Indonesia Satellite Communication Market Outlook to 2030

Region:Asia

Author(s):Shubham Kashyap

Product Code:KROD9156

December 2024

91

About the Report

Indonesia Satellite Communication Market Overview

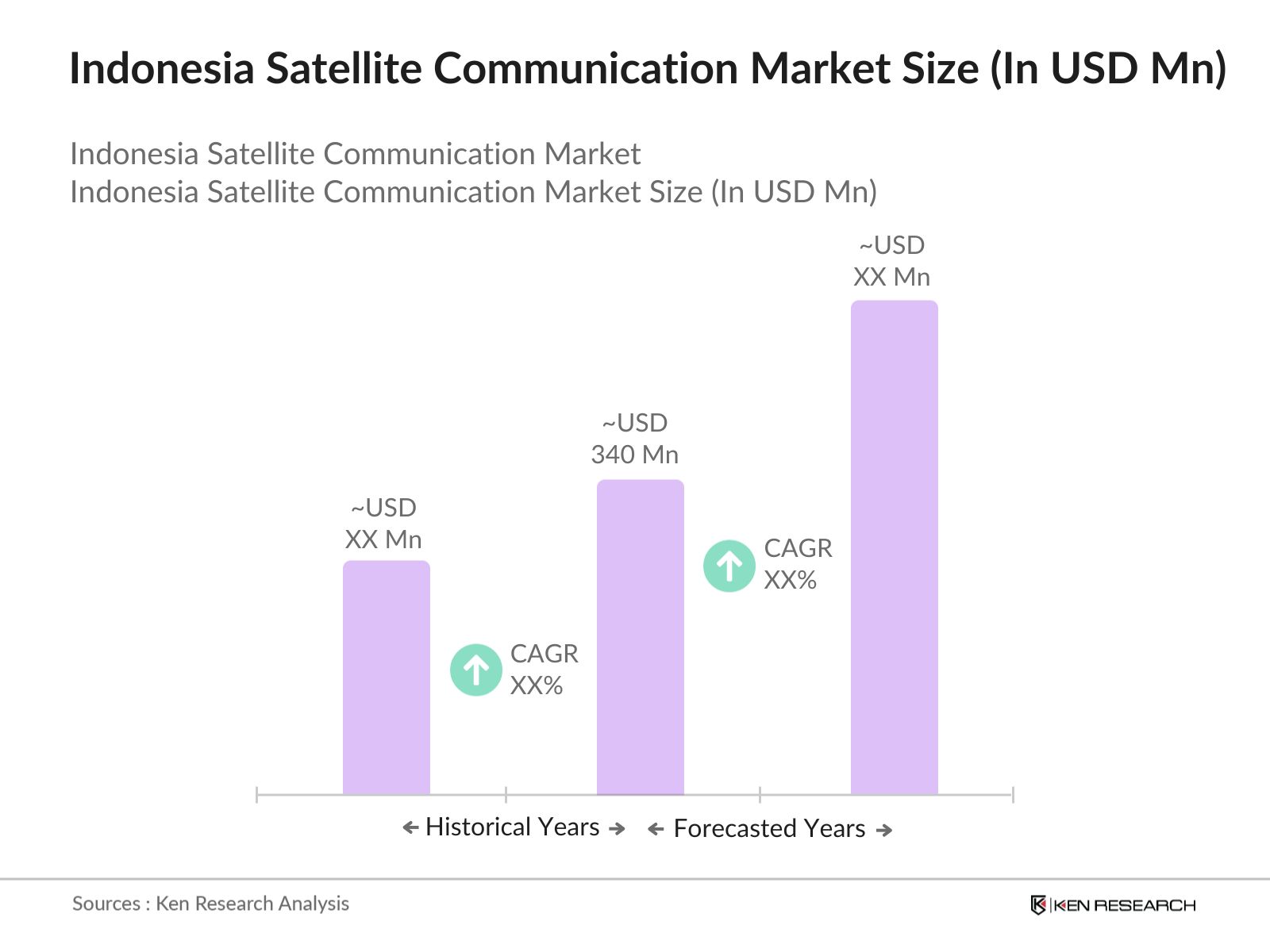

- The Indonesia Satellite Communication market is valued at USD 340 million, primarily driven by the country's vast geographical diversity, which necessitates reliable communication solutions across its numerous islands. This market is experiencing robust growth due to increasing government investment in digital infrastructure and the demand for satellite services in sectors such as maritime, aviation, and telecommunications. The push for enhancing connectivity in remote areas and the growing need for high-speed internet are solidifying Indonesia's position as a key player in the global satellite communication landscape.

- Major demand centers for satellite communication in Indonesia include Jakarta, Surabaya, and Batam. Jakarta leads due to its status as the capital and a commercial hub with extensive IT infrastructure. Surabaya, as the second-largest city, benefits from a growing technology sector and increased digital initiatives. Batam, being a strategic location for maritime activities, sees significant demand for satellite communication solutions, highlighting the region's commitment to enhancing connectivity across both urban and remote areas.

- The Indonesian government has developed the National Satellite Master Plan (NSMP) to optimize satellite utilization and enhance connectivity across the archipelago. Launched in 2022, the NSMP outlines plans for deploying new satellites, with a target to increase satellite capacity substantially over the next five years. This initiative aims to reduce dependency on foreign satellites and improve service quality, particularly in remote areas. The plan also includes the development of indigenous satellite technologies to foster local innovation and reduce operational costs.

Indonesia Satellite Communication Market Segmentation

- By Offering: The market is segmented by offering into ground equipment and services. The services segment currently holds a dominant market share, as businesses and government agencies increasingly recognize the critical role of satellite communication in achieving reliable connectivity. The growing demand for satellite internet services, especially in remote and underserved regions, propels this segment forward. The integration of innovative service models and the expansion of service providers further enhance the appeal of satellite communication services in Indonesia.

- By Platform: The market is further segmented by platform into portable, land, maritime, and airborne. The land platform segment dominates the market due to its extensive application in various industries, including telecommunications and broadcasting. The rise in demand for reliable terrestrial satellite services and the increasing deployment of land-based satellite systems for both fixed and mobile applications drive this segment's growth, making it an essential part of Indonesia's satellite communication landscape.

Indonesia Satellite Communication Market Competitive Landscape

The Indonesia Satellite Communication market is characterized by a mix of established local players and international companies that compete for market share. Key players include PT Telekomunikasi Indonesia, PT Pasifik Satelit Nusantara, and Intelsat S.A. These companies leverage their extensive service portfolios and investment in technological advancements to maintain leadership positions within the market.

Indonesia Satellite Communication Market Analysis

Growth Drivers

- Archipelagic Geography Necessitating Satellite Solutions: Indonesia, comprising over 17,000 islands, faces unique challenges in providing consistent communication services across its vast archipelago. The country's reliance on satellite communication is evident as around 44% of its population resides in remote areas, which are often inaccessible by traditional terrestrial networks. The Indonesian government has recognized this need, aiming to connect its rural and isolated regions effectively. In 2022, Indonesia's rural connectivity rate was around 55%, indicating significant room for improvement. The government plans to enhance satellite communication infrastructure to address these geographic challenges and improve connectivity for over 27 million underserved citizens.

- Increase in Demand for Reliable Connectivity: The need for reliable satellite communication is increasing as businesses and government agencies aim to improve connectivity in remote areas. With numerous islands and varying geography, satellite communication provides the necessary infrastructure to enhance telecommunications and internet access. According to the Indonesian Ministry of Communication and Information Technology, substantial investments are being made to expand satellite coverage and improve connectivity, indicating a growing recognition of the value that satellite services bring to both urban and rural populations.

- Government Initiatives for Digital Infrastructure: The Indonesian government is actively investing in digital infrastructure as part of its broader economic development strategy. Initiatives aimed at enhancing internet connectivity and digital services across the nation are significantly impacting the satellite communication market. With programs focusing on expanding broadband access to underserved regions, the government's commitment to improving digital communication through satellite technology is driving the market's growth trajectory.

Challenges

- High Initial Investment and Operational Costs: The satellite communication market in Indonesia faces significant challenges related to high initial investments and operational costs. The setup costs for satellite systems create barriers for new entrants, making it difficult to compete effectively in the market. The ongoing operational costs per satellite can be substantial, adding to the financial burden and deterring potential investments. This situation is particularly challenging in a market where profitability remains uncertain. Additionally, ongoing maintenance and upgrades contribute to the overall financial strain, highlighting the need for government incentives and support to encourage further investment in satellite infrastructure.

- Regulatory and Spectrum Allocation Issues: Regulatory challenges and spectrum allocation issues significantly impact the growth of the satellite communication market in Indonesia. The country has faced delays in licensing new satellite operators, hindering the timely deployment of satellite services and resulting in a lack of competition and innovation in the sector. The complexity of the spectrum allocation process complicates the establishment of new satellite networks, as compliance with both national regulations and international treaties is necessary. Addressing these regulatory hurdles is essential for fostering a more competitive and efficient satellite communication market.

Indonesia Satellite Communication Market Future Outlook

The Indonesia Satellite Communication market is expected to witness significant growth, fueled by ongoing government initiatives and advancements in satellite technology. As the demand for high-speed internet and reliable communication solutions continues to rise, the market will see increased investment in satellite infrastructure and innovative service offerings. The push for improved connectivity in remote regions will be a driving force, ensuring that satellite communication remains a vital component of Indonesia's digital landscape.

Future Market Opportunities

- Adoption of Low Earth Orbit (LEO) Satellites: The introduction of LEO satellites represents a transformative opportunity for the Indonesian satellite communication market. These satellites can provide high-speed internet with low latency, which is crucial for enhancing service delivery in remote areas. As LEO technology matures, companies that invest in this segment are likely to capture significant market share by offering improved connectivity solutions tailored to the unique needs of Indonesian consumers.

- Integration of IoT Applications: The growing Internet of Things (IoT) ecosystem presents substantial opportunities for satellite communication services. As more devices become interconnected, the demand for reliable communication channels to support IoT applications will increase. Satellite networks can facilitate the communication needs of various IoT deployments, particularly in agriculture, transportation, and logistics, driving further growth in the market. Providers that can develop IoT-compatible satellite solutions will position themselves favorably in the evolving landscape.

Scope of the Report

|

By Offering |

Ground Equipment Services |

|

By Platform |

Portable Land Maritime Airborne |

|

By End User |

Telecommunications Maritime Aviation Government and Defense Media and Entertainment |

|

By Frequency Band |

C Band Ku Band Ka Band L Band X Band |

|

By Region |

Java Sumatra Kalimantan Sulawesi Papua |

Products

Key Target Audience

Investors and Venture Capitalist Firms

Banks and Financial Institutions

Government and Regulatory Bodies (Ministry of Communication and Information Technology)

Telecommunications Operators

Broadcasting Companies

Maritime and Aviation Industries

Defense and Government Agencies

Satellite Service Providers

Companies

Players Mentioned in the Report

PT Telekomunikasi Indonesia

PT Pasifik Satelit Nusantara

PT Indosat Tbk

SES S.A.

Intelsat S.A.

PT Bank Rakyat Indonesia

PT Bank Mandiri

PT Bank Negara Indonesia

PT Indosat Ooredoo

PT Smartfren Telecom

PT XL Axiata

Hughes Network Systems

Gilat Satellite Networks

Telesat Canada

OneWeb

Table of Contents

Indonesia Satellite Communication Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

Indonesia Satellite Communication Market Size (In USD Million)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

Indonesia Satellite Communication Market Analysis

3.1. Growth Drivers

3.1.1. Archipelagic Geography Necessitating Satellite Solutions

3.1.2. Government Initiatives for Digital Infrastructure

3.1.3. Expansion of 5G and High-Throughput Satellites

3.1.4. Rising Demand in Maritime and Aviation Sectors

3.2. Market Challenges

3.2.1. High Initial Investment and Operational Costs

3.2.2. Regulatory and Spectrum Allocation Issues

3.2.3. Competition from Terrestrial Communication Networks

3.3. Opportunities

3.3.1. Integration of Low Earth Orbit (LEO) Satellites

3.3.2. Partnerships with International Satellite Operators

3.3.3. Development of Indigenous Satellite Technologies

3.4. Trends

3.4.1. Adoption of High-Throughput Satellites (HTS)

3.4.2. Growth in Satellite-Based Internet Services

3.4.3. Enhanced Focus on Satellite IoT Applications

3.5. Government Regulation

3.5.1. National Satellite Master Plan

3.5.2. Spectrum Licensing Policies

3.5.3. Incentives for Private Sector Participation

3.5.4. International Collaboration Agreements

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competitive Landscape

Indonesia Satellite Communication Market Segmentation

4.1. By Offering (In Value %)

4.1.1. Ground Equipment

4.1.2. Services

4.2. By Platform (In Value %)

4.2.1. Portable

4.2.2. Land

4.2.3. Maritime

4.2.4. Airborne

4.3. By End-User Vertical (In Value %)

4.3.1. Maritime

4.3.2. Defense and Government

4.3.3. Enterprises

4.3.4. Media and Entertainment

4.3.5. Other End-User Verticals

4.4. By Frequency Band (In Value %)

4.4.1. C Band

4.4.2. Ku Band

4.4.3. Ka Band

4.4.4. L Band

4.4.5. X Band

4.5. By Region (In Value %)

4.5.1. Java

4.5.2. Sumatra

4.5.3. Kalimantan

4.5.4. Sulawesi

4.5.5. Papua

Indonesia Satellite Communication Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. PT Telekomunikasi Indonesia (Telkom)

5.1.2. PT Pasifik Satelit Nusantara (PSN)

5.1.3. PT Indosat Tbk

5.1.4. PT Bank Rakyat Indonesia (BRI) Sat

5.1.5. PT Bank Negara Indonesia (BNI) Sat

5.1.6. PT Bank Mandiri Sat

5.1.7. PT Bank Tabungan Negara (BTN) Sat

5.1.8. PT Bank Central Asia (BCA) Sat

5.1.9. PT Bank Danamon Sat

5.1.10. PT Bank CIMB Niaga Sat

5.1.11. PT Bank Permata Sat

5.1.12. PT Bank Panin Sat

5.1.13. PT Bank Maybank Indonesia Sat

5.1.14. PT Bank OCBC NISP Sat

5.1.15. PT Bank UOB Indonesia Sat

5.2. Cross Comparison Parameters (Revenue, Market Share, Service Portfolio, Technological Capabilities, Regional Presence, Strategic Initiatives, Partnerships, Customer Base)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.6.1. Venture Capital Funding

5.6.2. Government Grants

5.6.3. Private Equity Investments

Indonesia Satellite Communication Market Regulatory Framework

6.1. Licensing Procedures

6.2. Spectrum Allocation Policies

6.3. Compliance Requirements

6.4. Certification Processes

Indonesia Satellite Communication Future Market Size (In USD Million)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

Indonesia Satellite Communication Future Market Segmentation

8.1. By Offering (In Value %)

8.2. By Platform (In Value %)

8.3. By End-User Vertical (In Value %)

8.4. By Frequency Band (In Value %)

8.5. By Region (In Value %)

Indonesia Satellite Communication Market Analysts Recommendations

9.1. Total Addressable Market (TAM), Serviceable Available Market (SAM), Serviceable Obtainable Market (SOM) Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Indonesia Satellite Communication market. This step relies on extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the Indonesia Satellite Communication market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and validated through computer-assisted telephone interviews (CATI) with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple satellite communication manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the Indonesia Satellite Communication market.

Frequently Asked Questions

01. How big is the Indonesia Satellite Communication market?

The Indonesia Satellite Communication market is valued at USD 340 million, driven by unique geographic challenges and government initiatives aimed at enhancing digital infrastructure.

02. What are the challenges in the Indonesia Satellite Communication market?

Challenges in the Indonesia Satellite Communication market include high initial investment costs, regulatory hurdles in spectrum allocation, and competition from terrestrial communication providers.

03. Who are the major players in the Indonesia Satellite Communication market?

Key players in the Indonesia Satellite Communication market include PT Telekomunikasi Indonesia, PT Pasifik Satelit Nusantara, and PT Indosat Tbk. These companies dominate due to their extensive service offerings and strong infrastructure.

04. What are the growth drivers of the Indonesia Satellite Communication market?

The Indonesia Satellite Communication market is propelled by government investments in digital connectivity, advancements in satellite technology, and rising demand for reliable communication services across various sectors.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.