Indonesia Textile Market Outlook to 2030

Region:Asia

Author(s):Shambhavi Awasthi

Product Code:KROD883

July 2024

100

About the Report

Indonesia Textile Market Overview

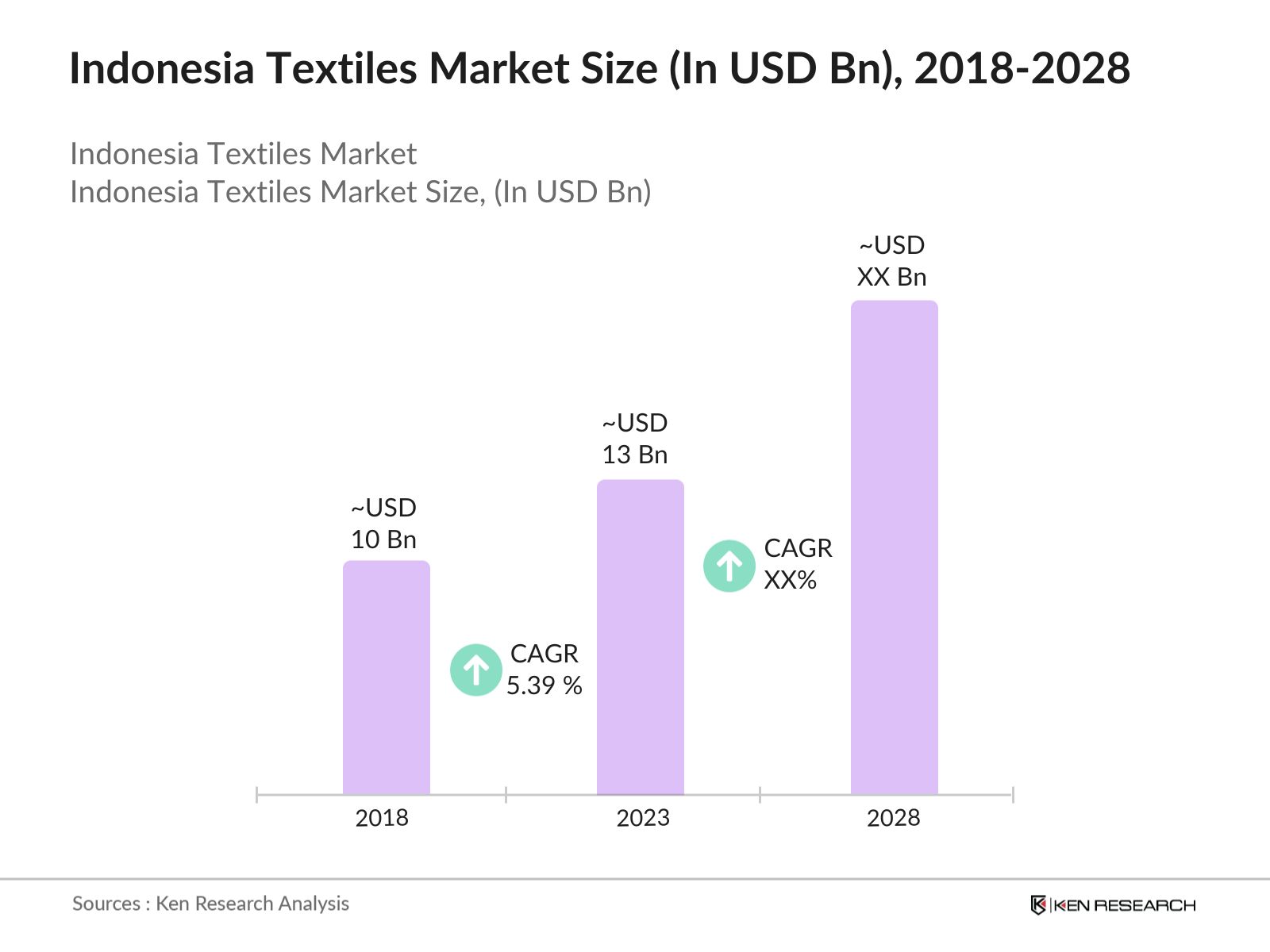

- The textiles market in Indonesia was valued at USD 13 billion in 2023, this growth is driven by several factors, including the combination of growing domestic demand, strong export growth, government support, and technological advancements. The increasing population and rising disposable income have boosted local consumption of textiles, while robust demand from international markets has propelled export growth.

- The market is fragmented by several key players which include Indo-Rama Synthetics, Sritex, Argo Pantes, and Pan Brothers, known for their diverse product offerings and strong market presence.

- In 2023, PT Sri Rejeki Isman Tbk (Sritex) announced a significant expansion plan with an investment of USD 200 million to increase its production capacity. This development aims to enhance the company's ability to meet growing demand both domestically and internationally.

Indonesia Textile Market Analysis

- Indonesia's textile exports have been on the rise, driven by strong demand from key markets such as the United States, Europe, and Japan. Government policies and incentives have provided significant support to the industry, encouraging investment and development. Additionally, technological advancements have improved manufacturing efficiency and product quality, further enhancing the competitiveness of Indonesia's textile sector on both domestic and global stages.

- The Indonesian government has implemented various policies to support the textile industry, including tax incentives, subsidies, and infrastructure development projects. The "Making Indonesia 4.0" initiative aims to modernize the manufacturing sector, including textiles, through the adoption of Industry 4.0 technologies.

- West Java is the dominant region in the Indonesia textile market, accounting for a significant share of the country's textile production. West Java is home to numerous industrial clusters specializing in textile and garment manufacturing. Cities like Bandung and Bogor have well-established textile industries with a concentration of factories and skilled labor.

Indonesia Textile Market Segmentation

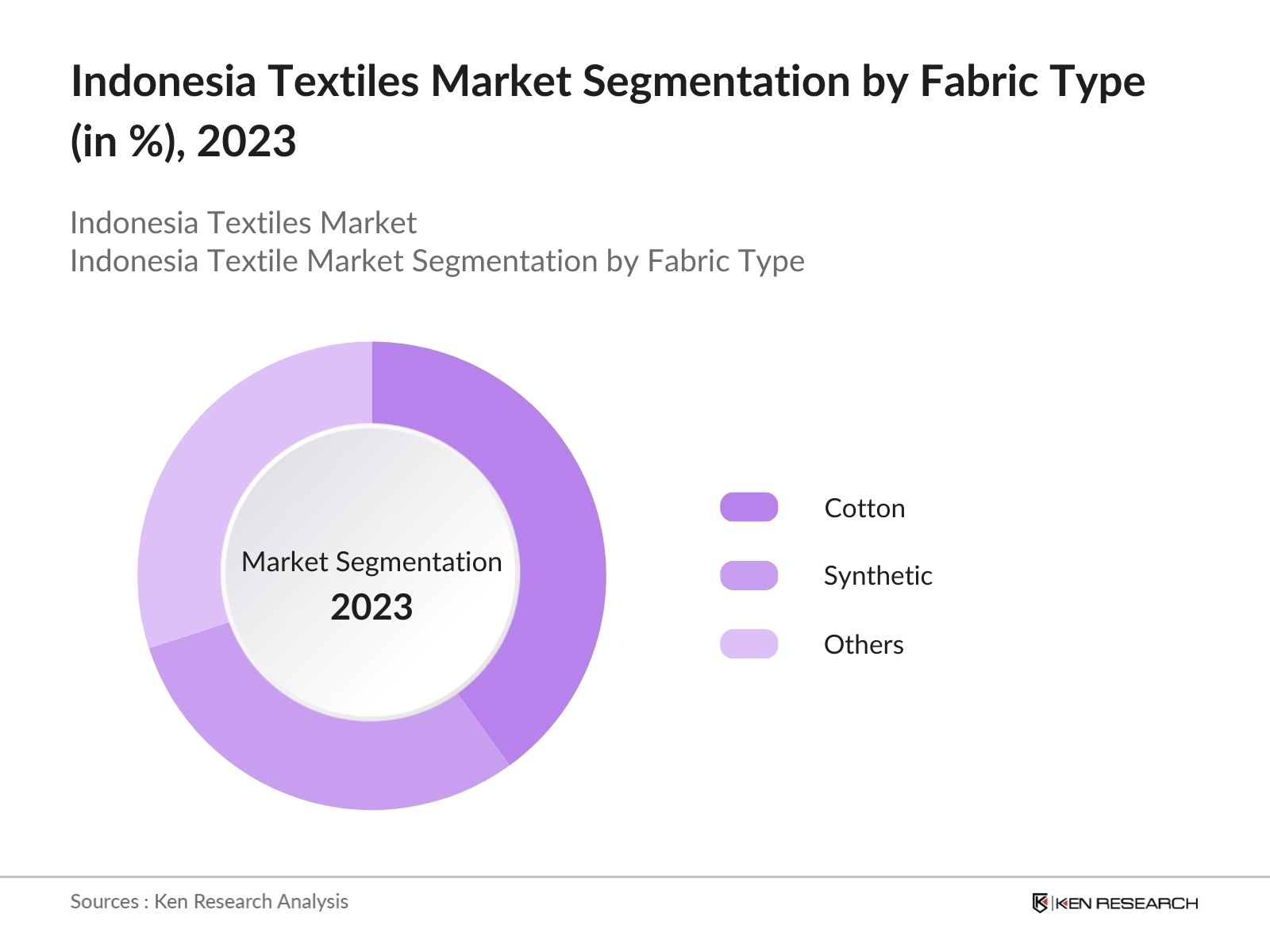

By Fabric Type: Indonesia Textile Market is segmented by fabric type into cotton, synthetic and others. Cotton was the dominant fabric type in the Indonesia Textile Market in 2023, due to its versatility and comfort appeal to diverse consumer segments. Cotton is the most grown crop in Indonesia and hence has become the most dominant fabric for textiles.

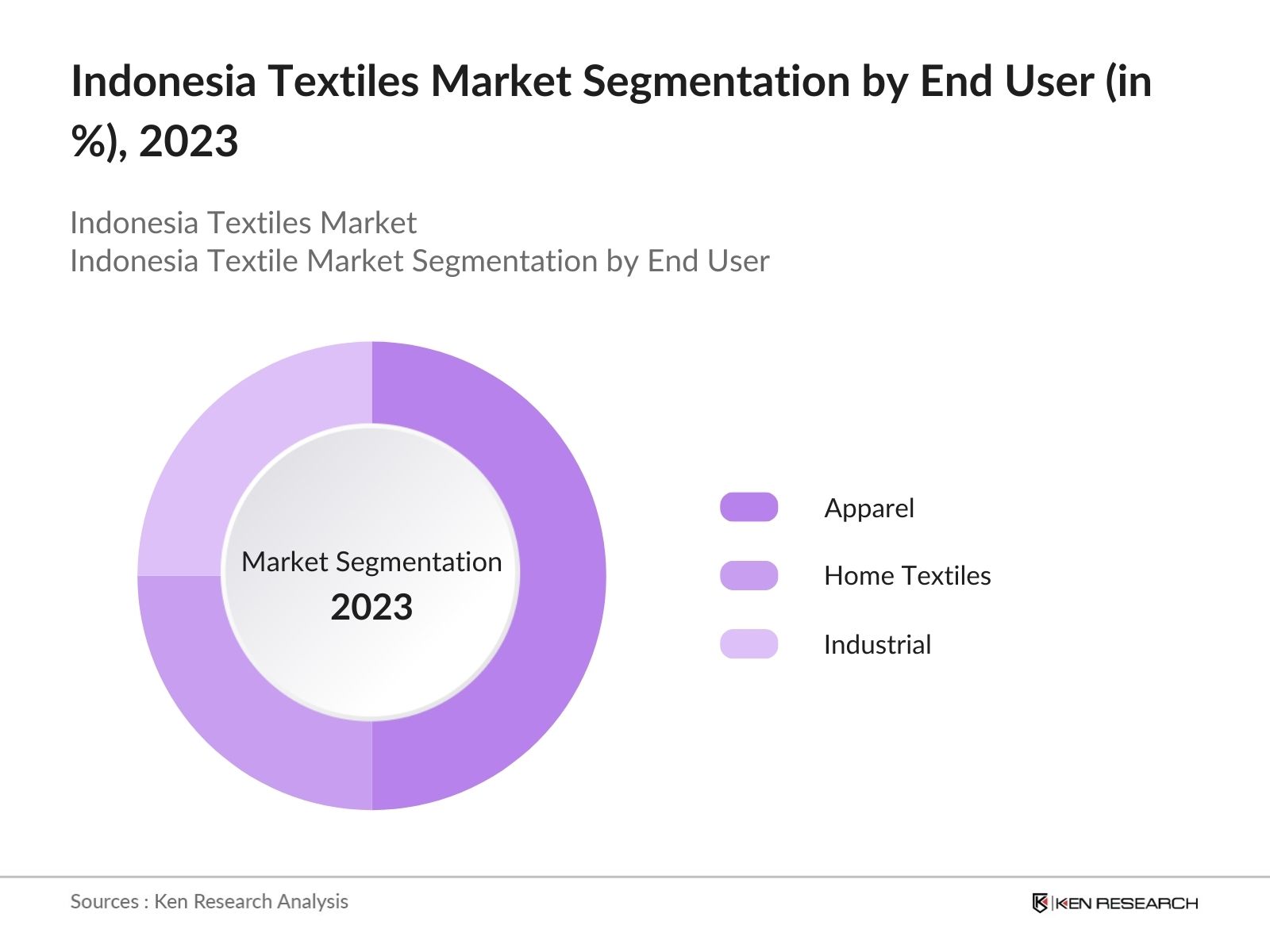

By End-User: Indonesia Textile Market is segmented by end-user into apparel, home textiles and industrial. In 2023, Apparel was the dominant end-user segment in Indonesia Textile Market due to Large-scale demand from domestic and international fashion markets. Apparel is the most revenue-focused sector of Indonesia.

By Region: The Indonesian textile market is segmented by region into Nort, South, West and East. In 2023, the West region, particularly the province of West Java, is the dominant region in the Indonesian textile market. West Java hosts the highest concentration of textile manufacturing facilities in Indonesia. The region is home to numerous large-scale textile factories and production units, which account for a significant portion of the country’s textile output. The West region, especially areas like Bandung in West Java, benefits from well-developed infrastructure and connectivity.

Indonesia Textile Market Competitive Landscape

|

Company |

Establishment Year |

Headquarters |

|

PT Sri Rejeki Isman Tbk (Sritex) |

1966 |

Sukoharjo, Indonesia |

|

PT Pan Brothers Tbk |

1980 |

Tangerang, Indonesia |

|

PT Asia Pacific Fibers Tbk |

1984 |

Jakarta, Indonesia |

|

PT Kahatex |

1979 |

Bandung, Indonesia |

|

PT Apac Inti Corpora |

1978 |

Jakarta, Indonesia |

- Pan Brothers Secures Contract (2022): In 2022, PT Pan Brothers Tbk secured a prestigious multi-year contract with a leading global fashion brand, significantly enhancing its market presence and export potential. The contract, valued at USD 150 million, is a testament to Pan Brothers' strong reputation for quality and reliability in the textile industry.

- Kahatex Facility Expansion (2022): In 2022, PT Kahatex undertook a major expansion of its dyeing and finishing facilities to enhance production capacity and meet the increasing demand for high-quality textiles. The enhanced facilities are expected to process an additional 500,000 meters of fabric per month, enabling Kahatex to better serve its clients in the fashion and home textile sectors.

- Asia Pacific Fibers Partnership (2023): In 2023, PT Asia Pacific Fibers Tbk announced a partnership with a global textile manufacturer to develop high-performance polyester fibers. This collaboration aims to leverage advanced materials and technologies to create innovative fiber solutions, positioning the company as a leader in the technical textile segment.

Indonesia Textile Market Industry Analysis

Indonesia Textile Market Growth Drivers:

- Increasing Domestic Consumption: Household spending on apparel and textiles has risen by 8% annually from 2018 according to Indonesia Statistics Bureau. The growing middle class and rising disposable incomes have led to increased domestic consumption of textile products. Indonesia’s middle class is expanding rapidly, with an estimated 52 million people joining the middle-income bracket between 2018 and 2023. Consumers are spending more on fashion and personal appearance, driving demand for a variety of textile products.

- Export Growth: The Ministry of Industry reported a 10% increase in textile and apparel exports in 2022, with the total export value reaching USD 14 billion. Strong demand from key markets such as the United States, Europe, and Japan has driven export growth. Trade agreements and competitive pricing make Indonesian textiles attractive in the global market.

- Government Support and Incentives: The Indonesian government has implemented various policies and incentives to support the textile industry. These include tax incentives, subsidies for upgrading machinery, and investment in infrastructure development. For instance, the government launched the "Roadmap of the Indonesian Textile and Garment Industry 2025" to promote sustainable practices.

Indonesia Textile Market Challenges

- Competition from Low-Cost Countries: Indonesian textile manufacturers face intense competition from countries like Bangladesh, Vietnam, and India, which offer lower production costs. According to the World Trade Organization (WTO), these countries benefit from cheaper labour and production efficiencies, which put pressure on Indonesian producers to maintain competitive pricing.

- Environmental Regulations and Sustainability Concerns: Increasing environmental regulations and the global shift towards sustainability present significant challenges for the Indonesian textile industry. The United Nations Industrial Development Organization (UNIDO) highlights that textile production is resource-intensive.

Indonesia Textile Market Government Initiatives

- Making Indonesia 4.0 (2018): The "Making Indonesia 4.0" initiative aims to modernize the manufacturing sector, including textiles, through the adoption of Industry 4.0 technologies. This initiative focuses on enhancing productivity, reducing production costs, and improving global competitiveness by integrating advanced manufacturing practices.

- Establishment of Special Economic Zones (SEZs): The establishment of SEZs provides a conducive environment for textile manufacturing with benefits such as tax exemptions, streamlined regulations, and improved infrastructure. SEZs attract foreign investments.

- Roadmap of the Indonesian Textile and Garment Industry 2025: The "Roadmap of the Indonesian Textile and Garment Industry 2025" focuses on promoting sustainable practices, improving labor conditions, and boosting innovation within the textile sector. This initiative includes measures to enhance the industry's global competitiveness, support the adoption of sustainable technologies.

Indonesia Textile Market Future Outlook

The Indonesia textile market will be driven by increasing domestic consumption, rising exports, and advancements in manufacturing technologies. The government's focus on improving infrastructure and fostering innovation within the industry will also play a crucial role in driving market growth.

Indonesia Textile Future Market Trends

- Sustainable Textiles: Growing consumer awareness about sustainability will be driving demand for eco-friendly textiles. Manufacturers will be investing more in sustainable materials and processes to meet this demand.

- Digital Transformation: The adoption of Industry 4.0 technologies, such as IoT and automation, is enhancing efficiency and productivity in the textile industry. Digital transformation will become a key competitive advantage.

- Expansion of E-commerce: The growth of e-commerce platforms will create new opportunities for textile manufacturers to reach a broader customer base. Online retail is also expected to drive significant demand for textile products.

Scope of the Report

|

By Fabric Type |

Cotton Synthetic Others |

|

By End User |

Apparel Home Textiles Industrial |

|

By Region |

North South West East |

Products

Key Target Audience – Organizations and Entities Who Can Benefit by Subscribing This Report:

Textile Manufacturers

Apparel and Clothing Brands

Clothing Retail Chains and Stores

Exporters and Importers

Government and Regulatory Bodies (Industry of Textiles, Ministry of Textiles etc.)

Investment Firms and Venture Capitalists

Clothing Raw Material Suppliers

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report:Â

Indo-Rama Synthetics

Sri Rejeki Isman Tbk (Sritex)

Pan Brothers

PT Dan Liris

Argo Pantes

PT Asia Pacific Fibers

PT Tifico Fiber Indonesia

PT Indorama Ventures Indonesia

PT Kahatex

PT Apac Inti Corpora

PT Trisula International

PT Eratex Djaja

PT Sinar Para Taruna

PT Unitex

PT Century Textile Industry (Centex)

Table of Contents

1. Indonesia Textiles Market Overview

1.1 Indonesia Textiles Market Taxonomy

2. Indonesia Textiles Market Size (in USD Bn), 2018-2023

3. Indonesia Textiles Market Analysis

3.1 Indonesia Textiles Market Growth Drivers

3.2 Indonesia Textiles Market Challenges and Issues

3.3 Indonesia Textiles Market Trends and Development

3.4 Indonesia Textiles Market Government Regulation

3.5 Indonesia Textiles Market SWOT Analysis

3.6 Indonesia Textiles Market Stake Ecosystem

3.7 Indonesia Textiles Market Competition Ecosystem

4. Indonesia Textiles Market Segmentation, 2023

4.1 Indonesia Textiles Market Segmentation by Fabric Type (in %), 2023

4.2 Indonesia Textiles Market Segmentation by End User (in %), 2023

4.3 Indonesia Textiles Market Segmentation by Region (in %), 2023

5. Indonesia Textiles Market Competition Benchmarking

5.1 Indonesia Textiles Market Cross-Comparison (no. of employees, company overview, business strategy, USP, recent development, operational parameters, financial parameters and advanced analytics)

6. Indonesia Textiles Market Future Market Size (in USD Bn), 2023-2028

7. Indonesia Textiles Market Future Market Segmentation, 2028

7.1 Indonesia Textiles Market Segmentation by Fabric Type (in %), 2028

7.2 Indonesia Textiles Market Segmentation by End User (in %), 2028

7.3 Indonesia Textiles Market Segmentation by Region (in %), 2028

8. Indonesia Textiles Market Analysts’ Recommendations

8.1 Indonesia Textiles Market TAM/SAM/SOM Analysis

8.2 Indonesia Textiles Market Customer Cohort Analysis

8.3 Indonesia Textiles Market Marketing Initiatives

8.4 Indonesia Textiles Market White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 01: Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around the market to collate industry-level information.Â

Step 02: Market Building:

Collating statistics on Indonesia Textiles Market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for Indonesia Textile Market. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.Â

Step 03: Validating and Finalizing:

Building market hypotheses and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.Â

Step 04: Research output:

Our team will approach multiple retail companies and understand the nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from textiles companies.Â

Frequently Asked Questions

01 How big is Indonesia textile market?

The current Indonesia Textile market size in 2023 is USD 13 billion driven by increasing adoption of electric vehicles (EVs), growing environmental concerns, and stringent government regulations on battery disposal.

02 Who are the major players in the Indonesian textile market?

In Indonesia textiles market has major players which include Indo-Rama Synthetics, Sritex, Argo Pantes, and Pan Brothers.

03 What are the key challenges faced by the Indonesia textile market?

Some of the major challenges in the Indonesia textile market include raw material costs, environmental concerns, competition, and skills shortage.

04 Which factors are driving Indonesia textile market?

The growth drivers in the Indonesia textile market include rising disposable incomes, export opportunities, and government support for the textile sector.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.