Indonesia Power Generation Market Outlook to 2030

Region:Asia

Author(s):Sanjeev

Product Code:KROD8483

December 2024

85

About the Report

Indonesia Power Generation Market Overview

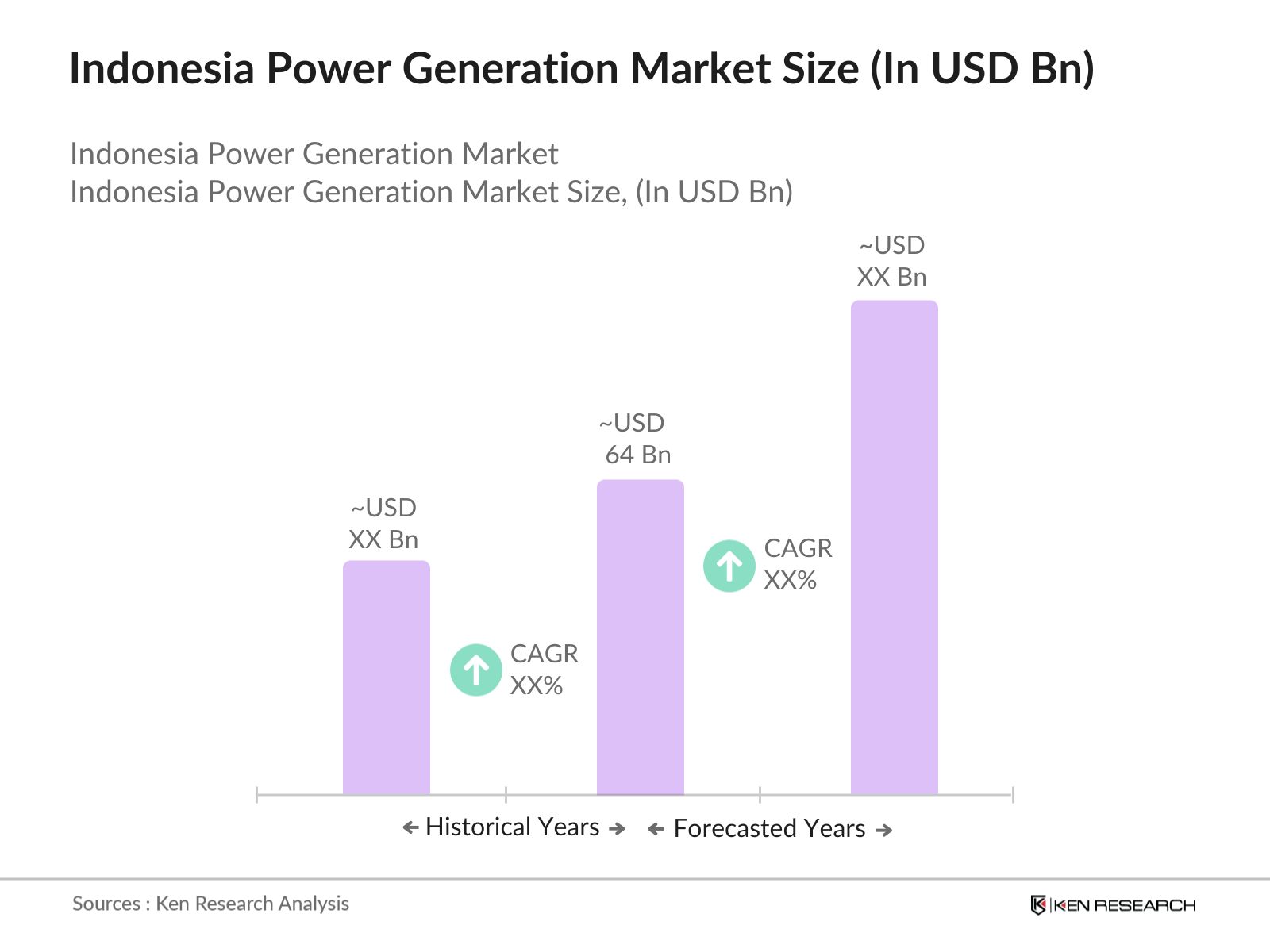

- The Indonesia Power Generation Market, valued at USD 64 billion, has experienced robust growth driven by rapid industrial expansion, population increase, and heightened energy demands. Key growth drivers include extensive government investments and supportive policies aimed at enhancing power generation capacity across various energy sources, particularly in renewables. Government programs, such as subsidies and incentives for solar and wind energy projects, are key factors pushing the sector forward.

- In Indonesia, regions like Java and Sumatra dominate the power generation market due to their dense population, high levels of industrialization, and established infrastructure. Java, as Indonesias economic hub, benefits from a concentrated industrial base and strong electricity demand, while Sumatra's coal-rich reserves make it a focal point for coal-based power production. Additionally, Javas energy network is more advanced, allowing easier integration of diverse energy sources.

- Indonesias National Energy Policy mandates a 23% renewable energy target by 2025. The policy enforces diversification of the energy mix, with a cap on coal-based generation. To meet these goals, the Ministry of Energy is enforcing annual energy reports to monitor renewable progress, which aligns with Indonesias 2060 net-zero commitment.

Indonesia Power Generation Market Segmentation

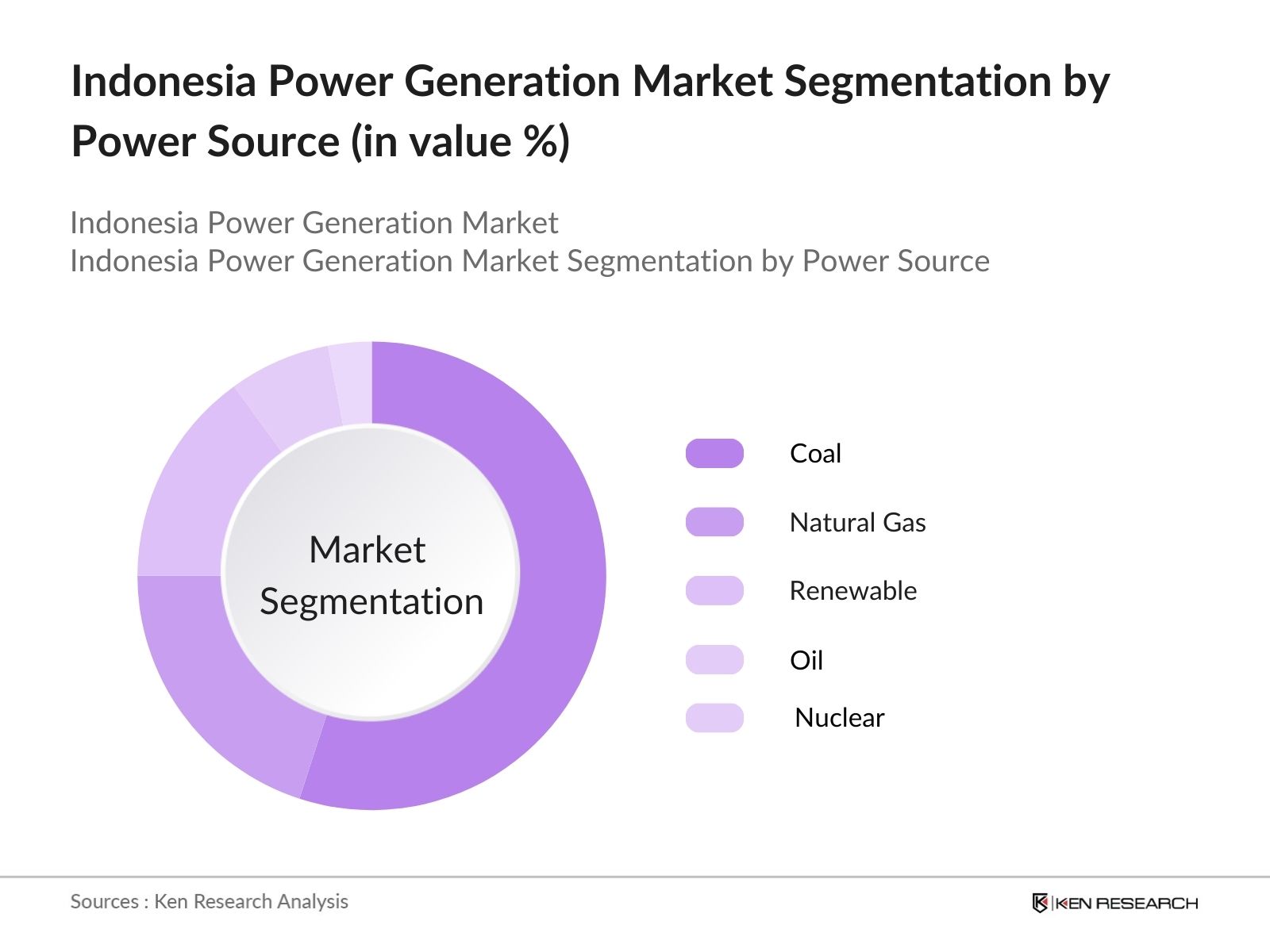

- By Power Source: Indonesia's power generation market is segmented by power source into coal, natural gas, renewable energy, oil, and nuclear. Currently, coal holds the dominant market share due to Indonesias abundant coal reserves, which make coal-based generation cost-effective and reliable for meeting high energy demand. This heavy reliance on coal is primarily due to its established infrastructure, lower operational costs, and government policies that historically supported coal production.

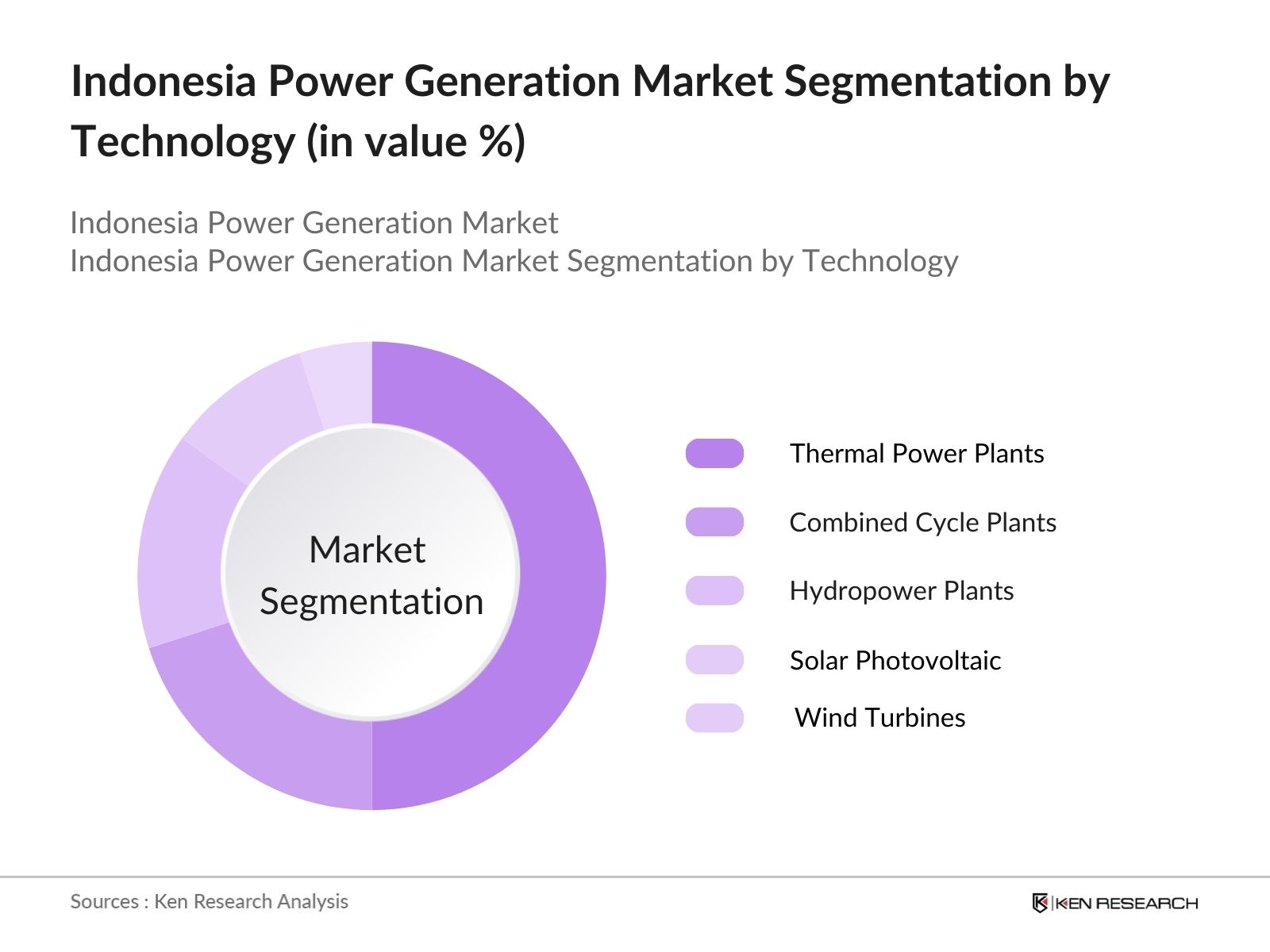

- By Technology: The technology segment in Indonesias power generation market includes thermal power plants, combined cycle power plants, hydropower plants, solar photovoltaic systems, and wind turbines. Thermal power plants dominate this segment due to their capacity to produce large amounts of energy at relatively low costs. The existing infrastructure for thermal power plants, coupled with low operational costs and government support, reinforces their dominance.

Indonesia Power Generation Market Competitive Landscape

The Indonesia Power Generation Market is characterized by the presence of several key players, including both local and international firms. The competitive landscape highlights the market's reliance on a few dominant companies that drive significant energy production capacity.

Indonesia Power Generation Market Analysis

Growth Drivers

- Demand for Reliable Power Supply: Indonesia's demand for stable power stems from its expanding urban population, projected to reach 157 million by 2024, which puts increased pressure on infrastructure (World Bank). The countrys electricity consumption has grown significantly, with PLN, the state-owned electricity company, reporting a 5.2% annual increase in electricity demand for the past two years due to both urban residential and commercial sectors. This rapid demand highlights the pressing need for continuous power supply improvements. According to Indonesias Ministry of Energy, current electrification targets aim to cover 100% of households by the end of 2024.

- Industrial and Economic Growth: With a 5.1% growth rate in GDP in 2023, Indonesia's industrial sectors are actively driving power demand. Key industries like manufacturing, which contributes 20% to the GDP, require stable power for operational efficiency. Investments in industrial parks, like Batang Industrial Park, further accelerate energy needs, with government plans to increase industrial capacity. The rapid industrialization has led to a consistent annual increase of 3% in industrial electricity demand. Government policies target strengthening the industrial contribution to the GDP, reaching USD 1.4 trillion by 2025.

- Expansion of Renewable Energy Projects: Indonesia is investing heavily in renewable projects, with a goal of achieving 23% renewable energy in its energy mix by 2025. Current installed capacity for renewable power sources has reached 12 GW, with an additional 5 GW planned by the end of 2024. Key projects include geothermal plants and solar PV initiatives, with government subsidies directed at reducing installation costs. This shift aligns with Indonesias 2060 net-zero emission targets, where renewables play a critical role in balancing fossil fuel dependence.

Market Challenges

- High Infrastructure Costs: Power generation infrastructure in Indonesia requires significant investment, with current projections by the Ministry of Energy indicating IDR 6.5 trillion needed to modernize the grid. The construction costs of renewable projects, particularly geothermal, are among the highest, with geothermal plants requiring IDR 40 billion per megawatt. High costs impact the timeline of renewable projects, posing a challenge to quick implementation in underdeveloped regions, where infrastructure is underfunded.

- Environmental Concerns and Regulations: Indonesia's environmental regulations are tightening, with increasing restrictions on emissions from fossil-fuel-based power generation. Coal, which accounted for 61% of Indonesias energy mix in 2023, is now under scrutiny, as the government targets a reduction in CO emissions by 29% by 2030. These regulations are driving power plants to adopt expensive compliance measures, challenging profitability and slowing down approvals for new plants

Indonesia Power Generation Market Future Outlook

The Indonesia Power Generation Market is poised for notable expansion, spurred by continuous government initiatives, increased private sector participation, and Indonesias commitment to renewable energy targets. Over the coming years, advancements in power technology, coupled with rising electricity demand in urban centers, are expected to drive growth in this sector. A notable shift toward green energy and distributed generation systems is anticipated, supported by favorable regulatory changes and increased investment in cleaner energy alternatives.

Future Market Opportunities

- Technological Advancements in Power Generation: Technological advancements, such as energy storage and smart grid systems, offer Indonesia the opportunity to enhance grid reliability. The government's energy roadmap highlights a 20% yearly increase in funding for technology-driven grid projects. PLN has invested over IDR 2 trillion in grid modernization, improving resilience and efficiency. Smart grids, along with energy storage, can stabilize Indonesias power supply, especially in remote areas.

- Investments in Renewable Energy: With foreign direct investment in renewable projects rising, renewable energy capacity is expected to expand significantly. Indonesia attracted over USD 4 billion in renewable investments in 2023, primarily in solar and hydro projects. Large-scale investments from Japan and South Korea further support Indonesia's renewable expansion goals. This influx of capital is expected to accelerate renewable projects, making them a cornerstone of the nations energy mix.

Scope of the Report

Coal Natural Gas Renewable Energy (Solar, Wind, Hydro, Biomass) Oil Nuclear | |

By Technology | Thermal Power Plants Combined Cycle Power Plants Hydropower Plants Solar Photovoltaic Systems Wind Turbines |

By Capacity | Below 100 MW 100-500 MW 500-1000 MW Above 1000 MW |

By End-User | Industrial Residential Commercial Utilities |

By Region | North East West South |

Major Players in the Indonesia Power Generation Market

- PT PLN (Persero)

- PT Pertamina

- Adaro Energy

- Cirebon Electric Power

- Star Energy Geothermal

- PT Indonesia Power

- Chevron Indonesia

- Medco Power Indonesia

- Jawa Satu Power

- PT Paiton Energy

- PT Pertamina Geothermal Energy

- PT Sumberdaya Sewatama

- Engie Indonesia

- PT Supreme Energy

- PT Bukit Asam

Products

Key Target Audience

Power Generation Companies

Energy Investment Firms

Infrastructure Development Companies

Renewable Energy Corporations

Government and Regulatory Bodies (Ministry of Energy and Mineral Resources, Indonesia Investment Coordinating Board)

Technology Providers for Power Sector

Environmental Agencies

Investor and Venture Capitalist Firms

Table of Contents

- Indonesia Power Generation Market Overview 1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview - Indonesia Power Generation Market Size (In USD Bn) 2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones - Indonesia Power Generation Market Analysis

3.1. Growth Drivers

3.1.1. Demand for Reliable Power Supply

3.1.2. Industrial and Economic Growth

3.1.3. Expansion of Renewable Energy Projects

3.1.4. Government Initiatives and Subsidies

3.2. Market Challenges

3.2.1. High Infrastructure Costs

3.2.2. Environmental Concerns and Regulations

3.2.3. Dependence on Fossil Fuels

3.2.4. Regulatory Barriers

3.3. Opportunities

3.3.1. Technological Advancements in Power Generation

3.3.2. Investments in Renewable Energy

3.3.3. Cross-border Energy Trade

3.3.4. Local Manufacturing and Workforce Development

3.4. Trends

3.4.1. Adoption of Smart Grid Technology

3.4.2. Increasing Distributed Energy Systems

3.4.3. Shift Towards Hybrid Energy Systems

3.4.4. Private Sector Participation in Power Projects

3.5. Government Regulation

3.5.1. National Energy Policy

3.5.2. Incentives for Renewable Projects

3.5.3. Environmental Compliance Standards

3.5.4. Tariff and Pricing Regulations

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competition Ecosystem - Indonesia Power Generation Market Segmentation

4.1. By Power Source (In Value %)

4.1.1. Coal

4.1.2. Natural Gas

4.1.3. Renewable Energy (Solar, Wind, Hydro, Biomass)

4.1.4. Oil

4.1.5. Nuclear

4.2. By Technology (In Value %)

4.2.1. Thermal Power Plants

4.2.2. Combined Cycle Power Plants

4.2.3. Hydropower Plants

4.2.4. Solar Photovoltaic Systems

4.2.5. Wind Turbines

4.3. By Capacity (In Value %)

4.3.1. Below 100 MW

4.3.2. 100-500 MW

4.3.3. 500-1000 MW

4.3.4. Above 1000 MW

4.4. By End-User (In Value %)

4.4.1. Industrial

4.4.2. Residential

4.4.3. Commercial

4.4.4. Utilities

4.5. By Region (In Value %)

4.5.1. North

4.5.2. South

4.5.3. West

4.5.4. East - Indonesia Power Generation Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. PT PLN (Persero)

5.1.2. PT Pertamina

5.1.3. Adaro Energy

5.1.4. Cirebon Electric Power

5.1.5. Jawa Satu Power

5.1.6. Medco Power Indonesia

5.1.7. Chevron Indonesia

5.1.8. Star Energy Geothermal

5.1.9. PT Paiton Energy

5.1.10. PT Indonesia Power

5.1.11. PT Supreme Energy

5.1.12. Engie Indonesia

5.1.13. PT Pertamina Geothermal Energy

5.1.14. PT Sumberdaya Sewatama

5.1.15. PT Bukit Asam

5.2. Cross Comparison Parameters (Revenue, Headquarters, Market Share, Power Generation Capacity, Power Source Mix, Regional Reach, Operational Efficiency, Environmental Compliance)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Government Subsidies

5.8. Private Equity Investments - Indonesia Power Generation Market Regulatory Framework

6.1. Environmental Compliance Standards

6.2. Licensing Requirements

6.3. Certification Processes

6.4. Local Content Requirements - Indonesia Power Generation Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth - Indonesia Power Generation Future Market Segmentation

8.1. By Power Source (In Value %)

8.2. By Technology (In Value %)

8.3. By Capacity (In Value %)

8.4. By End-User (In Value %)

8.5. By Region (In Value %) - Indonesia Power Generation Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

DisclaimerContact Us

Research Methodology

Step 1: Identification of Key Variables

This step involves constructing a comprehensive map of Indonesias power generation market, identifying major stakeholders. Through secondary research and industry reports, we define key factors like energy demand, production capacity, and economic impacts.

Step 2: Market Analysis and Construction

Historical data on power generation is compiled and analyzed to evaluate the trends across different power sources and technologies. This includes examining installed capacities, generation efficiency, and cost structures to validate growth patterns.

Step 3: Hypothesis Validation and Expert Consultation

Our research hypotheses are validated through consultations with industry experts and stakeholders within Indonesias energy sector, providing direct operational insights. These expert opinions offer critical guidance for data triangulation and final analysis.

Step 4: Research Synthesis and Final Output

The synthesized data is cross-referenced with primary interviews and company reports to ensure a high degree of accuracy in the final output. This comprehensive analysis provides a validated understanding of market dynamics, segment performance, and future projections.

Frequently Asked Questions

01. How big is the Indonesia Power Generation Market?

The Indonesia Power Generation Market is valued at USD 64 billion, driven by increasing demand for reliable power and robust industrialization efforts.02. What are the main challenges in the Indonesia Power Generation Market?

Challenges in Indonesia Power Generation Market include high initial infrastructure costs, regulatory hurdles, and environmental concerns regarding coal-based power generation.03. Who are the key players in the Indonesia Power Generation Market?

Prominent players in Indonesia Power Generation Market include PT PLN (Persero), PT Pertamina, Adaro Energy, Star Energy Geothermal, and Cirebon Electric Power.04. What are the growth drivers for the Indonesia Power Generation Market?

Indonesia Power Generation Market Growth is propelled by government support for renewable projects, a rising industrial base, and ongoing investments in power infrastructure.05. What are the emerging trends in the Indonesia Power Generation Market?

Trends in Indonesia Power Generation Market include the adoption of smart grid technology, the rise of distributed energy systems, and increased private sector involvement in renewable energy projects.06. How does government regulation impact the Indonesia Power Generation Market?

Government regulations play a critical role, particularly in supporting renewable projects through subsidies and enforcing environmental compliance across all power sources.Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.