Indonesia Pet Care Market Outlook to 2030

Region:Asia

Author(s):Abhinav kumar

Product Code:KROD4456

December 2024

97

About the Report

Indonesia Pet Care Market Overview

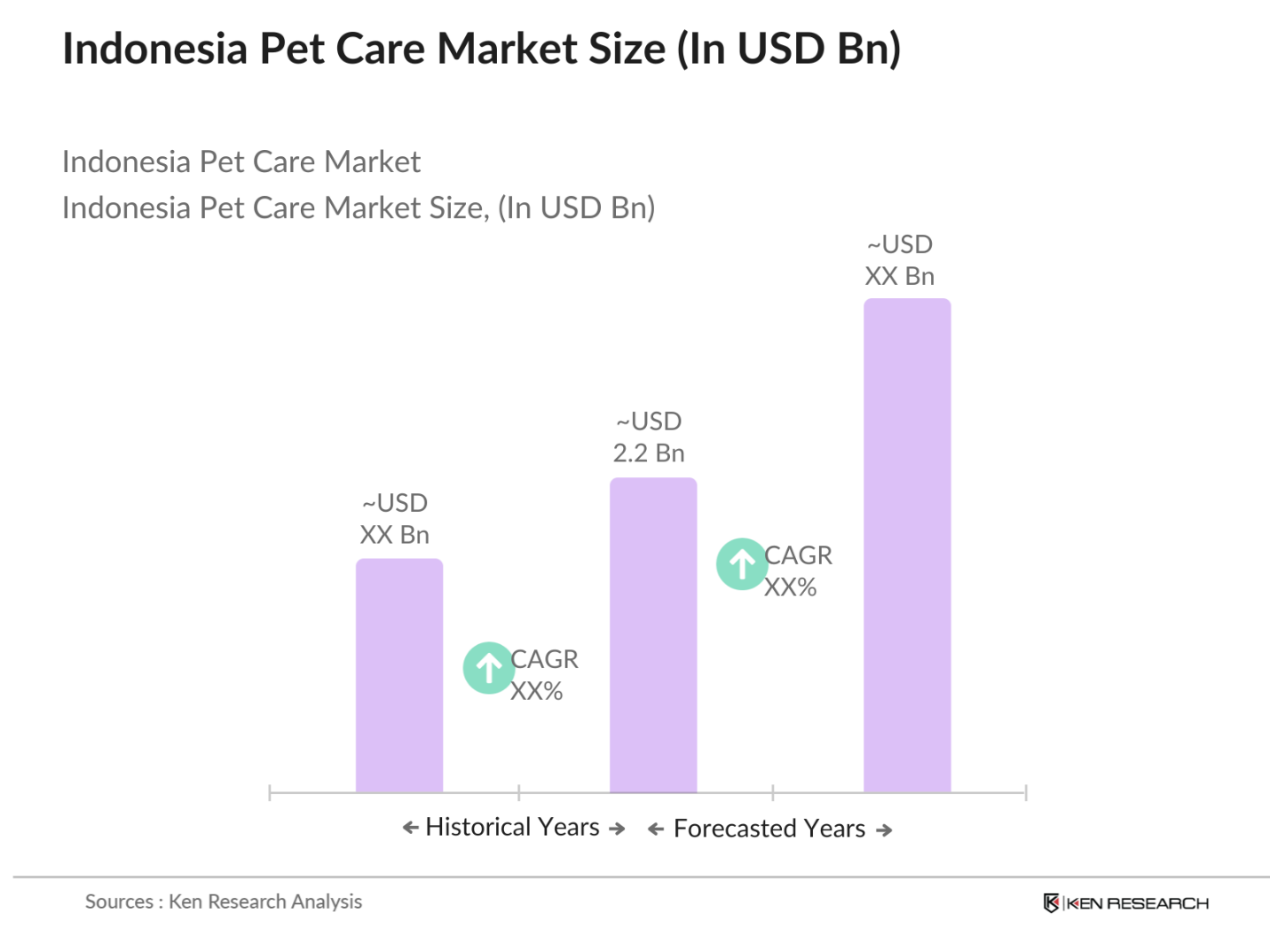

- The Indonesia pet care market is currently valued at USD 2.2 billion, driven by increasing urbanization, rising disposable incomes, and a growing trend of pet humanization among middle- and upper-class households. The demand for high-quality pet food and healthcare products has surged, reflecting changes in pet owners awareness about proper nutrition and preventive care. The market's growth has been consistent over the past five years, with consumer spending on pet care products rising steadily.

- Java and Sumatra are the dominant regions in Indonesia's pet care market due to their large urban populations and higher pet ownership rates. Java, in particular, leads the market because of its dense population and significant economic activity, which has led to the growth of premium pet care products and services. The economic development in these regions has enabled higher spending power, allowing consumers to invest more in their pets health and well-being.

- Indonesia's veterinary drug policies have tightened in recent years, with the Ministry of Agriculture introducing stricter controls on the approval and distribution of veterinary medicines. In 2024, new regulations were implemented to ensure the safety and efficacy of veterinary drugs, leading to longer approval times and increased oversight of pharmaceutical companies. These changes aim to align Indonesia with international standards for veterinary drug safety and improve overall animal health outcomes .

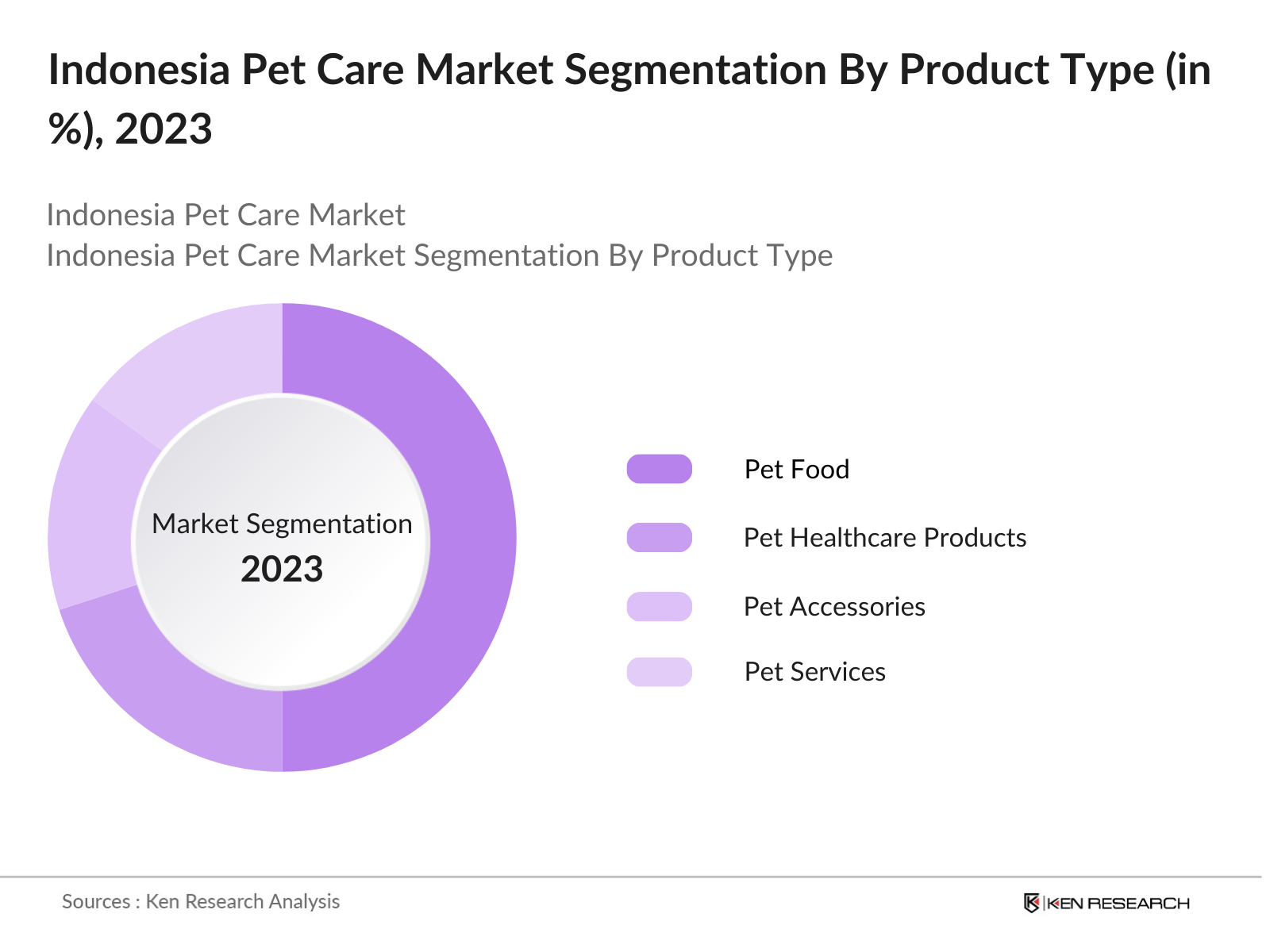

Indonesia Pet Care Market Segmentation

By Product Type: The Indonesia pet care market is segmented by product type into pet food, pet healthcare products, pet accessories, and pet services. Pet food holds the dominant market share under this segmentation due to the essential nature of feeding pets, with a shift towards premium and specialized diets for different pet needs. The growing demand for organic and grain-free pet foods, combined with increasing awareness of pet nutrition, has driven the dominance of this sub-segment. Brands such as Royal Canin and Pedigree cater to these needs with extensive product offerings.

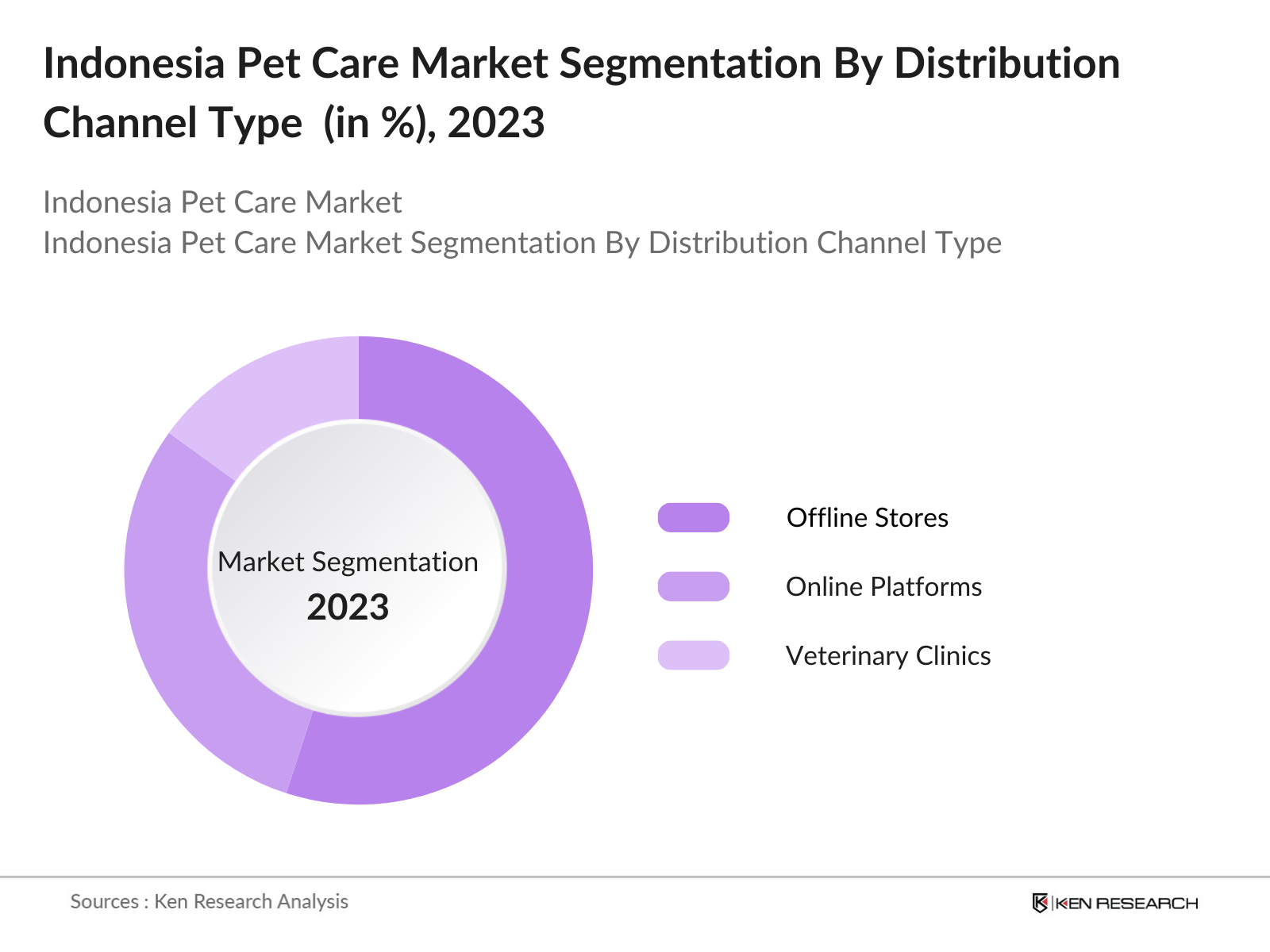

By Distribution Channel: The market is segmented by distribution channels into offline stores, online platforms, and veterinary clinics. Offline stores, including supermarkets and specialty pet shops, dominate the market because of their widespread presence and consumer preference for physically checking pet products before purchasing. However, online platforms are rapidly gaining traction, driven by the convenience of home delivery, availability of a wide range of products, and discounts. Major online retailers like Tokopedia and Shopee offer a variety of pet products, making online shopping a growing trend in urban areas.

Indonesia Pet Care Market Competitive Landscape

The Indonesia pet care market is dominated by both local and global players, with a mix of pet food manufacturers, healthcare providers, and retailers. The competitive landscape reflects the growing interest of multinational corporations in this sector, alongside domestic brands that cater to the local market. This consolidation is a result of the increasing pet population and rising disposable income, which have attracted companies aiming to capture the growing demand for premium pet care products.

Indonesia Pet Care Industry Analysis

Growth Drivers

- Rise in Pet Ownership: Indonesia's pet population has been steadily increasing, particularly in urban areas. In 2024, the country had over 35 million registered pet owners, a significant increase from previous years. This growth is driven by the expanding middle class and the increasing adoption of pets as companions in both urban and suburban households. The World Bank data indicates that Indonesias urban population reached 158 million in 2024, creating a favorable environment for pet ownership growth, especially among the middle-class demographic.

- Increasing Disposable Income: The rise in disposable income among Indonesian households has significantly contributed to the growth of the pet care industry. In 2024, Indonesias per capita income increased to $4,580, allowing more households to spend on premium pet care products and services. This increase in disposable income has particularly benefited urban households, where expenditure on pet care has grown as part of overall household spending. IMF reports show a consistent rise in household income across urban regions, aligning with the increase in pet-related spending .

- Expanding Middle-Class Demographic: The middle-class population in Indonesia continues to expand, with an estimated 90 million individuals classified as middle class in 2024. This demographic plays a crucial role in driving pet ownership and demand for high-quality pet care products. The World Bank indicates that Indonesias middle-class household expenditure on discretionary items, including pet care, increased by 20% between 2022 and 2024. The expansion of the middle class has directly impacted the demand for specialized pet services, including veterinary care and grooming .

Market Challenges

- Limited Availability of Specialized Pet Products: Indonesias pet care market faces challenges related to the distribution of specialized pet products, particularly in remote areas. In 2024, more than 40% of the countrys regions reported limited access to premium pet food and specialized products, primarily due to logistical constraints. Government efforts to improve infrastructure have yet to fully address these challenges, with the Ministry of Transportation reporting that many rural areas still lack access to the efficient supply chain networks necessary for nationwide distribution.

- High Costs of Premium Pet Food: Premium pet food remains costly in Indonesia, especially for middle- and lower-income households. In 2024, premium pet food products were priced between 20-30% higher than regular pet food, making it less accessible to a large segment of the population. This price gap has been a key challenge in the market, limiting the adoption of premium products. Data from Indonesias Ministry of Trade indicates that the price inflation for premium pet products has outpaced average inflation rates in the general food sector.

Indonesia Pet Care Market Future Outlook

Over the next five years, the Indonesia pet care market is expected to continue growing, driven by increasing pet ownership, especially in urban areas, and the rising trend of premiumization in pet food and healthcare. The introduction of innovative products, such as organic pet food and pet health supplements, will cater to the growing demand for healthier, premium products. Additionally, e-commerce platforms will play a crucial role in the future growth of the market, as more consumers shift to online shopping for their pet care needs. With increasing government attention on pet welfare and veterinary health standards, regulatory frameworks are expected to evolve, ensuring higher product quality and safety for pets. This will likely spur investments from multinational corporations aiming to expand their presence in Indonesia.

Opportunities

- E-Commerce Expansion: E-commerce has emerged as a significant growth avenue for the pet care market in Indonesia. In 2024, over 25% of pet care products were purchased through online platforms, driven by increased internet penetration and the convenience of home delivery. Indonesias e-commerce market, valued at $130 billion in 2024 according to the Ministry of Communication and Informatics, has facilitated the rapid growth of online pet care retail. The shift towards digital channels has opened opportunities for both domestic and international players in the market.

- Growth in Pet Insurance: Pet insurance is a growing segment in Indonesia, with more urban pet owners recognizing its importance for managing veterinary costs. In 2024, the number of insured pets surpassed 1 million, up from 600,000 in 2022. The rise in disposable income and pet health awareness are key drivers of this growth. Indonesias Financial Services Authority has reported an increase in pet insurance policy issuances, reflecting the growing demand for comprehensive pet healthcare coverage.

Scope of the Report

|

Product Type |

Pet Food Pet Healthcare Products Pet Accessories Pet Services |

|

Animal Type |

Dogs Cats Fish Birds Small Mammals |

|

Distribution Channel |

Offline Stores Online Platforms Veterinary Clinics |

|

Price Range |

Premium Products Mid-Range Products Mass Market Products |

|

Region |

Java Sumatra Kalimantan Sulawesi Bali & Nusa Tenggara |

Products

Key Target Audience

Pet Food companies

Pet Healthcare Industries

Veterinary Clinic and Hospital Industry

Government and Regulatory Bodies (Indonesia Food and Drug Authority)

Investor and Venture Capitalist Firms

Pet Grooming and Boarding Services Companies

E-commerce Platform Companies

Companies

Major Players

Mars, Inc.

Nestl Purina PetCare

Royal Canin Indonesia

Pedigree Indonesia

PT Mitra Perkasa Petindo

Hills Pet Nutrition

Bayer Animal Health

Zoetis Indonesia

DoggyMan Indonesia

Farmina Pet Foods

Procter & Gamble Pet Care

Whiskas Indonesia

IAMS Pet Food Indonesia

Bogo Pet Food

Arden Grange Indonesia

Table of Contents

1. Indonesia Pet Care Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Indonesia Pet Care Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Indonesia Pet Care Market Analysis

3.1. Growth Drivers

3.1.1. Rise in Pet Ownership (Pet Population Growth)

3.1.2. Increasing Disposable Income (Urban Household Spending)

3.1.3. Expanding Middle-Class Demographic (Middle-Class Penetration)

3.1.4. Growth in Pet Health Awareness (Preventive Veterinary Care)

3.2. Market Challenges

3.2.1. Limited Availability of Specialized Pet Products (Distribution Challenges)

3.2.2. High Costs of Premium Pet Food (Premiumization Costs)

3.2.3. Regulatory Barriers in Pet Pharmaceuticals (Veterinary Regulation)

3.3. Opportunities

3.3.1. E-Commerce Expansion (Online Retail Growth)

3.3.2. Growth in Pet Insurance (Insurance Penetration)

3.3.3. Demand for Organic and Natural Products (Health-Conscious Pet Owners)

3.4. Trends

3.4.1. Humanization of Pets (Pet Parenting)

3.4.2. Technological Advancements in Pet Care (Pet Wearables, GPS Trackers)

3.4.3. Rise in Pet Grooming Services (Grooming Market Expansion)

3.5. Government Regulations

3.5.1. Veterinary Drug Control (Government Veterinary Policies)

3.5.2. Import Restrictions on Pet Food (Import/Export Laws)

3.5.3. Pet Welfare Standards (Animal Welfare Act Compliance)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. Indonesia Pet Care Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Pet Food

4.1.2. Pet Healthcare Products

4.1.3. Pet Accessories

4.1.4. Pet Services

4.2. By Animal Type (In Value %)

4.2.1. Dogs

4.2.2. Cats

4.2.3. Fish

4.2.4. Birds

4.2.5. Small Mammals

4.3. By Distribution Channel (In Value %)

4.3.1. Offline Stores

4.3.2. Online Platforms

4.3.3. Veterinary Clinics

4.4. By Price Range (In Value %)

4.4.1. Premium Products

4.4.2. Mid-Range Products

4.4.3. Mass Market Products

4.5. By Region (In Value %)

4.5.1. Java

4.5.2. Sumatra

4.5.3. Kalimantan

4.5.4. Sulawesi

4.5.5. Bali & Nusa Tenggara

5. Indonesia Pet Care Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Mars, Inc.

5.1.2. Nestl Purina PetCare

5.1.3. PT Royal Canin Indonesia

5.1.4. Hills Pet Nutrition

5.1.5. Pedigree Indonesia

5.1.6. Procter & Gamble Pet Care

5.1.7. IAMS Pet Food Indonesia

5.1.8. Whiskas Indonesia

5.1.9. PT Mitra Perkasa Petindo

5.1.10. Bogo Pet Food

5.1.11. DoggyMan Indonesia

5.1.12. Arden Grange Indonesia

5.1.13. Farmina Pet Foods

5.1.14. Zoetis Indonesia

5.1.15. Bayer Animal Health

5.2. Cross Comparison Parameters

5.2.1. Revenue

5.2.2. Number of Employees

5.2.3. Geographical Presence

5.2.4. Product Portfolio Diversity

5.2.5. Market Share

5.2.6. Innovation/Technology Integration

5.2.7. Partnerships & Alliances

5.2.8. Sustainability Initiatives

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Indonesia Pet Care Market Regulatory Framework

6.1. Pet Food Standards and Certifications

6.2. Animal Welfare and Care Guidelines

6.3. Veterinary and Pet Pharmaceuticals Regulations

7. Indonesia Pet Care Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Indonesia Pet Care Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Animal Type (In Value %)

8.3. By Distribution Channel (In Value %)

8.4. By Price Range (In Value %)

8.5. By Region (In Value %)

9. Indonesia Pet Care Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involved identifying the main stakeholders and variables that influence the Indonesia pet care market, including manufacturers, distributors, and pet owners. We conducted extensive secondary research using government publications and proprietary databases to define these critical market drivers.

Step 2: Market Analysis and Construction

Historical market data for the Indonesia pet care industry were collected, covering aspects like pet food consumption trends and veterinary service growth. The revenue figures and market segmentation were analyzed to create an accurate snapshot of the current market landscape.

Step 3: Hypothesis Validation and Expert Consultation

We consulted industry experts and conducted interviews with representatives from key companies in the pet care sector to validate market hypotheses and trends. Their insights helped refine our revenue forecasts and validate market penetration data.

Step 4: Research Synthesis and Final Output

In the final step, data from primary and secondary sources were synthesized to create a cohesive analysis. Interviews with pet care manufacturers and distributors provided valuable insights, ensuring the accuracy of our final report.

Frequently Asked Questions

01. How big is the Indonesia Pet Care Market?

The Indonesia pet care market is valued at USD 2.2 billion, driven by increased pet ownership, rising disposable incomes, and a growing trend of premiumization in pet care products.

02. What are the challenges in the Indonesia Pet Care Market?

Key challenges include regulatory hurdles for pet food and healthcare products, limited availability of premium products in rural areas, and high costs associated with importing specialty pet foods.

03. Who are the major players in the Indonesia Pet Care Market?

Major players include Mars, Inc., Nestl Purina PetCare, Royal Canin Indonesia, and PT Mitra Perkasa Petindo, all of which have established a strong presence due to their wide product range and distribution networks.

04. What are the growth drivers of the Indonesia Pet Care Market?

Growth drivers include increasing disposable incomes, urbanization, and rising awareness of pet health and nutrition. The growing e-commerce sector also contributes to the markets expansion.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.