Indonesia Security Services Market Outlook to 2030

Region:Asia

Author(s):Yogita Sahu

Product Code:KROD7820

December 2024

90

About the Report

Indonesia Security Services Market Overview

- The Indonesia Security Services market is valued at USD 1.3 billion, based on a five-year historical analysis. This market is primarily driven by rising corporate security needs across sectors such as manufacturing, retail, and financial services. The rapid increase in urbanization, coupled with heightened security concerns in major cities, has led to a significant demand for both manned guarding services and advanced electronic security solutions.

- Dominant regions in the market include Java, particularly Jakarta, which remains the central hub for corporate and industrial activities. Jakartas importance stems from its role as the business and financial epicenter of Indonesia, attracting multinational corporations and large-scale enterprises that require stringent security services.

- In 2024, the Indonesian government introduced a national certification program aimed at enhancing the training and professionalism of private security firms. As part of this initiative, the government allocated funding to certify over 50,000 security personnel within the next two years. This certification ensures that private security personnel meet national safety and operational standards, thereby improving the credibility and efficiency of security services.

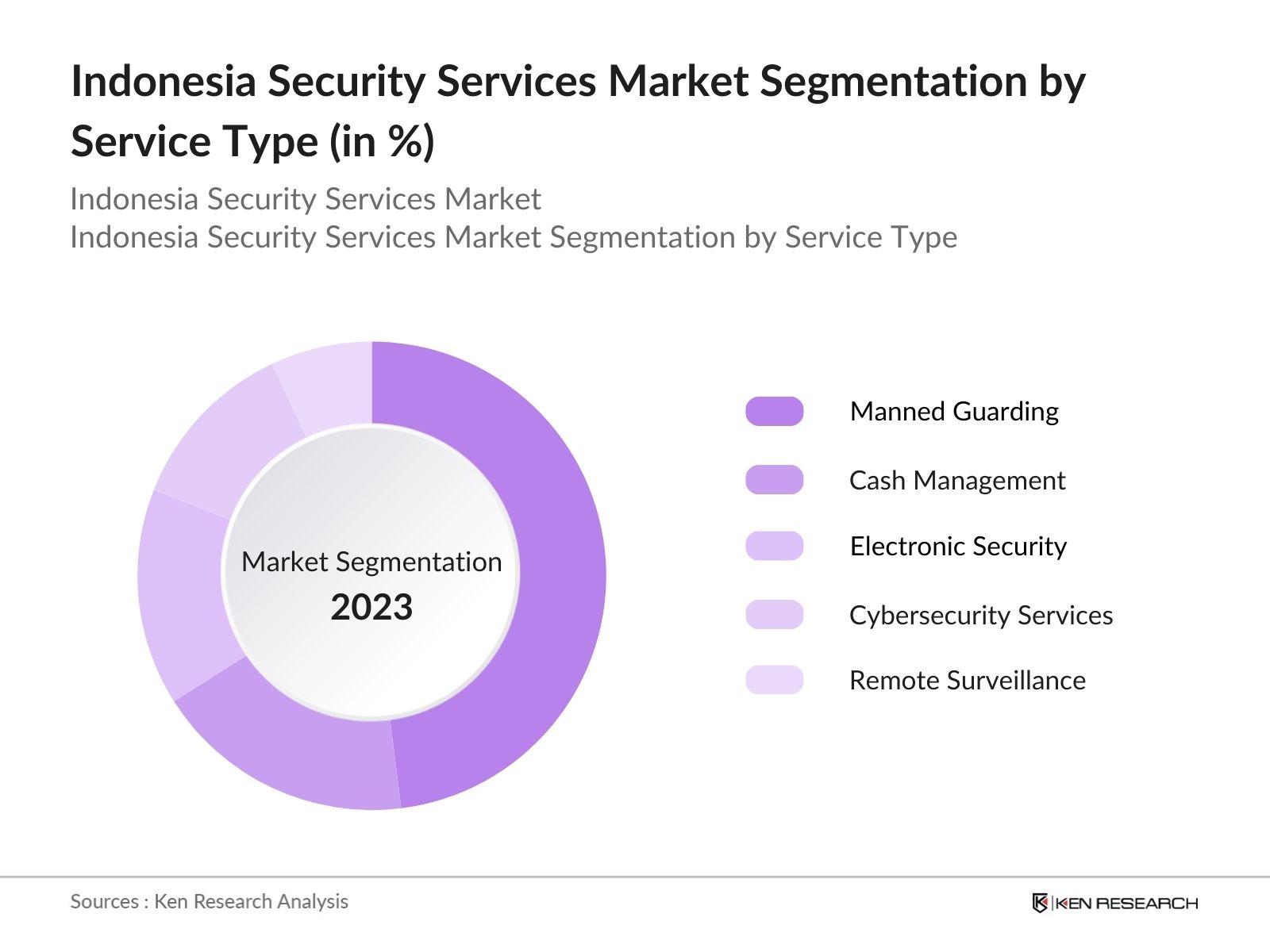

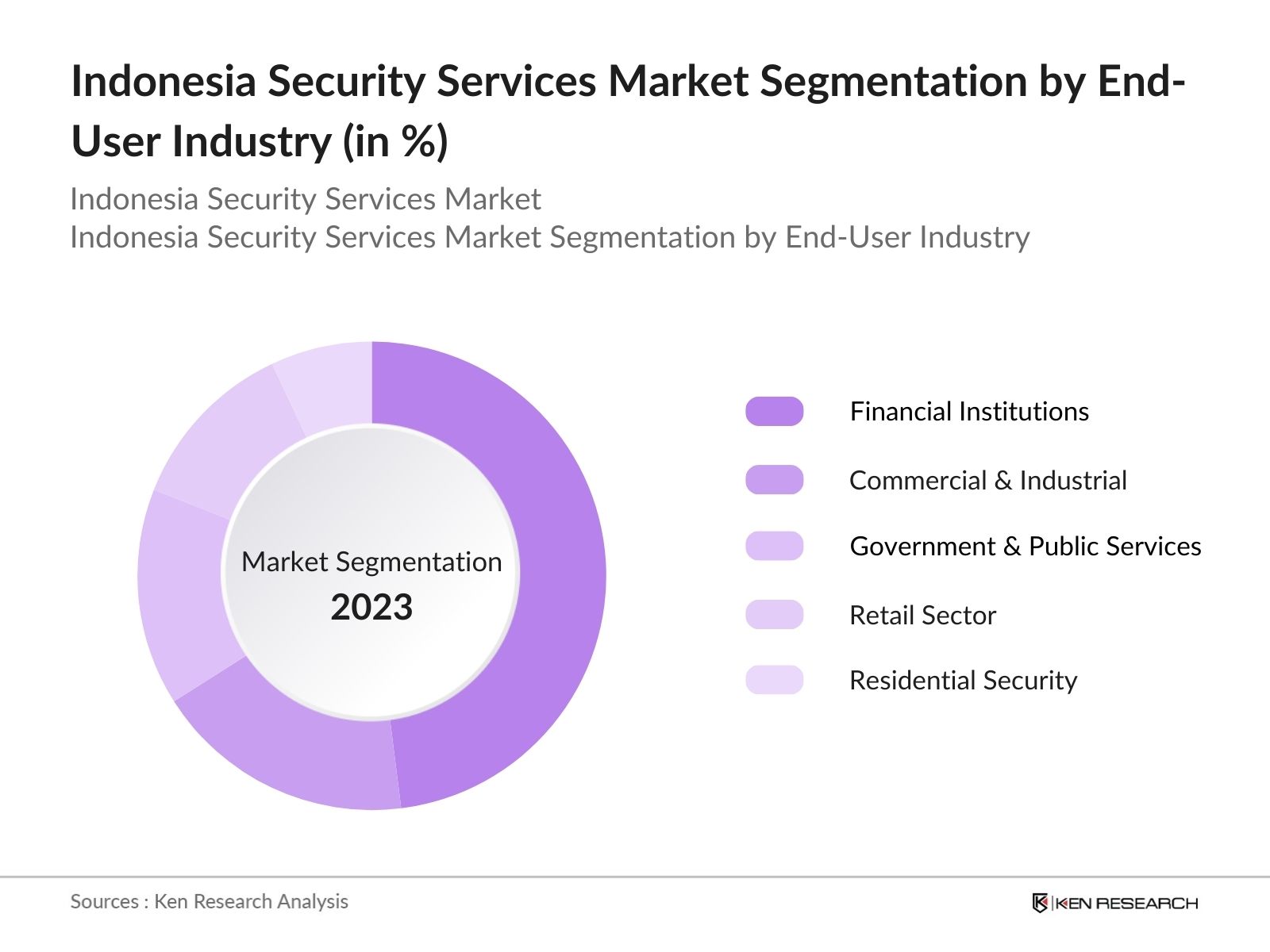

Indonesia Security Services Market Segmentation

By Service Type: The market is segmented by service type into manned guarding, cash management, electronic security solutions, cybersecurity services, and remote surveillance. Among these, manned guarding dominates the market due to the ongoing preference for physical security across industrial, commercial, and governmental institutions. Manned guarding offers real-time response and the presence of personnel, which is highly valued, especially for high-risk sites like financial institutions and public infrastructure.

By End-User Industry: The market is also segmented by end-user industry into commercial and industrial sectors, financial institutions, government and public services, retail sector, and residential security. Financial institutions hold a dominant position, driven by the need for stringent security measures, particularly in cash handling and fraud prevention. Institutions such as banks and insurance firms frequently require a combination of physical security and advanced cybersecurity systems to protect sensitive financial data.

Indonesia Security Services Market Competitive Landscape

The market is characterized by a fragmented landscape, where both international and local players compete for market share. Global security firms like G4S and Securitas AB have a strong presence, but local firms such as PT Bravo Satria Perkasa and PT Andalan Securindo are rapidly gaining market share through competitive pricing and localized services.

|

Company Name |

Establishment Year |

Headquarters |

No. of Employees |

Key Service Offered |

Annual Revenue (USD Mn) |

Client Base |

Technology Integration |

Certifications |

Geographic Presence |

|

G4S Plc |

1901 |

London, UK |

|||||||

|

Securitas AB |

1934 |

Stockholm, SE |

|||||||

|

PT Bravo Satria Perkasa |

1999 |

Jakarta, ID |

|||||||

|

PT Andalan Securindo |

2005 |

Jakarta, ID |

|||||||

|

Prosegur |

1976 |

Madrid, ES |

Indonesia Security Services Market Analysis

Market Growth Drivers

- Increasing Demand for Private Security Services in High-Crime Regions: As crime rates rise in regions like Jakarta and Surabaya, businesses and residential areas are increasingly turning to private security companies for protection. In 2024, the Ministry of National Development Planning highlighted a spike in criminal incidents, leading to the deployment of over 120,000 security personnel nationwide.

- Expansion of Industrial Zones Driving Security Needs: Indonesia is experiencing significant growth in its industrial and economic zones, especially in Java and Sumatra, which have over 10 new industrial parks set to open by 2025. Each of these zones is expected to require comprehensive security services, ranging from surveillance systems to on-ground personnel.

- Tourism Sector Boosting Security Requirements: Indonesias booming tourism sector, particularly in Bali, Lombok, and emerging destinations like Labuan Bajo, has increased the need for both public and private security. In 2024, the Ministry of Tourism recorded that 16 million tourists visited the country, a number set to rise in the coming years.

Market Challenges

- Unregulated Security Services Providers: The growth of unregistered and informal security service providers has posed a challenge to the formal security sector. In 2024, reports indicated that over 25,000 individuals were employed by these informal firms, often without proper training or legal backing.

- High Cost of Security Technology: The rising cost of implementing advanced security technologies, such as CCTV systems, biometric access controls, and surveillance drones, has become a financial burden for many security service providers. In 2024, it was reported that small and medium-sized security firms faced a 30% increase in the cost of acquiring modern security equipment.

Indonesia Security Services Market Future Outlook

Over the next five years, the Indonesia Security Services industry is expected to witness robust growth, driven by heightened security concerns, increasing urbanization, and growing investments in infrastructure projects.

Future Market Opportunities

- Increased Integration of IoT in Security Solutions: Over the next five years, Indonesias security market will witness greater integration of Internet of Things (IoT) technologies into security systems. By 2029, an estimated 200,000 new IoT-enabled security devices will be deployed in industrial and residential sectors, enhancing real-time monitoring and automation.

- Expansion of Security Services in Smart Cities: With continued investment in smart cities, private security services will expand significantly to support the advanced security infrastructure in cities like Jakarta, Surabaya, and Bandung. By 2029, it is estimated that smart city projects will generate over IDR 10 trillion in revenue for the security services market, as these cities implement integrated digital security frameworks that require both personnel and technology to function effectively.

Scope of the Report

|

By Service Type |

Manned Guarding Cash Management Electronic Security Cybersecurity Remote Surveillance |

|

By End-User Industry |

Commercial & Industrial Financial Institutions Retail Government & Public Residential |

|

By Technology Type |

CCTV Access Control Intruder Alarms Cloud-based Solutions AI-based Solutions |

|

By Region |

North East West South |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Security service providers

Banks and Financial Institution

Private Equity Firms

Government and regulatory bodies (Ministry of Law and Human Rights, Ministry of Defense)

Private security firms

Event organizers and management firms

Retailers and shopping mall operators

Investor and venture capitalist firms

Companies

Players Mentioned in the Report:

G4S Plc

Securitas AB

PT Bravo Satria Perkasa

Prosegur

PT Andalan Securindo

PT Garda Bhakti Nusantara

PT Swakarsa Bhakti

PT Sisrindosat

PT ISS Indonesia

PT Securindo Packatama Indonesia

Table of Contents

Indonesia Security Services Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate (CAGR, Value)

1.4 Market Segmentation Overview

Indonesia Security Services Market Size (in USD Bn)

2.1 Historical Market Size

2.2 Year-on-Year Growth Analysis

2.3 Key Market Developments and Milestones

Indonesia Security Services Market Analysis

3.1 Growth Drivers

3.1.1 Increasing Corporate Investments in Security (Corporate Expenditure)

3.1.2 Growing Demand for Personal Security Services (Personal Services Growth)

3.1.3 Rising Crime Rates and Urban Threats (Crime Statistics)

3.1.4 Expanding B2B Sector Demand (B2B Demand)

3.2 Market Challenges

3.2.1 High Labor and Operational Costs (Cost Structure Analysis)

3.2.2 Fragmented Industry with Regional Players (Industry Fragmentation)

3.2.3 Regulatory Barriers (Compliance Costs)

3.2.4 Limited Technology Adoption in Surveillance (Technological Gaps)

3.3 Opportunities

3.3.1 Technological Integration in Security Systems (Digital Transformation)

3.3.2 Expansion of Managed Security Services (Market Opportunities)

3.3.3 Growth in Public-Private Partnerships (PPP)

3.3.4 Penetration into Tier-II and Tier-III Cities (Regional Growth)

3.4 Trends

3.4.1 Adoption of AI and Data Analytics (Technological Trend)

3.4.2 Increasing Demand for Event Security (Event-driven Security)

3.4.3 Rise in Cloud-based Surveillance Solutions (Cloud Adoption)

3.4.4 Growth in Mobile Security Units (Mobile Services Expansion)

3.5 Government Regulation

3.5.1 Licensing Requirements for Security Firms (Regulatory Framework)

3.5.2 National Security Policy Changes (Policy Updates)

3.5.3 Import Tariff on Security Equipment (Tax Structure)

3.5.4 Public Infrastructure Protection Laws (Regulations)

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces

3.9 Competition Ecosystem

Indonesia Security Services Market Segmentation

4.1 By Service Type (in Value %)

4.1.1 Manned Guarding

4.1.2 Cash Management

4.1.3 Electronic Security Solutions

4.1.4 Cybersecurity Services

4.1.5 Remote Surveillance

4.2 By End-User Industry (in Value %)

4.2.1 Commercial and Industrial Sectors

4.2.2 Financial Institutions

4.2.3 Retail Sector

4.2.4 Government and Public Services

4.2.5 Residential Security

4.3 By Technology Type (in Value %)

4.3.1 CCTV and Surveillance Systems

4.3.2 Access Control Systems

4.3.3 Intruder Alarms

4.3.4 Cloud-based Security Solutions

4.3.5 AI-based Security Solutions

4.4 By Region (in Value %)

4.4.1 North

4.4.2 East

4.4.3 West

4.4.4 South

Indonesia Security Services Market Competitive Analysis

5.1 Detailed Profiles of Major Competitors

5.1.1 G4S Plc

5.1.2 Securitas AB

5.1.3 Prosegur

5.1.4 PT Bravo Satria Perkasa

5.1.5 PT Andalan Securindo

5.1.6 PT Garda Bhakti Nusantara

5.1.7 PT Swakarsa Bhakti

5.1.8 PT Sisrindosat

5.1.9 PT ISS Indonesia

5.1.10 PT Securindo Packatama Indonesia

5.1.11 PT. Mitra Pratama Mandiri

5.1.12 PT. Duta Security Indonesia

5.1.13 PT. Surya Security Indonesia

5.1.14 PT. Tri Satria Securindo

5.1.15 PT. Panji Wira Security

5.2 Cross-Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue, Service Offerings, Client Base, Geographic Reach, Certifications)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

Indonesia Security Services Market Regulatory Framework

6.1 Compliance Requirements

6.2 Certification Processes

6.3 Import and Export Regulations for Security Equipment

Indonesia Security Services Future Market Size (in USD Bn)

7.1 Market Size Projections

7.2 Key Factors Driving Future Market Growth

Indonesia Security Services Future Market Segmentation

8.1 By Service Type

8.2 By End-User Industry

8.3 By Technology Type

8.4 By Region

Indonesia Security Services Market Analysts Recommendations

9.1 Total Addressable Market (TAM) Analysis

9.2 Strategic Market Entry Recommendations

9.3 White Space Opportunity Analysis

9.4 Marketing Strategy Suggestions

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The first step involved mapping out the entire security services ecosystem in Indonesia, identifying key variables such as market drivers, industry challenges, and security technologies. This was done through extensive desk research, utilizing proprietary databases and secondary data from government sources.

Step 2: Market Analysis and Construction

In this phase, historical data on Indonesias security services were compiled, including metrics on manned guarding and electronic surveillance. The analysis focused on the penetration of security services in both urban and industrial areas, ensuring the reliability of revenue forecasts.

Step 3: Hypothesis Validation and Expert Consultation

To validate market trends and insights, industry experts from leading security firms and stakeholders in high-demand industries were consulted via CATIs. These consultations helped refine market projections and provided first-hand insights into the operational landscape.

Step 4: Research Synthesis and Final Output

Finally, a comprehensive report was compiled, integrating data on market trends, competitive dynamics, and future growth forecasts. The bottom-up approach ensured that all figures were validated through primary and secondary sources, providing an accurate outlook for the Indonesia Security Services market.

Frequently Asked Questions

01. How big is the Indonesia Security Services Market?

The Indonesia Security Services market is valued at USD 1.3 billion. The markets growth is driven by the rising demand for security solutions across the corporate, governmental, and industrial sectors.

02. What are the challenges in the Indonesia Security Services Market?

Key challenges in the Indonesia Security Services market include high operational costs, a fragmented industry with numerous small players, and regulatory barriers. The rising cost of labor, which accounts for a significant portion of the market's expenses, also limits profitability.

03. Who are the major players in the Indonesia Security Services Market?

Major players in the Indonesia Security Services market include G4S Plc, Securitas AB, PT Bravo Satria Perkasa, Prosegur, and PT Andalan Securindo. These companies dominate due to their extensive service portfolios and strong client bases.

04. What are the growth drivers of the Indonesia Security Services Market?

The Indonesia Security Services market is driven by the expansion of urban infrastructure, rising corporate investments in security, and the need for enhanced personal and public safety. Technological advancements in surveillance systems also contribute to market growth.

05. What are the future prospects for the Indonesia Security Services Market?

The Indonesia Security Services market is expected to grow in the coming years, with advancements in AI-based surveillance, increased adoption of cloud solutions, and rising demand from the expanding e-commerce and logistics sectors.Bottom of Form

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.