Indonesia Natural Gas Market Outlook to 2030

Region:Asia

Author(s):Shubham Kashyap

Product Code:KROD3444

November 2024

85

About the Report

Indonesia Natural Gas Market Overview

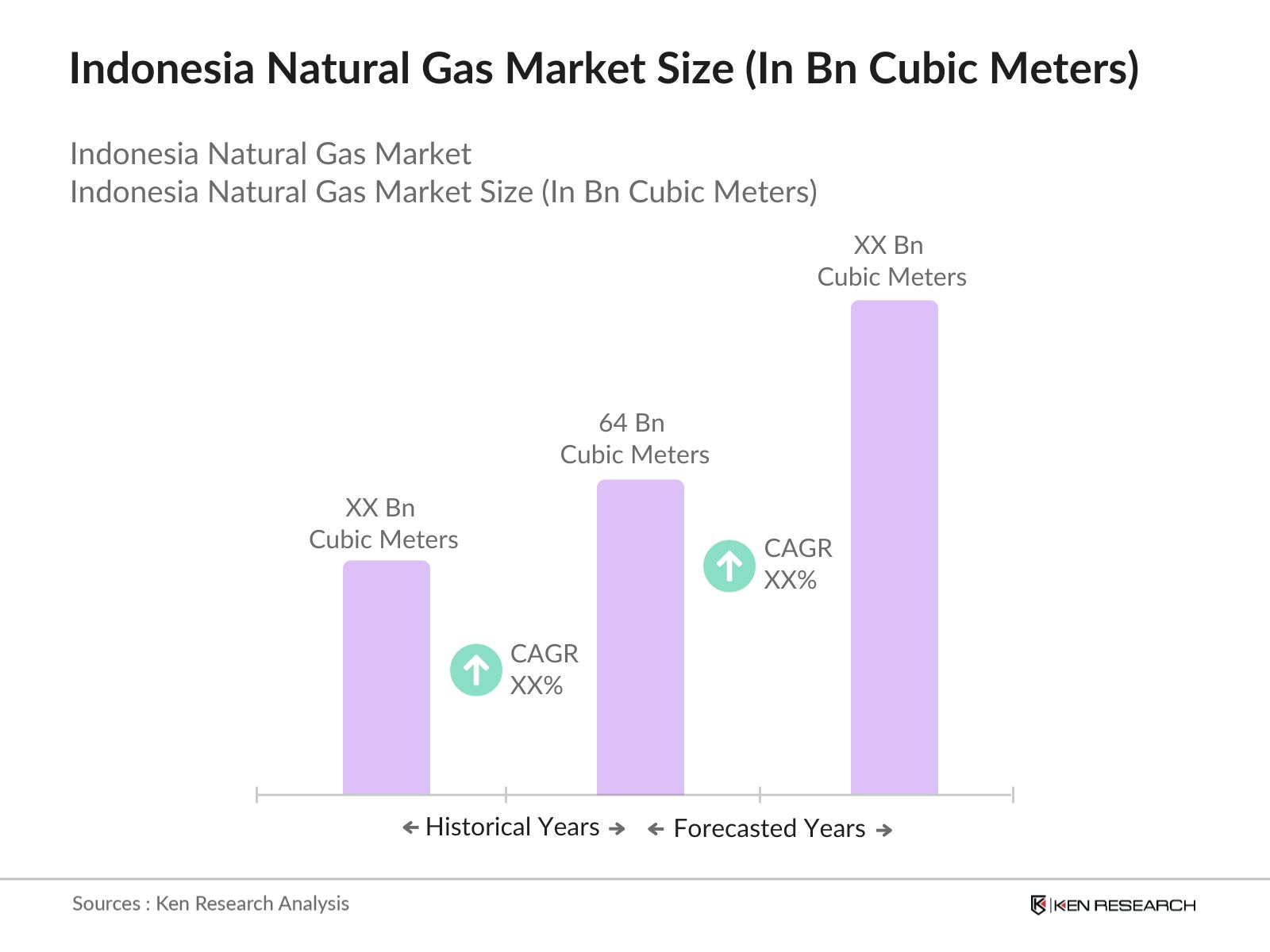

- The Indonesias proven natural gas reserves stand at 64 billion cubic meters, making it one of the largest reserves in the Asia-Pacific region. Indonesias natural gas market plays a pivotal role in the countrys energy landscape, driven by substantial reserves, growing domestic demand, and efforts to reduce reliance on oil imports. The sector is bolstered by favorable government policies aimed at increasing gas production, expanding domestic consumption, and promoting gas as a cleaner energy source compared to coal and oil.

- Indonesias natural gas market is predominantly influenced by major industrial cities such as Jakarta, Surabaya, and regions rich in natural resources like Kalimantan and Sumatra. These regions dominate the market due to their proximity to gas fields, major industrial hubs, and strategic investments in gas infrastructure. Kalimantan, for instance, has been a focal point for the countrys upstream gas operations, while Java has seen development in gas transportation and distribution infrastructure, solidifying its position as a major consumer.

- The government has initiated several strategic projects to expand Indonesias natural gas infrastructure, including the development of liquefied natural gas (LNG) facilities, gas pipelines, and gas processing plants. In 2023, the government approved USD 1.2 billion in investments for the development of new gas pipelines connecting major industrial areas, which is expected to facilitate easier transportation of gas to key demand centres.

Indonesia Natural Gas Market Segmentation

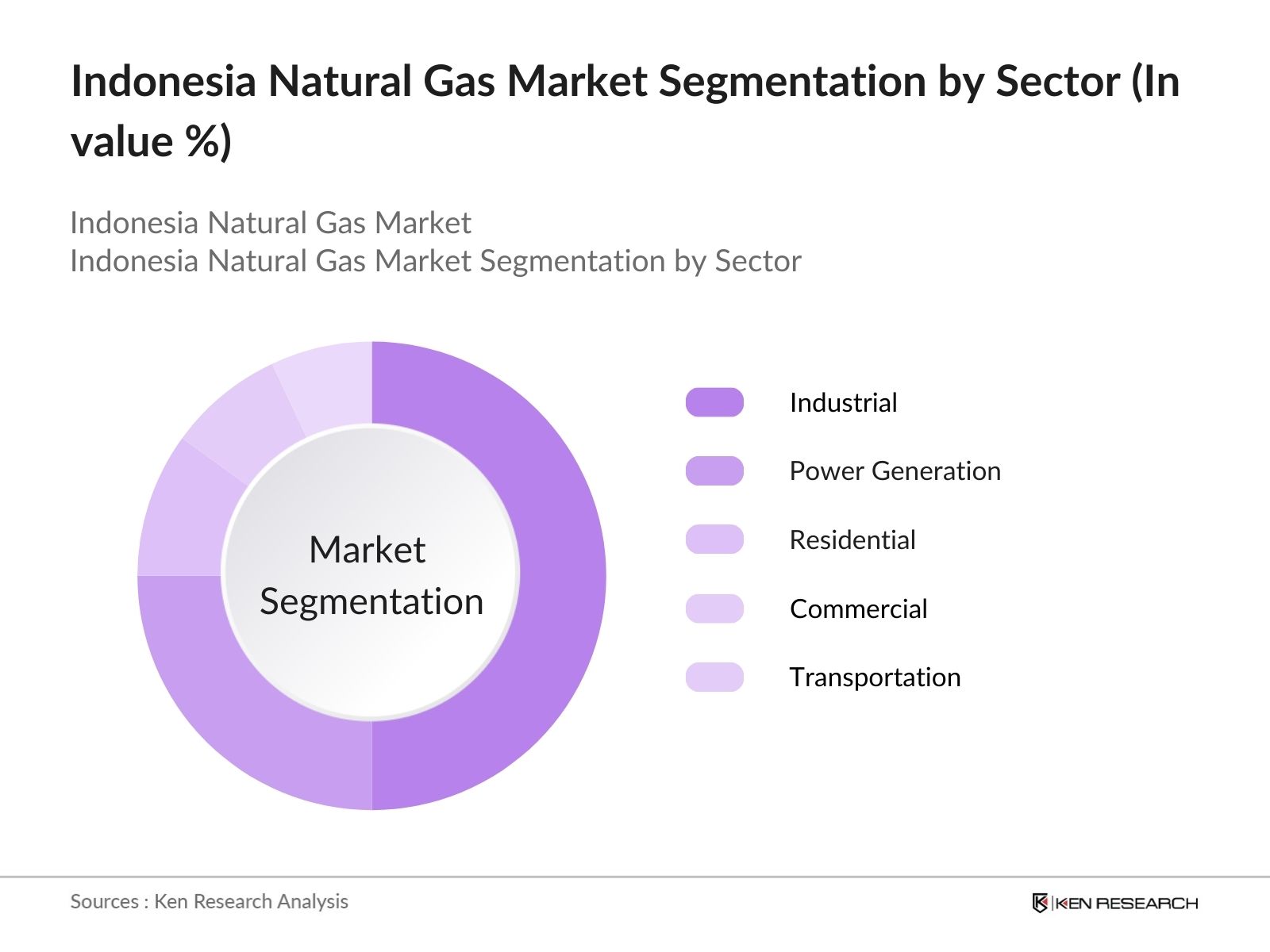

- By Sector: The market is segmented by consumption sectors, including industrial, power generation, and residential, commercial and transportation sectors. The industrial sector dominates the natural gas market, consuming around 50% of the total gas supply. Power generation follows closely, as the government continues to push for natural gas-fired power plants to reduce emissions from coal-powered facilities. The residential sector's contribution remains modest but is growing due to new policies encouraging household connections to the gas grid in urban centers.

- By Distribution Method: The market is also segmented by distribution methods, including pipeline gas and liquefied natural gas (LNG). Pipeline gas is the predominant method of distribution, supported by extensive pipeline infrastructure connecting production sites to industrial hubs. LNG, however, has gained momentum, particularly for export purposes. In 2023, Indonesia exported 5 million tonnes of LNG to regional markets like Japan, China, and South Korea, leveraging its strategic geographic location.

Indonesia Natural Gas Market Competitive Landscape

The Indonesia natural gas market is competitive, with major players including state-owned enterprises and multinational corporations. Pertamina, Indonesias state-owned oil and gas company, dominates the upstream and downstream sectors, including gas production, processing, and distribution. The entry of global energy giants such as Chevron and TotalEnergies has increased competition, particularly in exploration and production activities.

|

Company Name |

Establishment Year |

Headquarters |

Gas Production (Million Cubic Feet) |

LNG Export Capacity (Million Tonnes) |

Employees |

Revenue (2023) |

Investment in R&D (2023) |

Key Operations |

|

Pertamina |

1957 |

Indonesia |

||||||

|

Chevron |

1879 |

USA |

||||||

|

ExxonMobil |

1882 |

USA |

||||||

|

TotalEnergies |

1924 |

France |

||||||

|

Medco Energi |

1980 |

Indonesia |

Indonesia Natural Gas Market Industry Analysis

Growth Drivers

- Abundant Reserves and Increased Exploration Activities: Indonesia holds the largest proven natural gas reserves in Southeast Asia, with 98 trillion cubic feet (Tcf) as of 2024, making it a player in the regional market. New exploration activities, especially in East Natuna, are expected to bolster production. The government's proactive efforts, including opening up 10 exploration blocks for bidding in 2023, support further reserve discoveries. With enhanced exploration, Indonesias capacity to supply domestic and international markets has strengthened, helping to meet growing industrial demand.

- Government Policies Favoring Natural Gas Utilization: The Indonesian government has prioritized the transition from oil to natural gas to reduce the environmental impact of fossil fuel consumption. Policies promoting the use of natural gas in power generation and industry have been instrumental in driving demand. In 2023, the government issued a directive to increase the share of natural gas in the energy mix to 25% by 2030. Additionally, tax incentives and subsidies for gas-fired power plants have made gas an attractive energy source for industries.

- Rising Industrial and Power Sector Demand: In 2024, Indonesias industrial sector consumed 2.1 trillion cubic feet (Tcf) of natural gas, driven by the demand from sectors like petrochemicals, manufacturing, and steel production. Additionally, the power generation sector, which accounted for over 50% of the countrys gas consumption in 2023, continues to grow. As gas-fired power plants become more prevalent, natural gas demand is expected to remain robust, positioning Indonesia as a key regional player in the sector.

Market Challenges

- Inadequate Gas Distribution Infrastructure in Remote Areas: Despite Indonesias natural gas reserves, the distribution infrastructure, particularly in remote and rural areas, remains underdeveloped. The majority of gas pipelines are concentrated in more populated regions like Java and Sumatra, leaving areas such as Papua and East Nusa Tenggara underserved. This lack of infrastructure limits the reach of natural gas to remote industries and households. To address this issue, further investments are needed in expanding pipeline networks and related infrastructure, ensuring a more equitable distribution of natural gas across the country.

- Regulatory Bottlenecks and Licensing Delays: Despite ongoing efforts to streamline regulatory processes, delays in licensing and approvals for new exploration and production projects are still a notable challenge in Indonesia. The process of obtaining licenses for gas exploration can often slow down critical projects, particularly in key regions like East Kalimantan. These delays not only hinder the timely development of new gas fields but also impact the overall progress of Indonesias natural gas sector, highlighting the need for more efficient regulatory frameworks and faster approvals.

Indonesia Natural Gas Market Future Outlook

The Indonesia natural gas market is expected to continue its growth trajectory through 2028, driven by rising domestic demand, increased industrial usage, and ongoing government efforts to promote natural gas as a key energy source. The development of LNG facilities and expanded pipeline infrastructure will further support market expansion. The governments commitment to transitioning to cleaner energy sources is expected to bolster the natural gas market in the coming years.

Future Market Opportunities

- Expansion of LNG Export Facilities: Indonesias existing LNG facilities, like the Bontang LNG terminal, have been operating at near full capacity. To capitalize on growing demand in markets such as China and South Korea, Indonesia plans to add new export terminals, particularly in Papua and Sulawesi, with a projected increase of 25% in LNG handling capacity by 2025. This expansion will allow Indonesia to remain competitive in the global LNG market and provide additional revenue streams.

- Development of Gas-to-Power Projects: The Indonesian government has prioritized gas-to-power projects, such as the Jawa 1 project, which will generate 1,760 megawatts upon completion in 2024. This initiative aligns with the country's goal of reducing its dependence on coal-fired power plants, aiming for a 20% share of gas-generated electricity. These gas-to-power projects represent an opportunity to increase the utilization of domestic gas resources while contributing to the national energy grid.

Scope of the Report

|

By Sector |

Industrial Power Generation Residential Transportation Commercial |

|

By Distribution Method |

Pipeline Gas Liquefied Natural Gas (LNG) |

|

By Technology |

Conventional Gas Unconventional Gas (Shale, CBM) |

|

By Region |

Sumatra Kalimantan Java Papua Sulawesi |

Products

Key Target Audience

Investors and Venture Capital Firms

Government and Regulatory Bodies (Ministry of Energy and Mineral Resources, SKK Migas)

Oil and Gas Companies

Power Generation Companies

LNG Exporters

Natural Gas Distribution Companies

Industrial Users (Manufacturing, Mining)

Energy Infrastructure Developers

Banks and Financial Institutions

Companies

Players Mention in the Report

Pertamina

Chevron

ExxonMobil

TotalEnergies

Medco Energi

Santos Limited

Petronas

Eni

BP

Shell

Mubadala Petroleum

ConocoPhillips

Premier Oil

INPEX Corporation

Talisman Energy

Table of Contents

1. Indonesia Natural Gas Market Overview

1.1. Definition and Scope

1.2. Natural Gas Supply Chain Analysis (Production, Processing, Transportation, Distribution)

1.3. Market Taxonomy (By Sector, By Distribution Method, By Technology)

1.4. Natural Gas Market Structure and Ecosystem

1.5. Gas Infrastructure Overview (LNG Terminals, Pipelines, Storage Facilities)

2. Indonesia Natural Gas Market Size (In Trillion Cubic Feet)

2.1. Historical Market Size (Domestic Consumption, Export Volumes)

2.2. Key Market Developments and Milestones (Policy Shifts, Infrastructure Growth)

2.3. Year-On-Year Growth Analysis (Production, Consumption, Trade)

3. Indonesia Natural Gas Market Analysis

3.1. Growth Drivers

3.1.1. Abundant Reserves and Increased Exploration Activities

3.1.2. Government Policies Favoring Natural Gas Utilization

3.1.3. Rising Industrial and Power Sector Demand

3.1.4. LNG Export Potential to Regional Markets

3.2. Market Challenges

3.2.1. Inadequate Gas Distribution Infrastructure in Remote Areas

3.2.2. Global Price Volatility and Export Dependency

3.2.3. Regulatory Bottlenecks and Licensing Delays

3.2.4. Competition from Renewable Energy Alternatives

3.3. Opportunities

3.3.1. Expansion of LNG Export Facilities

3.3.2. Development of Gas-to-Power Projects

3.3.3. Partnerships for Infrastructure Modernization

3.3.4. Investment in Downstream Processing Facilities

3.4. Trends

3.4.1. Adoption of Digital Technologies in Gas Operations

3.4.2. Growing Focus on Decarbonization and Low-Emission Gas Solutions

3.4.3. Shift Towards Small-Scale LNG for Remote Areas

3.4.4. Integration of Natural Gas with Hydrogen Projects

3.5. Government Regulation

3.5.1. National Energy Policy (RUEN) and Gas Role

3.5.2. Gas Distribution and Pricing Regulations

3.5.3. Incentives for Private Sector Investments in Gas Infrastructure

3.5.4. Environmental Standards and Emission Reduction Policies

4. Indonesia Natural Gas Market Segmentation

4.1. By Sector (In Value % and Volume)

4.1.1. Industrial

4.1.2. Power Generation

4.1.3. Residential

4.1.4. Transportation (CNG Vehicles, Marine Fuel)

4.1.5. Commercial

4.2. By Distribution Method (In Value % and Volume)

4.2.1. Pipeline Gas

4.2.2. Liquefied Natural Gas (LNG)

4.3. By Technology (In Value % and Volume)

4.3.1. Conventional Gas

4.3.2. Unconventional Gas (Shale Gas, Coal Bed Methane)

4.4. By Region (In Value % and Volume)

4.4.1. Sumatra

4.4.2. Kalimantan

4.4.3. Java

4.4.4. Papua

4.4.5. Sulawesi

5. Indonesia Natural Gas Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Pertamina

5.1.2. Chevron

5.1.3. ExxonMobil

5.1.4. TotalEnergies

5.1.5. Shell

5.1.6. BP

5.1.7. Medco Energi

5.1.8. ConocoPhillips

5.1.9. Santos Limited

5.1.10. Premier Oil

5.1.11. Eni

5.1.12. Petronas

5.1.13. Talisman Energy

5.1.14. Mubadala Petroleum

5.1.15. INPEX Corporation

5.2. Cross Comparison Parameters (Production Capacity, LNG Export Capacity, Upstream Reserves, Market Share)

5.3. Market Share Analysis

5.4. Strategic Initiatives (Partnerships, Joint Ventures, Expansions)

5.5. Mergers And Acquisitions

5.6. Investment Analysis

5.7. Government Grants

5.8. Private Equity Investments

5.9. R&D Investment Analysis

6. Indonesia Natural Gas Market Regulatory Framework

6.1. Gas Supply Licensing Process

6.2. Export-Import Laws and Regulations

6.3. LNG Export Quotas and Regional Trade Agreements

6.4. Compliance with Environmental Laws

7. Indonesia Natural Gas Future Market Size (In Trillion Cubic Feet)

7.1. Future Market Size Projections (Domestic Consumption, Export Volumes)

7.2. Key Factors Driving Future Market Growth (Industrialization, Power Demand)

8. Indonesia Natural Gas Future Market Segmentation

8.1. By Sector (Industrial, Power, Residential, Commercial, Transportation)

8.2. By Distribution Method (Pipeline, LNG)

8.3. By Region (Sumatra, Java, Kalimantan, Papua, Sulawesi)

8.4. By Technology (Conventional, Unconventional)

9. Indonesia Natural Gas Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Strategic Investment Areas

9.3. Market Entry and Expansion Strategies

9.4. White Space Opportunities

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

In this step, a comprehensive ecosystem map is created for the Indonesia natural gas market, identifying all major stakeholders, including producers, consumers, and infrastructure developers. Desk research, coupled with proprietary databases, is utilized to gather relevant data on the markets key variables, including production, consumption, and export volumes.

Step 2: Market Analysis and Construction

Here, historical data on production, LNG exports, and gas consumption is analyzed. The ratio of gas infrastructure to demand centers is evaluated, ensuring accurate revenue estimates. Additionally, we assess the role of major infrastructure projects in shaping the market dynamics.

Step 3: Hypothesis Validation and Expert Consultation

Industry experts are consulted through computer-assisted telephone interviews (CATIs) to validate market hypotheses. These experts provide insights into key operational challenges and opportunities, ensuring that the market data reflects current trends and conditions.

Step 4: Research Synthesis and Final Output

This step involves gathering data from multiple gas producers and infrastructure operators to verify the accuracy of market statistics. The data is cross-checked with industry reports to ensure a comprehensive and validated final analysis.

Frequently Asked Questions

01. How big is the Indonesia Natural Gas Market?

The Indonesia natural gas market is valued at 64 billion cubic meters, driven by increasing demand from the industrial and power sectors, along with rising exports of LNG.

02. What are the challenges in the Indonesia Natural Gas Market?

Challenges in the Indonesia natural gas market include inadequate distribution infrastructure in remote areas, global gas price fluctuations, and regulatory hurdles. Additionally, competition from renewable energy sources presents a challenge to long-term growth.

03. Who are the major players in the Indonesia Natural Gas Market?

Key players in the Indonesia natural gas market include Pertamina, Chevron, ExxonMobil, TotalEnergies, and Medco Energi. These companies dominate due to their extensive production capabilities and well-established LNG export operations.

04. What are the growth drivers of the Indonesia Natural Gas Market?

Growth drivers in the Indonesia natural gas market - include abundant natural gas reserves, rising industrial demand, and government policies promoting the use of natural gas in power generation and exports. The expansion of LNG infrastructure also plays a role.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.