Indonesia Substitute for Rice Flour Market Outlook to 2030

Region:Asia

Author(s):Abhinav kumar

Product Code:KROD9256

December 2024

96

About the Report

Indonesia Substitute for Rice Flour Market Overview

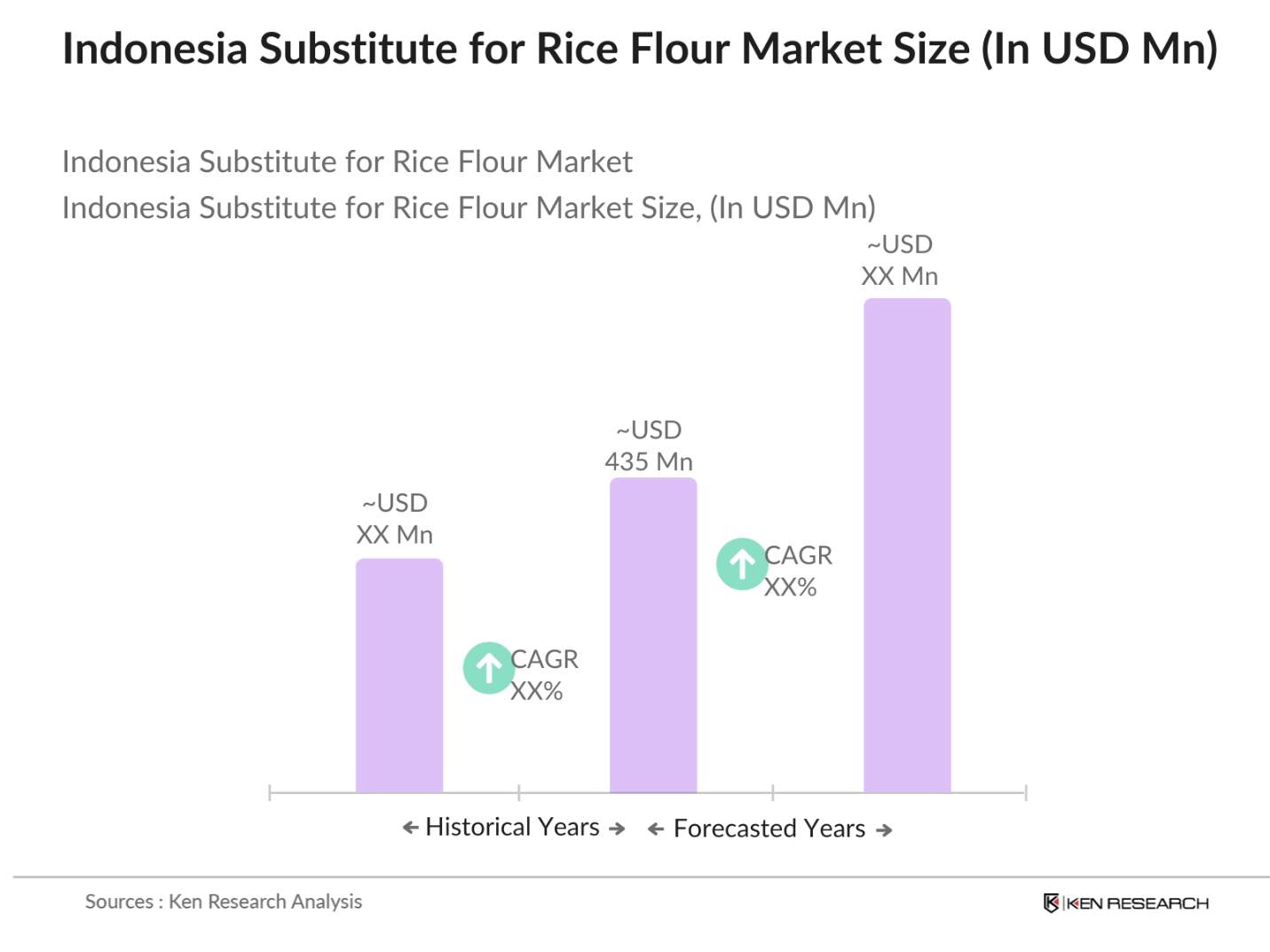

- The Indonesia Substitute for Rice Flour market is valued at USD 435 million, based on a five-year historical analysis. This market is driven by rising health consciousness among Indonesian consumers, especially with increasing gluten intolerance cases. Health-focused alternatives like sorghum, cassava, and almond flour are witnessing rising demand, propelled by government initiatives to promote food diversity and support local agriculture. Backed by a robust food processing industry and increasing consumer awareness, the market's steady growth reflects a shift toward healthier and local ingredients.

- Java and Sumatra are the dominant regions in Indonesias Substitute for Rice Flour market due to their substantial agricultural activities and high population density. These areas benefit from favorable conditions for alternative flour production, alongside well-established distribution channels. Java, in particular, is home to significant processing facilities, which further supports the market's prominence in this region.

- Indonesias national food security policies aim to reduce dependency on imported rice by promoting alternative grains for flour production. The Ministry of Agricultures 2024 policy framework supports initiatives that favor cassava and sorghum cultivation, ensuring a steady supply of raw materials for rice flour substitutes. These policies strengthen food security and create a robust domestic market for alternative flours.

Indonesia Substitute for Rice Flour Market Segmentation

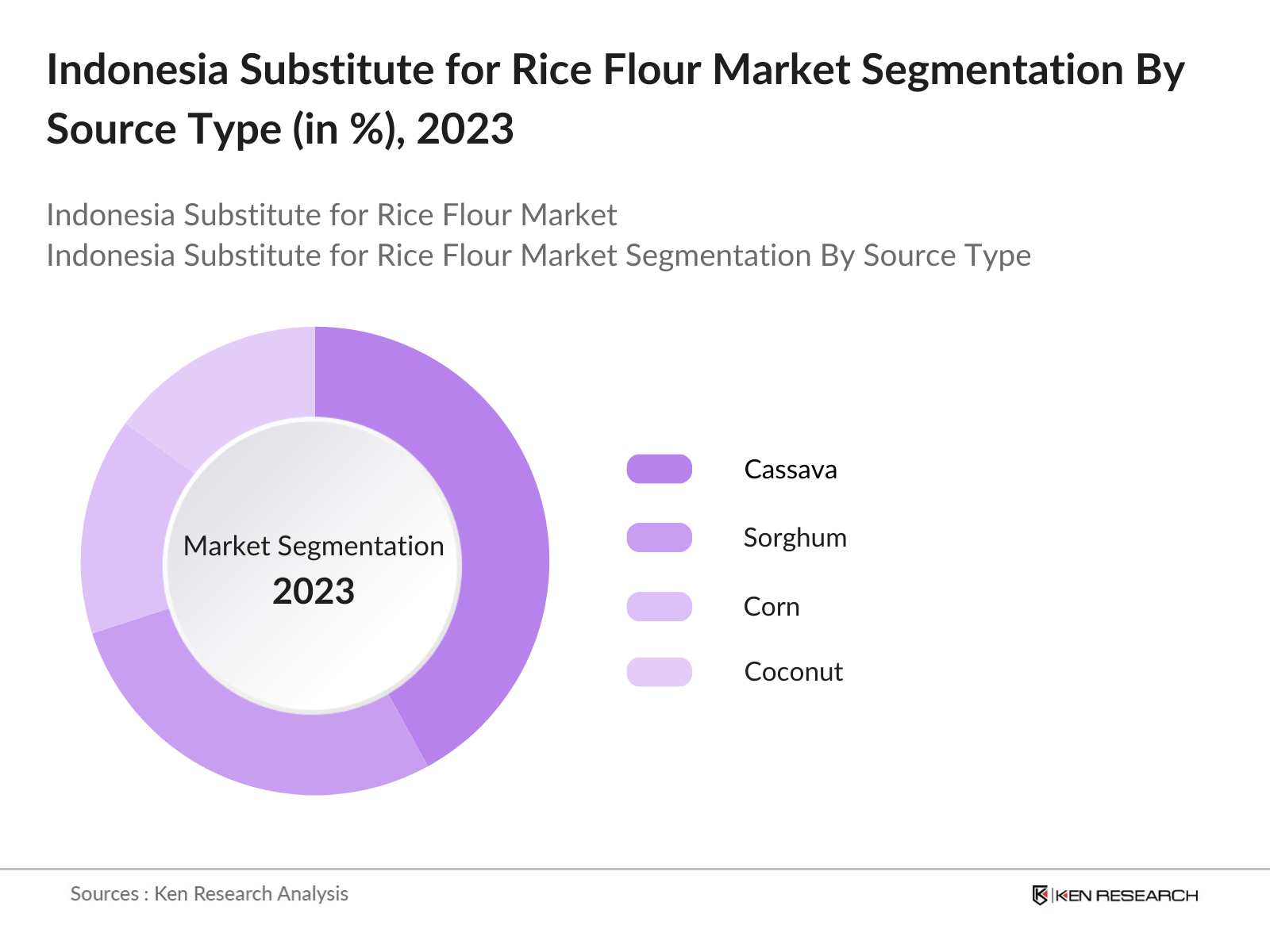

By Source: Indonesias Substitute for Rice Flour market is segmented by source into sorghum, cassava, corn, almond, and coconut. Cassava flour holds the dominant market share within this category, primarily due to its availability and affordability in Indonesia. Cassava is a staple crop in the region, making its flour an accessible and cost-effective alternative for both households and food manufacturers. The crop's adaptability to the local climate and government support for cassava cultivation reinforce its prominence in the substitute flour segment.

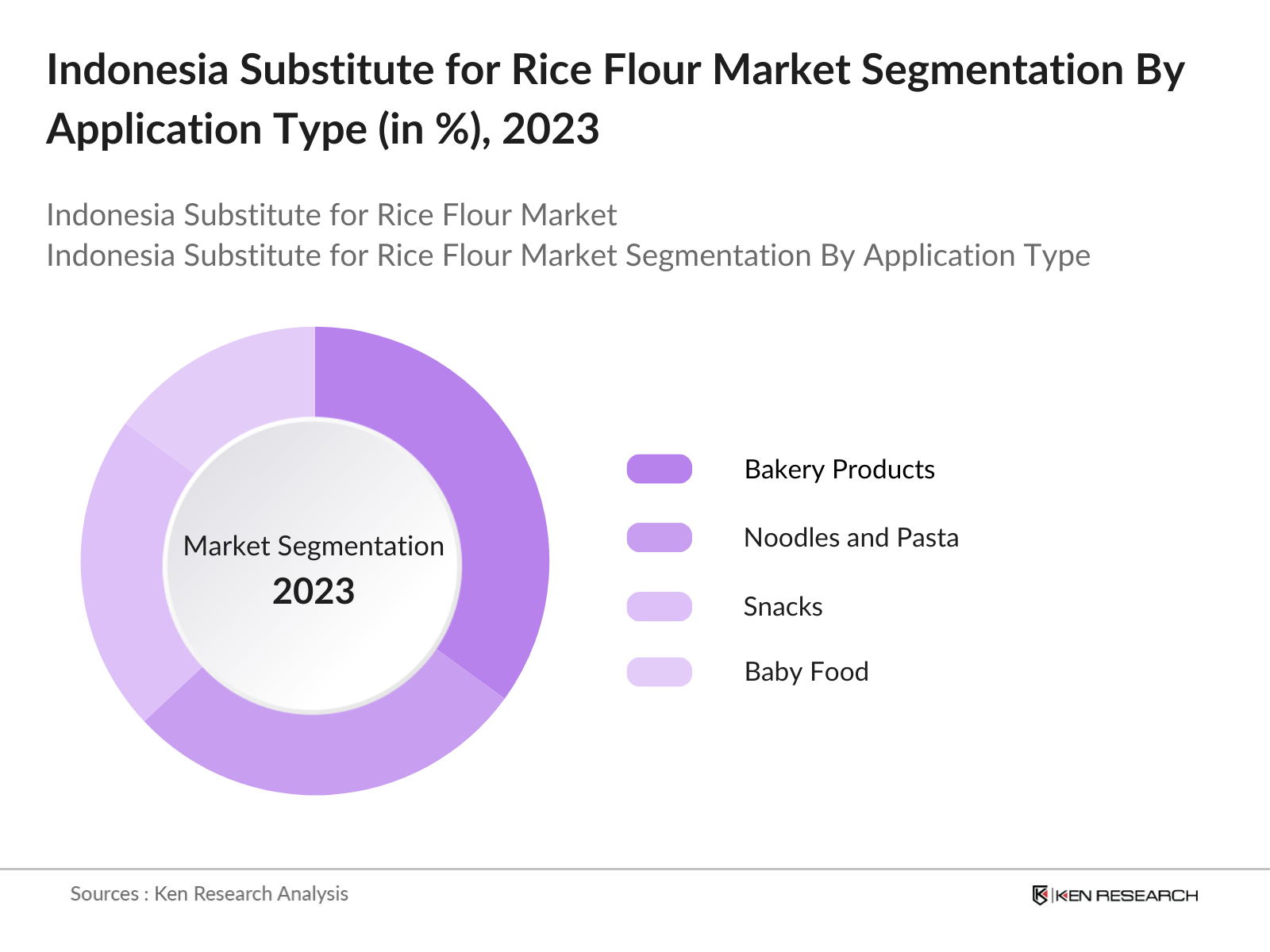

By Application: The market is segmented by application into bakery products, noodles and pasta, snacks, baby food, and sauces and dressings. Bakery products are the leading segment, driven by a growing trend toward gluten-free and healthier baked goods among urban consumers. Indonesian bakeries are increasingly adopting substitute flours to cater to the demand for nutrient-rich, gluten-free options. Sorghum and cassava flours are widely used, allowing manufacturers to produce traditional as well as innovative baked goods with enhanced nutritional profiles.

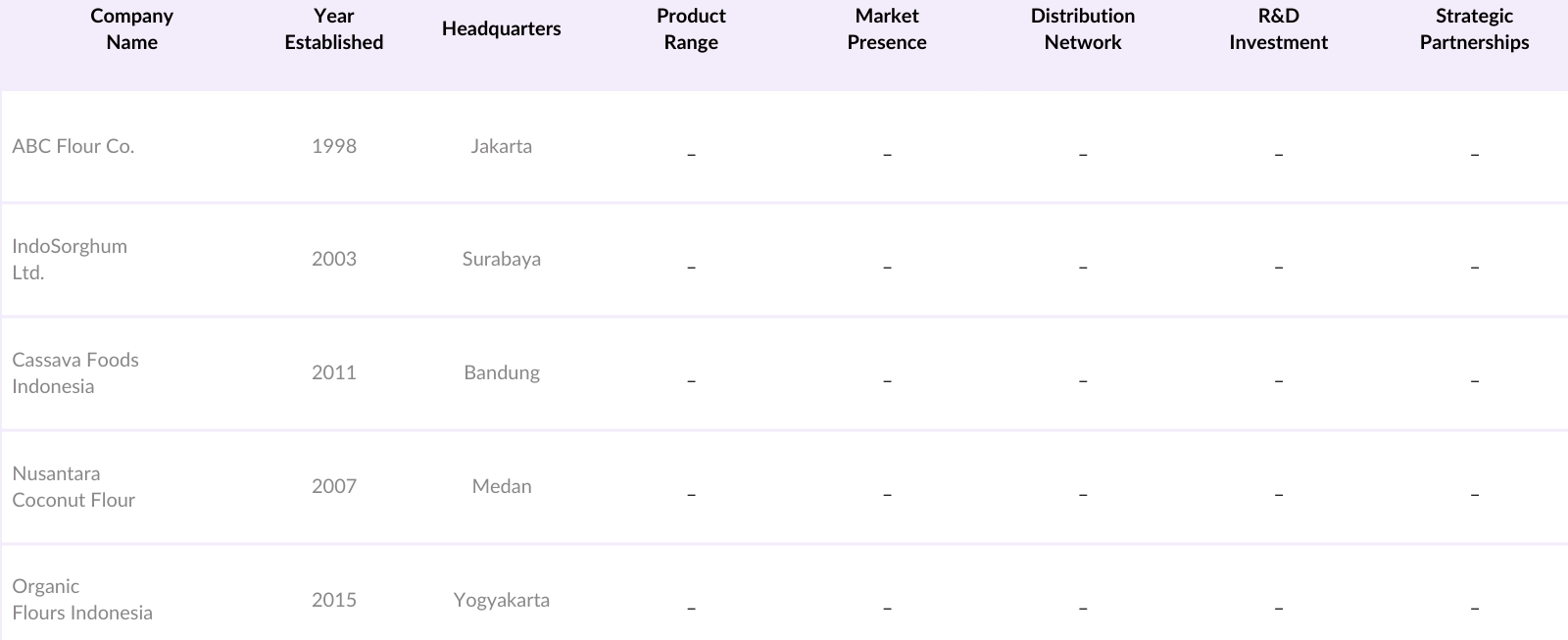

Indonesia Substitute for Rice Flour Market Competitive Landscape

The Indonesia Substitute for Rice Flour market is led by a few prominent players who dominate through their extensive distribution networks and diversified product offerings. The competitive landscape is shaped by companies leveraging local sourcing and strong brand loyalty. The presence of both domestic companies and international players intensifies competition, especially in the premium and organic flour categories.

Indonesia Substitute for Rice Flour Industry Analysis

Growth Drivers

- Increasing Prevalence of Gluten Intolerance: The prevalence of gluten intolerance has prompted a shift towards gluten-free products, creating demand for rice flour substitutes in Indonesia. With approximately 500,000 people reported as gluten-intolerant in 2024, according to the Ministry of Health, the gluten-free market segment is set to grow as consumers seek alternative flours such as sorghum and cassava. These local grains provide gluten-free options, aligning with dietary preferences while boosting demand for substitutes. Furthermore, the Ministry of Agricultures 2024 data suggests that domestic production of cassava flour alone has risen by 8,000 tons to meet this growing demand.

- Rising Health Consciousness Among Consumers: Indonesian consumers have become increasingly health-conscious, leading to higher demand for nutritious alternatives to rice flour. The National Health Survey of Indonesia in 2024 highlighted a surge in interest in high-fiber, low-calorie foods, with approximately 15% of the population actively seeking these products. Flours from local grains like sorghum and cassava are rich in essential nutrients, such as fiber and vitamins, which contribute to balanced diets. This health trend is supported by findings from the Ministry of Health that show a steady increase in per capita consumption of gluten-free products, particularly among urban populations.

- Government Initiatives Promoting Crop Diversification: The Indonesian government has promoted crop diversification under its Sustainable Agriculture Initiative, encouraging the production of sorghum and cassava as alternatives to rice. According to the Ministry of Agriculture, over $250 million was allocated in 2024 to support crop diversification projects, leading to a 12% increase in non-rice flour production compared to 2023. This initiative not only aids food security but also supports local farmers by diversifying their income sources. Enhanced support for alternative flours has led to partnerships with local producers, contributing to the growth of the rice flour substitute market.

Market Challenges

- Limited Consumer Awareness: Although alternative flours offer numerous health benefits, consumer awareness about these options remains low. According to a survey conducted by the Ministry of Trade in 2024, only 30% of Indonesians are aware of gluten-free products and their benefits. This lack of awareness hinders market expansion, as consumers continue to rely heavily on traditional rice flour. Educational campaigns and promotional efforts are needed to bridge this knowledge gap, which would support market growth for rice flour substitutes.

- High Production Costs of Alternative Flours

The production of alternative flours such as cassava and sorghum is cost-intensive due to the need for specialized processing techniques. Data from the Ministry of Agriculture in 2024 shows that production costs for these flours are approximately 30% higher than rice flour due to labor and equipment expenses. These costs impact market prices, making alternative flours less affordable for a larger segment of the population. Thus, high production costs pose a significant challenge to market adoption, requiring innovations to reduce expenses and improve competitiveness.

Indonesia Substitute for Rice Flour Market Future Outlook

Over the next five years, the Indonesia Substitute for Rice Flour market is expected to show robust growth driven by increased health consciousness, product innovation, and supportive government policies for crop diversification. Growing urbanization, the popularity of gluten-free diets, and the development of the local agricultural sector are anticipated to bolster market expansion, providing lucrative opportunities for both local and international market players.

Opportunities

- Innovation in Product Development: Innovative product development, such as the blending of cassava and sorghum flour with nutrient-enriched ingredients, has great potential to attract health-conscious consumers. The Ministry of Industry reported a rise in R&D investments, with approximately $50 million allocated towards developing new gluten-free products in 2024. These innovations are aimed at enhancing the nutritional profile of flours and creating a wider range of alternatives to rice flour, appealing to diverse consumer preferences. Such developments provide an opportunity for producers to introduce unique products and gain a competitive edge in the market.

- Expansion into Untapped Regional Markets: Many rural and semi-urban areas in Indonesia remain untapped markets for rice flour substitutes. A report by the Ministry of Villages in 2024 highlighted that alternative flours have minimal penetration in regions like East Kalimantan and Sulawesi, where distribution channels are underdeveloped. Expanding into these markets could significantly increase product reach and sales, especially if supported by infrastructure development projects currently underway. This geographic expansion represents a substantial growth opportunity for the rice flour substitute market in the coming years.

Scope of the Report

|

Source |

Sorghum Cassava Corn Almond Coconut |

|

Application |

Bakery Products Noodles and Pasta Snacks Baby Food Sauces and Dressings |

|

Distribution Channel |

Supermarkets and Hypermarkets Convenience Stores Online Retail Specialty Stores |

|

End User |

Household Foodservice Industry Food Manufacturers |

|

Region |

Java Sumatra Kalimantan Sulawesi Papua |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing to This Report:

Investor and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., Ministry of Agriculture, Ministry of Trade)

Alternative Flour Manufacturing Industries

Food and Beverage Companies

Organic Product Companies

E-commerce Platform Companies

Health and Wellness Product Companies

Large-Scale Food Processing Industries

Companies

Players Mentioned in the Report

ABC Flour Co.

IndoSorghum Ltd.

Cassava Foods Indonesia

Bali Almond Flour Co.

Nusantara Coconut Flour

Organic Flours Indonesia

GreenEarth Foods

Archipelago Flours Ltd.

Agrina Foods

Tropical Harvest Flours

Table of Contents

1. Indonesia Substitute for Rice Flour Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. Indonesia Substitute for Rice Flour Market Size (In USD Mn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. Indonesia Substitute for Rice Flour Market Analysis

3.1 Growth Drivers

3.1.1 Increasing Prevalence of Gluten Intolerance

3.1.2 Rising Health Consciousness Among Consumers

3.1.3 Government Initiatives Promoting Crop Diversification

3.1.4 Expansion of Food Processing Industry

3.2 Market Challenges

3.2.1 Limited Consumer Awareness

3.2.2 High Production Costs of Alternative Flours

3.2.3 Supply Chain Constraints

3.3 Opportunities

3.3.1 Innovation in Product Development

3.3.2 Expansion into Untapped Regional Markets

3.3.3 Strategic Partnerships and Collaborations

3.4 Trends

3.4.1 Adoption of Sorghum and Cassava Flours

3.4.2 Growth in Gluten-Free Product Lines

3.4.3 Increased Use of Local Grains

3.5 Government Regulation

3.5.1 National Food Security Policies

3.5.2 Import Tariffs on Wheat and Rice

3.5.3 Subsidies for Alternative Crop Cultivation

3.5.4 Quality Standards for Flour Products

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces

3.9 Competition Ecosystem

4. Indonesia Substitute for Rice Flour Market Segmentation

4.1 By Source (In Value %)

4.1.1 Sorghum

4.1.2 Cassava

4.1.3 Corn

4.1.4 Almond

4.1.5 Coconut

4.2 By Application (In Value %)

4.2.1 Bakery Products

4.2.2 Noodles and Pasta

4.2.3 Snacks

4.2.4 Baby Food

4.2.5 Sauces and Dressings

4.3 By Distribution Channel (In Value %)

4.3.1 Supermarkets and Hypermarkets

4.3.2 Convenience Stores

4.3.3 Online Retail

4.3.4 Specialty Stores

4.4 By End User (In Value %)

4.4.1 Household

4.4.2 Foodservice Industry

4.4.3 Food Manufacturers

4.5 By Region (In Value %)

4.5.1 Java

4.5.2 Sumatra

4.5.3 Kalimantan

4.5.4 Sulawesi

4.5.5 Papua

5. Indonesia Substitute for Rice Flour Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 ABC Flour Co.

5.1.2 IndoSorghum Ltd.

5.1.3 Cassava Foods Indonesia

5.1.4 Bali Almond Flour Co.

5.1.5 Nusantara Coconut Flour

5.1.6 Organic Flours Indonesia

5.1.7 GreenEarth Foods

5.1.8 Archipelago Flours Ltd.

5.1.9 Agrina Foods

5.1.10 Tropical Harvest Flours

5.1.11 PT. Multi Grain Mills

5.1.12 Premium Alt-Grains

5.1.13 Nusantara Health Foods

5.1.14 Java Flour Mills

5.1.15 Golden Coconut Co.

5.2 Cross Comparison Parameters (Headquarters, Number of Employees, Revenue, Product Range, Market Presence, Key Partnerships, Distribution Network, Research and Development Focus)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. Indonesia Substitute for Rice Flour Market Regulatory Framework

6.1 Food Safety Standards

6.2 Compliance Requirements

6.3 Certification Processes

7. Indonesia Substitute for Rice Flour Future Market Size (In USD Mn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. Indonesia Substitute for Rice Flour Future Market Segmentation

8.1 By Source (In Value %)

8.2 By Application (In Value %)

8.3 By Distribution Channel (In Value %)

8.4 By End User (In Value %)

8.5 By Region (In Value %)

9. Indonesia Substitute for Rice Flour Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The research begins with mapping the ecosystem of the Indonesia Substitute for Rice Flour market, identifying essential stakeholders such as manufacturers, distributors, and end users. This process involves in-depth desk research using proprietary databases and reliable industry sources to define key market variables.

Step 2: Market Analysis and Construction

This phase involves compiling historical data on market segments, including sales volumes for various flour types and regional consumption patterns. Additionally, quality metrics are assessed to ensure the accuracy of revenue data, reflecting actual market conditions.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are formed based on initial findings and subsequently validated through consultations with industry experts. Insights from these interviews provide a deeper understanding of operational and financial nuances within the market.

Step 4: Research Synthesis and Final Output

In the final stage, primary data from key players in the market is synthesized to refine market estimates and insights, resulting in a comprehensive and validated analysis of the Indonesia Substitute for Rice Flour market.

Frequently Asked Questions

1. How big is the Indonesia Substitute for Rice Flour Market?

The Indonesia Substitute for Rice Flour market is valued at USD 435 million, supported by increasing demand for gluten-free and health-focused products, along with strong government initiatives promoting local agricultural products.

2. What are the major growth drivers of the Indonesia Substitute for Rice Flour Market?

Growth drivers include rising consumer health awareness, increased demand for gluten-free products, and government support for crop diversification in Indonesia, fostering the use of alternative flours like cassava and sorghum.

3. Who are the major players in the Indonesia Substitute for Rice Flour Market?

Key players include ABC Flour Co., IndoSorghum Ltd., Cassava Foods Indonesia, Bali Almond Flour Co., and Nusantara Coconut Flour, known for their robust market presence and strategic use of local sourcing.

4. What are the main challenges faced by the Indonesia Substitute for Rice Flour Market?

Challenges include limited consumer awareness, high production costs of some alternative flours, and logistical constraints in reaching remote areas, which can impact product availability and pricing.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.