Indonesia LPG Market Outlook to 2030

Region:Asia

Author(s):Shubham Kashyap

Product Code:KROD5348

December 2024

91

About the Report

Indonesia LPG Market Overview

- The Indonesia LPG demand is recorded at 10.30 million tonnes, driven by growing urbanization, increasing household adoption of LPG, and extensive government subsidies promoting clean energy solutions. The market benefits from ongoing infrastructure development and the integration of modern distribution channels, ensuring reliable access to LPG across the country. Rising demand from residential, commercial, and industrial sectors reinforces the markets steady growth, establishing Indonesia as a major hub for LPG usage in Southeast Asia.

- Major demand centers for LPG in Indonesia include Jakarta, Surabaya, and Medan. These cities dominate due to their dense populations, robust economic activities, and well-established distribution networks. Urban households heavily rely on LPG for cooking and heating, while commercial and industrial entities use it for energy efficiency. Additionally, Java and Sumatra lead in consumption, backed by significant industrialization and government support for cleaner energy adoption in these regions.

- The government's subsidy program has been instrumental in promoting LPG adoption. In 2023, subsidies supported the import of 6.9 million tons of LPG, making it affordable for low-income households and stimulating market growth. These subsidies have also reduced the financial burden on nearly 57 million households dependent on LPG for cooking needs. Additionally, the program ensures price stability amidst fluctuating global oil prices, safeguarding domestic consumers from market volatility.

Indonesia LPG Market Segmentation

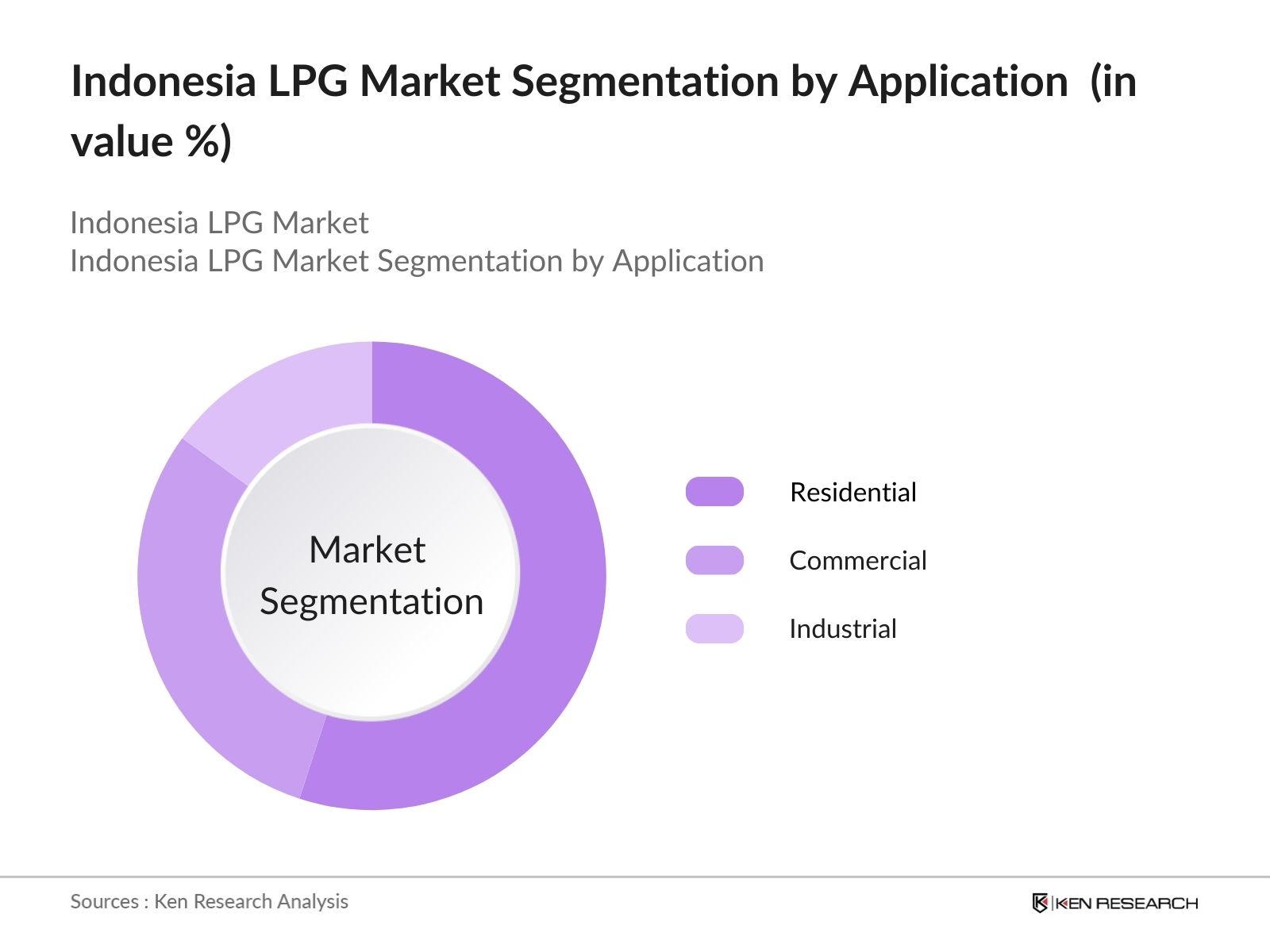

- By Application: The market is segmented by application into Residential, Commercial, and Industrial sectors. The Residential segment dominates with a 55% market share in 2023, attributed to the widespread use of LPG for cooking and heating in urban and rural households. Government subsidies and affordability initiatives ensure accessibility, driving its prominence in the market. The expansion of rural distribution networks and the promotion of LPG over traditional fuels further bolster its adoption across the country.

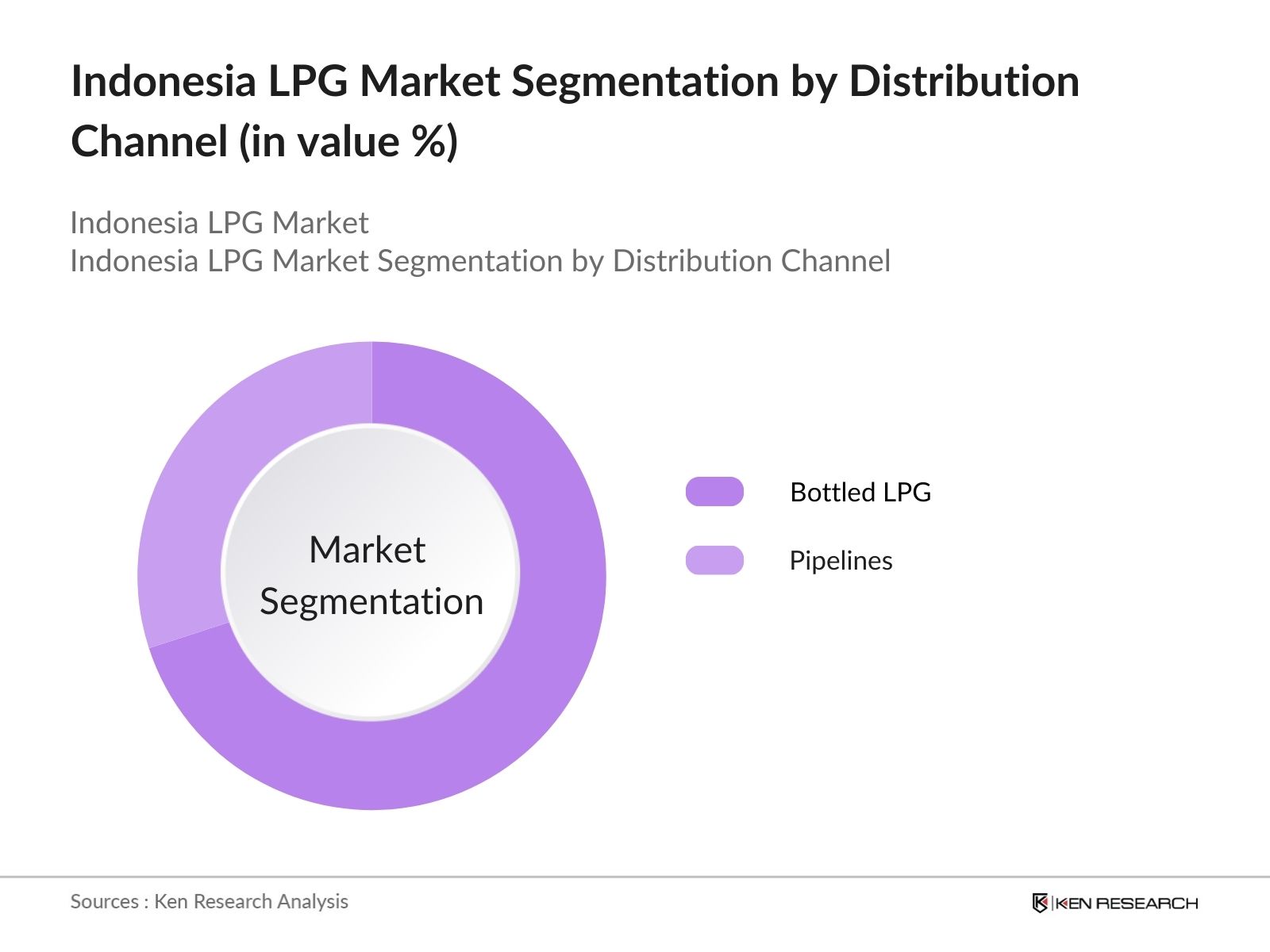

- By Distribution Channel: The market is also segmented by distribution channel into Bottled LPG and Pipelines. Bottled LPG holds a significant 70% market share in 2023 due to its convenience, availability, and accessibility in both urban and rural areas. Bottled LPG is distributed through an extensive network of retailers and suppliers, ensuring seamless access for households and small businesses. Its portability and compatibility with diverse storage systems contribute to its widespread dominance in Indonesias LPG market.

Indonesia LPG Market Competitive Landscape

The Indonesia LPG market is dominated by major players, including PT Pertamina (Persero), PT Indo Gas, PT Solusindo Sukses Internasional, PT Subulussalam, and PT UGI Corpora. These companies leverage their extensive distribution networks, government partnerships, and diverse product portfolios to maintain their market leadership.

Indonesia LPG Market Analysis

Growth Drivers

- Rising Population and Urbanization: Indonesia, with a population exceeding 273 million in 2024, continues to experience significant urbanization. The urban population has grown to over 150 million, leading to increased energy demands, particularly for cooking fuels like Liquefied Petroleum Gas (LPG). This demographic shift has resulted in higher household energy consumption, bolstering the LPG market. The increase in urban middle-class households, which are primary consumers of LPG, has further accelerated demand. Additionally, urbanization has spurred infrastructure growth, enhancing LPG distribution networks and accessibility.

- Increasing Household and Commercial Usage: The government's Kerosene-to-LPG Conversion Program has successfully transitioned millions of households to LPG, with over 10 million tons consumed domestically in 2023. This widespread adoption extends to commercial sectors, including restaurants and small enterprises, further driving LPG demand. LPG usage in the hospitality sector grew notably in regions like Jakarta and Bali, where food service businesses rely heavily on this fuel. Moreover, small and medium enterprises (SMEs) increasingly prefer LPG for its reliability and cost efficiency, expanding its market footprint.

- Government Subsidies and Initiatives: The Indonesian government has implemented subsidies to make LPG more affordable, particularly for low-income households. In 2023, subsidies covered approximately 6.9 million tons of LPG imports, reflecting the government's commitment to energy accessibility and supporting market growth. These subsidies also play a critical role in reducing poverty levels by ensuring basic energy needs are met affordably. Additionally, targeted subsidy schemes aim to address rural areas, further widening the consumer base for LPG adoption.

Challenges

- Price Volatility: The global fluctuation in crude oil prices directly impacts LPG costs, creating uncertainties for both suppliers and consumers. This volatility often leads to temporary supply shortages or surcharges, affecting overall market stability. Additionally, the unpredictable price environment complicates long-term planning for businesses relying on LPG. Governments and stakeholders face ongoing challenges in stabilizing prices to ensure consistent availability.

- Limited Pipeline Infrastructure: While bottled LPG dominates the market, the limited presence of pipelines restricts large-scale industrial adoption. Expanding pipeline networks requires substantial investment and regulatory approval, posing a challenge for market expansion. The lack of infrastructure also increases dependence on bottled LPG, which is less efficient for high-demand industrial applications.

Indonesia LPG Market Future Outlook

The Indonesia LPG market is poised for steady growth, fueled by increasing residential adoption, infrastructure development, and government subsidies promoting clean energy solutions. The transition towards green LPG alternatives and advancements in safety standards will further enhance market prospects. Additionally, the rise in industrial applications and the expansion of rural distribution networks are expected to unlock new growth opportunities, solidifying Indonesias position as a leading LPG market in Southeast Asia.

Future Market Opportunities

- Technological Advancements in LPG Distribution: Implementing advanced technologies, including Internet of Things (IoT) solutions, can optimize LPG distribution. Real-time monitoring and predictive maintenance can reduce operational costs and improve supply chain efficiency, enhancing market competitiveness. Digital tracking systems also improve transparency in the supply chain, ensuring timely deliveries and minimizing losses. Furthermore, automated inventory management enables distributors to better anticipate demand fluctuations and allocate resources effectively.

- Expansion in Rural Areas: Despite urban dominance, significant opportunities exist in rural regions where traditional biomass is still prevalent. Targeted infrastructure development and government programs can facilitate LPG adoption, expanding the market base. Partnerships with local organizations can accelerate distribution and build trust within rural communities. Additionally, awareness campaigns highlighting the health and environmental benefits of LPG over biomass can drive behavioral shifts and encourage adoption.

Scope of the Report

|

By Type |

Autogas (CNG) |

|

By Application |

Residential |

|

By Distribution Channel |

Pipelines |

|

By Packaging Type |

Cylinders |

|

By Region |

Java |

Products

Key Target Audience

Investors and Venture Capitalist Firms

Banks and Financial Institutions

Government and Regulatory Bodies (e.g., Ministry of Energy and Mineral Resources, National Energy Council)

LPG Distribution Companies

Energy Sector Analysts

Industrial Gas Consumers

Commercial Enterprises

Residential Energy Providers

Companies

Players Mentioned in the Report

PT Pertamina (Persero)

PT Indo Gas, Tbk

PT Subulussalam

PT Solusindo Sukses Internasional

PT UGI Corpora

PT Perkasa Gas Industri

PT Baruna Gas

PT Dwi Gas

PT Suryo Gas

PT Harjasapta Agung Sejahtera

PT Gas Alam

PT Geo Energy

PT Multi Gasindo Abadi

PT Samudera Gas

PT Cahaya Gasindo

Table of Contents

Indonesia Liquefied Petroleum Gas (LPG) Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

Indonesia Liquefied Petroleum Gas (LPG) Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

Indonesia Liquefied Petroleum Gas (LPG) Market Analysis

3.1. Growth Drivers

3.1.1. Rising Population and Urbanization

3.1.2. Increasing Household and Commercial Usage

3.1.3. Government Subsidies and Initiatives

3.1.4. Infrastructure Development

3.2. Market Challenges

3.2.1. Price Volatility

3.2.2. Supply Chain Disruptions

3.2.3. Competition from Alternative Fuels

3.3. Opportunities

3.3.1. Technological Advancements in LPG Distribution

3.3.2. Expansion in Rural Areas

3.3.3. Green LPG Solutions

3.4. Trends

3.4.1. Shift towards CNG and Renewable LPG

3.4.2. Adoption of IoT in LPG Distribution

3.4.3. Increased Safety Regulations

3.5. Government Regulation

3.5.1. National LPG Subsidy Program

3.5.2. Safety Standards and Compliance

3.5.3. Import-Export Policies

3.5.4. Public-Private Partnerships

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

Indonesia Liquefied Petroleum Gas (LPG) Market Segmentation

4.1. By Type (In Value %)

4.1.1. Autogas (CNG)

4.1.2. Domestic Use

4.1.3. Commercial Use

4.2. By Application (In Value %)

4.2.1. Residential

4.2.2. Commercial

4.2.3. Industrial

4.2.4. Transportation

4.3. By Distribution Channel (In Value %)

4.3.1. Pipelines

4.3.2. Bottled LPG

4.4. By Packaging Type (In Value %)

4.4.1. Cylinders

4.4.2. Bulk LPG

4.5. By Region (In Value %)

4.5.1. Java

4.5.2. Sumatra

4.5.3. Kalimantan

4.5.4. Sulawesi

4.5.5. Papua

Indonesia Liquefied Petroleum Gas (LPG) Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. PT Pertamina (Persero)

5.1.2. PT Indo Gas, Tbk

5.1.3. PT Subulussalam

5.1.4. PT Solusindo Sukses Internasional

5.1.5. PT UGI Corpora

5.1.6. PT Perkasa Gas Industri

5.1.7. PT Baruna Gas

5.1.8. PT Dwi Gas

5.1.9. PT Suryo Gas

5.1.10. PT Harjasapta Agung Sejahtera

5.1.11. PT Gas Alam

5.1.12. PT Geo Energy

5.1.13. PT Multi Gasindo Abadi

5.1.14. PT Samudera Gas

5.1.15. PT Cahaya Gasindo

5.2. Cross Comparison Parameters (Number of Employees, Headquarters, Inception Year, Revenue, Product Range, Distribution Channels, Market Share, Geographic Presence)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers And Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

Indonesia Liquefied Petroleum Gas (LPG) Market Regulatory Framework

6.1. Safety Standards

6.2. Compliance Requirements

6.3. Certification Processes

Indonesia Liquefied Petroleum Gas (LPG) Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

Indonesia Liquefied Petroleum Gas (LPG) Future Market Segmentation

8.1. By Type (In Value %)

8.2. By Application (In Value %)

8.3. By Distribution Channel (In Value %)

8.4. By Packaging Type (In Value %)

8.5. By Region (In Value %)

Indonesia Liquefied Petroleum Gas (LPG) Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Indonesia LPG Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the Indonesia LPG Market. This includes assessing market penetration, the ratio of distribution channels to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATI) with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple LPG manufacturers and distributors to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the Indonesia LPG market.

Frequently Asked Questions

How big is the Indonesia LPG Market?

The Indonesia LPG market is valued at 10.30 million tonnes, driven by increasing household adoption, industrial applications, and extensive government subsidies promoting clean energy solutions.

What are the growth drivers of the Indonesia LPG Market?

Key growth drivers in the Indonesia LPG market include expanding residential use of LPG, government investments in infrastructure, and rising demand from the industrial and commercial sectors.

Who are the major players in the Indonesia LPG Market?

Major players in the Indonesia LPG market include PT Pertamina (Persero), PT Indo Gas, PT Solusindo Sukses Internasional, PT Subulussalam, and PT UGI Corpora, leveraging extensive distribution networks and government partnerships.

What are the challenges in the Indonesia LPG Market?

Challenges in the Indonesia LPG market include price volatility due to global crude oil fluctuations and limited pipeline infrastructure for large-scale industrial use.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.