Indonesia Outdoor Equipment Market Outlook to 2030

Region:Asia

Author(s):Yogita Sahu

Product Code:KROD8158

December 2024

90

About the Report

Indonesia Outdoor Equipment Market Overview

- The Indonesia outdoor equipment market was valued at USD 337 million, driven by increasing interest in outdoor activities such as camping, hiking, and fishing. This growth is attributed to rising disposable incomes, an expanding middle class, and a surge in domestic tourism. Furthermore, the government's push for eco-tourism and adventure sports has fueled demand for outdoor equipment.

- The market is dominated by key urban centers such as Jakarta, Bali, and Bandung, which serve as tourism hubs and recreational destinations. These regions have experienced heightened demand due to their proximity to popular outdoor activity sites. For example, Bali, known for its scenic beauty and adventure tourism, has a strong customer base for water sports and hiking gear.

- The Indonesian government, through its Ministry of Tourism, has been actively promoting adventure and eco-tourism in regions such as Bali, Sumatra, and Kalimantan. In 2024, the Ministry of Tourism is targeting over 7.5 million adventure-seeking tourists. This promotion is expected to increase the demand for outdoor equipment like hiking gear, safety equipment, and camping gear, benefiting the market as more tourists engage in adventure-based activities.

Indonesia Outdoor Equipment Market Segmentation

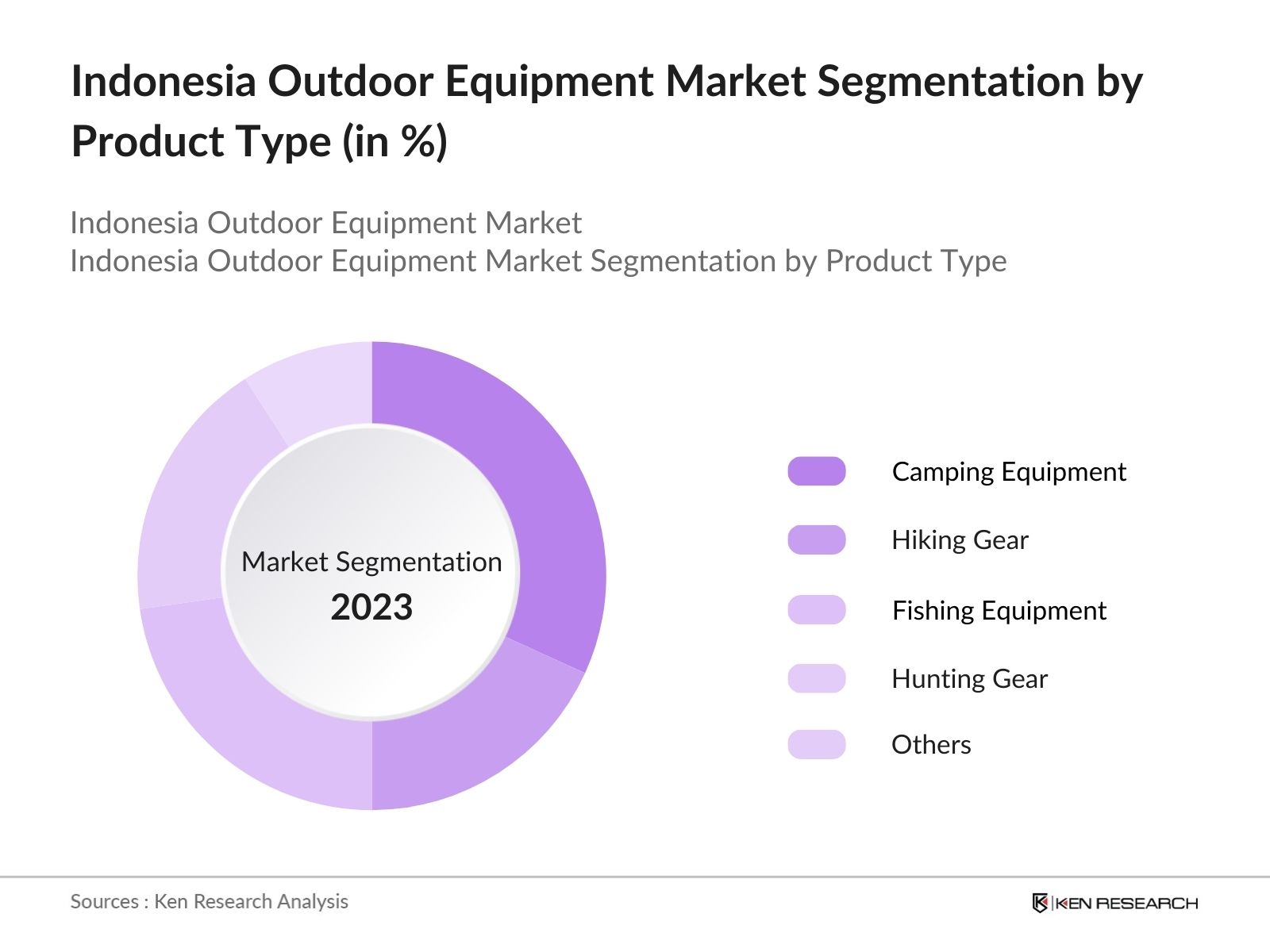

By Product Type: The market is segmented by product type into camping equipment, hiking gear, fishing equipment, hunting gear, and others. Currently, camping equipment dominates the market due to the increasing popularity of eco-friendly and adventure tourism, with both locals and international tourists seeking immersive outdoor experiences. Established brands in this segment have capitalized on this trend by offering a diverse range of products, including tents, backpacks, and portable cooking equipment, catering to both novice and seasoned campers.

By Distribution Channel: The market is further segmented by distribution channels into online and offline channels, including specialty stores, supermarkets, and hypermarkets. The online segment has been gaining prominence, especially post-pandemic, as more consumers prefer to purchase equipment through e-commerce platforms for convenience. This shift is driven by easy access to product comparisons, home delivery, and discount offerings.

Indonesia Outdoor Equipment Market Competitive Landscape

The market in Indonesia is competitive, with several domestic and international players vying for market share. Decathlon, a major international brand, has seen widespread adoption due to its affordable pricing and wide product range.

|

Company Name |

Establishment Year |

Headquarters |

Product Range |

Distribution Network |

Local Manufacturing |

Sustainability Initiatives |

Innovation Pipeline |

Revenue (2023, USD) |

|

Decathlon |

1976 |

France |

||||||

|

Eiger Adventure |

1989 |

Indonesia |

||||||

|

North Face |

1968 |

USA |

||||||

|

Patagonia |

1973 |

USA |

||||||

|

Columbia Sportswear |

1938 |

USA |

Indonesia Outdoor Equipment Market Analysis

Market Growth Drivers

- Increasing Popularity of Outdoor Sports: Outdoor sports like hiking, mountain biking, and water sports are gaining popularity among the youth population in Indonesia, fueled by local sports events and awareness campaigns. By 2024, Indonesia's sports and recreation market is expected to have substantial growth due to increasing local sports events. This has resulted in a spike in the demand for durable outdoor sports equipment.

- Government's Focus on Infrastructure Development: The Indonesian government has heavily invested in infrastructure projects, especially in remote areas and national parks, enhancing accessibility to outdoor adventure spots. In 2024, the government has allocated over IDR 400 trillion for infrastructure, facilitating tourism, and improving transportation networks to various outdoor locations.

- Growing Middle-Class and Outdoor Enthusiasts: Indonesia's expanding middle-class population, with an increasing interest in healthier lifestyles and outdoor activities, is driving the growth of the outdoor equipment market. Around 40 million Indonesians are expected to join the middle class by 2025, creating a solid customer base for outdoor gear.

Market Challenges

- Limited Domestic Manufacturing Capacity: The majority of outdoor equipment in Indonesia is imported, resulting in high costs and limited availability. The weak domestic manufacturing capacity forces retailers to rely heavily on imports, making it difficult to meet the growing demand in 2024. This leads to supply chain issues, which also result in fluctuating prices of outdoor gear and challenges in maintaining stock levels in rural and urban markets.

- High Competition from International Brands: International outdoor equipment brands dominate the Indonesian market due to their established reputation and variety of product offerings. By 2024, brands like The North Face, Columbia, and others are expected to continue holding a large share of the market, leaving little room for local brands to compete.

Indonesia Outdoor Equipment Market Future Outlook

Over the next five years, the Indonesia outdoor equipment industry is expected to witness growth, driven by rising consumer interest in adventure sports, government support for eco-tourism, and the increasing trend toward sustainable products.

Future Market Opportunities

- Increased Demand for Sustainable Outdoor Gear: In the next five years, the demand for sustainable and eco-friendly outdoor equipment is expected to rise. With the government's increasing focus on environmental protection and sustainability, companies will need to produce eco-conscious products to meet market regulations. By 2029, it is projected that 60% of outdoor gear sold in Indonesia will be made from biodegradable or recycled materials.

- Growth of Smart Outdoor Equipment: By 2029, outdoor equipment integrated with technology, such as GPS-enabled backpacks, smart tents with temperature regulation, and solar-powered cooking equipment, will gain popularity. The increased emphasis on safety during outdoor activities will drive demand for such technologically advanced gear, which can improve user experience and ensure safety in remote locations.

Scope of the Report

|

By Product Type |

Camping Equipment Hiking Gear Fishing Equipment Hunting Gear Others |

|

By Activity Type |

Camping Fishing Trekking Mountaineering Extreme Sports |

|

By Distribution Channel |

Online Offline (Specialty Stores, Supermarkets, Hypermarkets) |

|

By Region |

North East West South |

|

By End-User |

Individual Consumers Institutional Buyers Government Organizations |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Outdoor equipment manufacturers

Banks and Financial Institution

Adventure tourism operators

Government bodies (Ministry of Tourism, Ministry of Environment)

Investors and venture capital firms

Private Equity Firms

Sports Equipment Manufacturers

Companies

Players Mentioned in the Report:

Decathlon

Eiger Adventure

North Face

Patagonia

Columbia Sportswear

Jack Wolfskin

Adidas Outdoor

Black Diamond Equipment

Sea to Summit

Osprey Packs

Table of Contents

Indonesia Outdoor Equipment Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

Indonesia Outdoor Equipment Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

Indonesia Outdoor Equipment Market Analysis

3.1. Growth Drivers (Consumer Demand, Environmental Impact, Fitness Trends, Sports Activities)

3.2. Market Challenges (Logistics Costs, Regulatory Compliance, Product Durability, Import Tariffs)

3.3. Opportunities (Rural Expansion, Eco-Friendly Equipment, E-Commerce Penetration, Adventure Tourism)

3.4. Trends (Sustainability, Customization, Multi-purpose Equipment, Smart Technologies Integration)

3.5. Government Regulation (Custom Duties, Environmental Regulations, Safety Standards, Product Certification)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

Indonesia Outdoor Equipment Market Segmentation

4.1. By Product Type (In Value %)

Camping Equipment

Hiking Gear

Fishing Equipment

Hunting Gear

Others

4.2. By Activity Type (In Value %)

Camping

Fishing

Trekking

Mountaineering

Extreme Sports

4.3. By Distribution Channel (In Value %)

Online

Offline (Specialty Stores, Supermarkets, Hypermarkets)

4.4. By Region (In Value %)

North

East

West

South

4.5. By End-User (In Value %)

Individual Consumers

Institutional Buyers (Tourist Agencies, Event Organizers)

Government Organizations (Environmental, Sports)

Indonesia Outdoor Equipment Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Decathlon

5.1.2. Columbia Sportswear

5.1.3. North Face

5.1.4. Patagonia

5.1.5. Coleman

5.1.6. Eiger Adventure

5.1.7. Adidas Outdoor

5.1.8. Nike ACG

5.1.9. Black Diamond Equipment

5.1.10. Osprey Packs

5.1.11. Jack Wolfskin

5.1.12. Outdoor Research

5.1.13. Sea to Summit

5.1.14. Lafuma

5.1.15. REI Co-op

5.2. Cross Comparison Parameters (Revenue, Product Portfolio, Distribution Reach, Sustainability Initiatives, Technical Features, Innovation Pipeline, Local Manufacturing, Market Penetration)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Government Grants

5.8. Venture Capital Funding

Indonesia Outdoor Equipment Market Regulatory Framework

6.1. Environmental Standards

6.2. Certification Requirements

6.3. Compliance Regulations

6.4. Import/Export Regulations

Indonesia Outdoor Equipment Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

Indonesia Outdoor Equipment Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Activity Type (In Value %)

8.3. By Distribution Channel (In Value %)

8.4. By Region (In Value %)

8.5. By End-User (In Value %)

Indonesia Outdoor Equipment Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. White Space Opportunity Analysis

9.4. Marketing Initiatives

Research Methodology

Step 1: Identification of Key Variables

This step involves mapping the outdoor equipment ecosystem in Indonesia, identifying major stakeholders and market drivers. It draws from secondary research and proprietary databases to gather industry-level insights, focusing on factors like product demand, consumer behavior, and regulatory trends.

Step 2: Market Analysis and Construction

We gathered and analyzed historical data on the markets performance, focusing on growth drivers, consumption trends, and key regions. This phase helped estimate the markets value and pinpoint the dominant segments.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses were tested and validated through interviews with industry experts and stakeholders. Their feedback contributed to refining our data and ensuring accuracy in terms of operational insights.

Step 4: Research Synthesis and Final Output

Finally, direct interactions with manufacturers and retailers were conducted to acquire detailed insights into product offerings, sales performance, and consumer preferences, ensuring a robust, accurate analysis.

Frequently Asked Questions

01. How big is the Indonesia Outdoor Equipment Market?

The Indonesia outdoor equipment market was valued at USD 337 million, driven by increasing interest in adventure tourism and eco-friendly recreation.

02. What are the challenges in the Indonesia Outdoor Equipment Market?

Challenges in the Indonesia outdoor equipment market include regulatory barriers, logistics costs, and competition from global brands. Additionally, fluctuations in tourism numbers due to external factors like pandemics can impact demand.

03. Who are the major players in the Indonesia Outdoor Equipment Market?

Key players in the Indonesia outdoor equipment market include Decathlon, Eiger Adventure, North Face, Patagonia, and Columbia Sportswear, each leveraging unique strategies to capture market share.

04. What are the growth drivers of the Indonesia Outdoor Equipment Market?

Key drivers in the Indonesia outdoor equipment market include rising disposable incomes, expanding middle-class consumers, the growth of domestic adventure tourism, and government support for eco-tourism initiatives.

05. What is the forecast for the Indonesia Outdoor Equipment Market?

The Indonesia outdoor equipment market is expected to grow steadily over the next five years, bolstered by increasing demand for high-quality, durable outdoor gear and expanding retail channels in both urban and rural areas.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.