Indonesia Vision Care Market Outlook to 2030

Region:Global

Author(s):Shivani Mehra

Product Code:KROD11166

December 2024

100

About the Report

Indonesia Vision Care Market Overview

- The Indonesia Vision Care market is valued at approximately USD 397.25 million. This growth is primarily driven by the increasing prevalence of refractive errors, the rising geriatric population, and the expanding middle-class segment that is becoming more aware of eye health. Additionally, the growing number of ophthalmic surgeries and technological advancements in vision correction products are propelling market growth. The surge in online retail and e-commerce platforms for eyewear and contact lenses has further contributed to the market's expansion. Government initiatives and awareness campaigns on eye care have also played a crucial role in driving demand for vision care products.

- The dominant regions in the Indonesia Vision Care market include major metropolitan areas such as Jakarta, Surabaya, and Bali. These cities are home to a large proportion of the population with access to advanced eye care services, driving the demand for vision care products like eyeglasses, contact lenses, and corrective surgeries. Jakarta, being the capital and economic hub, witnesses the highest concentration of optical clinics and retail stores, making it a key player in the market. Furthermore, the governments efforts to improve healthcare access in urban areas have bolstered the market's growth in these cities.

- Indonesias regulatory framework for the import and export of vision care products is governed by strict guidelines established by the Ministry of Trade and the Indonesian Food and Drug Authority (BPOM). In 2022, the government introduced new regulations to streamline the importation of optical products, reducing barriers for international manufacturers while ensuring consumer safety. This regulation aims to make vision care products more accessible to the Indonesian market and encourage international trade.

Indonesia Vision Care Market Segmentation

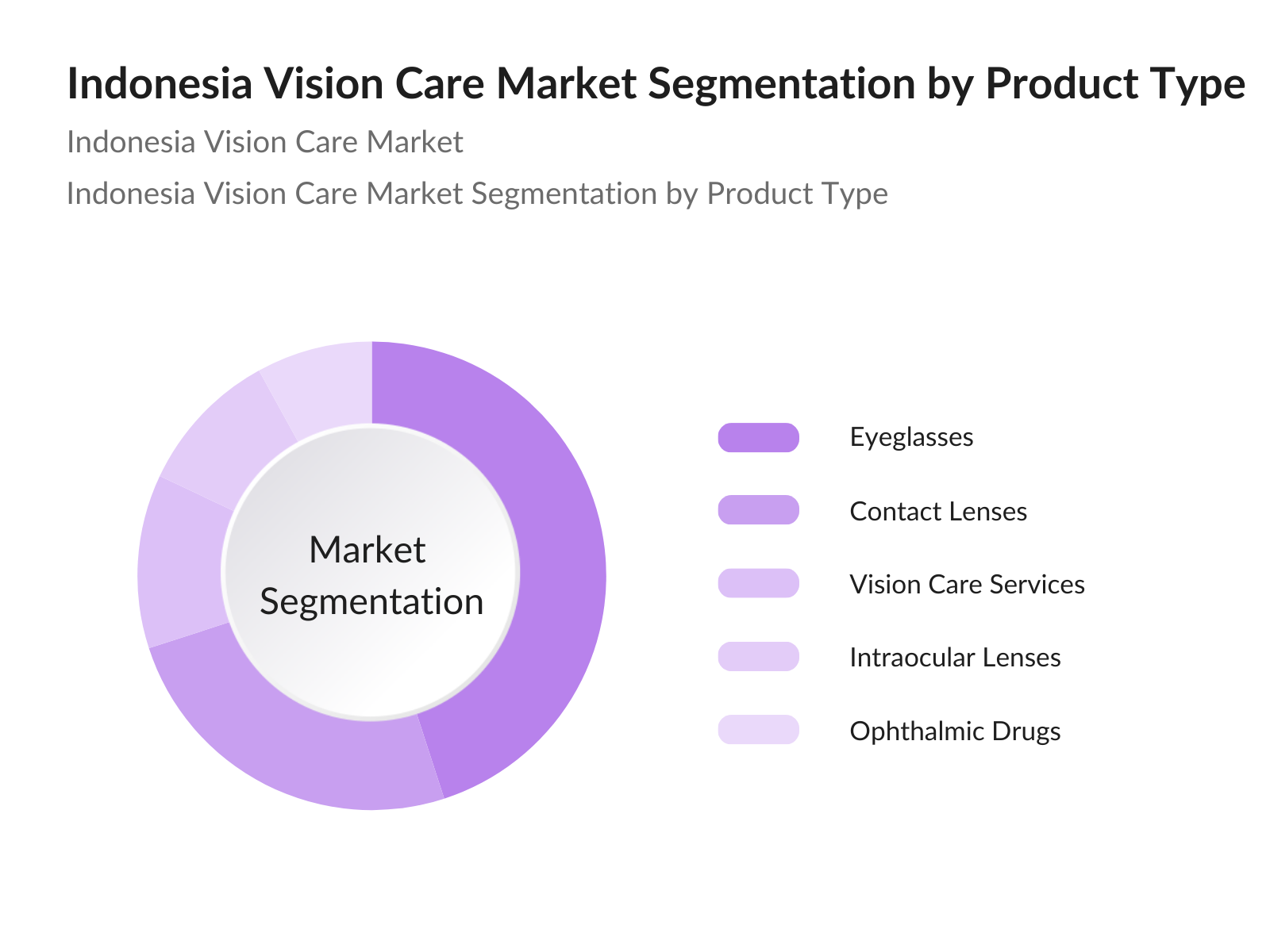

By Product Type: The Indonesia Vision Care market is segmented by product type into eyeglasses, contact lenses, intraocular lenses, ophthalmic drugs, and vision care services. Eyeglasses dominate this segment due to their long-standing popularity among Indonesians for both corrective and fashion purposes. Prescription eyeglasses, in particular, hold the highest market share, as they are a primary solution for those suffering from refractive errors such as myopia and hyperopia. Brands like Essilor and Hoya have cemented their dominance by offering a wide range of stylish, affordable eyeglass frames combined with high-quality lenses. As the middle class expands, demand for both functional and fashionable eyewear continues to grow.

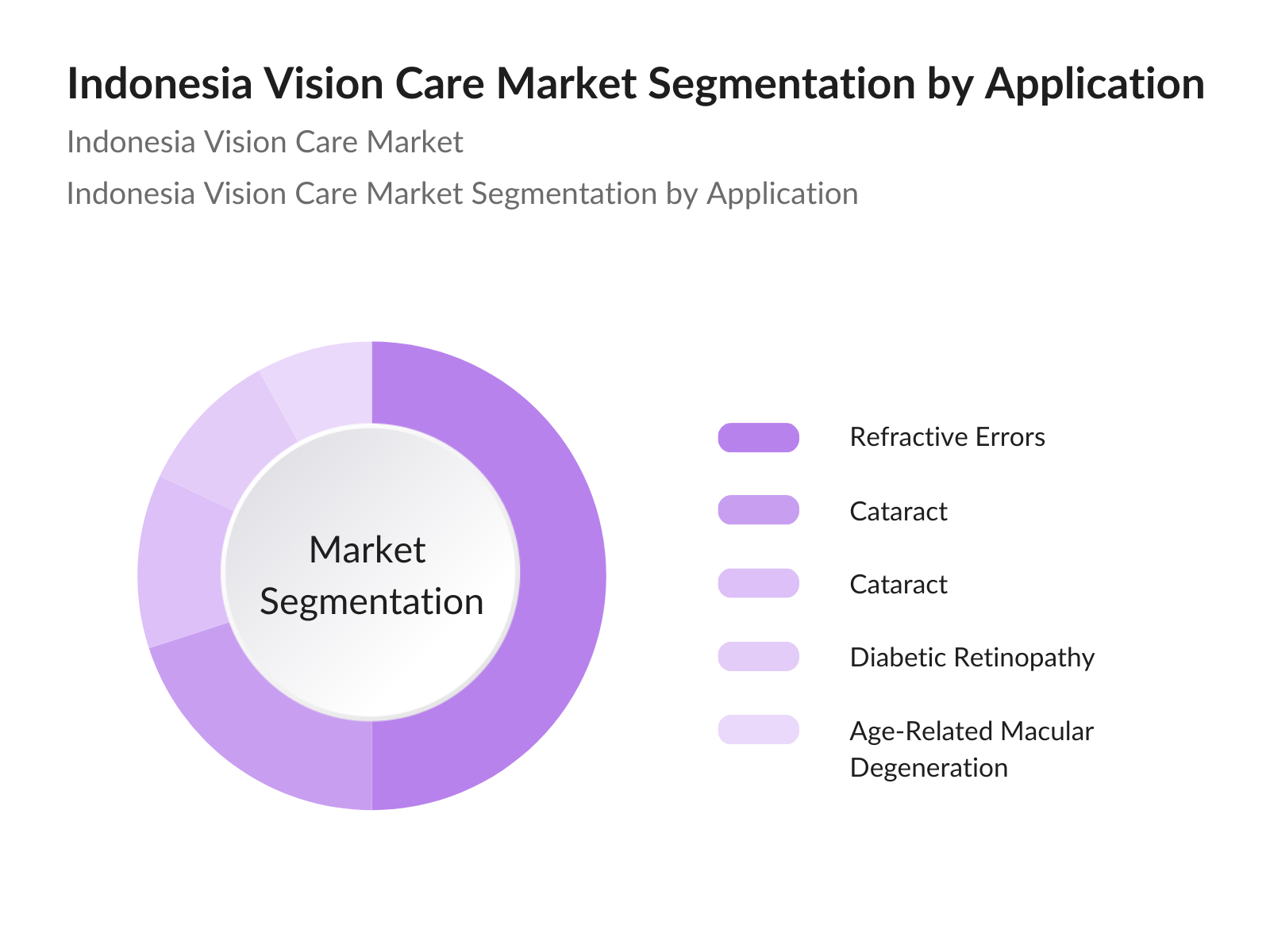

By Application: The market is also segmented by application into refractive errors, cataract, glaucoma, age-related macular degeneration (AMD), and diabetic retinopathy. Refractive errors, which include myopia, hyperopia, and astigmatism, dominate the market due to their high prevalence among Indonesians. As more people are diagnosed with these conditions, there is an increased demand for vision correction products. Cataracts are the second-largest contributor to market share, with a growing elderly population requiring cataract surgery and intraocular lenses. The rise in diabetic retinopathy cases is also influencing the demand for specialized treatments and medications.

Indonesia Vision Care Market Competitive Landscape

The Indonesian Vision Care market is dominated by a few key players, including both local and international brands. Major global companies like Essilor International, Hoya Corporation, and Johnson & Johnson Vision lead the market due to their extensive product portfolios and robust distribution networks. Local players also have a significant presence, particularly in providing affordable eye care solutions. The market is highly competitive, with these players constantly innovating to offer better eye care products and services. E-commerce platforms, like Tokopedia and Bukalapak, are further increasing market competition by providing convenient access to vision care products, especially in smaller cities and rural areas.

Indonesia Vision Care Market Analysis

Market Growth Drivers:

- Increasing Prevalence of Refractive Errors: Indonesia has witnessed a significant rise in refractive errors, with an estimated 45 million people affected by visual impairments due to refractive errors as of 2022. This increase can be attributed to factors like increased screen time, urbanization, and lifestyle changes. According to the World Health Organization (WHO), refractive errors are among the leading causes of visual impairment in Southeast Asia, including Indonesia, contributing to a growing demand for corrective eyewear and vision care products. Indonesias vision care sector is further supported by the government's focus on improving access to eye health services.

- Aging Population: Indonesia's population is experiencing rapid aging, with the number of people aged 60 years or older reaching approximately 25.5 million in 2022, a figure expected to grow steadily in the coming years. This demographic shift contributes to the rising demand for vision care products, particularly for age-related conditions such as presbyopia and cataracts. As the aging population becomes more susceptible to eye-related issues, the demand for corrective solutions, such as reading glasses and surgical treatments, is expected to rise sharply. This shift provides a robust opportunity for growth in the vision care market.

- Rising Awareness of Eye Health: Indonesias government and various NGOs have been actively promoting eye health awareness. The Indonesian Ministry of Health, through initiatives such as the "Gerakan Indonesia Cinta Mata" (Movement for Indonesia Loves Eyes), aims to reduce preventable blindness and visual impairment. Reports show that more Indonesians are seeking eye care services, with nearly 10 million visits recorded in 2022 alone. This rising awareness has directly contributed to a more informed consumer base, propelling the demand for various vision care products, including glasses and eye care solutions.

Market Challenges:

- High Cost of Advanced Vision Care Solutions: Advanced vision care products and treatments remain unaffordable for a significant portion of Indonesias population. The high cost of specialized eyewear, laser surgeries, and advanced diagnostic equipment limits access to quality eye care, particularly in rural and underserved regions. Data from the Indonesian Ministry of Health in 2022 suggests that a large portion of the rural population lacks access to affordable advanced eye care. The economic disparity in access to such products and services presents a significant barrier to the broader adoption of high-end vision care solutions.

- Regulatory Hurdles in Product Approvals: The regulatory environment in Indonesia for vision care products is complex, with stringent approval processes for new products. The Indonesian Food and Drug Authority (BPOM) requires a detailed submission process for any new medical devices or pharmaceuticals, including those in the vision care category. In 2022, BPOM processed over 1,000 product registrations, with approval times averaging 6-12 months. This lengthy and cumbersome process creates delays in bringing new, innovative products to market, posing a challenge for companies looking to expand their offerings.

Indonesia Vision Care Market Future Outlook

Over the next few years, the Indonesian Vision Care market is expected to show continued growth driven by a combination of technological advancements, a growing elderly population, and increasing awareness of eye health. As the middle class expands, there is greater spending on corrective and preventive eye care, including optometric consultations and advanced surgical solutions. Furthermore, as digital health and telemedicine solutions expand, new opportunities will emerge in the field of remote eye care diagnostics and treatment, adding a new layer of growth for this market.

Market Opportunities:

- Government Initiatives for Eye Health Programs: The Indonesian government has recognized the importance of eye health, with several initiatives focused on improving access to eye care services. In 2022, the government allocated $12 million for the "Gerakan Indonesia Cinta Mata" program, which aims to provide free eye care services and raise awareness about preventable blindness. Additionally, partnerships with international organizations have expanded the reach of these initiatives, offering further opportunities for growth in the vision care market.

- Collaborations with International Organizations: Indonesia has forged partnerships with international organizations like the World Health Organization (WHO) and the International Agency for the Prevention of Blindness (IAPB) to strengthen its eye care programs. In 2022, Indonesia received funding from WHO to improve the infrastructure and capacity of eye health services across the nation, particularly in rural and underserved areas. These collaborations are expected to enhance the markets growth, providing more resources and support for eye care initiatives.

Scope of the Report

|

By Product Type |

Eyeglasses Contact Lenses Intraocular Lenses Ophthalmic Drugs Vision Care Services |

|

By Application |

Refractive Errors Cataract Glaucoma Age-Related Macular Degeneration Diabetic Retinopathy |

|

By End-User |

Hospitals Optical Stores Online Retailers Eye Clinics Ambulatory Surgical Centers |

|

By Distribution Channel |

Offline Online |

|

By Region |

North-East Midwest West Coast Southern States |

Products

Key Target Audience

Investments and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., Ministry of Health of Indonesia, National Eye Health Program)

Optical Retail Chains

Private Health Insurers

Ophthalmic Product Manufacturers

Ophthalmologists and Optometrists

E-commerce Platforms (e.g., Tokopedia, Bukalapak)

Public Health Agencies

Companies

Players Mention in the Report

Essilor International

Hoya Corporation

Johnson & Johnson Vision

The Cooper Companies

Bausch & Lomb

Alcon Laboratories

Topcon Corporation

Carl Zeiss AG

Menicon Co., Ltd.

Rayner Surgical Group Limited

Rodenstock GmbH

Safilo Group S.p.A.

Seiko Optical Products Co., Ltd.

Shanghai Conant Optical Co., Ltd.

Nidek Co., Ltd.

Table of Contents

01. Indonesia Vision Care Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

02. Indonesia Vision Care Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

03. Indonesia Vision Care Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Prevalence of Refractive Errors

3.1.2. Aging Population

3.1.3. Rising Awareness of Eye Health

3.1.4. Technological Advancements in Vision Care Products

3.2. Market Challenges

3.2.1. High Cost of Advanced Vision Care Solutions

3.2.2. Limited Access to Eye Care Services in Rural Areas

3.2.3. Regulatory Hurdles in Product Approvals

3.3. Opportunities

3.3.1. Expansion of E-commerce Platforms for Vision Care Products

3.3.2. Government Initiatives for Eye Health Programs

3.3.3. Collaborations with International Organizations

3.4. Trends

3.4.1. Growth in Online Sales Channels

3.4.2. Adoption of Smart Eyewear

3.4.3. Integration of Artificial Intelligence in Eye Care Diagnostics

3.5. Government Regulation

3.5.1. National Eye Health Policies

3.5.2. Import and Export Regulations for Vision Care Products

3.5.3. Standards for Vision Care Services

3.5.4. Public Health Campaigns on Eye Health Awareness

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competitive Landscape

04. Indonesia Vision Care Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Eyeglasses

4.1.1.1. Prescription Eyeglasses

4.1.1.2. Fashion Eyewear

4.1.2. Contact Lenses

4.1.2.1. Soft Contact Lenses

4.1.2.2. Rigid Gas Permeable Lenses

4.1.3. Intraocular Lenses

4.1.3.1. Monofocal Lenses

4.1.3.2. Multifocal Lenses

4.1.4. Ophthalmic Drugs

4.1.4.1. Anti-Glaucoma Drugs

4.1.4.2. Anti-VEGF Drugs

4.1.5. Vision Care Services

4.1.5.1. Eye Examinations

4.1.5.2. Surgical Procedures

4.2. By Application (In Value %)

4.2.1. Refractive Errors

4.2.1.1. Myopia

4.2.1.2. Hyperopia

4.2.2. Cataract

4.2.3. Glaucoma

4.2.4. Age-Related Macular Degeneration

4.2.5. Diabetic Retinopathy

4.3. By End-User (In Value %)

4.3.1. Hospitals

4.3.2. Optical Stores

4.3.3. Online Retailers

4.3.4. Eye Clinics

4.3.5. Ambulatory Surgical Centers

4.4. By Distribution Channel (In Value %)

4.4.1. Offline

4.4.1.1. Retail Stores

4.4.1.2. Hospitals and Clinics

4.4.2. Online

4.4.2.1. E-commerce Platforms

4.4.2.2. Online Pharmacies

4.5. By Region (In Value %)

4.5.1. Java

4.5.2. Sumatra

4.5.3. Kalimantan

4.5.4. Sulawesi

4.5.5. Papua

05. Indonesia Vision Care Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Essilor International

5.1.2. Johnson & Johnson Vision

5.1.3. Hoya Corporation

5.1.4. The Cooper Companies

5.1.5. Novartis AG

5.1.6. Bausch & Lomb

5.1.7. Alcon Laboratories

5.1.8. Carl Zeiss AG

5.1.9. Topcon Corporation

5.1.10. Menicon Co., Ltd.

5.1.11. Rayner Surgical Group Limited

5.1.12. Rodenstock GmbH

5.1.13. Safilo Group S.p.A.

5.1.14. Seiko Optical Products Co., Ltd.

5.1.15. Shanghai Conant Optical Co., Ltd.

5.2. Cross Comparison Parameters

5.2.1. Market Share

5.2.2. Product Portfolio

5.2.3. Distribution Network

5.2.4. Financial Performance

5.2.5. Strategic Initiatives

5.2.6. Technological Advancements

5.2.7. Regulatory Compliance

5.2.8. Customer Satisfaction

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

06. Major Players

6.1. Essilor International

6.2. Johnson & Johnson Vision

6.3. Hoya Corporation

6.4. The Cooper Companies

6.5. Novartis AG

6.6. Bausch & Lomb

6.7. Alcon Laboratories

6.8. Carl Zeiss AG

6.9. Topcon Corporation

6.10. Menicon Co., Ltd.

6.11. Rayner Surgical Group Limited

6.12. Rodenstock GmbH

6.13. Safilo Group S.p.A.

6.14. Seiko Optical Products Co., Ltd.

6.15. Shanghai Conant Optical Co., Ltd.

07. Key Target Audience

7.1. Investments and Venture Capitalist Firms

7.2. Government and Regulatory Bodies (Ministry of Health of Indonesia, National Eye Health Program)

7.3. Optical Retail Chains

7.4. Private Health Insurers

7.5. Ophthalmic Product Manufacturers

7.6. Ophthalmologists and Optometrists

7.7. E-commerce Platforms (Tokopedia, Bukalapak)

7.8. Public Health Agencies

08. Research Methodology

8.1. Identification of Key Variables

8.2. Market Analysis and Construction

8.3. Hypothesis Validation and Expert Consultation

8.4. Research Synthesis and Final Output

09. Frequently Asked Questions

9.1. How big is the Indonesia Vision Care Market?

9.2. What are the key challenges in the Indonesia Vision Care Market?

9.3. Who are the major players in the Indonesia Vision Care Market?

9.4. What are the growth drivers in the Indonesia Vision Care Market?

9.5. What are the future prospects for the Indonesia Vision Care Market?

Research Methodology

Step 1: Identification of Key Variables

This phase involves mapping the entire ecosystem of the Indonesia Vision Care market, including stakeholders such as product manufacturers, healthcare providers, and consumers. Desk research is performed using secondary databases and industry reports to identify the key drivers and variables influencing market dynamics.

Step 2: Market Analysis and Construction

In this stage, historical data is compiled to assess the markets growth trajectory, including product demand, market penetration, and regional disparities. By examining previous market conditions and current trends, we estimate the revenue potential for each product category and segment.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are tested and validated through interviews with industry experts, including ophthalmologists, optometrists, and senior executives from vision care product companies. These consultations provide real-time operational insights, which are incorporated to refine market data.

Step 4: Research Synthesis and Final Output

Final research synthesis involves directly engaging with leading manufacturers and service providers to gain insights into market trends, consumer preferences, and future growth prospects. This phase serves to verify and validate all data, ensuring the final report reflects accurate, real-time market conditions.

Frequently Asked Questions

01. How big is the Indonesia Vision Care Market?

The Indonesia Vision Care Market was valued at USD 397.25 million, driven by increasing awareness about eye health, the rise in refractive errors, and an aging population.

02. What are the key challenges in the Indonesia Vision Care Market?

Challenges in the market include limited access to affordable eye care services in rural areas, high costs of advanced eyewear and surgeries, and the need for better regulatory frameworks for new technologies.

03. Who are the major players in the Indonesia Vision Care Market?

Key players include Essilor International, Hoya Corporation, Johnson & Johnson Vision, Bausch & Lomb, and The Cooper Companies. These companies lead due to their innovative products, strong market presence, and extensive distribution networks.

04. What are the growth drivers in the Indonesia Vision Care Market?

Key growth drivers include a rising awareness of eye health, an expanding middle class, and technological advancements in vision correction products such as smart eyewear and advanced contact lenses.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.