Indonesia Medical Devices Market Outlook to 2030

Region:Asia

Author(s):Mukul

Product Code:KROD9689

November 2024

99

About the Report

Indonesia Medical Devices Market Overview

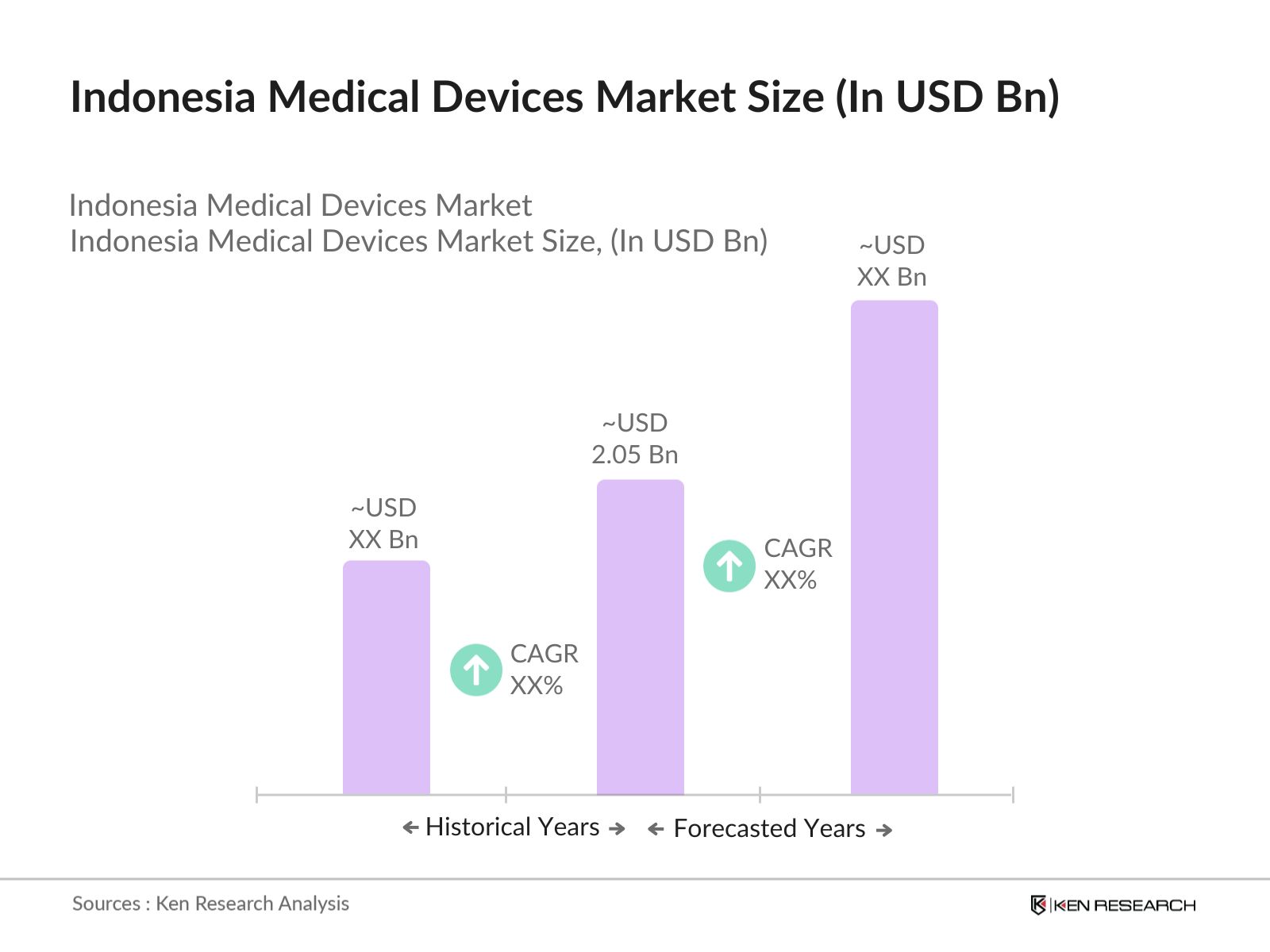

- The Indonesia Medical Devices market is valued at USD 2.05 billion, according to a five-year historical analysis. This market is primarily driven by rising healthcare expenditure, an aging population, and government initiatives promoting healthcare infrastructure development. The increasing demand for advanced diagnostic tools and home healthcare devices has fueled growth, with a significant contribution from both the private and public sectors aiming to modernize hospitals and clinics. Additionally, rapid urbanization and improvements in healthcare insurance penetration continue to support market expansion.

- The cities of Jakarta, Surabaya, and Bandung play a dominant role in the Indonesia Medical Devices market due to their dense populations and advanced healthcare infrastructure. These urban centers host the majority of private hospitals and high-end medical facilities, creating a strong demand for cutting-edge medical equipment. The capital's central position as a business hub also facilitates medical imports, ensuring a steady supply of new technologies. Java Island remains the primary focal point for market activity due to its healthcare development compared to other regions.

- Indonesias healthcare expenditure continues to rise, reaching IDR 1,500 trillion ($96 billion) in 2024, driven by government healthcare programs and increased demand for medical services. This rise in spending is expected to benefit the medical devices market, as hospitals and clinics allocate more funds toward the procurement of advanced equipment. With the government focusing on improving healthcare infrastructure and expanding healthcare access, there is growing demand for diagnostic, therapeutic, and surgical devices to meet the needs of a growing and aging population.

Indonesia Medical Devices Market Segmentation

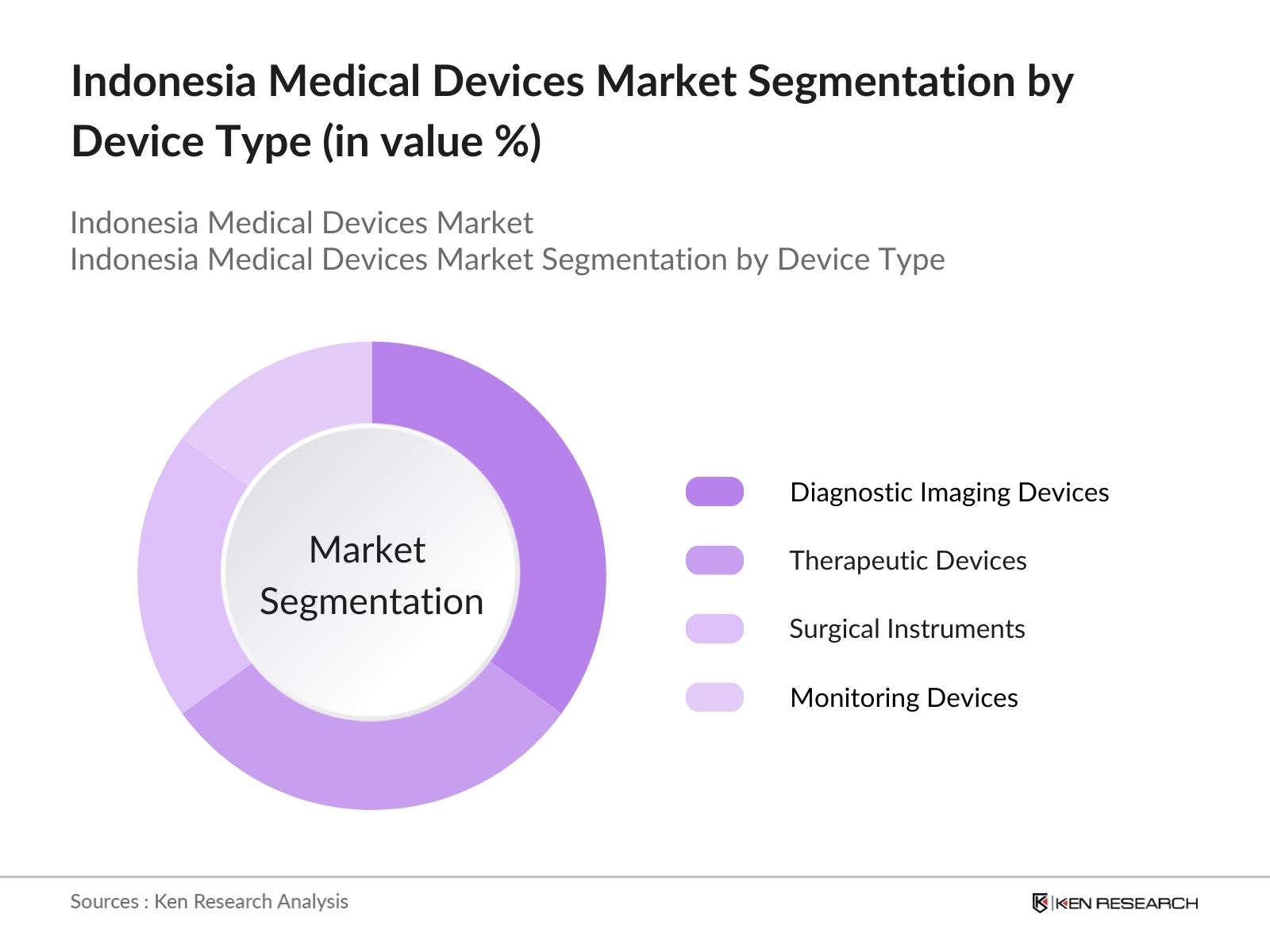

- By Device Type: The Indonesia Medical Devices market is segmented by device type into diagnostic imaging devices, therapeutic devices, surgical instruments, monitoring devices, and consumables. Diagnostic imaging devices currently dominate the market share. The growing prevalence of chronic diseases such as cardiovascular and respiratory disorders has increased the demand for accurate diagnostics, driving the adoption of these devices. Hospitals and clinics in urban centers are increasingly investing in upgrading their diagnostic capabilities to cater to the rising patient load.

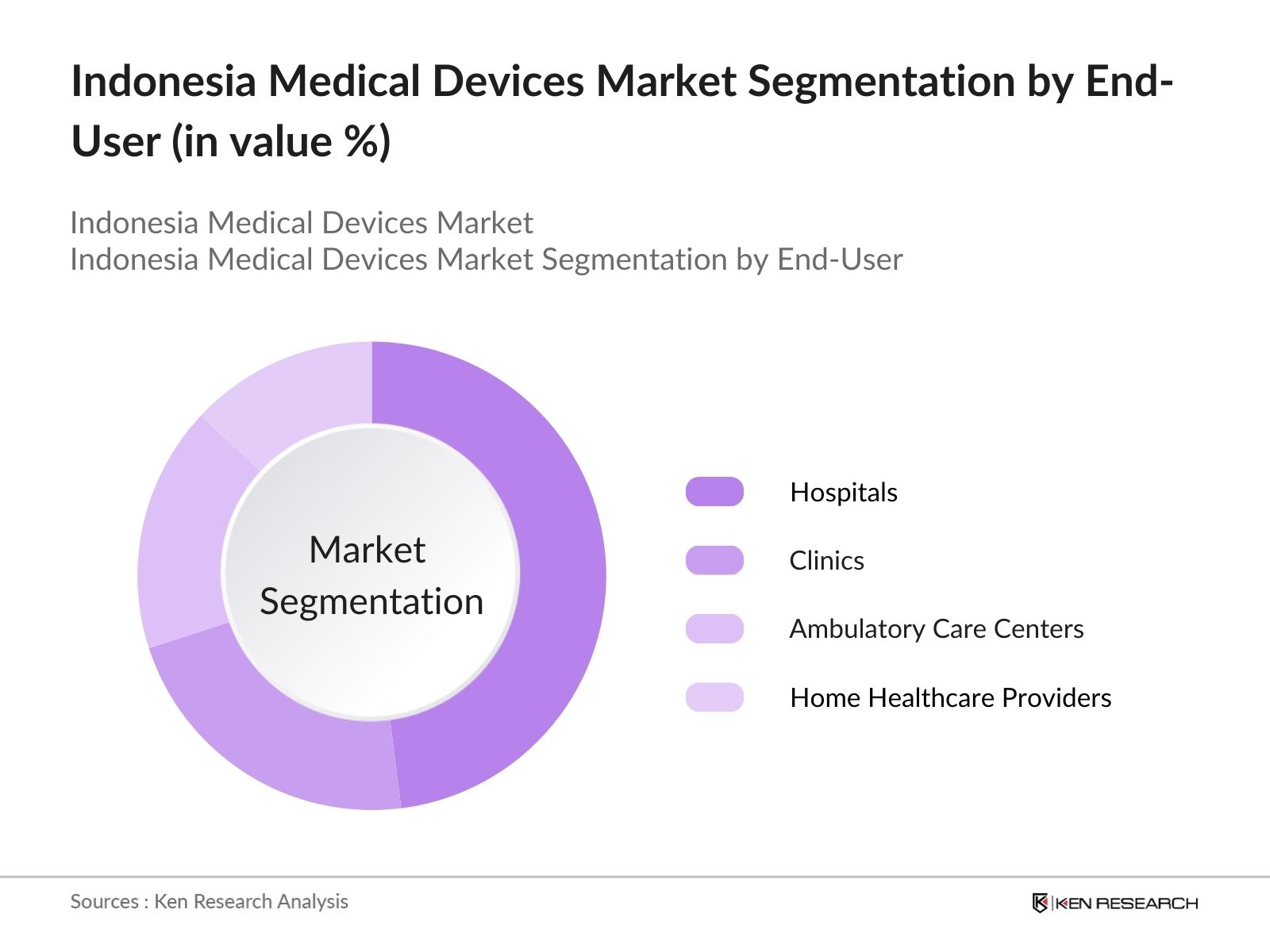

- By End-User: The market is further segmented by end-users, including hospitals, clinics, ambulatory care centers, and home healthcare providers. Hospitals hold the largest share in this category. Due to their comprehensive care offerings and extensive patient traffic, hospitals require a wide range of medical devices, including imaging systems, surgical instruments, and monitoring equipment. Moreover, Indonesias healthcare system has prioritized the development of hospitals in both public and private sectors, increasing their demand for sophisticated medical technologies.

Indonesia Medical Devices Market Competitive Landscape

The Indonesia Medical Devices market is dominated by several global and local companies. Local manufacturers like PT Kimia Farma and international giants such as Philips and Siemens Healthcare control a significant portion of the market. The presence of these established players highlights their influence over the market, offering a diverse range of medical devices catering to various specialties. Additionally, international companies frequently collaborate with local distributors to enhance their reach within Indonesia.

|

Company Name |

Establishment Year |

Headquarters |

Revenue (USD) |

Employees |

Product Range |

Geographical Presence |

R&D Investment |

Key Partnerships |

|

PT Kimia Farma |

1957 |

Jakarta, Indonesia |

- |

- |

- |

- |

- |

- |

|

Philips Healthcare |

1891 |

Amsterdam, Netherlands |

- |

- |

- |

- |

- |

- |

|

Siemens Healthineers |

1847 |

Erlangen, Germany |

- |

- |

- |

- |

- |

- |

|

GE Healthcare |

1892 |

Chicago, USA |

- |

- |

- |

- |

- |

- |

|

B. Braun Indonesia |

1839 |

Melsungen, Germany |

- |

- |

- |

- |

- |

- |

Indonesia Medical Devices Industry Analysis

Growth Drivers

- Aging Population: Indonesia's aging population is driving the demand for medical devices, particularly for elderly care and chronic disease management. As of 2024, Indonesia has over 29 million individuals aged 60 and above, representing nearly 11% of the total population. This demographic shift has increased the need for advanced healthcare equipment, such as diagnostic devices, mobility aids, and home healthcare solutions. The Indonesian Ministry of Health has noted a rise in chronic diseases such as diabetes and hypertension, which further necessitates advanced medical devices. This aging population puts pressure on healthcare services, thereby driving medical device adoption.

- Government Healthcare Initiatives: Indonesias healthcare reforms, such as the national health insurance program (JKN), have expanded healthcare access to over 230 million Indonesians by 2024, thus driving demand for medical devices. The government has allocated approximately IDR 156 trillion ($10 billion) to healthcare in 2024 to improve medical infrastructure and device availability. Furthermore, initiatives aimed at promoting the local manufacturing of medical devices to reduce import dependence are crucial in supporting the domestic market's growth. Government-backed programs to provide low-cost healthcare services continue to fuel the demand for various types of diagnostic and therapeutic equipment.

- Increasing Prevalence of Chronic Diseases: Chronic diseases, particularly cardiovascular diseases, diabetes, and respiratory disorders, are on the rise in Indonesia, prompting an increased demand for diagnostic and therapeutic medical devices. In 2024, approximately 22 million Indonesians are living with diabetes, and heart diseases are the leading cause of death. These figures underscore the critical need for sophisticated diagnostic tools, monitoring devices, and surgical equipment. As non-communicable diseases burden Indonesia's healthcare system, hospitals and clinics are increasingly adopting advanced medical technologies to manage these chronic conditions.

Market Restraints

- Regulatory Compliance and Approval Processes: The regulatory approval process for medical devices in Indonesia remains a significant challenge. The Indonesian Medical Device Regulatory Agency (BPOM) oversees strict guidelines for both locally produced and imported devices, with approval timelines extending up to 18 months for some products. In 2024, new regulatory reforms were introduced to ensure compliance with international standards, but the complexity of the process continues to slow market entry for new devices. Moreover, companies face difficulties in navigating the ASEAN Medical Device Directive, which requires compliance with regional standards before product approval.

- High Import Dependence: Indonesias medical device market is heavily reliant on imports, with around 90% of all medical devices used in the country being sourced from foreign manufacturers. This dependence has created significant challenges, especially in 2024, due to currency fluctuations and increased import costs. The Indonesian government is pushing for local manufacturing capabilities, but the current infrastructure is inadequate to meet domestic demand. This high import reliance also leaves the market vulnerable to global supply chain disruptions, which could delay the availability of essential medical devices in the country.

Indonesia Medical Devices Market Future Outlook

Over the next five years, the Indonesia Medical Devices market is expected to witness significant growth, driven by government initiatives focused on expanding healthcare access, the establishment of new hospitals, and a rising middle class with increasing healthcare awareness. The advancement of medical technologies such as AI-enabled diagnostics and wearable healthcare devices will further propel the market. Additionally, growing partnerships between local and global manufacturers are expected to bring innovations to the forefront, catering to the rising demand for high-quality medical care.

Market Opportunities

- Expansion of Telemedicine and Remote Healthcare Solutions: Telemedicine and remote healthcare are emerging as significant opportunities in Indonesia. As of 2024, the government has expanded telehealth services to reach rural populations, with over 15 million users benefiting from virtual healthcare services. The increased internet penetration rate, now at 77%, has enabled healthcare providers to adopt telemedicine platforms, reducing the burden on overcrowded hospitals and allowing patients in remote areas to access care. This trend has led to increased demand for telemedicine-compatible medical devices, such as portable diagnostic tools and remote monitoring systems.

- Growth of Medical Device Manufacturing Hubs: Indonesia is positioning itself as a regional manufacturing hub for medical devices. In 2024, the government introduced incentives to attract foreign direct investment (FDI) in medical device manufacturing, including tax holidays and reduced tariffs. Industrial zones in West Java and East Java are being developed to house medical device factories, with over $1.2 billion invested in new manufacturing facilities. These hubs are expected to boost domestic production, reduce import dependency, and create thousands of jobs, offering lucrative opportunities for investors and manufacturers alike.

Scope of the Report

|

By Device Type |

Diagnostic Imaging Devices |

|

By End-User |

Hospitals |

|

By Technology |

Digital Health Technology |

|

By Application |

Cardiology |

|

By Region |

Java |

Products

Key Target Audience

Hospitals and Clinics

Medical Device Manufacturers

Pharmaceutical Companies

Private Healthcare Providers

Government and Regulatory Bodies (BPOM, Ministry of Health)

Venture Capital and Investment Firms

Technology and Software Providers

Healthcare Infrastructure Developers

Companies

Players Mentioned in the Report:

PT Kimia Farma

Philips Healthcare Indonesia

Siemens Healthineers

GE Healthcare

B. Braun Indonesia

Medtronic

Abbott Indonesia

Terumo Indonesia

Stryker

Olympus

Cardinal Health

PT Mitra Keluarga Karyasehat

Zimmer Biomet

PT Prodia Widyahusada Tbk

Johnson & Johnson Indonesia

Table of Contents

1. Indonesia Medical Devices Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Indonesia Medical Devices Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Indonesia Medical Devices Market Analysis

3.1. Growth Drivers

3.1.1. Aging Population

3.1.2. Government Healthcare Initiatives

3.1.3. Increasing Prevalence of Chronic Diseases

3.1.4. Technological Advancements in Medical Devices

3.2. Market Challenges

3.2.1. Regulatory Compliance and Approval Processes

3.2.2. High Import Dependence

3.2.3. Inadequate Healthcare Infrastructure

3.2.4. Limited R&D Investment

3.3. Opportunities

3.3.1. Expansion of Telemedicine and Remote Healthcare Solutions

3.3.2. Growth of Medical Device Manufacturing Hubs

3.3.3. Rising Healthcare Expenditure

3.3.4. Private Sector Partnerships and Investments

3.4. Trends

3.4.1. Increasing Use of Wearable Medical Devices

3.4.2. Integration of IoT in Medical Devices

3.4.3. Growth in Home Healthcare Devices

3.4.4. Adoption of AI in Diagnostics

3.5. Government Regulations

3.5.1. Indonesia Medical Device Regulatory Agency (BPOM) Guidelines

3.5.2. Local Manufacturing and Import Regulations

3.5.3. Compliance with ASEAN Medical Device Directive

3.5.4. Healthcare Financing Policies

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competitive Landscape Overview

4. Indonesia Medical Devices Market Segmentation

4.1. By Device Type (In Value %)

4.1.1. Diagnostic Imaging Devices

4.1.2. Therapeutic Devices

4.1.3. Surgical Instruments

4.1.4. Monitoring Devices

4.1.5. Consumables and Accessories

4.2. By End-User (In Value %)

4.2.1. Hospitals

4.2.2. Clinics

4.2.3. Ambulatory Care Centers

4.2.4. Home Healthcare

4.3. By Technology (In Value %)

4.3.1. Digital Health Technology

4.3.2. Minimally Invasive Technology

4.3.3. Robotic Assistance

4.3.4. Imaging Technology

4.4. By Application (In Value %)

4.4.1. Cardiology

4.4.2. Oncology

4.4.3. Orthopedics

4.4.4. Neurology

4.4.5. General Surgery

4.5. By Region (In Value %)

4.5.1. Java

4.5.2. Sumatra

4.5.3. Kalimantan

4.5.4. Sulawesi

4.5.5. Papua

5. Indonesia Medical Devices Market Competitive Analysis

5.1. Detailed Profiles of Major Competitors

5.1.1. PT Kimia Farma

5.1.2. Philips Healthcare Indonesia

5.1.3. Siemens Healthineers

5.1.4. GE Healthcare

5.1.5. B. Braun Indonesia

5.1.6. Medtronic

5.1.7. Abbott Indonesia

5.1.8. Terumo Indonesia

5.1.9. Stryker

5.1.10. Olympus

5.1.11. Cardinal Health

5.1.12. PT Mitra Keluarga Karyasehat

5.1.13. Zimmer Biomet

5.1.14. PT Prodia Widyahusada Tbk

5.1.15. Johnson & Johnson Indonesia

5.2. Cross Comparison Parameters (Revenue, Market Share, Product Portfolio, R&D Investment, Geographical Presence, Key Partnerships, Recent Acquisitions, Technological Innovation)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment and Venture Capital Analysis

5.7. Government Grants and Incentives

5.8. Private Equity Investments

6. Indonesia Medical Devices Market Regulatory Framework

6.1. Medical Device Registration Process

6.2. Certification Standards (ISO, CE, FDA)

6.3. Local Manufacturing Compliance

6.4. Ethical Guidelines and Patient Safety Regulations

7. Indonesia Medical Devices Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Indonesia Medical Devices Future Market Segmentation

8.1. By Device Type (In Value %)

8.2. By End-User (In Value %)

8.3. By Technology (In Value %)

8.4. By Application (In Value %)

8.5. By Region (In Value %)

9. Indonesia Medical Devices Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Strategies

9.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Indonesia Medical Devices Market. This step is underpinned by extensive desk research, utilizing secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables influencing market dynamics, including technology adoption rates and healthcare access levels.

Step 2: Market Analysis and Construction

In this phase, historical data on market performance is compiled and analyzed. This includes assessing the distribution of medical devices across various regions and healthcare facilities, along with an analysis of the revenue generated from these devices. Data verification is performed to ensure accuracy and reliability.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and validated through interviews with industry experts, including healthcare administrators and medical device manufacturers. These consultations provide operational insights that refine market estimates and enhance data reliability.

Step 4: Research Synthesis and Final Output

The final phase synthesizes primary and secondary research findings, providing an accurate representation of the market's current and projected dynamics. Key insights from healthcare professionals and device manufacturers are integrated to verify the bottom-up approach, ensuring a comprehensive and validated report.

Frequently Asked Questions

1. How big is the Indonesia Medical Devices market?

The Indonesia Medical Devices market was valued at USD 2.05 billion, primarily driven by increasing healthcare expenditure and the expansion of hospital infrastructure.

2. What are the key challenges in the Indonesia Medical Devices market?

The primary challenges include regulatory hurdles, high dependence on imports, and the need for significant investments in local manufacturing to reduce import reliance.

3. Who are the major players in the Indonesia Medical Devices market?

Key players in the market include PT Kimia Farma, Philips Healthcare, Siemens Healthineers, GE Healthcare, and B. Braun Indonesia, all of whom have a strong presence in the country.

4. What are the growth drivers of the Indonesia Medical Devices market?

The market is driven by factors such as an aging population, increasing chronic disease prevalence, government healthcare reforms, and technological advancements in diagnostics and home healthcare devices.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.