Indonesia Motorcycle Market Outlook to 2030

Region:Asia

Author(s):Abhinav kumar

Product Code:KROD3602

December 2024

98

About the Report

Indonesia Motorcycle Market Overview

- The Indonesia Motorcycle market is valued at USD 6.8 billion, based on a five-year historical analysis. The market is driven by an increasing need for affordable and efficient transportation in both urban and rural regions. The market has grown due to factors like rising disposable incomes, urbanization, and the expansion of infrastructure, particularly in densely populated islands such as Java and Sumatra. Additionally, the government's focus on boosting domestic manufacturing and promoting electric vehicle adoption contributes significantly to market expansion.

- Java, Indonesia's most populous island, dominates the motorcycle market due to its high urban density, extensive road infrastructure, and strong demand for daily commutes. The island's metropolitan areas, like Jakarta and Surabaya, witness the highest motorcycle usage due to traffic congestion and the need for cost-effective personal transport. Additionally, Sumatra plays a key role in the market, given its developing road networks and increasing consumer demand for both commercial and personal motorcycles.

- As of 2023, Indonesia is on track to implement EURO 4 emission standards for all motorcycles by 2025, aligning with global environmental commitments. Current regulations mandate a reduction of NOx emissions to 0.5 g/km, aiming to improve air quality in urban areas. Compliance with these standards will require manufacturers to invest in cleaner technologies, shaping the future of the motorcycle market.

Indonesia Motorcycle Market Segmentation

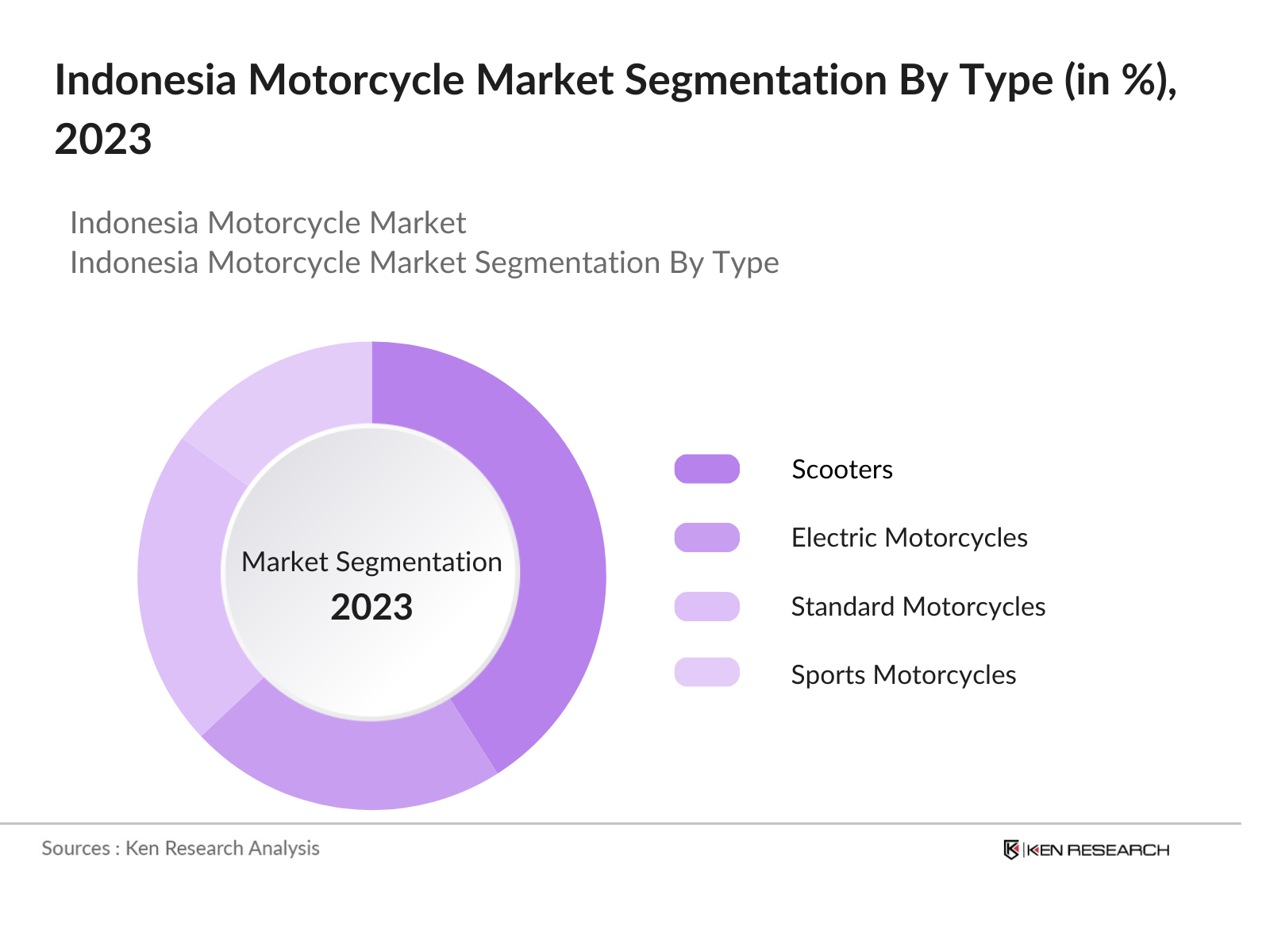

By Type: The Indonesia Motorcycle market is segmented by type into standard motorcycles, sports motorcycles, electric motorcycles, scooters, and off-road motorcycles. Recently, scooters have dominated the market due to their convenience, affordability, and increasing use for urban commuting. Brands like Honda and Yamaha have successfully captured this market by offering efficient, low-maintenance models tailored to city travel. The fuel efficiency and ease of navigation in congested areas make scooters the go-to option for both middle-class families and young professionals.

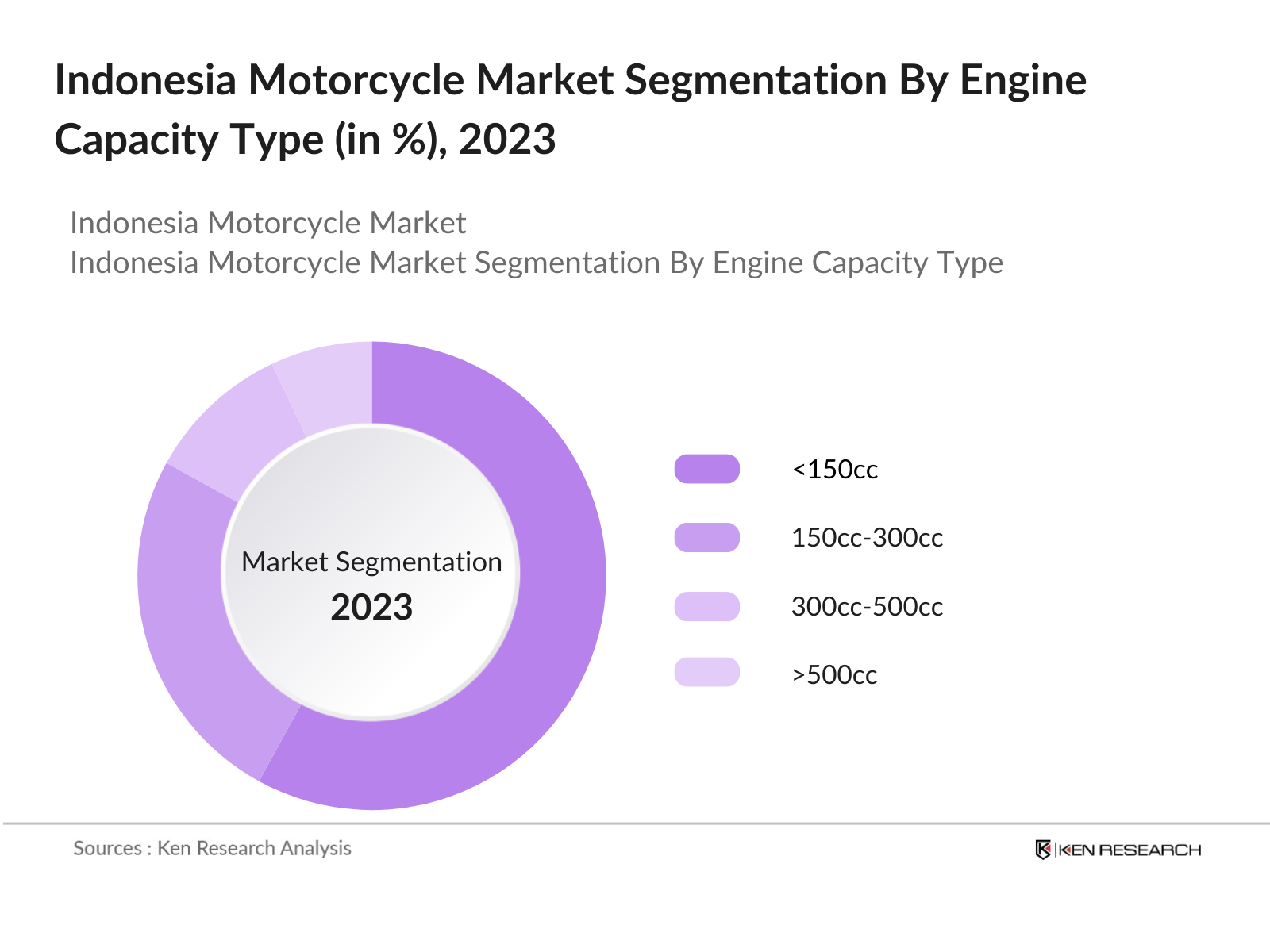

By Engine Capacity: The market is further segmented by engine capacity into <150cc, 150cc-300cc, 300cc-500cc, and >500cc. The <150cc segment holds the highest market share, driven by high demand for fuel-efficient and affordable motorcycles. This segment is especially favored by first-time buyers, commuters, and rural populations who require cost-effective transportation solutions. Manufacturers like Honda and Yamaha focus on producing models in this category, providing accessible financing and insurance options to capture a broader customer base.

Indonesia Motorcycle Market Competitive Landscape

The Indonesia Motorcycle market is dominated by both local and global manufacturers. Major players focus on product innovation, competitive pricing, and establishing extensive dealership networks across the country. Companies like Honda, Yamaha, and Suzuki leverage their strong brand presence and offer various financing options to maintain their market share. Additionally, the shift towards electric motorcycles is witnessing new entrants as companies like Viar Motor Indonesia and other local manufacturers aim to penetrate the growing EV market segment.

|

Company |

Establishment Year |

Headquarters |

Revenue (2023) |

Production Capacity |

R&D Spending |

Dealer Network |

Market Share |

Product Line Diversity |

|

Honda Motor Co., Ltd. |

1948 |

Tokyo, Japan |

USD 120 Bn |

4 million units/year |

High |

Extensive |

40% |

Broad |

|

Yamaha Motor Co., Ltd. |

1955 |

Iwata, Japan |

USD 65 Bn |

3 million units/year |

Medium |

Extensive |

35% |

Broad |

|

Suzuki Motor Corporation |

1909 |

Hamamatsu, Japan |

USD 35 Bn |

1.8 million units/year |

Medium |

Moderate |

15% |

Moderate |

|

Kawasaki Heavy Industries, Ltd. |

1896 |

Kobe, Japan |

USD 15 Bn |

500,000 units/year |

High |

Limited |

5% |

Limited |

|

PT Astra Honda Motor |

2000 |

Jakarta, Indonesia |

USD 12 Bn |

2 million units/year |

Low |

Extensive |

5% |

Limited |

Indonesia Motorcycle Industry Analysis

Growth Drivers

- Rising Disposable Income: Indonesia's per capita income reached approximately USD 4,200 in 2022, reflecting significant growth in the middle class, which is projected to expand to around 140 million individuals by 2025. This rising disposable income facilitates greater access to motorcycles, as consumers prioritize affordable and efficient transportation options. The middle class is expected to account for nearly 50% of total household spending by 2025, driving demand for motorcycles as a primary mode of transport.

- Urbanization and Infrastructure Development: As of 2023, urbanization in Indonesia has reached 56%, with projections suggesting this will rise to 70% by 2025. This rapid urban growth necessitates improved road infrastructure, with the government allocating IDR 420 trillion (approximately USD 29 billion) for road development projects in 2023. Enhanced infrastructure supports the increased movement of motorcycles, aligning with the growing urban population's need for efficient transport solutions.

- Demand for Affordable Transportation: With fuel prices averaging IDR 10,000 per liter (approximately USD 0.66) in 2023, motorcycles are favored for their fuel efficiency, with average consumption rates around 40 km/liter. Economic stability has led to a steady demand for affordable transportation options, as households seek cost-effective solutions in light of rising living expenses. The motorcycle remains a preferred choice for urban and suburban travel, further driving market growth.

Market Challenges

- High Import Taxes: Indonesia imposes tariffs on motorcycle imports ranging from 10% to 40%, significantly impacting the availability of foreign brands. In 2023, the government introduced stricter import policies, complicating the entry of international manufacturers. These high import taxes create a barrier for consumers who seek a wider variety of motorcycle models, limiting competition and potentially increasing prices for end-users.

- Environmental Regulations: The Indonesian government has implemented stringent emission standards, requiring compliance with EURO 3 regulations by 2025. The country currently faces significant air quality issues, with Jakarta reporting PM2.5 levels averaging 35 g/m in 2023, prompting authorities to tighten regulations on motorcycle emissions. This poses challenges for manufacturers who must adapt to these standards while maintaining affordability.

Indonesia Motorcycle Market Future Outlook

Over the next five years, the Indonesia Motorcycle market is expected to show significant growth, driven by increasing urbanization, a shift toward electric motorcycles, and government initiatives to support local manufacturing and reduce environmental impact. Continuous advancements in battery technology, combined with rising fuel prices, are likely to drive the adoption of electric motorcycles. Moreover, expanding infrastructure in rural areas and government incentives for electric vehicles will also contribute to market expansion.

Opportunities

- Growth of E-mobility: The Indonesian government aims to have 2 million electric motorcycles on the road by 2025, with current sales hovering around 10,000 units in 2023. Investment in battery technology and charging infrastructure is also increasing, with IDR 1 trillion (approximately USD 67 million) allocated for electric vehicle initiatives. This transition towards e-mobility represents a significant opportunity for market expansion and innovation in the motorcycle sector.

- Technological Advancements: Investment in connected vehicle technology is projected to reach IDR 5 trillion (approximately USD 334 million) by 2025, with Indonesian manufacturers exploring opportunities for integrating smart technologies in motorcycles. Innovations such as telematics systems and autonomous features can enhance user experience and safety, positioning Indonesia as a leader in motorcycle technology in Southeast Asia.

Scope of the Report

|

By Type |

Standard Motorcycles Sports Motorcycles Electric Motorcycles Scooters Off-road Motorcycles |

|

By Engine Capacity |

<150cc 150cc-300cc 300cc-500cc >500cc |

|

By Distribution Channel |

Online Retail Offline Retail OEM Dealerships Third-Party Distributors |

|

By Application |

Commercial Use Personal Use Recreational Use |

|

By Region |

Java Sumatra Kalimantan Sulawesi Bali |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing to This Report:

Motorcycle Manufacturing Companies

Automotive Component Companies

Electric Motorcycle Companies

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (Ministry of Industry, Ministry of Transportation)

Motorcycle Dealerships and Companies

Aftermarket and Maintenance Service Companies

Electric Vehicle Charging Infrastructure Companies

Companies

Players Mentioned in the Report:

Honda Motor Co., Ltd.

Yamaha Motor Co., Ltd.

Suzuki Motor Corporation

Kawasaki Heavy Industries, Ltd.

PT Astra Honda Motor

Bajaj Auto Ltd.

TVS Motor Company

Harley-Davidson, Inc.

Piaggio Group

Hero MotoCorp Ltd.

Royal Enfield

KTM AG

MV Agusta Motor S.p.A.

Ducati Motor Holding S.p.A.

Triumph Motorcycles Ltd.

Table of Contents

1. Indonesia Motorcycle Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. Indonesia Motorcycle Market Size (In USD Bn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. Indonesia Motorcycle Market Analysis

3.1 Growth Drivers

3.1.1 Rising Disposable Income (Per Capita Income, Middle-Class Growth)

3.1.2 Urbanization and Infrastructure Development (Urban Growth, Road Infrastructure)

3.1.3 Demand for Affordable Transportation (Fuel Efficiency, Economic Stability)

3.1.4 Government Initiatives (Local Manufacturing, Economic Incentives)

3.2 Market Challenges

3.2.1 High Import Taxes (Tariff Structures, Import Policies)

3.2.2 Environmental Regulations (Emission Standards, Pollution Control)

3.2.3 Traffic Congestion (Urban Density, Infrastructure Strain)

3.2.4 Limited Financing Options (Interest Rates, Financial Inclusion)

3.3 Opportunities

3.3.1 Growth of E-mobility (Electric Motorcycles, Battery Technologies)

3.3.2 Technological Advancements (Connected Vehicles, Autonomous Tech)

3.3.3 Expansion into Rural Markets (Rural Mobility, Affordability)

3.3.4 International Partnerships (Collaborations, Joint Ventures)

3.4 Trends

3.4.1 Shift towards Electric Vehicles (Electric Motorcycle Adoption, Charging Infrastructure)

3.4.2 Subscription and Rental Services (Shared Mobility, Subscription Models)

3.4.3 Smart Technology Integration (Telematics, Digital Dashboards)

3.4.4 Customization Trends (Personalized Bikes, Aftermarket Parts)

3.5 Government Regulation

3.5.1 Emission Standards (EURO 4 Compliance, Government Regulations)

3.5.2 Safety Regulations (Helmet Laws, Vehicle Safety Standards)

3.5.3 Import/Export Restrictions (Tariff Regulations, Bilateral Agreements)

3.5.4 Electric Vehicle Incentives (Subsidies, Tax Breaks)

3.6 SWOT Analysis

3.7 Stake Ecosystem

3.8 Porters Five Forces Analysis

3.9 Competitive Ecosystem

4. Indonesia Motorcycle Market Segmentation

4.1 By Type (In Value %)

4.1.1 Standard Motorcycles

4.1.2 Sports Motorcycles

4.1.3 Electric Motorcycles

4.1.4 Scooters

4.1.5 Off-road Motorcycles

4.2 By Engine Capacity (In Value %)

4.2.1 <150cc

4.2.2 150cc-300cc

4.2.3 300cc-500cc

4.2.4 >500cc

4.3 By Distribution Channel (In Value %)

4.3.1 Online Retail

4.3.2 Offline Retail

4.3.3 OEM Dealerships

4.3.4 Third-Party Distributors

4.4 By Application (In Value %)

4.4.1 Commercial Use

4.4.2 Personal Use

4.4.3 Recreational Use

4.5 By Region (In Value %)

4.5.1 Java

4.5.2 Sumatra

4.5.3 Kalimantan

4.5.4 Sulawesi

4.5.5 Bali

5. Indonesia Motorcycle Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Honda Motor Co., Ltd.

5.1.2 Yamaha Motor Co., Ltd.

5.1.3 Suzuki Motor Corporation

5.1.4 Kawasaki Heavy Industries, Ltd.

5.1.5 PT Astra Honda Motor

5.1.6 Bajaj Auto Ltd.

5.1.7 TVS Motor Company

5.1.8 Harley-Davidson, Inc.

5.1.9 Piaggio Group

5.1.10 Hero MotoCorp Ltd.

5.1.11 Royal Enfield

5.1.12 KTM AG

5.1.13 MV Agusta Motor S.p.A.

5.1.14 Ducati Motor Holding S.p.A.

5.1.15 Triumph Motorcycles Ltd.

5.2 Cross Comparison Parameters (Market Share, Production Capacity, R&D Spending, Revenue, Dealer Network, Product Line Diversity, Customer Service, Export Market Presence)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. Indonesia Motorcycle Market Regulatory Framework

6.1 Emission and Safety Standards

6.2 Import and Export Policies

6.3 Government Incentives for Electric Vehicles

7. Indonesia Motorcycle Market Future Size (In USD Bn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. Indonesia Motorcycle Market Future Segmentation

8.1 By Type (In Value %)

8.2 By Engine Capacity (In Value %)

8.3 By Distribution Channel (In Value %)

8.4 By Application (In Value %)

8.5 By Region (In Value %)

9. Indonesia Motorcycle Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Consumer Behavior Analysis

9.3 White Space Opportunity Analysis

9.4 Marketing and Branding Strategies

Research Methodology

Step 1: Identification of Key Variables

The first step involves mapping the motorcycle ecosystem in Indonesia, including all major stakeholders, such as manufacturers, suppliers, and end-users. Desk research, supported by secondary data, forms the foundation for understanding market dynamics and identifying key variables such as production volumes and sales trends.

Step 2: Market Analysis and Construction

We then analyze historical data, including motorcycle penetration rates and revenue generation by manufacturers. The analysis includes assessing trends in motorcycle preferences, engine capacities, and regional distribution. We also evaluate consumer behavior to validate market forecasts.

Step 3: Hypothesis Validation and Expert Consultation

Our market hypotheses are validated through interviews with industry experts, including executives from leading motorcycle companies and independent industry analysts. These consultations provide critical insights into operational challenges and market opportunities.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing primary and secondary research findings to produce a comprehensive market report. Data is further validated through direct engagement with manufacturers and retailers to ensure accuracy and reliability in estimating market size and segmentation.

Frequently Asked Questions

01. How big is the Indonesia Motorcycle Market?

The Indonesia Motorcycle market is valued at USD 6.8 billion, driven by growing consumer demand for affordable and efficient transportation solutions across both urban and rural areas.

02. What are the challenges in the Indonesia Motorcycle Market?

Challenges include stringent environmental regulations, traffic congestion, and rising fuel prices. Additionally, import taxes and limited financing options present barriers to market growth.

03. Who are the major players in the Indonesia Motorcycle Market?

Key players include Honda Motor Co., Ltd., Yamaha Motor Co., Ltd., Suzuki Motor Corporation, PT Astra Honda Motor, and Kawasaki Heavy Industries, Ltd., all of which have a strong presence in the market.

04. What are the growth drivers of the Indonesia Motorcycle Market?

The market is driven by increasing urbanization, rising disposable incomes, and government incentives for local manufacturing and electric vehicle adoption.

05. What trends are shaping the Indonesia Motorcycle Market?

Key trends include the shift toward electric motorcycles, smart technology integration, and the expansion of subscription-based and rental services, particularly in urban centers.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.