Indonesia Used Tractor Market Outlook to 2027

Driven By Remote Monitoring Technologies, Farm Mechanization and Dominated by Low Engine Power Tractors

Region:Asia

Author(s):Snigdha Gupta

Product Code:KR1258

November 2022

59

About the Report

The report provides a comprehensive analysis of the potential of Used in Indonesia. The report covers an overview and genesis of the industry, market size in terms of revenue generated.

Its market segmentations include segmentation by Power, Price, Purpose and Usage; growth enablers and drivers; challenges and bottlenecks; trends driving adoption trends; regulatory framework; end-user analysis, industry analysis, competitive landscape including competition scenario and market shares of major players. The report concludes with future market projections of each market segmentation and analyst recommendations.

Market Overview

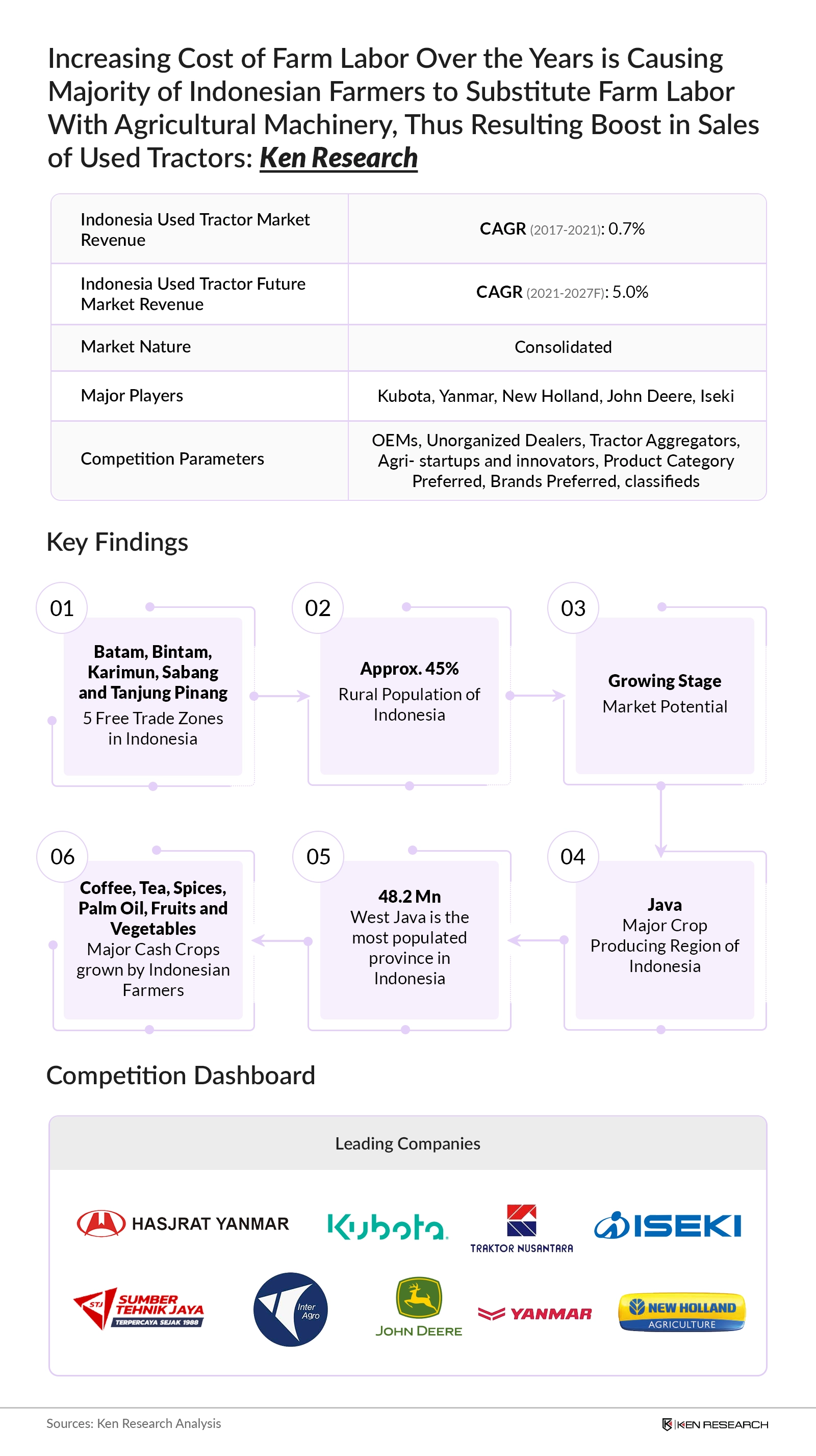

According to Ken Research estimates, the – The Indonesia Used Tractor Market has grown at a CAGR of 0.7% over the last four years owing to small land holding size, poor access to credit & financial institutions and deteriorating resource base are obstructing the growth of Used Tractors.

- Demand for lower HP tractors is high due to the low disposable income of farmers and high labor costs. One of the features of low HP tractor is that it can be used in small farms and gardens

- Such tractors also allow farmers to work during low visibility field conditions during rain, dust, and fog and maximize efficiency making farming more accurate and productive

Key Trends by Market Segment:

By of Type Purpose: Indonesian agricultural sector witnessed an upward trajectory, from subsistence & mixed farming towards semi-commercial & commercial farming thus, driving demand for 4W tractors in the country

By Region: Majority of the farming population is located in Java, with East Java having the highest number of farm households in the Java region.

Competitive Landscape:

The used tractor market is consolidated market with Kubota as the market leader with 50% market share (basis number of tractors sold). Other companies have comparatively lower market share while the market is being highly dominated by only a few companies.

Some of the major players in the market include John Dee, New Holland, Kubota, Yanmar, and others.

Future Outlook

The Used Tractor Market witnessed significant growth during the period 2017-2022, owing to demand for lower HP tractors is high due to the low disposable income of farmers and high labour costs. One of the features of low HP tractor is that it can be used in small farms and gardens.

Scope of the Report

|

By Type of Power |

Less Than 30 HP 31-60HP 60-100HP 100HP+ |

|

By Type of Purpose |

Agriculture Construction |

|

By Type of Region |

Java Sumatra Sulawesi Lesser sunda island |

|

By Type of Sale Distribution Channel |

Offline Channel Financial Institution/Auction Online Channel |

|

By Type of Price |

Less than 70,000,000 IDR 70,000,001-100,000,000 100,000,001- 150,000,000 150,000,001+ |

|

By Usage (hours) |

Less than 500 hours 501-1500 1501-3000 3001-5000+ |

Products

Key Target Audience – Organizations and Entities Who Can Benefit by Subscribing This Report

OEMs

Multi-Brands

Online Used Tractor Portals

Used Tractor Financing Companies

Government Bodies

Investors & Venture Capital Firms

Used Tractor Dealerships

Used Tractor Industry Players

Used Tractor Manufacturing Companies

Used Tractor Distributors

Used Tractor Auction Houses

Used Tractor Associations

Time Period Captured in the Report

Historical Period: 2017-2022P

Base Period: 2022P

Forecast Period: 2023F-2027F

Companies

Major Players Mentioned in the Report:

New Holland

Traktor Nusantara

Yanmar

John Deere

Kubota

Cnh

Jualo.Com

Tokopedia

Olx

Alibaba.Com

Shopee

Table of Contents

1. Executive Summary

1.1 Indonesia Used Tractor Market, 2022P

2. Country Overview of Used Tractor Market

2.1 Country Demographics of Indonesia

2.2 Population Analysis of Indonesia

3. Market Overview of Used Tractor Market in Indonesia

3.1 Overview of Indonesia Agricultural Sector, 2022P

3.2 Digital tools that generate farm and farmer data

3.3 Agricultural Technology adoption in Indonesia – Current Scenario and Forecasted Situation

3.4 Parameters that farmers consider before purchasing Agricultural Machinery in Indonesia

3.5 Import and Export of Tractors in Indonesia

3.6 Ecosystems of Major Entities in Used Tractor Market

3.7 Value Chain Analysis

4. Market Size of Used Tractor Market in Indonesia, 2017-2022P

4.1 Market Size of Used Tractor Market in Indonesia, 2017-2022P

5. Market Segmentation of Used Tractor Market in Indonesia, 2022P

5.1 Market Segmentation By Power and Purpose, 2022P

5.2 Market Segmentation By Region and Distribution Channel, 2022P

5.3 Market Segmentation By Price and Usage(hours), 2022P

6. Industry Analysis

6.1 SWOT Analysis of Indonesia Used Tractor Market

6.2 Trends in Indonesia Used Tractor Market

6.3 Growth Drivers of Used Tractor Market in Indonesia

6.4 Government Regulations

6.5 Issues and Challenges in the Used Tractor Market in Indonesia

7. Competitive Analysis

7.1 Cross Comparison of Major Players

7.2 Market share of Major Used Tractor Companies, 2022P

8. Snapshot on Indonesia Used Tractor Market

8.1 Snapshot on Climate Change

8.2 Snapshot on Staple Crop of Indonesia

8.3 Snapshot on Second Hand Agriculture Equipment market in Indonesia

9. Future Market Size for Indonesia Used Tractor, 2023F-2027F

9.1 Market Size of Used Tractor Market in Indonesia, 2023F-2027F

9.2 Future Trend - GPS Enabled Tractors

9.3 Future Trend - Self Driving Tractors

10. Future Segmentation for Indonesia Used Tractor Market,2027F

10.1 Market Segmentation By Power and Purpose, 2027F

10.2 Market Segmentation By Region and Distribution Channel, 2027F

10.3 Market Segmentation By Price and Usage(hours), 2027F

11. Analyst Recommendations

11.1 Analyst Recommendations

11.2 On- Demand Tractor Services

12. Research Methodology

12.1 Market Definitions and Assumptions

12.2 Abbreviations and Limitations

12.3 Market Sizing Approach

12.4 Consolidated Research Approach

12.5 Sample Size Inclusion

Research Methodology

Step 1: Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.

Step 2: Market Building:

Collating statistics on new and used tractor sales over the years, to compute overall market size of used tractors.

Step 3: Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry exerts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step 4: Research output:

Our team will approach multiple channels and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from used tractor providers.

Frequently Asked Questions

01 What is the Study Period of this Market Report?

The Indonesia Used Tractor Marketis covered from 2017–2022 in this report, including a forecast for 2023-2027.

02 What is the Future Growth Rate of the Indonesia Used Tractor Market?

The Indonesia Used Tractor Market is expected to witness a CAGR of ~5% over the next six years.

03 What are the Key Factors Driving the Indonesia Used Tractor Market?

Expanding Farm Land Size, Technological Upgradation and Growing Demand for Low Engine Power Tractors are key Growth Drivers of Indonesian Agricultural Market.

04 Which is the major segment for use of tractors in the Indonesia Used Tractor Market?

The agriculture segment held the largest share of the Indonesia Used Tractor Market in 2021.

05 Who are the Key Players in the Indonesia Used Tractor Market?

John Dee, New Holland, Kubota, Yanmar, are the key players in the Indonesia Used Tractor Market.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.