Indonesia Set Top Box Market Outlook to 2030

Region:Asia

Author(s):Meenakshi Bisht

Product Code:KROD6700

December 2024

98

About the Report

Indonesia Set Top Box Market Overview

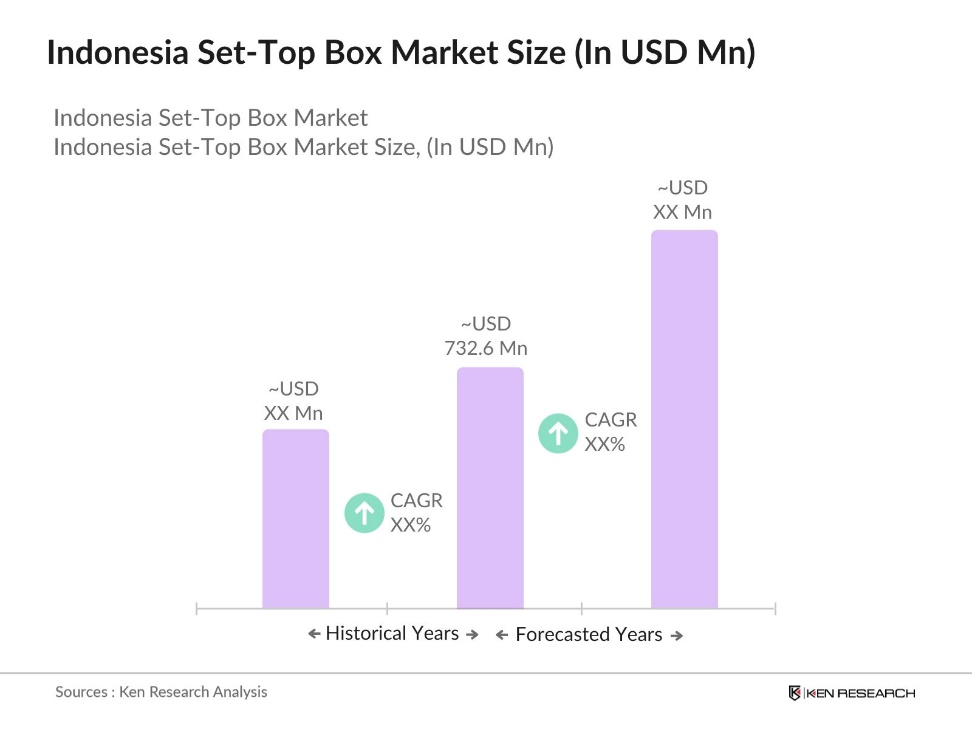

- The Indonesia Set-Top Box Market is valued at USD 732.6 million based on a five-year historical analysis. The market growth is driven by the rapid digitalization of TV services across Indonesia, as the country moves away from analog broadcasting systems. A major driver of this growth is the government's mandate to transition to digital TV. Additionally, increasing consumer demand for enhanced viewing experiences, such as HD and UHD resolutions, has propelled the demand for advanced set-top boxes that support these features, further boosting market growth.

- The market dominance in Indonesia is largely concentrated in cities like Jakarta, Surabaya, and Bandung due to the higher adoption of digital TV services in urban areas. These regions have well-established infrastructure for high-speed internet, which supports IPTV and OTT services, driving the demand for hybrid and IPTV set-top boxes. The high population density and growing middle-class demographic in these cities further fuel market growth by increasing demand for superior entertainment options.

- Indonesias broadcasting spectrum allocation policies have advanced the shift to digital TV by releasing additional spectrum, enabling more efficient bandwidth use. This improves the quality of free-to-air and pay-TV services. In 2023, new frequency bands were allocated to digital TV providers, ensuring wider access to digital broadcasts with minimal interference. These policies significantly impact the set-top box market, increasing demand for compatible devices.

Indonesia Set Top Box Market Segmentation

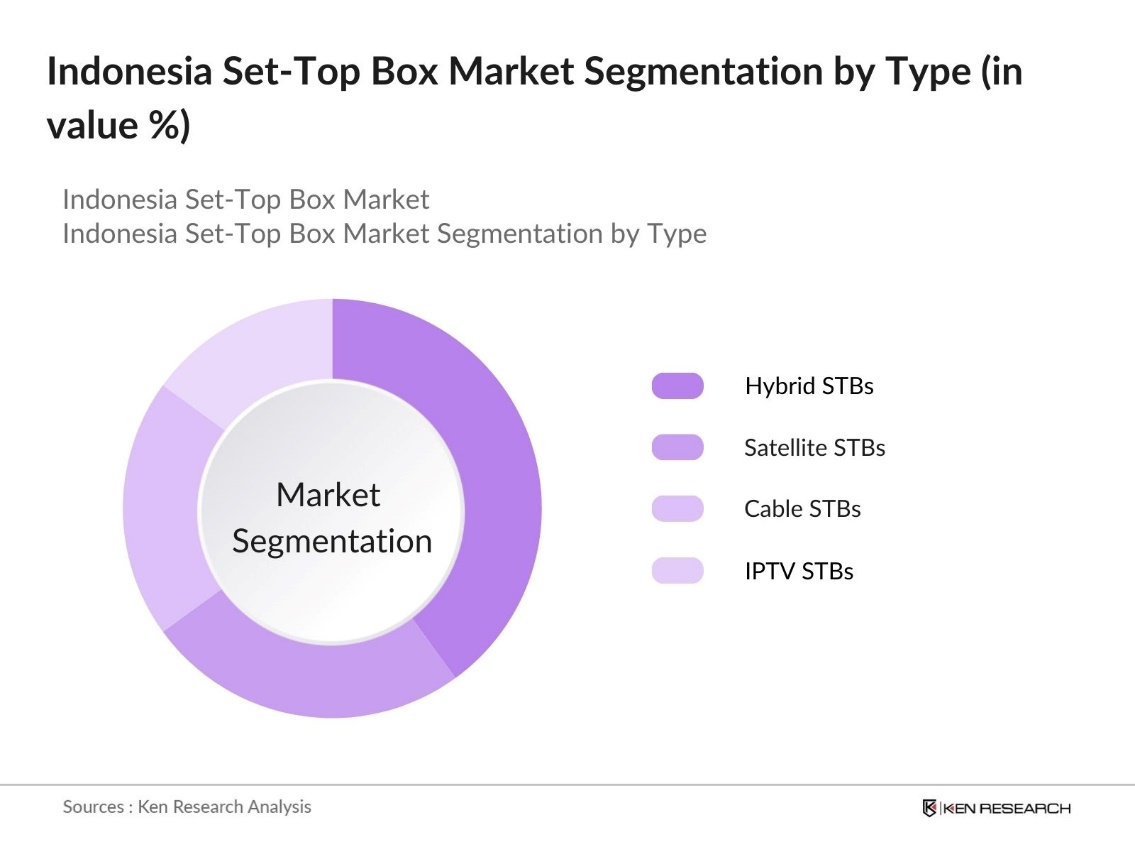

By Type: The Indonesia Set-Top Box market is segmented by product type into cable STBs, satellite STBs, IPTV STBs, and hybrid STBs. Among these, hybrid STBs currently dominate the market share due to their ability to offer consumers both traditional broadcast content and on-demand services via OTT platforms. This versatility makes hybrid STBs a preferred choice, particularly in urban areas where high-speed internet is readily available. Their ability to integrate internet-based content with digital broadcast services also ensures future-proofing against further technological advancements.

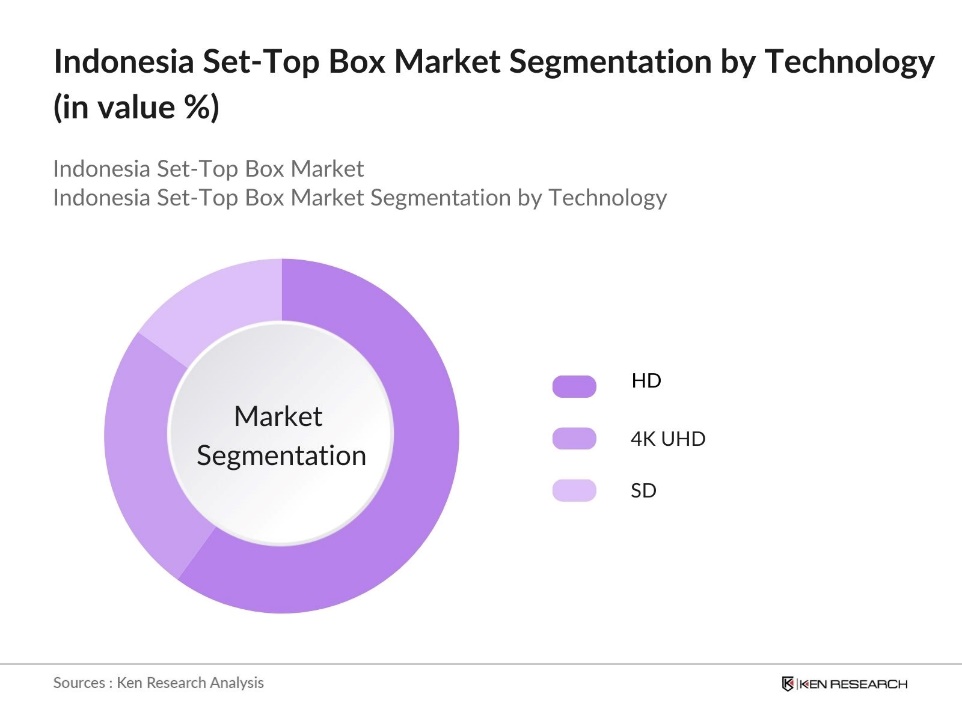

By Technology: The market is further segmented by technology into Standard Definition (SD), High Definition (HD), and 4K Ultra High Definition (UHD). High Definition (HD) set-top boxes currently lead the market due to the widespread availability of HD content, which aligns with consumer demand for better visual experiences. The HD segment's dominance is supported by its affordability and compatibility with the majority of current TV models. Although UHD STBs are growing in demand, HD remains the dominant technology in terms of market share.

Indonesia Set Top Box Market Competitive Landscape

The market is dominated by a mix of local and global players. Major companies in this space have secured their positions through strategic partnerships with broadcasters, telecom providers, and technological innovations. The market is characterized by consolidation, with key players expanding their product portfolios to include hybrid and IPTV STBs, which offer more value to consumers.

|

Company Name |

Year of Establishment |

Headquarters |

Market Segment |

No. of Employees |

Partnerships |

Technology Focus |

Product Portfolio |

Revenue |

|

PT MNC Sky Vision |

1989 |

Jakarta, Indonesia |

||||||

|

PT Link Net Tbk |

1996 |

Jakarta, Indonesia |

||||||

|

Huawei Technologies |

1987 |

Shenzhen, China |

||||||

|

Kaonmedia Co., Ltd |

2001 |

Seongnam, South Korea |

||||||

|

ZTE Indonesia |

1985 |

Shenzhen, China |

Indonesia Set Top Box Industry Analysis

Growth Drivers

- Rising Digital TV Penetration: The Indonesian market has seen a surge in digital TV penetration due to government mandates and consumer demand. By 2024, Indonesias digital TV rollout is expected to cover more cities. The transition from analog to digital TV is key, with million of households targeted for the switch. This rise in digital TV is driven by improved access to affordable devices and enhanced TV content. Indonesia's population of over 278.7 million, coupled with increasing urbanization, has created a favorable environment for digital services.

- Growing Consumer Demand for Enhanced TV Viewing Experiences (HD, UHD, OTT Support)

Indonesian consumers are increasingly demanding higher-quality viewing experiences, with HD, UHD, and OTT support becoming essential. The urbanization rate, which currently stands at 58.9%, reflects an increasing middle class, with disposable incomes rising. This trend highlights the markets readiness for enhanced TV technologies. - Increased Internet Connectivity: Indonesias improved internet infrastructure has fueled the demand for set-top boxes with OTT and streaming capabilities. Government projects like the Palapa Ring have expanded broadband access, especially in rural areas. High-speed internet enables better streaming experiences, leading to increased adoption of set-top boxes that support internet integration, making connectivity a key driver for digital TV growth in the country.

Market Challenges

- High Competition from OTT Platforms: The rise of OTT platforms like Netflix and Disney+ has posed a significant challenge for the set-top box market in Indonesia. These platforms offer on-demand, flexible content, making them a popular choice for consumers. As more people prefer mobile streaming over traditional cable or satellite, the competition from OTT services pressures the set-top box industry to innovate, particularly through hybrid models that combine cable and OTT functionalities.

- High Cost of Advanced Set-Top Boxes (Hybrid, 4K Devices): Advanced set-top boxes, including hybrid models and those supporting 4K, tend to have higher production costs, making them more expensive for consumers. This limits their widespread adoption, especially in price-sensitive segments. Economic factors like inflation and restricted spending power further challenge lower-income households in upgrading their existing TV setups to more advanced devices

Indonesia Set Top Box Market Future Outlook

Over the next five years, the Indonesia Set-Top Box market is expected to show significant growth, driven by the continued shift towards digital TV services, rising consumer demand for high-definition and 4K content, and the increasing popularity of OTT platforms. Government initiatives, such as the mandatory transition from analog to digital broadcasting, will further fuel the market. In addition, advancements in set-top box technology, including the integration of smart TV functionalities and cloud-based services, are anticipated to provide significant opportunities for market expansion.

Market Opportunities

- Emerging Smart TV Integration: The rising popularity of smart TVs creates significant opportunities for set-top box manufacturers. Many smart TVs require enhanced set-top boxes to support additional features like UHD or hybrid viewing. The integration of advanced technology, such as voice control and content aggregation, can drive new revenue streams. This is especially true in urban areas where tech-savvy consumers prefer all-in-one entertainment solutions that combine multiple functionalities.

- Growth of Streaming Services: The expansion of streaming services presents opportunities for set-top box manufacturers that offer seamless OTT integration. As streaming becomes increasingly popular, there is a growing demand for set-top boxes that can support multiple platforms, providing consumers with a consolidated viewing experience. Both international and local streaming services also open up partnership possibilities for set-top box providers looking to tap into the growing market.

Scope of the Report

|

Type |

Cable STBs Satellite STBs IPTV STBs Hybrid STBs |

|

Technology |

Standard Definition (SD) High Definition (HD) 4K Ultra HD |

|

Application |

Residential Commercial |

|

Distribution Channel |

Offline (Retailers, Distributors) Online (E-commerce) |

|

Region |

Java Sumatra Kalimantan Sulawesi Papua |

Products

Key Target Audience

Home Automation Companies

Hospitality Industry

Set-Top Box Manufacturers

Broadcasting Companies

E-commerce Platforms

Investors and venture capital Firms

Banks and Financial Institutions

Government and regulatory bodies (Ministry of Communication and Information Technology, Indonesian Broadcasting Commission)

Companies

Players Mentioned in the Report

PT MNC Sky Vision

PT Link Net Tbk

Transvision (PT Indonusa Telemedia)

PT Telekomunikasi Indonesia

PT Indosat Ooredoo Hutchison

PT First Media Tbk

Huawei Technologies Indonesia

ZTE Indonesia

Kaonmedia Co., Ltd

Skyworth Digital

Table of Contents

1. Indonesia Set-Top Box Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Indonesia Set-Top Box Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Indonesia Set-Top Box Market Analysis

3.1. Growth Drivers

3.1.1. Rising Digital TV Penetration

3.1.2. Government Digitalization Mandates (Mandatory Analog Switch-Off)

3.1.3. Growing Consumer Demand for Enhanced TV Viewing Experiences (HD, UHD, OTT Support)

3.1.4. Increased Internet Connectivity

3.2. Market Challenges

3.2.1. High Competition from OTT Platforms

3.2.2. High Cost of Advanced Set-Top Boxes (Hybrid, 4K Devices)

3.2.3. Lack of Awareness in Rural Areas

3.3. Opportunities

3.3.1. Emerging Smart TV Integration

3.3.2. Growth of Streaming Services

3.3.3. Partnership Opportunities with Telecom Providers

3.4. Trends

3.4.1. Adoption of Hybrid Set-Top Boxes (DVB & OTT)

3.4.2. Cloud-based Set-Top Box Models

3.4.3. Demand for 4K and UHD Set-Top Boxes

3.5. Government Regulation

3.5.1. Analog to Digital Migration Policies

3.5.2. Broadcasting Spectrum Allocation Policies

3.5.3. Public-Private Collaborations on Digital TV Rollout

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (STB Manufacturers, Broadcasters, ISPs, Telecom Operators)

3.8. Porters Five Forces

3.9. Competitive Landscape

4. Indonesia Set-Top Box Market Segmentation

4.1. By Type (In Value %)

4.1.1. Cable STBs

4.1.2. Satellite STBs

4.1.3. IPTV STBs

4.1.4. Hybrid STBs

4.2. By Technology (In Value %)

4.2.1. Standard Definition (SD)

4.2.2. High Definition (HD)

4.2.3. 4K Ultra High Definition (UHD)

4.3. By Application (In Value %)

4.3.1. Residential

4.3.2. Commercial

4.4. By Distribution Channel (In Value %)

4.4.1. Offline (Retailers, Distributors)

4.4.2. Online (E-commerce)

4.5. By Region (In Value %)

4.5.1. Java

4.5.2. Sumatra

4.5.3. Kalimantan

4.5.4. Sulawesi

4.5.5. Papua

5. Indonesia Set-Top Box Market Competitive Analysis

5.1 Detailed Profiles of Major Competitors

5.1.1. PT MNC Sky Vision

5.1.2. PT Link Net Tbk

5.1.3. Transvision (PT Indonusa Telemedia)

5.1.4. PT Telekomunikasi Indonesia

5.1.5. PT Indosat Ooredoo Hutchison

5.1.6. PT First Media Tbk

5.1.7. Huawei Technologies Indonesia

5.1.8. ZTE Indonesia

5.1.9. Kaonmedia Co., Ltd

5.1.10. Skyworth Digital

5.1.11. Sagemcom

5.1.12. Humax Co., Ltd

5.1.13. Technicolor SA

5.1.14. Arris Group (CommScope)

5.1.15. LG Electronics Indonesia

5.2 Cross Comparison Parameters (Market Presence, Product Portfolio, Service Offerings, Partnerships, Innovation)

5.3. Market Share Analysis

5.4. Strategic Initiatives (Product Launches, Market Expansion)

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7 Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Indonesia Set-Top Box Market Regulatory Framework

6.1. Digital TV Transition Standards

6.2. Compliance Requirements for STB Manufacturers

6.3. Certification and Licensing Processes

7. Indonesia Set-Top Box Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Indonesia Set-Top Box Future Market Segmentation

8.1. By Type (In Value %)

8.2. By Technology (In Value %)

8.3. By Application (In Value %)

8.4. By Distribution Channel (In Value %)

8.5. By Region (In Value %)

9. Indonesia Set-Top Box Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The first phase involves creating an ecosystem map of all the major stakeholders in the Indonesia Set-Top Box market. Desk research and proprietary databases are employed to gather crucial industry information and define variables that drive market dynamics.

Step 2: Market Analysis and Construction

In this phase, historical data is analyzed to assess the penetration of set-top boxes in Indonesia, focusing on key factors like revenue generation and the ratio of digital to analog services. The quality of services offered by key players is evaluated to ensure accurate revenue projections.

Step 3: Hypothesis Validation and Expert Consultation

To validate market hypotheses, consultations with industry experts via computer-assisted telephone interviews (CATIs) are conducted. Insights from these professionals are essential for refining data and corroborating the findings.

Step 4: Research Synthesis and Final Output

The final stage includes engaging directly with set-top box manufacturers to gather detailed insights on product segments, sales trends, and consumer preferences. This bottom-up approach is integrated with validated data to ensure a comprehensive market analysis.

Frequently Asked Questions

01. How big is the Indonesia Set-Top Box Market?

The Indonesia Set-Top Box Market is valued at USD 732.6 million, driven by the transition from analog to digital TV services and increasing consumer demand for HD and UHD content.

02. What are the challenges in the Indonesia Set-Top Box Market?

Challenges in Indonesia Set-Top Box Market include the high cost of advanced set-top boxes, competition from OTT platforms, and the lack of consumer awareness in rural regions. Additionally, infrastructure limitations in remote areas pose difficulties.

03. Who are the major players in the Indonesia Set-Top Box Market?

Key players in Indonesia Set-Top Box Market include PT MNC Sky Vision, Huawei Technologies Indonesia, PT Link Net Tbk, Kaonmedia Co., Ltd, and ZTE Indonesia. These companies dominate due to strategic partnerships, strong product portfolios, and technological innovations.

04. What are the growth drivers of the Indonesia Set-Top Box Market?

The Indonesia Set-Top Box Market is propelled by government mandates to transition to digital TV, growing demand for HD and UHD content, and the increasing popularity of OTT platforms.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.