Indonesia Palm Oil Market Outlook to 2030

Region:Asia

Author(s):Meenakshi Bisht

Product Code:KROD7770

November 2024

82

About the Report

Indonesia Palm Oil Market Overview

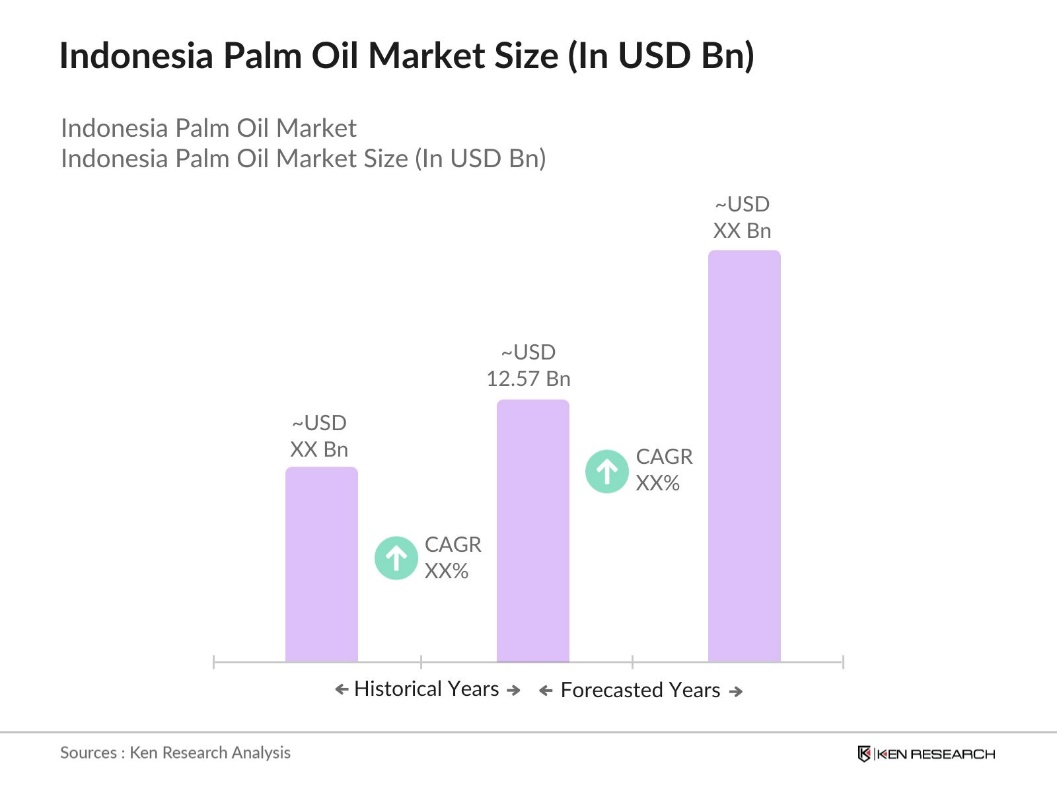

- The Indonesia palm oil market is valued at USD 12.57 billion, reflecting its pivotal role in both domestic and international markets. This substantial valuation is driven by the country's vast cultivation areas, favorable climatic conditions, and advancements in processing technologies, which collectively enhance production efficiency and output.

- Indonesia stands as the world's leading producer and exporter of palm oil, with Sumatra and Kalimantan being the dominant regions for cultivation. These areas offer optimal conditions for oil palm growth, including suitable rainfall patterns and soil types, contributing to high yield rates. The strategic focus on these regions has solidified Indonesia's dominance in the global palm oil market.

- The ISPO certification is a regulatory initiative by the Indonesian government aimed at promoting sustainable practices within the palm oil industry. As of July 2023, the Indonesian Sustainable Palm Oil (ISPO) certification covers approximately 5.45 million hectares, which represents over 37% of Indonesia's total palm oil plantation area. ISPO compliance is mandatory for both large-scale producers and smallholders, reinforcing sustainable standards across the industry.

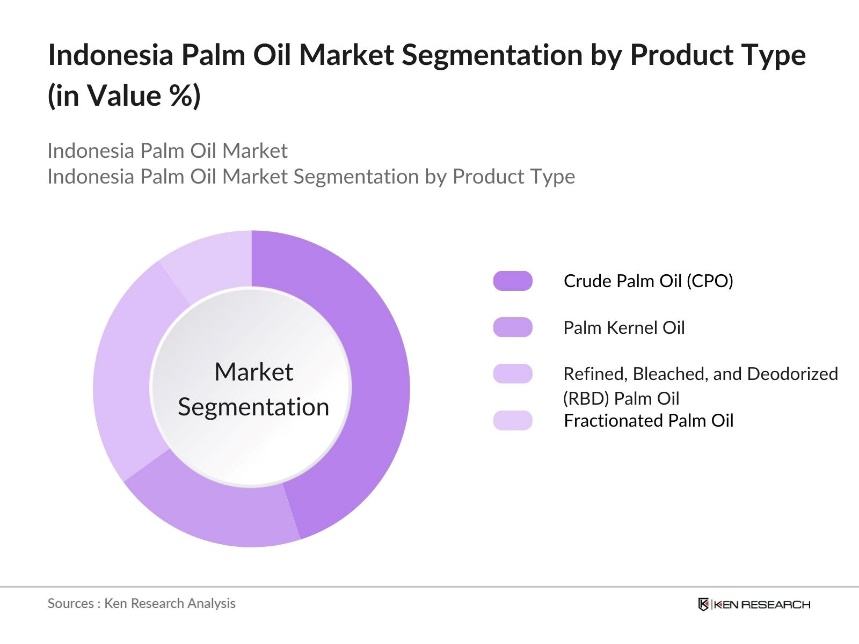

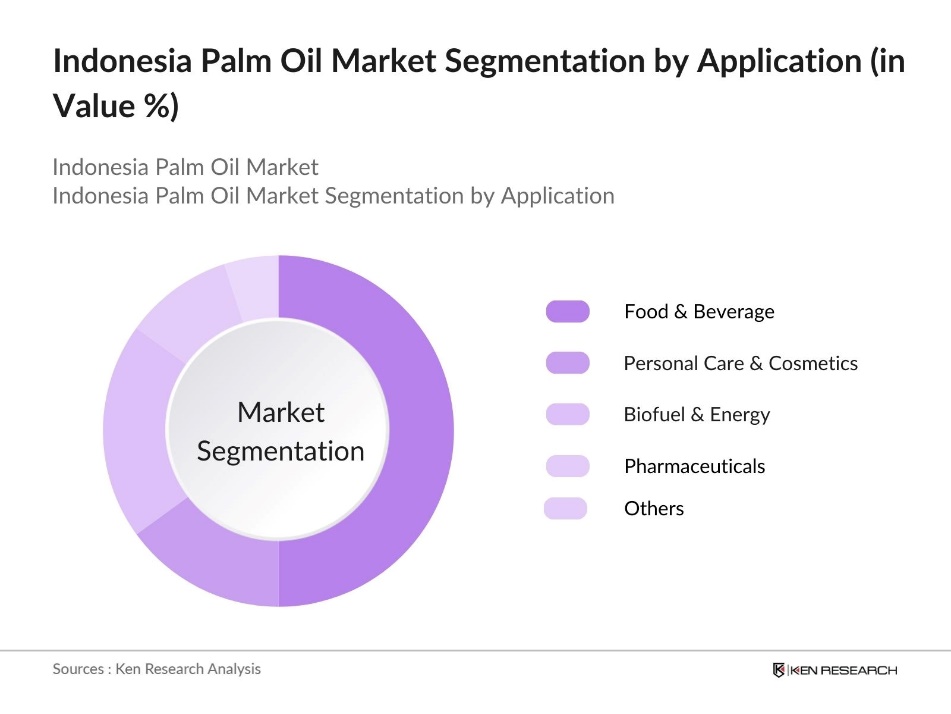

Indonesia Palm Oil Market Segmentation

By Product Type: The market is segmented by product type into Crude Palm Oil (CPO), Palm Kernel Oil, Refined, Bleached, and Deodorized (RBD) Palm Oil, and Fractionated Palm Oil. Among these, Crude Palm Oil holds a dominant market share due to its extensive use in the food and beverage industry. Its versatility and cost-effectiveness make it a preferred choice for various applications, including cooking oils and processed foods.

By Application: The market is segmented by application into Food & Beverage, Personal Care & Cosmetics, Biofuel & Energy, Pharmaceuticals, and Others. The Food & Beverage sector dominates this segmentation, driven by the high demand for palm oil in cooking, baking, and as an ingredient in numerous processed foods. Its stability at high temperatures and neutral taste make it ideal for culinary uses.

Indonesia Palm Oil Market Competitive Landscape

The Indonesia palm oil market is characterized by the presence of several key players who contribute significantly to production and export activities. This competitive landscape underscores the market's robustness and the strategic importance of palm oil in Indonesia's economy.

Indonesia Palm Oil Industry Analysis

Growth Drivers

- Rising Global Demand for Edible Oils: Global demand for edible oils, including palm oil, has been on the rise due to population growth and changing dietary patterns. Indonesia, as a major exporter, has benefited from this trend, with palm oil exports contributing significantly to the national economy. In 2023, the country exported substantial volumes of palm oil to markets such as India, China, and the European Union, highlighting its pivotal role in the global edible oil market.

- Expansion of Cultivation Areas: Indonesia is the world's largest producer of palm oil, accounting for over 54% of global exports as of 2023, with production reaching 47 million metric tons of crude palm oil. This growth is driven by the country's commitment to increasing palm oil production to meet both domestic and international demand. The expansion has been particularly notable in regions such as Sumatra and Kalimantan, where vast tracts of land have been converted into oil palm plantations. This increase in cultivation area has positioned Indonesia as a leading global producer of palm oil, contributing substantially to the nation's economy.

- Technological Advancements in Processing: Technological advancements have enhanced the efficiency of palm oil processing in Indonesia. Modern milling techniques and improved extraction methods have increased oil yields and reduced waste. Additionally, the adoption of digital technologies in supply chain management has streamlined operations, ensuring better traceability and quality control. These innovations have strengthened Indonesia's position in the competitive global palm oil market.

Market Challenges

- Environmental Concerns and Deforestation: The expansion of oil palm plantations has raised environmental concerns, particularly regarding deforestation. In recent years, deforestation for oil palm plantations has increased, reversing a decade-long decline in forest loss. This has led to criticism from environmental groups and international stakeholders, urging Indonesia to adopt more sustainable practices to mitigate environmental impact.

- Labor Shortages: The palm oil industry in Indonesia faces labor shortages, impacting productivity. Factors contributing to this include rural-to-urban migration and the physically demanding nature of plantation work. The labor shortage has been exacerbated by the COVID-19 pandemic, which restricted movement and affected labor availability. Addressing this challenge is crucial for maintaining production levels and meeting market demand.

Indonesia Palm Oil Market Future Outlook

Over the next five years, the Indonesia palm oil market is expected to experience significant growth, driven by continuous government support, advancements in processing technologies, and increasing global demand for sustainable and versatile edible oils. The implementation of sustainable practices and certifications, such as the Indonesian Sustainable Palm Oil (ISPO) standards, is anticipated to enhance market credibility and open new avenues in environmentally conscious markets. Additionally, the diversification into biofuels and value-added palm oil products is projected to further stimulate market expansion.

Market Opportunities

- Sustainable Certification Programs: Indonesias Indonesian Sustainable Palm Oil (ISPO) certification promotes sustainable practices within the palm oil industry. This initiative aims to align production with international environmental standards, boosting the market appeal of Indonesian palm oil. By implementing ISPO, Indonesia addresses key environmental concerns, enhancing market access for its palm oil in environmentally conscious regions.

- Diversification into Biofuels: Indonesias biodiesel program targets a 50% palm oil-based blend, reducing fuel import reliance and boosting local demand. This strategic shift aligns with global renewable energy trends, creating significant growth opportunities for the palm oil industry while reducing export dependency and stabilizing the sector amidst international market fluctuations.

Scope of the Report

Product Type | - Crude Palm Oil (CPO) |

Application | - Food & Beverage |

Nature | - Organic |

Region | - Sumatra |

Products

Key Target Audience

Food & Beverage Manufacturers

Personal Care & Cosmetics Companies

Biofuel & Energy Companies

Pharmaceutical Companies

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., Indonesian Ministry of Agriculture, Indonesian Palm Oil Association)

Banks and Financial Institutions

Companies

Players Mentioned in the Report

Wilmar International Ltd.

Golden Agri-Resources Ltd.

Musim Mas Group

Astra Agro Lestari Tbk PT

Asian Agri

First Resources Limited

PT Salim Ivomas Pratama Tbk

PT PP London Sumatra Indonesia Tbk

PT Sinar Mas Agro Resources and Technology Tbk

PT Bakrie Sumatera Plantations Tbk

Table of Contents

1. Indonesia Palm Oil Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Indonesia Palm Oil Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Indonesia Palm Oil Market Analysis

3.1. Growth Drivers

3.1.1. Expansion of Cultivation Areas

3.1.2. Government Policies and Incentives

3.1.3. Rising Global Demand for Edible Oils

3.1.4. Technological Advancements in Processing

3.2. Market Challenges

3.2.1. Environmental Concerns and Deforestation

3.2.2. Fluctuating Global Prices

3.2.3. Labor Shortages

3.3. Opportunities

3.3.1. Sustainable Certification Programs

3.3.2. Diversification into Biofuels

3.3.3. Value-Added Palm Oil Products

3.4. Trends

3.4.1. Adoption of Sustainable Practices

3.4.2. Integration of Digital Technologies in Supply Chain

3.4.3. Increased Investment in Research and Development

3.5. Government Regulation

3.5.1. Indonesian Sustainable Palm Oil (ISPO) Standards

3.5.2. Export Tax Policies

3.5.3. Land Use Regulations

3.5.4. Environmental Protection Laws

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. Indonesia Palm Oil Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Crude Palm Oil (CPO)

4.1.2. Palm Kernel Oil

4.1.3. Refined, Bleached, and Deodorized (RBD) Palm Oil

4.1.4. Fractionated Palm Oil

4.2. By Application (In Value %)

4.2.1. Food & Beverage

4.2.2. Personal Care & Cosmetics

4.2.3. Biofuel & Energy

4.2.4. Pharmaceuticals

4.2.5. Others

4.3. By Nature (In Value %)

4.3.1. Organic

4.3.2. Conventional

4.4. By Region (In Value %)

4.4.1. Sumatra

4.4.2. Kalimantan

4.4.3. Sulawesi

4.4.4. Papua

4.4.5. Java

5. Indonesia Palm Oil Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Wilmar International Ltd.

5.1.2. Golden Agri-Resources Ltd.

5.1.3. Musim Mas Group

5.1.4. Astra Agro Lestari Tbk PT

5.1.5. Asian Agri

5.1.6. First Resources Limited

5.1.7. PT Salim Ivomas Pratama Tbk

5.1.8. PT PP London Sumatra Indonesia Tbk

5.1.9. PT Sinar Mas Agro Resources and Technology Tbk

5.1.10. PT Bakrie Sumatera Plantations Tbk

5.1.11. PT Dharma Satya Nusantara Tbk

5.1.12. PT Tunas Baru Lampung Tbk

5.1.13. PT Sawit Sumbermas Sarana Tbk

5.1.14. PT Triputra Agro Persada

5.1.15. PT Kencana Agri Ltd.

5.2. Cross Comparison Parameters (Production Capacity, Market Share, Revenue, Sustainability Certifications, Geographic Presence, Product Portfolio, R&D Investment, Strategic Initiatives)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Indonesia Palm Oil Market Regulatory Framework

6.1. Environmental Standards

6.2. Compliance Requirements

6.3. Certification Processes

7. Indonesia Palm Oil Market Future Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Indonesia Palm Oil Market Future Segmentation

8.1. By Product Type (In Value %)

8.2. By Application (In Value %)

8.3. By Nature (In Value %)

8.4. By Region (In Value %)

9. Indonesia Palm Oil Market Analysts Recommendations

9.1. Total Addressable Market (TAM), Serviceable Available Market (SAM), Serviceable Obtainable Market (SOM) Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

DisclaimerContact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Indonesia Palm Oil Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the Indonesia Palm Oil Market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics is conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations provide valuable operational and financial insights directly from industry practitioners, which are instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple palm oil producers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction serves to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the Indonesia Palm Oil Market.

Frequently Asked Questions

01 How big is the Indonesia Palm Oil Market?

The Indonesia Palm Oil Market was valued at USD 12.57 billion, driven by favorable climatic conditions, vast cultivation areas, and advancements in processing technologies, which collectively enhance production efficiency and output.

02 What are the key drivers of the Indonesia Palm Oil Market?

The key drivers of the Indonesia Palm Oil Market include rising global demand for edible oils, government support through incentives and policies, and technological advancements in palm oil processing.

03 Which regions dominate the Indonesia Palm Oil Market?

The regions of Sumatra and Kalimantan dominate the Indonesia Palm Oil Market due to their favorable climatic conditions, suitable rainfall patterns, and optimal soil types for oil palm cultivation. These regions provide the ideal environment for palm oil production, contributing to high yield rates and making Indonesia a global leader in the industry.

04 What challenges are faced by the Indonesia Palm Oil Market?

The Indonesia Palm Oil Market faces challenges including environmental concerns related to deforestation, fluctuating global prices, and labor shortages. Additionally, compliance with international sustainability standards requires significant investment in sustainable practices, which can pose a financial burden for smaller producers.

Palm Oil Market

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.