Indonesia Plant-Based Food and Beverage Market Outlook to 2030

Region:Asia

Author(s):Abhinav kumar

Product Code:KROD7815

December 2024

94

About the Report

Indonesia Plant-Based Food and Beverage Market Overview

- The Indonesia plant-based food and beverage market is valued at USD 940 billion based on a five-year historical analysis. This market is primarily driven by increasing health awareness among Indonesian consumers, who are gradually shifting from animal-based products to plant-based alternatives. Factors such as lactose intolerance, demand for vegan-friendly options, and rising environmental concerns are also influencing this transition. Furthermore, manufacturers are actively promoting plant-based products with clean labels, which is fueling the markets growth.

- Dominant regions in Indonesia include Jakarta and Bali, where the plant-based food movement is gaining significant traction. Jakarta, as the capital city, hosts a growing middle class with higher disposable incomes, while Balis focus on eco-friendly lifestyles and tourism has accelerated the adoption of plant-based alternatives. These regions dominate the market because of their more progressive consumer base and the presence of retailers and restaurants catering to plant-based diets.

- Indonesias Food and Drug Monitoring Agency (BPOM) has implemented stringent food safety standards for plant-based products. In 2023, new regulations were introduced that require manufacturers to meet specific hygiene and safety guidelines to prevent contamination. The government is now actively enforcing these regulations to ensure that plant-based food products meet the same standards as their animal-based counterparts.

Indonesia Plant-Based Food and Beverage Market Segmentation

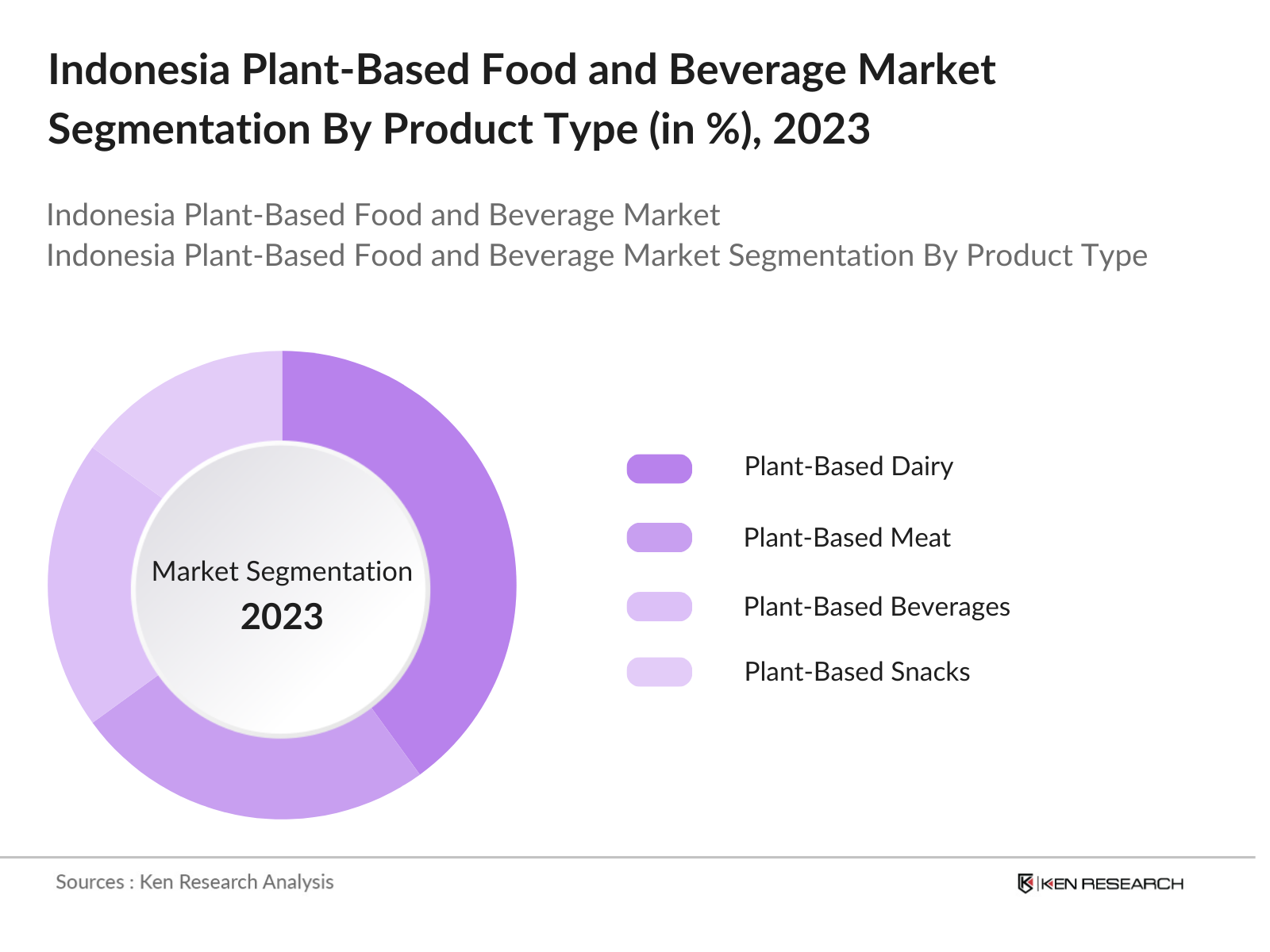

By Product Type: The Indonesia plant-based food and beverage market is segmented by product type into plant-based meat, plant-based dairy, plant-based beverages, and plant-based snacks. Recently, plant-based dairy has shown dominance in the market, driven by consumer demand for milk alternatives such as almond milk and soy milk. This is primarily due to growing health concerns over lactose intolerance and dairy-related allergies. Additionally, major brands are introducing innovative products like flavored plant-based yogurts and cheeses, further boosting this sub-segment.

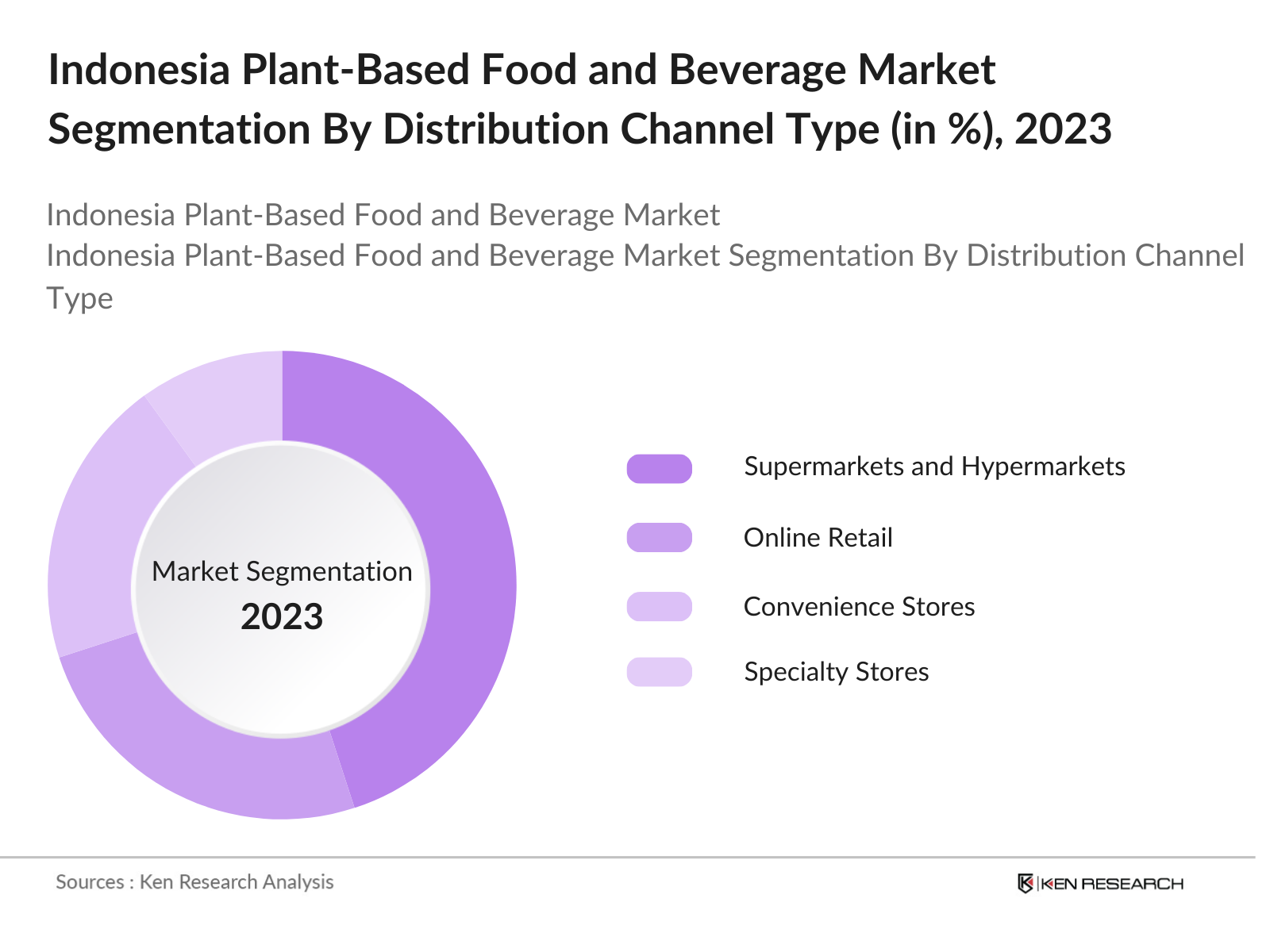

By Distribution Channel: In the Indonesia plant-based food and beverage market, distribution channels are divided into supermarkets and hypermarkets, online retail, convenience stores, and specialty stores. Supermarkets and hypermarkets are leading this segment due to their ability to offer a wide variety of plant-based products and capitalize on the growing trend of health-conscious shoppers. In urban areas, these stores serve as one-stop shopping destinations where consumers can access different categories of plant-based products, making it easier to adopt a plant-based lifestyle.

Indonesia Plant-Based Food and Beverage Market Competitive Landscape

The Indonesia plant-based food and beverage market is dominated by several key players, ranging from local brands to multinational companies. The presence of both domestic and international companies demonstrates the market's competitive and evolving nature, with businesses focusing on innovation, sustainability, and consumer preferences. Key players have leveraged partnerships, new product launches, and extensive marketing to capture consumer attention. The competitive landscape in Indonesia is shaped by a combination of local companies like Green Rebel Foods and Nutrisari, which have strong regional understanding, and global players such as Oatly and Beyond Meat that bring international expertise. These companies have leveraged product innovation, branding, and distribution strategies to establish themselves as leaders in the market.

|

Company Name |

Establishment Year |

Headquarters |

Key Metrics |

|

Green Rebel Foods |

2019 |

Jakarta, Indonesia |

Product innovation, clean labeling, consumer education |

|

Nutrisari |

1975 |

Jakarta, Indonesia |

Nationwide distribution, focus on affordability |

|

Oatly |

1994 |

Malm, Sweden |

Global presence, dairy alternatives, sustainable packaging |

|

Beyond Meat |

2009 |

El Segundo, USA |

R&D investment, partnerships with restaurants |

|

Javara Indonesia |

2008 |

Jakarta, Indonesia |

Use of indigenous ingredients, eco-friendly practices |

Indonesia Plant-Based Food and Beverage Industry Analysis

Growth Drivers

- Rising Consumer Preference for Plant-Based Alternatives: The shift towards plant-based alternatives in Indonesia is driven by an increasing consumer preference for healthier diets. According to a report from the Indonesian Ministry of Health, over 50 million Indonesians have turned to reducing animal-based products in their diet by 2023 due to rising health concerns like diabetes and heart disease. Additionally, urban populations, particularly in Jakarta and Bali, are leading this trend with a significant number of young consumers opting for plant-based foods due to perceived health benefits.

- Increased Awareness of Health Benefits: Health consciousness among Indonesian consumers is rising steadily, as evidenced by a 25% increase in healthcare expenditure over the past five years, according to the World Bank. This increase correlates with a growing awareness of the health benefits associated with plant-based foods, particularly in combating non-communicable diseases such as hypertension and obesity, which affect 38 million people in Indonesia. This trend is particularly noticeable in metropolitan areas where government health campaigns are actively promoting plant-based diets.

- Growing Vegan and Flexitarian Populations: Indonesia has seen a rise in its vegan and flexitarian populations, particularly among younger generations. Data from the Indonesian Vegan Society shows that there are currently 2 million vegans in Indonesia, with flexitarians accounting for an additional 10 million consumers in 2023. This increase has been bolstered by public campaigns promoting plant-based lifestyles and the availability of vegan products across major supermarket chains.

Market Challenges

- High Cost of Plant-Based Ingredients: The cost of plant-based ingredients in Indonesia remains a significant challenge. According to data from the Indonesian Ministry of Agriculture, the price of imported plant-based proteins, such as soy and pea protein, is 20% higher than locally sourced animal-based proteins. These higher costs, driven by limited domestic production and reliance on imports from countries like the U.S. and Brazil, contribute to the premium pricing of plant-based products in the market.

- Limited Availability of Raw Materials: The limited availability of raw materials for plant-based products is another challenge facing the Indonesian market. Only 15% of the country's total agricultural land is currently used for growing plant-based protein sources, as reported by the Ministry of Agriculture. This has led to dependency on imports to meet the growing demand for plant-based foods, particularly proteins like soybeans and pulses, which are not widely cultivated in Indonesia.

Indonesia Plant-Based Food and Beverage Market Future Outlook

Over the next five years, the Indonesia plant-based food and beverage market is expected to witness significant growth due to evolving consumer preferences, government support for sustainability, and increased availability of plant-based products. With rising awareness about climate change and personal health, consumers are likely to continue adopting plant-based diets, thereby boosting the demand for plant-based meat, dairy, and beverages. Companies are expected to invest more in product innovation and expand distribution networks to reach a wider audience across both urban and rural regions.

Opportunities

- Expansion of Distribution Channels: The expansion of distribution channels presents a significant growth opportunity for plant-based food and beverage producers in Indonesia. Major e-commerce platforms like Tokopedia and Shopee have reported a 40% increase in the sale of plant-based products in 2023. Additionally, large supermarket chains such as Carrefour and Hypermart are expanding their plant-based offerings, increasing accessibility for consumers across urban and rural areas.

- Partnerships with Established F&B Brands: Collaborations between plant-based companies and established food and beverage brands are helping to expand market reach. In 2023, Indonesias largest food conglomerate, Indofood, partnered with a local plant-based protein startup to introduce a new line of vegan noodles. Such partnerships have been critical in bringing plant-based products to mainstream consumers and improving product visibility across Indonesia.

Scope of the Report

|

Product Type |

Plant-Based Meat Plant-Based Dairy Plant-Based Beverages Plant-Based Snacks Others |

|

Source |

Soy-Based Pea Protein-Based Wheat-Based Nut-Based Others |

|

Distribution Channel |

Supermarkets and Hypermarkets Convenience Stores Online Retail Specialty Stores Direct-to-Consumer |

|

End User |

Household Foodservice Institutional |

|

Region |

Java Sumatra Kalimantan Sulawesi Bali and Nusa Tenggara |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Plant-Based Food Manufacturing Companies

Foodservice and Restaurant Industries

Health and Wellness Brand Companies

Online Retail Companies

Government and Regulatory Bodies (e.g., BPOM, Indonesian Ministry of Health)

Investor and Venture Capitalist Firms

Environmental Advocacy Group Industries

Companies

Players Mentioned in the Report

Green Rebel Foods

Nutrisari

Javara Indonesia

Oatly

Beyond Meat

Nestl Indonesia

Upfield

Unilever Indonesia

Sarihusada Generasi Mahardhika

Alpro

Table of Contents

1. Indonesia Plant-Based Food and Beverage Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Indonesia Plant-Based Food and Beverage Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Indonesia Plant-Based Food and Beverage Market Analysis

3.1. Growth Drivers

3.1.1. Rising Consumer Preference for Plant-Based Alternatives

3.1.2. Increased Awareness of Health Benefits

3.1.3. Growing Vegan and Flexitarian Populations

3.1.4. Sustainability and Ethical Consumption Trends

3.2. Market Challenges

3.2.1. High Cost of Plant-Based Ingredients

3.2.2. Limited Availability of Raw Materials

3.2.3. Regulatory Challenges and Compliance

3.3. Opportunities

3.3.1. Expansion of Distribution Channels

3.3.2. Partnerships with Established F&B Brands

3.3.3. Innovation in Plant-Based Meat and Dairy Alternatives

3.4. Trends

3.4.1. Use of Indigenous Indonesian Plant Sources (e.g., tempeh, jackfruit)

3.4.2. Increased Focus on Clean Label Products

3.4.3. Investments in Research and Development for Flavor Enhancements

3.5. Government Regulation

3.5.1. Food Safety Standards for Plant-Based Products

3.5.2. Labeling and Certification Requirements

3.5.3. Support for Sustainable Food Production Initiatives

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competitive Ecosystem

4. Indonesia Plant-Based Food and Beverage Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Plant-Based Meat

4.1.2. Plant-Based Dairy

4.1.3. Plant-Based Beverages

4.1.4. Plant-Based Snacks

4.1.5. Others (e.g., Plant-Based Condiments)

4.2. By Source (In Value %)

4.2.1. Soy-Based

4.2.2. Pea Protein-Based

4.2.3. Wheat-Based

4.2.4. Nut-Based

4.2.5. Others (e.g., Jackfruit, Tempeh)

4.3. By Distribution Channel (In Value %)

4.3.1. Supermarkets and Hypermarkets

4.3.2. Convenience Stores

4.3.3. Online Retail

4.3.4. Specialty Stores

4.3.5. Direct-to-Consumer

4.4. By End User (In Value %)

4.4.1. Household

4.4.2. Foodservice (Restaurants, Cafes)

4.4.3. Institutional

4.5. By Region (In Value %)

4.5.1. Java

4.5.2. Sumatra

4.5.3. Kalimantan

4.5.4. Sulawesi

4.5.5. Bali and Nusa Tenggara

5. Indonesia Plant-Based Food and Beverage Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Green Rebel Foods

5.1.2. Nutrisari

5.1.3. Javara Indonesia

5.1.4. Oatly

5.1.5. Beyond Meat

5.1.6. Nestl Indonesia

5.1.7. Upfield

5.1.8. Unilever Indonesia

5.1.9. Sarihusada Generasi Mahardhika

5.1.10. Alpro

5.1.11. Biofoods

5.1.12. SoyJoy Indonesia

5.1.13. The Kraft Heinz Company

5.1.14. Danone Indonesia

5.1.15. PT Indofood Sukses Makmur Tbk

5.2. Cross Comparison Parameters (Product Portfolio, Revenue, Market Share, Distribution Reach, Innovation Focus, Partnerships, Sustainability Initiatives, Consumer Penetration)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers And Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Indonesia Plant-Based Food and Beverage Market Regulatory Framework

6.1. Food Safety and Labeling Standards

6.2. Import and Export Regulations

6.3. Certification Processes

7. Indonesia Plant-Based Food and Beverage Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Indonesia Plant-Based Food and Beverage Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Source (In Value %)

8.3. By Distribution Channel (In Value %)

8.4. By End User (In Value %)

8.5. By Region (In Value %)

9. Indonesia Plant-Based Food and Beverage Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial stage involves identifying critical factors driving the Indonesia plant-based food and beverage market. Extensive desk research, supported by proprietary databases, was conducted to map key stakeholders and their roles. This phase also involved gathering data from secondary sources, including company financials and government publications.

Step 2: Market Analysis and Construction

This phase focused on analyzing historical market data and segment growth, specifically focusing on product demand and distribution trends. Industry reports and sales data from key players were assessed to ensure accurate revenue forecasts and growth projections.

Step 3: Hypothesis Validation and Expert Consultation

Key market hypotheses were validated through consultations with industry experts, manufacturers, and retail executives. These interviews provided valuable insights into market operations, challenges, and opportunities, complementing the quantitative data collected.

Step 4: Research Synthesis and Final Output

Finally, the gathered data was synthesized into actionable insights and forecasts. This final report includes qualitative analysis from industry experts and hard data collected from reliable sources, ensuring accuracy and reliability in predicting market growth.

Frequently Asked Questions

01. How big is the Indonesia Plant-Based Food and Beverage Market?

The Indonesia plant-based food and beverage market is valued at USD 940 billion, driven by consumer preferences for healthier, sustainable, and ethical food choices, as well as an increase in lactose intolerance cases.

02. What are the challenges in the Indonesia Plant-Based Food and Beverage Market?

Challenges include limited availability of raw materials for production, high costs of plant-based ingredients, and the need for regulatory clarity on food safety standards for new products entering the market.

03. Who are the major players in the Indonesia Plant-Based Food and Beverage Market?

Major players include Green Rebel Foods, Nutrisari, Javara Indonesia, Oatly, and Beyond Meat. These companies dominate due to their innovative products, strong marketing strategies, and extensive distribution networks.

04. What are the growth drivers of the Indonesia Plant-Based Food and Beverage Market?

Key growth drivers include increasing health awareness, growing demand for sustainable food options, and the introduction of plant-based alternatives by established brands to cater to the growing vegan and flexitarian population.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.