Indonesia Life Insurance Market Outlook to 2030

Region:Asia

Author(s):Shreya Garg

Product Code:KROD5393

December 2024

92

About the Report

Indonesia Life Insurance Market Overview

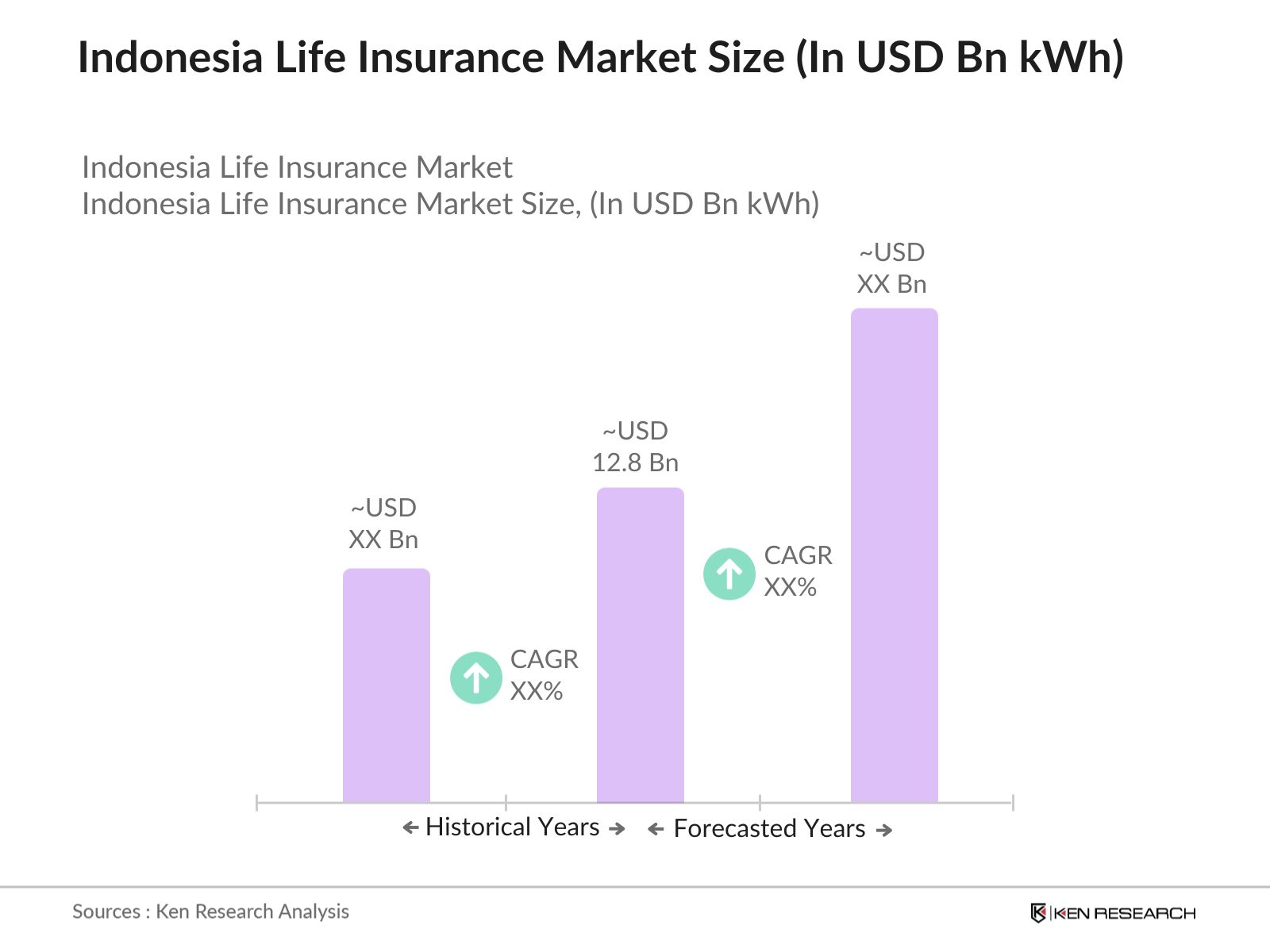

- The Indonesia life insurance market is valued at USD 12.8 billion, based on a five-year historical analysis. The market has been driven by increasing awareness of financial security among Indonesias growing middle-class population, coupled with favorable government policies promoting life insurance. The rise in the availability of digital platforms, facilitating easy access to policies, and the increased penetration of bancassurance, have further fueled market expansion.

- Jakarta, Bandung, and Surabaya dominate the life insurance market in Indonesia, primarily due to their large populations, higher income levels, and increasing urbanization. These cities serve as the economic hubs of Indonesia, which allows greater access to life insurance products through widespread financial institutions and insurance agents. The growing financial literacy in these regions also contributes to their dominance.

- The OJK plays a pivotal role in regulating Indonesias life insurance market. In 2023, new regulations were introduced to improve consumer protection and increase transparency within the insurance industry. These regulations include stricter guidelines for policy disclosures, helping to build consumer trust and encouraging greater insurance uptake. OJKs oversight has been crucial in stabilizing the market, ensuring that life insurance companies operate with financial integrity and meet consumer protection standards. These regulations have also facilitated the expansion of digital insurance platforms by establishing clear compliance frameworks.

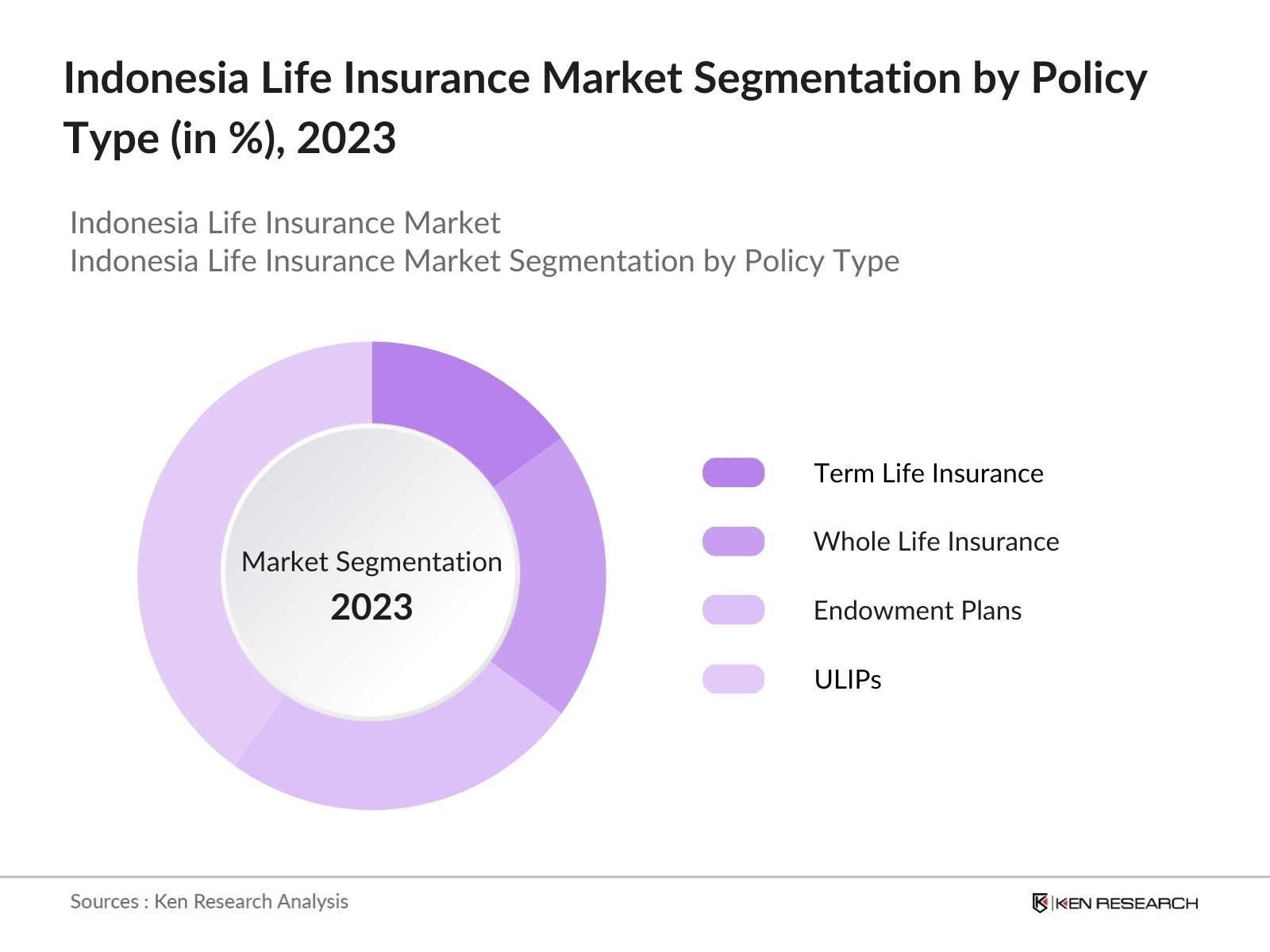

Indonesia Life Insurance Market Segmentation

By Policy Type: The market is segmented by policy type into term life insurance, whole life insurance, endowment plans, and unit-linked insurance plans (ULIPs). Recently, ULIPs have dominated the market share under this segmentation due to their dual benefit of insurance and investment, which appeals to Indonesias rising middle class. ULIPs allow policyholders to invest in equity or debt markets while securing life coverage, making them attractive for individuals seeking both growth and protection.

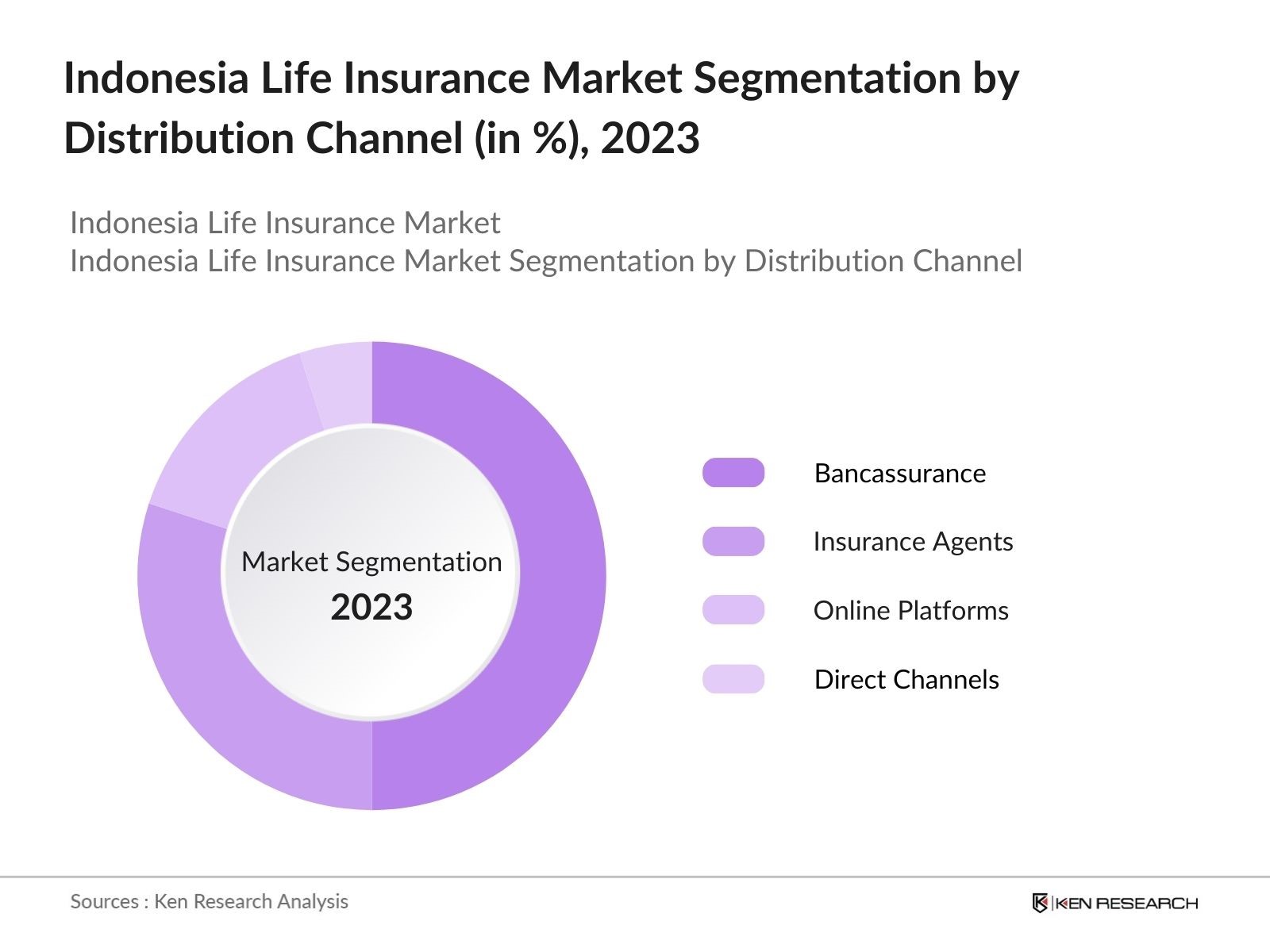

By Distribution Channel: The market is also segmented by distribution channels, including bancassurance, insurance agents, online platforms, and direct channels. Bancassurance leads the distribution channels in terms of market share. Its dominance is due to the established partnerships between leading banks and insurance companies, offering a seamless experience for customers. The convenience of purchasing insurance products directly through trusted financial institutions drives its popularity.

Indonesia Life Insurance Market Competitive Landscape

The Indonesia life insurance market is dominated by a combination of local and international players, reflecting consolidation among key companies. Major players such as Prudential Indonesia and AIA Financial Indonesia benefit from established brand recognition and robust product portfolios. The entry of digital insurance providers is also shaping the competitive landscape.

Table: Major Players in Indonesia Life Insurance Market

|

Company Name |

Establishment Year |

Headquarters |

Policy Offerings |

Claim Settlement Ratio |

Customer Satisfaction |

Digitalization Level |

Market Share |

Revenue Growth |

New Product Launches |

|

Prudential Indonesia |

1995 |

Jakarta |

|||||||

|

Allianz Indonesia |

1981 |

Jakarta |

|||||||

|

Manulife Indonesia |

1985 |

Jakarta |

|||||||

|

BNI Life Insurance |

1997 |

Jakarta |

|||||||

|

Sinarmas MSIG Life |

1984 |

Jakarta |

Indonesia Life Insurance Industry Analysis

Growth Drivers

- Increase in Financial Literacy: The Indonesian government has ramped up efforts to improve financial literacy, aiming for 90 million individuals to have access to financial education by 2024. This focus on literacy has resulted in an increase in insurance penetration, as more individuals understand the importance of life insurance. OJK (Financial Services Authority) programs have been instrumental in this, significantly raising public awareness of insurance benefits. This heightened awareness has directly impacted life insurance subscriptions, especially among urban populations who are now better equipped to make informed financial decisions.

- Government Regulations Promoting Insurance Penetration: The Indonesian government, through OJK, has introduced regulations designed to expand insurance penetration across the country. Key regulations, including compulsory health insurance programs and initiatives that make insurance coverage easier for low-income groups, are propelling the life insurance market. In 2023, OJK reported a significant increase in insurance policyholders, especially within urban regions, due to more simplified regulatory frameworks. These regulations have not only supported life insurance growth but also improved market transparency and consumer trust, ensuring a broader reach of insurance products.

- Expansion of Digital Insurance Platforms: Digitalization is transforming Indonesias life insurance landscape. By 2023, over 180 million internet users were present in the country, a key driver behind the growth of digital insurance platforms. Insurers are leveraging mobile apps and online platforms to reach tech-savvy consumers, allowing for easier policy management, faster claims processing, and broader product accessibility. Digital insurance platforms have seen a notable increase in subscriptions, as consumers shift toward more convenient digital channels. The Indonesian government has also supported this transformation by promoting digital infrastructure improvements in the financial sector.

Market Challenges

- Low Awareness in Rural Areas: Despite progress in financial literacy, a large portion of Indonesias rural population remains unaware of life insurance benefits. In 2023, rural communities accounted for over 43% of the countrys population, with a significant gap in insurance awareness between urban and rural areas. Government data shows that only a small fraction of rural households hold life insurance policies, primarily due to limited access to financial education and insurance products. Addressing this challenge is crucial for the continued growth of the market, particularly as rural areas represent untapped potential for insurers.

- Complex Policy Structures: Many Indonesian consumers are deterred by the complexity of life insurance policies. The OJK has identified that consumers struggle to understand policy terms, contributing to low uptake rates. In 2023, a survey by the Financial Services Authority revealed that over 40% of respondents found life insurance policies too difficult to comprehend, which has slowed market expansion. The need for more straightforward, transparent, and consumer-friendly insurance products is evident, particularly as the industry seeks to attract more first-time policyholders.

Indonesia Life Insurance Market Future Outlook

Over the next five years, the Indonesia life insurance market is poised for substantial growth, driven by the rising demand for financial protection and investment products among the middle class. The increased adoption of digital insurance platforms, along with supportive government policies, will further accelerate market growth. The evolving distribution landscape, especially in rural areas, presents a significant opportunity for expansion. The growing integration of AI and data analytics in insurance processes will enhance the customer experience and lead to more customized policies.

Future Market Opportunities

- Growth of Takaful Insurance: The Takaful insurance segment is experiencing rapid growth in Indonesia, with a significant portion of the population, approximately 229 million Muslims in 2023, seeking Sharia-compliant financial products. Takaful life insurance policies are increasingly popular, catering to a market that prefers financial services aligned with Islamic principles. The market has seen substantial growth due to increased awareness and government support promoting Islamic finance. This segment represents a major opportunity for insurers, as Takaful continues to capture a growing share of Indonesias life insurance market.

- Partnerships with Tech Startups for Digital Solutions: Partnerships between traditional insurers and tech startups are opening new avenues for growth in Indonesia's life insurance market. In 2023, the country saw over 2,300 fintech startups, many of which are focused on digital insurance solutions. Collaborations between these startups and established insurers are enabling innovative product offerings, streamlined customer experiences, and greater accessibility to insurance products. These partnerships are crucial for expanding market reach, particularly in underserved areas, and leveraging Indonesias rapidly growing digital economy to drive insurance adoption.

Scope of the Report

|

By Policy Type |

Term Life Insurance Whole Life Insurance Endowment Plans ULIPs |

|

By Distribution Channel |

Bancassurance Insurance Agents Online Platforms Direct Channels |

|

By End-User Demographics |

Millennials Working Professionals Senior Citizens |

|

By Region |

Java Sumatra Kalimantan Sulawesi |

|

By Premium Type |

Single Premium Regular Premium |

Products

Key Target Audience

Life Insurance Providers

Bancassurance Partners

Digital Insurance Platforms

Policyholders (Working Professionals, Millennials, Senior Citizens)

Takaful Operators

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (OJK - Financial Services Authority)

Financial Institutions (Banks, Credit Unions)

Companies

Major Players

Prudential Indonesia

AIA Financial Indonesia

Allianz Indonesia

Manulife Indonesia

Sinarmas MSIG Life

AXA Mandiri

BNI Life Insurance

Jiwasraya

Panin Dai-ichi Life

Zurich Topas Life

Generali Indonesia

FWD Life Indonesia

Sequis Life

BRI Life

Tokio Marine Indonesia

Table of Contents

1. Indonesia Life Insurance Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Indonesia Life Insurance Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Indonesia Life Insurance Market Analysis

3.1. Growth Drivers

3.1.1. Rising Middle-Class Population

3.1.2. Increase in Financial Literacy

3.1.3. Government Regulations Promoting Insurance Penetration

3.1.4. Expansion of Digital Insurance Platforms

3.2. Market Challenges

3.2.1. Low Awareness in Rural Areas

3.2.2. Complex Policy Structures

3.2.3. Limited Distribution Channels

3.3. Opportunities

3.3.1. Growth of Takaful Insurance

3.3.2. Partnerships with Tech Startups for Digital Solutions

3.3.3. Penetration into Untapped Regions

3.4. Trends

3.4.1. Integration of AI and Data Analytics in Underwriting

3.4.2. Customizable Life Insurance Plans

3.4.3. Rise in Direct-to-Consumer Models

3.5. Government Regulation

3.5.1. OJK (Financial Services Authority) Regulations

3.5.2. Mandatory Health Insurance Programs

3.5.3. Initiatives to Increase Insurance Literacy

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. Indonesia Life Insurance Market Segmentation

4.1. By Policy Type (In Value %)

4.1.1. Term Life Insurance

4.1.2. Whole Life Insurance

4.1.3. Endowment Plans

4.1.4. Unit-linked Insurance Plans (ULIPs)

4.2. By Distribution Channel (In Value %)

4.2.1. Bancassurance

4.2.2. Insurance Agents

4.2.3. Online Platforms

4.2.4. Direct Channels

4.3. By End-User Demographics (In Value %)

4.3.1. Millennials

4.3.2. Working Professionals

4.3.3. Senior Citizens

4.4. By Region (In Value %)

4.4.1. Java

4.4.2. Sumatra

4.4.3. Kalimantan

4.4.4. Sulawesi

4.5. By Premium Type (In Value %)

4.5.1. Single Premium

4.5.2. Regular Premium

5. Indonesia Life Insurance Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Prudential Indonesia

5.1.2. Manulife Indonesia

5.1.3. AIA Financial Indonesia

5.1.4. Allianz Indonesia

5.1.5. AXA Mandiri

5.1.6. Generali Indonesia

5.1.7. FWD Life Indonesia

5.1.8. Sinarmas MSIG Life

5.1.9. Tokio Marine Indonesia

5.1.10. BNI Life Insurance

5.1.11. Jiwasraya

5.1.12. Panin Dai-ichi Life

5.1.13. BRI Life

5.1.14. Zurich Topas Life

5.1.15. Sequis Life

5.2. Cross Comparison Parameters (Policy Offerings, Claim Settlement Ratio, Customer Satisfaction, Distribution Channels, Digitalization Level, Market Share, Revenue Growth, New Product Launches)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Indonesia Life Insurance Market Regulatory Framework

6.1. OJK Guidelines

6.2. Licensing and Compliance Requirements

6.3. Certification Processes

7. Indonesia Life Insurance Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Indonesia Life Insurance Market Analysts Recommendations

8.1. TAM/SAM/SOM Analysis

8.2. Customer Cohort Analysis

8.3. Marketing Initiatives

8.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

This phase involved creating a stakeholder ecosystem map of the Indonesia life insurance market. Desk research was conducted using secondary databases to collect market information. The goal was to identify key market drivers such as government regulations, policy types, and distribution channels.

Step 2: Market Analysis and Construction

Historical data on market penetration, growth trends, and distribution networks were analyzed to understand the revenue generation of Indonesias life insurance market. Service quality indicators were also examined to ensure accurate revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Consultations with industry experts were conducted via computer-assisted telephone interviews (CATIs) to validate market hypotheses. This provided insights into market trends and key operational challenges faced by industry players.

Step 4: Research Synthesis and Final Output

The final phase involved gathering data from insurance providers and bancassurance partners to validate market share estimates and future growth potential. This synthesis ensured a comprehensive understanding of the market dynamics.

Frequently Asked Questions

01. How big is Indonesia Life Insurance Market?

The Indonesia life insurance market is valued at USD 12.8 billion, driven by increasing consumer awareness of financial protection and the rise of digital insurance platforms.

02. What are the challenges in Indonesia Life Insurance Market?

Challenges in Indonesia life insurance market include low insurance penetration in rural areas, regulatory complexities, and a lack of financial literacy among some segments of the population.

03. Who are the major players in the Indonesia Life Insurance Market?

Key players in the Indonesia life insurance market include Prudential Indonesia, AIA Financial Indonesia, Allianz Indonesia, Manulife Indonesia, and Sinarmas MSIG Life.

04. What are the growth drivers of Indonesia Life Insurance Market?

The Indonesia life insurance market is driven by the expansion of bancassurance, increasing financial literacy, and rising demand for customized insurance products. Sharia-compliant Takaful insurance is also contributing to growth.

05. What trends are shaping the Indonesia Life Insurance Market?

The integration of AI in underwriting processes, the rise of direct-to-consumer models, and increased demand for ULIPs (unit-linked insurance plans) are shaping the Indonesia life insurance market.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.