Indonesia Seed Market

by Types of Seeds (Fruits and Vegetables Seeds, Grains and Cereals Seeds and Plantation Crops Seeds), by Hybrid Seeds and Non-hybrid Seeds, by Organized and Unorganized Players, by Farmer Saved and Commercial Seeds - Outlook to 2021

Region:Asia

Product Code:KR574

January 2018

168

About the Report

Detailed comparative analysis of major seed market players has also been provided. Various marketing analysis factors such as trends and developments and SWOT analysis are also added in the study. The future analysis of the overall Indonesia seed market has also been discussed along with recommendations from analyst view.

Indonesia Seed Market Segmentation

Indonesia is the largest palm oil producer in the world and the expansion in oil palm plantation area in the country has triggered the growth of revenues from sales of plantation crop seeds during 2016. The islands of Indonesia had about ~ million hectares of land under palm oil cultivation during the same year.

The least share in the market revenues from sales of various types of seeds in the islands of Indonesia was contributed by fruits and vegetables seeds sold during 2016. The segment accounted for a minority share of ~% and contributed USD ~ million to the overall revenues during 2016.

Competitive Scenario in Indonesia Seed Market

Key Topics Covered in the Report:

- Indonesia Agriculture Overview

- Value Chain Analysis of Indonesia Seed Market

- Indonesia Seed Market Size by Revenue

- Market Segmentation - By Types of Seeds (Fruits and Vegetables Seeds, Grains and Cereals Seeds and Plantation Crop Seeds); By Grains and Cereals Seeds (Rice/Paddy Seeds, Corn Seeds, Soy Seeds and Others); By Plantation Crops Seeds (Palm Oil Seeds, Rubber Seeds, Coconut Seeds, Coffee Seeds, Cocoa Seeds and Others); By Fruits and Vegetables Seeds (Tomato Seeds, Potato Seeds, Green Beans Seeds, Cassava Seeds, Onion Seeds, Sweet Potato Seeds and Others); By Hybrid Seeds and Non-hybrid Seeds; By Organized and Unorganized Players; By Farmer Saved and Commercial Seeds

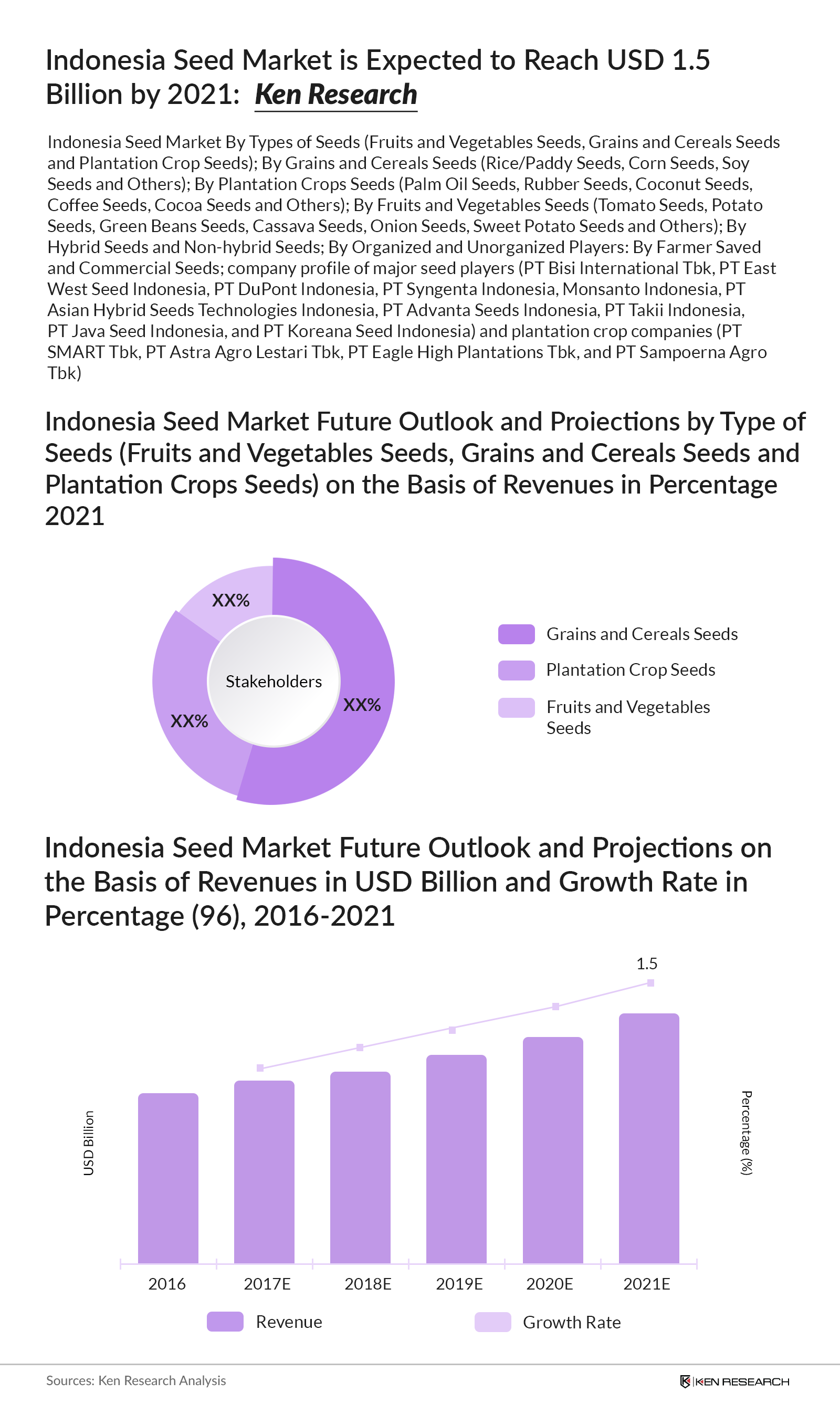

- Case Study for Determining Cost Benefit Analysis for Using Hybrid Corn Seeds as Compared to Non-Hybrid Corn Seeds by Farmers in Indonesia

- Consumer Viewpoints in Indonesia Seed Market

- SWOT Analysis of Indonesia Seed Market

- Trends and Developments in Indonesia Seed Market

- Issues and Challenges in Indonesia Seed Market

- Competitive Scenario in Indonesia Seed Market

- Company Profiles of Major Seed Market Players

- Future Outlook and Projections for Indonesia Seed Market

- Analyst Recommendations

- Macro-Economic Factors Impacting Indonesia Seed Market

Products

Companies

- PT Bisi International Tbk,

- PT East West Seed Indonesia,

- PT DuPont Indonesia,

- PT Syngenta Indonesia,

- Monsanto Indonesia,

- PT Asian Hybrid Seeds Technologies Indonesia,

- PT Advanta Seeds Indonesia,

- PT Takii Indonesia,

- PT Java Seed Indonesia,

- and PT Koreana Seed Indonesia,

- PT SMART Tbk,

- PT Astra Agro Lestari Tbk,

- PT Eagle High Plantations Tbk,

- and PT Sampoerna Agro Tbk

Table of Contents

1. Executive Summary

Market Overview and Present Scenario

Indonesia Seed Market Segmentation

Competitive Scenario in Indonesia Seed Market

Indonesia Seed Market Future Outlook and Projections

2. Research Methodology

2.1. Market Definitions

2.2. Abbreviations

2.3. Market Size and Modeling

General Approach – Market Sizing

Market Sizing – Indonesia Seed Market

Variables (Dependent and Independent)

Multi Factor Based Sensitivity Model

Regression Matrix

Limitations

Final Conclusion

3. Indonesia Seed Market Introduction

4. Value Chain Analysis of Indonesia Seed Market

Problems in Value Chain

5. Agricultural Overview

5.1. Total Land under Cultivation and Distribution by Major Crops

Total Land under Cultivation, 2011-2015

Land under Cultivation of Major Food Crops in Indonesia

Land under Cultivation of Major Plantation Crops in Indonesia

5.2. Changes in Cropping Patterns of Major Crops and Factors Driving Change

5.2.1. Expected Changes in Cropping Pattern of Rice, Cassava and Maize in Indonesia

Rice

Cassava

Maize (Corn)

Palm Oil

Rubber

Sugarcane

5.3. Farm Holding Structure in Indonesia

5.3.1. Number of Farms and Farm Holding Size, 2010-2015

5.3.2. Nature of Ownership

Palm Oil and Rubber Plantation Ownership Structure

Sugarcane Plantation Ownership Structure

Food Crops Land Ownership Structure

Land Ownership Rights Problem

Anticipated Regulation on Land Ownership size limit of new Palm Oil Plantation

5.4. Agricultural Practices

Intensive/Extensive Agriculture

Scale of Mechanization

5.5. Snapshot on Irrigated and Non-Irrigated Land In Indonesia

5.6. Existing Problems in Agricultural Development in Indonesia

6. Indonesia Seed Market Size By Revenues, 2011-2016

7. Indonesia Seed Market Segmentation

7.1. By Type of Seeds (Fruits and Vegetables Seeds, Grains and Cereals Seeds and Plantation

Crop Seeds), 2016

7.1.1. By Type of Grains and Cereals Seeds (Rice/Paddy Seeds, Corn Seeds, Soy Seeds and

Others), 2016

By Hybrid Seeds and Non-Hybrid Seeds

By Organized and Unorganized Players, 2016

7.1.2. By Type of Plantation Crop Seeds (Palm Oil Seeds, Rubber Seeds, Coconut Seeds,

Coffee Seeds, Cocoa Seeds and Others), 2016

By Hybrid and Non-Hybrid Seeds

By Organized and Unorganized Players, 2016

7.1.3. By Type of Fruits and Vegetables Seeds (Tomato Seeds, Potato Seeds, Green Beans

Seeds, Cassava Seeds, Onion Seeds, Sweet Potato Seeds and Others), 2016

By Hybrid and Non-Hybrid Seeds, 2016

By Organized and Unorganized Players, 2016

7.2. By Farmer Saved and Commercial Seeds, 2016

8. Case Study for Determining Cost Benefit Analysis for Using Hybrid Corn Seeds as Compared

to Non-Hybrid Corn Seeds by Farmers in Indonesia

Cropping Cycle: November-February

Cropping Cycle: March-June

Cropping Cycle: July-September

Profitability Analysis for Using Hybrid Corn Seeds Over Non-Hybrid Corn Seeds

9. Consumer Viewpoints in Indonesia Seed Market

9.1. Vendor Selection Criteria of Farmers in Indonesia Seed Market

9.2. Decision Making Factors Before Purchasing Seeds by Farmers in Indonesia

9.3. Pain Points Faced by Farmers After Purchasing Seeds in Indonesia

Low Productivity Due to the Absence of Better Quality Seeds

Lack of Proper Distribution Network

10. SWOT Analysis of Indonesia Seed Market

11. Trends and Developments in Indonesia Seed Market

11.1. Increasing Palm Oil Production and Exports in Indonesia, 2011-2016

11.2. Growth in Indonesia Horticulture Sector

11.3. Rising Initiatives to Surge Rice Production in Indonesia

11.4. Allocating Free Seeds to Increase Food Crop Production in Indonesia

11.5. Declining Dominant Position of Foreign Players in Indonesia Seed Market

11.6. Acceptance of Biotech Corn Seeds by Indonesian Farmers

12. Issues and Challenges in Indonesia Seed Market

12.1. New Plantation Law, 2014

12.2. Declining Employment in Indonesia Agriculture Sector, 2011-2016

12.3. Involvement of Longer Time to Develop Seeds

12.4. Unstable Climatic Conditions in Indonesia

13. Government Regulations in Indonesia Seed Market

13.1. Classification of Seeds as Per MoA

13.2. Certification Process of Seeds in Indonesia

13.3. Strategic Plan, 2015 - 2019

13.4. Import Mechanisms of Horticulture Seeds

General Provisions in International Trading of Horticulture Seeds

Import Provisions in Horticulture Seeds

Requirements for Importing Horticulture Seeds

Licensing Procedures for Import of Horticulture Seeds

14. Competitive Scenario in Indonesia Seed Market

15. Company Profiles of Major Players in Indonesia Seed Market

15.1. PT Bisi International Tbk

15.2. PT East West Seed Indonesia

15.3. PT DuPont Indonesia

15.4. Other Major Players in Indonesia Seed Market

16. Company Profiles of Major Plantation Crops Companies in Indonesia

17. Indonesia Seed Market Future Outlook and Projections, 2016-2021

17.1. By Type of Seeds (Fruits and Vegetables Seeds, Grains and Cereals Seeds and

Plantation Crops Seeds), 2021

17.1.1. By Type of Grains and Cereals Seeds (Rice/Paddy Seeds, Corn Seeds, Soy Seeds and

Others), 2021

17.1.2. By Type of Fruits and Vegetables Seeds (Tomato Seeds, Potato Seeds, Green Beans

Seeds, Cassava Seeds, Onion Seeds, Sweet Potato Seeds and Others), 2021

17.2. By Organized and Unorganized Sector, 2021

17.3. Future Opportunities and Trends in Indonesia Seed Market, 2017-2021

18. Analyst Recommendations

19. Macro Economic Factors Affecting Indonesia Seed Market, 2011-2021

19.1. Crop Production in Indonesia, 2011-2021

19.2. Harvested Area under Grains and Cereals Crops in Indonesia, 2011-2021

19.3. Global Seed Market, 2011-2021

19.4. Agriculture Machinery Market in Indonesia, 2011-2016

Disclaimer Contact UsWhy Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.