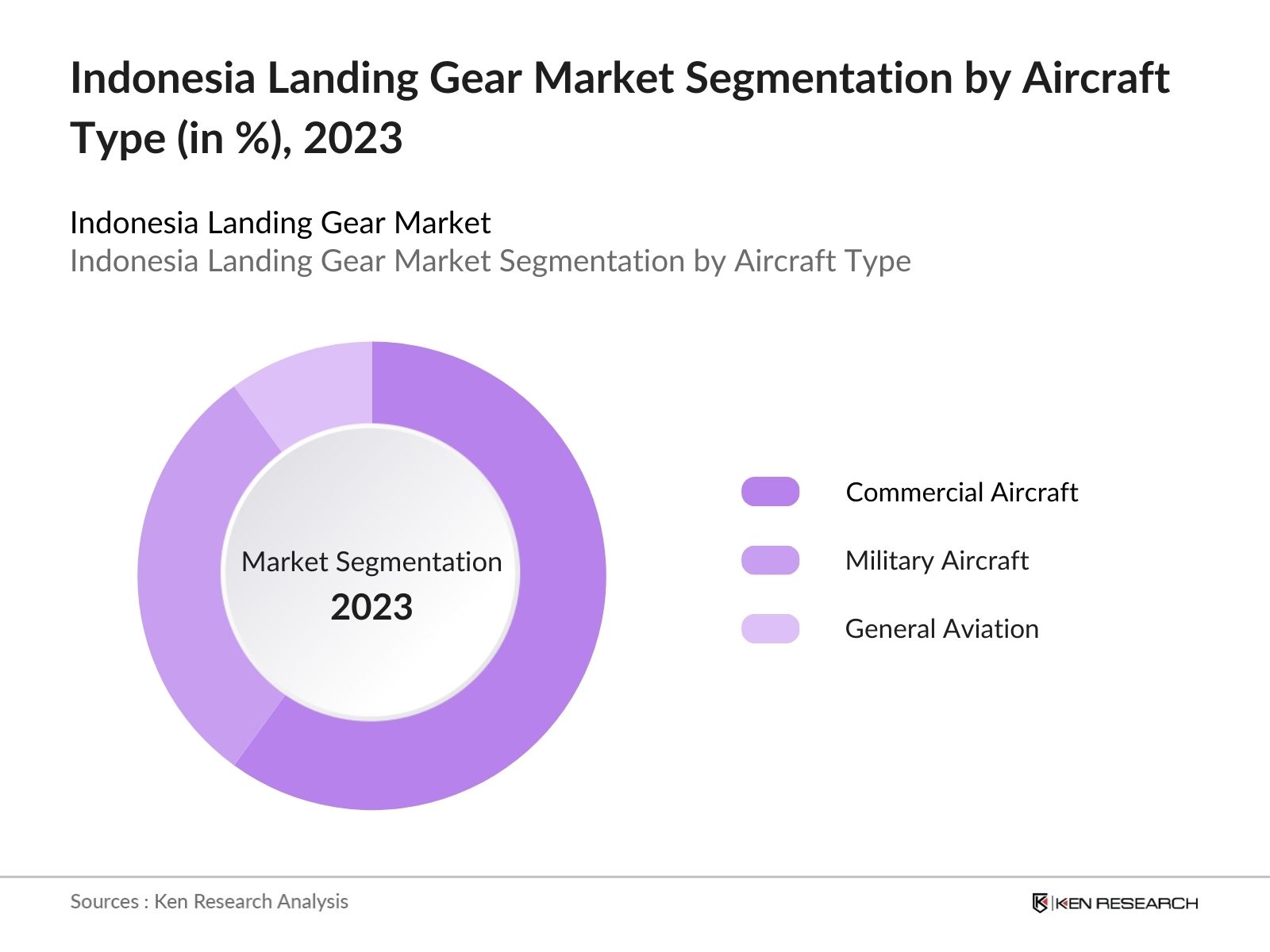

By Aircraft Type: The market is also segmented by aircraft type into commercial aircraft, military aircraft, and general aviation. In 2023, commercial aircraft held the largest market share, driven by the rapid growth of low-cost carriers and the increase in air travel demand. The expansion of airline fleets and the introduction of new routes have contributed significantly to the dominance of this segment.

By Region: The Indonesia Landing Gear Market is segmented by region into North, South, East, and West Indonesia. In 2023, the West region held the dominant market share due to its advanced infrastructure and concentration of aerospace manufacturing activities. The region's strategic location and well-developed transportation networks make it an ideal hub for the aviation industry.

Indonesia Landing Gear Market Competitive Landscape

|

Company Name |

Establishment Year |

Headquarters |

|

Collins Aerospace |

2018 |

West Java, Indonesia |

|

Safran Landing Systems |

2019 |

Jakarta, Indonesia |

|

Liebherr-Aerospace |

2020 |

Surabaya, Indonesia |

|

Heroux-Devtek |

2017 |

Bandung, Indonesia |

|

CIRCOR Aerospace |

2019 |

Medan, Indonesia |

- Collins Aerospace Expansion: Collins Aerospace's expertise and leadership in avionics upgrades for C-130 military transport aircraft used by the Indonesian Air Force. They also have several collaborations and agreements between Collins Aerospace and Indonesian companies like PT Dirgantara Indonesia (PTDI) and GMF AeroAsia.

- Liebherr-Aerospace Partnership: In 2023, Liebherr-Aerospace announced a partnership with Garuda Indonesia to supply advanced landing gear systems for their new fleet of aircraft. At the 2015 Paris Air Show, Garuda Indonesia has committed to purchase 50 Boeing 77 Max, 8 aircraft. This deal strengthens Liebherr-Aerospace's presence in the Southeast Asian market and supports Garuda Indonesia's fleet expansion plans.

- CIRCOR Aerospace: Circor and their distribution partner provide Indonesia’s first super-critical power plant with a complete sump pump package. The installation was delivered on time and within budget, with CIRCOR providing the pumps and start-up. The customer was so impressed by the project management, delivery, pricing and scope of supply provided by CIRCOR and BCU that he increased the order quantity from eight to fifteen pumps.

Indonesia Landing Gear Industry Analysis

Indonesia Landing Gear Market Growth Drivers

- Rising Aerospace Manufacturing Investments: Indonesia's aerospace industry, including the Maintenance, Repair, and Operations (MRO) sector, has been identified as one of the sectors with significant potential for economic growth. It has recorded $44 billion in combined domestic and foreign investments in the first half of 2023, with aviation transportation included. This substantial investment also positively impacts the landing gear market in Indonesia, as increased activity in the aerospace and MRO sectors drives demand for high-quality, reliable landing gear components.

- Technological Advancements in Landing Gear Systems: The integration of advanced materials and technologies, such as composite materials and real-time monitoring sensors, has significantly improved the efficiency and reliability of landing gear systems. Indonesia's aerospace sector is investing heavily in research and development to enhance the performance and safety of landing gear, driving Indonesia’s Landing Gear market growth.

- Expansion of Low-Cost Carriers: The growth of low-cost carriers (LCCs) in Indonesia has fueled the demand for new aircraft and, consequently, landing gear systems. In 2023, LCCs accounted for over 60 million passenger bookings, and this number is projected to grow further as new routes and services are introduced. The expansion of LCCs directly contributes to the increased demand for landing gear systems.

Indonesia Landing Gear Market Challenges

- High Cost of Raw Materials: The aviation industry faces challenges due to the high cost of raw materials used in landing gear production. In 2023, the price of titanium, a critical component, rose over USD 5,500 per metric ton. This increase has led to higher production costs, impacting the profitability of landing gear manufacturers.

- Supply Chain Disruptions: Supply chain disruptions have posed significant challenges to the landing gear market. In 2023, global supply chain issues resulted in delays and shortages of essential components, leading to production setbacks. These disruptions have affected the timely delivery of landing gear systems to aircraft manufacturers and operators.

- Environmental Concerns: Indonesia has ratified the Paris Agreement to the United Nations Framework Convention on Climate Change through Law No. 16 of 2016 on the Ratification of Paris Agreement to the United Nations Framework Convention on Climate Change. Compliance with these regulations requires significant investments in sustainable practices, posing challenges for manufacturers.

Indonesia Landing Gear Market Government Initiatives

- Aviation Infrastructure Enhancement Program: In 2023, the Indonesian government launched the "Aviation Infrastructure Enhancement Program" This year, the Transportation Ministry through the Air Transportation Directorate General is preparing a budget of Rp1.22 trillion to build seven new airports to improve interregional connectivity.

- Local Manufacturing Promotion: The Indonesian government has introduced policies to promote local manufacturing of aerospace components, one of them include mandating more domestic processing and manufacturing to create a requirement for large, manpower-intensive facilities in remote areas, which aligns with the capabilities of the domestically-produced N219 turboprop aircraft.

- Public-Private Partnerships: The Indonesian government established public-private partnerships (PPPs) to accelerate the development of aerospace infrastructure and manufacturing capabilities. It has approved the Greater Bandung Light Rail Transit (LRT) project to be developed through a public-private partnership scheme. JERA and PLN are partnering to develop LNG infrastructure in Indonesia.

Indonesia Landing Gear Market Future Outlook

The Indonesia Landing Gear Market is projected to show continuous growth trajectory. The future growth will be driven by continuous advancements in landing gear technology, increased investments in aerospace infrastructure, and the expansion of low-cost carriers in Indonesia.

Future Trends

- Adoption of Smart Landing Gear Systems: Integration of artificial intelligence: AI applications in landing gear systems will contribute to predictive analytics, fault diagnosis, and optimization of performance, ensuring operational reliability This will enhance safety and reduce maintenance costs, driven by investments in advanced technologies, therefore making a buzz in Indonesia landing gear market.

- Growth in Electric Aircraft: The development and adoption of electric aircraft will drive demand for innovative landing gear solutions. By 2028, Indonesia is expected to have a significant fleet of electric aircraft, necessitating landing gear systems designed specifically for these aircraft. The market for electric aircraft landing gear systems is anticipated to touch the growth pitch extensively.

- Expansion of Low-Cost Carriers: The expansion of low-cost carriers (LCCs) in Indonesia will continue to fuel the demand for new aircraft and landing gear systems. By 2028, LCCs are projected to account for over 100 million passenger bookings, significantly contributing to the growth of the landing gear market.

Scope of the Report

|

By Product Type |

Main Landing Gear Tail Landing Gear Nose Landing Gear |

|

By Aircraft Type |

Commercial Aircraft Military Aircraft General Aircraft |

|

By Region |

North South East West |

Products

Key Target Audience – Organizations and Entities Who Can Benefit by Subscribing This Report:

Aircraft Manufacturers

Aviation Maintenance, Repair, and Overhaul (MRO) Companies

Aerospace Component Suppliers

Airlines and Charter Services

Aerospace Engineering Firms

Banking and Financial Institutions

Investors & VC Firms

Ministry of Transportation (Kementerian Perhubungan)

Directorate General of Civil Aviation (Direktorat Jenderal Perhubungan Udara)

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report:Â

Collins Aerospace

Safran Landing Systems

Liebherr-Aerospace

Heroux-Devtek

CIRCOR Aerospace

AAR Corporation

Parker Hannifin Corporation

Crane Aerospace & Electronics

Magellan Aerospace

Triumph Group

UTC Aerospace Systems

Eaton Corporation

Honeywell International Inc.

GKN Aerospace

BAE Systems

Table of Contents

1. Indonesia Landing Gear Market Overview

1.1 Indonesia Landing Gear Market Taxonomy

2. Indonesia Landing Gear Market Size (in USD Bn), 2018-2023

3. Indonesia Landing Gear Market Analysis

3.1 Indonesia Landing Gear Market Growth Drivers

3.2 Indonesia Landing Gear Market Challenges and Issues

3.3 Indonesia Landing Gear Market Trends and Development

3.4 Indonesia Landing Gear Market Government Regulation

3.5 Indonesia Landing Gear Market SWOT Analysis

3.6 Indonesia Landing Gear Market Stake Ecosystem

3.7 Indonesia Landing Gear Market Competition Ecosystem

4. Indonesia Landing Gear Market Segmentation, 2023

4.1 Indonesia Landing Gear Market Segmentation by Product Type (in value %), 2023

4.2 Indonesia Landing Gear Market Segmentation by Aircraft Type (in value %), 2023

4.3 Indonesia Landing Gear Market Segmentation by Region (in value %), 2023

5. Indonesia Landing Gear Market Competition Benchmarking

5.1 Indonesia Landing Gear Market Cross-Comparison (no. of employees, company overview, business strategy, USP, recent development, operational parameters, financial parameters and advanced analytics)

6. Indonesia Landing Gear Future Market Size (in USD Bn), 2023-2028

7. Indonesia Landing Gear Future Market Segmentation, 2028

7.1 Indonesia Landing Gear Market Segmentation by Product Type (in value %), 2028

7.2 Indonesia Landing Gear Market Segmentation by Aircraft Type (in value %), 2028

7.3 Indonesia Landing Gear Market Segmentation by Region (in value %), 2028

8. Indonesia Landing Gear Market Analysts’ Recommendations

8.1 Indonesia Landing Gear Market TAM/SAM/SOM Analysis

8.2 Indonesia Landing Gear Market Customer Cohort Analysis

8.3 Indonesia Landing Gear Market Marketing Initiatives

8.4 Indonesia Landing Gear Market White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1 Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.Â

Step 2 Market Building:

Collating statistics on Indonesia landing gear market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for Indonesia landing gear industry. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.Â

Step 3 Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.Â

Step 4 Research output:

Our team will approach multiple smart refrigerator companies and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from aircraft landing gear companies.

Frequently Asked Questions

01 How big is Indonesia Landing Gear Market?

The Indonesia landing gear market has experienced notable growth, this is reflected by Global landing gear market reaching a valuation of USD 7.3 billion in 2023. The growth in its market size is driven by the increase in air travel and the expansion of both commercial and military aircraft fleets.

02 What are the growth drivers of the Indonesia Landing Gear Market?

Key growth drivers in the Indonesia landing gear market include the increase in air traffic, substantial investments in aerospace manufacturing, advancements in landing gear technology, and the rapid expansion of low-cost carriers.

03 What are challenges faced by Indonesia Landing Gear Market?

Challenges in the Indonesia landing gear market include high costs of raw materials like titanium, supply chain disruptions causing delays and shortages, stringent regulatory compliance requirements introduced by the Directorate General of Civil Aviation, and the need to adhere to new environmental regulations focusing on sustainability.

04 Who are the major players in the Indonesia Landing Gear Market?

Major players in the Indonesia landing gear market include Collins Aerospace, Safran Landing Systems, Liebherr-Aerospace, Heroux-Devtek, and CIRCOR Aerospace. These companies lead the market through advanced technological capabilities, significant investments, and strategic partnerships with key aircraft manufacturers in the region.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.