Indonesia Metaverse Market Outlook to 2030

Region:Asia

Author(s):Sanjna Verma

Product Code:KROD500

December 2024

94

About the Report

Indonesia Metaverse Market Overview

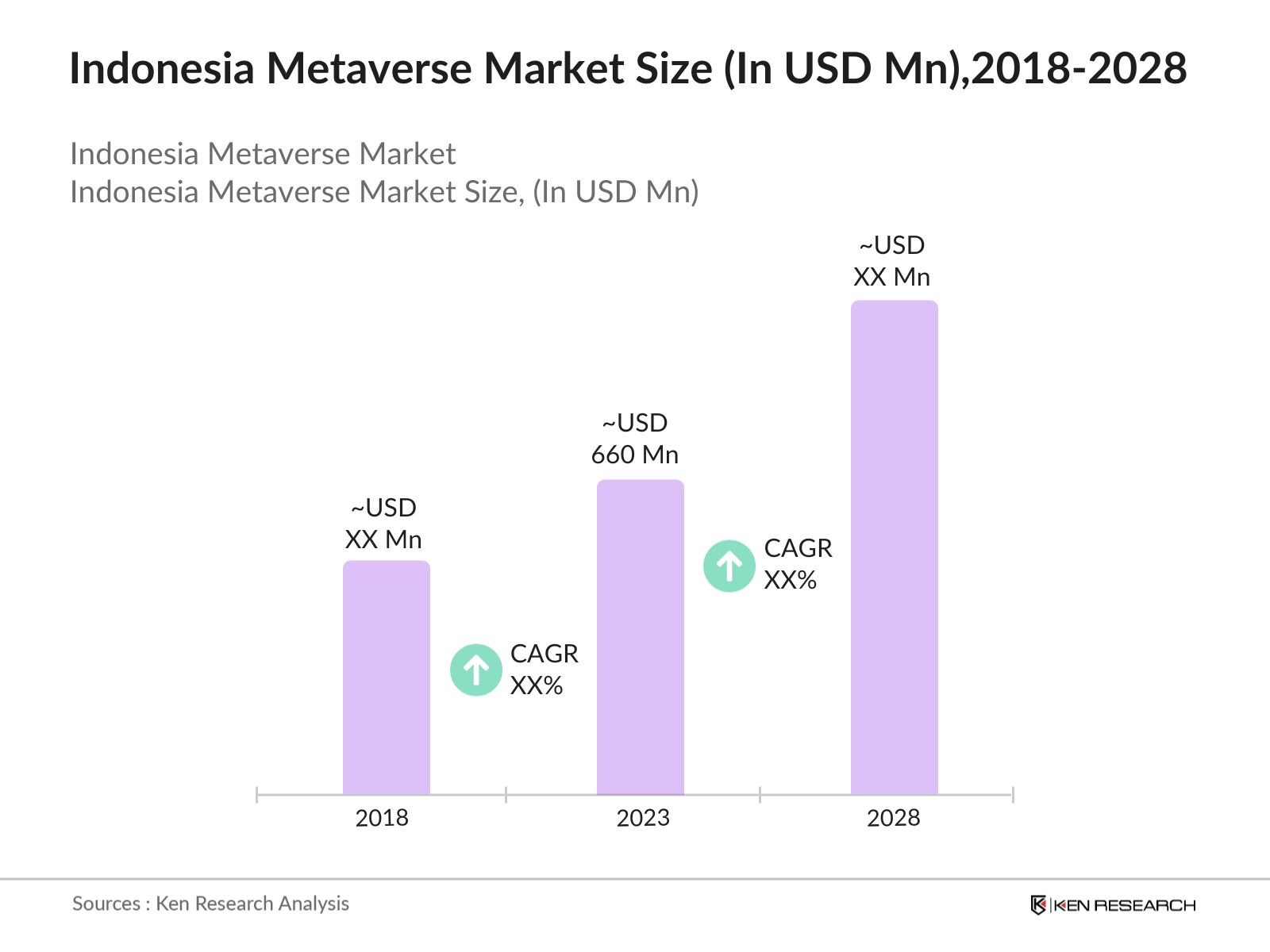

- In 2023, Indonesia's Metaverse market has reached a valuation of USD 660 billion, underscoring the nation's rapid digital transformation and growing embrace of immersive technologies. This substantial market value reflects the increasing integration of virtual and augmented reality, blockchain, and other cutting-edge technologies into various sectors of the Indonesian economy.

- Key players in the Indonesia Metaverse market include Meta Platforms Inc., Roblox Corporation, Microsoft Corporation, Google LLC, and local tech firms like GoTo Group and Telkom Indonesia. These companies are leading the development and deployment of Metaverse platforms, leveraging their technological expertise and vast user bases to drive adoption and innovation in the market.

- In 2024, Telkom Indonesia engaged with Goldman Sachs and Mandiri Sekuritas to assist in finding a strategic investor for its data center business. This initiative is part of a broader strategy to bolster its capabilities in the digital economy, which includes expanding into areas like the metaverse and cloud services.

- Jakarta, Surabaya, and Bandung are the dominant cities in the Indonesia Metaverse market due to their advanced digital infrastructure, high internet penetration rates, and significant presence of tech-savvy populations. These cities also host major tech companies and innovation hubs, driving the development and adoption of Metaverse technologies.

Indonesia Metaverse Market Segmentation

The Indonesia Metaverse Market can be segmented based on several factors:

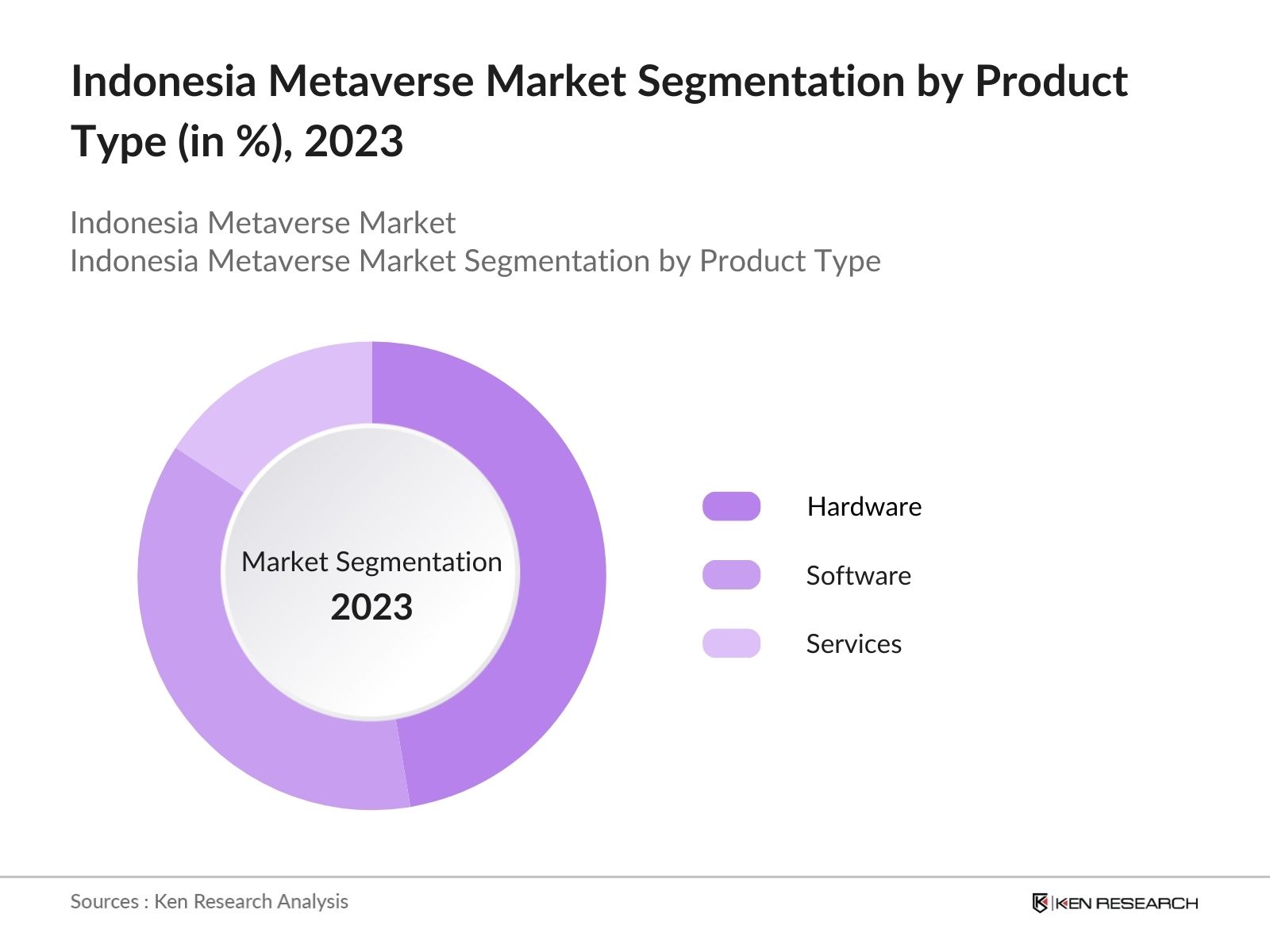

By Product Type: Indonesia Metaverse market is segmented by component into hardware, software and services. In 2023, hardware has a dominant market share due to the high demand for VR headsets and AR glasses. The increasing affordability and availability of advanced hardware devices from major tech companies are key factors contributing to this dominance.

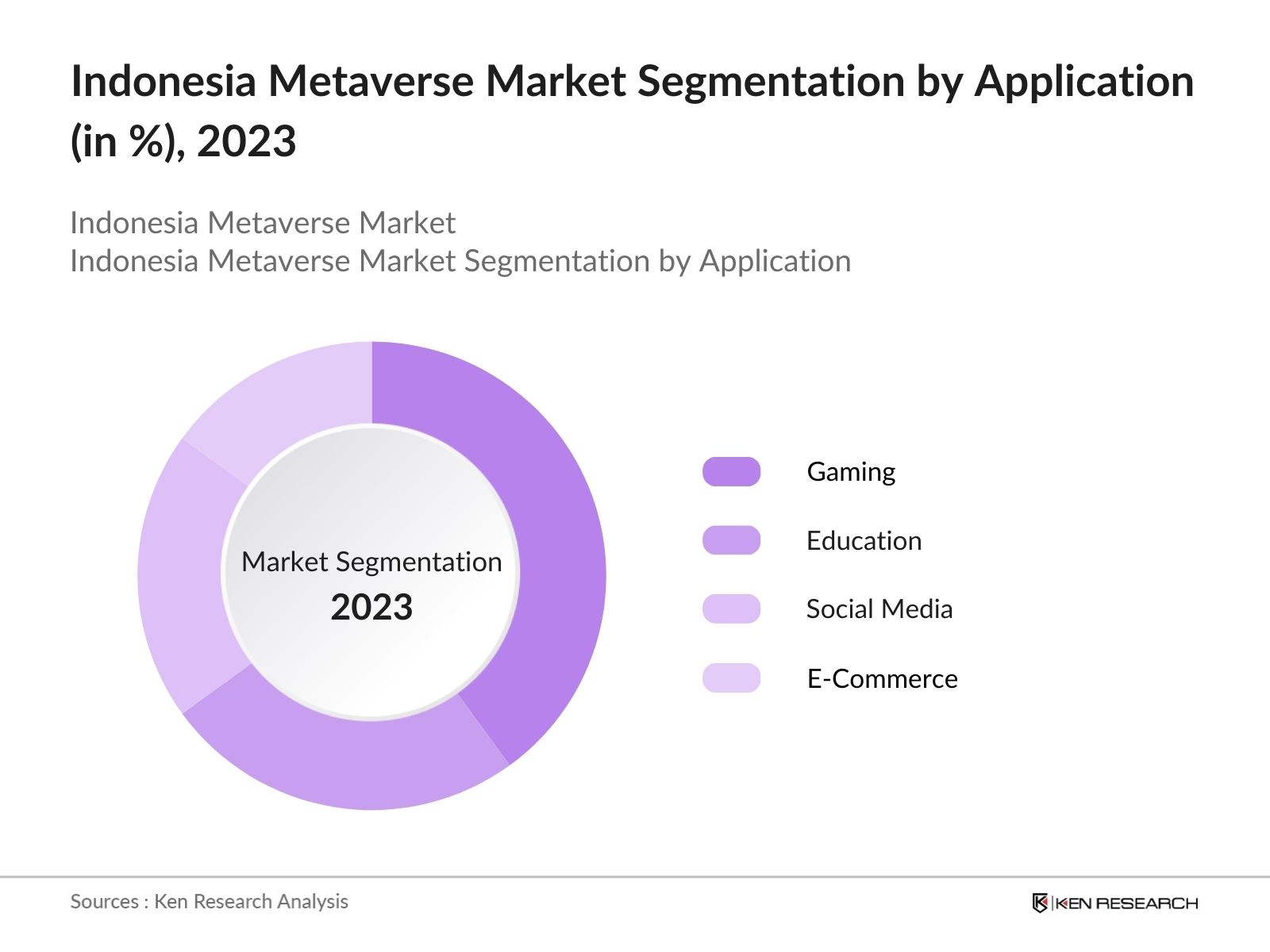

By Application: Indonesia Metaverse Market is segmented by application into gaming, education, social media and e-commerce. In 2023, Gaming is a dominant sub-segment, driven by the widespread adoption of VR and AR in the gaming industry. The immersive experiences offered by Metaverse platforms have revolutionized gaming, attracting a large user base and substantial investments.

By Region: Indonesia Metaverse Market is segmented by region into Java, Sumatra, Kalimantan, and Bali. In 2023, Java dominates the market in 2023 due to its advanced digital infrastructure, high internet penetration rates, and the presence of major tech hubs like Jakarta and Bandung. The regions strong economic activities and government support for digital initiatives further bolster its leading position in the market.

Indonesia Metaverse Market Competitive Landscape

|

Company |

Establishment Year |

Headquarters |

|

Meta Platforms Inc. |

2004 |

Menlo Park, USA |

|

Roblox Corporation |

2006 |

San Mateo, USA |

|

Microsoft Corporation |

1975 |

Redmond, USA |

|

Google LLC |

1998 |

Mountain View, USA |

|

Telkom Indonesia |

1965 |

Jakarta, Indonesia |

- Microsoft & AI Infrastructure in Indonesia: In 2024, Microsoft announced a $1.7 billion investment over the next four years to build new cloud and AI infrastructure in Indonesia, provide AI skilling opportunities for 840,000 people, and support the nation's growing developer community. This represents Microsoft's largest investment in Indonesia in its 29-year history there.

- Meta Platforms & Horizon Worlds: In 2021, Meta Platforms Inc. has made significant strides with its social VR platform, Horizon Worlds, since its public launch. Horizon Worlds was officially launched for users aged 18 and older in the U.S. and Canada. The platform allows users to create and explore virtual spaces, build games, and socialize in a VR environment.

Indonesia Metaverse Industry Analysis

Growth Drivers

- Increased Investment in Digital Infrastructure: The Indonesian government's investment in digital infrastructure has significantly boosted the Metaverse market. In 2023, the Indonesian government started providing tax exemptions of up to 100% for data centres with investments over $34 million to attract investors. This investment is crucial for supporting the bandwidth and low latency requirements essential for immersive Metaverse experiences.

- Growing Consumer Adoption of Virtual Reality (VR) and Augmented Reality (AR): AR/VR headset vendors include Meta, Sony, and HTC who offer VR devices, while Microsoft, Magic Leap, Vuzix, and Apple offer AR headsets and glasses. This increasing consumer interest is driven by the availability of affordable VR devices and the rising popularity of immersive gaming and social experiences.

- Support from Educational Institutions: Indonesian educational institutions are increasingly integrating Metaverse technologies into their curriculums. Companies like STEMROBO are providing comprehensive solutions, including VR labs and AR applications that allow students to visualize concepts in 3D. This trend is supported by government grants and partnerships with tech companies, aiming to revolutionize education through immersive learning environments.

Challenges

- High Cost of Advanced Technologies: Despite the growing interest, the high cost of advanced VR and AR technologies remains a significant barrier. The average price of a high-end VR headset was $600 to $1,000, which is beyond the reach of many consumers in Indonesia. This cost barrier limits widespread adoption and poses a challenge for market growth.

- Limited Digital Literacy: Indonesia faces challenges related to digital literacy, especially in rural areas. A few percentages of rural population had access to digital literacy programs, which hampers the adoption of Metaverse technologies. Efforts to bridge this digital divide are essential for the market to reach its full potential.

Government Initiatives

- Indonesia Digital Roadmap (2021-2024): The Indonesian government has published a "Digital Roadmap" for 2021-2024 as a strategic guide for the country's digital transformation. The roadmap is being implemented in four areas: Digital Society, Digital Infrastructure, Digital Economy and Digital Administration. The government has tasked state carrier PT Telkom Indonesia to develop a metaverse platform for local MSMEs to compete with larger foreign businesses.

- National 5G Network Expansion Plan: The government aimed to provide 5G services along main traffic routes by the end of 2023, with a goal of achieving "virtually nationwide" coverage by the end of 2025. This plan aims to provide the necessary bandwidth and low latency for Metaverse applications, thereby facilitating their adoption and use.

Indonesia Metaverse Future Market Outlook

Indonesia Metaverse market is poised for significant growth over the next five years, driven by increased investments in digital infrastructure and the widespread adoption of immersive technologies. By 2028, the market is expected to experience robust expansion, supported by the government's continuous efforts to enhance digital literacy and infrastructure.

Future Trends

- Integration of AR and VR: By 2028, the integration of augmented reality (AR) and virtual reality (VR) is anticipated to revolutionize various sectors in Indonesia, including education, healthcare, and entertainment. These immersive technologies will enhance user experiences, making learning more interactive, improving patient care through virtual consultations, and providing engaging entertainment options. As businesses adopt AR and VR, they will create new avenues for customer engagement and brand loyalty, ultimately driving growth in the metaverse.

- Rise of DeFi and NFTs: By 2028, the growth of decentralized finance (DeFi) and non-fungible tokens (NFTs) is expected to reshape the Indonesian metaverse landscape. These blockchain-based innovations will provide new revenue streams and business models, allowing creators and consumers to engage in the trade of digital assets with greater security and transparency. As the popularity of NFTs rises, it will foster a vibrant marketplace for digital art, collectibles, and virtual goods, driving increased participation in the metaverse economy.

Scope of the Report

|

By Product Type |

Hardware Software Services |

|

By End User |

Gaming Education Social Media E-Commerce |

|

By Region |

Java Sumatra Kalimantan Bali |

Products

Key Target Audience

Technology companies

Virtual reality and augmented reality developers

Gaming companies

E-commerce companies

Educational Institutions and EdTech Companies

Telecommunications Companies

Investment & Venture Capitalist Firms

Government & Regulatory Bodies (Kominfor, BRTI)

Companies

Major Players

Meta Platforms Inc.

Roblox Corporation

Microsoft Corporation

Google LLC

Telkom Indonesia

GoTo Group

Huawei Technologies

Samsung Electronics

Sony Corporation

NVIDIA Corporation

Unity Technologies

Autodesk Inc.

HTC Corporation

Epic Games Inc.

ByteDance Ltd.

Table of Contents

1. Indonesia Metaverse Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Indonesia Metaverse Market Size (in USD Bn), 2018-2023

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Indonesia Metaverse Market Analysis

3.1. Growth Drivers

3.1.1. Increased Investment in Digital Infrastructure

3.1.2. Growing Consumer Adoption of VR and AR

3.1.3. Support from Educational Institutions

3.2. Restraints

3.2.1. High Cost of Advanced Technologies

3.2.2. Limited Digital Literacy

3.2.3. Regulatory Hurdles

3.3. Opportunities

3.3.1. Technological Advancements

3.3.2. International Collaborations

3.3.3. Expansion into Rural Areas

3.4. Trends

3.4.1. Integration with Smart Cities

3.4.2. Expansion of Virtual Learning Environments

3.4.3. Growth of Virtual Commerce

3.5. Government Regulation

3.5.1. Digital Indonesia Roadmap 2023-2024

3.5.2. National 5G Network Expansion Plan 2023

3.5.3. Smart City Initiatives

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Competition Ecosystem

4. Indonesia Metaverse Market Segmentation, 2023

4.1. By Component (in Value %)

4.1.1. Hardware

4.1.2. Software

4.1.3. Services

4.2. By Application (in Value %)

4.2.1. Gaming

4.2.2. Education

4.2.3. Social Media

4.2.4. E-commerce

4.3. By Region (in Value %)

4.3.1. Java

4.3.2. Surabaya

4.3.3. Kalimantan

4.3.4. Bali

5. Indonesia Metaverse Market Cross Comparison

5.1 Detailed Profiles of Major Companies

5.1.1. Meta Platforms Inc.

5.1.2. Roblox Corporation

5.1.3. Microsoft Corporation

5.1.4. Google LLC

5.1.5. Telkom Indonesia

5.1.6. GoTo Group

5.1.7. Samsung Electronics

5.1.8. Sony Corporation

5.1.9. Huawei Technologies

5.1.10. NVIDIA Corporation

5.1.11. Unity Technologies

5.1.12. HTC Corporation

5.1.13. Epic Games Inc.

5.1.14. ByteDance Ltd.

5.2 Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue)

6. Indonesia Metaverse Market Competitive Landscape

6.1. Market Share Analysis

6.2. Strategic Initiatives

6.3. Mergers and Acquisitions

6.4. Investment Analysis

6.4.1. Venture Capital Funding

6.4.2. Government Grants

6.4.3. Private Equity Investments

7. Indonesia Metaverse Market Regulatory Framework

7.1. Digital Infrastructure Regulations

7.2. Compliance Requirements

7.3. Certification Processes

8. Indonesia Metaverse Market Future Size (in USD Bn), 2023-2028

8.1. Future Market Size Projections

8.2. Key Factors Driving Future Market Growth

9. Indonesia Metaverse Market Future Segmentation, 2028

9.1. By Product Type (in Value %)

9.2. By Application (in Value %)

9.3. By Region (in Value %)

10. Indonesia Metaverse Market Analysts Recommendations

10.1. TAM/SAM/SOM Analysis

10.2. Customer Cohort Analysis

10.3. Marketing Initiatives

10.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.

Step 2: Market Building:

Collating statistics on Indonesia Metaverse Market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for Indonesia Metaverse Market. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step 3: Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step 4: Research output:

Our team will approach multiple metaverse companies and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from metaverse companies.

Frequently Asked Questions

01 How big is Indonesia Metaverse?

In 2023, Indonesia's Metaverse market has reached a valuation of USD 660 billion, underscoring the nation's rapid digital transformation and growing embrace of immersive technologies. This substantial market value reflects the increasing integration of virtual and augmented reality, blockchain, and other cutting-edge technologies into various sectors of the Indonesian economy.

02 What are the growth drivers of the Indonesia Metaverse Market?

Indonesia Metaverse Market is driven by increased investment in digital infrastructure, growing consumer adoption of VR and AR technologies, and the integration of Metaverse technologies into educational institutions. Government initiatives also play a significant role in promoting digital transformation.

03 What are the key challenges faced by the Indonesia Metaverse Market?

Challenges in Indonesia Metaverse Market include the high cost of advanced VR and AR technologies, limited digital literacy in rural areas, and regulatory hurdles related to data privacy and cybersecurity. These factors can hinder the widespread adoption and growth of Metaverse technologies in Indonesia.

04 Who are major players in the Indonesia Metaverse Market?

Key players in the Indonesia Metaverse market include Meta Platforms Inc., Roblox Corporation, Microsoft Corporation, Google LLC, and local tech firms like GoTo Group and Telkom Indonesia. These companies are leading the development and deployment of Metaverse platforms, leveraging their technological expertise

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.