Indonesia Shampoo Market Outlook to 2030

Region:Asia

Author(s):Abhinav kumar

Product Code:KROD4526

December 2024

94

About the Report

Indonesia Shampoo Market Overview

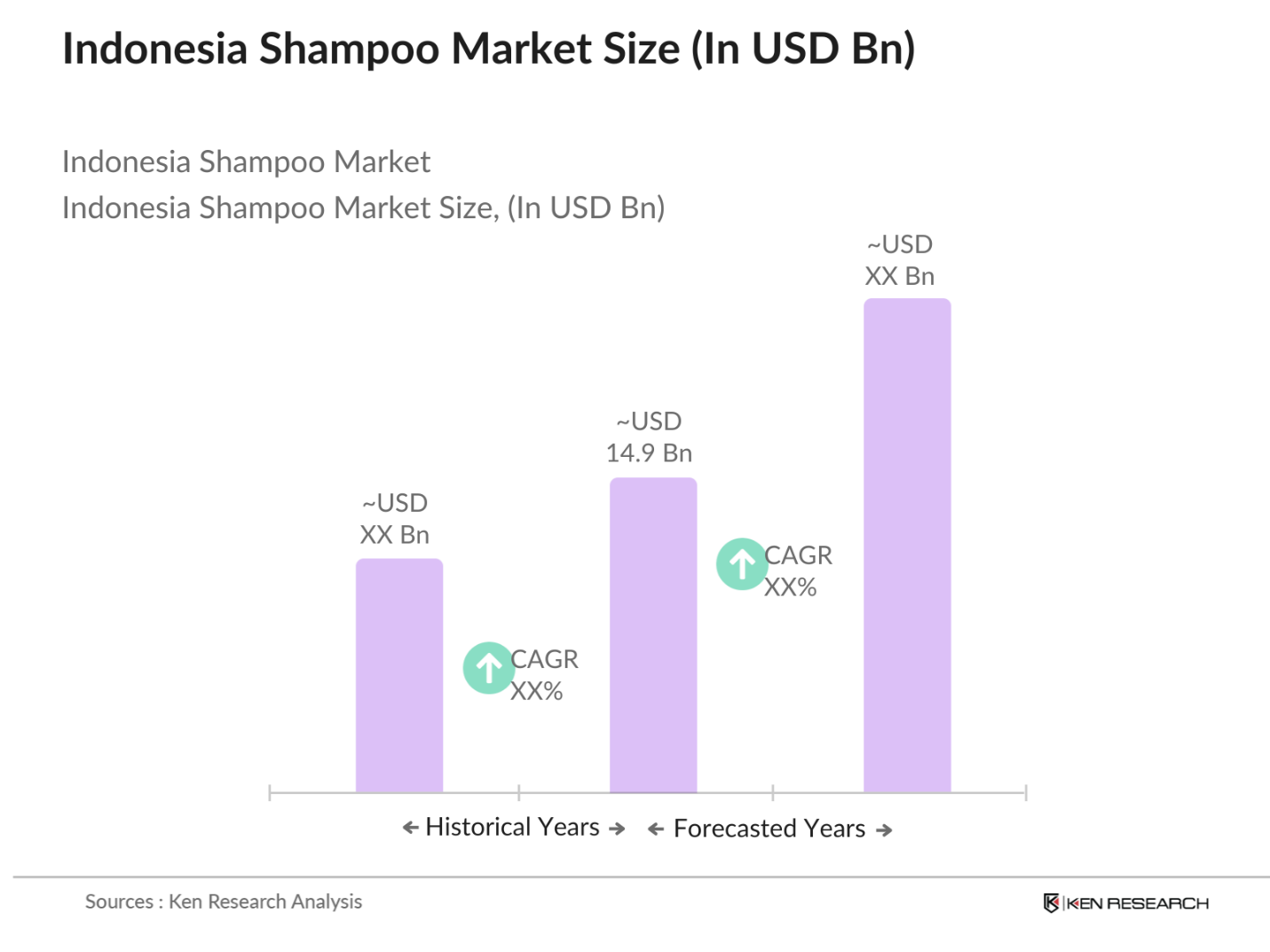

- The Indonesia Shampoo Market is valued at USD 14.9 billion, based on a five-year historical analysis. The market is primarily driven by increasing consumer demand for hair care products, particularly in urban areas where awareness about personal grooming is high. This demand is further bolstered by the growing middle-class population, which has led to a surge in the purchase of premium and organic shampoo products. The rise in e-commerce platforms has also played a significant role in facilitating access to a variety of shampoo brands across the country.

- The dominance of cities like Jakarta, Surabaya, and Bandung in the shampoo market is attributed to their large urban populations and higher disposable incomes, which lead to increased demand for personal care products. Jakarta, being the capital and most densely populated city, is the leading market for shampoo products due to its diverse consumer base and higher awareness of premium hair care options. The presence of international and local manufacturers in these cities also contributes to their market dominance.

- The regulatory framework for cosmetic products in Indonesia is governed by BPOM, which strictly enforces safety standards for shampoos. In 2023, over 120 new cosmetic products were evaluated for compliance with BPOM's safety regulations, ensuring that harmful ingredients are not used in formulations. These regulations also cover labeling and marketing claims, requiring companies to provide detailed ingredient information. Additionally, shampoo products must comply with halal certification requirements set forth by the Indonesian Halal Authority, reflecting the religious preferences of a significant portion of the population.

Indonesia Shampoo Market Segmentation

By Product Type: The Indonesia Shampoo market is segmented by product type into Dry Shampoos, Anti-dandruff Shampoos, Organic Shampoos, and Medicated Shampoos. Among these, Anti-dandruff Shampoos have been gaining significant traction, owing to the country's tropical climate, which exacerbates scalp conditions such as dandruff. Consumers are increasingly opting for anti-dandruff shampoos to maintain scalp health, which has led to their dominance in this segment. Brands like Head & Shoulders and Clear have firmly established themselves due to their specialized formulations addressing dandruff issues.

By Distribution Channel: The market is further segmented by distribution channels into Supermarkets & Hypermarkets, Specialty Stores, E-commerce, and Convenience Stores. E-commerce has been the dominant channel in recent years, accounting for a significant share of sales. The convenience of online shopping, coupled with the availability of a wide range of products and frequent discounts, has contributed to this growth. Platforms like Shopee and Tokopedia have emerged as leading channels for shampoo purchases in Indonesia.

Indonesia Shampoo Market Competitive Landscape

The Indonesia Shampoo Market is competitive, with both international and local players vying for market share. Major players include multinational giants like Unilever and Procter & Gamble, alongside prominent local brands such as Wardah and Sensatia Botanicals. These companies have established strong distribution networks, often partnering with local retailers and leveraging e-commerce platforms to reach a broader consumer base. Their focus on innovation, sustainability, and consumer-centric marketing strategies has helped them maintain a competitive edge.

Indonesia Shampoo Industry Analysis

Growth Drivers

- Urbanization Impact on Consumer Preferences: Urbanization in Indonesia has significantly reshaped consumer preferences, particularly in the FMCG sector like shampoos. With an urbanization rate exceeding 56%, according to World Bank data, more Indonesians are migrating to cities, increasing demand for modern hygiene products. This urban migration has spurred consumption of higher-quality and international shampoo brands, driven by exposure to global standards and improved access to retail channels. Urban dwellers also prioritize convenience, leading to greater use of e-commerce platforms for shampoo purchases. The rapid growth of urban areas in Indonesia continues to directly impact consumer preferences for premium products .

- Influence of Rising Disposable Income: Rising disposable income in Indonesia has greatly contributed to increased shampoo consumption. In 2023, the average per capita income in Indonesia was $4,500, up from $4,300 in 2022 (World Bank). This increase in income levels has enhanced consumers' purchasing power, enabling them to opt for premium shampoo brands over basic alternatives. Rising disposable income is also tied to lifestyle changes, with consumers more willing to invest in personal care products like shampoos that offer additional benefits such as hair repair, color protection, and scalp care.

- Expansion of E-commerce and Retail Channels: Indonesias booming e-commerce sector is reshaping the shampoo market, with retail sales via online platforms projected to grow steadily in 2024. Data from Bank Indonesia highlights that in 2023, online retail transactions in the country reached $31 billion, driven by increasing internet penetration and smartphone use. This shift towards digital commerce has made it easier for consumers across urban and rural areas to access a wide range of shampoo brands and products. Additionally, major e-commerce platforms have been instrumental in promoting innovative product lines from both international and local shampoo brands.

Market Challenges

- Stringent Government Regulations on Ingredients: Indonesia's cosmetic product regulations have become increasingly stringent, impacting the shampoo industry. Under the BPOM (National Agency of Drug and Food Control) regulations, shampoos containing harmful chemicals are heavily scrutinized, with a particular focus on ingredients such as parabens and sulfates. In 2023, BPOM rejected or recalled 85 cosmetic products for non-compliance, emphasizing the need for shampoo manufacturers to ensure safe formulations. The regulatory burden extends to ensuring halal certification, with the Indonesian Halal Authority enforcing strict compliance on all cosmetic products entering the local market.

- Challenges with Distribution in Rural Areas: Distribution remains a significant challenge for shampoo manufacturers in Indonesia, especially when reaching the vast rural population. Around 43% of Indonesians still live in rural areas, according to World Bank data from 2023. These regions often lack adequate infrastructure for efficient supply chain operations, resulting in higher costs for transportation and storage. This hampers access to branded shampoo products in rural areas, where consumers are more likely to opt for local alternatives or traditional hair care solutions due to limited product availability.

Indonesia Shampoo Market Future Outlook

Over the next five years, the Indonesia Shampoo Market is projected to experience steady growth, driven by rising consumer awareness regarding hair care, increasing demand for organic and natural products, and the expansion of e-commerce platforms. Furthermore, the trend towards personalized hair care solutions is expected to gain momentum as consumers seek products tailored to their specific hair types and concerns. The continued shift towards eco-friendly and sustainable packaging will also be a key growth driver, particularly among younger, environmentally-conscious consumers.

Opportunities

- Growing Demand for Herbal and Organic Shampoos: The demand for herbal and organic shampoos is rapidly growing in Indonesia, fueled by consumers' increasing awareness of the benefits of natural ingredients. In 2023, approximately 25% of consumers in urban areas preferred herbal shampoos over synthetic alternatives, according to data from Indonesias Ministry of Industry. This trend aligns with the global shift towards clean beauty products. Herbal shampoos with ingredients like ginseng, moringa, and green tea are particularly popular, driving new product development and expansion opportunities for manufacturers focusing on organic formulations.

- Innovative Product Formulations for Scalp Health: In Indonesia, scalp care is becoming a significant area of focus in the shampoo market, with new product formulations targeting specific concerns like dandruff and oily scalp. The scalp care segment saw a 15% increase in product launches in 2023 (Indonesia Ministry of Health). This is driven by the countrys tropical climate, which makes scalp issues more prevalent. Companies are now developing shampoos with enhanced active ingredients such as salicylic acid and probiotics to cater to this growing consumer need. Scalp care shampoos are particularly gaining traction among millennials, who seek solutions tailored to hair and scalp health

Scope of the Report

|

Product Type |

Dry Shampoos Anti-dandruff Shampoos Organic Shampoos Medicated Shampoos |

|

Distribution Channel |

Supermarkets & Hypermarkets Specialty Stores E-commerce Convenience Stores |

|

Demographic |

Men Women Children |

|

Hair Type |

Normal Hair, Oily Hair, Dry Hair, Curly Hair |

|

Region |

Java, Sumatra, Kalimantan, Bali, Sulawesi |

Products

Key Target Audience

Shampoo Companies

E-commerce Companies

Raw Material Companies

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (Indonesian FDA)

Advertising Companies

Packaging Solutions Companies

Companies

Players in the Report

Unilever Indonesia

Procter & Gamble Indonesia

L'Oral Indonesia

Wardah Cosmetics

Sensatia Botanicals

The Himalaya Drug Company

Johnson & Johnson

Colgate-Palmolive

Makarizo

PZ Cussons Indonesia

Table of Contents

1. Indonesia Shampoo Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Indonesia Shampoo Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Indonesia Shampoo Market Analysis

3.1. Growth Drivers (Urbanization, Lifestyle Changes, Rising Disposable Income)

3.1.1. Urbanization Impact on Consumer Preferences

3.1.2. Influence of Rising Disposable Income

3.1.3. Expansion of E-commerce and Retail Channels

3.2. Market Challenges (Product Safety Regulations, Competition from Local Brands)

3.2.1. Stringent Government Regulations on Ingredients

3.2.2. Challenges with Distribution in Rural Areas

3.2.3. Competition from Local and Herbal Brands

3.3. Opportunities (Product Innovations, Increasing Demand for Organic Products)

3.3.1. Growing Demand for Herbal and Organic Shampoos

3.3.2. Innovative Product Formulations for Scalp Health

3.3.3. Collaborations with Influencers for Digital Marketing

3.4. Trends (Sustainability, Ingredient Transparency, Scalp Care)

3.4.1. Rising Focus on Sustainable Packaging Solutions

3.4.2. Increased Transparency in Ingredient Labelling

3.4.3. Growing Popularity of Anti-pollution and Scalp Care Shampoos

3.5. Government Regulation (Product Certifications, Import Restrictions)

3.5.1. Regulatory Framework for Cosmetic Products

3.5.2. Import Duties and Tariffs on Raw Materials

3.5.3. Impact of Indonesian Halal Regulations on Shampoo Manufacturing

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. Indonesia Shampoo Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Dry Shampoos

4.1.2. Anti-dandruff Shampoos

4.1.3. Organic Shampoos

4.1.4. Medicated Shampoos

4.2. By Distribution Channel (In Value %)

4.2.1. Supermarkets & Hypermarkets

4.2.2. Specialty Stores

4.2.3. E-commerce

4.2.4. Convenience Stores

4.3. By Demographic (In Value %)

4.3.1. Men

4.3.2. Women

4.3.3. Children

4.4. By Hair Type (In Value %)

4.4.1. Normal Hair

4.4.2. Oily Hair

4.4.3. Dry Hair

4.4.4. Curly Hair

4.5. By Region (In Value %)

4.5.1. Java

4.5.2. Sumatra

4.5.3. Kalimantan

4.5.4. Bali

4.5.5. Sulawesi

5. Indonesia Shampoo Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Unilever Indonesia

5.1.2. Procter & Gamble Indonesia

5.1.3. L'Oral Indonesia

5.1.4. Johnson & Johnson

5.1.5. Kao Corporation

5.1.6. PZ Cussons Indonesia

5.1.7. Beiersdorf Indonesia

5.1.8. Colgate-Palmolive

5.1.9. The Himalaya Drug Company

5.1.10. The Body Shop Indonesia

5.1.11. Wardah Cosmetics

5.1.12. Sensatia Botanicals

5.1.13. Makarizo

5.1.14. Mustika Ratu

5.1.15. Erha Dermatology

5.2. Cross Comparison Parameters (Revenue, Product Innovation, Market Share, R&D Investment, No. of Employees, Product Range, Distribution Network, Sustainability Practices)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Private Equity Investments

6. Indonesia Shampoo Market Regulatory Framework

6.1. Product Safety Standards

6.2. Compliance and Certification Processes

6.3. Environmental and Sustainability Requirements

7. Indonesia Shampoo Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Indonesia Shampoo Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Distribution Channel (In Value %)

8.3. By Demographic (In Value %)

8.4. By Hair Type (In Value %)

8.5. By Region (In Value %)

9. Indonesia Shampoo Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Market Expansion Strategies

9.4. Product Development Opportunities

Research Methodology

Step 1: Identification of Key Variables

The first phase involves identifying and defining the primary stakeholders in the Indonesia Shampoo Market. Extensive desk research is conducted, gathering data from government reports, trade associations, and secondary databases to pinpoint key variables that influence market performance.

Step 2: Market Analysis and Construction

This step focuses on analyzing historical data on product types, distribution channels, and regional demand. Factors like market penetration and shampoo consumption rates are scrutinized to gauge the performance of different market segments.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed through desk research and subsequently validated by conducting in-depth interviews with industry experts. These consultations offer valuable insights into sales performance, pricing strategies, and emerging trends in the shampoo market.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing the data collected from various sources to produce a detailed, validated report. This step ensures that all market forecasts and insights are thoroughly vetted and grounded in factual analysis.

Frequently Asked Questions

01. How big is the Indonesia Shampoo Market?

The Indonesia Shampoo Market is valued at USD 14.9 billion, with growth driven by rising consumer demand, increasing urbanization, and the expansion of e-commerce platforms, enabling easier access to a wide range of products.

02. What are the challenges in the Indonesia Shampoo Market?

The primary challenges include stringent government regulations related to product safety, increasing competition from local and international brands, and fluctuating raw material prices that impact manufacturing costs.

03. Who are the major players in the Indonesia Shampoo Market?

Key players in the market include Unilever Indonesia, Procter & Gamble, L'Oral Indonesia, Wardah Cosmetics, and Sensatia Botanicals. These companies have established a strong foothold in the market through innovative product offerings and extensive distribution networks.

04. What are the growth drivers of the Indonesia Shampoo Market?

Growth drivers include increasing consumer awareness about personal grooming, rising disposable incomes, and the growing demand for organic and specialized hair care products. E-commerce platforms have also significantly contributed to market expansion.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.