Indonesia Plastic Bottles Market Outlook to 2030

Region:Asia

Author(s):Vijay Kumar

Product Code:KROD9457

November 2024

96

About the Report

Indonesia Plastic Bottles Market Overview

- The Indonesia Plastic Bottles market is valued at USD 307 million, based on a five-year historical analysis. This market is primarily driven by the demand for lightweight, durable, and recyclable packaging solutions across sectors like beverages, personal care, and household products. The increasing urbanization and a rising preference for convenient, on-the-go packaging have positioned plastic bottles as essential in meeting Indonesia's high-volume packaging needs, especially in fast-growing consumer markets.

- The dominant regions in the Indonesia Plastic Bottles Market include Java and Sumatra, where urbanization, population density, and the presence of manufacturing facilities significantly drive market demand. Java, with its dense industrial activities and population concentration, leads in consumption due to its robust infrastructure and high demand for packaged goods. Sumatra's emerging industrial activities also contribute to its influence on the market.

- Indonesias Waste Management Act mandates plastic producers to contribute to waste reduction, with strict compliance checks initiated in 2024. Plastic bottle manufacturers are required to participate in Extended Producer Responsibility (EPR) programs, contributing to a recycling target of 50% of plastic waste by 2025. This policy has led to increased participation in recycling initiatives and bolstered sustainable production.

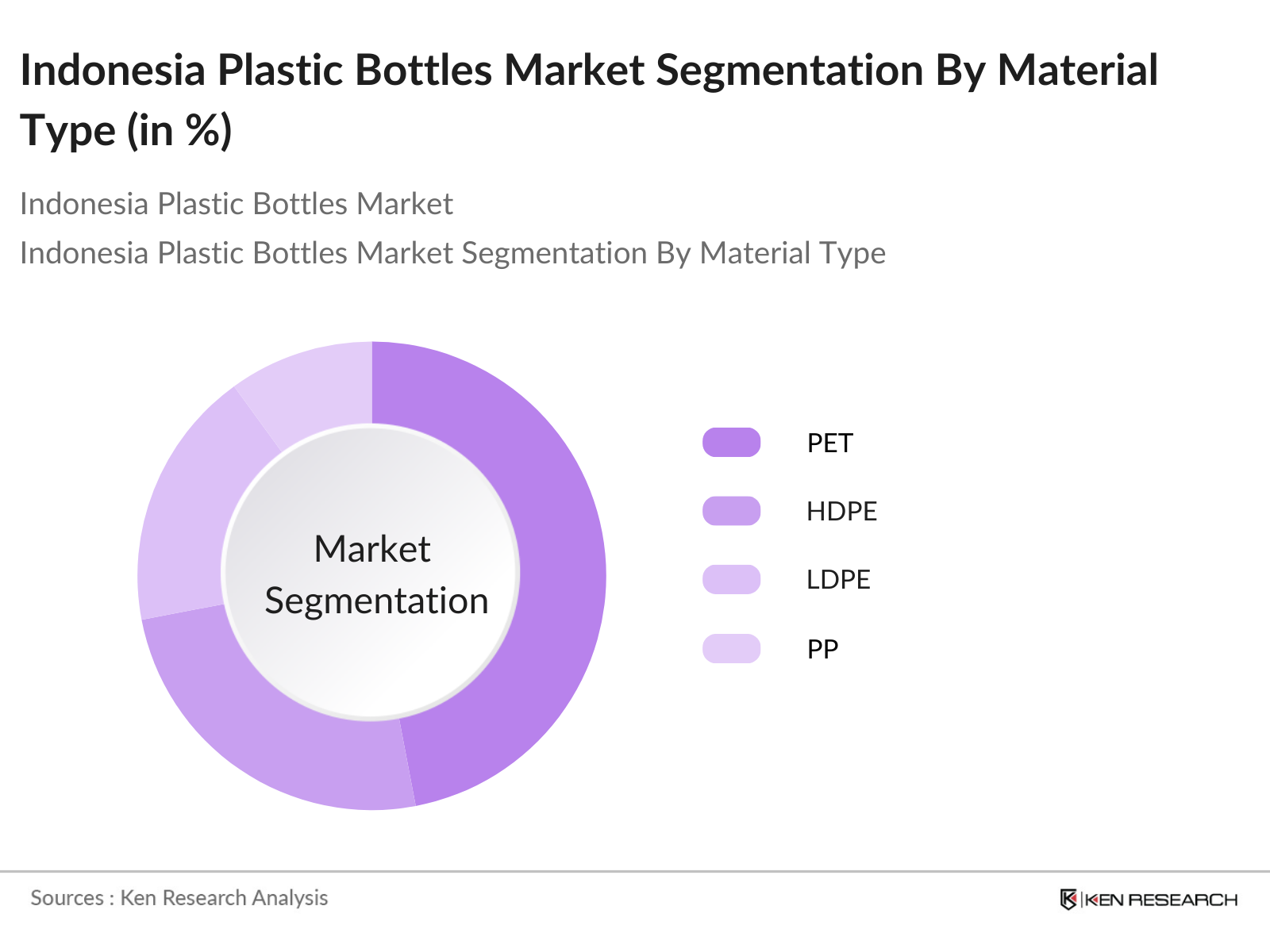

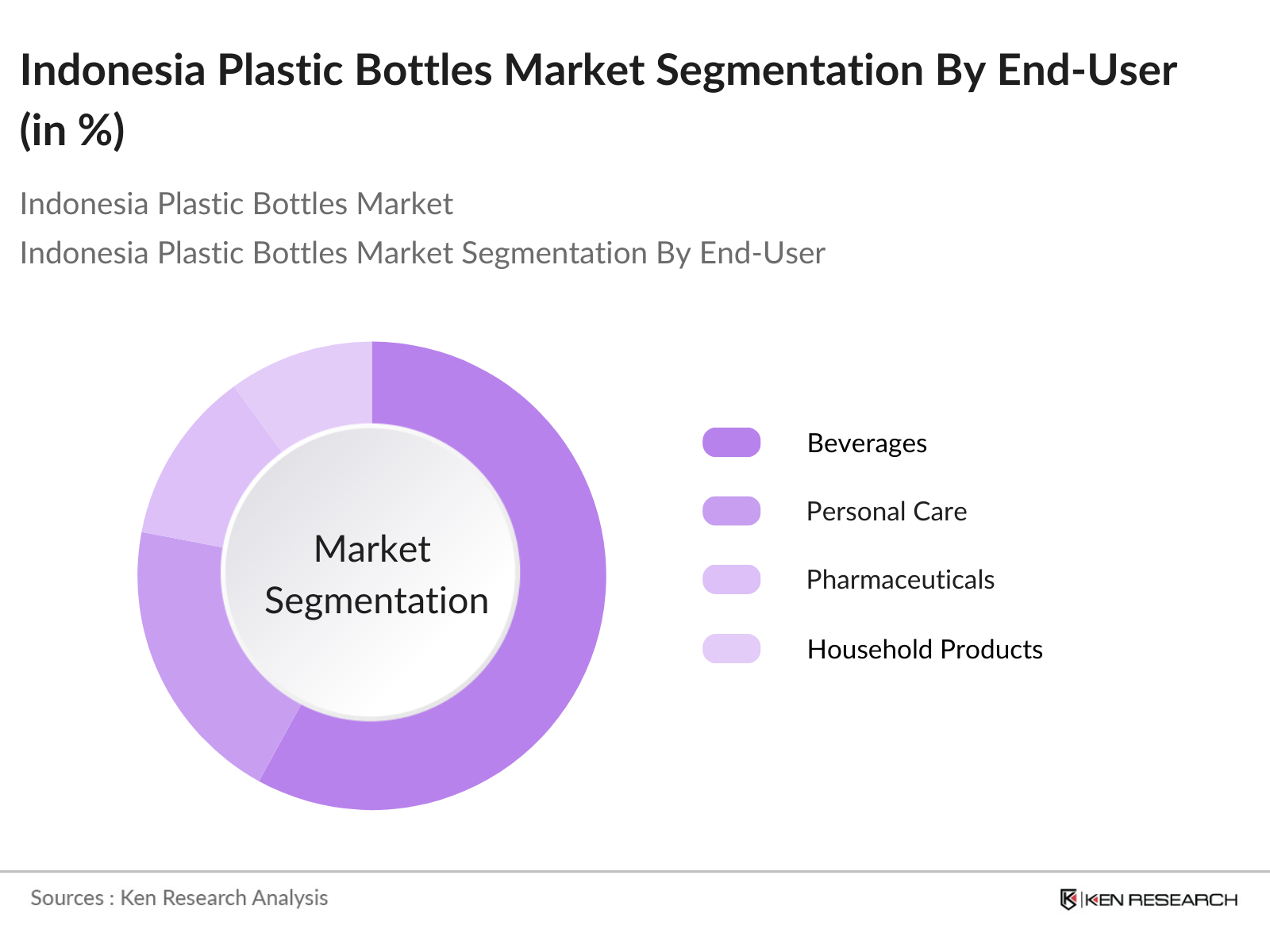

Indonesia Plastic Bottles Market Segmentation

By Material Type: Indonesias plastic bottles market is segmented by material type into PET, HDPE, LDPE, PP, and Others. PET holds the largest market share due to its lightweight and recyclable nature, which aligns with consumer preferences for environmentally friendly packaging. The beverage sector widely adopts PET for bottling water, soft drinks, and other beverages, supported by its ability to maintain product integrity and safety.

By End-User Industry: The Indonesia plastic bottles market is segmented by end-user industry into beverages, personal care, pharmaceuticals, household products, and industrial uses. Beverages dominate the segment due to high consumption rates of bottled water and soft drinks in the country. Consumers prefer bottled beverages for portability, shelf life, and product safety, which has made this segment the largest within the plastic bottles market.

Indonesia Plastic Bottles Market Competitive Landscape

The Indonesia Plastic Bottles Market is led by prominent domestic players such as PT Indo Tirta Abadi and PT Dynapack Indonesia, alongside international giants. This consolidation underscores the significant influence of these key companies on the market, benefiting from high manufacturing capacity and extensive distribution networks.

Indonesia Plastic Bottles Industry Analysis

Growth Drivers

- Rising Demand from Beverage Industry (Volume by Industry): The demand for plastic bottles in Indonesia has seen a significant uptick, with the beverage industry being a primary driver. Indonesias beverage production reached around 25 billion liters in 2023, supported by a rising population and higher consumption of packaged drinks (World Bank, 2023). The need for convenient, lightweight packaging has made plastic bottles the preferred choice for soft drinks, juices, and water. The increase in urbanizationestimated at 56.9% in 2024is pushing demand further, as urban consumers have a higher dependency on packaged beverages.

- Shift Toward Lightweight Packaging (Environmental Impact): Indonesias packaging industry is shifting towards lightweight plastic bottles to reduce environmental impact. By 2024, advancements in plastic technology allow bottles to weigh up to 15% less than traditional models, helping reduce material usage and waste. This shift aligns with Indonesias goal to decrease plastic waste in marine environments by 70% by 2025, as stated in the national action plan. These lightweight bottles are now more prevalent, accounting for about 60% of the beverage industry's packaging.

- High Recycling Rates in Indonesia (Recycling Efficiency): Indonesia has achieved an impressive recycling rate, with 50% of plastic bottles being recycled annually, according to the Ministry of Environment and Forestry. This figure is notably higher than the regional average, largely due to government incentives and community-driven recycling programs. In 2024, Indonesias recycling efficiency increased with new facilities, processing over 1.2 million tons of plastic annually, reducing landfill waste significantly.

Market Challenges

- Regulatory Compliance (Government Regulations): Indonesias stringent regulations on plastic packaging, especially concerning waste management, have increased compliance costs for manufacturers. The national mandate for Extended Producer Responsibility (EPR) requires plastic bottle manufacturers to recycle a portion of their output, which has raised operational costs by an average of 10% in 2024. The governments aim to achieve full compliance by 2025 puts additional pressure on smaller manufacturers struggling with resource constraints. Indonesian Ministry of Industry.

- Competition from Alternative Packaging (Market Diversification): The plastic bottle industry faces competition from glass and aluminum packaging, increasingly favored for environmental reasons. In 2024, alternative packaging comprises about 12% of the market for beverages, a growth spurred by consumer preference for eco-friendly options. The Indonesian government has also introduced incentives for companies adopting non-plastic packaging solutions, creating competitive pressure on plastic bottle manufacturers to innovate and adapt.

Indonesia Plastic Bottles Market Future Outlook

The Indonesia Plastic Bottles Market is expected to experience notable growth, driven by increasing investments in biodegradable and recyclable materials. The beverage industry's demand, especially for bottled water, and rising environmental awareness among consumers are also contributing factors. The market will likely benefit from regulatory developments encouraging recycling and waste reduction, reinforcing sustainability in packaging solutions.

Market Opportunities

- Adoption of Recycled PET Bottles (Eco-Friendly Initiatives): Indonesia has been expanding its use of recycled PET (rPET) in manufacturing, with nearly 35% of plastic bottles now incorporating recycled material. This aligns with the national strategy to boost recycled plastic use by 50% by 2025. The integration of rPET not only lowers production costs but also supports Indonesias environmental goals, making it a profitable opportunity for manufacturers. Ministry of Industry.

- Export Potential in Southeast Asia (Regional Demand): Indonesias plastic bottle industry is increasingly positioned as a supplier within Southeast Asia, with exports reaching 150,000 tons in 2023. Demand from neighboring countries like Malaysia and Thailand, where plastic packaging is prominent in food and beverage industries, is growing. This export potential is fueled by Indonesias competitive production costs and strategic location within ASEAN.

Scope of the Report

|

By Material Type |

PET (Polyethylene Terephthalate) HDPE (High-Density Polyethylene) LDPE (Low-Density Polyethylene) PP (Polypropylene) Others |

|

By End-User |

Beverage Personal Care Pharmaceuticals Household Products Industrial Uses |

|

By Technology |

Blow Molding Injection Molding Extrusion Thermoforming |

|

By Capacity |

Less than 100 ml 100 ml to 500 ml 500 ml to 1L Above 1L |

|

By Region |

Java Sumatra Kalimantan Sulawesi Bali |

Products

Key Target Audience

Beverage Manufacturers

Personal Care Product Manufacturers

Pharmaceutical Companies

Household Goods Producers

Industrial Packaging Firms

Investments and Venture Capital Firms

Government and Regulatory Bodies (e.g., Ministry of Industry, Ministry of Environment and Forestry)

Eco-Friendly Packaging Advocates

Companies

Players Mentioned in the Report

PT Indo Tirta Abadi

PT Dwi Selo Giri Mas

PT Dynapack Indonesia

PT Anugerah Mandiri Karya Plastik

PT Nusantara Polimer

PT Panca Budi Idaman

PT Kirana Pacifik Luas

PT Plastik Karawang

PT Petrokimia Gresik

PT Tirta Marta

Table of Contents

1. Indonesia Plastic Bottles Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. Indonesia Plastic Bottles Market Size (In USD Bn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. Indonesia Plastic Bottles Market Analysis

3.1 Growth Drivers

3.1.1 Rising Demand from Beverage Industry (Volume by Industry)

3.1.2 Shift Toward Lightweight Packaging (Environmental Impact)

3.1.3 High Recycling Rates in Indonesia (Recycling Efficiency)

3.1.4 Increased Investment in Biodegradable Plastics (Sustainability Index)

3.2 Market Challenges

3.2.1 Regulatory Compliance (Government Regulations)

3.2.2 Competition from Alternative Packaging (Market Diversification)

3.2.3 Rising Costs of Raw Materials (Cost Sensitivity)

3.3 Opportunities

3.3.1 Adoption of Recycled PET Bottles (Eco-Friendly Initiatives)

3.3.2 Export Potential in Southeast Asia (Regional Demand)

3.3.3 Technological Advancements in Plastic Manufacturing (Innovation Metrics)

3.4 Trends

3.4.1 Growth in Single-Use Plastic Restrictions (Legislation Impact)

3.4.2 Integration of Smart Packaging Solutions (Technology Penetration)

3.4.3 Increasing Focus on Refillable Bottle Designs (Product Innovation)

3.5 Government Regulation

3.5.1 Waste Management Policies (Compliance Requirements)

3.5.2 Recycling Mandates for Manufacturers (Recycling Standards)

3.5.3 Environmental Fees on Plastic Usage (Cost Impact on Production)

3.6 SWOT Analysis

3.7 Stake Ecosystem

3.8 Porters Five Forces

3.9 Competitive Ecosystem

4. Indonesia Plastic Bottles Market Segmentation

4.1 By Material Type (In Value %)

4.1.1 PET (Polyethylene Terephthalate)

4.1.2 HDPE (High-Density Polyethylene)

4.1.3 LDPE (Low-Density Polyethylene)

4.1.4 PP (Polypropylene)

4.1.5 Others

4.2 By End-User Industry (In Value %)

4.2.1 Beverage

4.2.2 Personal Care

4.2.3 Pharmaceuticals

4.2.4 Household Products

4.2.5 Industrial Uses

4.3 By Technology (In Value %)

4.3.1 Blow Molding

4.3.2 Injection Molding

4.3.3 Extrusion

4.3.4 Thermoforming

4.4 By Capacity (In Value %)

4.4.1 Less than 100 ml

4.4.2 100 ml to 500 ml

4.4.3 500 ml to 1L

4.4.4 Above 1L

4.5 By Region (In Value %)

4.5.1 Java

4.5.2 Sumatra

4.5.3 Kalimantan

4.5.4 Sulawesi

4.5.5 Bali

5. Indonesia Plastic Bottles Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 PT Indo Tirta Abadi

5.1.2 PT Dwi Selo Giri Mas

5.1.3 PT Dynapack Indonesia

5.1.4 PT Anugerah Mandiri Karya Plastik

5.1.5 PT Tirta Marta

5.1.6 PT Plastik Karawang

5.1.7 PT Sekawan Sumber Sejahtera

5.1.8 PT Polytama Propindo

5.1.9 PT Panca Budi Idaman

5.1.10 PT Petrokimia Gresik

5.1.11 PT Starindo Jaya Packaging

5.1.12 PT Modern Plastic Industry

5.1.13 PT Nusantara Polimer

5.1.14 PT Astra Graphia Tbk

5.1.15 PT Kirana Pacifik Luas

5.2 Cross Comparison Parameters (Headquarters, No. of Employees, Market Presence, Product Portfolio, Revenue, Certifications, Export Potential, Production Capacity)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Private Equity Investments

5.8 Government Grants

5.9 Venture Capital Funding

6. Indonesia Plastic Bottles Market Regulatory Framework

6.1 Plastic Ban Policies

6.2 Recycling Regulations

6.3 Producer Responsibility Laws

6.4 Environmental Certifications

6.5 Compliance with International Standards

7. Indonesia Plastic Bottles Future Market Size (In USD Bn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. Indonesia Plastic Bottles Future Market Segmentation

8.1 By Material Type (In Value %)

8.2 By End-User Industry (In Value %)

8.3 By Technology (In Value %)

8.4 By Capacity (In Value %)

8.5 By Region (In Value %)

9. Indonesia Plastic Bottles Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase identifies primary stakeholders within the Indonesia Plastic Bottles Market ecosystem. This is accomplished through extensive desk research and examination of secondary and proprietary data sources to define variables affecting market dynamics.

Step 2: Market Analysis and Construction

Historical data on the Indonesia Plastic Bottles Market is analyzed, focusing on product penetration, revenue generation, and volume distribution across key end-user industries. A detailed evaluation of production quality is also conducted to ensure accurate revenue forecasts.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are validated through expert consultations with industry players. These consultations, conducted through CATIs, provide key insights into operational aspects, enabling a deeper understanding of market growth trajectories.

Step 4: Research Synthesis and Final Output

In the final phase, data from plastic bottle manufacturers are reviewed to gather insights into product performance, consumer preferences, and market challenges. This synthesis ensures that the market analysis accurately reflects the Indonesia Plastic Bottles Markets current and prospective dynamics.

Frequently Asked Questions

1. How big is the Indonesia Plastic Bottles Market?

The Indonesia Plastic Bottles market is valued at USD 307 million, based on a five-year historical analysis. This market is primarily driven by the demand for lightweight, durable, and recyclable packaging solutions across sectors like beverages, personal care, and household products.

2. What are the challenges in the Indonesia Plastic Bottles Market?

The market faces challenges including regulatory restrictions on plastic usage, fluctuating raw material prices, and competition from alternative packaging solutions that emphasize eco-friendliness.

3. Who are the major players in the Indonesia Plastic Bottles Market?

Key players include PT Indo Tirta Abadi, PT Dynapack Indonesia, and PT Nusantara Polimer, among others. These companies dominate due to strong distribution networks, high production capacity, and a commitment to sustainability initiatives.

4. What factors are driving the Indonesia Plastic Bottles Market?

Growth in this market is driven by the increasing demand for on-the-go beverage packaging, a growing middle-class population, and significant investments in PET and biodegradable plastics by local manufacturers.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.