Indonesia Liquified Petroleum Gas Market Outlook to 2030

Region:Asia

Author(s):Paribhasha Tiwari

Product Code:KROD7225

December 2024

95

About the Report

Indonesia Liquified Petroleum Gas Market Overview

- The Indonesia Liquefied Petroleum Gas (LPG) market, valued at USD 12.5 billion, is primarily driven by the government's subsidies promoting LPG as a household cooking fuel. This initiative has significantly increased domestic consumption, positioning LPG as a cleaner alternative to traditional biomass fuels.

- Java and Sumatra are the dominant regions in Indonesia's LPG market. Their dominance is attributed to high population densities, rapid urbanization, and well-established distribution infrastructures, which facilitate efficient LPG supply and consumption.

- By 2029, the LPG market is expected to see widespread integration of smart technology in residential and commercial applications. Connected LPG systems that monitor consumption and optimize usage patterns are projected to serve over 15 million households worldwide, offering enhanced convenience and energy efficiency.

Indonesia Liquified Petroleum Gas Market Segmentation

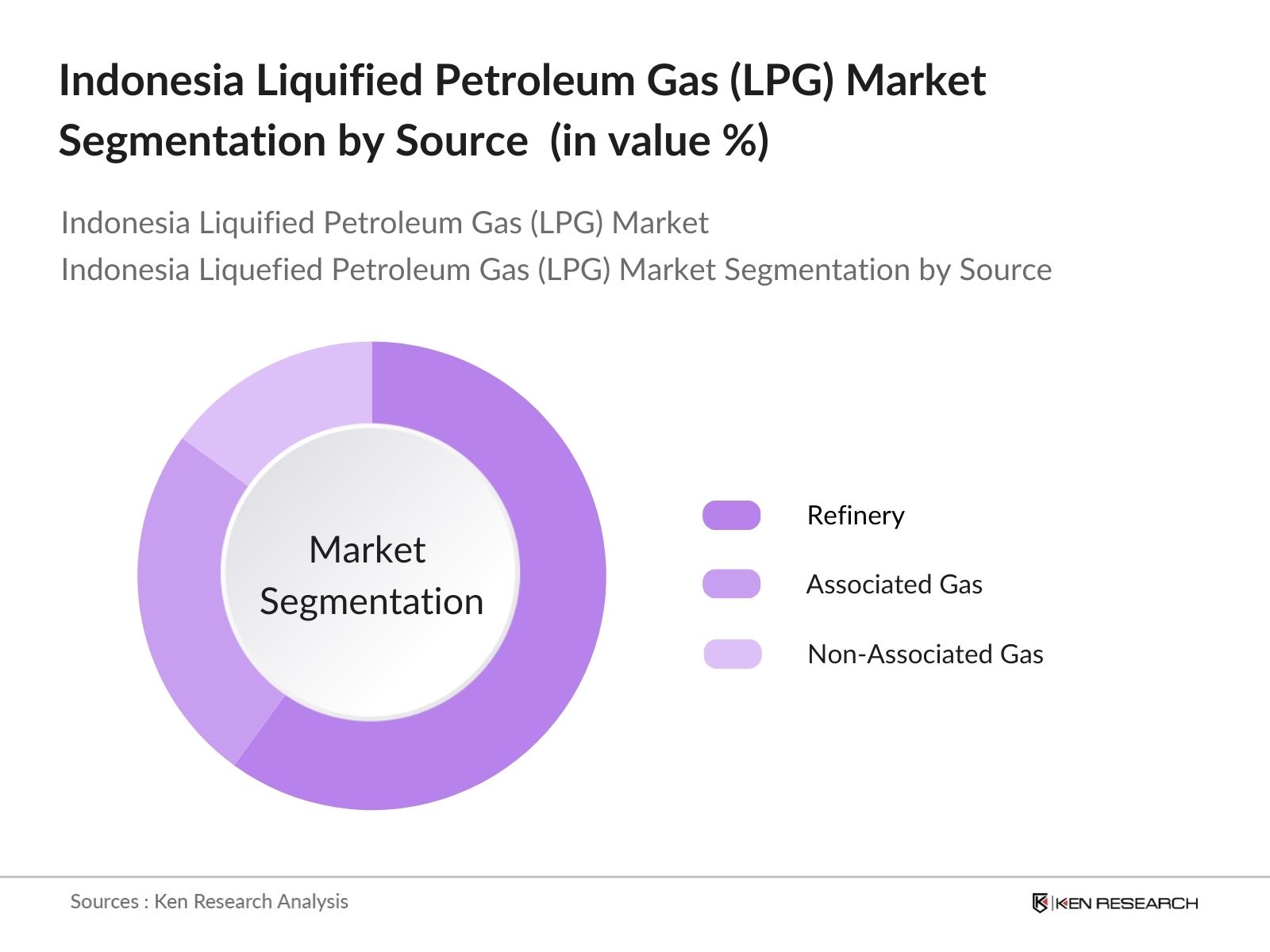

By Source: Indonesia's LPG market is segmented by source into refinery, associated gas, and non-associated gas. The refinery segment holds a dominant market share due to the country's extensive oil refining capacity, which produces significant quantities of LPG as a byproduct. This abundance ensures a steady supply to meet domestic demand.

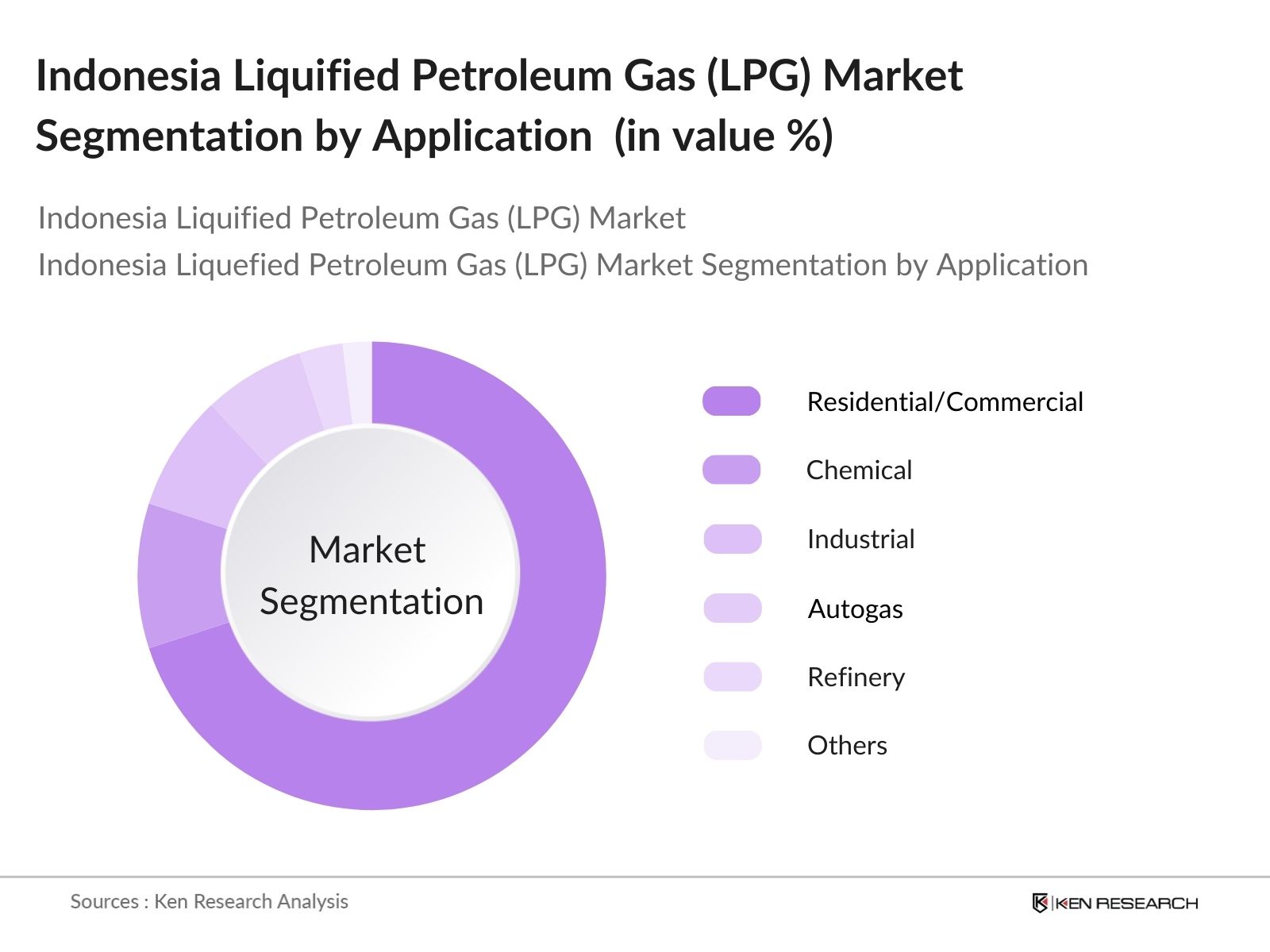

By Application: The market is further segmented by application into residential/commercial, chemical, industrial, autogas, refinery, and others. The residential/commercial segment leads the market, driven by widespread use of LPG for cooking and heating in households and businesses. Government subsidies and initiatives promoting LPG over traditional fuels have bolstered this segment's growth.

Indonesia Liquified Petroleum Gas Market Competitive Landscape

The Indonesian LPG market is characterized by a mix of state-owned enterprises and international oil companies. Pertamina, the state-owned oil and gas company, plays a pivotal role in production and distribution. International players like TotalEnergies and Shell Indonesia also contribute significantly, leveraging their global expertise and resources.

Indonesia Liquified Petroleum Gas Market Analysis

Growth Drivers

- Government Subsidies for Household LPG Usage: In 2024, governments worldwide are incentivizing the use of LPG in households by providing substantial subsidies. For example, India allocated over 100 billion rupees to promote clean cooking fuels, aiming to reach more than 85 million households by 2025. These initiatives drive higher LPG demand as consumers benefit from affordable access to cleaner energy sources, particularly in low-income communities, encouraging a shift from traditional biomass fuels.

- Expansion of Petrochemical Industries: With significant investments in petrochemical infrastructure, major economies such as the United States and China are increasing demand for LPG as a feedstock. In China alone, petrochemical companies are anticipated to consume over 25 million tons of LPG annually, driven by growth in manufacturing outputs and rising production of plastics and synthetic materials. This demand is expected to rise consistently, enhancing LPG market stability.

- Shift Towards Cleaner Energy Sources: In 2024, several governments are enforcing stricter environmental regulations to reduce carbon emissions, resulting in a preference for LPG over other fossil fuels. For instance, Japan has mandated LPG adoption in various industrial applications, leading to projected additional annual demand of nearly 7 million tons in the next two years. The cleaner combustion profile of LPG also aligns with global sustainability targets, which boosts its appeal across sectors.

Market Challenges

- Infrastructure Limitations in Distribution: Despite increasing demand, many developing regions lack the necessary infrastructure to support consistent LPG distribution. In Africa, for example, over 50% of rural communities face LPG shortages due to inadequate storage and transportation networks, limiting the markets growth potential. Investment in infrastructure remains crucial to unlocking demand in underserved areas.

- Competition from Alternative Energy Sources: The adoption of renewable energy sources, such as solar and wind, challenges the LPG market. In 2024, renewable energy installations globally reached over 290 gigawatts, reducing dependence on fossil fuels, including LPG. Countries like Germany are intensifying renewable energy targets, affecting LPG's market share as cleaner and lower-cost alternatives become available.

Indonesia Liquified Petroleum Gas Market Future Outlook

Over the next five years, Indonesia's LPG market is expected to experience steady growth, driven by ongoing government support, infrastructure development, and increasing consumer demand for cleaner energy sources. The government's plans to boost domestic LPG production by approximately 1 million metric tons annually aim to reduce reliance on imports and achieve energy self-sufficiency.

Market Opportunities

- Technological Advancements in LPG Applications: Recent innovations in LPG-powered technology have expanded its utility across industries. Advanced LPG-powered machinery in the agriculture sector is estimated to increase crop yields by up to 20% through efficient energy use. This technological expansion creates opportunities for LPG providers to tap into new industry segments with tailored solutions.

- Expansion into Rural and Underserved Areas: Governments and private players are investing heavily in LPG distribution to reach remote areas. For example, in 2024, India allocated resources to bring LPG to 12,000 rural villages, providing access to millions of households. The strategic expansion into underserved regions is projected to grow overall LPG demand and improve energy accessibility.

Scope of the Report

|

By Source |

Refinery |

|

By Application |

Residential/Commercial |

|

By Distribution Channel |

Direct/Institutional Sales |

|

By Region |

Java |

Products

Key Target Audience

LPG Distributors and Retailers

Industrial LPG Consumers

Residential and Commercial LPG Users

Automotive Industry Stakeholders

Environmental and Sustainability Organizations

Infrastructure Development Companies

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., Ministry of Energy and Mineral Resources)

Companies

Players Mentioned in the Report:

Pertamina

TotalEnergies

Shell Indonesia

ExxonMobil Indonesia

BP Indonesia

Petronas

Medco Energi

Chevron Indonesia

ConocoPhillips Indonesia

Eni Indonesia

Table of Contents

1. Indonesia Liquified Petroleum Gas Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. Indonesia Liquified Petroleum Gas Market Size (in USD Billion)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. Indonesia Liquified Petroleum Gas Market Analysis

3.1 Growth Drivers

3.1.1 Government Subsidies for Household LPG Usage

3.1.2 Expansion of Petrochemical Industries

3.1.3 Rising Urbanization and Disposable Incomes

3.1.4 Shift Towards Cleaner Energy Sources

3.2 Market Challenges

3.2.1 Infrastructure Limitations in Distribution

3.2.2 Competition from Alternative Energy Sources

3.2.3 Price Volatility in Global LPG Markets

3.3 Opportunities

3.3.1 Technological Advancements in LPG Applications

3.3.2 Expansion into Rural and Underserved Areas

3.3.3 Potential for Export Growth

3.4 Trends

3.4.1 Adoption of LPG in Automotive Sector

3.4.2 Integration with Smart Energy Solutions

3.4.3 Development of Small-Scale LPG Distribution Models

3.5 Government Regulations

3.5.1 National Energy Policy on LPG Usage

3.5.2 Subsidy Programs and Their Impact

3.5.3 Safety and Environmental Standards

3.5.4 Public-Private Partnerships in Energy Sector

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porter's Five Forces Analysis

3.9 Competitive Landscape

4. Indonesia Liquified Petroleum Gas Market Segmentation

4.1 By Source (in Value %)

4.1.1 Refinery

4.1.2 Associated Gas

4.1.3 Non-Associated Gas

4.2 By Application (in Value %)

4.2.1 Residential/Commercial

4.2.2 Chemical

4.2.3 Industrial

4.2.4 Autogas

4.2.5 Refinery

4.2.6 Others

4.3 By Distribution Channel (in Value %)

4.3.1 Direct/Institutional Sales

4.3.2 Retail Sales

4.3.3 Other Channel Sales

4.4 By Region (in Value %)

4.4.1 Java

4.4.2 Sumatra

4.4.3 Kalimantan

4.4.4 Sulawesi

4.4.5 Papua

5. Indonesia Liquified Petroleum Gas Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Pertamina

5.1.2 TotalEnergies

5.1.3 Shell Indonesia

5.1.4 ExxonMobil Indonesia

5.1.5 BP Indonesia

5.1.6 Petronas

5.1.7 Medco Energi

5.1.8 Chevron Indonesia

5.1.9 ConocoPhillips Indonesia

5.1.10 Eni Indonesia

5.1.11 Repsol Indonesia

5.1.12 Mubadala Petroleum

5.1.13 Santos Indonesia

5.1.14 Husky-CNOOC Madura Limited

5.1.15 Premier Oil Indonesia

5.2 Cross Comparison Parameters

5.2.1 Number of Employees

5.2.2 Headquarters Location

5.2.3 Year of Establishment

5.2.4 Revenue

5.2.5 Market Share

5.2.6 Product Portfolio

5.2.7 Regional Presence

5.2.8 Strategic Initiatives

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. Indonesia Liquified Petroleum Gas Market Regulatory Framework

6.1 Environmental Standards

6.2 Compliance Requirements

6.3 Certification Processes

7. Indonesia Liquified Petroleum Gas Future Market Size (in USD Billion)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8.Indonesia Liquified Petroleum Gas Future Market Segmentation

8.1 By Source (in Value %)

8.2 By Application (in Value %)

8.3 By Distribution Channel (in Value %)

8.4 By Region (in Value %)

9. Indonesia Liquified Petroleum Gas Market Analysts Recommendations

9.1 Total Addressable Market (TAM), Serviceable Available Market (SAM), and Serviceable Obtainable Market (SOM) Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Indonesia LPG Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the Indonesia LPG Market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics is conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations provide valuable operational and financial insights directly from industry practitioners, which are instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple LPG producers and distributors to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction serves to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the Indonesia LPG market.

Frequently Asked Questions

01. How big is the Indonesia LPG Market?

The Indonesia LPG market is valued at USD 12.5 billion, driven by government subsidies that promote LPG as a primary fuel for households and businesses. This shift supports clean energy goals by replacing biomass and other traditional fuels with LPG.

02. What are the challenges in the Indonesia LPG Market?

Challenges in the Indonesia LPG market include limited distribution infrastructure in rural areas, exposure to global oil price fluctuations, and competition from alternative fuels like natural gas and electricity, impacting market growth.

03. Who are the major players in the Indonesia LPG Market?

Pertamina, TotalEnergies, Shell Indonesia, ExxonMobil Indonesia, and BP Indonesia dominate the Indonesia LPG market, leveraging extensive distribution networks and technological expertise to maintain a competitive edge.

04. What are the growth drivers of the Indonesia LPG Market?

Government subsidies, expanding petrochemical industries, urbanization, and shifting consumer preference towards cleaner fuels are key growth drivers of Indonesia LPG market.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.