Indonesia Software as a Service Market Outlook to 2030

Region:Asia

Author(s):Sanjna Verma

Product Code:KROD5858

December 2024

98

About the Report

Indonesia Software as a Service Market Overview

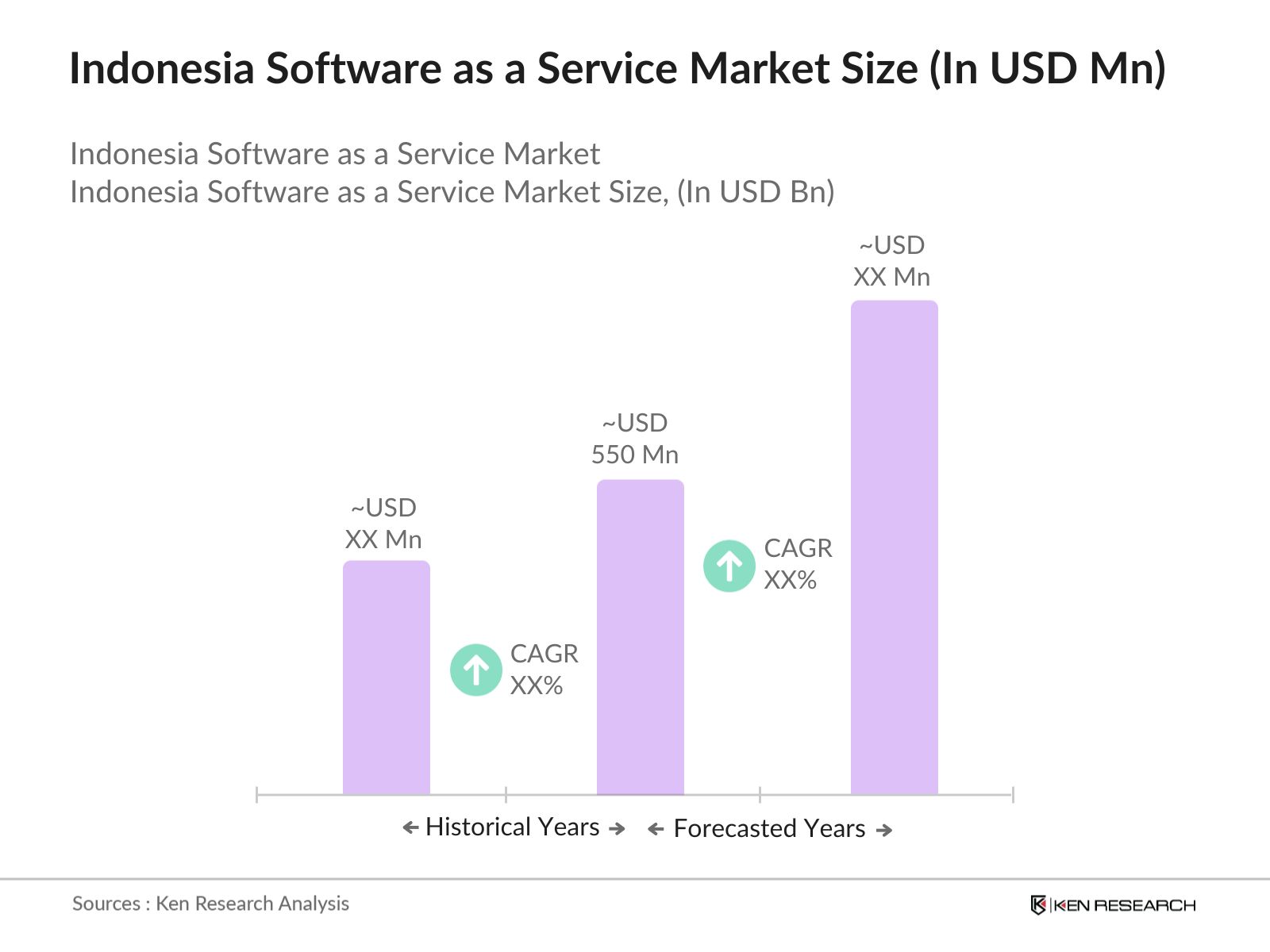

- Indonesia Software as a Service (SaaS) is valued at USD 550 million. This growth is fueled by the increasing demand for flexible, scalable software solutions among small and medium-sized enterprises (SMEs), as well as digital transformation initiatives launched by both the government and private enterprises. Key factors such as the expanding e-commerce sector and the need for better customer relationship management tools have further contributed to the market's expansion.

- Jakarta and other urban hubs like Surabaya and Bandung dominate the SaaS market in Indonesia due to their high concentration of businesses, better internet infrastructure, and proximity to technology hubs. These cities house a large number of financial, retail, and logistics firms, which rely heavily on SaaS solutions for managing customer data, supply chains, and business operations.

- The Indonesian governments digital economy framework aims to foster the growth of digital businesses, with the goal of creating a $200 billion digital economy by 2025. Through initiatives like "Indonesia Digital Nation," the government has been focusing on improving digital literacy, investing in digital infrastructure, and promoting cloud-based solutions to support economic growth. This framework encourages SaaS adoption as a critical tool for businesses transitioning to digital models, helping them enhance productivity and competitiveness.

Indonesia Software as a Service (SaaS) Market Segmentation

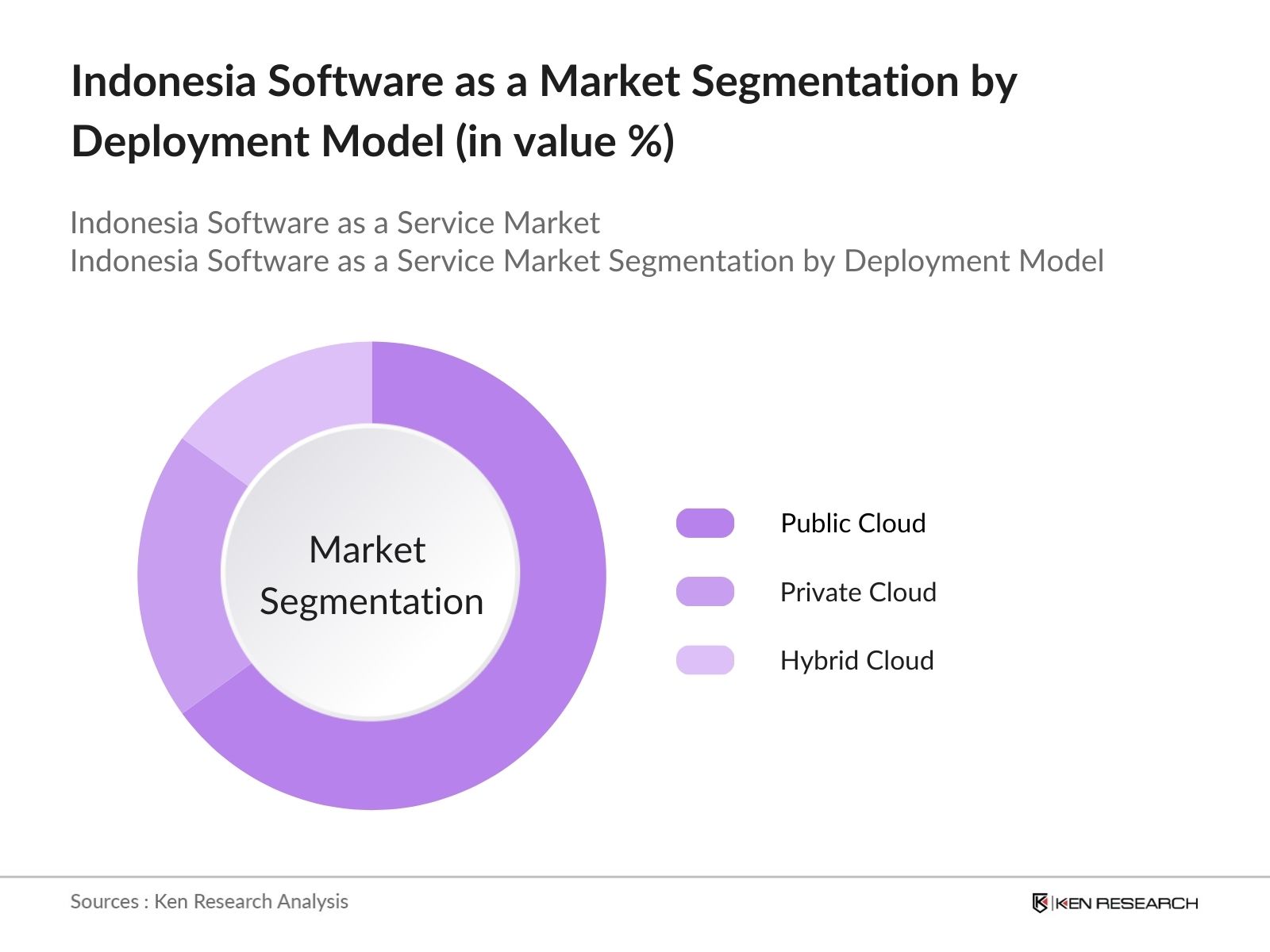

By Deployment Model: Indonesias SaaS market is segmented by deployment model into public cloud, private cloud, and hybrid cloud. Public cloud is the dominant segment due to its cost-effectiveness and scalability. In 2023, public cloud deployment models account for 65% of the market share. This dominance is attributed to businesses favoring public cloud due to lower initial costs, easier scalability, and flexibility in handling fluctuating workloads. Global providers like AWS and Google Cloud have established strong footholds, further driving public cloud adoption.

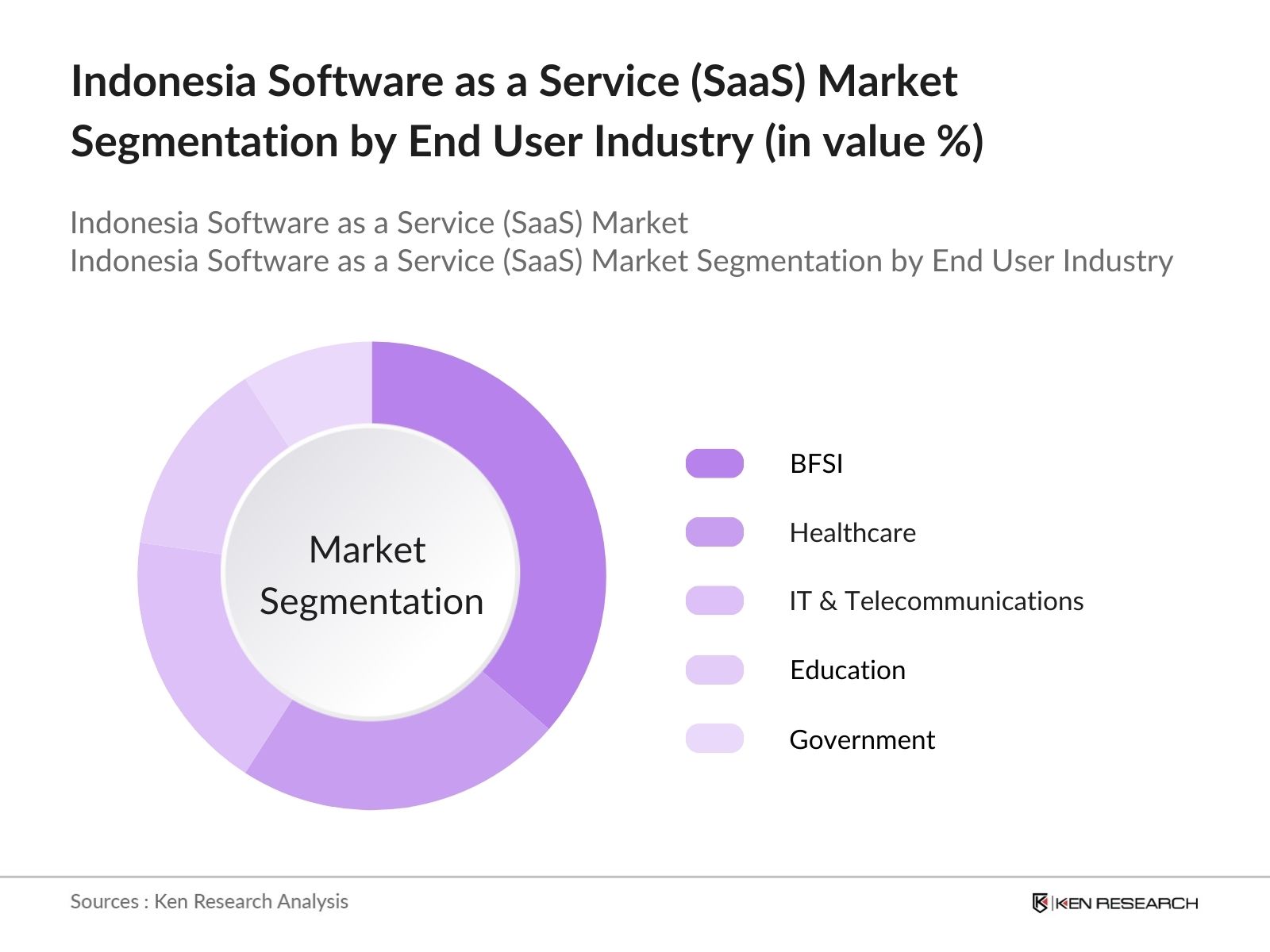

By End-User Industry: The SaaS market in Indonesia is also segmented by end-user industries, including BFSI, healthcare, IT and telecommunications, education, and government. The BFSI sector has emerged as the largest consumer of SaaS solutions, commanding 40% of the market share in 2023. This is primarily due to the sectors ongoing digital transformation initiatives aimed at improving customer experience and increasing operational efficiency. Cloud-based CRM and ERP systems are in high demand to manage large volumes of customer data and regulatory compliance requirements.

Indonesia Software as a Service (SaaS) Market Competitive Landscape

Indonesia Software as a Service (SaaS) Market Competitive Landscape

The Indonesia SaaS market is dominated by a combination of global giants and local players, creating a competitive and consolidated environment. Major companies like Microsoft, Oracle, and Salesforce dominate the landscape due to their extensive product portfolios and widespread adoption of their platforms by enterprises. Local firms like Telkom Indonesias IndiCloud have a growing presence, catering to specific industries and sectors with localized offerings.

|

Company |

Establishment Year |

Headquarters |

Revenue |

Market Penetration |

Product Offering |

Cloud Platform |

Customer Base |

Local Partnerships |

|

Microsoft Indonesia |

1995 |

Jakarta |

- |

- |

- |

- |

- |

- |

|

Oracle Indonesia |

1997 |

Jakarta |

- |

- |

- |

- |

- |

- |

|

Salesforce Indonesia |

2005 |

Jakarta |

- |

- |

- |

- |

- |

- |

|

Google Cloud Indonesia |

2012 |

Jakarta |

- |

- |

- |

- |

- |

- |

|

Telkom Indonesia (IndiCloud) |

2010 |

Jakarta |

- |

- |

- |

- |

- |

- |

Indonesia Software as a Service (SaaS) Market Analysis

Growth Drivers

- Cloud Adoption Across Industries: Indonesia has witnessed significant cloud adoption across industries, driven by rapid digitalization and the need for efficient infrastructure. As of 2023, over 70% of large enterprises in Indonesia have adopted some form of cloud technology to enhance operational efficiency and scalability, according to the Indonesian Ministry of Communication and Informatics. This is particularly relevant in sectors like banking, retail, and telecommunications, which rely on data-driven solutions.

- Digital Transformation Initiatives: The Indonesian government has emphasized the importance of digital transformation, especially within the framework of "Making Indonesia 4.0," which seeks to position the country among the world's top ten economies by 2030. As part of this initiative, the government allocated approximately $70 billion for digital infrastructure development between 2020 and 2024. This investment is driving the adoption of SaaS across various sectors, including manufacturing and services, accelerating the shift to digital business models to improve productivity and global competitiveness.

- Government Regulations Promoting Cloud Solutions: The Indonesian governments regulatory frameworks, such as Government Regulation No. 71 of 2019 on Electronic Systems and Transactions, have incentivized the adoption of cloud-based solutions by standardizing data storage requirements and promoting cloud data centers within the country. These policies have led to the establishment of local data centers by global cloud providers like Google and Microsoft, helping companies comply with regulations while leveraging global cloud technologies. The rise in local cloud infrastructure has made SaaS adoption more accessible for businesses of all sizes.

Challenges

- Data Privacy and Security Concerns: Data privacy remains a significant challenge in the Indonesian SaaS market. With the Personal Data Protection Law (UU PDP) coming into effect in 2023, businesses must ensure compliance, particularly around sensitive information handling. However, less than 30% of businesses reported full compliance with the new regulations, indicating a potential risk for SaaS adoption. This hesitancy can slow down cloud adoption in sectors like finance and healthcare, where data sensitivity is paramount.

- High Dependency on Internet Infrastructure: Indonesia's SaaS market growth is highly dependent on reliable internet infrastructure. As of 2023, the countrys average internet speed stood at 23 Mbps, which is below the global average of 32 Mbps, according to the Indonesian Internet Service Providers Association (APJII). In rural areas, internet penetration is still below 40%, posing challenges for SaaS adoption, especially among SMEs in non-urban regions.

Indonesia Software as a Service (SaaS) Market Future Outlook

Indonesia SaaS market is expected to experience accelerated growth driven by increasing digital transformation across multiple industries. Continuous government support for cloud adoption, advancements in data analytics, and a growing demand for scalable software solutions will be key drivers of market expansion. Additionally, the emergence of artificial intelligence (AI) and machine learning (ML) technologies is expected to bolster SaaS applications, allowing companies to offer more personalized and automated solutions to their customers.

Market Opportunities

- Expansion into Untapped Sectors (e.g., Healthcare, Education): The healthcare and education sectors in Indonesia present significant growth opportunities for SaaS providers. The Indonesian government allocated $37 billion in 2023 to healthcare infrastructure, which includes digital health initiatives. The education sector also saw increased digital spending, with over 60,000 schools transitioning to online learning platforms during the pandemic.

- Integration with AI and Machine Learning Technologies: Artificial Intelligence (AI) and Machine Learning (ML) are gaining traction in Indonesias SaaS market, with growing demand for predictive analytics, automation, and business intelligence tools. According to a 2023 World Bank report, the Indonesian government has been actively promoting AI initiatives, investing $33 million in AI research and development. SaaS providers integrating AI and ML capabilities are well-positioned to capture this market, particularly in sectors like retail, finance, and logistics, which rely heavily on data-driven insights.

Scope of the Report

|

By Deployment Model |

Public Cloud |

|

By End-User Industry |

Banking, Financial Services, and Insurance (BFSI) |

|

By Application Type |

Customer Relationship Management (CRM) |

|

By Enterprise Size |

Small and Medium Enterprises (SMEs) |

|

By Region |

Greater Jakarta |

Products

Key Target Audience

SaaS Solution Providers

Large Enterprises (Financial, Retail, Logistics)

Small and Medium-Sized Enterprises (SMEs)

E-commerce Companies

IT and Telecommunication Providers

Healthcare Organizations

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (Ministry of Communication and Informatics)

Companies

Players Mentioned in the Report

Microsoft Indonesia

Oracle Indonesia

Salesforce Indonesia

Google Cloud Indonesia

Telkom Indonesia (IndiCloud)

Amazon Web Services (AWS) Indonesia

SAP Indonesia

Zoho Corporation

Freshworks Indonesia

NetSuite Indonesia

Table of Contents

1. Indonesia SaaS Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. Indonesia SaaS Market Size (In USD Mn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. Indonesia SaaS Market Analysis

3.1 Growth Drivers

3.1.1 Cloud Adoption Across Industries

3.1.2 Digital Transformation Initiatives

3.1.3 Government Regulations Promoting Cloud Solutions

3.1.4 Demand from SMEs for Scalable Solutions

3.2 Market Challenges

3.2.1 Data Privacy and Security Concerns

3.2.2 High Dependency on Internet Infrastructure

3.2.3 Limited Localized SaaS Offerings

3.3 Opportunities

3.3.1 Expansion into Untapped Sectors (e.g., Healthcare, Education)

3.3.2 Rising Demand for SaaS in Remote Workforce Management

3.3.3 Integration with AI and Machine Learning Technologies

3.4 Trends

3.4.1 Growth in SaaS Subscription Models

3.4.2 Increased Focus on Customizable SaaS Solutions

3.4.3 Higher Adoption of SaaS for ERP, CRM, and HR Management

3.5 Government Regulation

3.5.1 Digital Economy Framework

3.5.2 Data Protection and Cybersecurity Laws

3.5.3 National Cloud Computing Policies

3.6 Stakeholder Ecosystem

3.7 SWOT Analysis

3.8 Porters Five Forces

3.9 Competition Ecosystem

4. Indonesia SaaS Market Segmentation

4.1 By Deployment Model (In Value %)

4.1.1 Public Cloud

4.1.2 Private Cloud

4.1.3 Hybrid Cloud

4.2 By End-User Industry (In Value %)

4.2.1 Banking, Financial Services, and Insurance (BFSI)

4.2.2 Healthcare

4.2.3 IT and Telecommunications

4.2.4 Education

4.2.5 Government

4.3 By Application Type (In Value %)

4.3.1 Customer Relationship Management (CRM)

4.3.2 Enterprise Resource Planning (ERP)

4.3.3 Human Resource Management (HRM)

4.3.4 Collaboration Tools

4.3.5 E-commerce Solutions

4.4 By Enterprise Size (In Value %)

4.4.1 Small and Medium Enterprises (SMEs)

4.4.2 Large Enterprises

4.5 By Region (In Value %)

4.5.1 Greater Jakarta

4.5.2 Java

4.5.3 Sumatra

4.5.4 Bali and Nusa Tenggara

4.5.5 Kalimantan

5. Indonesia SaaS Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 PT Microsoft Indonesia

5.1.2 Oracle Indonesia

5.1.3 SAP Indonesia

5.1.4 Salesforce Indonesia

5.1.5 Zoho Corporation

5.1.6 Google Cloud Indonesia

5.1.7 Amazon Web Services (AWS) Indonesia

5.1.8 PT Telkom Indonesia (IndiCloud)

5.1.9 NetSuite Indonesia

5.1.10 Freshworks Indonesia

5.2 Cross Comparison Parameters (Revenue, Inception Year, Product Offering, Market Share, Partnerships)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Support and Incentives

6. Indonesia SaaS Market Regulatory Framework

6.1 Data Protection Laws (Personal Data Protection Act)

6.2 Compliance and Certification Standards (ISO 27001, SOC 2)

6.3 Cloud Computing Guidelines

6.4 Cybersecurity Framework

7. Indonesia SaaS Future Market Size (In USD Mn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. Indonesia SaaS Future Market Segmentation

8.1 By Deployment Model (In Value %)

8.2 By End-User Industry (In Value %)

8.3 By Application Type (In Value %)

8.4 By Enterprise Size (In Value %)

8.5 By Region (In Value %)

9. Indonesia SaaS Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The research process begins with constructing an ecosystem map that encompasses all key stakeholders in the Indonesia SaaS market. This includes extensive desk research using proprietary databases and secondary resources to capture market dynamics and trends. The objective is to define critical factors like cloud adoption rate, end-user demand, and software development challenges.

Step 2: Market Analysis and Construction

In this phase, we collect and analyze historical market data, including SaaS penetration, enterprise software adoption, and the growth of cloud infrastructure. We also assess market revenue generation and the impact of internet infrastructure quality on SaaS deployment in Indonesia.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses related to the SaaS market are validated through consultations with industry professionals, cloud service providers, and system integrators. These interviews provide insights into market behavior, product offerings, and customer requirements, refining the research findings.

Step 4: Research Synthesis and Final Output

Finally, we engage with SaaS vendors to obtain detailed product segment data, market performance, and consumer trends. This bottom-up approach ensures that all statistical insights are validated and align with market conditions, leading to a comprehensive analysis of the Indonesia SaaS market.

Frequently Asked Questions

01. How big is the Indonesia SaaS market?

The Indonesia SaaS market is valued at USD 550 million, driven by digital transformation efforts and a growing demand for scalable cloud solutions among enterprises and SMEs.

02. What are the challenges in the Indonesia SaaS market?

Key challenges of Indonesia SaaS market include data privacy concerns, reliance on robust internet infrastructure, and limited availability of localized SaaS solutions. Additionally, regulatory compliance and security requirements pose hurdles for SaaS providers.

03. Who are the major players in the Indonesia SaaS market?

Major players of Indonesia SaaS market include global companies such as Microsoft, Oracle, Salesforce, and local entities like Telkom Indonesias IndiCloud. These firms dominate the market due to their comprehensive product offerings and strong client bases.

04. What are the growth drivers of the Indonesia SaaS market?

Growth drivers of Indonesia SaaS market include the increasing adoption of cloud technologies, digital transformation initiatives across industries, and the rising demand for cost-effective, scalable software solutions. The governments push for IT modernization and cloud adoption is also a key factor.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.