Indonesia Plant-Based Meat Market Outlook to 2030

Region:Asia

Author(s):Sanjeev

Product Code:KROD4488

December 2024

95

About the Report

Indonesia Plant-Based Meat Market Overview

- The Indonesia plant-based meat market is valued at USD 500 million, driven by increasing consumer awareness about health and sustainability, as well as strong governmental support for sustainable agricultural practices. A combination of rising disposable income and a growing middle-class population has also accelerated the demand for plant-based food products. The plant-based meat sector is attracting investments from both domestic and international players, further propelling market growth.

- Jakarta and Surabaya are key cities leading the market, driven by their large populations, modern retail infrastructure, and consumer inclination toward healthier lifestyle choices. The widespread presence of supermarkets and hypermarkets, which offer an array of plant-based products, plays a significant role in these cities' dominance. Furthermore, these urban centers are home to a growing number of restaurants and foodservice outlets that have adopted plant-based offerings, aligning with consumer preferences for sustainable dining options.

- Indonesias Food and Drug Authority introduced stricter regulations in 2023 to ensure the safety and proper labeling of plant-based products. All plant-based meat producers are required to disclose ingredient sources and processing methods to guarantee transparency. These regulations have been set to safeguard consumer health while fostering market trust, thereby encouraging plant-based product adoption. The government is also working on harmonizing food labeling standards with international best practices to boost the export potential of Indonesian plant-based products.

Indonesia Plant-Based Meat Market Segmentation

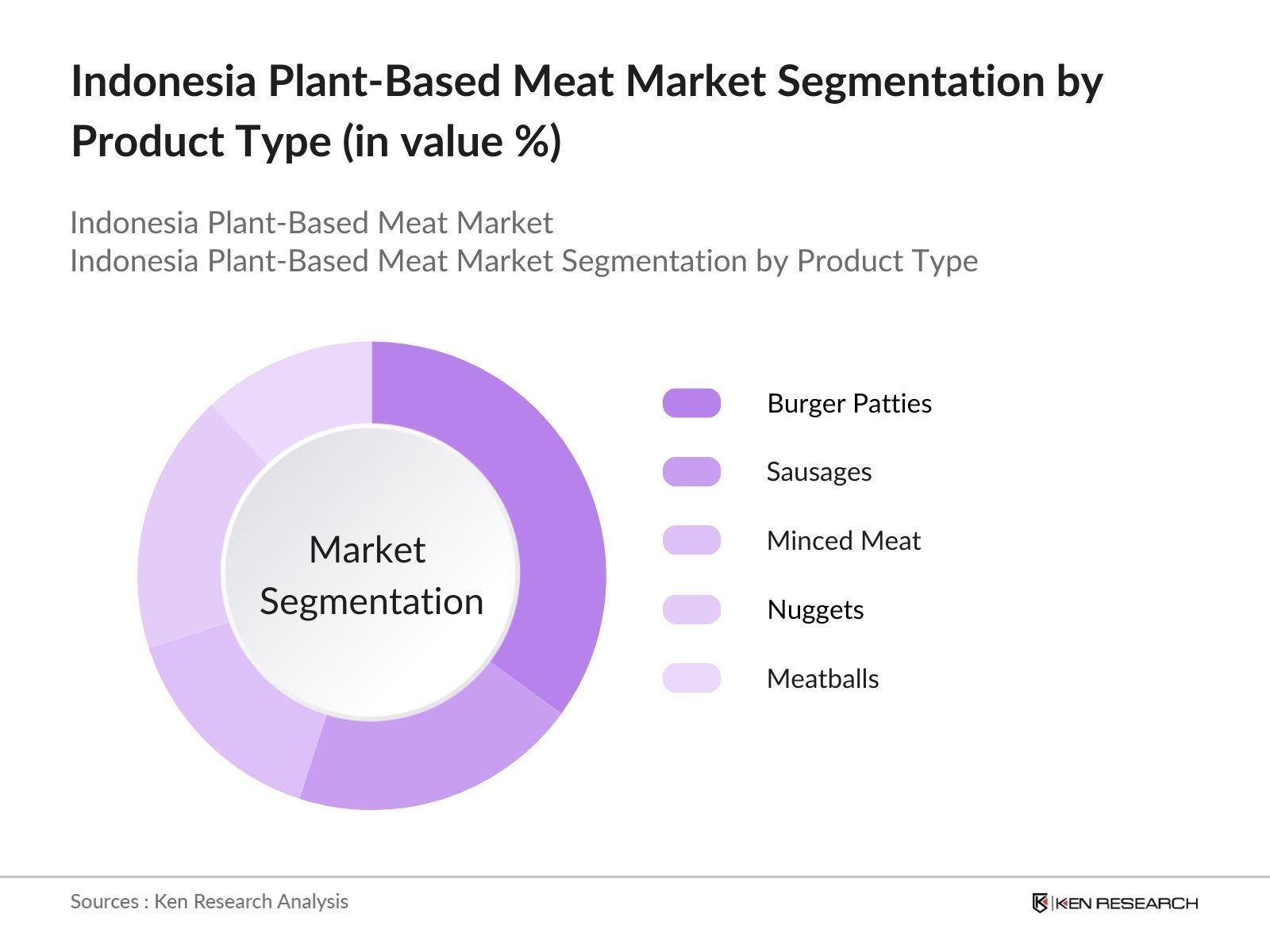

- By Product Type: The meat market is segmented into burger patties, sausages, minced meat, nuggets, and meatballs. Burger patties dominate the product type category due to their familiarity with consumers and the increasing availability of ready-to-cook options in retail stores. Leading fast-food chains in Indonesia, such as Burger King and KFC, have also introduced plant-based burger options, which further boosts demand for this segment. Furthermore, burger patties have benefited from aggressive marketing campaigns by key players, enhancing their appeal to both flexitarians and vegans.

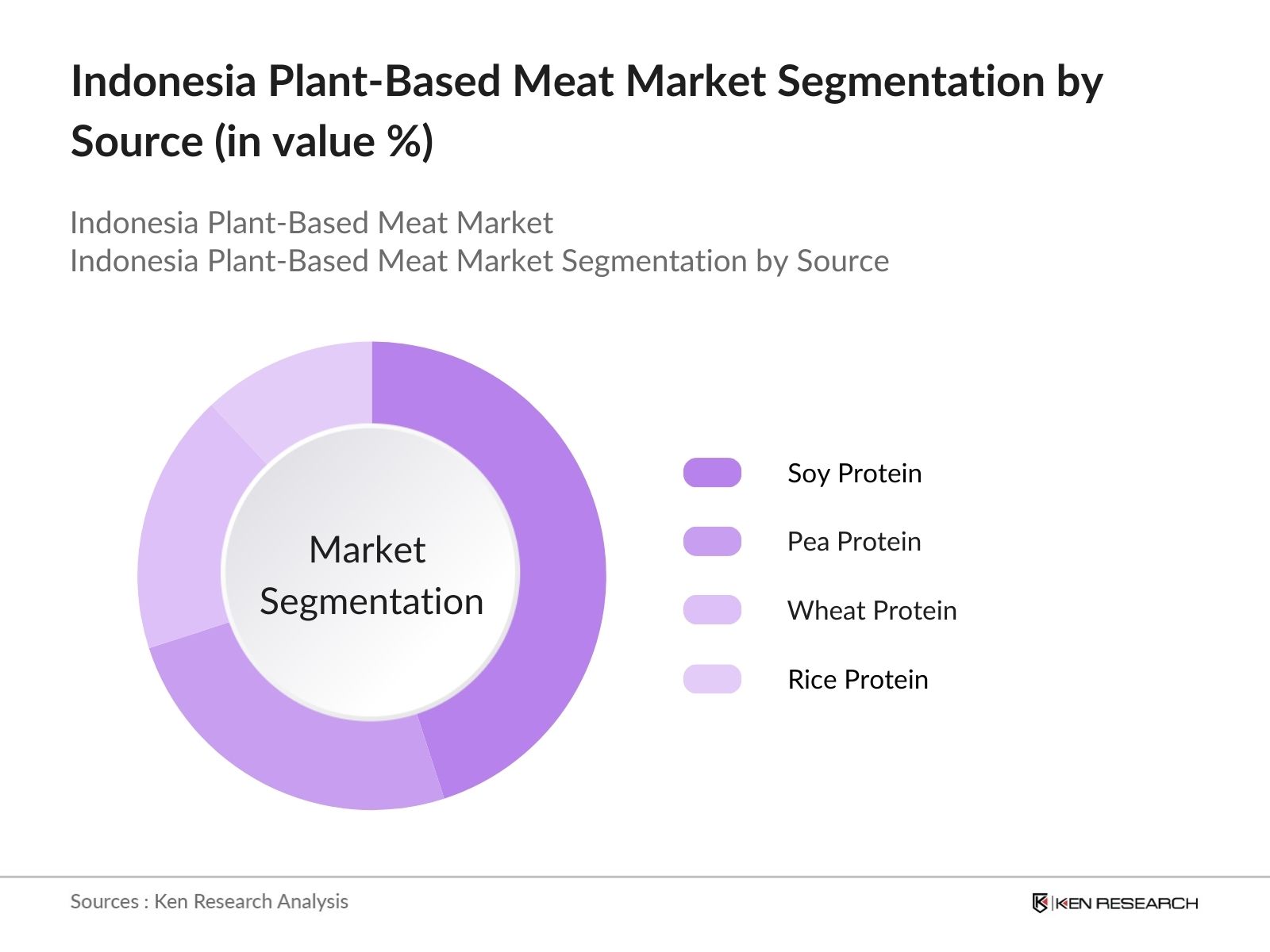

- By Source: The market is segmented by source into soy protein, pea protein, wheat protein, and rice protein. Soy protein currently dominates the market, holding the largest share due to its versatility and nutritional profile, which resonates well with the traditional diets of Indonesian consumers. Soy protein is a well-established ingredient in Indonesia, commonly used in local foods like tofu and tempeh, making the transition to soy-based meat alternatives seamless for consumers. Moreover, soy protein is more affordable than other plant-based protein options, making it accessible to a broader demographic.

Indonesia Plant-Based Meat Market Competitive Landscape

The Indonesian plant-based meat market is competitive, with both international and domestic players striving for market leadership. Key players have leveraged partnerships with local retailers and foodservice chains to boost their market presence. Companies are also heavily investing in product innovation and marketing to cater to the growing demand for plant-based options. The market is marked by intense rivalry as companies strive to introduce new flavors, textures, and product formats that appeal to both flexitarians and vegans.

|

Company |

Established |

Headquarters |

Number of Employees |

Revenue (USD Bn) |

Product Portfolio |

|

Green Rebel Foods |

2020 |

Jakarta, Indonesia |

|||

|

Beyond Meat |

2009 |

El Segundo, USA |

|||

|

Impossible Foods |

2011 |

Redwood City, USA |

|||

|

Harvest Gourmet (Nestle) |

2020 |

Switzerland |

|||

|

OmniMeat |

2018 |

Hong Kong |

Indonesia Plant-Based Meat Industry Analysis

Growth Drivers

- Rising Consumer Demand for Health-Conscious Food Products: Indonesia has seen a shift toward health-conscious consumption due to rising lifestyle diseases like obesity and diabetes. According to the Indonesian Ministry of Health, non-communicable diseases accounted for 73% of total deaths in 2022, pushing consumers to seek healthier alternatives such as plant-based meat. Furthermore, in 2024, the Indonesian Food and Beverage Association reported that demand for plant-based food products has increased by over 30% as more consumers become aware of the benefits of a plant-forward diet. The government's "Healthy Indonesia 2025" initiative also emphasizes plant-based diets to combat health-related issues.

- Increasing Veganism and Flexitarian Diet Trends: Indonesia's rising vegan and flexitarian movements are key drivers for the plant-based meat market. According to a report by the Indonesian Vegan Society, more than 2.5 million Indonesians are either vegan or vegetarian as of 2024, representing a growing base for plant-based products. Flexitarianism is also on the rise, with urban consumers increasingly reducing meat consumption for environmental and health reasons. This shift in dietary habits is largely driven by social media awareness campaigns and celebrity endorsements promoting plant-based lifestyles.

- Government Support for Sustainable Food Production (Subsidies, Regulations, Policies): The Indonesian government has taken significant steps to encourage sustainable food production, including the promotion of plant-based alternatives. In 2024, the Ministry of Agriculture allocated $200 million in subsidies to support research, innovation, and local startups focusing on plant-based food technology. Additionally, the government is actively pushing for plant-based alternatives through its National Sustainable Agriculture Policy, which aims to reduce meat consumption by 10% over the next decade to lower the countrys carbon footprint.

Market Challenges

- High Production Costs: One of the key challenges facing the plant-based meat market in Indonesia is the high cost of production. According to the Indonesian Chamber of Commerce in 2024, plant-based meat production requires more advanced technology and specialized ingredients compared to traditional meat, resulting in higher operational expenses. The lack of locally sourced, high-quality raw materials further escalates costs. This has made plant-based products more expensive, limiting their accessibility to a wider population, especially in price-sensitive regions.

- Consumer Skepticism Toward Taste and Texture: Despite growing health and environmental awareness, many Indonesian consumers remain skeptical about the taste and texture of plant-based meat. According to a survey conducted by the Indonesian Consumer Foundation in 2023, 65% of respondents cited taste as a barrier to adopting plant-based alternatives. Consumers in rural areas, in particular, express reservations about whether plant-based products can match the flavor and satisfaction of traditional meat, presenting a significant hurdle for market growth.

Indonesia Plant-Based Meat Market Future Outlook

Over the next five years, the Indonesia plant-based meat market is expected to witness substantial growth. This growth will be driven by consumer demand for healthier, sustainable food options, government initiatives to promote sustainable agricultural practices, and increased investment in plant-based food innovations. The expansion of plant-based offerings into mainstream retail channels and restaurants will also fuel this growth, as more consumers adopt flexitarian or vegetarian diets. Additionally, advancements in plant protein technology and ongoing marketing campaigns aimed at educating consumers about the benefits of plant-based meat will further accelerate market expansion.

Future Market Opportunities

- Partnerships with Local Retailers and Foodservice Chains: One promising opportunity lies in forming strategic partnerships with local retailers and foodservice chains. In 2024, over 35% of the country's plant-based meat sales were driven by the foodservice sector, particularly in urban centers. Fast-food chains and supermarket partnerships have been instrumental in introducing plant-based products to a wider audience. For instance, collaboration with Indonesian retail giants like Hypermart has expanded consumer access to plant-based meats. Such partnerships are expected to drive greater market penetration moving forward.

- Innovations in Alternative Protein Sources (Fermentation, Cultivated Meat): Technological advancements in alternative proteins, particularly fermentation and cultivated meat, present new growth avenues for Indonesia's plant-based market. The Indonesian National Research and Innovation Agency has been heavily investing in research to develop fermentation-based protein sources that are sustainable and affordable. In 2024, these innovations contributed to a 15% increase in the diversity of available plant-based meat products. This focus on cutting-edge protein technologies is expected to attract both consumer interest and government support in the coming years.

Scope of the Report

|

Product Type |

Burger Patties Sausages Minced Mea Nuggets, Meatballs |

|

By Source |

Soy Protein Pea Protein Wheat Protein Rice Protein |

|

By Distribution Channel |

Supermarkets/Hypermarkets Convenience Stores Specialty Stores Online Retail |

|

By End-Use |

Foodservice Retail Consumers |

|

By Region |

North East West South |

Products

Indonesia Plant-Based Meat Market Key Target Audience

Retailers and Supermarkets

Plant-Based Meat Manufacturers

Restaurants and Foodservice Chains

Health and Wellness Brands

Government and Regulatory Bodies (Indonesia Food and Drug Authority, Ministry of Agriculture)

Banks and Financial Institues

Environmental Advocacy Groups

Investment and Venture Capitalist Firms

Sustainable Agriculture Stakeholders

Companies

Indonesia Plant-Based Meat Market Major Players

Green Rebel Foods

Beyond Meat

Impossible Foods

Harvest Gourmet (Nestle)

OmniMeat

TaniHub

The Vegetarian Butcher (Unilever)

Phuture Foods

Next Meats

ALDI Food Asia

V2Food

Vitasoy

Hey Jack!

Fable Foods

Shandi Global

Table of Contents

1. Indonesia Plant-Based Meat Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Indonesia Plant-Based Meat Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Indonesia Plant-Based Meat Market Analysis

3.1. Growth Drivers

3.1.1. Rising Consumer Demand for Health-Conscious Food Products

3.1.2. Increasing Veganism and Flexitarian Diet Trends

3.1.3. Government Support for Sustainable Food Production (Subsidies, Regulations, Policies)

3.1.4. Growing Environmental Concerns (Carbon Emissions, Resource Use)

3.1.5. Technological Advancements in Food Processing and Ingredients

3.2. Market Challenges

3.2.1. High Production Costs

3.2.2. Consumer Skepticism Toward Taste and Texture

3.2.3. Lack of Awareness in Rural Regions

3.2.4. Supply Chain Limitations (Raw Materials, Logistics)

3.3. Opportunities

3.3.1. Partnerships with Local Retailers and Foodservice Chains

3.3.2. Innovations in Alternative Protein Sources (Fermentation, Cultivated Meat)

3.3.3. Expansion in Emerging Markets (Tier II & III Cities)

3.3.4. Government Initiatives to Promote Sustainable Agriculture

3.4. Trends

3.4.1. Increasing Product Diversification (Plant-Based Seafood, Dairy Alternatives)

3.4.2. Rising Adoption of Clean Label and Organic Ingredients

3.4.3. Digital Marketing and E-commerce Penetration in the Plant-Based Segment

3.5. Government Regulation

3.5.1. Food Safety and Labeling Regulations (Plant-Based Products)

3.5.2. Import-Export Regulations for Alternative Proteins

3.5.3. Environmental Standards for Plant-Based Meat Production

3.5.4. Investment Incentives for Startups in Plant-Based Sector

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. Indonesia Plant-Based Meat Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Burger Patties

4.1.2. Sausages

4.1.3. Minced Meat

4.1.4. Nuggets

4.1.5. Meatballs

4.2. By Source (In Value %)

4.2.1. Soy Protein

4.2.2. Pea Protein

4.2.3. Wheat Protein

4.2.4. Rice Protein

4.3. By Distribution Channel (In Value %)

4.3.1. Supermarkets/Hypermarkets

4.3.2. Convenience Stores

4.3.3. Specialty Stores

4.3.4. Online Retail

4.4. By End-Use (In Value %)

4.4.1. Foodservice

4.4.2. Retail Consumers

4.5. By Region (In Value %)

4.5.1. North

4.5.2. South

4.5.3. East

4.5.4. West

5. Indonesia Plant-Based Meat Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Green Rebel Foods

5.1.2. Harvest Gourmet (Nestle)

5.1.3. Beyond Meat

5.1.4. Impossible Foods

5.1.5. OmniMeat

5.1.6. TaniHub

5.1.7. The Vegetarian Butcher (Unilever)

5.1.8. Phuture Foods

5.1.9. Next Meats

5.1.10. ALDI Food Asia

5.1.11. V2Food

5.1.12. Vitasoy

5.1.13. Hey Jack!

5.1.14. Fable Foods

5.1.15. Shandi Global

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue, Production Capacity, Product Portfolio, Regional Presence, Sustainability Initiatives)

5.3. Market Share Analysis

5.4. Strategic Initiatives (Joint Ventures, Strategic Partnerships, Expansion Plans)

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Indonesia Plant-Based Meat Market Regulatory Framework

6.1. Food Safety Standards

6.2. Labeling and Marketing Regulations

6.3. Import and Export Compliance

6.4. Certification for Organic and Non-GMO Products

7. Indonesia Plant-Based Meat Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Indonesia Plant-Based Meat Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Source (In Value %)

8.3. By Distribution Channel (In Value %)

8.4. By End-Use (In Value %)

8.5. By Region (In Value %)

9. Indonesia Plant-Based Meat Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

DisclaimerContact Us

Research Methodology

Step 1: Identification of Key Variables

The first phase includes constructing an ecosystem map of all stakeholders in the Indonesia Plant-Based Meat Market. This process involves desk research and the use of proprietary databases to gather comprehensive data at the industry level. The goal is to identify the key factors influencing market dynamics.

Step 2: Market Analysis and Construction

In this stage, historical data on the Indonesia Plant-Based Meat Market is compiled and analyzed. This involves assessing product penetration, evaluating retail presence, and calculating revenue generation. Additionally, service quality is measured to ensure accuracy in market size estimations.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are generated and then validated through expert interviews using CATI methods. Industry professionals provide insights into operational and financial aspects, helping to refine market estimates.

Step 4: Research Synthesis and Final Output

The final step involves direct communication with plant-based meat manufacturers to gain detailed insights into product performance, consumer trends, and sales data. This ensures that the final report provides an accurate and comprehensive view of the market.

Frequently Asked Questions

01. How big is the Indonesia Plant-Based Meat Market?

The Indonesia plant-based meat market is valued at USD 500 million, driven by rising health awareness, a shift toward sustainable consumption, and government support for eco-friendly food products.

02. What are the challenges in the Indonesia Plant-Based Meat Market?

Key challenges in Indonesia plant-based meat market include the high cost of production, consumer skepticism around taste and texture, and limited availability in rural areas, making market penetration difficult in certain regions.

03. Who are the major players in the Indonesia Plant-Based Meat Market?

Major players in Indonesia plant-based meat market include Green Rebel Foods, Beyond Meat, Impossible Foods, Harvest Gourmet (Nestle), and OmniMeat, all of which have established strong distribution networks and product innovation capabilities.

04. What are the growth drivers of the Indonesia Plant-Based Meat Market?

The Indonesia plant-based meat market is driven by factors such as the rising popularity of flexitarian and vegan diets, government support for sustainable agriculture, and increasing consumer demand for health-conscious products.

05. What trends are influencing the Indonesia Plant-Based Meat Market?

Key trends in Indonesia plant-based meat market include the diversification of plant-based meat products, the use of clean-label ingredients, and the rising adoption of plant-based foods in mainstream retail and foodservice outlets.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.