Indonesia Online Education Market Outlook to 2030

Region:Asia

Author(s):Sanjeev

Product Code:KROD2151

November 2024

83

About the Report

Indonesia Online Education Market Overview

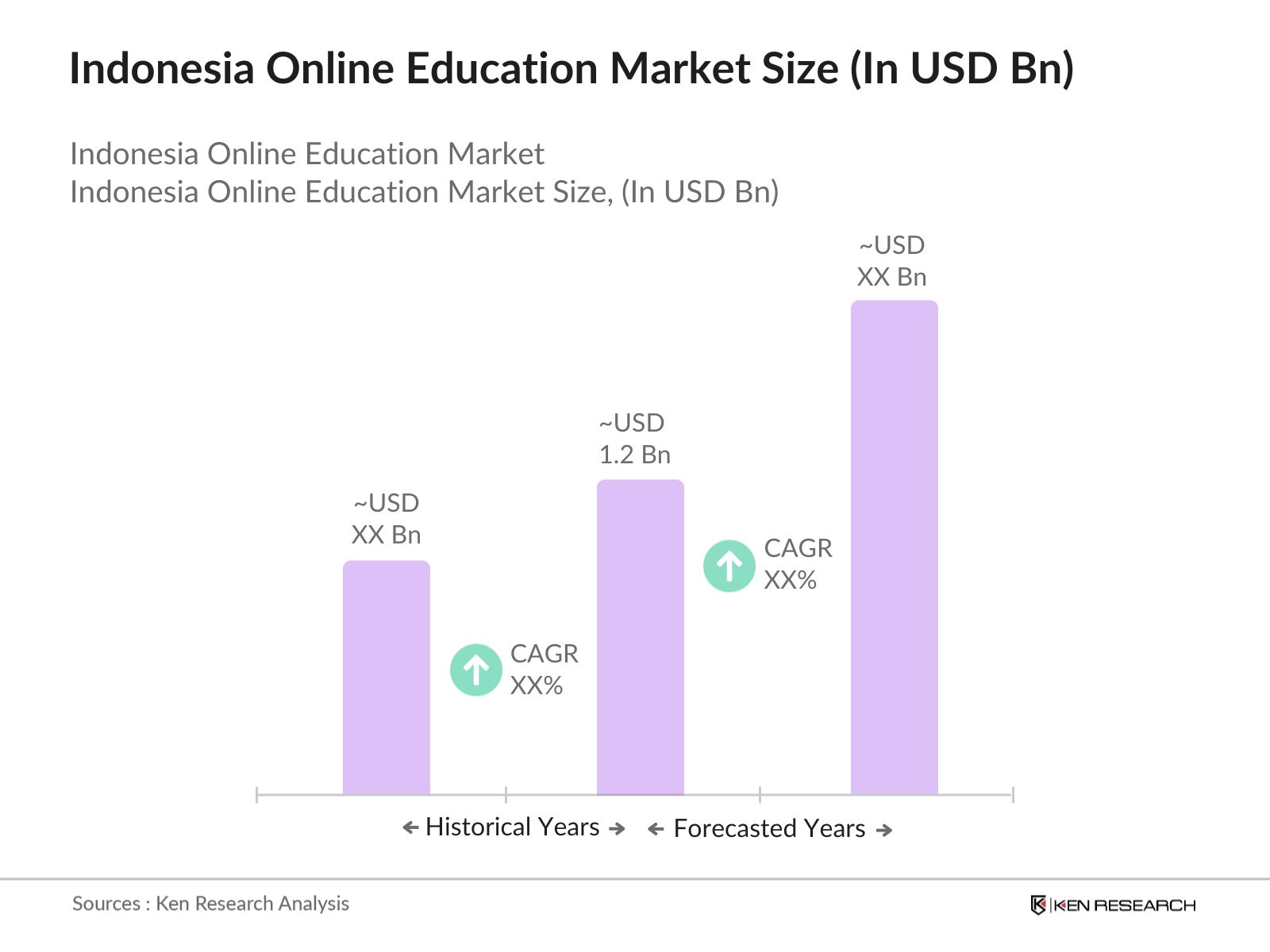

- The Indonesia Online Education Market has shown substantial growth, with the market valued at USD 1.2 billion. This growth is driven primarily by the increasing internet penetration across the country and the rise of digital literacy. More than 60% of Indonesia's population has internet access, which has contributed to the expansion of e-learning platforms, especially in urban areas. The governments initiatives, such as the "Making Indonesia 4.0" roadmap, have further accelerated the adoption of digital learning, driving market growth.

- Dominant regions within the market include Jakarta, Surabaya, and Bandung. These cities are at the forefront of the online education revolution due to their high internet infrastructure development and the increasing demand for upskilling among working professionals and students. Jakarta, being the capital, is home to many educational institutions and government initiatives that focus on digital education, further enhancing its role in the dominance of the online education sector.

- The Indonesian governments e-learning programs have been growing steadily, with a focus on expanding digital literacy across the nation. In 2024, the Ministry of Education launched initiatives to incorporate e-learning into public schools. At most about, 75,000 schools now have access to government-supported e-learning tools, benefiting more than 20 million students. These programs are designed to provide high-quality educational content, especially in remote areas, and ensure that online education meets national standards for curriculum development.

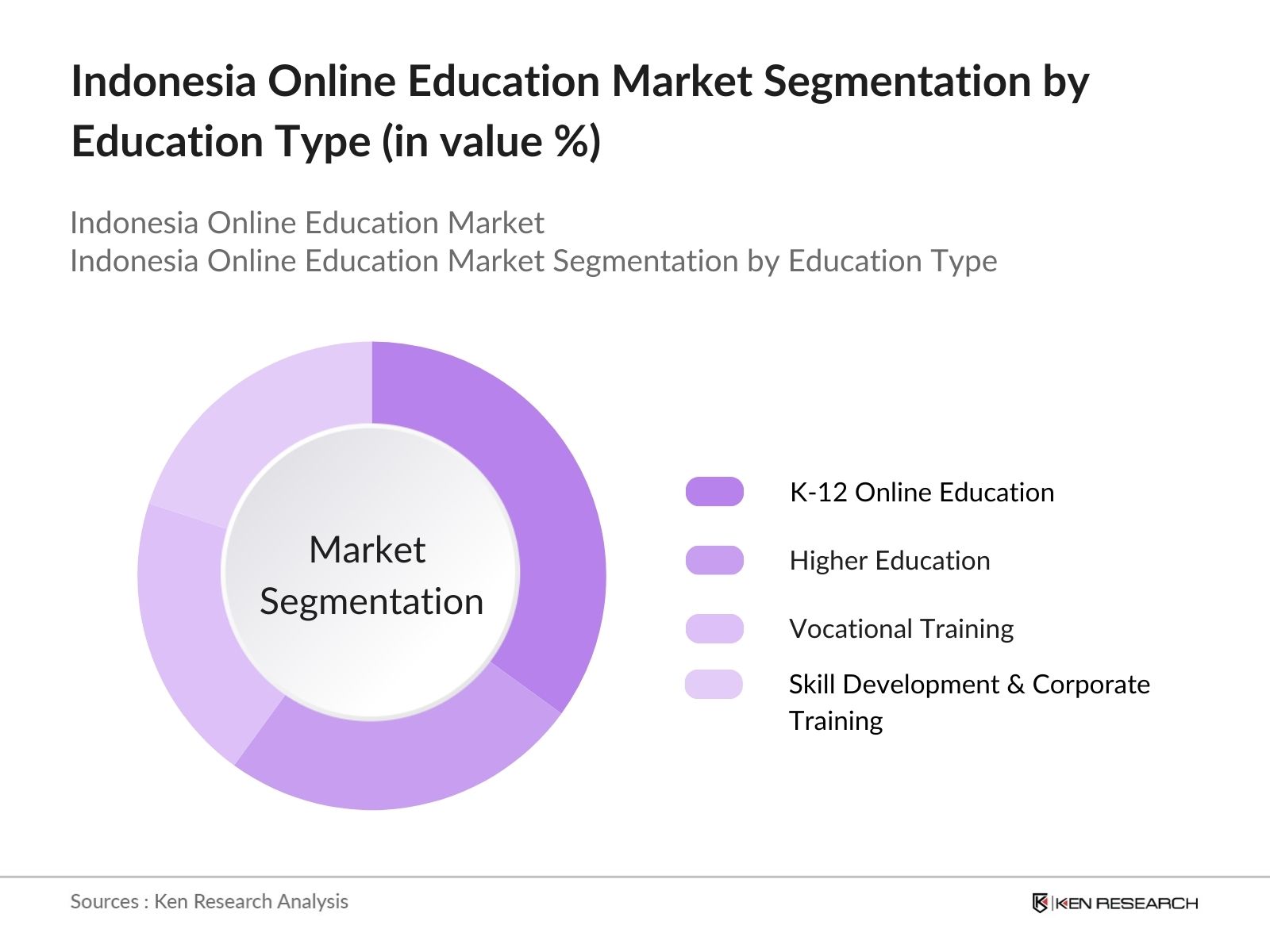

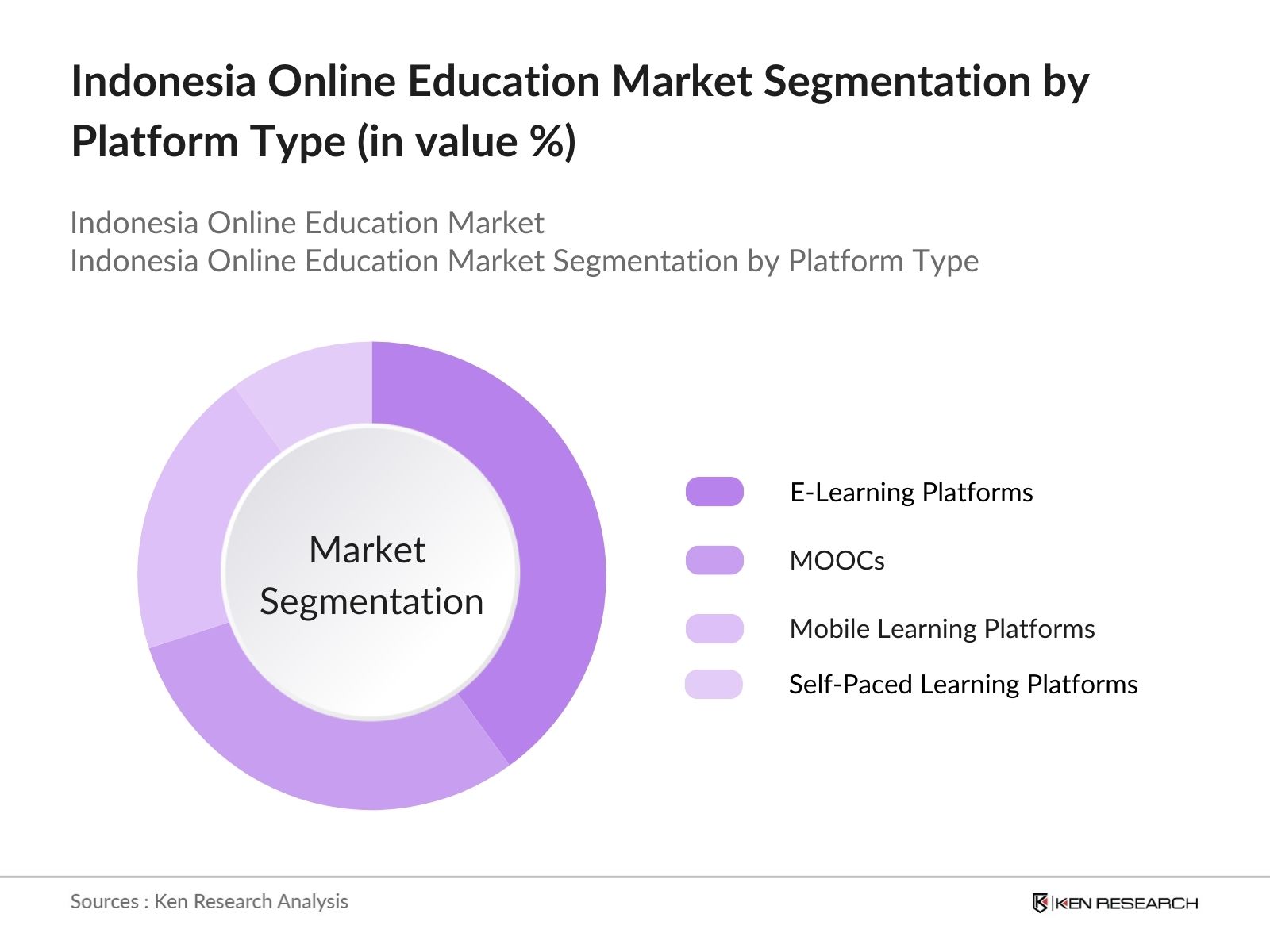

Indonesia Online Education Market Segmentation

The Indonesia Online Education Market is segmented into by education type and by platform type.

- By Education Type: The market is segmented into K-12 online education, higher education, vocational training, and skill development & corporate training. K-12 online education holds the dominant share, driven by the increase in school closures during the pandemic and the integration of digital platforms in the curriculum. The ease of accessibility, convenience, and cost-effectiveness have made online learning an attractive option for students and parents, which is why this segment leads the market.

- By Platform Type: In terms of platform type, the market is segmented into e-learning platforms, MOOCs (Massive Open Online Courses), mobile learning platforms, and self-paced learning platforms. E-learning platforms dominate this category, accounting for 40% of the market share in 2023. The prominence of platforms like Ruangguru and Zenius Education, offering a wide range of courses and interactive learning tools, contributes to their dominance. These platforms cater to diverse student needs, ranging from primary education to professional upskilling, making them the preferred choice.

Indonesia Online Education Market Competitive Landscape

The Indonesia Online Education Market is dominated by a mix of local and international players. Key companies include Ruangguru, Zenius Education, and international platforms like Coursera and edX. The competitive landscape highlights the growing influence of local companies, which understand the specific needs of the Indonesian market and are able to adapt their offerings accordingly.

The market is highly competitive, with companies focusing on enhancing user engagement through innovative learning tools, expanding their content libraries, and collaborating with educational institutions. Partnerships with government bodies and international organizations have further strengthened the market positioning of these companies.

|

Company Name |

Established Year |

Headquarters |

Platform Type |

Revenue Model |

Key Courses Offered |

Target Audience |

Number of Enrollments |

Partnerships |

Technology Integration |

|

Ruangguru |

2014 |

Jakarta |

|||||||

|

Zenius Education |

2004 |

Jakarta |

|||||||

|

Quipper |

2010 |

Jakarta |

|||||||

|

Skill Academy by Ruangguru |

2019 |

Jakarta |

|||||||

|

Coursera (Indonesia) |

2012 |

USA |

Indonesia Online Education Industry Analysis

Market Growth Drivers

- Digital Transformation of the Education System: The Indonesian government has invested heavily in digital education transformation. As of 2023, over 204 million Indonesians are using the internet, representing over 74% of the population, with digital penetration increasing every year. Digital classrooms and e-learning platforms are increasingly integrated into the national curriculum, with the Ministry of Education supporting more online platforms to foster inclusivity in education. The expansion of e-learning platforms has also been bolstered by government initiatives such as the Merdeka Belajar (Freedom of Learning) program, which aims to integrate technology into schools.

- Rising Awareness of Online Learning: Indonesia's online learning sector has gained momentum, particularly during and after the COVID-19 pandemic. According to World Bank data, Indonesias education system saw a 70% rise in the adoption of digital learning tools as part of the national curriculum between 2022-2024. The shift is driven by increasing awareness among students and parents about the advantages of flexible, on-demand learning. With over 50 million students engaged in formal education in Indonesia, this rising awareness signals a fundamental shift towards blended and online learning environments.

- Growth of Mobile Learning Platforms: In 2024, mobile learning is on the rise in Indonesia due to the widespread availability of smartphones. The Indonesian Association of Internet Service Providers (APJII) reports that 89% of internet users access the internet via mobile devices. With nearly 70% of the population having mobile broadband subscriptions, mobile learning platforms are growing rapidly. This trend is supported by Indonesias younger population, where the median age is 29.7 years, ensuring a tech-savvy, mobile-first learning ecosystem that encourages remote education, particularly for university students and professionals seeking continuous learning.

Market Challenges

- High Drop-out Rates in Online Learning: While online education is expanding, Indonesia faces high drop-out rates in online learning environments, especially among rural populations. The Ministry of Education reported that in 2023, 33% of students in online programs did not complete their courses. One of the contributing factors is the limited digital literacy among teachers and students, particularly in underserved regions. The high drop-out rate is further exacerbated by inconsistent internet access in rural areas and a lack of personalized engagement in virtual classrooms, which hampers student retention.

- Lack of Engagement in Virtual Classrooms: A key challenge in Indonesias online education market is the low engagement level in virtual classrooms. According to the Ministry of Education and Culture, 25% of students in e-learning platforms reported decreased motivation and focus during online sessions in 2024. Factors contributing to this disengagement include a lack of interactive content, teacher-student interaction, and technical issues such as unstable connections. This has led to the creation of more engaging platforms that include gamification and interactive tools to keep students actively involved.

Indonesia Online Education Market Future Outlook

Over the next five years, the Indonesia Online Education Market is expected to experience significant growth, driven by increasing demand for flexible learning solutions, the rise of digital transformation initiatives, and government-backed education reforms. With more institutions integrating online platforms into their curriculum and professionals seeking new skills through digital platforms, the future of the market is bright. Local companies are expected to further consolidate their positions by diversifying their offerings and enhancing technological integration, while global platforms will continue expanding their reach through partnerships with Indonesian educational institutions.

Future Market Opportunities

- Collaboration with International Universities: Collaboration between Indonesian e-learning platforms and international universities has opened new doors for students and professionals. In 2023, Indonesia signed educational cooperation agreements with over 30 international universities, including institutions from Australia and the UK. These collaborations are aimed at enhancing online course offerings in diverse fields such as business, IT, and engineering. Students benefit from international accreditation, improving their employment prospects in both local and global markets. The influx of international partnerships also facilitates access to advanced technologies and teaching methodologies.

- Development of Skill-Based Courses: The demand for skill-based courses is increasing, particularly in vocational and professional training. According to the International Labour Organization (ILO), Indonesia's workforce of 140 million people is transitioning towards industries requiring digital, technical, and soft skills. As a result, online education platforms are increasingly offering specialized courses in IT, healthcare, digital marketing, and entrepreneurship. These skill-based programs, supported by the governments skill development initiatives, are aimed at improving employment rates and addressing skill gaps in Indonesias labor market.

Scope of the Report

|

|||||||||

|

By Platform Type |

|

||||||||

|

By Mode of Learning |

|

||||||||

|

By End User |

|

||||||||

|

By Region |

North East West South |

Products

Key Target Audience

EdTech Companies

Corporate Training Providers

K-12 Educational Institutions

Higher Education Institutions

Government and Regulatory Bodies (Ministry of Education and Culture, Badan Nasional Sertifikasi Profesi)

Technology Providers for E-learning Solutions

Investors and Venture Capital Firms

Banks and Financial Institutes

Professional Associations (Indonesia Education Practitioners Association)

Companies

Players Mention in the Report

Ruangguru

Zenius Education

Quipper

Kelas Pintar

HarukaEdu

Pahamify

Google for Education (Indonesia)

edX (Indonesia)

Udemy (Indonesia)

Skill Academy by Ruangguru

Coursera (Indonesia)

Khan Academy (Indonesia)

Duolingo (Indonesia)

LinkedIn Learning (Indonesia)

Sekolahmu

Table of Contents

1. Indonesia Online Education Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy (platform types, education level, and delivery methods)

1.3 Market Growth Rate (driven by internet penetration, digitalization of education)

1.4 Market Segmentation Overview

2. Indonesia Online Education Market Size (In USD Bn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. Indonesia Online Education Market Analysis

3.1 Growth Drivers (Increased Internet Access, Government Digital Initiatives, Demand for Lifelong Learning)

3.1.1 Digital Transformation of the Education System

3.1.2 Rising Awareness of Online Learning

3.1.3 Growth of Mobile Learning Platforms

3.1.4 Integration of Artificial Intelligence in Education

3.2 Market Challenges (Low Digital Literacy, Internet Accessibility in Rural Areas)

3.2.1 High Drop-out Rates in Online Learning

3.2.2 Lack of Engagement in Virtual Classrooms

3.2.3 Competition from Traditional Education Institutions

3.3 Opportunities (Corporate Training, Expansion of Multilingual Learning Content)

3.3.1 Collaboration with International Universities

3.3.2 Development of Skill-Based Courses

3.3.3 Government Initiatives Supporting Online Learning

3.4 Trends (Gamification, Microlearning, VR/AR in Learning)

3.4.1 Emergence of Adaptive Learning Technology

3.4.2 Personalized Learning Experiences

3.4.3 Peer-to-Peer Learning Models

3.5 Government Regulation (Policy Reforms, Accreditation of Online Courses)

3.5.1 Government E-Learning Programs

3.5.2 National Curriculum Integration

3.5.3 Data Privacy Regulations for EdTech Platforms

3.5.4 Public-Private Partnerships in Education

4. Indonesia Online Education Market Segmentation

4.1 By Education Type (In Value %)

4.1.1 K-12 Online Education

4.1.2 Higher Education

4.1.3 Vocational Training

4.1.4 Skill Development & Corporate Training

4.2 By Platform Type (In Value %)

4.2.1 E-Learning Platforms

4.2.2 MOOCs (Massive Open Online Courses)

4.2.3 Mobile Learning Platforms

4.2.4 Self-Paced Learning Platforms

4.3 By Mode of Learning (In Value %)

4.3.1 Synchronous Learning

4.3.2 Asynchronous Learning

4.4 By Region (In Value %)

4.4.1 North

4.4.2 East

4.4.3 West

4.4.4 South

4.5 By End User (In Value %)

4.5.1 Students

4.5.2 Professionals

4.5.3 Institutions (Schools, Universities)

4.5.4 Corporates

5. Indonesia Online Education Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Ruangguru

5.1.2 Zenius Education

5.1.3 Quipper

5.1.4 Kelas Pintar

5.1.5 HarukaEdu

5.1.6 Pahamify

5.1.7 Google for Education (Indonesia)

5.1.8 edX (Indonesia)

5.1.9 Udemy (Indonesia)

5.1.10 Skill Academy by Ruangguru

5.1.11 Coursera (Indonesia)

5.1.12 Khan Academy (Indonesia)

5.1.13 Duolingo (Indonesia)

5.1.14 LinkedIn Learning (Indonesia)

5.1.15 Sekolahmu

5.2 Cross Comparison Parameters (Platform Type, Learning Model, Revenue Model, Target Audience, Headquarters, Number of Enrollments, Technology Stack, Learning Content Type)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. Indonesia Online Education Market Regulatory Framework

6.1 Education Standards Compliance

6.2 Certification Requirements for Online Courses

6.3 Accreditation Policies for E-Learning Platforms

7. Indonesia Online Education Future Market Size (In USD Bn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. Indonesia Online Education Future Market Segmentation

8.1 By Education Type (In Value %)

8.2 By Platform Type (In Value %)

8.3 By Mode of Learning (In Value %)

8.4 By Region (In Value %)

8.5 By End User (In Value %)

9. Indonesia Online Education Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Segmentation and Engagement Strategy

9.3 Strategic Marketing Initiatives

9.4 White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

In the initial phase, we identify the primary stakeholders within the Indonesia Online Education Market. Desk research, incorporating proprietary databases and government publications, allows us to map out the ecosystem. The objective is to establish the critical variables impacting market growth, including internet penetration, education reform, and digital literacy.

Step 2: Market Analysis and Construction

This phase involves analyzing historical data to track market penetration and user adoption trends. We review the correlation between mobile device ownership, internet access, and online education uptake to estimate revenue generation and market size. Additional factors such as user engagement levels are examined for reliability.

Step 3: Hypothesis Validation and Expert Consultation

To refine our findings, we conduct telephone interviews with industry professionals, including executives from major EdTech companies. These consultations provide critical insights into operational and financial performance, which help validate our market hypotheses.

Step 4: Research Synthesis and Final Output

In this final phase, we engage directly with key educational institutions and technology providers. Insights on user behavior, course completion rates, and popular learning modules are gathered to complement our bottom-up analysis. This ensures that our final report provides a thorough and accurate view of the Indonesia Online Education Market.

Frequently Asked Questions

01. How big is the Indonesia Online Education Market?

The Indonesia Online Education Market is valued at USD 1.2 billion in 2023, driven by the country's increasing internet penetration and government initiatives promoting digital education.

02. What are the challenges in the Indonesia Online Education Market?

Indonesia Online Education Market Challenges include limited digital literacy in rural areas, high drop-out rates for online courses, and competition from traditional education systems. Additionally, engaging students in virtual classrooms remains a challenge.

03. Who are the major players in the Indonesia Online Education Market?

Key players in the Indonesia Online Education Market include Ruangguru, Zenius Education, Quipper, Skill Academy, and Coursera (Indonesia). These companies dominate due to their strong digital platforms, extensive course offerings, and partnerships with educational institutions.

04. What are the growth drivers of the Indonesia Online Education Market?

The Indonesia Online Education Market is driven by increased internet penetration, growing demand for digital learning tools, and government-backed educational reforms. The rise of mobile learning platforms has also contributed to market expansion.

05. What are the future opportunities in the Indonesia Online Education Market?

Indonesia Online Education Market Opportunities include the expansion of corporate training programs, increased adoption of AI-driven learning tools, and partnerships with international educational institutions. As digital literacy improves, the market is expected to diversify further.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.