Indonesia Marine Lubricants Market Outlook to 2030

Region:Asia

Author(s):Sanjeev

Product Code:KROD2502

December 2024

95

About the Report

Indonesia Marine Lubricants Market Overview

- The Indonesia Marine Lubricants Market, valued at USD 280 million, is largely driven by the extensive maritime industry, comprising cargo shipping, fishing fleets, and offshore oil exploration. Indonesias vast archipelago, with over 17,000 islands, necessitates a well-developed shipping network, resulting in high demand for marine lubricants. Demand is bolstered by both domestic and international shipping routes, with a growing focus on eco-friendly lubricant solutions aligning with global environmental standards.

- Major port cities like Jakarta, Surabaya, and Balikpapan dominate the Indonesia Marine Lubricants Market, driven by their strategic locations and high shipping activity. Jakarta's Tanjung Priok Port, as Indonesias largest and busiest port, acts as a hub for import-export activities, while Surabaya and Balikpapan are central to industrial shipping and offshore activities. This regional dominance is influenced by well-established port infrastructure and proximity to key shipping routes.

- Indonesias government enforces strict environmental standards in the marine sector to reduce emissions, impacting the marine lubricant market. In 2024, compliance checks by the Ministry of Environment targeted 40% of the fleet, requiring eco-friendly lubricant use in response to national pollution concerns. These regulations drive the adoption of low-emission and biodegradable lubricants, encouraging environmentally responsible products in the market.

Indonesia Marine Lubricants Market Segmentation

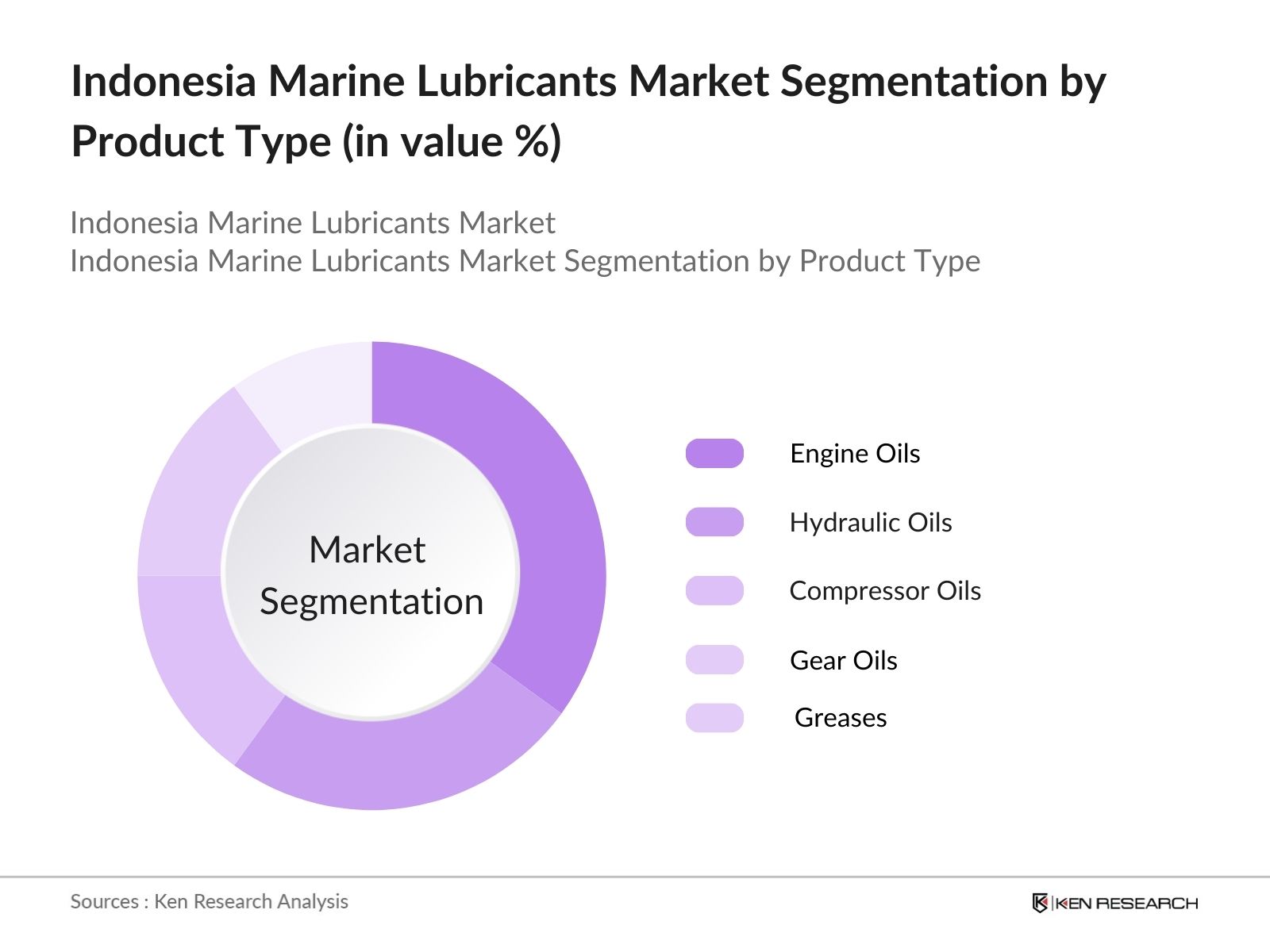

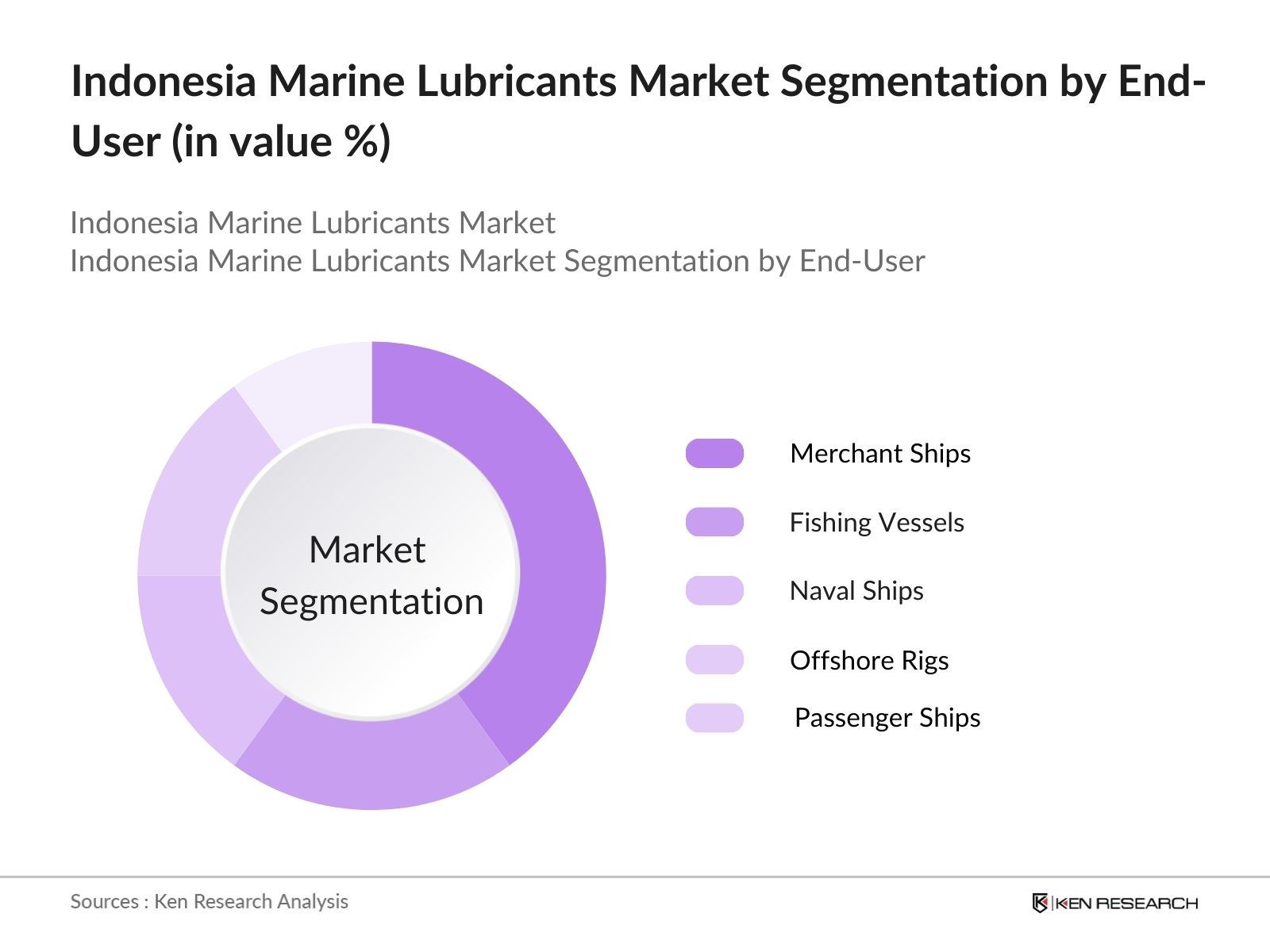

Indonesias marine lubricant market is segmented by product type and by end-user.

- By Product Type: Indonesias marine lubricant market is segmented into engine oils, hydraulic oils, compressor oils, gear oils, and greases. Engine oils hold the dominant market share due to their essential role in maintaining ship engines efficiency and durability. With the extensive use of commercial and industrial fleets across Indonesia, demand for high-performance engine oils remains robust. Market leaders like Shell and PT Pertamina focus on developing products tailored for high-load and high-temperature applications, further consolidating engine oils position in this segment.

- By End-User: The market is also segmented by end-user into merchant ships, fishing vessels, naval ships, offshore rigs, and passenger ships. Merchant ships are the largest consumers due to their frequent and extensive use in transporting goods domestically and internationally. The demand from merchant vessels is driven by Indonesias position in the global shipping industry, necessitating high lubricant consumption to ensure uninterrupted and efficient operations.

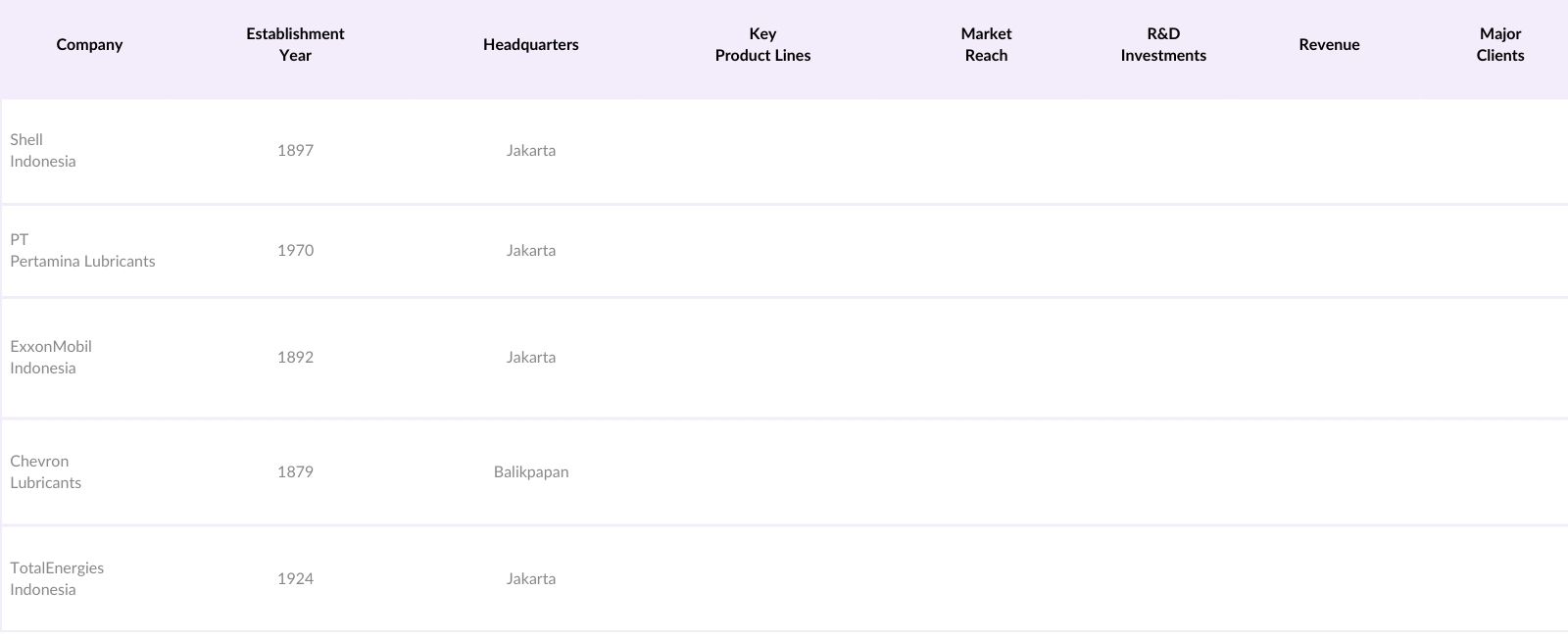

Indonesia Marine Lubricants Market Competitive Landscape

The Indonesia Marine Lubricants Market is characterized by a mix of global and local players, with international companies like Shell and ExxonMobil dominating due to their advanced R&D and established product portfolios. Local firms such as PT Pertamina Lubricants are also significant contributors, leveraging local knowledge and distribution networks.

Indonesia Marine Lubricants Market Analysis

Growth Drivers

- Rise in Maritime Trade Activities: Indonesias maritime trade significantly boosts the demand for marine lubricants. As the worlds largest archipelagic nation, Indonesias seaborne trade has reached 6.3 billion metric tons in 2024, driven by domestic and regional shipments, as reported by Indonesias Ministry of Transportation. With over 17,000 islands, Indonesia relies heavily on maritime transport, and increased vessel activity has led to higher lubricant demand to maintain vessel performance. Moreover, its strategic location along major global shipping routes increases the need for reliable marine operations. This heightened maritime traffic necessitates regular lubricant consumption for vessel maintenance and operational efficiency.

- Increasing Ship Maintenance Requirements: The expansion of Indonesia's fleet to 19,500 vessels in 2024, covering both commercial and industrial purposes, underscores the need for frequent ship maintenance. As vessels undertake more extensive routes, demand for quality marine lubricants that reduce engine wear and fuel consumption rises. Regular maintenance, driven by regulatory guidelines set by Indonesias Maritime Authority, enhances the efficiency and life of these ships, increasing the need for specialized lubricants. Routine maintenance ensures adherence to operational standards and minimizes downtime in a market where 80% of goods rely on marine logistics.

- Government Maritime Policies (e.g., Cabotage Principle): Indonesia's implementation of the Cabotage Principle mandates that domestic shipping be conducted by Indonesian-flagged vessels, which increases local vessel registration and, consequently, lubricant demand. With over 70% of Indonesia's domestic cargo carried by Indonesian vessels, the policy has spurred the purchase of local marine lubricants. In 2024, the government supported an increase in local vessel registration by 12%, further driving lubricant requirements across Indonesia's substantial maritime network. These policies aim to boost domestic ship operators, creating a stable market for local lubricant suppliers.

Market Challenges

- High Operational Costs; Operating costs in the Indonesian marine sector remain high, with fuel and maintenance accounting for over 55% of vessel expenses. As the maritime industry complies with stricter maintenance protocols, the price for maintenance materials like marine lubricants also rises. Indonesias Ministry of Industry reports that high operational costs limit profitability for smaller shipping firms, adding financial pressure that influences lubricant purchasing decisions. These cost constraints can reduce the demand for premium lubricants, pushing operators toward more cost-effective alternatives, despite quality concerns. Indonesian Ministry of Industry

- Environmental Regulations (Compliance with IMO 2020 Sulfur Cap): Indonesias compliance with the IMO 2020 sulfur cap, limiting sulfur emissions to 0.5% in marine fuels, has increased the demand for low-sulfur marine lubricants. Since 2020, Indonesias Environmental Ministry has monitored vessel compliance, imposing stricter requirements for lubricants that reduce emissions. These environmental regulations affect approximately 45% of Indonesias fleet, making eco-friendly lubricants a necessity. Meeting compliance standards raises operational expenses for ship operators, creating a challenge for local suppliers to offer affordable, compliant lubricants.

Indonesia Marine Lubricants Market Future Outlook

The Indonesia Marine Lubricants Market is anticipated to witness significant growth, propelled by increased maritime trade activities, continued infrastructure investments, and stricter environmental regulations. The adoption of bio-based and synthetic lubricants is expected to expand as global and local marine companies focus on sustainability and efficiency improvements. With the expansion of Indonesias maritime logistics and international trade network, the market for high-performance lubricants is projected to grow, meeting the needs of an evolving shipping industry.

Market Opportunities

- Technological Innovations in Lubricants: Advancements in lubricant technology present opportunities for enhanced fuel efficiency and reduced emissions in Indonesias shipping sector. New formulations that prolong engine life and minimize carbon deposits are gaining attention among operators aiming to meet stringent environmental standards. For instance, the development of nanotechnology-based lubricants that optimize performance in high-sulfur environments can cater to Indonesia's diverse vessel types. Indonesias Ministry of Industry notes the potential of local innovation hubs to boost technology in lubricant production, supporting a market shift toward high-performance, eco-friendly solutions.

- Potential Expansion in Domestic Shipbuilding: Indonesias domestic shipbuilding industry is poised for growth, supported by government investments of 4.7 trillion IDR in 2024 aimed at enhancing port infrastructure and domestic ship production capacity. This expansion directly influences the demand for marine lubricants, as more vessels require maintenance post-production. In 2024, Indonesia saw a 15% increase in locally built ships, a trend expected to sustain lubricant consumption due to higher national vessel ownership. This government-backed expansion creates a reliable demand pipeline for domestic lubricant suppliers.

Scope of the Report

|

Engine Oils Hydraulic Oils Compressor Oils Gear Oils Greases |

|

|

By End-User |

Merchant Ships Fishing Vessels, Naval Ships Offshore Rigs Passenger Ships |

|

By Distribution Channel |

Direct Sales Distributors Online Platforms |

|

By Technology Type |

Synthetic Lubricants Mineral-Based Lubricants Bio-Based Lubricants |

|

By Region |

North East West South |

Products

Key Target Audience

Maritime Transport Operators

Ship Maintenance Providers

Lubricant Distributors and Suppliers

Marine Engineering Companies

Government and Regulatory Bodies (Ministry of Transportation, Directorate General of Sea Transportation)

Investors and Venture Capitalist Firms

Offshore Oil and Gas Exploration Companies

Environmental Organizations and Advocacy Groups

Companies

Major Players in the Market

Shell Indonesia

PT Pertamina Lubricants

ExxonMobil Indonesia

Chevron Lubricants

TotalEnergies Indonesia

BP Marine

Castrol Indonesia

Idemitsu Indonesia

Gulf Oil Marine

Sinopec Marine Lubricants

Fuchs Lubricants Indonesia

JX Nippon Oil & Energy

Phillips 66 Lubricants

PetroChina Lubricants

Total Marine Solutions

Table of Contents

1. Indonesia Marine Lubricants Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate Analysis

1.4. Market Segmentation Overview

2. Indonesia Marine Lubricants Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Indonesia Marine Lubricants Market Dynamics

3.1. Growth Drivers

3.1.1. Rise in Maritime Trade Activities

3.1.2. Increasing Ship Maintenance Requirements

3.1.3. Government Maritime Policies (e.g., Cabotage Principle)

3.2. Market Challenges

3.2.1. High Operational Costs

3.2.2. Environmental Regulations (Compliance with IMO 2020 Sulfur Cap)

3.2.3. Supply Chain Disruptions

3.3. Opportunities

3.3.1. Technological Innovations in Lubricants

3.3.2. Potential Expansion in Domestic Shipbuilding

3.3.3. Collaboration with Global Marine Suppliers

3.4. Trends

3.4.1. Adoption of Bio-Based Lubricants

3.4.2. Preference for High-Performance Synthetic Oils

3.4.3. Integration of Digital Monitoring Solutions

3.5. Government Regulations

3.5.1. Environmental Compliance Standards

3.5.2. Licensing and Certification Requirements

3.5.3. National Shipping Policy (Impact on Lubricant Demand)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competitive Ecosystem

4. Indonesia Marine Lubricants Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Engine Oils

4.1.2. Hydraulic Oils

4.1.3. Compressor Oils

4.1.4. Gear Oils

4.1.5. Greases

4.2. By End-User (In Value %)

4.2.1. Merchant Ships

4.2.2. Fishing Vessels

4.2.3. Naval Ships

4.2.4. Offshore Rigs

4.2.5. Passenger Ships

4.3. By Distribution Channel (In Value %)

4.3.1. Direct Sales

4.3.2. Distributors

4.3.3. Online Platforms

4.4. By Technology Type (In Value %)

4.4.1. Synthetic Lubricants

4.4.2. Mineral-Based Lubricants

4.4.3. Bio-Based Lubricants

4.5. By Region (In Value %)

4.5.1. North

4.5.2. East

4.5.3. West

4.5.4. South

5. Indonesia Marine Lubricants Market Competitive Landscape

5.1. Detailed Profiles of Major Companies

5.1.1. Shell Indonesia

5.1.2. PT Pertamina Lubricants

5.1.3. ExxonMobil Indonesia

5.1.4. Chevron Lubricants Indonesia

5.1.5. TotalEnergies Indonesia

5.1.6. BP Marine

5.1.7. Castrol Indonesia

5.1.8. Idemitsu Indonesia

5.1.9. Gulf Oil Marine

5.1.10. Sinopec Marine Lubricants

5.1.11. Fuchs Lubricants Indonesia

5.1.12. JX Nippon Oil & Energy

5.1.13. Phillips 66 Lubricants

5.1.14. PetroChina Lubricants

5.1.15. Total Marine Solutions

5.2. Cross-Comparison Parameters (Number of Employees, Headquarters, Inception Year, Revenue, Market Share, Key Product Lines, Geographic Reach, R&D Investments)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Indonesia Marine Lubricants Market Regulatory Framework

6.1. Environmental Standards Compliance

6.2. Licensing and Certification Processes

6.3. Compliance Requirements (Emission Controls)

7. Indonesia Marine Lubricants Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Drivers for Future Growth

8. Indonesia Marine Lubricants Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By End-User (In Value %)

8.3. By Distribution Channel (In Value %)

8.4. By Technology Type (In Value %)

8.5. By Region (In Value %)

9. Indonesia Marine Lubricants Market Analyst Recommendations

9.1. Total Addressable Market (TAM), Serviceable Available Market (SAM), and Serviceable Obtainable Market (SOM) Analysis

9.2. Customer Cohort Analysis

9.3. Marketing and Brand Positioning Initiatives

9.4. White Space Opportunity Analysis

DisclaimerContact Us

Research Methodology

Step 1: Identification of Key Variables

The initial phase focuses on identifying the critical variables influencing the Indonesia Marine Lubricants Market, including consumption patterns, product innovation, and regulatory compliance. An ecosystem map is developed through comprehensive desk research using primary and secondary databases to pinpoint these elements.

Step 2: Market Analysis and Construction

This step involves gathering and analyzing historical data on market demand, lubricant applications, and end-user segment penetration. A thorough examination of product sales trends and consumption ratios is conducted to establish reliable revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and validated through consultations with industry experts via phone interviews and in-person discussions. Insights from these consultations provide operational and financial details, enhancing the data accuracy and supporting the report's findings.

Step 4: Research Synthesis and Final Output

In the final stage, insights from leading marine lubricant manufacturers and distributors are integrated to validate sales data, consumer preferences, and product performance, ensuring the report offers a comprehensive and validated analysis of the Indonesia Marine Lubricants Market.

Frequently Asked Questions

01. How big is the Indonesia Marine Lubricants Market?

The Indonesia Marine Lubricants Market is valued at USD 280 million, driven by the demand from commercial shipping and offshore operations in major port cities.

02. What challenges does the Indonesia Marine Lubricants Market face?

Challenges in Indonesia Marine Lubricants Market include stringent environmental regulations, high operational costs, and supply chain disruptions, which may affect the consistent availability and cost of lubricants.

03. Who are the major players in the Indonesia Marine Lubricants Market?

Key players include in Indonesia Marine Lubricants Market are Shell Indonesia, PT Pertamina Lubricants, ExxonMobil Indonesia, Chevron Lubricants, and TotalEnergies Indonesia, dominating due to strong distribution networks and product innovations.

04. What drives the growth of the Indonesia Marine Lubricants Market?

Indonesia Marine Lubricants Market Growth is propelled by Indonesias maritime trade expansion, government maritime policies, and the ongoing demand for high-performance lubricants across diverse vessel types.

05. Which regions are the key consumers in the Indonesia Marine Lubricants Market?

Jakarta, Surabaya, and Balikpapan are significant regions, driven by their strategic ports, industrial shipping activities, and proximity to key trade routes.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.