Indonesia OTT Platform Market Outlook to 2030

Region:Asia

Author(s):Sanjeev

Product Code:KROD3879

November 2024

99

About the Report

Indonesia OTT Platform Market Overview

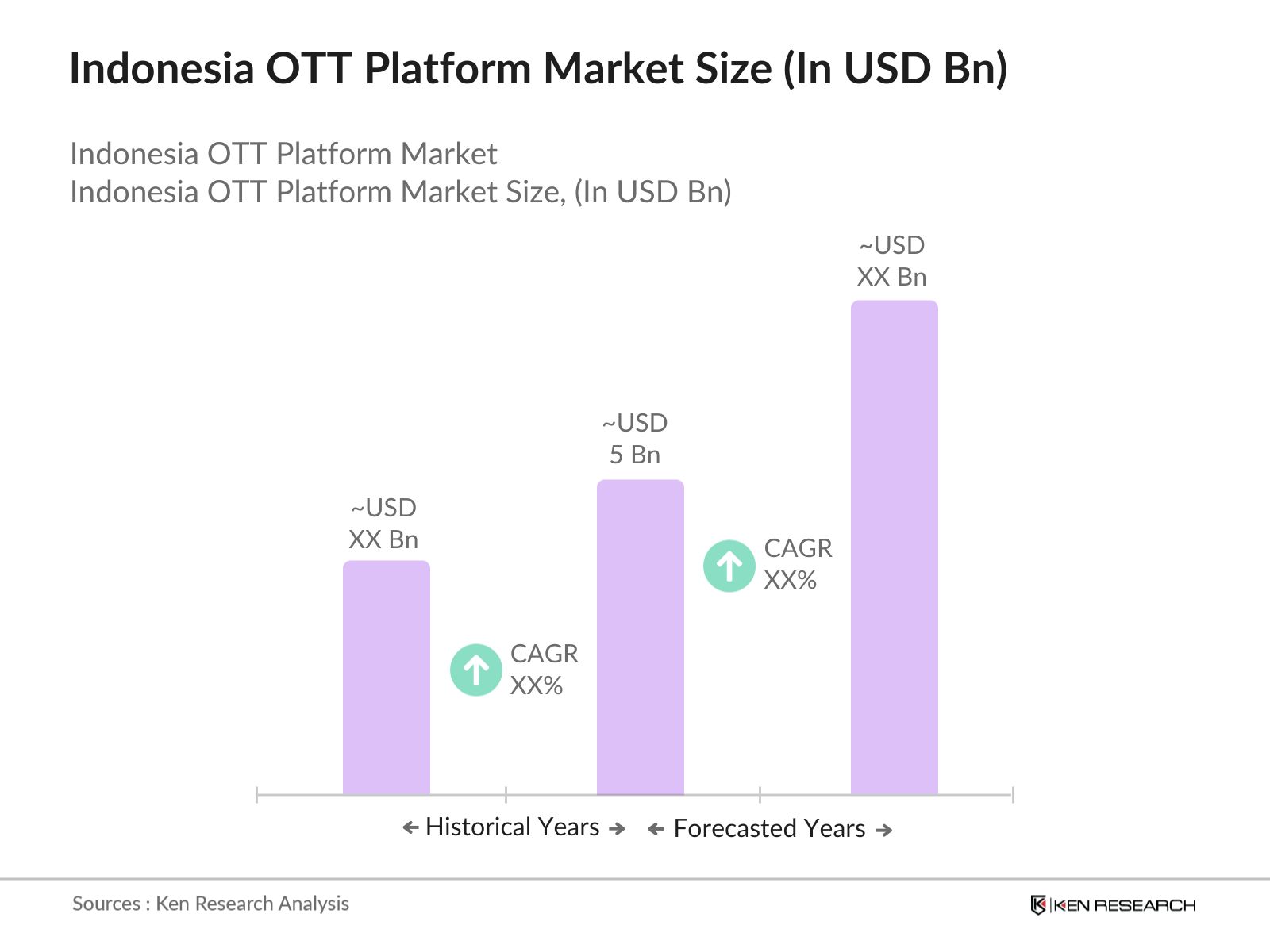

- The Indonesia OTT Platform market is valued at USD 5 billion, driven by the rapid expansion of internet infrastructure and an increase in the number of mobile users. The demand for localized content and easy access to digital media has fueled this growth. With major telecom companies offering affordable data plans, more consumers are turning to OTT platforms for entertainment. Additionally, Indonesias young, tech-savvy population is driving the adoption of these services as they prefer on-demand content to traditional TV services, contributing to significant market growth.

- Major cities like Jakarta and Surabaya dominate the OTT platform market in Indonesia. Jakartas dominance is attributed to its dense population, high internet penetration, and tech-friendly infrastructure, making it the largest consumer base for OTT platforms. Surabaya follows closely due to its rapid urbanization and increasing mobile user base. Both cities also benefit from a higher average income, which allows for more spending on subscription-based platforms, while rural areas are catching up with improving internet access.

- Indonesias OTT platforms must comply with stringent content regulations, including censorship of materials deemed inappropriate by the Indonesian Broadcasting Commission. In 2023, over 200 pieces of content were removed or censored due to violations of government standards. These regulations have created operational challenges for OTT providers, especially international platforms that must tailor their content to fit local guidelines. The governments strict enforcement of these policies aims to protect cultural values but often restricts the range of content available to users.

Indonesia OTT Platform Market Segmentation

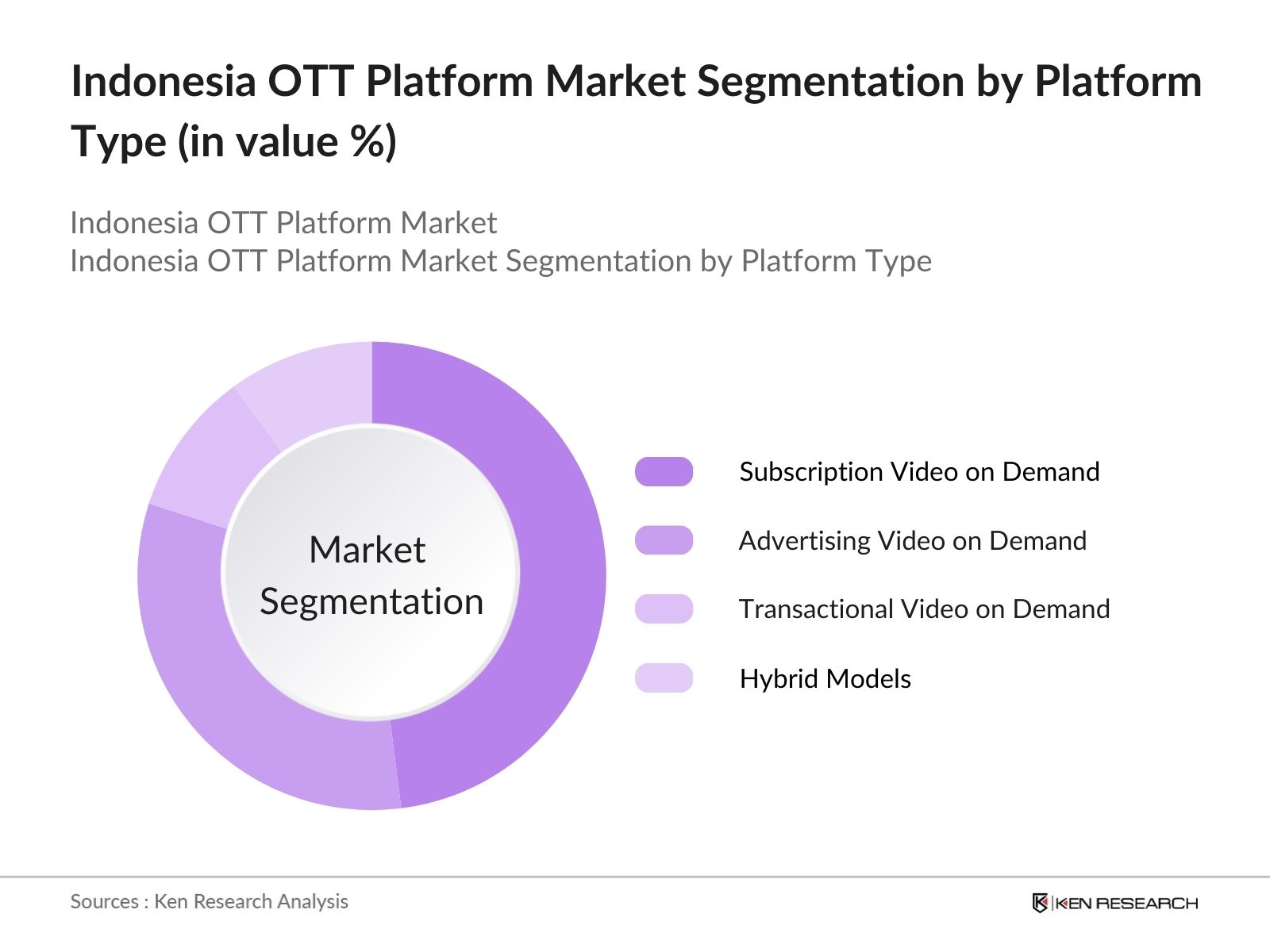

- By Platform Type: The market is segmented by platform type into Subscription Video on Demand (SVOD), Advertising Video on Demand (AVOD), Transactional Video on Demand (TVOD), and Hybrid Models. The SVOD segment holds the dominant market share due to the rising demand for uninterrupted, ad-free content. Leading platforms like Netflix, Disney+ Hotstar, and Amazon Prime Video have capitalized on this trend, offering premium content in exchange for monthly or yearly subscriptions. Consumers prefer this model as it provides access to exclusive series and movies, which are often unavailable on other platforms.

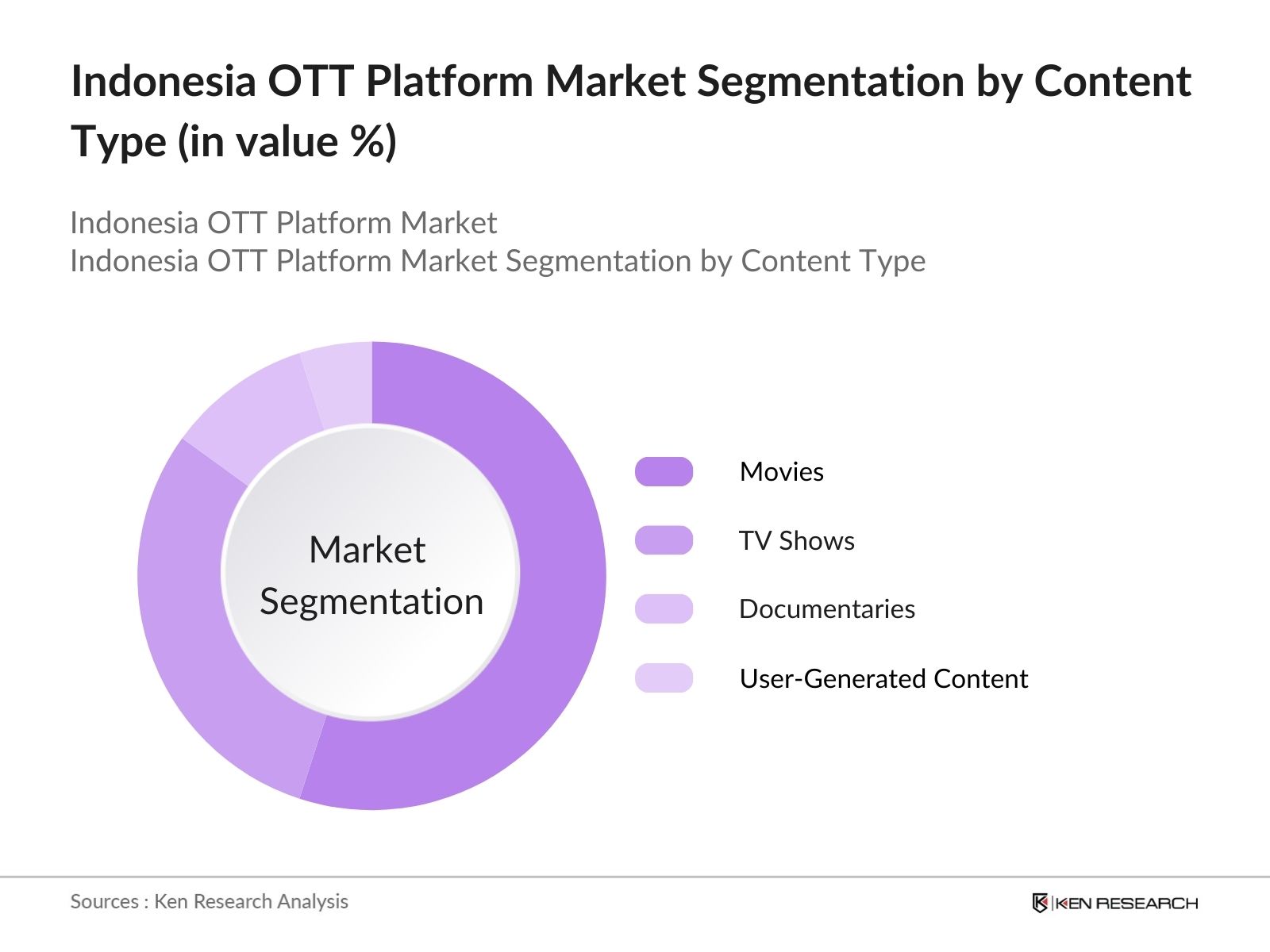

- By Content Type: The market is segmented by content type into Movies, TV Shows, Documentaries, and User-Generated Content. The Movies sub-segment dominates the market, owing to Indonesia's long-standing cinematic culture and the increasing number of international and local films available on OTT platforms. Platforms such as Netflix and Disney+ Hotstar have also invested heavily in local movie production, which resonates well with Indonesian viewers, further increasing the demand for movie content.

Indonesia OTT Platform Market Competitive Landscape

The Indonesia OTT Platform market is dominated by several local and global players who continuously innovate to retain their market positions. The market is characterized by the heavy investment in content creation and partnerships with local telecom companies to enhance accessibility. The market is highly competitive, with companies like Netflix and Disney+ Hotstar holding significant positions due to their extensive content libraries and strong brand presence. Local players like Vidio and Viu are also gaining traction by offering localized content and flexible pricing models.

|

Company |

Established |

Headquarters |

Subscribers |

Revenue Model |

Mobile App Integration |

Content Library |

Original Productions |

Partnerships |

|

Netflix |

1997 |

Los Gatos, USA |

||||||

|

Disney+ Hotstar |

2015 |

Burbank, USA |

||||||

|

Amazon Prime Video |

2006 |

Seattle, USA |

||||||

|

Vidio |

2014 |

Jakarta, Indonesia |

||||||

|

Viu |

2015 |

Hong Kong, China |

Indonesia OTT Platform Industry Analysis

Market Growth Drivers

- Increased Internet Penetration: As of 2023, Indonesia had over 210 million internet users, a significant increase from previous years, driven by government initiatives to improve digital infrastructure. The Palapa Ring project, completed in 2021, played a critical role in expanding broadband access across the country, including remote areas. This widespread connectivity has bolstered the adoption of OTT platforms, with over 150 million Indonesians now accessing video streaming services regularly. The World Banks Digital Economy Report highlights that Indonesias internet penetration rate reached 76% in 2023, further driving the growth of OTT platforms.

- Mobile Device Proliferation: Indonesia saw a dramatic rise in mobile device usage, with over 345 million mobile connections in 2023, exceeding the population by nearly 1.3 times. This surge is a crucial driver for OTT platforms, as most users access streaming services through smartphones. The Indonesian Ministry of Communication and Informatics has reported that mobile data traffic increased by 40% in 2022, largely due to the consumption of video content. With affordable smartphone availability and the growing 4G/5G networks, the OTT market is set to thrive based on current user behavior.

- Content Localization: OTT platforms in Indonesia are increasingly adopting content localization strategies to cater to regional tastes. In 2023, over 30% of the content on leading OTT platforms was localized, featuring Indonesian languages and cultural themes. This has significantly boosted user engagement, with platforms like Vidio and WeTV seeing a 20% growth in daily active users after launching localized content. Government regulations also mandate a minimum of 10% local content on digital platforms, pushing providers to produce more region-specific shows, making this a key growth driver.

Market Challenges

- Content Piracy Issues: Despite the growth of legal platforms, content piracy remains a significant hurdle for Indonesias OTT industry. Many internet users continue to access pirated content, leading to revenue losses for legitimate platforms. While the government has made efforts to combat piracy by blocking illegal streaming websites, the issue persists due to the availability of free alternatives and the relatively high costs of legal subscriptions for certain demographics. This ongoing challenge affects the potential revenue growth of OTT platforms in the country.

- High Competition Among Providers: The Indonesian OTT sector is highly competitive, with numerous active players, both global and local. Leading global platforms face significant competition from local services that have gained market share by offering localized content and competitive pricing strategies. The markets fragmentation makes it challenging for platforms to maintain user loyalty and profitability. Intense competition also leads to higher content costs, as providers vie for exclusive rights to attract and retain subscribers, creating further operational pressures.

Indonesia OTT Platform Market Future Outlook

Over the next few years, the Indonesia OTT Platform market is expected to witness substantial growth, driven by technological advancements in mobile internet access, increased penetration of smartphones, and strategic partnerships between OTT platforms and telecom operators. The rise of original content production and increased focus on local languages will further accelerate the growth of this market. As consumers shift away from traditional TV towards on-demand entertainment, the demand for premium and diversified content will continue to rise, encouraging more international players to enter the market.

Market Opportunities

- Rising Demand for Original Content: In 2023, OTT platforms reported a 25% increase in demand for original content, as users seek more exclusive shows and movies. This trend is particularly strong in Indonesia, where platforms like WeTV and Vidio have invested heavily in producing original series featuring Indonesian actors and settings. The Indonesian Film Council stated that local OTT platforms are expected to release over 50 original titles by the end of 2024, reflecting a growing market for locally-produced, unique content that distinguishes platforms from competitors.

- Expansion into Rural Areas: Rural areas represent a vast, untapped market for OTT platforms in Indonesia. By 2023, around 60% of rural households had access to broadband internet, up from 50% in 2022, according to Indonesias Central Bureau of Statistics. OTT platforms see immense potential in expanding into these areas, where the growing penetration of affordable smartphones and digital literacy programs is increasing demand for entertainment services. Collaborations with local telecom providers to improve infrastructure further present an opportunity for platforms to reach new audiences in these regions.

Scope of the Report

|

By Platform Type |

Subscription Video on Demand Advertising Video on Demand Transactional Video on Demand Hybrid Models |

|

By Content Type |

Movies TV Shows Documentaries User-Generated Content |

|

By Revenue Model |

Subscription-Based Ad-Based Transaction-Based |

|

By Device Type |

Smartphones Smart TVs Laptops/Tablets Streaming Devices |

|

By Region |

North East West South |

Products

Key Target Audience

OTT Platform Providers

Telecom Operators (Telkomsel, XL Axiata, Indosat Ooredoo)

Content Creators and Producers

Mobile Application Developers

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (Indonesian Ministry of Communication and Informatics)

Banks and Financial Institutes

Advertising Agencies

Streaming Device Manufacturers

Companies

Indonesia OTT Platform Major Players

Netflix

Disney+ Hotstar

Amazon Prime Video

Vidio

Viu

Hooq

GoPlay

iQiyi

WeTV

Catchplay+

Mola TV

MAXstream

Sushiroll

Vision+

Iflix

Table of Contents

1. Indonesia OTT Platform Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Indonesia OTT Platform Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Indonesia OTT Platform Market Analysis

3.1. Growth Drivers

3.1.1. Increased Internet Penetration

3.1.2. Mobile Device Proliferation

3.1.3. Content Localization

3.1.4. Rising Adoption of Subscription Models

3.2. Market Challenges

3.2.1. Content Piracy Issues

3.2.2. High Competition Among Providers

3.2.3. Regulatory Challenges

3.3. Opportunities

3.3.1. Rising Demand for Original Content

3.3.2. Expansion into Rural Areas

3.3.3. Collaborations with Telecom Providers

3.4. Trends

3.4.1. Growth in Subscription Video-on-Demand (SVOD)

3.4.2. Rise in Ad-Supported Video-on-Demand (AVOD)

3.4.3. Integration of AI and Data Analytics for Personalization

3.5. Government Regulation

3.5.1. Content Regulations and Censorship

3.5.2. Data Privacy and Protection Laws

3.5.3. Local Content Quotas and Licensing

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. Indonesia OTT Platform Market Segmentation

4.1. By Platform Type (In Value %)

4.1.1. Subscription Video on Demand (SVOD)

4.1.2. Advertising Video on Demand (AVOD)

4.1.3. Transactional Video on Demand (TVOD)

4.1.4. Hybrid Models

4.2. By Content Type (In Value %)

4.2.1. Movies

4.2.2. TV Shows

4.2.3. Documentaries

4.2.4. User-Generated Content

4.3. By Revenue Model (In Value %)

4.3.1. Subscription-Based

4.3.2. Ad-Based

4.3.3. Transaction-Based

4.4. By Device Type (In Value %)

4.4.1. Smartphones

4.4.2. Smart TVs

4.4.3. Laptops/Tablets

4.4.4. Streaming Devices

4.5. By Region (In Value %)

4.5.1. North

4.5.2. East

4.5.3. West

4.5.4. South

5. Indonesia OTT Platform Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Netflix Inc.

5.1.2. Disney+ Hotstar

5.1.3. Amazon Prime Video

5.1.4. Hooq

5.1.5. Vidio

5.1.6. Iflix

5.1.7. GoPlay

5.1.8. Viu

5.1.9. WeTV

5.1.10. Catchplay+

5.1.11. iQiyi

5.1.12. Vision+

5.1.13. Mola TV

5.1.14. MAXstream

5.1.15. Sushiroll

5.2. Cross Comparison Parameters (No. of Subscribers, Original Content, Local Content Partnership, Subscription Cost, Mobile App User Interface, Monthly Active Users, Platform Integration, Ad Revenue)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Indonesia OTT Platform Market Regulatory Framework

6.1. Content Licensing Regulations

6.2. Compliance with Local Content Quotas

6.3. Data Privacy and Protection Laws

6.4. Content Moderation and Censorship Policies

7. Indonesia OTT Platform Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Indonesia OTT Platform Future Market Segmentation

8.1. By Platform Type (In Value %)

8.2. By Content Type (In Value %)

8.3. By Revenue Model (In Value %)

8.4. By Device Type (In Value %)

8.5. By Region (In Value %)

9. Indonesia OTT Platform Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping out all major stakeholders in the Indonesia OTT Platform market. Extensive desk research is conducted using secondary data and proprietary databases to gather insights into the critical factors driving the market. The primary objective is to define the variables influencing the market, such as consumer preferences, content availability, and internet penetration.

Step 2: Market Analysis and Construction

In this phase, historical market data is compiled and analyzed, focusing on subscriber growth, platform revenue models, and content consumption patterns. We assess the penetration of OTT platforms across different device types, understanding their impact on overall market revenue. This analysis is crucial for developing accurate market forecasts.

Step 3: Hypothesis Validation and Expert Consultation

To validate our market assumptions, we engage industry experts through structured interviews and consultations. Experts from major OTT platforms and telecom operators provide valuable insights on content consumption trends, regulatory challenges, and market opportunities. These expert opinions are integrated into our final analysis.

Step 4: Research Synthesis and Final Output

The final step involves synthesizing all gathered data and insights into a comprehensive market report. A bottom-up approach is used to validate the findings and ensure the accuracy of data related to market size, segmentation, and growth forecasts. This approach guarantees a reliable and complete analysis of the Indonesia OTT Platform market.

Frequently Asked Questions

01. How big is the Indonesia OTT Platform Market?

The Indonesia OTT Platform market is valued at USD 5 billion, driven by increasing mobile penetration, affordable data plans, and the rising demand for localized content.

02. What are the challenges in the Indonesia OTT Platform Market?

Challenges include content piracy, regulatory hurdles related to censorship, and intense competition among global and local players. Additionally, bandwidth issues in rural areas affect platform accessibility.

03. Who are the major players in the Indonesia OTT Platform Market?

Key players in the market include Netflix, Disney+ Hotstar, Amazon Prime Video, Vidio, and Viu. These companies dominate due to their extensive content libraries, strategic partnerships with telecom operators, and strong brand presence.

04. What are the growth drivers of the Indonesia OTT Platform Market?

Growth is propelled by factors such as the expansion of internet infrastructure, the proliferation of smartphones, and the increasing demand for on-demand entertainment. Localization of content has also played a significant role in attracting more viewers.

05. What is the future outlook for the Indonesia OTT Platform Market?

The market is expected to grow further, driven by advancements in mobile internet technology, increased investment in original content, and rising consumer preferences for ad-free subscription services.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.