Indonesia Warehousing Market Outlook to 2028

Region:Asia

Author(s):Kartik and Rajat

Product Code:KR1441

September 2024

81

About the Report

Indonesia Warehousing Market Overview

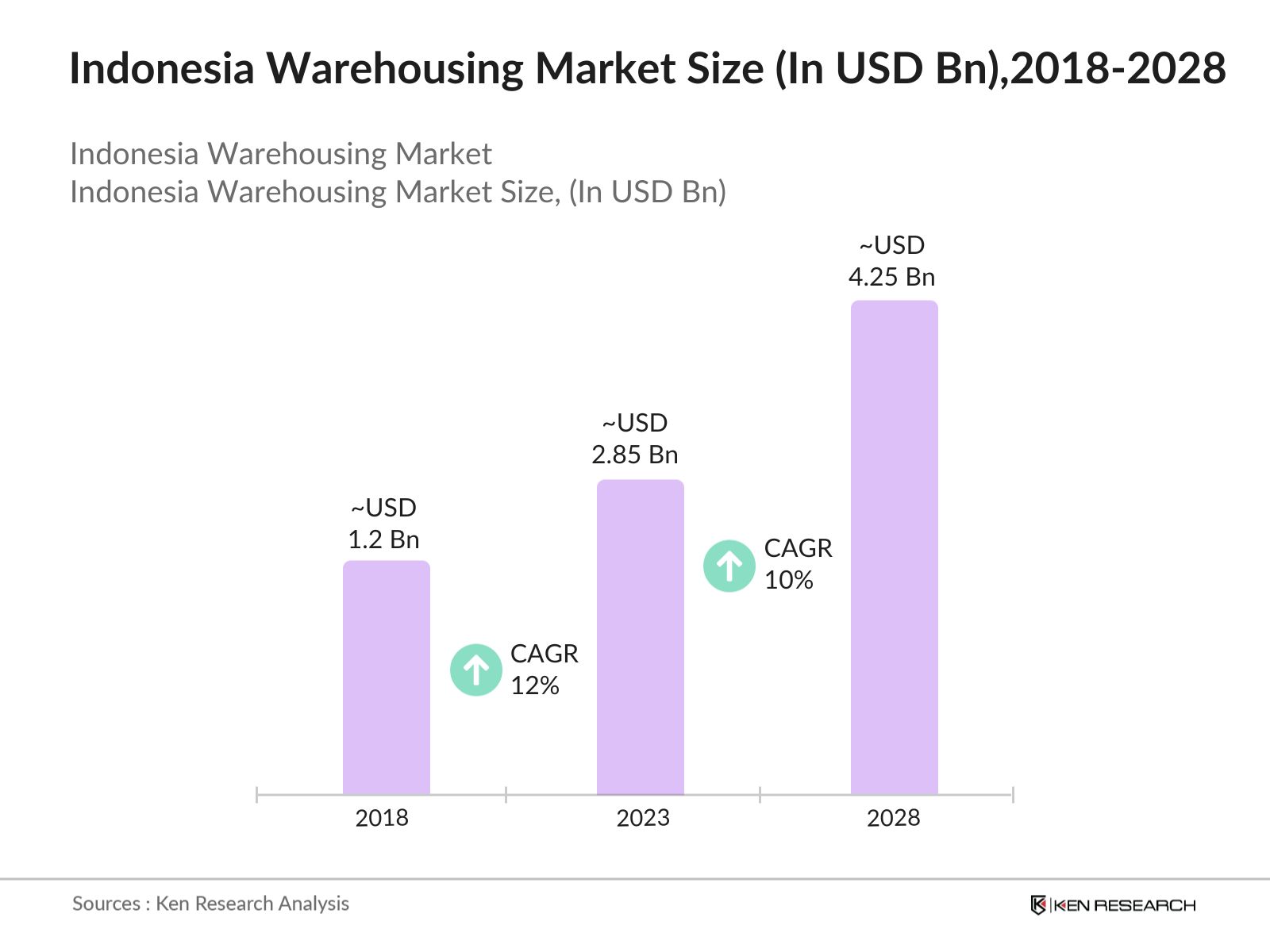

- The Indonesia warehousing market was valued at USD 2.85 billion in 2023. This growth is primarily fueled by the rising demand for efficient storage and distribution services, particularly in urban areas where consumption rates are highest. The logistics sector's expansion, supported by improvements in infrastructure and government initiatives, has also played a crucial role in driving market growth.

- Several key players dominate the Indonesia warehousing market, including LOGOS, DHL Supply Chain, Cainiao Network, PT Mega Manunggal Property (MMP), and BGR Logistik. These companies are prominent due to their extensive networks, advanced technology integration, and strategic partnerships that enable them to meet the growing demand for warehousing services.

- In September 2022, Yogyakarta began developing a warehouse zone in Kulonprogo Regency with an investment of IDR 274.06 billion. The project boasts an internal rate of return (IRR) of 12.64%, with a net present value (NPV) of IDR 76.6 billion and a payback period of 13.6 years, reflecting its significant potential in boosting local logistics capacity.

- Java dominates the Indonesian warehousing market because of the population density and access to trade some of the major ports and routes. This facilitates efficient distribution and logistics for both domestic and international markets. Additionally, Java's dense population and industrial base create high demand for warehousing services, particularly in major cities like Jakarta and Surabaya, enhancing its market dominance.

Indonesia Warehousing Market Segmentation

By Business Model: The Indonesia warehousing market is segmented by business model into industrial freight, ICDs/CFS, Cold Storage, Custom Warehouse, Others. Industrial Freight dominates the market in 2023, due to high demand for retail goods and perishables, driven by e-commerce growth and the need for efficient supply chains in Indonesia's expanding market.

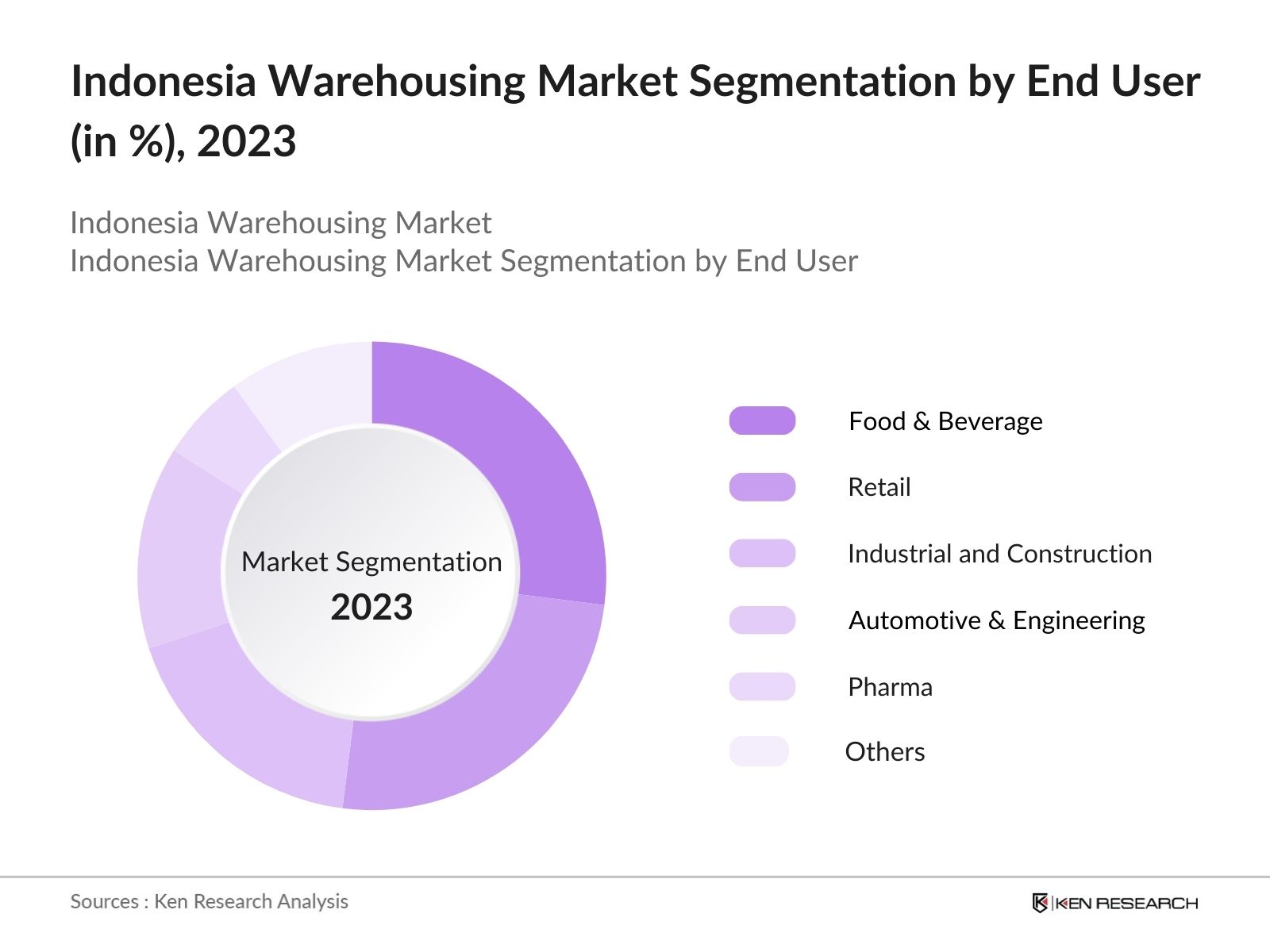

By End-User: The indonesia warehousing market is segmented by end user into food and beverage, retail, industrial & construction, automotive & engineering, pharma and others. The Food & Beverage sector leads due to the constant demand for fresh and packaged food products, requiring extensive storage facilities. Additionally, the growing e-commerce industry boosts the retail segment, enhancing its share in the market.

By Region: The Indonesia Warehousing market is segmented by Region into Java, Sumatra, Kalimantan, Sulawesi, Riau Islands and Others. Java dominates the Indonesian warehousing market due to its central location, which provides strategic access to major trade routes and ports. This facilitates efficient distribution and logistics for both domestic and international markets. Java's dense population and industrial base create high demand for warehousing services.

Indonesia Warehousing Market Competitive Landscape

|

Company |

Headquarter |

Establishment Year |

|

Mega Manunggal Property |

Jakarta, Indonesia |

2010 |

|

Genesis |

Jakarta, Indonesia |

2016 |

|

Logos |

Jakarta, Indonesia |

2015 |

|

Linc Group |

Jakarta, Indonesia |

2001 |

- Mega Manunggal Property (MMP): In 2023, the company succeeded in obtaining ISO 9001 and 14001 certifications and completed the Pondok Ungu Extension project, covering an area of 5,616 sqm. In the same year, through its subsidiary PT Mega Tridaya Properti, MMP acquired a 45% share in PT Mega Khatulistiwa Properti (MKP) for IDR 1.7 trillion.

- LOGOS: Astra, Hongkong Land, and LOGOS establish a joint venture to manage and develop modern logistics warehouses. They also partnered with IFC to develop Green Logistics Hub, which will deliver modern and high-quality logistics warehousing in Indonesias rapidly growing e-commerce market.

Indonesia Warehousing Industry Analysis

Indonesia Warehousing Market Growth Drivers

- Multi-Storey Warehouse Development: In Indonesia, especially in densely populated areas like Greater Jakarta, the trend of multi-storey warehouses is gaining momentum due to land scarcity and high costs. By 2023, 2% of modern warehouses were multi-storey, and this number is expected to rise to 56% in 2024. By 2025, 8 out of 19 new logistics projects in Greater Jakarta will be multi-storey warehouses, significantly increasing storage capacity.

- Booming Food and Beverage Industry: Indonesia's Food and Beverage (F&B) industry continues to grow, driven by a population of 275.7 million and a rising middle class. By the end of 2023, the Ministry of Industry plans to enable at least 80 F&B business owners to receive competency certificates, preparing them for Indonesia 4.0. This growth creates a significant demand for warehouse space, particularly in Jakarta, where several large FMCG warehouse facilities are being developed.

- Growing Presence of SMEs and E-Commerce: Indonesia is home to over 62 million SMEs, with the e-commerce market projected to reach USD 44.8 billion in 2023. The rapid expansion of e-commerce is driving the demand for reliable warehousing solutions. The e-commerce market is expected to grow at a CAGR of 10.4%, reaching USD 66.7 billion by 2027, highlighting the need for enhanced warehousing capabilities.

Indonesia Warehousing Market Challenges:

- Warehouse Space and Efficiency: The current inefficiency in warehouse utilization is a significant challenge in Indonesia. Typically, only 10%-20% of the total building capacity is used, leading to underutilized spaces. As demand for warehousing increases, especially in densely populated and expensive regions like Greater Jakarta, overcoming these inefficiencies becomes crucial for meeting market needs.

- High Cost and Limited Availability of Land: In regions like Greater Jakarta, where land is limited and expensive, developing new warehouse facilities is becoming increasingly challenging. This situation pushes companies to innovate, such as adopting multi-storey warehouses to maximize the use of available land. However, the high cost and limited availability of land remain a significant barrier to expanding warehouse infrastructure in these key regions.

Indonesia Warehousing Market Government Initiatives:

- Regulatory Framework on Bonded Logistic Centers: The introduction of Bonded Logistic Centers in 2015 aimed to enhance the manufacturing sector and improve logistics efficiency in Indonesia. Entrepreneurs managing Bonded Storage Places are required to use a computer-based information system to record goods' entry and release. This regulation established a new type of storage facility, the Bonded Logistic Center.

- Provision for Customs Warehouses to Self-Govern: In 2020, the Indonesian customs authority granted 119 of the 1,372 bonded warehouses in the country the right to self-govern under the Kawasan Berikat Mandiri initiative. According to the Indonesian Customs Roadmap, 500 self-administered customs warehouses are expected to operate by 2022, with no physical checks required.

Indonesia Warehousing Market Future Outlook

The Indonesia warehousing market is poised for further growth, with expectations to reach approximately USD 4.25 billion by 2028, driven by continued e-commerce expansion, foreign direct investments, and advancements in logistics technology. The market is expected to diversify with increased participation from international players and the adoption of smart warehousing solutions.

Future Market Trends

- Adoption of Smart Warehousing Technologies: The future of the Indonesia warehousing market will see increased adoption of smart technologies such as AI-driven warehouse management systems, IoT-enabled tracking, and automation. These innovations will improve efficiency, reduce operational costs, and enhance inventory accuracy, making warehousing operations more streamlined and responsive to market demands.

- Growth of Regional Warehousing Hubs: As Indonesia's infrastructure continues to improve, there will be a shift towards the development of regional warehousing hubs outside of Jakarta. Regions like Surabaya and Medan are expected to become key logistics centers, driven by strategic investments in transportation networks and the decentralization of industrial activities across the country.

Scope of the Report

|

By Business Model |

Industrial Freight ICDs/CFS Cold Storage Custom Warehouse Others |

|

By Storage Type |

Bonded Non-Bonded |

|

By End User |

Food And Beverage Retail Industrial & Construction Automotive Engineering Pharma Others |

|

By Supply Area |

Grade A Grade B Grade C |

|

By Region |

Java Sumatra Kalimantan Sulawesi Riau Islands Others |

Products

Key Target Audience:

E-commerce Companies

Manufacturing Companies

Automotive Companies

Healthcare Companies

Ministry of Transportation

Real Estate Developers

Logistics Companies

Investors and VC Firms

Infrastructure Development Firms

Transportation Companies

Cold Chain Service Providers

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report:

Kamadjaja Logistics

Cipta Krida Bahari

Mega Manung

Samudera Indonesia Tbk

Linc Group

Puninar Logistics

Indra Jaya Swastika (IJS)

Agility Logistics

United Tractors Pandu Engineering

DHL Supply Chain Indonesia

Schenker Petrolog Utama

Nippon Express Indonesia

Table of Contents

1. Indonesia Warehousing Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. Indonesia Warehousing Market Size (In USD Bn), 2018-2023

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. Indonesia Warehousing Market Analysis

3.1 Growth Drivers

3.2 Market Challenges

3.3 Opportunities

3.4 Trends

3.5 Government Regulations

3.6 Swot Analysis

3.7 Stakeholder Ecosystem

3.8 Porter’s Five Forces

3.9 Competition Ecosystem

4. Indonesia Warehousing Market Segmentation (In Value %), 2023

4.1 By Business Model

4.2 By Storage Type

4.3 By End User

4.4 By Supply Area

4.5 By Region

5. Indonesia Warehousing Market Competitive Analysis

5.1 Detailed Profiles of Major Competitors

5.2 Cross Comparison Parameters (Market Share, Product Portfolio, Regional Presence, R&D Investment, Production Capacity, Distribution Network, Brand Recognition, Strategic Partnerships)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. Indonesia Warehousing Market Regulatory Framework

6.1 Environmental Standards

6.2 Compliance Requirements

6.3 Certification Processes

7. Indonesia Warehousing Market Future Size (In USD Bn), 2023-2028

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. Indonesia Warehousing Market Future Segmentation (In Value %), 2028

8.1 By Business Model

8.2 By Storage Type

8.3 By End User

8.4 By Supply Area

8.5 By Region

9. Indonesia Warehousing Market Analyst’s Recommendations

9.1 Tam/Sam/Som Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Market Hypothesis Development Using AI-Based Data Extraction

The research team initially developed a market hypothesis by analyzing the number of warehouses in the country using an AI-based extraction database. The data on the number of warehouses were then segmented based on various market dynamics, including their average sizes and types. This segmentation allowed for a detailed computation of the overall market supply.

Step 2: In-Depth Stakeholder Interviews and Proprietary Data Collection

To gain deeper insights into the warehousing market supply in Indonesia, the research team conducted extensive interviews with key stakeholders within the industry. These stakeholders included Heads of Operations, Centre Managers, and Branch Supervisors from various companies. With these interviews, the team utilized internal research conducted by major warehousing companies operating in Indonesia. This internal research offered proprietary insights and data that were not publicly available, enriching the overall understanding of the market.

Step 3: Validation of Market Supply with Secondary Sources

The market size, in terms of supply, was validated through a thorough sanity check using multiple secondary sources. These sources provided detailed information on the size and capacity of warehouses in specific regions or of particular types. This cross-referencing with secondary data ensured the accuracy and reliability of our findings. The secondary sources included industry reports, market analysis publications, government databases, and academic studies, which helped in corroborating the initial hypothesis and provided a comprehensive view of the market supply landscape in Indonesia.

Step 4: Revenue Estimation Through Weighted Average Occupancy and Rental Pricing

The total supply was then multiplied by the average occupancy rate and rental price to determine the warehousing revenue. The rental price and occupancy was computed by taking the weighted average of different types of warehouses available in the country. By assigning appropriate weights to each warehouse type based on their market share, occupancy rate and price, a more accurate and representative average rental price and occupancy rate was obtained. For instance, cold storage facilities, which constitute less than 10% of the overall market, have a rental price that is three times higher than that of general warehouses.

Frequently Asked Questions

01 How big is Indonesia Warehousing Market?

The Indonesia warehousing market was valued at USD 2.85 billion in 2023. This growth is primarily fueled by the rising demand for efficient storage and distribution services, particularly in urban areas where consumption rates are highest. The logistics sector's expansion, supported by improvements in infrastructure and government initiatives, has also played a crucial role in driving market growth.

02 What are the growth drivers of the Indonesia Warehousing Market?

Key growth drivers include the rapid expansion of e-commerce, government initiatives to enhance infrastructure, and the increasing need for organized and modern warehousing solutions. In 2023, e-commerce sales accounted for over 25% of total retail sales, significantly boosting demand for warehousing space.

03 What are challenges faced by Indonesia Warehousing Market?

Challenges include high operational costs, land scarcity in urban areas, and the rising cost of land, particularly in key cities like Jakarta. In 2023, land prices in Jakarta increased by 15%, making it difficult for companies to expand warehousing facilities. Additionally, there is a shortage of skilled labor and high costs associated with implementing advanced technologies.

04 Who are the major players in the Indonesia Warehousing Market?

Major players include Kamadjaja Logistics, Cipta Krida Bahari, Mega Manunggal Property, Samudera Indonesia Tbk, and Linc Group. These companies dominate the market through their extensive networks, modern facilities, and comprehensive logistics services, catering to diverse industries across Indonesia.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.