Indonesia Managed Services Market Outlook to 2030

Region:Asia

Author(s):Vijay Kumar

Product Code:KROD5052

December 2024

90

About the Report

Indonesia Managed Services Market Overview

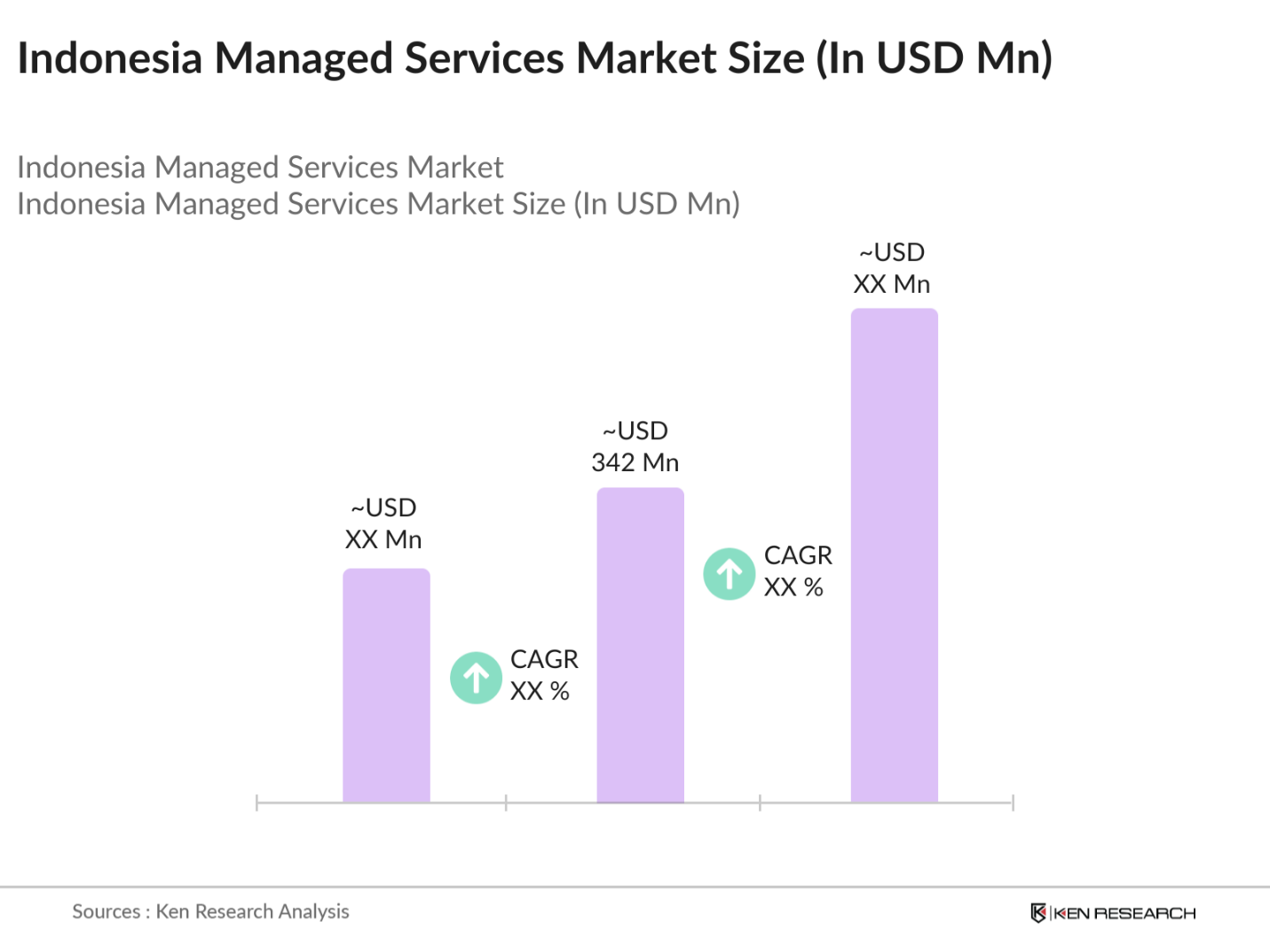

- The Indonesia Managed Services market is valued at USD 342 million, based on a five-year historical analysis. This market is primarily driven by the growing demand for outsourced IT services, including cloud management, cybersecurity solutions, and data storage, as companies across various sectors strive for digital transformation. Businesses in Indonesia are increasingly adopting managed services to enhance operational efficiency, minimize IT infrastructure costs, and improve cybersecurity measures, especially in sectors like banking, telecommunications, and retail.

- Indonesias managed services market is dominated by Jakarta, Surabaya, and Bandung, primarily due to their status as major business hubs with well-established IT infrastructure. These cities host the headquarters of many large enterprises and multinational corporations, which are the primary consumers of managed services. Their rapid adoption of cloud computing and digital technologies makes them key markets for managed service providers (MSPs) in the country. Additionally, the government's push for smart city projects and the rise of digital transformation in urban areas further supports the dominance of these regions.

- Indonesias Personal Data Protection (PDP) law, enacted in 2022, has imposed strict rules on how companies collect, store, and process personal data. All organizations handling sensitive data must store it locally, presenting challenges for international businesses but also opportunities for local managed service providers to offer compliance solutions. This law aims to safeguard data privacy and ensure adherence to international standards, affecting businesses across all sectors.

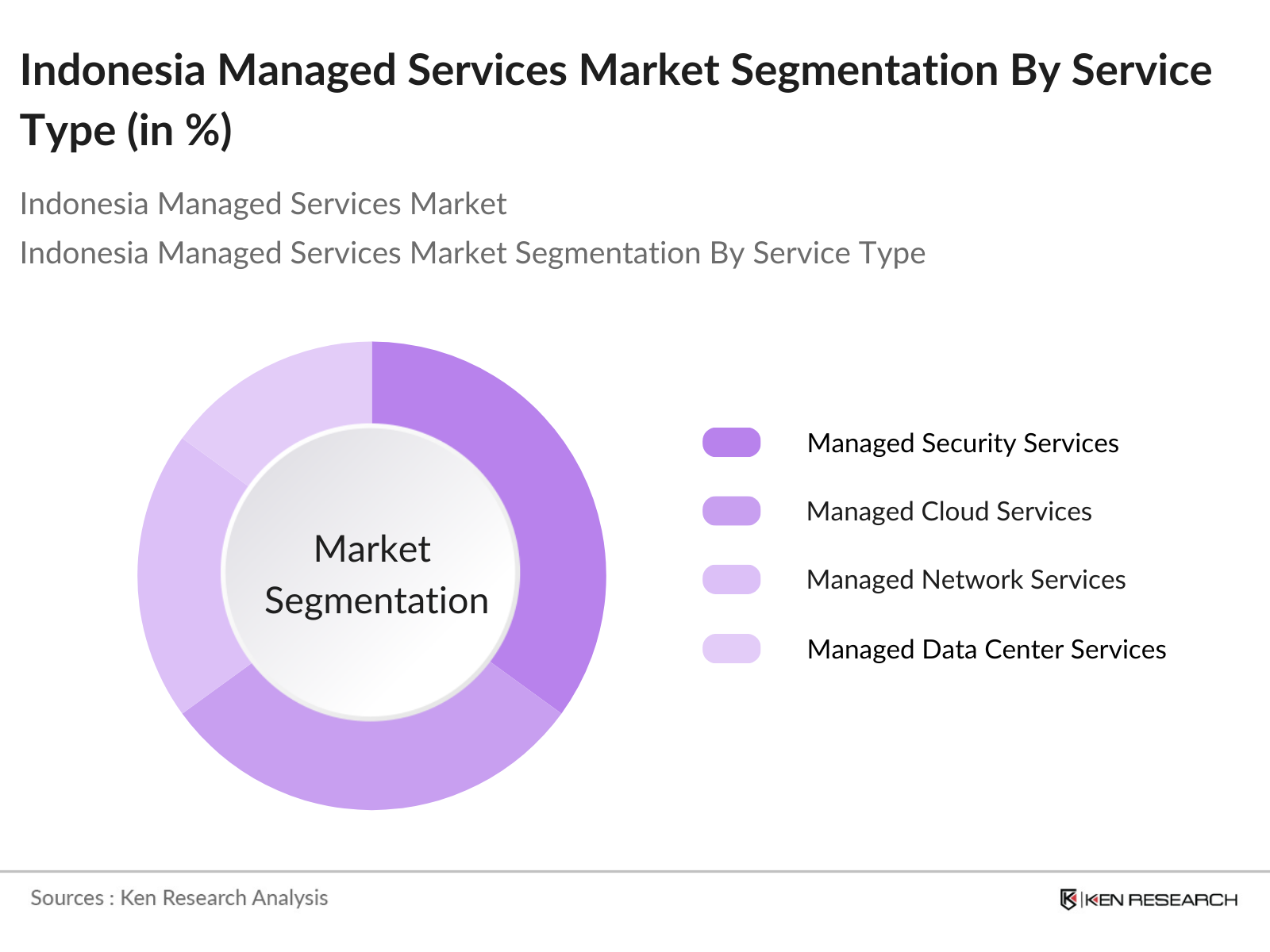

Indonesia Managed Services Market Segmentation

By Service Type: The market is segmented by service type into managed security services, managed cloud services, managed network services, and managed data center services. Managed security services have the largest market share in this segment due to the rising threat of cyberattacks and the increasing importance of regulatory compliance for data protection. With businesses facing a growing number of security breaches, managed security providers offer expertise and solutions to safeguard critical infrastructure.

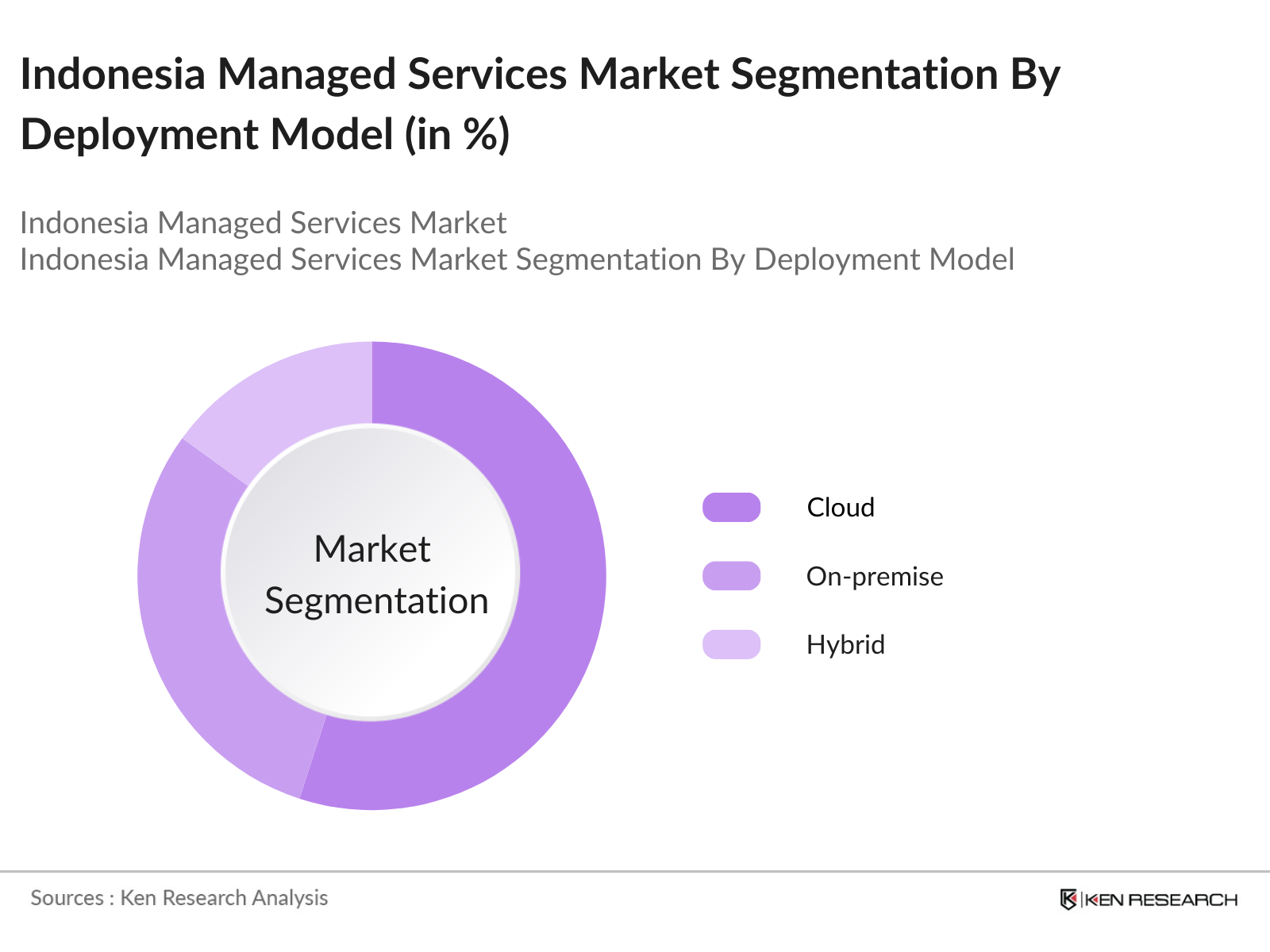

By Deployment Model: The market is also segmented by deployment model into on-premise, cloud, and hybrid services. Cloud-based deployment dominates the segment with a substantial market share due to the cost-efficiency, scalability, and flexibility it offers businesses. The shift towards cloud-based solutions allows companies to reduce capital expenditure on physical infrastructure and manage their IT services remotely.

Indonesia Managed Services Market Competitive Landscape

The Indonesia Managed Services market is dominated by several key players, who account for a significant portion of the market share. These companies have established a strong foothold through strategic partnerships, acquisitions, and the provision of comprehensive managed services solutions tailored to the local market. The market features both domestic and international players, each leveraging their expertise to cater to the growing demand for IT outsourcing and managed solutions.

Indonesia Managed Services Industry Analysis

Growth Drivers

- Growing IT Infrastructure (Cloud Adoption, Data Center Expansion, Network Modernization): Indonesias IT infrastructure is expanding rapidly, driven by cloud adoption and the increase in data center development. According to the World Bank, Indonesia's digital economy is expected to reach a significant portion of its GDP, driven by its strong cloud infrastructure growth. In 2024, Indonesia is home to over 15 hyperscale data centers, up from just 9 in 2020, bolstered by network modernization initiatives. The Indonesian government continues to prioritize digital infrastructure under its "Making Indonesia 4.0" initiative, adding substantial investments to upgrade networks and promote data centers.

- Increased Focus on Cybersecurity (Regulatory Compliance, Data Privacy Laws): As Indonesia's economy becomes increasingly digital, its focus on cybersecurity and regulatory compliance has intensified. The Indonesian government introduced the Personal Data Protection (PDP) law in 2022 to address rising cyber threats, requiring businesses to implement stricter cybersecurity measures. Indonesia experienced over 495 million cyberattacks in 2023, signaling a critical need for enhanced protection measures.

- Digital Transformation Initiatives (Government, SMEs, and Enterprises): Indonesias government has been at the forefront of digital transformation initiatives, particularly with its "Making Indonesia 4.0" program aimed at revolutionizing industries through digital integration. By 2024, over 25 million SMEs have adopted digital solutions, such as cloud computing and managed services, to enhance their operations. Enterprises, including both local and multinational firms, are increasingly relying on managed service providers to drive efficiency and reduce operational costs, a trend that continues to push the demand for managed IT services.

Market Challenges

- Shortage of Skilled IT Professionals: Indonesia faces a growing shortage of skilled IT professionals, with only around 6% of its 2024 workforce qualified in high-level IT positions. According to the Ministry of Manpower, this skills gap is widening, creating significant challenges for businesses looking to scale IT operations. The shortage of talent has resulted in increased reliance on managed service providers to fill the expertise gap, particularly in sectors like cloud management and cybersecurity.

- High Initial Setup Costs: Managed services require substantial initial investments, which remain a key challenge for many businesses in Indonesia. In particular, the setup costs for managed cloud services and IT infrastructure remain a barrier for small and medium-sized enterprises (SMEs). The Indonesian government estimates that the average upfront cost for implementing cloud-based managed services is approximately IDR 1.5 billion ($100,000), which restricts access for smaller firms.

Indonesia Managed Services Market Future Outlook

Over the next five years, the Indonesia Managed Services market is expected to experience substantial growth driven by rapid digital transformation across various industries. Key factors include the expansion of cloud infrastructure, increased demand for managed cybersecurity services, and the growing need for IT infrastructure management among SMEs. Moreover, government initiatives promoting digitalization and smart city development will further boost the adoption of managed services, with companies seeking efficient ways to manage their IT operations.

Market Opportunities

- Expanding SME Sector (Cloud-based Managed Services): Indonesias small and medium enterprises (SME) sector is flourishing, with over 64 million SMEs now contributing nearly 61% to the national GDP, according to the Indonesian Ministry of SMEs and Cooperatives. With many SMEs rapidly embracing cloud-based managed services to scale operations and improve digital capabilities, the demand for tailored solutions continues to grow. Managed service providers that focus on the SME market are set to benefit from this expanding customer base.

- Emergence of Industry 4.0 (IoT, AI-driven Managed Services): The industrial sector in Indonesia is rapidly advancing towards Industry 4.0, with IoT and AI at the center of transformation efforts. Indonesias manufacturing sector alone accounts for 20% of the nations GDP, and companies in this space are adopting AI-driven managed services to optimize production. The rise of smart factories and AI-powered systems presents an immense opportunity for managed service providers to integrate cutting-edge technologies into client operations, driving efficiency and reducing costs.

Scope of the Report

|

Service Type |

Managed Security Services Managed Network Services Managed Data Center Services Managed Cloud Services Managed Mobility Services |

|

Deployment Model |

On-premise Cloud, Hybrid |

|

Enterprise Size |

Small and Medium Enterprises (SMEs) Large Enterprises |

|

Vertical |

BFSI IT & Telecom Government Healthcare Manufacturing |

|

Region |

Java Sumatra Kalimantan Sulawesi Papua |

Products

Key Target Audience

IT and Telecommunication Companies

Financial Institutions (BCA, BRI)

Healthcare Providers (Pertamina, BPJS Health)

Government and Regulatory Bodies (Ministry of Communication and Informatics, Bank Indonesia)

Manufacturing Companies (Unilever Indonesia, Indofood)

Technology Startups

Investments and Venture Capitalist Firms

Cloud Service Providers (AWS, Microsoft Azure)

Companies

Players Mentioned in the Report

Telkomsigma

PT Lintasarta

NTT Communications

PT Datacomm Diangraha

XL Axiata

PT Mastersystem Infotama

IBM Indonesia

Accenture

Huawei Indonesia

Fujitsu Indonesia

Table of Contents

1. Indonesia Managed Services Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Indonesia Managed Services Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Indonesia Managed Services Market Analysis

3.1. Growth Drivers

3.1.1. Growing IT Infrastructure (Cloud Adoption, Data Center Expansion, Network Modernization)

3.1.2. Increased Focus on Cybersecurity (Regulatory Compliance, Data Privacy Laws)

3.1.3. Digital Transformation Initiatives (Government, SMEs, and Enterprises)

3.1.4. Rising Demand for Business Continuity and Disaster Recovery Solutions

3.2. Market Challenges

3.2.1. Shortage of Skilled IT Professionals

3.2.2. High Initial Setup Costs

3.2.3. Complex Regulatory Environment (Data Sovereignty, Local Hosting Requirements)

3.3. Opportunities

3.3.1. Expanding SME Sector (Cloud-based Managed Services)

3.3.2. Emergence of Industry 4.0 (IoT, AI-driven Managed Services)

3.3.3. Integration of AI and Automation in Managed Services

3.4. Trends

3.4.1. Rise of Hybrid Cloud Solutions

3.4.2. Increase in IT Outsourcing to Managed Service Providers (MSPs)

3.4.3. Shift Toward Managed Security Services

3.5. Government Regulation

3.5.1. Data Protection and Privacy Regulations (PDP Bill, Data Localization Laws)

3.5.2. Compliance Requirements for MSPs

3.5.3. Public-Private Partnerships in IT Infrastructure

3.6. SWOT Analysis

3.6.1. Strengths

3.6.2. Weaknesses

3.6.3. Opportunities

3.6.4. Threats

3.7. Stakeholder Ecosystem

3.7.1. MSPs

3.7.2. End-users (Enterprises, Government, SMEs)

3.7.3. Technology Partners (Cloud Service Providers, IT Hardware Suppliers)

3.8. Porters Five Forces Analysis

3.9. Competition Ecosystem

4. Indonesia Managed Services Market Segmentation

4.1. By Service Type (In Value %)

4.1.1. Managed Security Services

4.1.2. Managed Network Services

4.1.3. Managed Data Center Services

4.1.4. Managed Cloud Services

4.1.5. Managed Mobility Services

4.2. By Deployment Model (In Value %)

4.2.1. On-premise

4.2.2. Cloud

4.2.3. Hybrid

4.3. By Enterprise Size (In Value %)

4.3.1. Small and Medium Enterprises (SMEs)

4.3.2. Large Enterprises

4.4. By Vertical (In Value %)

4.4.1. BFSI

4.4.2. IT & Telecom

4.4.3. Government

4.4.4. Healthcare

4.4.5. Manufacturing

4.5. By Region (In Value %)

4.5.1. Java

4.5.2. Sumatra

4.5.3. Kalimantan

4.5.4. Sulawesi

4.5.5. Papua

5. Indonesia Managed Services Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Telkomsigma

5.1.2. XL Axiata

5.1.3. PT Mastersystem Infotama

5.1.4. NTT Communications

5.1.5. PT Datacomm Diangraha

5.1.6. PT Lintasarta

5.1.7. PT IndoInternet

5.1.8. Telkomtelstra

5.1.9. IBM Indonesia

5.1.10. Accenture

5.1.11. Dimension Data

5.1.12. Huawei Indonesia

5.1.13. Fujitsu Indonesia

5.1.14. PT Trikomsel Oke

5.1.15. GITS Indonesia

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue, Service Offerings, Industry Focus, Key Clients, Strategic Partnerships)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Indonesia Managed Services Market Regulatory Framework

6.1. Data Protection Regulations

6.2. Compliance Requirements for MSPs

6.3. Certification Processes

7. Indonesia Managed Services Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Indonesia Managed Services Future Market Segmentation

8.1. By Service Type (In Value %)

8.2. By Deployment Model (In Value %)

8.3. By Enterprise Size (In Value %)

8.4. By Vertical (In Value %)

8.5. By Region (In Value %)

9. Indonesia Managed Services Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The first step involved identifying major stakeholders within the Indonesia Managed Services Market, including managed service providers, cloud service providers, and industry associations. This step was grounded in extensive secondary research from proprietary databases, trade journals, and industry reports.

Step 2: Market Analysis and Construction

Historical data for the Indonesia Managed Services market was compiled to evaluate key market metrics such as market penetration and service adoption rates. Data on revenue generation from various service categories was collected to assess overall market trends.

Step 3: Hypothesis Validation and Expert Consultation

Market assumptions were validated through expert consultations with managed service providers and IT industry professionals in Indonesia. This provided critical operational insights, which were factored into the market forecasts and analyses.

Step 4: Research Synthesis and Final Output

The final phase involved synthesizing data from interviews and historical research to produce a comprehensive market report. Special emphasis was placed on validating the accuracy of revenue figures and service segment growth rates.

Frequently Asked Questions

01. How big is the Indonesia Managed Services Market?

The Indonesia Managed Services market is valued at USD 342 million, based on a five-year historical analysis. This market is primarily driven by the growing demand for outsourced IT services, including cloud management, cybersecurity solutions, and data storage, as companies across various sectors strive for digital transformation.

02. What are the challenges in the Indonesia Managed Services Market?

The market faces challenges such as a shortage of skilled IT professionals, high initial setup costs for MSPs, and the complex regulatory environment regarding data localization and protection.

03. Who are the major players in the Indonesia Managed Services Market?

Key players in the market include Telkomsigma, PT Lintasarta, NTT Communications, PT Datacomm Diangraha, and XL Axiata. These companies dominate due to their extensive service portfolios and partnerships with global tech giants.

04. What are the growth drivers of the Indonesia Managed Services Market?

Growth drivers include the rapid adoption of cloud technologies, increased cybersecurity risks, and the digital transformation initiatives of both large enterprises and SMEs across the country.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.