Indonesia Medical Technology Market Outlook to 2030

Region:Asia

Author(s):Yogita Sahu

Product Code:KROD11121

December 2024

100

About the Report

Indonesia Medical Technology Market Overview

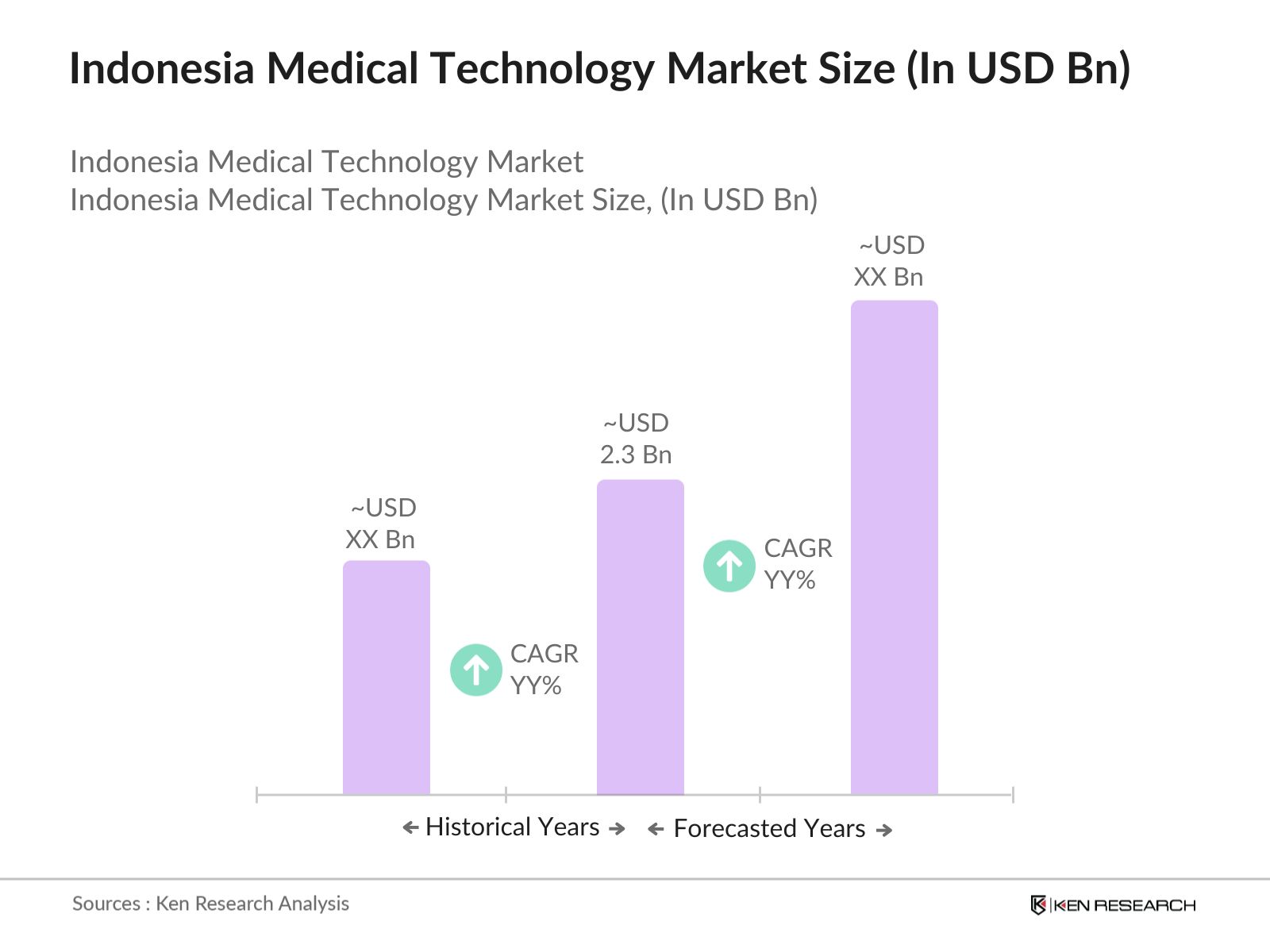

- The Indonesia Medical Technology Market, valued at USD 2.3 billion, has experienced robust growth driven by increasing healthcare needs and technological advancements. Demand for digital health solutions, patient monitoring systems, and diagnostics has surged, supported by government healthcare initiatives and infrastructure investments. The emphasis on healthcare quality, paired with rising private sector investments, continues to drive the adoption of advanced medical technologies in hospitals and clinics nationwide.

- Java, the most populous region, dominates the market due to its advanced healthcare facilities and significant investments in medical infrastructure. Additionally, Sumatra has shown growth due to government healthcare expansion projects and a rising number of diagnostic centers. These regions established infrastructure and focus on healthcare improvement make them primary contributors to market leadership within Indonesia.

- In 2024, the Indonesian government launched the Health Transformation Program, with an investment of 20 trillion IDR aimed at improving healthcare infrastructure, including the development of regional health centers equipped with essential diagnostic and surgical tools. The initiative focuses on expanding healthcare access to rural areas, ensuring medical technology reaches underserved populations by the end of 2028.

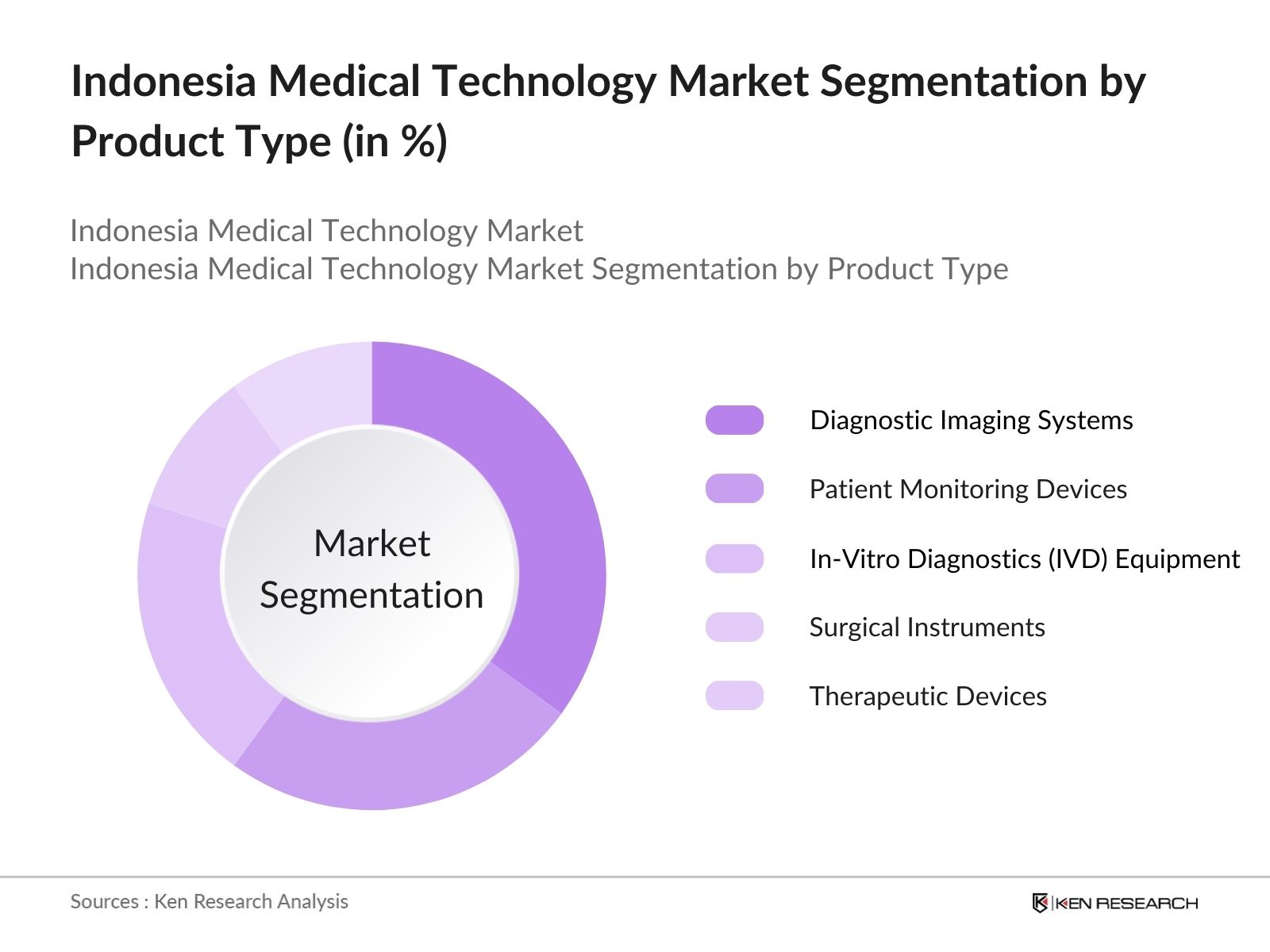

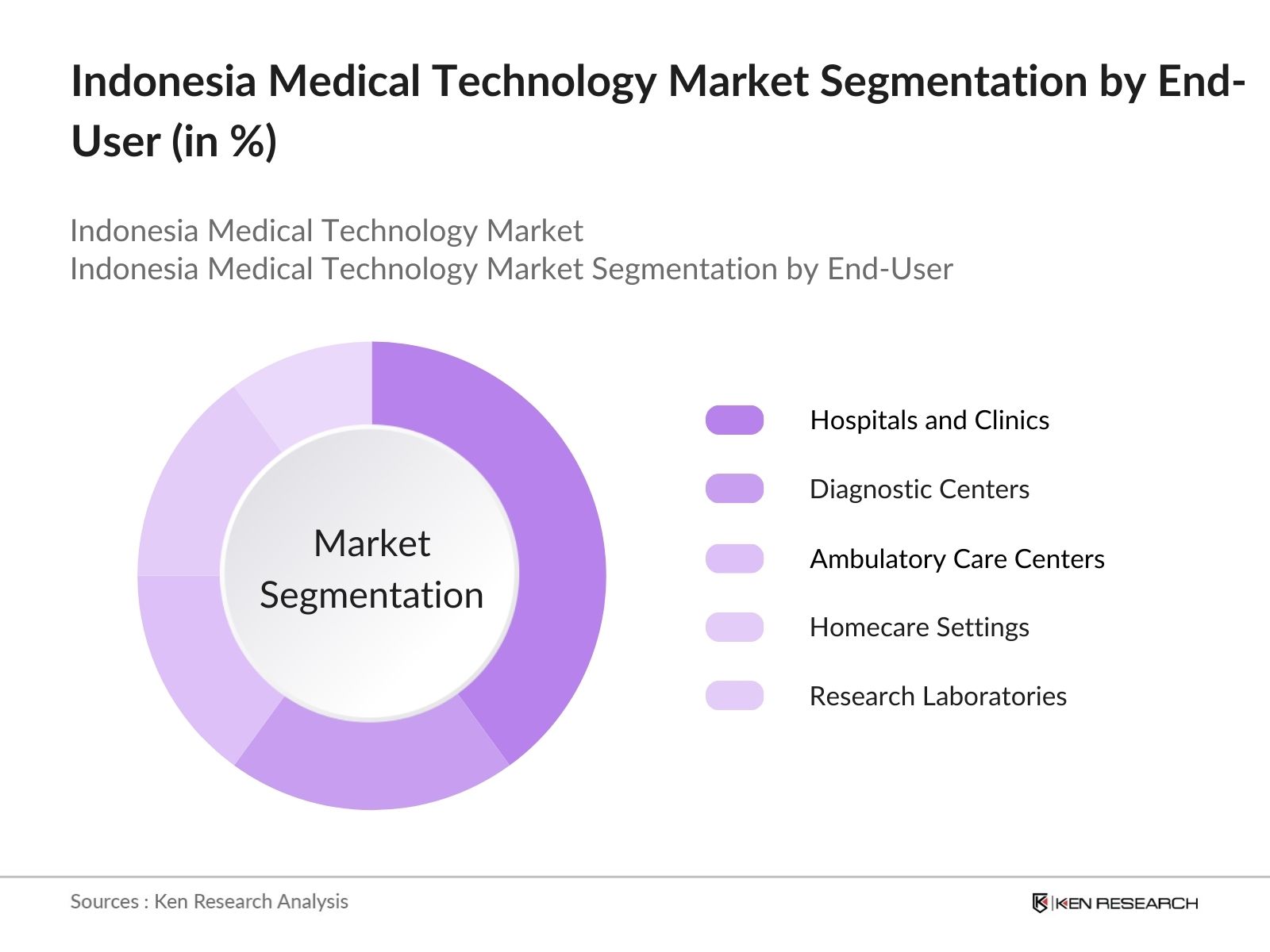

Indonesia Medical Technology Market Segmentation

By Product Type: The market is segmented by product type into diagnostic imaging systems, patient monitoring devices, in-vitro diagnostics (IVD) equipment, surgical instruments, and therapeutic devices. Diagnostic imaging systems lead this segment due to their critical role in early disease detection and the government's support for equipping healthcare facilities with modern diagnostic tools. The need for efficient imaging solutions, such as MRI and CT scanners, to address the increasing disease burden is a driving factor for this segments dominance.

By End-User: The market is also segmented by end-user, including hospitals and clinics, diagnostic centers, ambulatory care centers, homecare settings, and research laboratories. Hospitals and clinics dominate this segment, reflecting their role as primary healthcare providers. Hospitals and clinics are increasingly adopting advanced medical technology solutions to improve patient outcomes and streamline healthcare delivery. With continued investments in hospital infrastructure, this segment remains crucial for market growth.

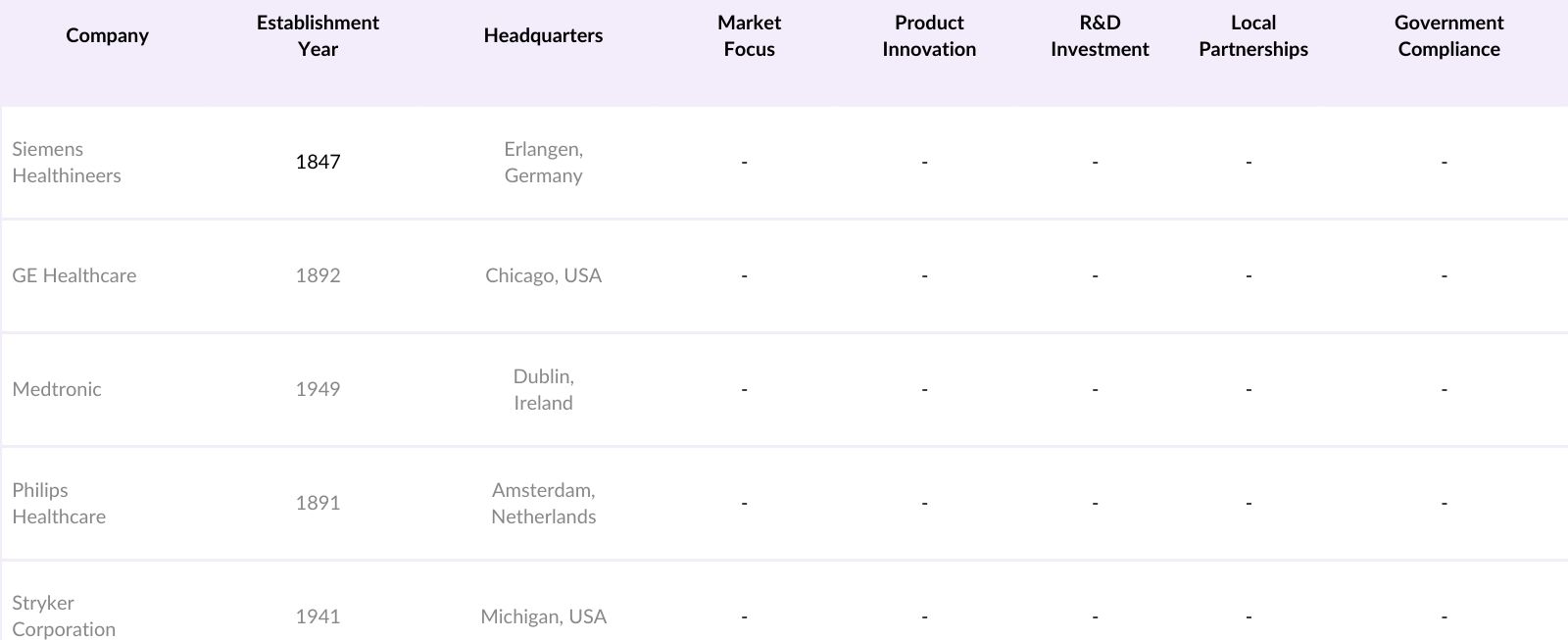

Indonesia Medical Technology Market Competitive Landscape

The market is characterized by prominent international players and a few emerging local companies. Global firms like Siemens Healthineers, GE Healthcare, and Medtronic dominate due to their extensive product portfolios, high-quality standards, and reputation.

Indonesia Medical Technology Market Analysis

Market Growth Drivers

- Increasing Demand for Advanced Diagnostic Equipment: In 2024, Indonesia witnessed a surge in hospital visits, with over 750 million patient encounters recorded in public and private hospitals. This increase has led to heightened demand for diagnostic equipment such as MRI, CT, and ultrasound machines. The Indonesian government, aiming to reduce the burden on healthcare facilities, has been investing heavily in advanced diagnostic technology, particularly in underserved regions with limited access to essential medical equipment.

- Rising Burden of Chronic Diseases: Indonesia is grappling with a substantial rise in non-communicable diseases, with an estimated 52 million cases of diabetes and heart disease documented in 2024. This increase in chronic illnesses has fueled demand for long-term care devices, including monitoring systems, insulin pumps, and wearable devices to manage health remotely.

- Growing Investment in Telemedicine Services: Telemedicine usage in Indonesia saw a sharp rise in 2024, recording over 40 million consultations through online healthcare platforms due to limited access to healthcare facilities in remote areas. In response, the Indonesian government has partnered with key technology players to enhance telehealth infrastructure, allocating over 1.7 trillion IDR in digital healthcare technologies to ensure access to "virtual clinics" across the archipelago.

Market Challenges

- Regulatory and Approval Delays: Indonesias complex regulatory environment has led to delays in medical device approvals, affecting around 6,500 device applications in 2024. This delay not only impacts the introduction of new technologies but also results in prolonged procurement cycles, costing the medical technology industry approximately 1.2 trillion IDR annually.

- Insufficient Infrastructure in Rural Areas: Despite major investment, nearly 3,800 rural healthcare facilities in Indonesia lack adequate infrastructure, including diagnostic and surgical equipment. This shortfall directly impacts healthcare accessibility, with over 23 million rural residents unable to receive essential services due to infrastructural inadequacies.

Indonesia Medical Technology Market Future Outlook

Over the next five years, the Indonesia Medical Technology industry is expected to expand, driven by a surge in demand for advanced diagnostic and monitoring solutions. Government investments, rising healthcare expenditures, and increased private sector participation will contribute to this growth.

Future Market Opportunities

- Rise in Artificial Intelligence in Diagnostics and Treatment: By 2028, Indonesia is expected to implement AI-driven diagnostic tools in over 500 healthcare facilities, supported by investments exceeding 2 trillion IDR in AI technology. These tools will enhance diagnostic accuracy and reduce diagnostic times, addressing the shortage of skilled medical professionals and improving patient outcomes.

- Expansion of Telehealth Services Across the Archipelago: The Indonesian government plans to extend telemedicine coverage to over 90 million people by 2028, investing an estimated 3.5 trillion IDR in infrastructure and partnerships with tech firms. This expansion will ensure comprehensive access to healthcare, especially in rural regions, reducing the dependency on physical healthcare facilities.

Scope of the Report

|

Product Type |

Diagnostic Imaging Systems Patient Monitoring Devices In-Vitro Diagnostics (IVD) Equipment Surgical Instruments Therapeutic Devices |

|

End-User |

Hospitals and Clinics Diagnostic Centers Ambulatory Care Centers Homecare Settings Research Laboratories |

|

Technology |

Digital Health and Telemedicine Wearable Devices Robotics and AI in Healthcare 3D Printing for Medical Applications Biotech and Genomics |

|

Application |

Cardiology Oncology Neurology Orthopedics General Healthcare |

|

Region |

North East West South |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Medical Device Manufacturers

Healthcare Providers (Hospitals and Clinics)

Diagnostic Centers and Labs

Home Healthcare Solutions Providers

Government and Regulatory Bodies (e.g., Indonesia Ministry of Health)

Medical Research Institutions

Investor and Venture Capitalist Firms

Insurance Providers

Companies

Siemens Healthineers

GE Healthcare

Medtronic

Philips Healthcare

Stryker Corporation

Abbott Laboratories

Johnson & Johnson

Roche Diagnostics

Olympus Corporation

Canon Medical Systems

Table of Contents

1. Indonesia Medical Technology Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Indonesia Medical Technology Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Indonesia Medical Technology Market Analysis

3.1. Growth Drivers

3.1.1. Technological Advancements

3.1.2. Increasing Healthcare Expenditure

3.1.3. Aging Population & Chronic Disease Prevalence

3.1.4. Government Initiatives and Support

3.2. Market Challenges

3.2.1. High Capital Requirements

3.2.2. Regulatory Compliance

3.2.3. Data Security Concerns

3.3. Opportunities

3.3.1. Expansion of Telemedicine

3.3.2. Rising Demand for Wearable Devices

3.3.3. Integration of AI in Diagnostics

3.4. Trends

3.4.1. Adoption of Robotics in Surgeries

3.4.2. Increase in Portable Diagnostics Devices

3.4.3. IoT Integration in Medical Devices

3.5. Government Regulations

3.5.1. Medical Device Regulations (BPOM and MOH Standards)

3.5.2. Import Restrictions and Compliance

3.5.3. National Health Program Initiatives

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porter’s Five Forces

3.9. Competitive Landscape Ecosystem

4. Indonesia Medical Technology Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Diagnostic Imaging Systems

4.1.2. Patient Monitoring Devices

4.1.3. In-Vitro Diagnostics (IVD) Equipment

4.1.4. Surgical Instruments

4.1.5. Therapeutic Devices

4.2. By End-User (In Value %)

4.2.1. Hospitals and Clinics

4.2.2. Diagnostic Centers

4.2.3. Ambulatory Care Centers

4.2.4. Homecare Settings

4.2.5. Research Laboratories

4.3. By Technology (In Value %)

4.3.1. Digital Health and Telemedicine

4.3.2. Wearable Devices

4.3.3. Robotics and AI in Healthcare

4.3.4. 3D Printing for Medical Applications

4.3.5. Biotech and Genomics

4.4. By Application (In Value %)

4.4.1. Cardiology

4.4.2. Oncology

4.4.3. Neurology

4.4.4. Orthopedics

4.4.5. General Healthcare

4.5. By Region (In Value %)

4.5.1. North

4.5.2. East

4.5.3. West

4.5.4. South

5. Indonesia Medical Technology Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Medtronic

5.1.2. Siemens Healthineers

5.1.3. Philips Healthcare

5.1.4. GE Healthcare

5.1.5. Stryker Corporation

5.1.6. Abbott Laboratories

5.1.7. Johnson & Johnson

5.1.8. Roche Diagnostics

5.1.9. Olympus Corporation

5.1.10. Canon Medical Systems

5.1.11. Terumo Corporation

5.1.12. BD (Becton, Dickinson and Company)

5.1.13. Zimmer Biomet

5.1.14. Danaher Corporation

5.1.15. Boston Scientific

5.2. Cross Comparison Parameters (Product Portfolio, Headquarters, Inception Year, Revenue, Market Reach, Product Innovation, R&D Investment, Regulatory Compliance)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Government Grants and Incentives

5.8. Private Equity and Venture Capital Involvement

6. Indonesia Medical Technology Market Regulatory Framework

6.1. Licensing Requirements

6.2. Compliance with International Standards (ISO, CE Marking)

6.3. Certification Processes for Medical Devices

7. Indonesia Medical Technology Market Future Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Growth

8. Indonesia Medical Technology Market Future Segmentation

8.1. By Product Type (In Value %)

8.2. By End-User (In Value %)

8.3. By Technology (In Value %)

8.4. By Application (In Value %)

8.5. By Region (In Value %)

9. Indonesia Medical Technology Market Analysts’ Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Segment Analysis

9.3. Marketing Initiatives

9.4. Identification of White Space Opportunities

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The initial step involved mapping the Indonesian Medical Technology ecosystem. This included a detailed review of stakeholders such as healthcare providers, device manufacturers, and government bodies to understand key variables affecting the market.

Step 2: Market Analysis and Construction

Historical market data was analyzed to understand the evolution of product demand and adoption across different healthcare settings. Insights from credible industry reports were incorporated to ensure accuracy in revenue estimation.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses were developed and validated through interviews with industry experts, including product managers and regulatory professionals. These insights refined our data on market drivers, challenges, and growth areas.

Step 4: Research Synthesis and Final Output

Finally, comprehensive interactions with medical technology companies provided further insights into market-specific factors, enabling a holistic analysis that aligns with current and future market trends.

Frequently Asked Questions

01. How big is Indonesia Medical Technology Market?

The Indonesia Medical Technology Market was valued at USD 2.3 billion, with growth attributed to increased healthcare spending, technological advancements, and supportive government policies.

02. What are the main challenges in Indonesia Medical Technology Market?

Challenges in the Indonesia Medical Technology Market include high initial investment costs, regulatory compliance, and a need for skilled personnel to manage and operate advanced medical devices.

03. Who are the key players in Indonesia Medical Technology Market?

Major players in the Indonesia Medical Technology Market include Siemens Healthineers, GE Healthcare, Medtronic, Philips Healthcare, and Stryker Corporation, all of which dominate due to extensive product ranges and strong distribution networks.

04. What drives growth in the Indonesia Medical Technology Market?

Key growth drivers in the Indonesia Medical Technology Market are the rising prevalence of chronic diseases, advancements in diagnostics, and government initiatives focused on improving healthcare access.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.