Indonesia Satellite Communication (SATCOM) Market Outlook to 2030

Region:Asia

Author(s):Abhinav kumar

Product Code:KROD7605

December 2024

91

About the Report

Indonesia Satellite Communication Market Overview

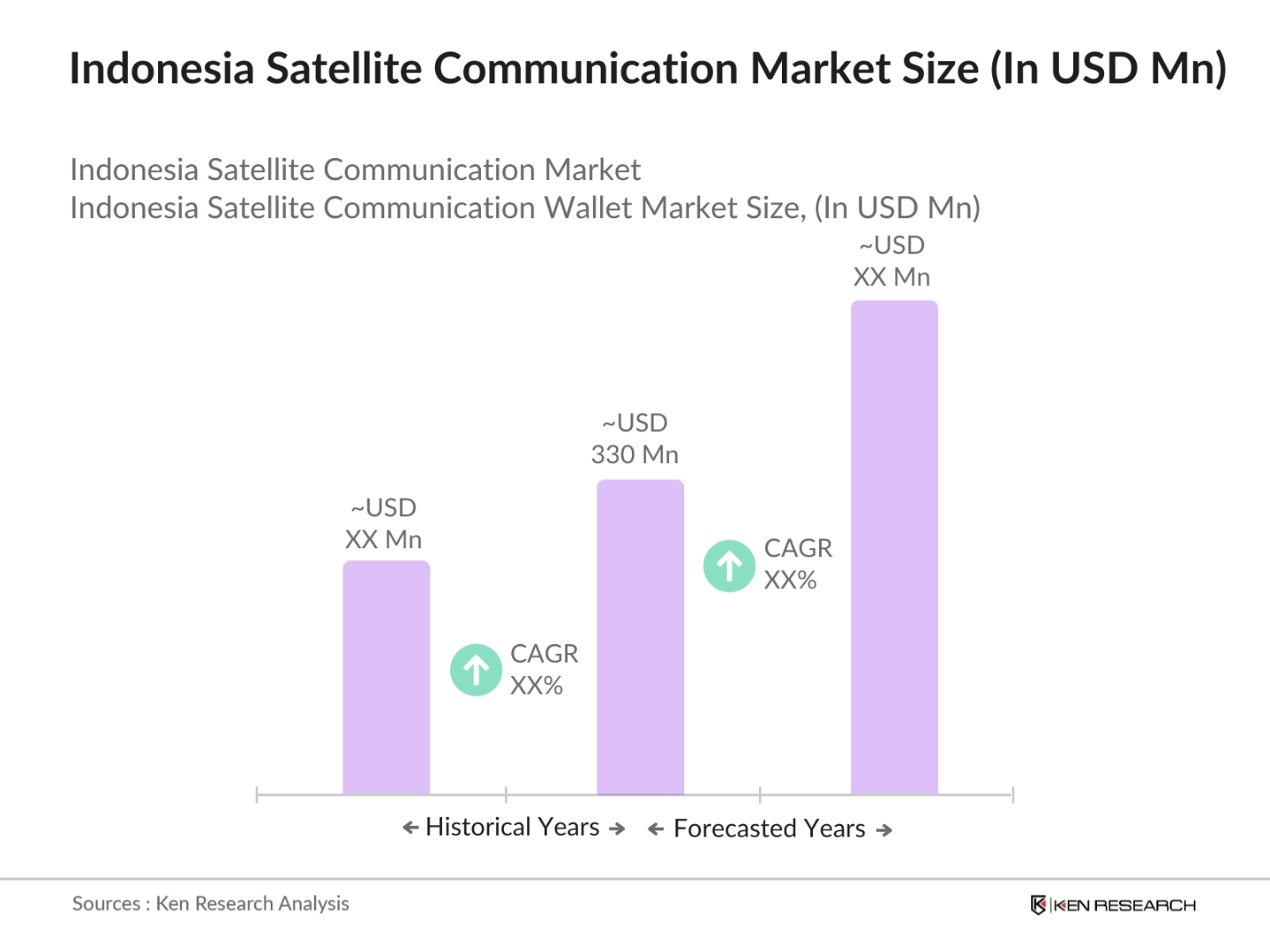

- The Indonesia Satellite Communication (SATCOM) market, valued at USD 330 million, is driven primarily by the expanding need for robust communication infrastructure across remote and underserved regions. Over the past few years, the market has been influenced by increasing government initiatives aimed at promoting digital transformation and the need for secure communication networks in both public and private sectors. The rise of low-earth orbit (LEO) satellites and the deployment of next-generation geostationary satellites have contributed significantly to this growth.

- Jakarta and Surabaya lead the demand for satellite communication services in Indonesia, largely due to their roles as economic hubs and their focus on technological advancements. Jakarta, as the countrys capital, drives the demand for government-related satellite services, while Surabayas growing industrial base creates demand for commercial SATCOM applications. Additionally, the countrys remote islands and provinces see increased demand for satellite services to bridge communication gaps.

- The Ministry of Communication and Information Technology is responsible for regulating the allocation of spectrum for satellite services in Indonesia. The governments focus on ensuring efficient spectrum usage is key to supporting the growing demand for SATCOM services. In 2022, the ministry allocated new frequency bands to accommodate next-generation satellite technologies, which is critical for ensuring uninterrupted satellite services across the country.

Indonesia Satellite Communication Market Segmentation

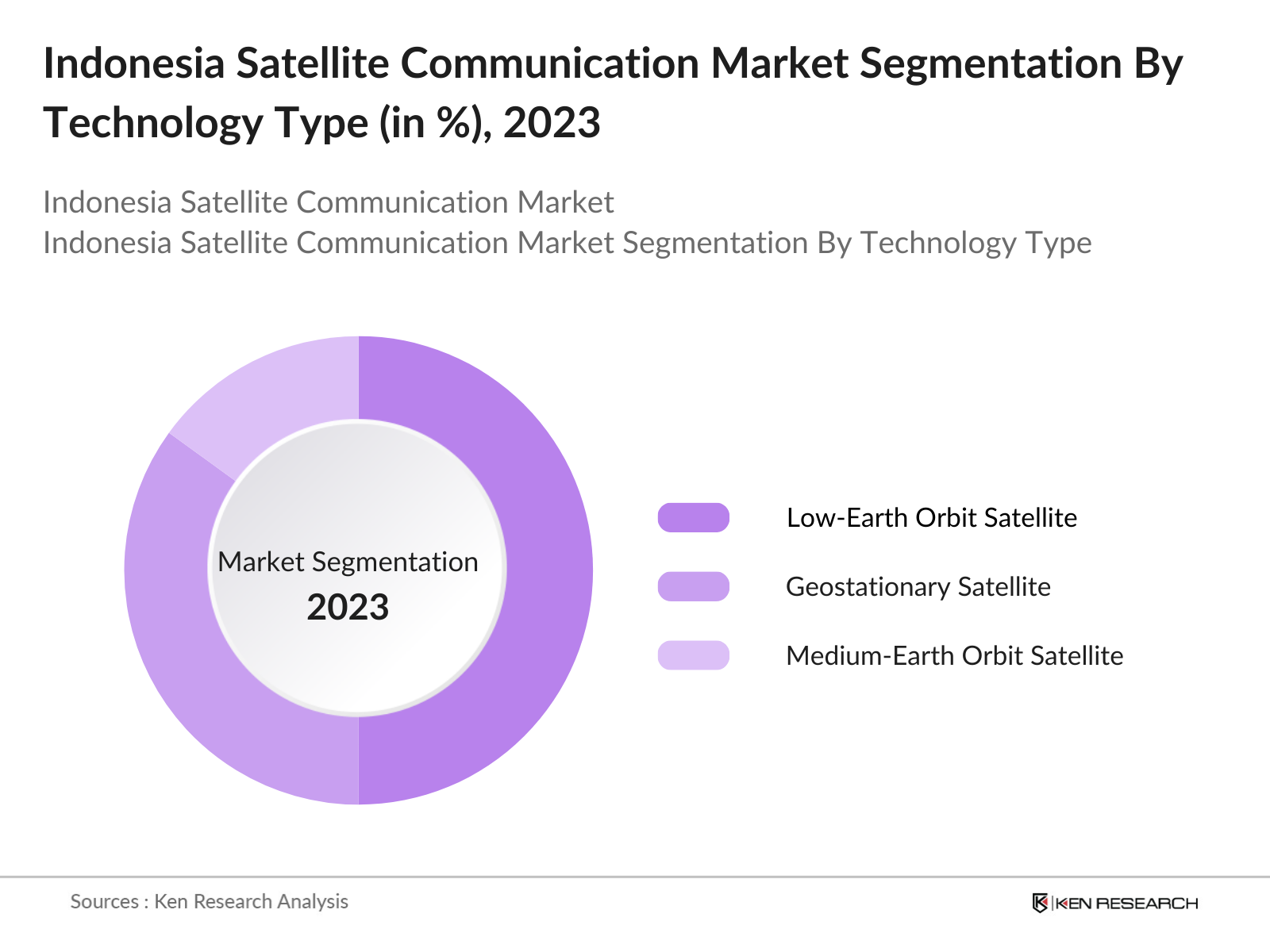

By Technology Type: Indonesia SATCOM market is segmented by technology type into geostationary satellite systems, low-earth orbit satellites (LEO), and medium-earth orbit satellites (MEO). The low-earth orbit satellite segment has shown dominance in the market due to its increasing application in providing high-speed internet services to underserved areas. LEO satellites, with their closer proximity to the Earth, allow for reduced latency, which is particularly crucial for real-time communication and data transfer services in Indonesias remote and island regions.

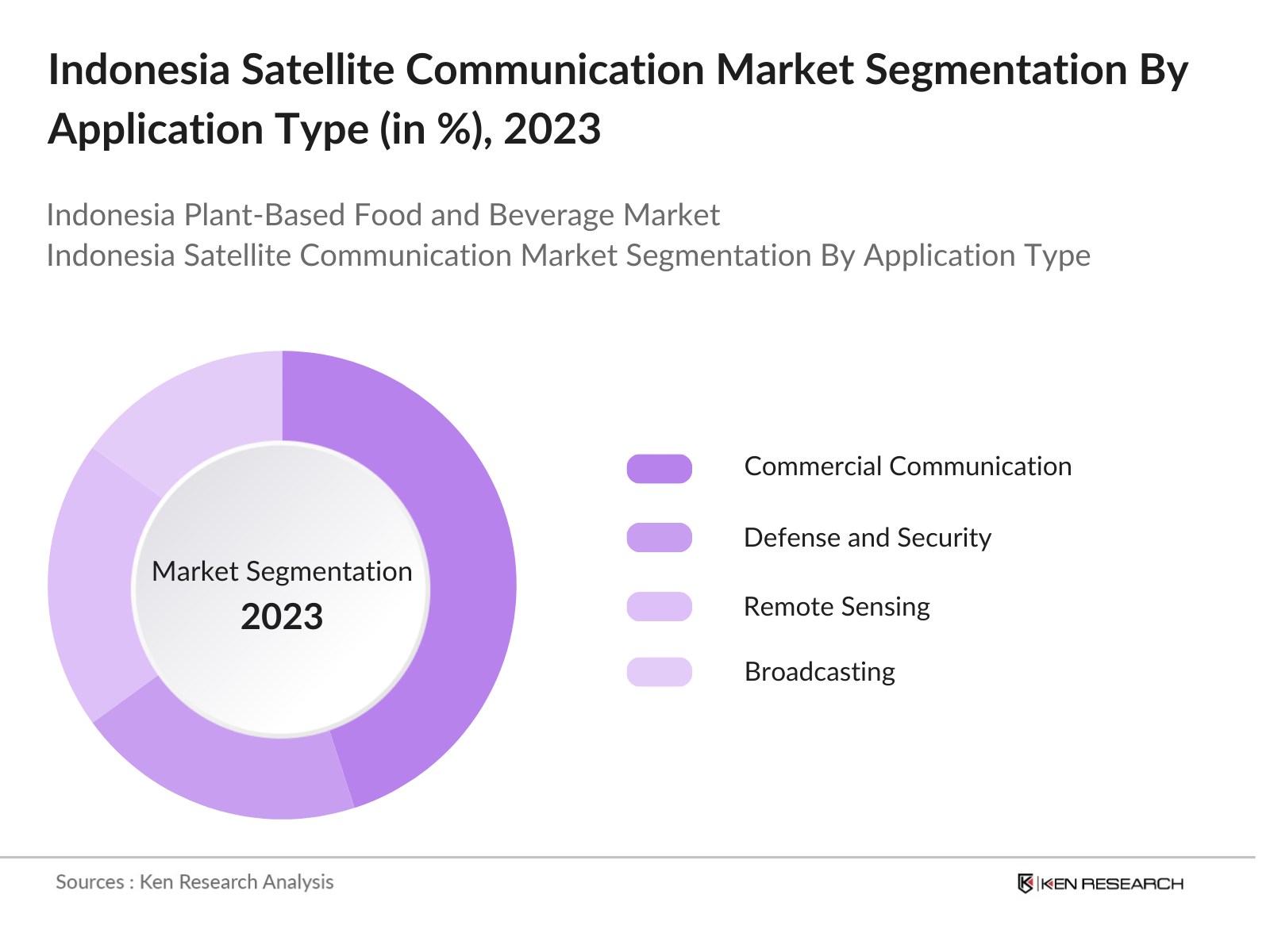

By Application: The Indonesia SATCOM market is also segmented by application into commercial communication, defense and security, remote sensing, broadcasting, and maritime and aviation. Commercial communication is currently the dominant application due to the high demand for satellite-based broadband connectivity in the countrys rural areas. The rapid expansion of mobile network operators and internet service providers relying on satellite backhaul has propelled this segments dominance, making satellite communication a key element of Indonesia's digital economy.

Indonesia Satellite Communication Market Competitive Landscape

The Indonesia SATCOM market is dominated by key players that offer a variety of services ranging from satellite broadband to defense communications. The presence of international satellite providers alongside local companies indicates a robust competitive environment. These companies leverage advanced satellite technologies such as high-throughput satellites (HTS) and low-latency LEO satellite constellations to cater to a wide range of industries including telecom, maritime, and aviation.

|

Company |

Establishment Year |

Headquarters |

No. of Satellites |

Satellite Coverage |

Revenue (USD) |

Technology Type |

Key Application |

Key Regions |

|

PT Pasifik Satelit Nusantara |

1991 |

Jakarta, Indonesia |

_ |

_ |

_ |

_ |

_ |

_ |

|

PT Telekomunikasi Indonesia |

1856 |

Bandung, Indonesia |

_ |

_ |

_ |

_ |

_ |

_ |

|

Indosat Ooredoo |

1967 |

Jakarta, Indonesia |

_ |

_ |

_ |

_ |

_ |

_ |

|

SES S.A. |

1985 |

Luxembourg |

_ |

_ |

_ |

_ |

_ |

_ |

|

Eutelsat |

1977 |

Paris, France |

_ |

_ |

_ |

_ |

_ |

_ |

Indonesia Satellite Communication Industry Analysis

Growth Drivers

- Expansion of 5G Networks: The rollout of 5G in Indonesia is driving the demand for satellite communication (SATCOM), especially in remote and underserved regions where terrestrial networks are inadequate. SATCOM plays a crucial role in providing backhaul services to these 5G networks. By 2024, Indonesia is expected to have 88,000 base transceiver stations (BTS) deployed to support 5G coverage, requiring robust backhaul solutions like SATCOM. This expansion enhances overall connectivity, supporting digital transformation goals. The Palapa Ring project, which aims to provide high-speed internet across the country, benefits directly from SATCOM technology.

- Increased Demand for Broadband Connectivity: As of 2023, approximately 30% of Indonesia's population still resides in rural areas with limited internet access. The government is working to close this digital divide by leveraging satellite communication to provide broadband connectivity in these underserved regions. SATCOM enables internet access in islands, mountainous areas, and other hard-to-reach regions. The Palapa Ring project has already connected more than 500 remote districts with high-speed internet, boosting SATCOM demand. Government efforts aim to extend broadband services to over 12,000 villages by 2024.

- Government Initiatives: The Indonesian government has invested $1.3 billion in the Palapa Ring project to build a nationwide fiber-optic network, enhancing SATCOMs role in supporting the backbone infrastructure for internet connectivity. The project connects rural and remote regions via satellite, ensuring broadband access to 34 provinces. Additionally, the government aims to grow the digital economy, which is expected to contribute over $140 billion to the GDP by 2025. This emphasizes SATCOMs role in enabling internet services in areas where fiber optics remain unfeasible. Source: Ministry of Communication and Information Technology

Market Challenges

- High Capital Expenditure on Satellite Launches: The deployment of satellites involves high capital expenditures, particularly in the cost of satellite manufacturing, launching, and maintenance. Each satellite launch can cost anywhere between $60 million and $150 million, depending on the satellite's size and purpose. For instance, Indonesias SATRIA-1 satellite, launched in 2023, required an investment of $540 million. These costs pose challenges for both public and private sector operators in expanding SATCOM infrastructure and service offerings.

- Regulatory Barriers: Indonesias SATCOM market faces regulatory challenges, including the lengthy and complex process of obtaining licenses and securing spectrum allocation. The Ministry of Communication and Information Technology regulates satellite spectrum management, and delays or difficulties in securing spectrum can hinder the deployment of new SATCOM services. The World Bank has noted that these regulatory hurdles can slow technological deployment and innovation in the telecommunications sector, impacting the speed of SATCOM adoption.

Indonesia Satellite Communication Market Future Outlook

The Indonesia SATCOM market is poised for considerable growth in the coming years due to a convergence of factors such as rising demand for satellite internet services, government-backed digital transformation initiatives, and the deployment of next-generation satellite technologies. Investments in low-latency and high-speed satellite systems, including LEO constellations, are expected to transform the countrys communication infrastructure, especially in rural and remote regions. Further, the increasing need for secure communication systems for national defense, coupled with the expansion of telemedicine and distance learning services in isolated areas, will drive future demand for SATCOM services. The continued collaboration between private satellite operators and the Indonesian government is likely to accelerate the deployment of advanced satellite communication technologies.

Opportunities

- Emergence of Low-Earth Orbit (LEO) Satellite Systems: The introduction of Low-Earth Orbit (LEO) satellite constellations presents a transformative opportunity for Indonesias SATCOM market. These systems provide faster communication and lower latency compared to traditional geostationary satellites. Companies like SpaceXs Starlink and OneWeb have expressed interest in collaborating with Indonesian firms to enhance internet coverage in underserved regions. By 2024, LEO satellites are expected to significantly reduce the cost of broadband services, making SATCOM more accessible to rural populations.

- Increasing Demand for Maritime and Aviation Connectivity: Given Indonesia's position as the worlds largest archipelagic nation, maritime and aviation sectors are increasingly dependent on reliable satellite communication for operations. SATCOM is essential for ship-to-shore communication, navigation, and real-time monitoring of vessels. With over 70,000 commercial vessels operating in Indonesias waters, the demand for maritime SATCOM services has surged. Similarly, aviation SATCOM demand is growing, with over 100 million air passengers annually requiring real-time in-flight connectivity.

Scope of the Report

|

Technology Type |

Geostationary Satellite Systems Medium Earth Orbit Satellites Low Earth Orbit Satellites High-Throughput Satellites |

|

Application |

Commercial Communication Defense and Security Remote Sensing Broadcasting Maritime and Aviation |

|

Frequency Band |

C-Band Ku-Band Ka-Band X-Band |

|

Service Type |

Fixed Satellite Services Mobile Satellite Services Broadcast Satellite Services Hybrid Satellite Services |

|

Region |

Sumatra Java Kalimantan Sulawesi Papua |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Satellite Communication Operation Companies

Government and Regulatory Bodies (Ministry of Communication and Information Technology)

Defense and Security Agencies (Indonesian National Armed Forces)

Telecommunications Industries

Maritime and Aviation Companies

Investor and Venture Capitalist Firms

Internet Service Providing Companies

Broadcast Media Companies

Companies

Players Mentioned in the Report

PT Pasifik Satelit Nusantara

Telkom Indonesia

Indosat Ooredoo

Inmarsat

SES S.A.

GlobalSat Asia Pacific

Thales Alenia Space

Airbus Defense and Space

Hughes Network Systems

SpaceX

Table of Contents

1. Indonesia SATCOM Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate (Specific to satellite infrastructure expansion, regulatory reforms, and economic impact of SATCOM)

1.4 Market Segmentation Overview

2. Indonesia SATCOM Market Size (In USD Bn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones (Government partnerships, infrastructure investments)

3. Indonesia SATCOM Market Analysis

3.1 Growth Drivers

3.1.1 Expansion of 5G Networks

3.1.2 Increased Demand for Broadband Connectivity

3.1.3 Government Initiatives

3.1.4 Defense and National Security Requirements

3.2 Market Challenges

3.2.1 High Capital Expenditure on Satellite Launches

3.2.2 Regulatory Barriers

3.2.3 Environmental Concerns

3.3 Opportunities

3.3.1 Emergence of Low-Earth Orbit (LEO) Satellite Systems

3.3.2 Increasing Demand for Maritime and Aviation Connectivity

3.3.3 Collaboration with International Satellite Operators

3.4 Trends

3.4.1 Adoption of Software-Defined Satellites

3.4.2 Integration of IoT and Satellite Connectivity

3.4.3 Rising Use of Small Satellites

3.5 Government Regulation

3.5.1 Spectrum Management and Licensing

3.5.2 Regulatory Framework for Commercial Satellites

3.5.3 National Defense SATCOM Programs

3.5.4 Public-Private Partnerships in SATCOM Infrastructure

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces Analysis

3.9 Competition Ecosystem (Highlighting industry-specific competitive dynamics like satellite manufacturing and ground infrastructure development)

4. Indonesia SATCOM Market Segmentation

4.1 By Technology Type (In Value %)

4.1.1 Geostationary Satellite Systems (GEO)

4.1.2 Medium Earth Orbit Satellites (MEO)

4.1.3 Low Earth Orbit Satellites (LEO)

4.1.4 High-Throughput Satellites (HTS)

4.2 By Application (In Value %)

4.2.1 Commercial Communication (Telecom, broadband services)

4.2.2 Defense and Security

4.2.3 Remote Sensing

4.2.4 Broadcasting (Television, radio)

4.2.5 Maritime and Aviation

4.3 By Frequency Band (In Value %)

4.3.1 C-Band

4.3.2 Ku-Band

4.3.3 Ka-Band

4.3.4 X-Band

4.4 By Service Type (In Value %)

4.4.1 Fixed Satellite Services (FSS)

4.4.2 Mobile Satellite Services (MSS)

4.4.3 Broadcast Satellite Services (BSS)

4.4.4 Hybrid Satellite Services

4.5 By Region (In Value %)

4.5.1 Sumatra

4.5.2 Java

4.5.3 Kalimantan

4.5.4 Sulawesi

4.5.5 Papua

5. Indonesia SATCOM Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 PT Pasifik Satelit Nusantara

5.1.2 PT Telekomunikasi Indonesia (Telkom)

5.1.3 Indosat Ooredoo

5.1.4 GlobalSat Asia

5.1.5 SES S.A.

5.1.6 Inmarsat

5.1.7 Eutelsat

5.1.8 Thales Alenia Space

5.1.9 Boeing Space Systems

5.1.10 Airbus Defense and Space

5.1.11 Lockheed Martin

5.1.12 Hughes Network Systems

5.1.13 SpaceX

5.1.14 OneWeb

5.1.15 Yahsat

5.2 Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue, Satellite Capacity, Orbit Type, Frequency Band Utilized, Service Coverage)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers And Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. Indonesia SATCOM Market Regulatory Framework

6.1 National Communication Satellite Policies

6.2 Compliance Requirements for Satellite Operators

6.3 Spectrum Licensing and Allocation

6.4 Certification Processes for SATCOM Infrastructure

7. Indonesia SATCOM Future Market Size (In USD Bn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth (Demand for rural connectivity, LEO constellation deployment)

8. Indonesia SATCOM Future Market Segmentation

8.1 By Technology Type (In Value %)

8.2 By Application (In Value %)

8.3 By Frequency Band (In Value %)

8.4 By Service Type (In Value %)

8.5 By Region (In Value %)

9. Indonesia SATCOM Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis (Enterprise, defense, public sector)

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis (Specific market gaps in infrastructure and service)

Research Methodology

Step 1: Identification of Key Variables

This step involved mapping out the entire ecosystem of the Indonesia SATCOM market, identifying major stakeholders such as satellite operators, end-users (government, defense, telecom), and regulatory bodies. Secondary research through proprietary databases and published government documents was conducted to understand the key variables affecting the market.

Step 2: Market Analysis and Construction

Historical data for the SATCOM market was analyzed to identify growth patterns and market penetration. Key metrics such as satellite deployment rates, service adoption, and market coverage were examined to establish the current market landscape.

Step 3: Hypothesis Validation and Expert Consultation

Market assumptions were validated through discussions with industry experts and representatives from leading satellite communication companies. These consultations provided insights into the operational challenges and financial metrics that impact market growth.

Step 4: Research Synthesis and Final Output

A comprehensive analysis of the Indonesia SATCOM market was developed by synthesizing inputs from primary and secondary sources. The final report includes detailed insights on market segmentation, key growth drivers, and competitive dynamics, ensuring an accurate and data-backed assessment.

Frequently Asked Questions

01. How big is the Indonesia SATCOM Market?

The Indonesia SATCOM market is valued at USD 330 million, driven by increasing demand for broadband connectivity and communication services in remote and underserved regions.

02. What are the challenges in the Indonesia SATCOM Market?

Challenges include high capital expenditure for satellite launches, regulatory barriers in licensing and spectrum allocation, and environmental concerns related to space debris management.

03. Who are the major players in the Indonesia SATCOM Market?

Major players include PT Pasifik Satelit Nusantara, Telkom Indonesia, Inmarsat, SES S.A., and GlobalSat Asia Pacific. These companies dominate due to their extensive satellite fleets, government partnerships, and coverage capabilities.

04. What are the growth drivers of the Indonesia SATCOM Market?

Key growth drivers include the expansion of 5G networks, increasing demand for rural broadband connectivity, government initiatives promoting digital transformation, and the rise of low-latency satellite services.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.