Indonesia Prebiotics Market Outlook to 2030

Region:Asia

Author(s):Shubham Kashyap

Product Code:KROD8148

December 2024

81

About the Report

Indonesia Prebiotics Market Overview

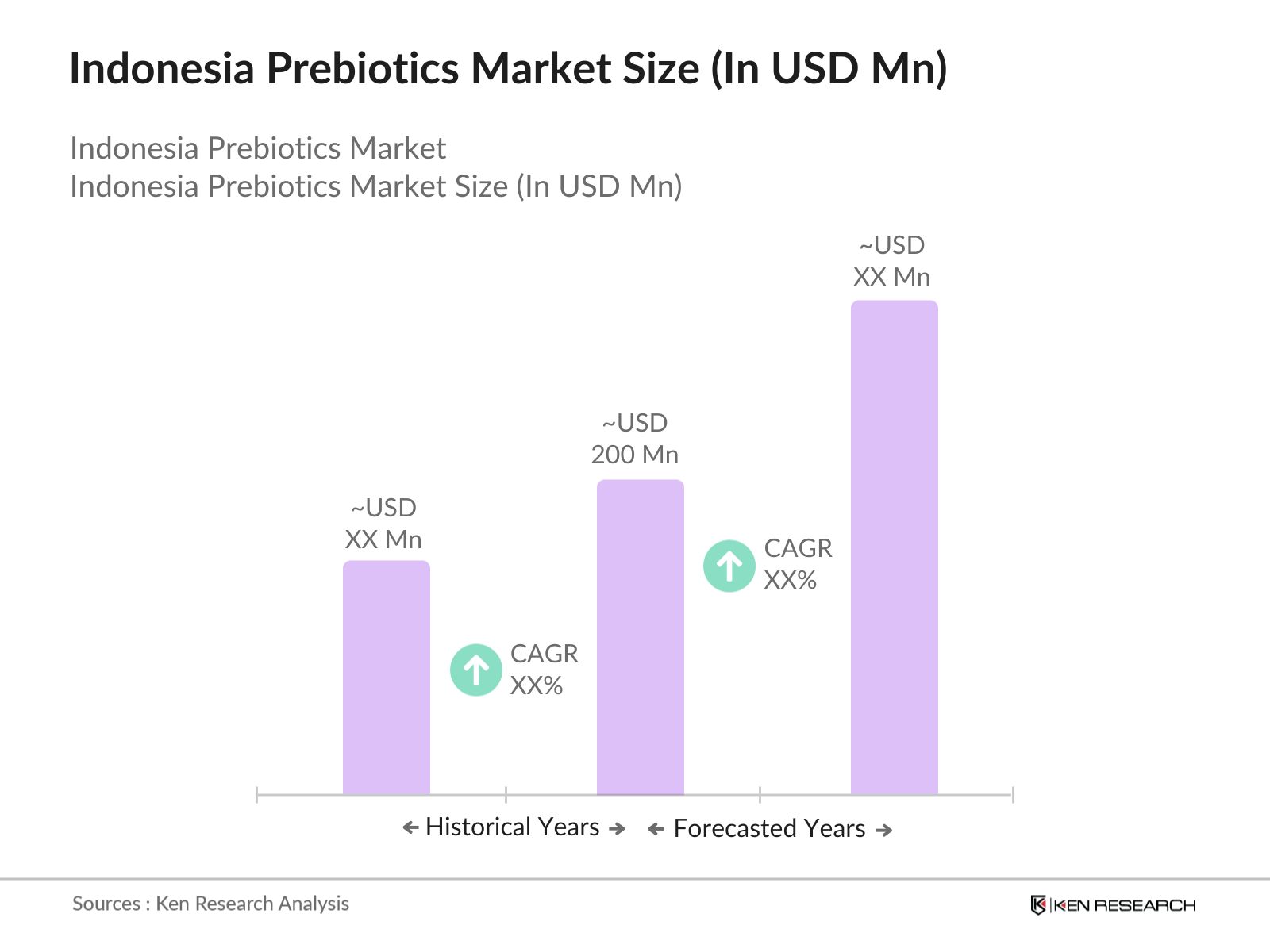

- The Indonesia Prebiotics Market, valued at USD 200 million, is experiencing notable growth due to rising health awareness and the demand for functional foods among health-conscious consumers. With a population increasingly focused on digestive health and wellness, prebiotic productsincluding dietary supplements and functional food ingredientsare becoming essential in both urban and rural households. This growth is further supported by innovations in product formulations, offering benefits that appeal to diverse dietary preferences and health needs among Indonesian consumers.

- Dominance in the Indonesia Prebiotics Market is primarily seen in urban centers like Jakarta, Surabaya, and Bandung, driven by higher disposable incomes, better access to health food retailers, and a growing awareness of gut health benefits. These cities have extensive distribution networks, allowing prebiotic products to be readily available for consumers who prioritize wellness. The established infrastructure and consumer education initiatives in these regions also support sustained demand for prebiotics among busy, health-focused consumers.

- In 2024, Indonesian regulatory bodies, including BPOM (Badan Pengawas Obat dan Makanan), implemented stricter standards for functional foods, impacting the prebiotics segment. Compliance with these standards is mandatory, ensuring products meet quality and safety benchmarks. For prebiotic products, this includes restrictions on artificial additives and enhanced labelling requirements, encouraging manufacturers to align with Indonesias health policies and meet consumer expectations.

Indonesia Prebiotics Market Segmentation

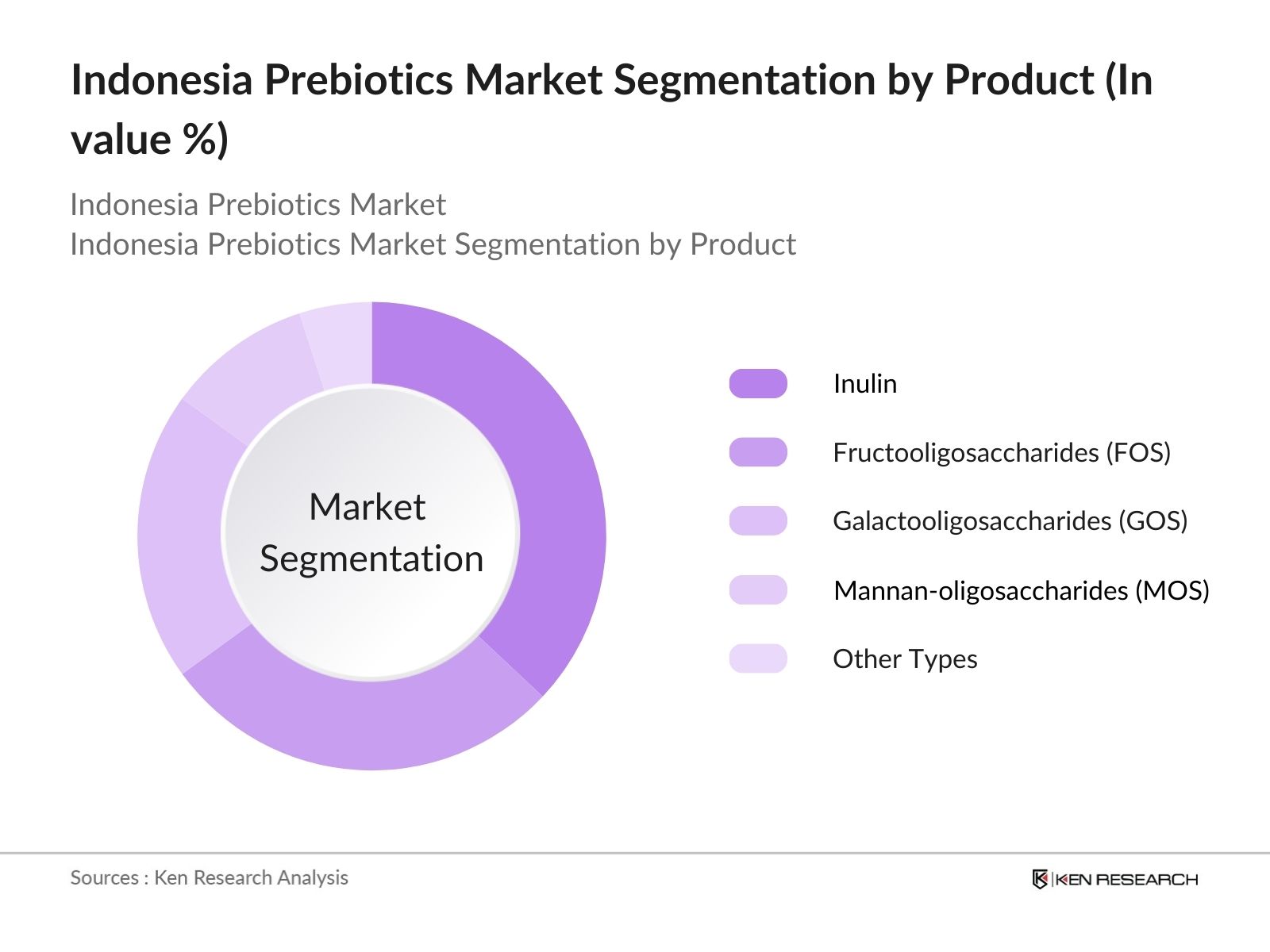

- By Product Type: The market is segmented by product type into Inulin, Fructooligosaccharides (FOS), Galactooligosaccharides (GOS), Mannan-oligosaccharides (MOS), and Other Types. Inulin has recently gained a leading market share within the product type segment, driven by its versatility in both food and beverage applications and its well-known benefits for digestive health. Brands leveraging inulin have successfully positioned it as an essential ingredient for wellness, with consumers increasingly choosing inulin-based products for its prebiotic benefits and as a natural sweetener alternative.

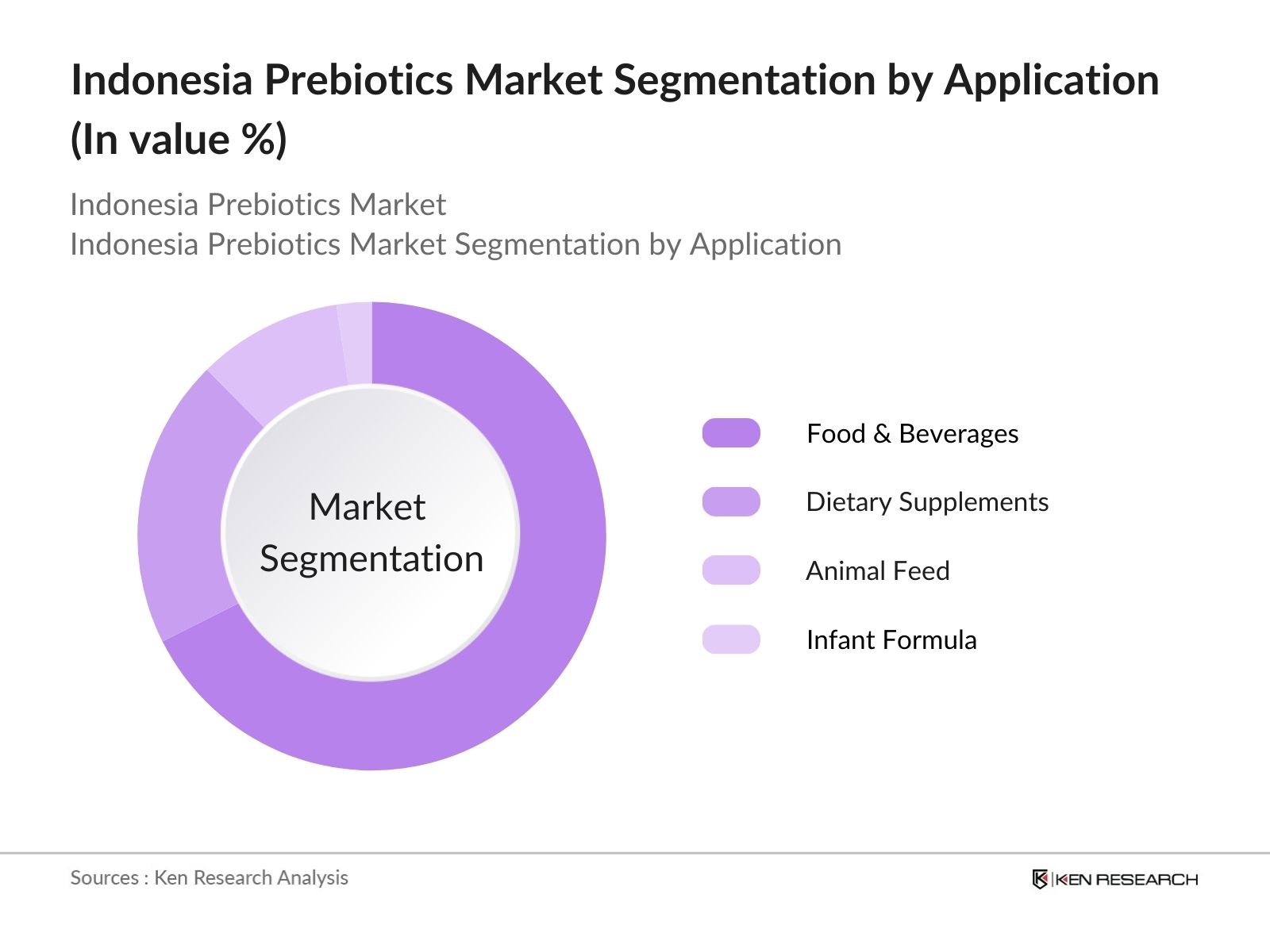

- By Application: The Indonesia Prebiotics Market is segmented by application into Food & Beverages, Dietary Supplements, Animal Feed, and Infant Formula. The Food & Beverages segment holds the largest market share due to its high consumer demand for functional foods that promote gut health. Prebiotics have become a common ingredient in dairy products, snacks, and beverages as consumers increasingly seek products that support health and wellness, establishing food and beverages as a dominant application in this market.

Indonesia Prebiotics Market Competitive Landscape

The Indonesia Prebiotics Market is highly competitive, with a mix of local and global companies recognized for strong product offerings and strategic distribution channels suited to the Indonesian market. Key players such as Cargill, FrieslandCampina, and Abbott Laboratories have developed substantial market positions, leveraging innovative products and partnerships with local retailers to extend their reach across the country.

Indonesia Prebiotics Market Analysis

Growth Drivers

- Increasing Health Awareness: Health awareness has been a significant driver in Indonesia, with government campaigns boosting nutritional understanding among its 277 million population. The World Health Organization (WHO) noted a steady rise in demand for dietary supplements, including prebiotics, with a substantial increase in awareness programs in urban centers across Jakarta and Surabaya. In 2023, the Ministry of Health recorded millions of Indonesians participating in health-awareness initiatives, emphasizing the importance of gut health, which prebiotics directly supports. These efforts highlight prebiotics' role in preventive healthcare

- Rise in Functional Food Demand: Indonesia's functional food sector has grown, with the country's import of key ingredients rising by thousands of tons in 2023, as per the Ministry of Trade. This surge is driven by an increased focus on foods with health benefits. Indonesia's National Agency of Drug and Food Control (BPOM) states that functional food production, particularly gut-supporting prebiotic ingredients, has grown by approximately 5 million units in urban areas. This growth underscores consumer preference for functional foods and positions prebiotics as a crucial component in this sector.

- Government Health Initiatives: Government initiatives are directly promoting prebiotic-rich diets to combat health issues. The Ministry of Health's Healthy Indonesia 2025 program aims to reduce digestive disorders noteable over the next two years through dietary guidance. In 2023 alone, the government allocated over IDR 3.5 trillion toward health promotion activities in urban centers, focusing on improved gut health. This initiative emphasizes dietary supplementation, including prebiotics, positioning them as essential to public health goals.

Market Challenges

- Supply Chain and Production Costs: Indonesia's prebiotics market faces significant supply chain challenges, with frequent delays in sourcing essential ingredients due to port congestion, alongside rising import costs. In 2023, import taxes on health-related ingredients increased by an average of IDR 1.5 million per ton, further complicating the supply chain. These factors impact the stability of the prebiotics supply chain as companies struggle to ensure consistent product availability, particularly for imports reliant on foreign suppliers, causing disruptions in meeting rising domestic demand.

- Health Concerns Over Product Additives: Growing consumer awareness regarding health risks associated with artificial additives and high-sugar content has intensified scrutiny of prebiotic products. In response, public health campaigns launched by the Ministry of Health promote reduced sugar intake, urging manufacturers to adapt formulations to align with consumer preferences for cleaner, additive-free products. These changes are fostering a market shift toward natural and health-conscious prebiotic options, further driven by heightened demand for transparency in ingredient sourcing and labeling.

Indonesia Prebiotics Market Future Outlook

The Indonesia Prebiotics Market is anticipated to sustain growth over the coming years, driven by the rising importance of digestive health and increased product diversification. Companies are likely to innovate with natural, low-sugar prebiotic formulations and target health-conscious consumers through online retail channels. As awareness of wellness and nutrition continues to expand, prebiotic product manufacturers are expected to leverage organic and functional ingredients to attract a broader audience.

Future Market Opportunities

- Incorporation of Organic Ingredients: With rising consumer interest in natural and organic products, prebiotic brands in Indonesia have the opportunity to focus on clean label formulations. The Ministry of Agriculture reports growing demand for nutrient-rich, low-sugar prebiotics, which companies can capitalize on through organic product innovation. This trend aligns with Indonesias health policies, making functional foods a promising area for future growth.

- Expansion of Retail and Digital Channels: The retail landscape for prebiotics is evolving alongside Indonesias digital economy. E-commerce sales increased by abillion in 2024, with functional food and health supplements among the most popular categories. The Ministry of Trade has indicated that this digital shift reflects improved online purchasing infrastructure, creating opportunities for companies with strong direct-to-consumer platforms to expand their reach.

Scope of the Report

|

By Product Type |

Inulin Fructooligosaccharides (FOS) Galactooligosaccharides (GOS) Mannan-oligosaccharides (MOS) Other Types |

|

By Application |

Food & Beverages Dietary Supplements Animal Feed Infant Formula |

|

By Source |

Plant-Based Dairy-Based Synthetic |

|

By Form |

Powder Liquid Capsules |

|

By Region |

Java Sumatra Kalimantan Sulawesi Bali & Nusa Tenggara |

Products

Key Target Audience

Investors and Venture Capitalist Firms

Banks and Financial Institutions

Government and Regulatory Bodies (e.g., Ministry of Health Indonesia, National Agency of Drug and Food Control)

Food & Beverage Manufacturers

Nutraceutical Companies

Animal Feed Producers

E-commerce Retailers

Distribution and Supply Chain Partners

Companies

Players Mentioned in the Report

Cargill, Inc.

DuPont de Nemours, Inc.

FrieslandCampina

Abbott Laboratories

Beneo GmbH

Jarrow Formulas

Ingredion Incorporated

Clasado Biosciences

Yakult Honsha Co., Ltd.

Roquette Frres

Kerry Group

Sensus B.V.

Cosucra Groupe Warcoing

Nexira

Tata Chemicals Ltd.

Table of Contents

1. Indonesia Prebiotics Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Indonesia Prebiotics Market Size (in USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Indonesia Prebiotics Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Health Awareness

3.1.2. Rise in Functional Food Demand

3.1.3. Government Health Initiatives

3.1.4. Urbanization and Lifestyle Changes

3.2. Market Challenges

3.2.1. High Production Costs

3.2.2. Limited Consumer Awareness

3.2.3. Regulatory Constraints

3.3. Opportunities

3.3.1. Innovation in Product Formulations

3.3.2. Expansion into Emerging Regions

3.3.3. Strategic Partnerships and Collaborations

3.4. Trends

3.4.1. Demand for Organic Prebiotics

3.4.2. Growth in Dairy Alternatives

3.4.3. Rise in Probiotic-Prebiotic Combinations

3.5. Government Regulation

3.5.1. Food Safety Standards

3.5.2. Labeling Requirements

3.5.3. Import and Export Regulations

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competitive Ecosystem

4. Indonesia Prebiotics Market Segmentation

4.1. By Product Type (in Value %)

4.1.1. Inulin

4.1.2. Fructooligosaccharides (FOS)

4.1.3. Galactooligosaccharides (GOS)

4.1.4. Mannan-oligosaccharides (MOS)

4.1.5. Other Types

4.2. By Application (in Value %)

4.2.1. Food & Beverages

4.2.2. Dietary Supplements

4.2.3. Animal Feed

4.2.4. Infant Formula

4.3. By Source (in Value %)

4.3.1. Plant-Based

4.3.2. Dairy-Based

4.3.3. Synthetic

4.4. By Form (in Value %)

4.4.1. Powder

4.4.2. Liquid

4.4.3. Capsules

4.5. By Region (in Value %)

4.5.1. Java Kalimantan

4.5.2. Sumatra

4.5.3. Sulawesi

4.5.4 Bali & Nusa Tenggara

5. Indonesia Prebiotics Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Cargill, Inc.

5.1.2. DuPont de Nemours, Inc.

5.1.3. FrieslandCampina

5.1.4. Abbott Laboratories

5.1.5. Beneo GmbH

5.1.6. Jarrow Formulas

5.1.7. Ingredion Incorporated

5.1.8. Clasado Biosciences

5.1.9. Yakult Honsha Co., Ltd.

5.1.10. Roquette Frres

5.1.11. Kerry Group

5.1.12. Sensus B.V.

5.1.13. Cosucra Groupe Warcoing

5.1.14. Nexira

5.1.15. Tata Chemicals Ltd.

5.2. Cross-Comparison Parameters (Market Position, Revenue, Distribution Reach, Research & Development, Product Portfolio, Regional Presence, Market Share, Strategic Partnerships)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Joint Ventures

5.8. Government Support Initiatives

5.9. Product Launches and Innovations

6. Indonesia Prebiotics Market Regulatory Framework

6.1. Food and Safety Regulations

6.2. Nutritional Labeling Requirements

6.3. Import/Export Regulations

6.4. Compliance with National Health Guidelines

7. Indonesia Prebiotics Future Market Size (in USD Bn)

7.1. Projected Market Growth

7.2. Key Factors Influencing Future Growth

8. Indonesia Prebiotics Future Market Segmentation

8.1. By Product Type (in Value %)

8.2. By Application (in Value %)

8.3. By Source (in Value %)

8.4. By Form (in Value %)

8.5. By Region (in Value %)

9. Indonesia Prebiotics Market Analysts Recommendations

9.1. Total Addressable Market (TAM)/Serviceable Available Market (SAM)/Serviceable Obtainable Market (SOM) Analysis

9.2. Customer Cohort Analysis

9.3. Strategic Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial step focuses on constructing a comprehensive map of stakeholders within the Indonesia Prebiotics Market. Extensive desk research and proprietary data are utilized to identify the critical factors influencing the market's growth trajectory.

Step 2: Market Analysis and Construction

This phase involves compiling historical data related to market size, adoption rates, and revenue growth. We also assess market penetration levels and distribution channel statistics to ensure reliable data for further analysis.

Step 3: Hypothesis Validation and Expert Consultation

Industry hypotheses are formulated and validated through structured interviews with industry experts. Their insights into market trends and operational challenges are essential in corroborating quantitative findings.

Step 4: Research Synthesis and Final Output

The final step synthesizes all data, leveraging feedback from industry players to produce a validated report. This ensures accuracy in assessing market segmentation, competitive landscape, and future growth prospects.

Frequently Asked Questions

How big is the Indonesia Prebiotics Market?

The Indonesia Prebiotics Market is valued at USD 200 million, driven by consumer interest in gut health and functional foods that offer digestive benefits.

What are the key challenges in the Indonesia Prebiotics Market?

Challenges in the Indonesia Prebiotics Market include high production costs and limited consumer awareness, which can restrict market adoption, particularly in rural areas.

Who are the major players in the Indonesia Prebiotics Market?

Key players in the Indonesia Prebiotics Market include Cargill, Abbott Laboratories, FrieslandCampina, and DuPont, all known for their innovative product portfolios and extensive distribution networks.

What are the growth drivers for the Indonesia Prebiotics Market?

Indonesia Prebiotics Market growth is propelled by rising health consciousness, increased consumption of functional foods, and government support for dietary health initiatives.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.