Indonesia Plastic Market Outlook to 2030

Region:Asia

Author(s):Abhinav kumar

Product Code:KROD6038

November 2024

89

About the Report

Indonesia Plastic Market Overview

- The Indonesia plastic market is valued at USD 5.7 billion, based on a five-year historical analysis. The market has been driven by the booming demand for plastics in various industries such as packaging, automotive, and construction. A growing middle class, urbanization, and an increasing need for high-performance plastic materials in sectors like automotive and electronics are fueling this demand. Additionally, Indonesia's strong position as a manufacturing hub in Southeast Asia contributes to the growth of the plastic market, alongside governmental investments in infrastructure development.

- Dominant cities and regions in Indonesia, such as Jakarta and Surabaya, dominate the plastic market due to their robust industrial bases and manufacturing facilities. Jakarta, being the capital, houses most of the country's large-scale manufacturers and acts as a major logistics hub for both imports and exports. Additionally, Sumatra and Java are key players due to their high concentration of consumer goods, automotive manufacturing, and construction industries, all of which are heavy users of plastic products.

- In response to the escalating plastic waste crisis, the Indonesian government has implemented stringent regulations aimed at managing plastic waste more effectively. In 2022, the Ministry of Environment and Forestry introduced a comprehensive waste management plan requiring municipalities to adopt waste segregation practices. The goal is to improve waste collection and processing, targeting a reduction of plastic waste entering landfills and oceans. These regulations not only promote responsible waste management but also encourage the development of recycling facilities, positioning Indonesia as a leader in sustainable waste practices.

Indonesia Plastic Market Segmentation

By Product Type: The Indonesia plastic market is segmented by product type into Polyethylene (PE), Polypropylene (PP), Polyethylene Terephthalate (PET), Polystyrene (PS), and Polyvinyl Chloride (PVC). Recently, Polypropylene (PP) has gained a dominant market share in Indonesia under the product type segmentation, due to its versatility and broad application across packaging, automotive parts, and household goods. The polymer's high resistance to chemical wear and ability to be recycled make it favorable, especially with the ongoing push for sustainability in packaging materials.

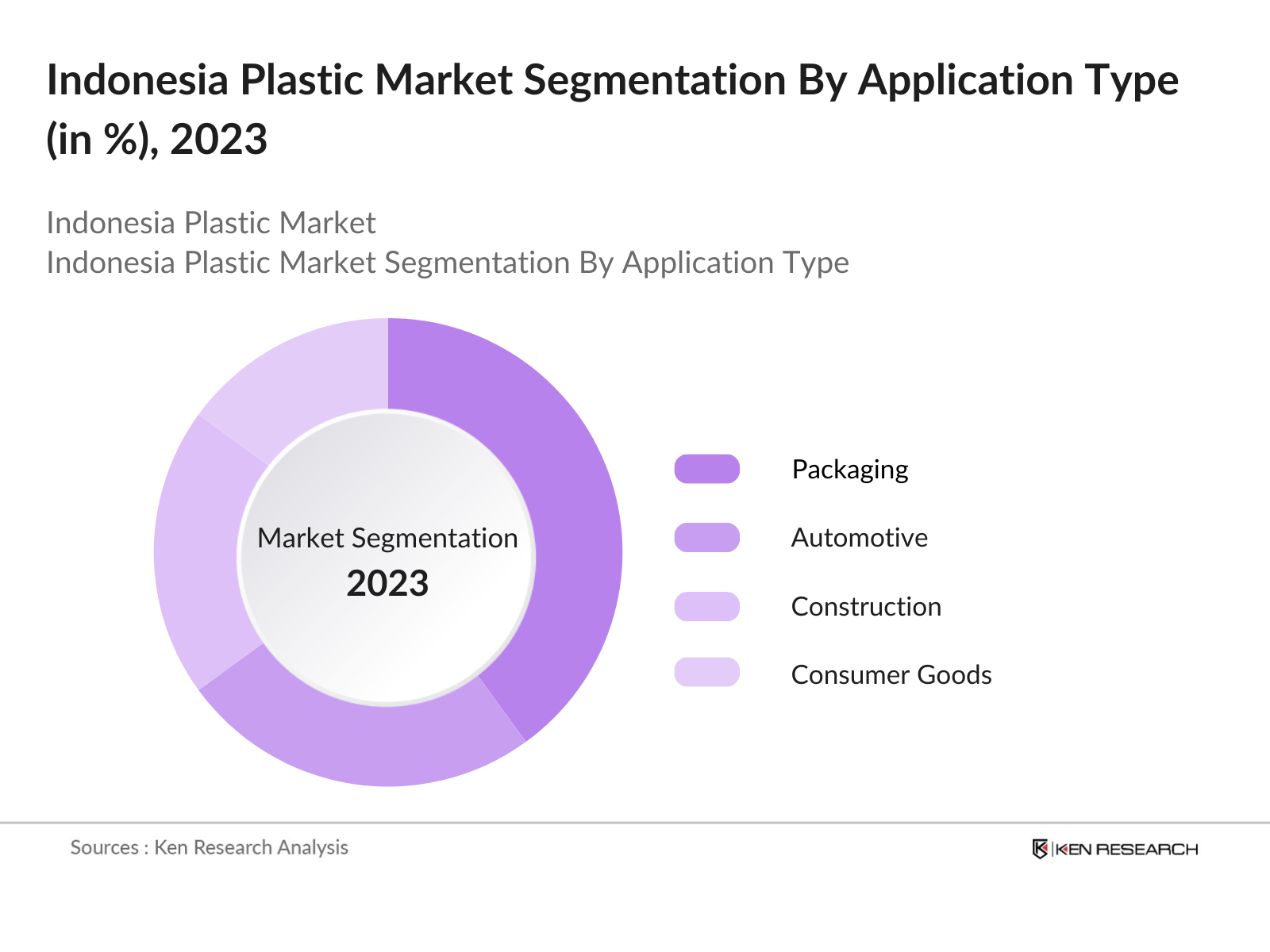

By Application: Indonesia's plastic market is further segmented by application into packaging, automotive, construction, consumer goods, and electronics. Packaging applications hold the largest market share due to the continuous growth of e-commerce and retail industries. Packaging materials, especially single-use plastics and food-grade plastics, have seen steady demand as the countrys consumer market expands. Lightweight, durable, and cost-effective plastic packaging solutions continue to dominate, driven by the rising consumption of packaged foods and beverages, as well as increased demand from online retailers.

Indonesia Plastic Market Competitive Landscape

The Indonesia plastic market is dominated by several key players that have well-established operations in the region. These companies dominate the market due to their ability to innovate in product development, meet regulatory standards, and efficiently cater to the high demands of both local and international industries. Companies like PT Chandra Asri Petrochemical and PT Lotte Chemical Indonesia lead the market through their integrated supply chains and robust production capacities.

Indonesia Plastic Industry Analysis

Growth Drivers

- Rapid Urbanization and Industrialization: Indonesia is experiencing significant urbanization, with projections indicating that over 60% of its population will reside in urban areas by 2025. This shift is driving demand for plastic products, particularly in urban infrastructure development and housing. The urban population growth is expected to increase the demand for consumer goods, including plastics, leading to a higher consumption rate. Industrialization efforts are further boosting the plastic market as industries require various plastic materials for manufacturing. In 2022, the urban population reached approximately 157 million, highlighting the urgent need for plastic in urban planning and development.

- Increasing Plastic Consumption in Packaging: The packaging sector is a major consumer of plastic in Indonesia, accounting for nearly 35% of the country's total plastic demand. With the rise of e-commerce and changing consumer behaviors, plastic packaging needs are surging. In 2022, the Indonesian packaging industry was valued at over $17 billion, with projections indicating that it will continue to grow as online retail sales increase. The convenience and versatility of plastic packaging make it a preferred choice for various products, contributing significantly to the overall demand for plastics in Indonesia.

- Expansion in Automotive and Construction Sectors: The automotive and construction sectors in Indonesia are experiencing robust growth, with both industries showing increased utilization of plastic components. The automotive sector alone is projected to produce over 1.5 million vehicles by 2025, relying heavily on lightweight plastics for fuel efficiency and design flexibility. In construction, the government's infrastructure development plans aim to construct 1 million homes annually, driving demand for plastic materials used in plumbing, electrical, and insulation applications. In 2022, construction investments reached around $40 billion, supporting the need for versatile plastic solutions.

Market Challenges

- Environmental Concerns: Environmental issues pose significant challenges for the Indonesian plastic market. In 2022, Indonesia ranked second globally in terms of plastic waste leakage into the ocean, with approximately 3.2 million tons of plastic waste entering marine ecosystems each year. This alarming statistic has led to increased scrutiny and public outcry regarding plastic use. The country's inability to effectively manage plastic waste is resulting in pollution that affects not only marine life but also public health. Addressing these environmental concerns is critical for the sustainability of the plastic industry, pushing for more stringent regulations and practices.

- Fluctuating Raw Material Prices: Fluctuating prices of raw materials, particularly crude oil, significantly impact the plastic market in Indonesia. In 2022, the average price of crude oil surged to approximately $100 per barrel, contributing to increased production costs for plastic manufacturers. As petroleum derivatives are a primary source for many plastic products, rising crude oil prices lead to higher costs for plastic production. This fluctuation in raw material prices complicates financial forecasting for manufacturers, resulting in pricing uncertainties and potential market instability. The volatility of global oil markets further exacerbates this challenge.

Indonesia Plastic Market Future Outlook

Over the next 5 years, the Indonesia plastic market is expected to experience significant growth, driven by increasing demand for sustainable plastic solutions, advancements in recycling technologies, and growth in key industries such as automotive and construction. With increasing government regulations on single-use plastics and the growing trend of environmentally conscious consumers, the market is moving toward more sustainable materials such as biodegradable plastics and enhanced recycling techniques. Furthermore, industrial growth in packaging and electronics sectors will continue to create steady demand for plastic products across the country. The Indonesian governments initiatives to modernize its infrastructure and industrial facilities, coupled with foreign investment in manufacturing, will further accelerate growth in the plastic sector. Opportunities also exist in plastic exports to neighboring Southeast Asian countries, as Indonesia strengthens its trade relationships within the region.

Opportunities

- Rising Demand for Biodegradable Plastics: The growing environmental awareness among consumers is driving demand for biodegradable plastics in Indonesia. In 2022, the market for biodegradable plastics reached approximately $100 million, with projections indicating continued growth as companies shift towards sustainable alternatives. The government supports this transition through initiatives that promote eco-friendly products, including funding for research and development in biodegradable materials. By capitalizing on this trend, manufacturers can diversify their product offerings and meet the increasing consumer preference for sustainable solutions, positioning themselves for future growth in the market.

- Growing Exports of Plastic Products: Indonesia's plastic exports are on the rise, reflecting the country's competitive advantage in manufacturing. In 2022, plastic product exports were valued at approximately $3 billion, with a strong demand from Southeast Asian markets and beyond. The government is actively promoting exports through various trade agreements, enhancing access to international markets. This growth in exports presents significant opportunities for local manufacturers to expand their reach and improve economies of scale, ultimately driving the overall growth of the plastic sector in Indonesia.

Scope of the Report

|

By Product Type |

Polyethylene (PE) Polypropylene (PP) PET PS PVC |

|

By Application |

Packaging Automotive Construction Consumer Goods Electronics |

|

By Processing Technology |

Injection Molding Blow Molding Extrusion Thermoforming 3D Printing |

|

By End-User |

Food & Beverage Healthcare Industrial Machinery Agriculture Electronics |

|

By Region |

Java Sumatra Kalimantan Sulawesi Bali and Nusa Tenggara |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Plastic Manufacturing Industries

Packaging Companies

Automotive Manufacturing Industries

Consumer Goods Manufacturing Companies

Electronics Manufacturing Industries

Construction Companies

Investor and Venture Capitalist Firms

Government and Regulatory Bodies (Ministry of Industry, Ministry of Environment and Forestry)

Companies

Players Mentioned in the Report

PT Chandra Asri Petrochemical

PT Lotte Chemical Indonesia

PT TPC Indo Plastic & Chemicals

PT Asahimas Chemical

PT Trinseo Indonesia

PT Pan Era Group

PT Berlina Tbk

PT Plastik Makmur Sentosa

PT Solo Abadi Indonesia

PT Pelita Mekar Semesta

Table of Contents

1. Indonesia Plastic Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Indonesia Plastic Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Indonesia Plastic Market Analysis

3.1. Growth Drivers

3.1.1. Rapid Urbanization and Industrialization

3.1.2. Increasing Plastic Consumption in Packaging

3.1.3. Expansion in Automotive and Construction Sectors

3.1.4. Government Initiatives for Plastic Waste Management

3.2. Market Challenges

3.2.1. Environmental Concerns

3.2.2. Fluctuating Raw Material Prices

3.2.3. Stringent Government Regulations

3.3. Opportunities

3.3.1. Rising Demand for Biodegradable Plastics

3.3.2. Growing Exports of Plastic Products

3.3.3. Advancements in Recycling Technologies

3.4. Trends

3.4.1. Shift Toward Sustainable Packaging Solutions

3.4.2. Increased Use of High-Performance Plastics in Automotives

3.4.3. Adoption of Circular Economy Practices

3.5. Government Regulation

3.5.1. Regulations on Plastic Waste Management

3.5.2. Incentives for Eco-friendly Products

3.5.3. National Plastic Reduction Programs

3.6. SWOT Analysis

Strengths, Weaknesses, Opportunities, Threats

3.7. Stake Ecosystem

Overview of Key Stakeholders

3.8. Porters Five Forces

Bargaining Power of Suppliers, Buyers, Threat of Substitutes, New Entrants, Industry Rivalry

3.9. Competition Ecosystem

Key Players and Market Structure

4. Indonesia Plastic Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Polyethylene (PE)

4.1.2. Polypropylene (PP)

4.1.3. Polyethylene Terephthalate (PET)

4.1.4. Polystyrene (PS)

4.1.5. Polyvinyl Chloride (PVC)

4.2. By Application (In Value %)

4.2.1. Packaging

4.2.2. Automotive

4.2.3. Construction

4.2.4. Consumer Goods

4.2.5. Electronics

4.3. By Processing Technology (In Value %)

4.3.1. Injection Molding

4.3.2. Blow Molding

4.3.3. Extrusion

4.3.4. Thermoforming

4.3.5. 3D Printing

4.4. By End-User (In Value %)

4.4.1. Food & Beverage

4.4.2. Healthcare

4.4.3. Industrial Machinery

4.4.4. Agriculture

4.4.5. Electronics

4.5. By Region (In Value %)

4.5.1. Java

4.5.2. Sumatra

4.5.3. Kalimantan

4.5.4. Sulawesi

4.5.5. Bali and Nusa Tenggara

5. Indonesia Plastic Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. PT Chandra Asri Petrochemical

5.1.2. PT Lotte Chemical Indonesia

5.1.3. PT TPC Indo Plastic & Chemicals

5.1.4. PT Asahimas Chemical

5.1.5. PT Trinseo Indonesia

5.1.6. PT Pan Era Group

5.1.7. PT Berlina Tbk

5.1.8. PT Plastik Makmur Sentosa

5.1.9. PT Solo Abadi Indonesia

5.1.10. PT Pelita Mekar Semesta

5.1.11. PT Dynapack Indonesia

5.1.12. PT Indo Tirta Abadi

5.1.13. PT Polychem Indonesia

5.1.14. PT Avia Avian Tbk

5.1.15. PT Sido Muncul Tbk

5.2. Cross Comparison Parameters (Market Share, Number of Employees, Production Capacity, Revenue)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Private Equity Investments

6. Indonesia Plastic Market Regulatory Framework

6.1. Environmental Standards and Regulations

6.2. Plastic Waste Management Compliance

6.3. Certification and Licensing Requirements

7. Indonesia Plastic Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Indonesia Plastic Market Future Segmentation

8.1. By Product Type (In Value %)

8.2. By Application (In Value %)

8.3. By Processing Technology (In Value %)

8.4. By End-User (In Value %)

8.5. By Region (In Value %)

9. Indonesia Plastic Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Indonesia Plastic Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the Indonesia Plastic Market. This includes assessing market penetration, product type adoption rates, and resultant revenue generation. Furthermore, an evaluation of product life cycle and performance data ensures reliability and accuracy in revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and validated through consultations with industry experts representing a diverse array of companies. These expert interviews provide valuable operational and financial insights, which are instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing findings from both primary and secondary sources. This includes direct engagement with plastic manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This process ensures a comprehensive and validated analysis of the Indonesia Plastic Market.

Frequently Asked Questions

1. How big is Indonesia Plastic Market?

The Indonesia plastic market is valued at USD 5.7 billion, driven by demand in packaging, automotive, and construction sectors. The market is experiencing steady growth, supported by government infrastructure projects and increasing plastic consumption.

2. What are the challenges in Indonesia Plastic Market?

Challenges include fluctuating raw material prices, regulatory pressures regarding plastic waste management, and the environmental impact of plastic products. These factors contribute to operational and cost challenges for manufacturers.

3. Who are the major players in the Indonesia Plastic Market?

Key players in the market include PT Chandra Asri Petrochemical, PT Lotte Chemical Indonesia, and PT TPC Indo Plastic & Chemicals, among others. These companies dominate due to their extensive production capacities, strong distribution networks, and diversified product portfolios.

4. What are the growth drivers of Indonesia Plastic Market?

The market is driven by the rapid growth of the packaging sector, increased demand in automotive and construction, and advancements in plastic recycling technologies. Consumer preference for lightweight, durable materials also boosts market demand.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.