Indonesia Machine Tool Market Outlook to 2030

Region:Asia

Author(s):Paribhasha Tiwari

Product Code:KROD3856

November 2024

87

About the Report

Indonesia Machine Tool Market Overview

- The Indonesia Machine Tool market is valued at USD 4 billion based on a five-year historical analysis. The market is primarily driven by rapid industrialization and the growth of sectors such as automotive, aerospace, and electronics manufacturing. These industries are investing heavily in automation and precision engineering, leading to an increased demand for advanced machine tools. Additionally, government initiatives focused on boosting local manufacturing and infrastructure development have further accelerated the demand for machine tools.

- Java and Sumatra dominate the Indonesia machine tool market due to their well-established manufacturing hubs and large-scale infrastructure projects. Java, being the countrys industrial core, houses a significant number of factories, especially in automotive and electronics, whereas Sumatras proximity to neighboring markets provides strategic advantages for exports. These regions benefit from skilled labor availability, robust infrastructure, and significant government support, making them the top contributors to market demand.

- German manufacturers are intensifying their business operations in Indonesia, as highlighted during the VDW's Technology Symposium held in Jakarta. This initiative aims to enhance collaboration with local industries, particularly in sectors like automotive and metalworking.

Indonesia Machine Tool Market Segmentation

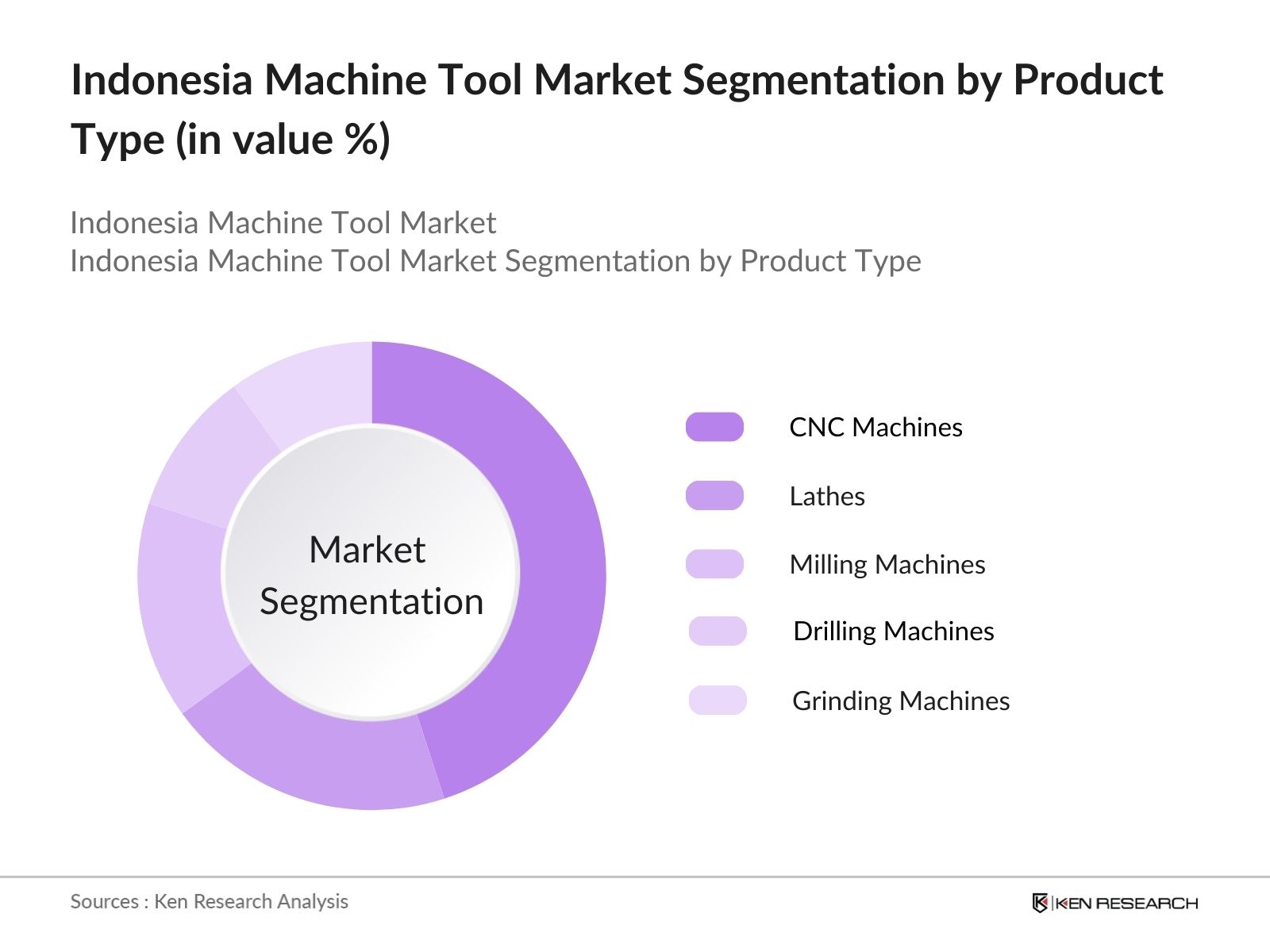

By Product Type: The Indonesia machine tool market is segmented by product type into CNC Machines, Lathes, Milling Machines, Drilling Machines, and Grinding Machines. CNC Machines hold the largest market share in the product type segment due to their versatility, precision, and increasing adoption in high-value manufacturing sectors like automotive and aerospace. The demand for CNC machines is propelled by the rise of Industry 4.0, where manufacturers are adopting smart, automated solutions to increase productivity and efficiency.

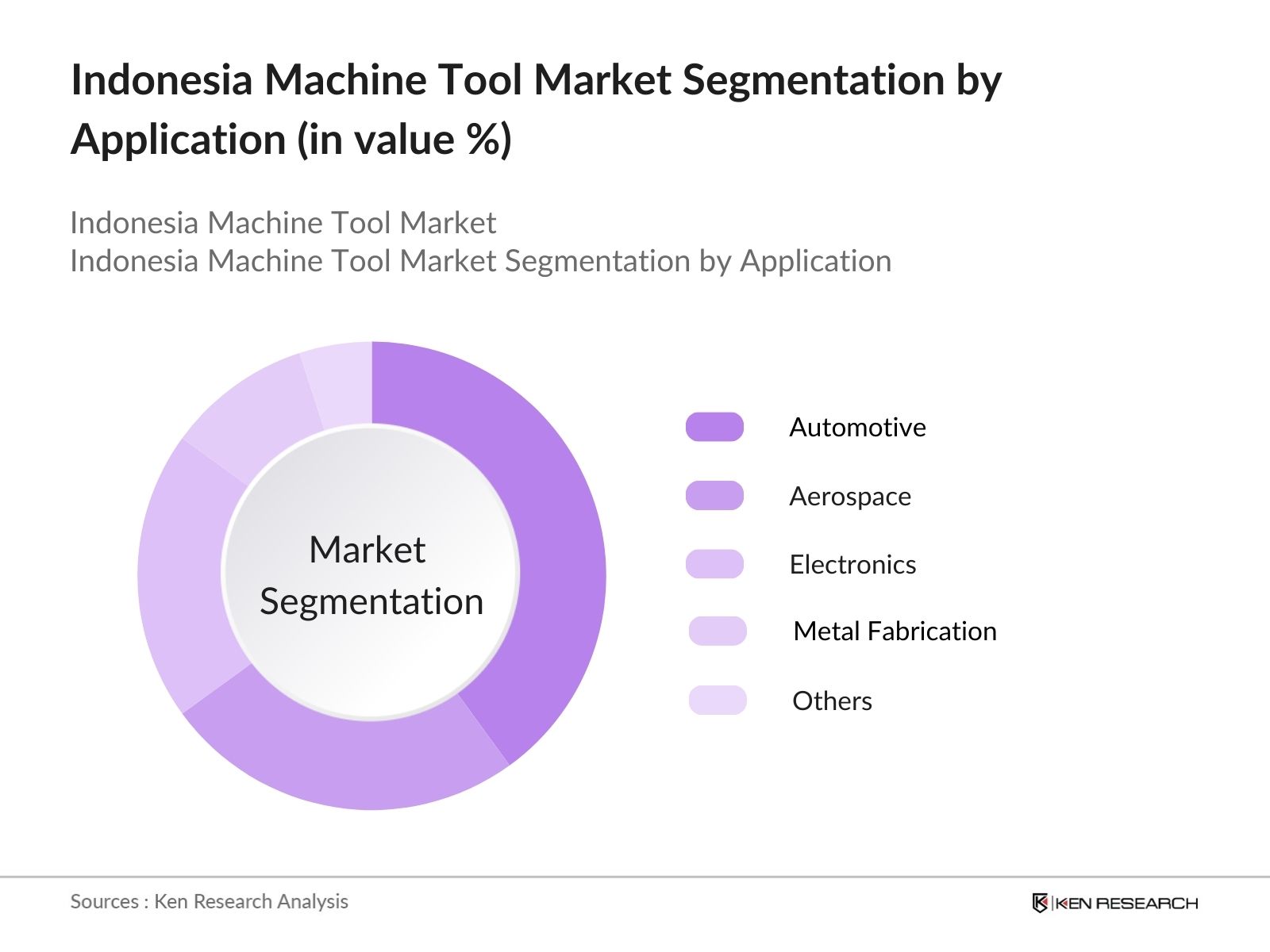

By Application: Indonesia's machine tool market is segmented by application into Automotive, Aerospace, Electronics, Metal Fabrication, and Others (Energy, Oil & Gas). Automotive is the leading application sector with the highest market share, driven by Indonesias strong position as a regional automotive manufacturing hub. The countrys automotive industry continues to grow due to increasing vehicle production, exports, and investments from global automakers. The need for precision engineering in automotive production further fuels the demand for advanced machine tools.

Indonesia Machine Tool Market Competitive Landscape

The Indonesia machine tool market is dominated by both local and international manufacturers. The market is highly competitive, with major players focusing on innovations, R&D, and strategic partnerships to enhance their product offerings. Companies like DMG Mori and Mazak have established their dominance due to their global presence, high-quality products, and strong distributor networks in the region.

|

Company Name |

Establishment Year |

Headquarters |

Revenue |

Production Capacity |

Geographic Presence |

Technological Innovation |

Product Portfolio |

Employee Strength |

|

DMG Mori Seiki |

1948 |

Nagoya, Japan |

- |

- |

- |

- |

- |

- |

|

Mazak Corporation |

1919 |

Aichi, Japan |

- |

- |

- |

- |

- |

- |

|

Okuma Corporation |

1898 |

Aichi, Japan |

- |

- |

- |

- |

- |

- |

|

Haas Automation, Inc. |

1983 |

Oxnard, California, USA |

- |

- |

- |

- |

- |

- |

|

Trumpf Group |

1923 |

Ditzingen, Germany |

- |

- |

- |

- |

- |

- |

Indonesia Machine Tool Market Analysis

Growth Drivers

- Industrialization in Indonesia: Indonesia has been steadily advancing its industrial sector, which is contributing significantly to the growth of the machine tool market. The countrys manufacturing industry output was approximately USD 230 billion in 2022, according to the World Bank. As the fourth largest economy in Asia, Indonesia's industrial expansion, particularly in electronics and machinery, is increasing demand for precision machine tools. Furthermore, government initiatives under the "Making Indonesia 4.0" roadmap, aimed at boosting the manufacturing sector, provide further stimulus for the adoption of advanced machine tools to support this industrial transformation.

- Infrastructure Projects and Government Investments: The Indonesian government allocated over USD 28 billion for infrastructure development in its 2024 budget. Massive projects such as the construction of new industrial parks, highways, and rail networks are driving the demand for machine tools. The National Strategic Projects (PSN), with over 200 infrastructure projects slated for completion by 2024, are boosting the need for heavy machinery and precision machine tools for construction and manufacturing activities. The Ministry of Industry is also targeting investments of USD 50 billion in the next five years to bolster local production.

- Technological Advancements in Manufacturing: Indonesia's adoption of advanced manufacturing technologies, particularly in sectors such as automotive, electronics, and precision engineering, is pushing the demand for high-tech machine tools like CNC (Computer Numerical Control) systems. The Indonesian Ministry of Industry has encouraged the adoption of Industry 4.0 technologies through tax incentives for automation. In 2024, approximately 35% of the manufacturing units across Indonesia have integrated automation technologies, demanding sophisticated machine tools for efficient production processes. These advancements aim to increase productivity by reducing manual intervention.

Market Challenges

- Availability of Skilled Labor: Despite government initiatives to improve the country's technical education, the shortage of skilled labor remains a challenge for the machine tool industry. According to Indonesia's Ministry of Manpower, around 30% of manufacturing firms face difficulties in hiring workers trained in handling CNC machines and advanced manufacturing tools. This lack of skilled personnel often hampers the efficient operation of advanced machinery, reducing overall productivity. In 2024, the Indonesian government has set aside approximately USD 3.5 billion for vocational training programs to address this issue.

- Fluctuations in Raw Material Prices: The volatility in raw material prices, particularly steel and aluminum, is another significant challenge for the machine tool market in Indonesia. Steel prices surged by over 25% in 2022 due to supply chain disruptions, impacting the cost of manufacturing machine tools. Manufacturers face difficulties in pricing their products competitively, and the unpredictability of raw material costs adds to the operational risk. Moreover, Indonesia's reliance on imports for specialized alloys exacerbates the situation, further straining the production costs for machine tool manufacturers.

Indonesia Machine Tool Market Future Outlook

Over the next five years, the Indonesia machine tool market is expected to experience steady growth, driven by continued government investments in infrastructure and manufacturing. The growing adoption of smart manufacturing solutions and advancements in automation technology are also expected to drive the demand for more sophisticated and efficient machine tools. The governments focus on developing industrial zones and attracting foreign investments in the automotive and aerospace sectors will further support the market's expansion.

Market Opportunities

- Increasing Adoption of CNC (Computer Numerical Control) Machines: The adoption of CNC machines is expanding rapidly in Indonesia, particularly in the automotive and electronics industries. CNC machines provide the precision and efficiency necessary for large-scale production, which has become increasingly critical as the country industrializes. In 2023, the import of CNC machines increased by 15%, according to the Indonesian Ministry of Trade. Additionally, incentives such as import tax reductions for advanced manufacturing tools have made CNC technology more accessible to local manufacturers, positioning Indonesia as a growing market for these high-precision machines.

- Expansion of Export Opportunities: Indonesia's machine tool manufacturing capabilities are growing, presenting new export opportunities, particularly within Southeast Asia. In 2022, the export value of machine tools from Indonesia increased to USD 400 million, as demand grew from neighboring countries such as Malaysia, Vietnam, and Thailand. The government's trade agreements and export incentives, including reduced tariffs on machinery, are expected to further boost the market. With the ASEAN Free Trade Area (AFTA) facilitating easier market access, Indonesia's machine tool industry is well-positioned to capitalize on regional demand.

Scope of the Report

|

By Product Type |

CNC Machines Lathes Milling Machines Drilling Machines Grinding Machines |

|

By Application |

Automotive Aerospace Electronics Metal Fabrication Others (Energy, Oil & Gas) |

|

By Automation Level |

Conventional Machine Tools Semi-Automated Machine Tools Fully Automated Machine Tools |

|

By Sales Channel |

Direct Sales Distributors/Dealers Online Sales |

|

By Region |

Java Sumatra Kalimantan Sulawesi Bali |

Products

Key Target Audience

Automotive Manufacturers

Aerospace Industry Players

Electronics Manufacturing Companies

Metal Fabricators

Government and Regulatory Bodies (Ministry of Industry, Investment Coordinating Board)

Machine Tool Distributors and Dealers

Investment and Venture Capitalist Firms

Machine Tool End-Users (Energy, Oil & Gas)

Companies

Players mentioned in the report:

DMG Mori Seiki

Mazak Corporation

Okuma Corporation

Haas Automation, Inc.

Trumpf Group

Amada Co., Ltd.

FANUC Corporation

Heller Maschinenfabrik GmbH

Doosan Machine Tools

JTEKT Corporation

Hyundai Wia

Makino Milling Machine Co.

FFG Europe & Americas

Yamazaki Mazak Indonesia

Hardinge Inc.

Table of Contents

1. Indonesia Machine Tool Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. Indonesia Machine Tool Market Size (In USD Bn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. Indonesia Machine Tool Market Analysis

3.1 Growth Drivers

3.1.1 Industrialization in Indonesia

3.1.2 Infrastructure Projects and Government Investments

3.1.3 Technological Advancements in Manufacturing

3.1.4 Rising Demand from Automotive and Aerospace Sectors

3.2 Market Challenges

3.2.1 High Initial Setup Costs

3.2.2 Availability of Skilled Labor

3.2.3 Fluctuations in Raw Material Prices

3.3 Opportunities

3.3.1 Increasing Adoption of CNC (Computer Numerical Control) Machines

3.3.2 Growth in Precision Engineering

3.3.3 Expansion of Export Opportunities

3.4 Trends

3.4.1 Integration of Automation and Robotics in Machine Tools

3.4.2 Shift Toward Green Manufacturing Technologies

3.4.3 Adoption of Industry 4.0

3.5 Government Regulations

3.5.1 Local Manufacturing Incentives

3.5.2 Import Tariffs and Trade Policies

3.5.3 Environmental Regulations

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces Analysis

3.9 Competitive Ecosystem

4. Indonesia Machine Tool Market Segmentation

4.1 By Product Type (In Value %)

4.1.1 CNC Machines

4.1.2 Lathes

4.1.3 Milling Machines

4.1.4 Drilling Machines

4.1.5 Grinding Machines

4.2 By Application (In Value %)

4.2.1 Automotive

4.2.2 Aerospace

4.2.3 Electronics

4.2.4 Metal Fabrication

4.2.5 Others (Energy, Oil & Gas)

4.3 By Automation Level (In Value %)

4.3.1 Conventional Machine Tools

4.3.2 Semi-Automated Machine Tools

4.3.3 Fully Automated Machine Tools

4.4 By Sales Channel (In Value %)

4.4.1 Direct Sales

4.4.2 Distributors/Dealers

4.4.3 Online Sales

4.5 By Region (In Value %)

4.5.1 Java

4.5.2 Sumatra

4.5.3 Kalimantan

4.5.4 Sulawesi

4.5.5 Bali

5. Indonesia Machine Tool Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 DMG Mori Seiki

5.1.2 Mazak Corporation

5.1.3 Okuma Corporation

5.1.4 Makino Milling Machine Co.

5.1.5 Haas Automation, Inc.

5.1.6 Trumpf Group

5.1.7 Hyundai Wia

5.1.8 JTEKT Corporation

5.1.9 Amada Co., Ltd.

5.1.10 Heller Maschinenfabrik GmbH

5.1.11 Doosan Machine Tools

5.1.12 FANUC Corporation

5.1.13 FFG Europe & Americas

5.1.14 Yamazaki Mazak Indonesia

5.1.15 Hardinge Inc.

5.2 Cross Comparison Parameters (Revenue, Production Capacity, Geographic Presence, Product Portfolio, R&D Investments, Technological Innovation, Market Penetration, Employee Strength)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Government Grants

5.8 Private Equity Investments

6. Indonesia Machine Tool Market Regulatory Framework

6.1 Compliance Requirements for Machine Tools

6.2 Safety Standards and Certifications

6.3 Import Regulations and Duties

7. Indonesia Machine Tool Future Market Size (In USD Bn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. Indonesia Machine Tool Future Market Segmentation

8.1 By Product Type (In Value %)

8.2 By Application (In Value %)

8.3 By Automation Level (In Value %)

8.4 By Sales Channel (In Value %)

8.5 By Region (In Value %)

9. Indonesia Machine Tool Market Analysts' Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 White Space Opportunity Analysis

9.3 Marketing Initiatives

9.4 Customer Cohort Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves the identification of critical market variables, such as product types, applications, and technology adoption trends within the Indonesia machine tool market. This step is based on thorough secondary research involving industry publications, government reports, and proprietary databases.

Step 2: Market Analysis and Construction

In this phase, we analyze historical data on market size, demand, and trends to construct a comprehensive overview of the market. We evaluate the key drivers, challenges, and opportunities that have influenced market growth and assess their impact on the industry.

Step 3: Hypothesis Validation and Expert Consultation

To validate the market hypotheses, we engage industry experts through interviews and surveys. These consultations provide insights into operational challenges, financial performance, and future trends that shape the machine tool market in Indonesia.

Step 4: Research Synthesis and Final Output

In the final stage, the gathered data is synthesized to produce a detailed report. This report is further refined through engagement with machine tool manufacturers, providing accurate market forecasts and recommendations.

Frequently Asked Questions

01. How big is the Indonesia Machine Tool Market?

The Indonesia machine tool market is valued at USD 4 billion, driven by rapid industrialization and increasing demand from the automotive and aerospace sectors. This growth is fueled by investments in advanced manufacturing technologies.

02. What are the challenges in the Indonesia Machine Tool Market?

Key challenges in the Indonesia machine tool marketinclude high initial setup costs for advanced machinery, availability of skilled labor, and fluctuations in raw material prices. These factors can affect the profitability of manufacturers and slow down-market adoption.

03. Who are the major players in the Indonesia Machine Tool Market?

Key players in the Indonesia machine tool marketinclude DMG Mori Seiki, Mazak Corporation, Okuma Corporation, Haas Automation, Inc., and Trumpf Group. These companies dominate the market due to their technological innovation, strong distributor networks, and global presence.

04. What are the growth drivers of the Indonesia Machine Tool Market?

The Indonesia machine tool market is driven by factors such as the growth of the automotive and aerospace industries, government incentives for local manufacturing, and the increasing adoption of CNC machines and automation technologies in precision engineering.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.