Indonesia Ready to Drink Tea Market Outlook to 2030

Region:Asia

Author(s):Meenakshi Bisht

Product Code:KROD7735

November 2024

82

About the Report

Indonesia Ready to Drink Tea Market Overview

- The Indonesia Ready to Drink (RTD) Tea Market is valued at USD 1.1 billion, based on a five-year historical analysis. This growth is largely driven by the rising demand for convenient and healthy beverages. With increasing health awareness among consumers, particularly among millennials, there is a growing shift toward RTD tea, which is perceived as a healthier alternative to carbonated drinks. Moreover, the expansion of distribution channels, including convenience stores and online platforms, has contributed to the market's growth.

- Cities like Jakarta, Surabaya, and Bandung dominate the Indonesia RTD tea market due to their large urban populations, higher disposable incomes, and greater awareness of health-related products. Urbanization in these cities has led to a fast-paced lifestyle, increasing the demand for ready-to-consume products like RTD tea. Additionally, the presence of a wide range of retail outlets and cafes in these cities makes RTD tea more accessible, fueling its growth in these regions.

- Indonesias trade policies impact the RTD tea market, especially regarding import and export regulations. The government has implemented import restrictions on certain raw materials used in RTD tea production, such as sugar and flavor additives, to promote the use of locally sourced ingredients. In 2022, the government introduced new tariffs on imported sugar, further encouraging local sourcing. Additionally, export incentives for tea producers have been expanded to boost international trade, allowing Indonesian RTD tea brands to increase their presence in foreign markets.

Indonesia Ready to Drink Tea Market Segmentation

By Product Type: The Indonesia Ready to Drink tea market is segmented by product type into black tea, green tea, herbal tea, and fruit-infused tea. Recently, black tea has held a dominant market share under this segmentation due to its longstanding cultural presence and its perceived health benefits. Black tea, often associated with boosting heart health and reducing oxidative stress, remains a popular choice among consumers. Moreover, the established brands like Sinar Sosro have played a key role in maintaining this segments dominance.

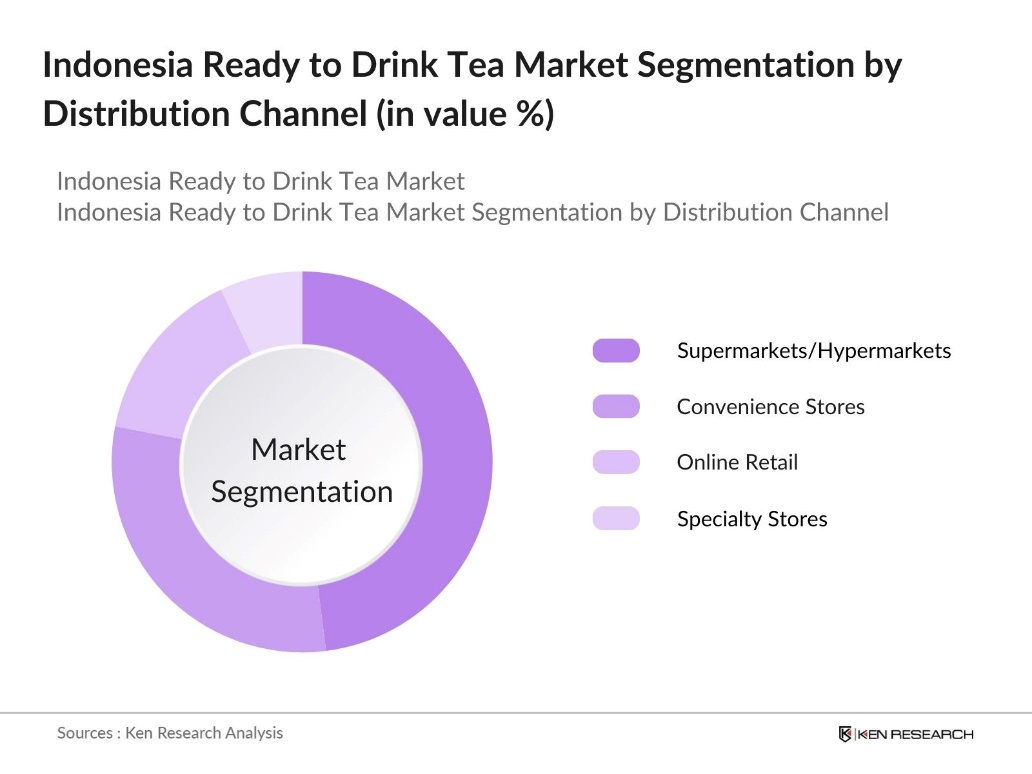

By Distribution Channel: The RTD tea market in Indonesia is segmented by distribution channels into supermarkets/hypermarkets, convenience stores, online retail, and specialty stores. Supermarkets/hypermarkets have a dominant market share because they offer consumers the convenience of a one-stop shopping experience. They also provide ample shelf space for various RTD tea brands and promotional deals, making them a preferred destination for bulk buyers and urban consumers.

Indonesia Ready to Drink Tea Market Competitive Landscape

The market is dominated by both local and international players who have solidified their market presence through extensive product offerings and distribution networks. Companies like PT Sinar Sosro and Coca-Cola Amatil Indonesia hold significant shares due to their wide distribution networks and established consumer trust. This consolidation reflects the influence these major companies hold over the market, shaping both pricing strategies and product development.

|

Company |

Established |

Headquarters |

Market Penetration Strategy |

Product Portfolio |

Distribution Network |

Brand Loyalty |

Sustainability Initiatives |

|

PT Sinar Sosro |

1940 |

Bekasi, Indonesia |

|||||

|

Coca-Cola Amatil Indonesia |

1992 |

Jakarta, Indonesia |

|||||

|

Unilever Indonesia |

1933 |

Jakarta, Indonesia |

|||||

|

PT Mayora Indah Tbk |

1948 |

Jakarta, Indonesia |

|||||

|

F&N Beverages |

1883 |

Singapore |

Indonesia Ready to Drink Tea Industry Analysis

Growth Drivers

- Growing Demand for Convenience Beverages: As urbanization progresses, busy lifestyles are driving the demand for convenience-oriented products like RTD tea. Indonesias urban population reached 58.57% in 2023, contributing to increased consumption of on-the-go beverages. RTD tea offers a quick, refreshing option that aligns with the fast-paced lives of urban consumers. Moreover, the retail market for beverages in Indonesia is further supporting the RTD tea markets growth as convenience becomes a key purchasing factor for many Indonesians.

- Rising Disposable Income: Indonesias gross national income (GNI) per capita increased to USD 4,580 in 2022, providing consumers with greater purchasing power to explore premium RTD tea options. As disposable incomes rise, consumers are more likely to spend on higher-quality and niche tea varieties, including organic and functional beverages. This shift toward premiumization has been particularly noticeable in urban areas, where middle-class consumption of RTD tea has grown significantly. The expanding middle-class population now accounts for approximately 45 million people in Indonesia.

- Urbanization and Lifestyle Shifts: Urbanization in Indonesia is influencing consumer preferences toward ready-to-drink (RTD) beverages. The fast pace of urban life has led to an increased demand for convenient, on-the-go beverage options, with RTD tea emerging as a popular choice. This shift is also linked to lifestyle changes that emphasize health and wellness, making RTD tea a favored option among health-conscious consumers. The market is witnessing sustained growth as urban lifestyles continue to evolve, and the demand for convenient, healthier beverage options remains strong.

Market Challenges

- High Competition from Other Beverage Segments: Indonesias beverage industry is highly competitive, with RTD tea facing strong competition from segments like RTD coffee, energy drinks, and fruit juices. To stand out, RTD tea brands need to emphasize health benefits and unique flavors. The market is fragmented, with established brands dominating various beverage categories, making it challenging for RTD tea to carve a niche, particularly in the premium or health-conscious segments.

- Supply Chain Disruptions: Supply chain disruptions remain a significant challenge for the RTD tea market in Indonesia. Issues related to logistics, raw material availability, and operational costs have affected the timely production and distribution of RTD tea products. External factors such as rising transportation costs and delays in shipping networks further complicate supply chains, impacting manufacturers' ability to meet demand consistently.

Indonesia Ready to Drink Tea Market Future Outlook

The Indonesia Ready to Drink Tea market is expected to witness significant growth, driven by the increasing consumer demand for healthier and convenient beverage options. With the continuous expansion of e-commerce and the rising trend of health-conscious products, RTD tea manufacturers are expected to introduce new flavors and healthier variations to meet consumer preferences. Additionally, advancements in sustainable packaging are expected to contribute to the markets growth as companies focus on reducing their environmental footprint.

Market Opportunities

- Expansion of Organic and Functional Tea Varieties: The rising demand for organic and functional beverages creates an opportunity for the RTD tea market in Indonesia. Consumers are increasingly interested in healthier and natural products, prompting RTD tea brands to expand their offerings with organic and functional varieties. These beverages, often associated with benefits like improved digestion or enhanced immunity, appeal especially to younger, health-conscious consumers, positioning the market for growth in this category.

- Growth in E-commerce Platforms: Indonesia's rapidly growing e-commerce sector offers a significant opportunity for RTD tea brands. The rise of online shopping enables these brands to reach a broader audience and provide convenient access to a variety of products. E-commerce also allows for targeted marketing strategies, particularly towards health-conscious consumers seeking premium and organic RTD tea options, enhancing brand visibility and market penetration.

Scope of the Report

|

Product Type |

Black Tea Green Tea Herbal Tea Fruit-Infused Tea |

|

Distribution Channel |

Supermarkets/Hypermarkets Convenience Stores Online Retail Specialty Stores |

|

Packaging Type |

Bottles Cans Cartons |

|

Sweetener Type |

Sugar-Sweetened Sugar-Free Natural Sweeteners |

|

Region |

Java Bali Sumatra Kalimantan Sulawesi |

Products

Key Target Audience

Beverage Manufacturers

E-commerce Platform

Airlines and Travel Companies

Cafeteria and Catering Services

Packaging Industry

Government and Regulatory Bodies (BPOM, Ministry of Trade)

Investors and venture capital Firms

Banks and Financial Institutions

Companies

Players Mentioned in the Report

PT Sinar Sosro

Coca-Cola Amatil Indonesia

Unilever Indonesia

PT Mayora Indah Tbk

F&N Beverages

Nestl Indonesia

Suntory Garuda Beverage

Danone Aqua

The Coca-Cola Company

Indofood Asahi Sukses Beverage

Table of Contents

1. Indonesia Ready to Drink Tea Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Indonesia Ready to Drink Tea Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Indonesia Ready to Drink Tea Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Health Consciousness

3.1.2. Growing Demand for Convenience Beverages

3.1.3. Rising Disposable Income

3.1.4. Urbanization and Lifestyle Shifts

3.2. Market Challenges

3.2.1. High Competition from Other Beverage Segments

3.2.2. Supply Chain Disruptions

3.2.3. Fluctuating Raw Material Costs

3.3. Opportunities

3.3.1. Expansion of Organic and Functional Tea Varieties

3.3.2. Growth in E-commerce Platforms

3.3.3. International Market Penetration

3.4. Trends

3.4.1. Shift Toward Natural and Low-Sugar Alternatives

3.4.2. Adoption of Sustainable Packaging

3.4.3. Integration of Local Flavors

3.5. Government Regulations

3.5.1. Food Safety and Standards Regulations

3.5.2. Import and Export Policies

3.5.3. Packaging and Labeling Standards

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. Indonesia Ready to Drink Tea Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Black Tea

4.1.2. Green Tea

4.1.3. Herbal Tea

4.1.4. Fruit-Infused Tea

4.2. By Distribution Channel (In Value %)

4.2.1. Supermarkets/Hypermarkets

4.2.2. Convenience Stores

4.2.3. Online Retail

4.2.4. Specialty Stores

4.3. By Packaging Type (In Value %)

4.3.1. Bottles

4.3.2. Cans

4.3.3. Cartons

4.4. By Sweetener Type (In Value %)

4.4.1. Sugar-Sweetened

4.4.2. Sugar-Free

4.4.3. Natural Sweeteners

4.5. By Region (In Value %)

4.5.1. Java

4.5.2. Bali

4.5.3. Sumatra

4.5.4. Kalimantan

4.5.5. Sulawesi

5. Indonesia Ready to Drink Tea Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1. PT Sinar Sosro

5.1.2. Coca-Cola Amatil Indonesia

5.1.3. PT Mayora Indah Tbk

5.1.4. Unilever Indonesia

5.1.5. F&N Beverages

5.1.6. Nestl Indonesia

5.1.7. Suntory Garuda Beverage

5.1.8. Danone Aqua

5.1.9. The Coca-Cola Company

5.1.10. Indofood Asahi Sukses Beverage

5.1.11. Marjan Tea

5.1.12. AICE

5.1.13. Ultrajaya Milk Industry Tbk

5.1.14. Gold Peak Tea

5.1.15. Vitasoy Indonesia

5.2 Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue, Product Portfolio, Distribution Reach, Market Penetration Strategy, Sustainability Initiatives)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7 Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Indonesia Ready to Drink Tea Market Regulatory Framework

6.1. Food and Beverage Safety Standards

6.2. Import and Export Compliance

6.3. Packaging and Environmental Laws

7. Indonesia Ready to Drink Tea Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Indonesia Ready to Drink Tea Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Distribution Channel (In Value %)

8.3. By Packaging Type (In Value %)

8.4. By Sweetener Type (In Value %)

8.5. By Region (In Value %)

9. Indonesia Ready to Drink Tea Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The first step involves mapping all stakeholders in the Indonesia Ready to Drink Tea Market. This includes conducting extensive desk research and analyzing secondary data from industry reports, government databases, and proprietary sources to define the major variables influencing the market.

Step 2: Market Analysis and Construction

In this phase, historical data is compiled to evaluate market growth and penetration. We analyze the ratio of RTD tea sales across various distribution channels and assess market revenue generation to ensure reliable market estimates.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses developed from the data are validated through consultations with industry experts. Computer-assisted telephone interviews (CATIs) are conducted with executives from RTD tea manufacturers and retailers to gain operational insights and confirm market data.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing all collected data and verifying it through direct engagement with major players. This ensures that the market insights are accurate, validated, and reflective of current market trends.

Frequently Asked Questions

01 How big is the Indonesia Ready to Drink Tea Market?

The Indonesia Ready to Drink Tea Market is valued at USD 1.1 billion, driven by growing health consciousness and the expansion of retail networks.

02 What are the challenges in the Indonesia Ready to Drink Tea Market?

The Indonesia Ready to Drink Tea Market faces challenges such as intense competition from other beverages, fluctuating raw material prices, and supply chain disruptions affecting product availability.

03 Who are the major players in the Indonesia Ready to Drink Tea Market?

Key players in Indonesia Ready to Drink Tea Market include PT Sinar Sosro, Coca-Cola Amatil Indonesia, Unilever Indonesia, and F&N Beverages. These companies dominate due to their strong distribution networks and well-established consumer trust.

04 What are the growth drivers of the Indonesia Ready to Drink Tea Market?

The Indonesia Ready to Drink Tea Market growth is driven by increasing consumer demand for convenient beverages, health consciousness, and the rise of e-commerce platforms. Urbanization has also played a significant role in boosting demand.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.