Indonesia Printed Electronics Market Outlook to 2030

Region:Asia

Author(s):Sanjna

Product Code:KROD550

November 2024

87

About the Report

Indonesia Printed Electronics Market Overview

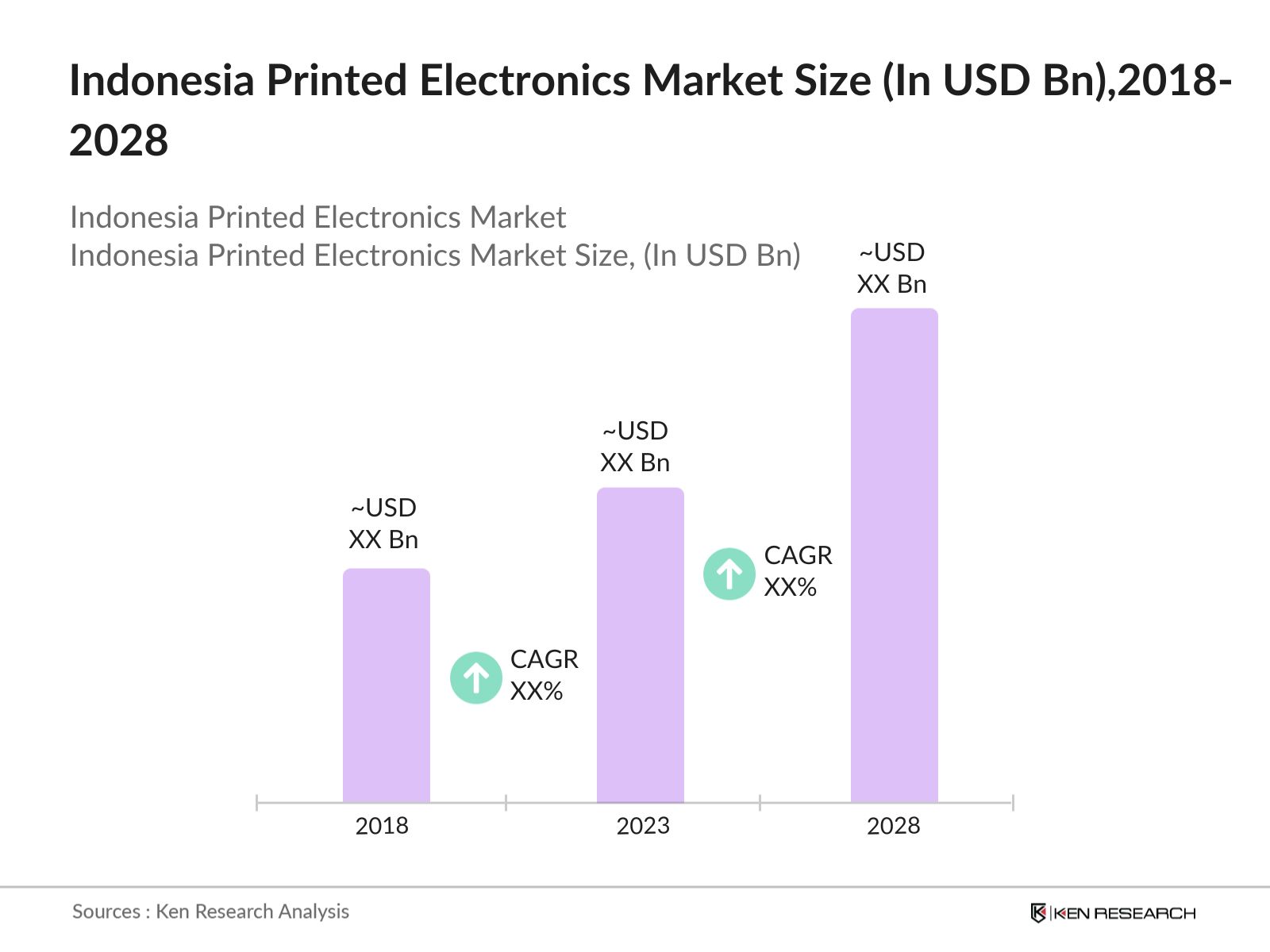

- Indonesia Printed Electronics Market has been growing at a notable rate. This is reflected by Global Printed Electronics Market reaching a valuation of $72.5 billion. The growth is supported by advancements in printing technologies, enabling the production of low-cost and high-performance electronic components.

- Key players in the Indonesia Printed Electronics Market include PT. Flextronics, PT. Indolux Electronics, and PT. Graphene Indonesia. These companies are leading the market with their innovative products and extensive distribution networks. Their focus on research and development has positioned them as leaders in the adoption and implementation of printed electronics technology.

- Jakarta and Surabaya are the dominant cities in the Indonesia Printed Electronics Market. Jakarta, being the capital city, hosts numerous technology companies and research institutions, making it a hub for innovation. Surabaya, with its strategic location and industrial base, has become a key center for the manufacturing and distribution of printed electronics.

- In 2024, Microsoft has announced a significant investment of $1.7 billion aimed at enhancing cloud and AI infrastructure in Indonesia. This investment is set to span four years and includes plans to train 840,000 individuals in AI skills, aligning with Indonesia's ambitions for digital transformation and economic growth.

Indonesia Printed Electronics Market Segmentation

The Indonesia Printed Electronics Market can be segmented based on several factors:

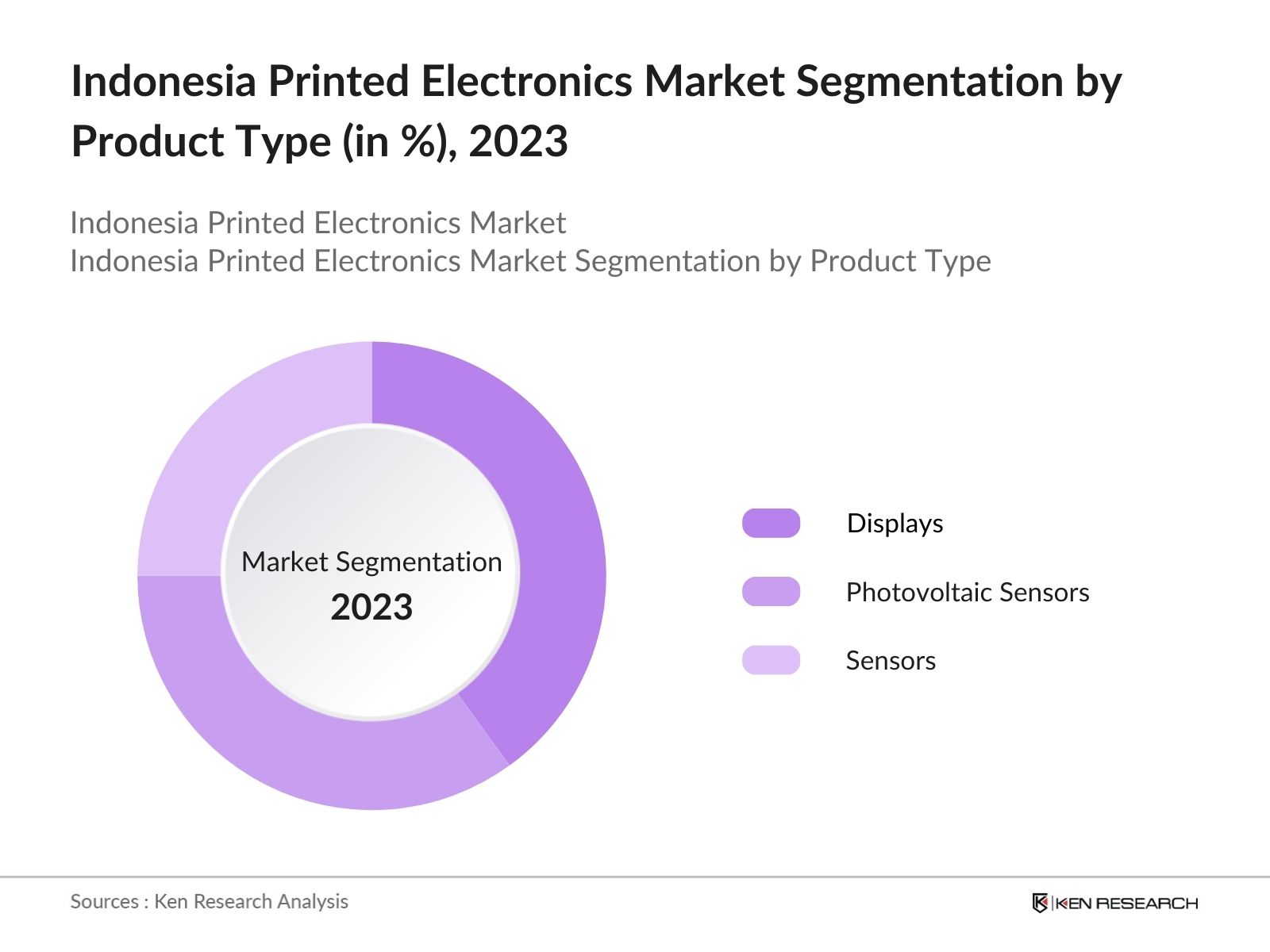

By Product Type: Indonesia Printed Electronics Market is segmented by Product Type into Displays, Photovoltaic Cells & Sensors. In 2023, the Indonesia Printed Electronics Market is led by the Displays sub-segment, driven by increasing demand for flexible and lightweight displays in consumer electronics and advertising. The dominance of Displays is attributed to their versatility and rising adoption across various applications, making them the most prominent product type in the market, ahead of Photovoltaic Cells and Sensors.

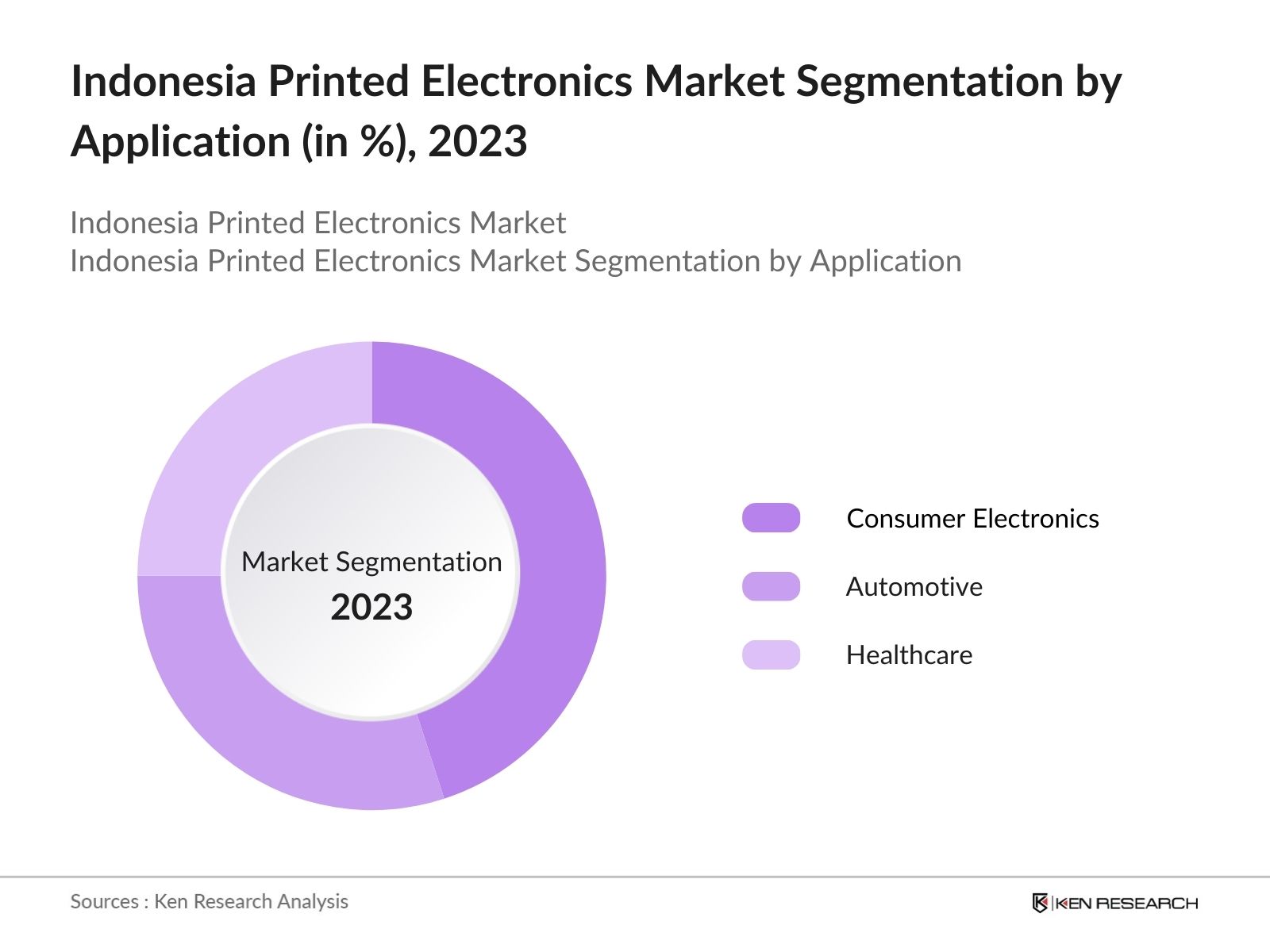

By Application: Indonesia Printed Electronics Market is segmented by End User into Consumer Electronics, Automotive & Healthcare. In 2023, the Consumer Electronics sub-segment leads the Indonesia Printed Electronics Market, driven by the widespread use of printed electronics in smartphones, tablets, and wearable gadgets. This dominance is fueled by ongoing innovations as companies strive to meet the growing consumer demand for advanced and efficient electronic products, positioning Consumer Electronics ahead of Automotive and Healthcare in the market.

By Region: Indonesia Printed Electronics Market is segmented by region into North, South, East & West. In 2023, the northern region leads the Indonesia Printed Electronics Market, holding the highest share. This dominance is driven by the presence of major technology companies, research institutions, and strong government support, which have collectively made the northern region a key hub for printed electronics innovation and manufacturing, outpacing other regions in the market.

Indonesia Printed Electronics Market Competitive Landscape

|

Company Name |

Establishment Year |

Headquarters |

|

PT. Flextronics |

1990 |

Jakarta |

|

PT. Indolux Electronics |

1995 |

Surabaya |

|

PT. Graphene Indonesia |

2005 |

Bandung |

|

PT. Polytronik |

2000 |

Yogyakarta |

|

PT. NanoTech |

2010 |

Jakarta |

- Pt. Flextronics: In 2024, PT Flextronics Indonesia has been actively exporting a range of products to the United States. Notable shipments include two ICT machines were sent to Los Angeles, California, weighing 1,210 kg. Several vacuum cleaners were shipped to Los Angeles and Long Beach, California, with weights ranging from approximately 27,000 kg to 13,716 kg for various orders.

- Pt. Nanotech: In 2022, PT Nanotech Indonesia Global Tbk conducted its initial public offering (IPO), issuing 1.285 billion shares at a price of IDR 100 per share. The IPO was part of the company's strategy to enhance its capital base and support its growth in the nanotechnology sector, which includes applications in materials, health, aquaculture, and other fields.

Indonesia Printed Electronics Industry Analysis

Indonesia Printed Electronics Market Growth Drivers:

- Increased Adoption of Renewable Energy Solutions: Indonesia possesses the largest geothermal reserves globally, estimated at 23.7 GW, with a target to achieve 7.24 GW of operational capacity by 2025. Indonesia's push towards harnessing its vast geothermal reserves is set to drive significant growth in the printed electronics market, particularly in photovoltaic applications.

- Government Support for Advanced Manufacturing: Digital Industry Centre 4.0 (PIDI 4.0) was launched in 2021; this scheme is instrumental in manufacturing printed electronics. It enables manufacturers to enhance their supply chains through digitalization, fostering innovation, and accelerating the adoption of advanced manufacturing technologies.

- Growing Demand in the Consumer Electronics Sector: Printed electronics are increasingly being integrated into various consumer gadgets. The mobile device market is the largest subsector of the consumer electronics market in Indonesia, with 190 million smartphone users across the country in 2023. This trend is driven by consumer preference for lightweight, durable, and energy-efficient products, which printed electronics uniquely provide.

Indonesia Printed Electronics Market Challenges:

- High Initial Costs and Technical Complexity: One of the primary challenges facing the Indonesia Printed Electronics Market is the high initial cost of setting up production facilities and the technical complexity involved in manufacturing printed electronics. This high entry barrier limits the number of new entrants in the market and slows down the overall market expansion.

- Limited Awareness and Expertise: There is a significant gap in awareness and technical expertise related to printed electronics among manufacturers and consumers in Indonesia. This lack of knowledge hampers the adoption rate and restricts the market from reaching its full potential.

Indonesia Printed Electronics Market Government Initiatives:

- Digital Infrastructure Development: In 2023, The Ministry of Communication and Informatics has set ambitious goals to improve Indonesia's digital infrastructure. This includes the development of upstream infrastructure such as fiber optic cables, Base Transceiver Stations (BTS), and satellites. These developments are crucial for providing the necessary infrastructure for the growth of printed electronics and other digital technologies in Indonesia.

- National Data Centre (PDN): The establishment of the National Data Centre (PDN) is a critical part of Indonesia's digital strategy. The first PDN, built to Tier-IV international standards, is located approximately 40 kilometers outside Jakarta and is equipped with 25,000 CPU cores, 40 petabytes of storage, and 200 TB of memory. This supports efficient state administration and data interoperability, which are essential for the development and application of printed electronics.

Indonesia Printed Electronics Future Market Outlook

Indonesia Printed Electronics Market is expected to witness exponential growth by 2028. The increasing adoption of printed electronics in various sectors, coupled with government initiatives and technological advancements, will drive this growth.

Future Trends

- Expansion of the Renewable Energy Sector: The renewable energy sector is projected to drive the demand for printed photovoltaic cells over the next five years. This expansion will contribute to the market's growth, supported by technological advancements and cost reductions in printed photovoltaic cells.

- Advancements in Printed Electronics Manufacturing Technologies: Technological advancements in printing techniques and materials are expected to revolutionize the printed electronics market by 2028. Innovations such as nano-printing and roll-to-roll manufacturing will enhance production efficiency and reduce costs. These advancements will lead to an increase in production capacity, making printed electronics more accessible and widespread across various applications.

Scope of the Report

|

By Product Type |

Displays Photovoltaic Cells Sensors |

|

By Application |

Consumer Electronics Automotive Healthcare |

|

By Region |

North South East West |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Electronics Manufacturers

Automotive Companies

Renewable Energy Companies

Consumer Electronics Retailers

Industrial Automation Companies

Healthcare and Medical Device Companies

Telecommunications Companies

Banks & Financial Institutions

Government & Regulatory Bodies (Ministry of Industry, Ministry of Communication & IT etc.)

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report:

PT. Flextronics

PT. Indolux Electronics

PT. Graphene Indonesia

PT. Polytronik

PT. NanoTech

PT. Elektron

PT. TechnoFlex

PT. Suryatech

PT. MegaTek

PT. InnoPrint

PT. Digitronics

PT. ElecPrint

PT. FutureTek

PT. SmartPrint

PT. PrintTech

Table of Contents

1. Indonesia Printed Electronics Market Overview

1.1 Indonesia Printed Electronics Market Taxonomy

2. Indonesia Printed Electronics Market Size (in USD Bn), 2018-2023

3. Indonesia Printed Electronics Market Analysis

3.1 Indonesia Printed Electronics Market Growth Drivers

3.2 Indonesia Printed Electronics Market Challenges and Issues

3.3 Indonesia Printed Electronics Market Trends and Development

3.4 Indonesia Printed Electronics Market Government Regulation

3.5 Indonesia Printed Electronics Market SWOT Analysis

3.6 Indonesia Printed Electronics Market Stake Ecosystem

3.7 Indonesia Printed Electronics Market Competition Ecosystem

4. Indonesia Printed Electronics Market Segmentation, 2023

4.1 Indonesia Printed Electronics Market Segmentation by Product Type (in value %), 2023

4.2 Indonesia Printed Electronics Market Segmentation by Application (in value %), 2023

4.3 Indonesia Printed Electronics Market Segmentation by Region (in value %), 2023

5. Indonesia Printed Electronics Market Competition Benchmarking

5.1 Indonesia Printed Electronics Market Cross-Comparison (no. of employees, company overview, business strategy, USP, recent development, operational parameters, financial parameters and advanced analytics)

6. Indonesia Printed Electronics Future Market Size (in USD Bn), 2023-2028

7. Indonesia Printed Electronics Future Market Segmentation, 2028

7.1 Indonesia Printed Electronics Market Segmentation by Product Type (in value %), 2028

7.2 Indonesia Printed Electronics Market Segmentation by Application (in value %), 2028

7.3 Indonesia Printed Electronics Market Segmentation by Region (in value %), 2028

8. Indonesia Printed Electronics Market Analysts Recommendations

8.1 Indonesia Printed Electronics Market TAM/SAM/SOM Analysis

8.2 Indonesia Printed Electronics Market Customer Cohort Analysis

8.3 Indonesia Printed Electronics Market Marketing Initiatives

8.4 Indonesia Printed Electronics Market White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.

Step 2: Market Building:

Collating statistics on Indonesia Printed Electronics Market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for Indonesia Printed Electronics Market. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step 3: Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry exerts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step 4: Research Output:

Our team will approach multiple printed electronics suppliers and distributors companies and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from printed electronics suppliers and distributors companies.

Frequently Asked Questions

01 How big is Indonesia Printed Electronics Market?

Indonesia Printed Electronics Market has been growing at a notable rate. This is driven by Global Printed Electronics Market which reached a valuation of $72.5 billion. The growth is supported by advancements in printing technologies

02 What are the growth drivers of the Indonesia Printed Electronics Market?

Growth drivers of Indonesia Printed Electronics Market include the increased adoption of renewable energy solutions, government support through initiatives like Electronics 4.0, and the growing demand for printed electronics in the consumer electronics sector. These factors are significantly contributing to market expansion.

03 What are challenges in Indonesia Printed Electronics Market?

Challenges include high initial costs of setting up production facilities, technical complexities, and limited awareness and expertise among manufacturers and consumers. Additionally, the market faces supply chain disruptions due to its dependence on imported raw materials.

04 Who are major players in Indonesia Printed Electronics Market?

Major players in Indonesia Printed Electronics Market include PT. Flextronics, PT. Indolux Electronics, and PT. Graphene Indonesia. These companies are leading the market with their innovative products and extensive distribution networks.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.