Indonesia Virtual Reality and Augmented Reality Market Outlook to 2030

Region:Asia

Author(s):Naman Rohilla

Product Code:KROD740

July 2024

90

About the Report

Indonesia Virtual and Augmented Reality Market Overview

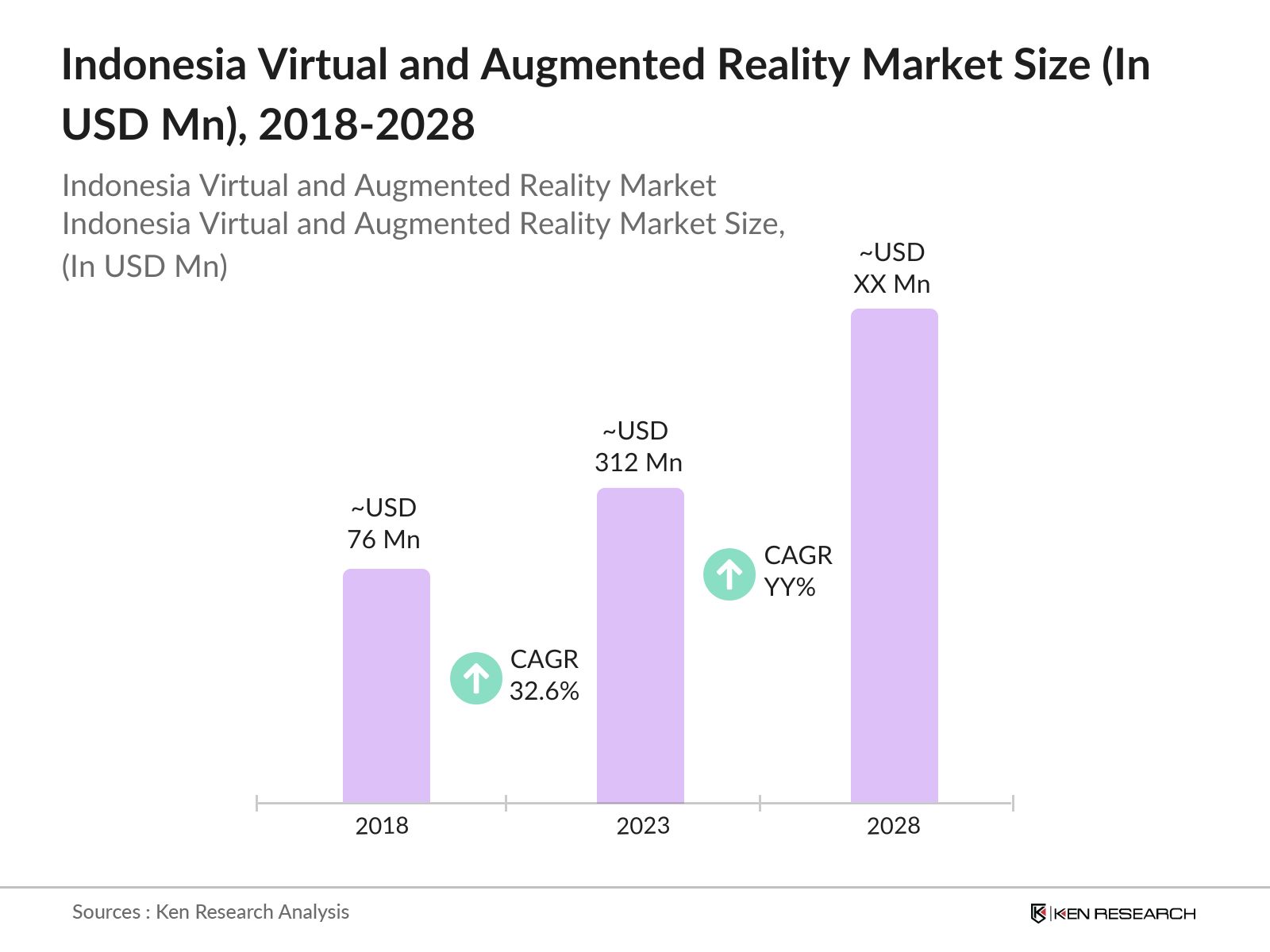

- The Indonesia Virtual and Augmented Reality Market was valued at USD 312 million in 2023, with a compound annual growth rate (CAGR) of 32.6%. This growth is driven by the increasing adoption of VR and AR technologies across various sectors such as entertainment, education, healthcare, and real estate.

- The major players in the Indonesia virtual and augmented reality market include PT Sentra Inovasi Solusindo, Shinta VR, Octagon Studio, Samsung Indonesia, and WIR Group. These players have established a strong presence in the market through strategic investments, innovative product offerings, and partnerships with local and international organizations.

- In 2023, Shinta VR launched its new virtual reality education platform, "Xperiencify," which aims to revolutionize the education sector. The platform has already been adopted by over 300 schools, reaching more than 150,000 students. This development received investment from local and international investors, totalling USD 15 million.

- In 2023, the North region, especially Jakarta, leads the market due to its well-developed infrastructure, high concentration of tech-savvy consumers, and presence of major VR and AR companies such as Samsung Indonesia, Shinta VR, and PT Sentra Inovasi Solusindo.

Indonesia Virtual and Augmented Reality Market Segmentation

Indonesia's virtual and augmented reality market is segmented into product type, application, and region.

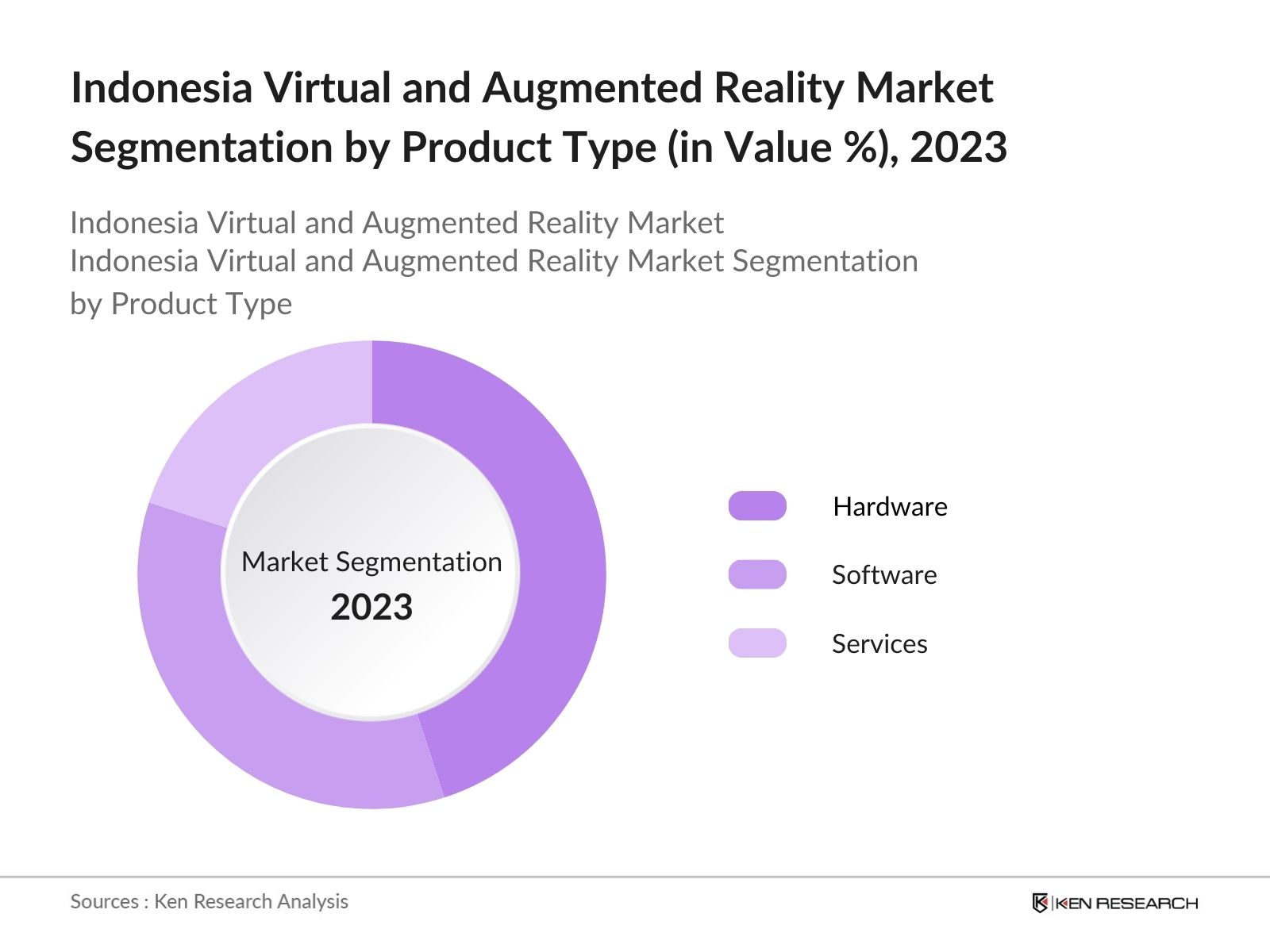

By Product Type: The Indonesian VR and AR market can be segmented by product type into hardware, software, and services. In 2023, the hardware segment held the largest market share due to the increasing adoption of VR headsets and AR glasses.

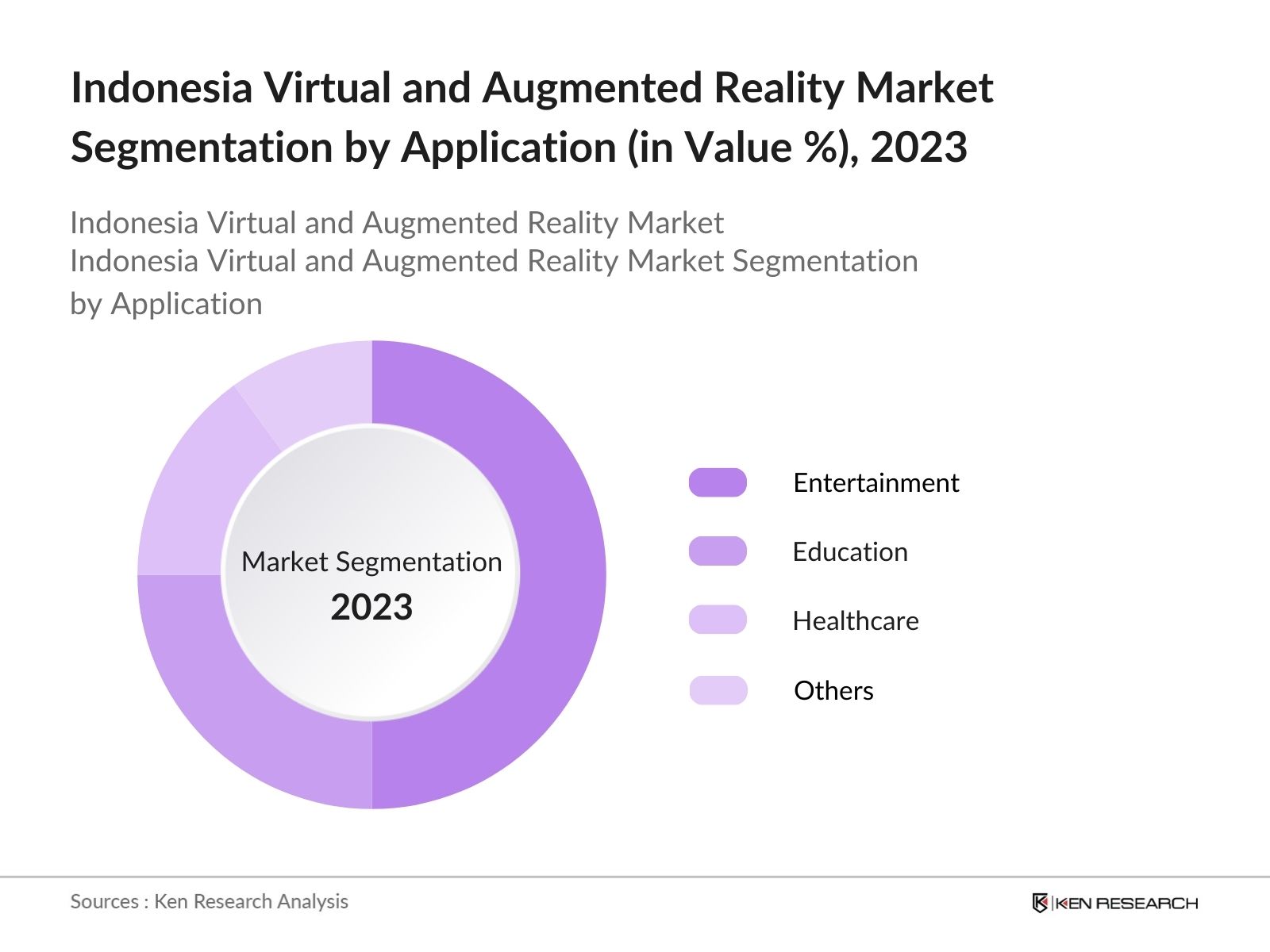

By Application: The market is also segmented by application into entertainment, education, healthcare, and others (real estate, tourism, and industrial training). The entertainment segment's dominance is driven by the popularity of VR gaming and immersive media experiences. The proliferation of VR gaming cafes and the increasing availability of VR content on streaming platforms have contributed to this segment's growth.

By Region: The market is segmented by region into North, South, East, and West. In 2023, North region including Jakarta accounted for highest market revenue, with a major portion coming from the entertainment and education sectors. The city's vibrant startup ecosystem and strong government support for digital initiatives further contribute to its leading position in the market.

By Region: The market is segmented by region into North, South, East, and West. In 2023, North region including Jakarta accounted for highest market revenue, with a major portion coming from the entertainment and education sectors. The city's vibrant startup ecosystem and strong government support for digital initiatives further contribute to its leading position in the market.

Indonesia Virtual and Augmented Reality Market Competitive Landscape

|

Company |

Establishment Year |

Headquarters |

|

PT Sentra Inovasi Solusindo |

2012 |

Jakarta |

|

Shinta VR |

2016 |

Jakarta |

|

Octagon Studio |

2015 |

Bandung |

|

Samsung Indonesia |

1989 |

Jakarta |

|

WIR Group |

2009 |

Jakarta |

- Octagon Studio: Octagon Studio introduced "ARpedia," an AR-based educational product, in 2023. This product combines augmented reality with traditional learning materials to create immersive educational experiences. ARpedia has been implemented in over 200 schools, benefiting around 100,000 students and receiving positive feedback from educators and students alike.

- Samsung Indonesia: In 2024, Samsung Indonesia announced some advancements in its VR hardware, making high-quality devices more accessible to consumers and businesses. The company invested USD 20 million in research and development, resulting in the launch of a new VR headset model that has already sold 50,000 units within the first quarter of the year.

Indonesia Virtual and Augmented Reality Market Analysis

Indonesia Virtual and Augmented Reality Market Growth Drivers:

- Increased Investment in Education Sector: In 2023 and 2024, the Indonesian government allocated over USD 50 million to integrate VR and AR into the national education curriculum. This investment aims to enhance learning experiences and improve student engagement. According to the Ministry of Education and Culture, around 3,000 schools nationwide have started implementing VR-based learning modules, benefiting over 1.5 million students.

- Rising Adoption in Healthcare: In 2024, hospitals in Jakarta and Surabaya collectively invested USD 25 million in VR-based medical equipment and training programs. This adoption is expected to improve patient outcomes and reduce healthcare costs, as reported by the Indonesian Health Economics Association.

- Tourism and Hospitality Enhancement: In 2024, the Indonesian Ministry of Tourism invested USD 10 million in VR projects to create virtual tours of popular destinations such as Bali, Yogyakarta, and Lombok. These virtual experiences allow potential tourists to explore attractions and accommodations before booking, resulting in a higher number of international and domestic visitors. The tourism and hospitality industry in Indonesia is increasingly adopting VR and AR technologies to attract and engage tourists.

Indonesia Virtual and Augmented Reality Market Challenges:

- High Cost of VR and AR Technologies: According to the Indonesian Consumer Electronics Association in 2024, the average cost of a high-quality VR headset was around USD 600, making it unaffordable for many educational institutions and small businesses. The high cost of VR and AR hardware and software remains a barrier to widespread adoption.

- Limited Internet Infrastructure: In 2024, Indonesia still faces challenges with limited and uneven internet infrastructure, especially in rural areas. According to the Indonesian Internet Service Providers Association, only 60% of the population has access to reliable high-speed internet, which is crucial for optimal VR and AR experiences. This limitation affects the market's growth potential in less urbanized regions.

Indonesia Virtual and Augmented Reality Market Government Initiatives:

- Digital Indonesia 2024 Initiative: In 2023, the Indonesian government launched the "Digital Indonesia 2024" initiative, allocating USD 75 million to promote the adoption of VR and AR technologies. This initiative aims to enhance digital literacy, create new economic opportunities, and foster innovation. The initiative's impact is already visible, with over 500 new startups registered in the VR and AR sector by early 2024.

- Support for Startups: The Indonesian government has launched a support program for VR and AR startups, providing financial grants and mentorship opportunities. In 2023, the program disbursed USD 10 million in grants to 200 startups, fostering innovation and entrepreneurship in the VR and AR sector. This initiative aims to create a vibrant ecosystem for technology startups in Indonesia.

Indonesia Virtual and Augmented Reality Future Market Outlook

Indonesia's virtual and augmented reality market is expected to grow in the coming years. The market is also likely to shift towards more organized with established players and online platforms expanding their reach.

Indonesia Virtual and Augmented Reality Future Market Trends

- Rise of VR in Corporate Training: By 2028, more than 1,000 Indonesian companies are expected to adopt VR training solutions, providing immersive training experiences to over 500,000 employees. The need for effective and engaging training methods will drive this shift. Corporate training programs using VR and AR technologies are expected to become more prevalent.

- Development of VR and AR Content Creation: By 2028, the Indonesian market will see a surge in VR and AR content creators, with over 1,000 new companies entering the sector and generating revenue from content creation and distribution. The demand for high-quality VR and AR content is expected to grow, leading to the development of more sophisticated content creation tools and platforms.

Scope of the Report

|

By Product Type |

Hardware Software Services |

|

By Application |

Entertainment       Education  Healthcare Others        |

|

By Region |

North South East West |

Products

Key Target Audience – Organizations and Entities Who Can Benefit by Subscribing This Report:

Government and Regulatory Bodies

Banks and Financial Institutes

Investors and Venture Capitalists

Entertainment Companies

VR and AR Content Creators

Technology Startups

Investors and Venture Capitalists

Training and Development Companies

Hardware Manufacturers

Time Period Captured in the Report

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report:

PT Sentra Inovasi Solusindo

Shinta VR

Octagon Studio

Samsung Indonesia

WIR Group

Agate International

Arsanesia

Altermyth

Arsanesia

com

Mobiliari Group

Mirum Jakarta

GITS Indonesia

Telekomunikasi Indonesia

XRMEDIA

Table of Contents

1. Indonesia Virtual and Augmented Reality Market Overview

1.1 Indonesia Virtual and Augmented Reality Market Taxonomy

2. Indonesia Virtual and Augmented Reality Market Size (in USD Bn), 2018-2023

3. Indonesia Virtual and Augmented Reality Market Analysis

3.1 Indonesia Virtual and Augmented Reality Market Growth Drivers

3.2 Indonesia Virtual and Augmented Reality Market Challenges and Issues

3.3 Indonesia Virtual and Augmented Reality Market Trends and Development

3.4 Indonesia Virtual and Augmented Reality Market Government Regulation

3.5 Indonesia Virtual and Augmented Reality Market SWOT Analysis

3.6 Indonesia Virtual and Augmented Reality Market Stake Ecosystem

3.7 Indonesia Virtual and Augmented Reality Market Competition Ecosystem

4. Indonesia Virtual and Augmented Reality Market Segmentation, 2023

4.1 Indonesia Virtual and Augmented Reality Market Segmentation by Product Type (in Value %), 2023

4.2 Indonesia Virtual and Augmented Reality Market Segmentation by Application (in Value %), 2023

4.3 Indonesia Virtual and Augmented Reality Market Segmentation by Region (in Value %), 2023

5. Indonesia Virtual and Augmented Reality Market Competition Benchmarking

5.1 Indonesia Virtual and Augmented Reality Market Cross-Comparison (no. of employees, company overview, business strategy, USP, recent development, operational parameters, financial parameters and advanced analytics)

6. Indonesia Virtual and Augmented Reality Future Market Size (in USD Bn), 2023-2028

7. Indonesia Virtual and Augmented Reality Future Market Segmentation, 2028

7.1 Indonesia Virtual and Augmented Reality Market Segmentation by Product Type (in Value %), 2028

7.2 Indonesia Virtual and Augmented Reality Market Segmentation by Application (in Value %), 2028

7.3 Indonesia Virtual and Augmented Reality Market Segmentation by Region (in Value %), 2028

8. Indonesia Virtual and Augmented Reality Market Analysts’ Recommendations

8.1 Indonesia Virtual and Augmented Reality Market TAM/SAM/SOM Analysis

8.2 Indonesia Virtual and Augmented Reality Market Customer Cohort Analysis

8.3 Indonesia Virtual and Augmented Reality Market Marketing Initiatives

8.4 Indonesia Virtual and Augmented Reality Market White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step: 1 Identifying Key Variables

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around the market to collate industry-level information.

Step: 2 Market Building

Collating statistics on the Indonesia virtual and augmented reality market over the years, and analyzing the penetration of marketplaces as well as the ratio of service providers to compute the revenue generated for the market. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step: 3 Validating and Finalizing

Building market hypotheses and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step: 4 Research Output

Our team will approach multiple VR and AR suppliers and manufacturing companies and understand the nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through the bottom-to-top approach from the VR and AR suppliers and manufacturing companies.

Frequently Asked Questions

01 How big is the Indonesia Virtual and Augmented Reality Market?

The Indonesia virtual and augmented reality market was valued at USD 76 million in 2018 and reached USD 312 million in 2023, with a compound annual growth rate (CAGR) of 32.6%. This growth is driven by the increasing adoption of VR and AR technologies across various sectors such as entertainment, education, healthcare, and real estate.

02 Who are the major players in the Indonesia Virtual and Augmented Reality Market?

The major players in the Indonesia virtual and augmented reality market are PT Sentra Inovasi Solusindo, Shinta VR, Octagon Studio, Samsung Indonesia, and WIR Group. These players have made a strong mark in the market through strategic investments, innovative products, and partnerships with local and international organizations.

03 What are the growth drivers of the Indonesia Virtual and Augmented Reality Market?

The growth drivers of Indonesia's virtual and augmented reality market include increasing investment in the education sector, rising adoption in healthcare, entertainment industry boom, and increasing use of VR and AR for employee training and development.

04 What are the challenges in the Indonesia Virtual and Augmented Reality Market?

Some of the major challenges in Indonesia's virtual and augmented reality market include the high cost of VR and AR technologies, lack of skilled professionals, limited internet infrastructure, also faces regulatory challenges.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.