Indonesia Software Market Outlook to 2030

Region:Asia

Author(s):Meenakshi Bisht

Product Code:KROD5888

December 2024

93

About the Report

Indonesia Software Market Overview

- The Indonesia Software Market is valued at USD 1 billion, driven by increased digital transformation across sectors, and the demand for cloud-based solutions. This market growth is largely supported by Indonesias rapid adoption of technology in both public and private sectors, as well as increasing reliance on SaaS platforms for cost-effective business solutions.

- Jakarta and Surabaya stand out as dominant cities in the Indonesia Software Market due to their developed IT infrastructure and being home to several major corporations and tech startups. Jakarta, as the capital, acts as the hub for technological innovation and investment in the country, while Surabayas growing digital ecosystem fosters business development. Both cities benefit from strong internet penetration and government-backed IT initiatives.

- The Indonesian government has introduced new tax incentives and other benefits for investors in Special Economic Zones (SEZs) to attract foreign investment and boost regional economic growth. These initiatives include up to 20 years of corporate income tax exemptions based on investment size, tax holidays, VAT exemptions, and 100% foreign ownership rights. These measures are aimed at increasing investment in SEZs, with four new zones planned, focusing on logistics, energy, and digital industries in 2024.

Indonesia Software Market Segmentation

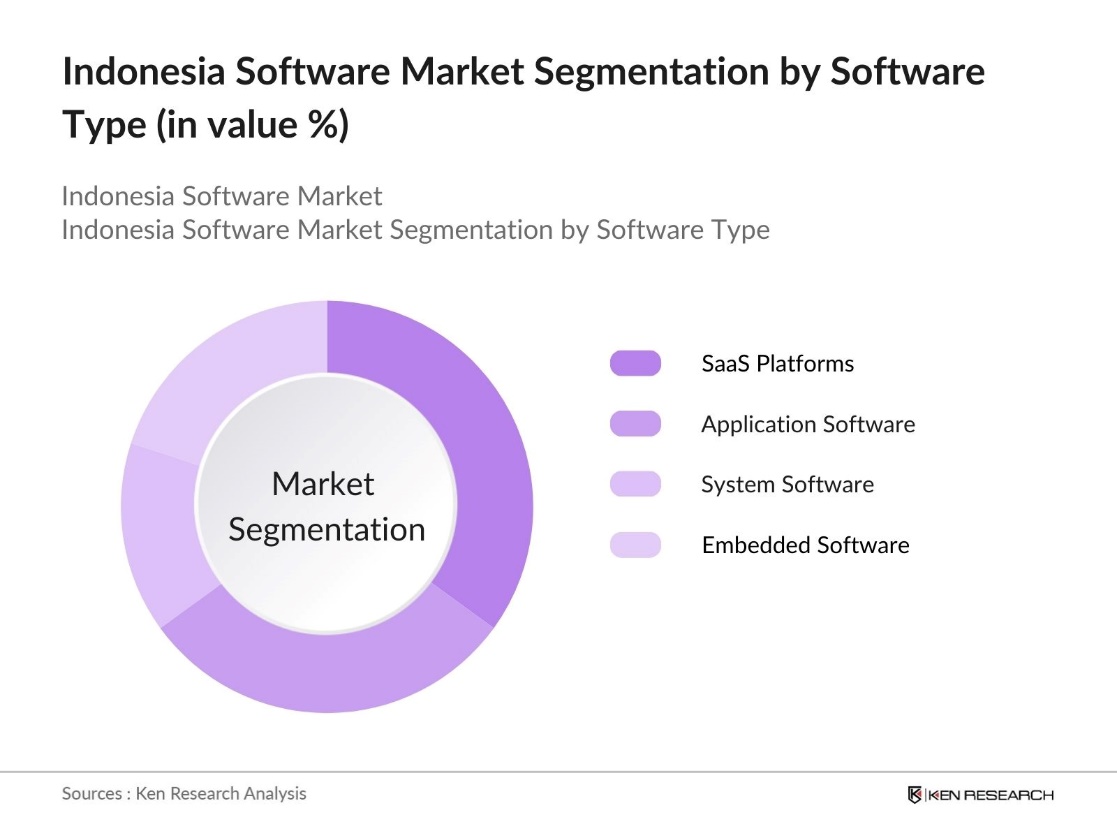

By Software Type: The Indonesia Software Market is segmented by software type into system software, application software, embedded software, and SaaS platforms. SaaS platforms hold a dominant market share due to the flexibility, cost-efficiency, and scalability they provide for businesses of all sizes. The subscription-based model of SaaS platforms, combined with the growing need for remote work solutions, is contributing to its rising popularity. This trend is further accelerated by the increasing digital transformation across industries such as banking, e-commerce, and retail.

By End-User Industry: The Indonesia Software Market is also segmented by end-user industry into healthcare, banking & financial services, education, government, and manufacturing. The banking & financial services industry leads this segment, as financial institutions continue to invest heavily in advanced software solutions to enhance customer experience, ensure security, and streamline operations. The rise of fintech and digital banking services further drives demand for cutting-edge software solutions in this sector.

Indonesia Software Market Competitive Landscape

The market is shaped by a mix of global giants and local players, with intense competition driving innovation. Major global software providers like Microsoft and Oracle have established a significant presence in Indonesia, leveraging their cloud solutions and enterprise software portfolios. Local IT companies are also rising in prominence by offering localized solutions that cater to Indonesias unique business environment and regulatory landscape.

|

Company Name |

Establishment Year |

Headquarters |

Software Focus |

Revenue (USD Bn) |

Key Products |

Cloud Service Adoption |

Number of Employees |

Geographic Presence |

|

Microsoft Indonesia |

1995 |

Jakarta |

||||||

|

Oracle Indonesia |

1989 |

Jakarta |

||||||

|

SAP Indonesia |

1999 |

Jakarta |

||||||

|

PT Telkom Indonesia |

1965 |

Jakarta |

||||||

|

PT Google Cloud Indonesia |

2015 |

Jakarta |

Indonesia Software Industry Analysis

Growth Drivers

- Increasing Demand for Cloud-Based Solutions: Indonesias rapid adoption of cloud technologies is a significant growth driver in its software market. A survey indicated that a substantial 94% of cloud service users in Indonesia plan to increase their investment in cloud technology by 2023. Cloud adoption in the public sector has also been fueled by digital transformation policies, with the Indonesian government migrating key services to cloud platforms. The data-driven economy has surged, with cloud-based data centers supporting an influx of tech start-ups.

- Growing Digitalization Across Industries: E-commerce transactions give the biggest contribution to Indonesia's digital economy, where in 2021 the value reached US$53 billion. Large enterprises are deploying software to automate processes, with over 30% of Indonesian businesses already using enterprise resource planning (ERP) software to streamline operations. Additionally, the adoption of mobile and web applications for customer services has surged, particularly in banking and healthcare, supported by government-led initiatives such as Making Indonesia 4.0 to foster a digitally-driven manufacturing sector.

- Expanding Tech Start-Up Ecosystem: Indonesia has become a prominent hub for tech start-ups, particularly in sectors like cloud computing, fintech, and e-commerce. Major cities like Jakarta, Bandung, and Surabaya have seen rapid growth in the number of tech start-ups, with innovation hubs and accelerators emerging to support their development. This thriving ecosystem is also attracting significant foreign investment, leading to further growth and the creation of new opportunities in the software market. Venture capital funding plays a key role in driving innovation, allowing start-ups to develop custom software solutions across various industries.

Market Challenges

- High Licensing and Maintenance Costs for Advanced Software: The high cost of software licensing is a major barrier for small and medium-sized enterprises (SMEs) in Indonesia, particularly for advanced solutions like artificial intelligence and machine learning. These costs often force businesses to rely on outdated or unauthorized software, limiting technology adoption. This issue is most prevalent in sectors like manufacturing and retail, where budget constraints slow the overall market growth.

- Limited Availability of Skilled Software Developers: Indonesia's software market faces a shortage of skilled developers, especially in areas like cybersecurity and cloud computing. The limited availability of talent forces companies to outsource development or rely on international experts. Despite local universities producing IT graduates, few specialize in high-demand skills, creating a gap that restricts the adoption of new technologies and hampers market growth.

Indonesia Software Market Future Outlook

Over the next few years, the Indonesia Software Market is expected to witness significant growth driven by the continuous digital transformation initiatives, increasing demand for cloud-based services, and the rapid growth of e-commerce and fintech industries. With the government actively supporting IT infrastructure development and digital literacy programs, businesses across various sectors are embracing software solutions to optimize operations and enhance productivity.

Market Opportunities

- Growth of Software-as-a-Service (SaaS) Market: Indonesias SaaS market is expanding rapidly due to increased cloud adoption across industries. Businesses are leveraging SaaS platforms for key functions like customer relationship management and human resources management, drawn by their flexibility and cost-effectiveness. The rise of tech start-ups further drives this trend, as they favor scalable SaaS solutions. This growth opens opportunities in sectors such as healthcare, education, and retail.

- Opportunities in Mobile App Development: Indonesias mobile-first economy creates significant opportunities in mobile app development, particularly in fintech, e-commerce, and social media. Start-ups are focusing on mobile solutions for underserved markets like rural banking and healthcare. As mobile transactions grow, developers are well-positioned to meet rising demand for innovative apps across various industries.

Scope of the Report

|

By Software Type |

System Software Application Software Embedded Software SaaS Platforms |

|

By End-User Industry |

Healthcare Banking & Financial Services Education Government Manufacturing |

|

By Deployment Model |

On-Premise Cloud-Base Hybrid |

|

By Enterprise Size |

Small & Medium Enterprises (SMEs) Large Enterprises |

|

By Region |

Java Sumatra Kalimantan Sulawesi Papua |

Products

Key Target Audience

Blockchain Technology Firms

IT Outsourcing Companies

Logistics and Supply Chain Companies

Telecommunication Companies

E-Commerce Companies

Investor and venture capital Firms

Banks and Financial Institutions

Government and Regulatory Bodies (Indonesia Ministry of Communication and Information Technology)

Companies

Players Mentioned in the Report

Microsoft Indonesia

Oracle Indonesia

SAP Indonesia

PT Telkom Indonesia

PT Google Cloud Indonesia

Fujitsu Indonesia

PT IBM Indonesia

PT Alibaba Cloud Indonesia

Accenture Indonesia

Red Hat Indonesia

Table of Contents

1. Indonesia Software Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Indonesia Software Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Indonesia Software Market Analysis

3.1. Growth Drivers (Cloud Adoption, Digital Transformation Initiatives, Government Policies)

3.1.1. Increasing Demand for Cloud-Based Solutions

3.1.2. Growing Digitalization Across Industries

3.1.3. Favorable Government Policies for IT Sector Development

3.1.4. Expanding Tech Start-up Ecosystem

3.2. Market Challenges (High Software Licensing Costs, Skills Gap)

3.2.1. High Licensing and Maintenance Costs for Advanced Software

3.2.2. Limited Availability of Skilled Software Developers

3.2.3. Slow Adoption of New Technologies by SMEs

3.2.4. Cybersecurity Concerns

3.3. Opportunities (Rising Demand for SaaS, Digital Government Programs)

3.3.1. Growth of Software-as-a-Service (SaaS) Market

3.3.2. Government Initiatives Supporting E-Governance and Digital Services

3.3.3. Opportunities in Mobile App Development

3.3.4. Integration of AI and Automation Technologies

3.4. Trends (Cloud-Native Applications, Remote Work Tools)

3.4.1. Adoption of Cloud-Native Applications

3.4.2. Increasing Use of Remote Work and Collaboration Tools

3.4.3. Growth in Custom Software Development Services

3.4.4. Rise in Open-Source Software Adoption

3.5. Government Regulations (Digital Economy Policies, Data Protection)

3.5.1. Digital Economy Regulations by Indonesia Government

3.5.2. Data Protection and Cybersecurity Laws

3.5.3. Compliance Standards for Software Licensing

3.5.4. Tax Incentives for IT Sector

3.6. SWOT Analysis (Strengths, Weaknesses, Opportunities, Threats)

3.7. Stakeholder Ecosystem (Developers, SaaS Providers, IT Consultants)

3.8. Porters Five Forces Analysis (Competitive Rivalry, Threat of New Entrants)

3.9. Competitive Landscape Analysis

4. Indonesia Software Market Segmentation

4.1. By Software Type (In Value %)

4.1.1. System Software

4.1.2. Application Software

4.1.3. Embedded Software

4.1.4. SaaS Platforms

4.2. By End-User Industry (In Value %)

4.2.1. Healthcare

4.2.2. Banking & Financial Services

4.2.3. Education

4.2.4. Government

4.2.5. Manufacturing

4.3. By Deployment Model (In Value %)

4.3.1. On-Premise

4.3.2. Cloud-Based

4.3.3. Hybrid

4.4. By Enterprise Size (In Value %)

4.4.1. Small & Medium Enterprises (SMEs)

4.4.2. Large Enterprises

4.5. By Region (In Value %)

4.5.1. Java

4.5.2. Sumatra

4.5.3. Kalimantan

4.5.4. Sulawesi

4.5.5. Papua

5. Indonesia Software Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Microsoft Indonesia

5.1.2. Oracle Indonesia

5.1.3. SAP Indonesia

5.1.4. PT NetApp Indonesia

5.1.5. PT IBM Indonesia

5.1.6. PT Accenture Indonesia

5.1.7. PT Google Cloud Indonesia

5.1.8. PT Dell Technologies Indonesia

5.1.9. Fujitsu Indonesia

5.1.10. PT Alibaba Cloud Indonesia

5.1.11. Red Hat Indonesia

5.1.12. PT Salesforce Indonesia

5.1.13. Infosys Technologies Indonesia

5.1.14. PT Huawei Technologies Indonesia

5.1.15. PT VMWare Indonesia

5.2. Cross Comparison Parameters (Revenue, Number of Employees, Software Portfolio, Cloud Services Adoption, Customer Base, Data Center Presence, Market Penetration, Geographic Reach)

5.3. Market Share Analysis (In Value %)

5.4. Strategic Initiatives (R&D Investments, Cloud Expansion, Local Partnerships)

5.5. Mergers and Acquisitions

5.6. Investment Analysis (Venture Capital, Private Equity)

5.7. Government Grants and Tax Incentives

5.8. Private Equity Investments

6. Indonesia Software Market Regulatory Framework

6.1. Data Localization Laws

6.2. Intellectual Property Rights in Software

6.3. Licensing and Compliance Standards

6.4. Open-Source Software Regulations

7. Indonesia Software Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Indonesia Software Market Analysts Recommendations

8.1. TAM/SAM/SOM Analysis

8.2. Customer Cohort Analysis

8.3. Marketing Initiatives

8.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial step involved developing an ecosystem map for the Indonesia Software Market, identifying major stakeholders and analyzing market drivers. This phase included extensive desk research, utilizing proprietary databases, government reports, and secondary data from industry bodies to gather relevant insights.

Step 2: Market Analysis and Construction

This phase focused on compiling historical data related to the market, evaluating the penetration of software solutions in various industries, and assessing revenue generation trends. A thorough analysis of software usage across industries helped in constructing a reliable revenue model.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses were validated through interviews with industry experts, including software developers and IT service providers, ensuring that the data was grounded in practical insights. These consultations provided critical operational and financial information.

Step 4: Research Synthesis and Final Output

The final stage involved synthesizing all collected data, refining the market estimates, and producing a comprehensive analysis. Direct consultations with software vendors ensured the reliability of the market projections, aligning them with the bottom-up approach used for the study.

Frequently Asked Questions

01 How big is the Indonesia Software Market?

The Indonesia Software Market is valued at USD 1 billion, driven by growing demand for cloud-based solutions and software-as-a-service platforms across industries like banking, healthcare, and education.

02 What are the key challenges in the Indonesia Software Market?

Key challenges in Indonesia Software Market include the high cost of advanced software licenses, a shortage of skilled developers, and cybersecurity concerns, which have hindered the adoption of new technologies by small and medium enterprises.

03 Who are the major players in the Indonesia Software Market?

Major players in Indonesia Software Market include Microsoft Indonesia, Oracle Indonesia, PT Telkom Indonesia, SAP Indonesia, and PT Google Cloud Indonesia, dominating due to their strong cloud offerings and extensive market presence.

04 What is driving the growth of the Indonesia Software Market?

The Indonesia Software Market growth is driven by increasing digital transformation initiatives, growing adoption of cloud-based services, and government policies aimed at supporting IT infrastructure development.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.