Indonesia Wealth Management Market Outlook to 2030

Region:Asia

Author(s):Shubham Kashyap

Product Code:KROD1966

June 2025

90

About the Report

Indonesia Wealth Management Market Overview

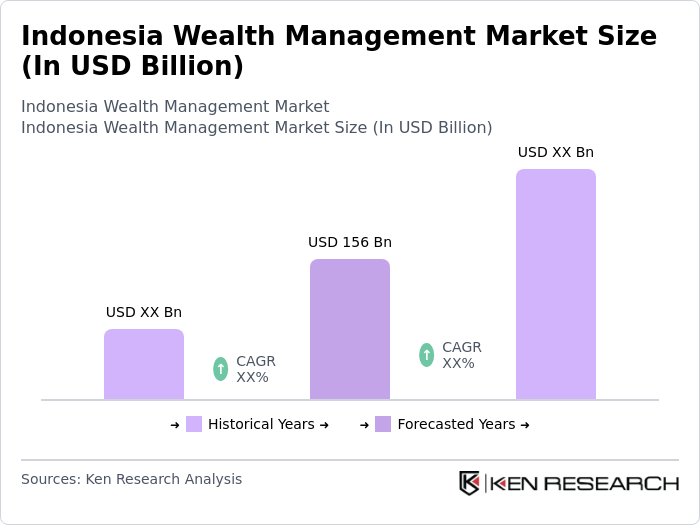

- The Indonesia Wealth Management Market was valued at USD 156 billion, based on a five-year historical analysis. This growth is primarily driven by rising disposable incomes, increasing financial literacy, and a growing middle class that seeks investment opportunities. The market is also supported by the expansion of digital financial services, which have made wealth management more accessible to a broader audience.

- Key cities dominating the market include Jakarta, Surabaya, and Bandung. Jakarta, as the capital and economic hub, attracts significant investments and hosts numerous financial institutions. Surabaya and Bandung are also emerging as important centers due to their growing populations and increasing economic activities, which contribute to the demand for wealth management services.

- In 2023, the Indonesian government implemented a new regulation aimed at enhancing the transparency and accountability of wealth management firms. This regulation mandates that all wealth management companies must adhere to strict reporting standards and conduct regular audits to ensure compliance with financial regulations, thereby protecting investors and promoting trust in the financial system.

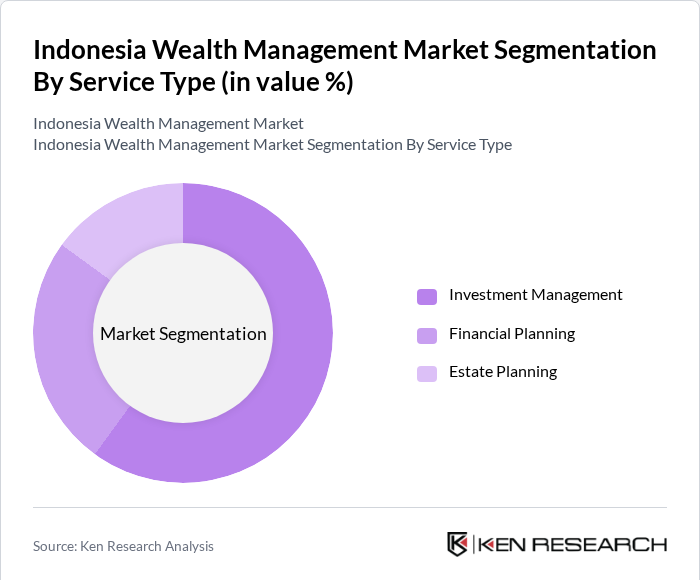

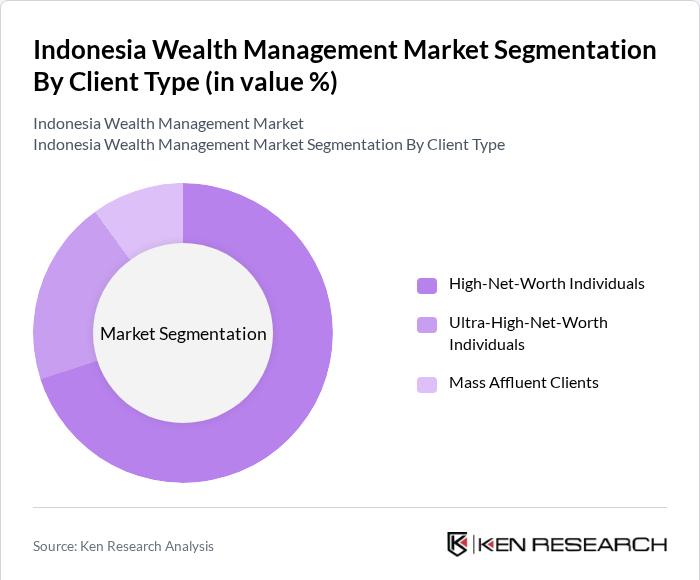

Indonesia Wealth Management Market Segmentation

By Service Type: The wealth management market is segmented into investment management, financial planning, and estate planning. Among these, investment management is the dominant sub-segment, driven by the increasing interest in diverse investment options such as mutual funds, stocks, and bonds. Investors are becoming more sophisticated, seeking tailored investment strategies that align with their financial goals. The rise of digital platforms has also facilitated easier access to investment management services, further propelling its growth.

By Client Type: The market is segmented into high-net-worth individuals (HNWIs), ultra-high-net-worth individuals (UHNWIs), and mass affluent clients. The high-net-worth individuals segment is the most significant, as it encompasses a large portion of the wealth in Indonesia. HNWIs are increasingly seeking personalized wealth management services to preserve and grow their assets. This segment is characterized by a strong demand for bespoke investment strategies and comprehensive financial planning, which are essential for managing substantial portfolios.

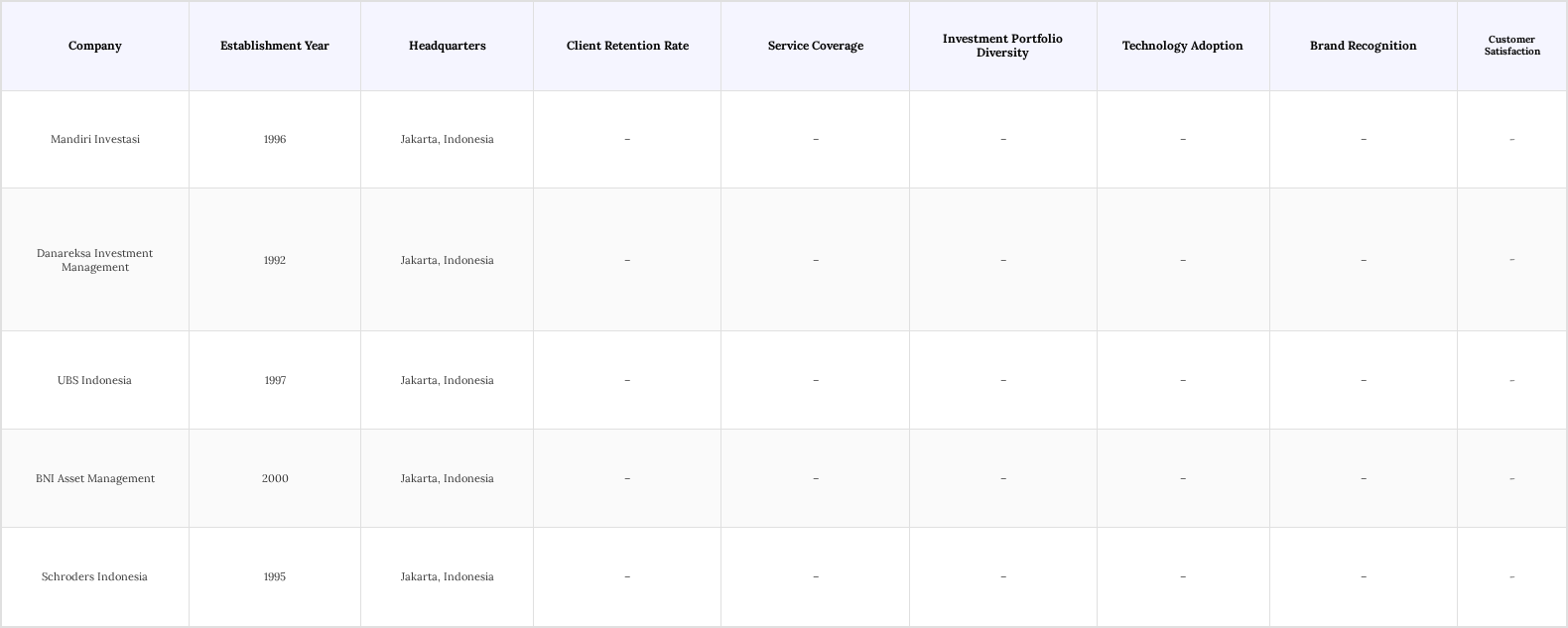

Indonesia Wealth Management Market Competitive Landscape

The Indonesia Wealth Management Market is characterized by a competitive landscape with several key players, including Mandiri Investasi, Danareksa Investment Management, and UBS Indonesia. These companies are known for their comprehensive service offerings and strong brand recognition. The market is moderately concentrated, with a mix of local and international firms competing for market share through innovative financial products and personalized services.

Indonesia Wealth Management Market Industry Analysis

Growth Drivers

- Increasing Affluence of the High-Net-Worth Segment: The rise of the affluent segment in Indonesia is a significant driver of the wealth management market. As of 2024, approximately 1.5% of Indonesia's population, or around 1.8 million people, belong to the affluent segment, with an average annual income of USD 4,000. This demographic shift is expected to lead to an increase in disposable income, which is projected to grow by 7% annually. Consequently, more individuals are seeking wealth management services to optimize their financial portfolios. The World Bank has noted that the affluent segment's consumption patterns are shifting towards financial products, with a 15% increase in demand for investment services over the past year.

- Expansion of Digital Wealth Management Solutions: The digital transformation in Indonesia is reshaping the wealth management landscape. In 2024, internet penetration is estimated at around 79.5%, with mobile penetration exceeding 120%, reflecting widespread connectivity. This accessibility has driven strong growth in digital wealth management platforms, with user adoption increasing significantly year-on-year. Companies like Mandiri Investasi and Danareksa are leveraging technology to offer online investment platforms tailored to tech-savvy younger investors. The Financial Services Authority of Indonesia (OJK) reported that digital investment platforms attracted over USD 10.5 billion in assets under management in the past year, highlighting the rapid expansion and growing importance of digital solutions in Indonesia’s wealth management sector.

- Rising Demand for Financial Literacy and Advisory Services: The growing awareness of the importance of financial literacy is driving demand for advisory services in Indonesia. In 2024, surveys indicate that 65% of Indonesians recognize the need for financial planning, a significant increase from 50% in 2020. This shift is attributed to various government initiatives aimed at promoting financial education, which have reached over 10 million individuals through workshops and online courses. As a result, the demand for professional financial advisory services has surged, with a reported 25% increase in clients seeking personalized financial planning.

Market Challenges

- Regulatory Compliance and Changes: The wealth management industry in Indonesia faces significant challenges related to regulatory compliance. In 2024, the OJK has introduced new regulations aimed at enhancing consumer protection and transparency in financial services. While these regulations are essential for safeguarding investors, they also impose additional compliance costs on wealth management firms. For instance, firms are now required to allocate up to 5% of their operational budget to meet compliance standards, which can strain smaller companies.

- Economic Volatility and Market Fluctuations: Indonesia's economy is susceptible to various external factors, including global economic conditions and commodity price fluctuations. In 2024, the Indonesian economy is projected to grow at a rate of 5.0%, but uncertainties such as inflation rates, which are expected to hover around 4.5%, can impact investor confidence. Market volatility can lead to fluctuations in asset values, affecting the performance of investment portfolios managed by wealth management firms.

Indonesia Wealth Management Market Future Outlook

The future of the Indonesia wealth management market appears promising, driven by technological advancements and a growing emphasis on personalized services. As digital platforms continue to evolve, wealth management firms are expected to enhance their offerings, catering to the diverse needs of clients. The increasing focus on sustainable investing will also shape the market landscape, encouraging firms to adopt responsible investment strategies.

Market Opportunities

- Growth of Sustainable and Impact Investing: The rising awareness of environmental, social, and governance (ESG) factors is creating significant opportunities in the wealth management sector. In 2025, it is estimated that sustainable investment assets in Indonesia will reach USD 335 million, reflecting a growing trend among investors who prioritize ethical considerations in their investment decisions. Wealth management firms that incorporate sustainable investment options into their portfolios can attract a new segment of socially conscious investors.

- Technological Advancements in Financial Services: The rapid advancement of technology presents a unique opportunity for wealth management firms in Indonesia. In 2024, the adoption of fintech solutions is expected to increase, with majority of wealth management firms planning to invest in technology to enhance their service delivery. Innovations such as robo-advisors and AI-driven investment platforms are becoming more prevalent, allowing firms to offer personalized investment strategies at a lower cost.

Scope of the Report

| By Service Type |

Investment Management Financial Planning Estate Planning |

| By Client Type |

High-Net-Worth Individuals (HNWIs) Ultra-High-Net-Worth Individuals (UHNWIs) Mass Affluent Clients |

| By Distribution Channel |

Direct Sales Online Platforms Financial Advisors |

| By Geographic Region |

Java Bali Sumatra Kalimantan |

| By Investment Type |

Mutual Funds Stocks Bonds Real Estate |

Products

Key Target Audience

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., OJK - Financial Services Authority of Indonesia)

Private Wealth Management Firms

Family Offices

Insurance Companies

Pension Funds

Investment Banks

Financial Technology (FinTech) Companies

Companies

Players Mentioned in the Report:

Mandiri Investasi

Danareksa Investment Management

UBS Indonesia

BNI Asset Management

Schroders Indonesia

Nusantara Wealth Advisors

Archipelago Capital Management

Merah Putih Asset Strategies

Cendana Financial Group

Sinar Investasi Indonesia

Table of Contents

### Table of Contents

1. Indonesia Wealth Management Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Indonesia Wealth Management Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Indonesia Wealth Management Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Affluence of the Middle Class

3.1.2. Rising Demand for Financial Literacy and Advisory Services

3.1.3. Expansion of Digital Wealth Management Solutions

3.2. Market Challenges

3.2.1. Regulatory Compliance and Changes

3.2.2. Economic Volatility and Market Fluctuations

3.2.3. Competition from Non-Traditional Financial Institutions

3.3. Opportunities

3.3.1. Growth of Sustainable and Impact Investing

3.3.2. Technological Advancements in Financial Services

3.3.3. Increasing Interest in Alternative Investment Products

3.4. Trends

3.4.1. Shift Towards Personalized Wealth Management Services

3.4.2. Integration of Artificial Intelligence in Investment Strategies

3.4.3. Growing Popularity of Robo-Advisors

3.5. Government Regulation

3.5.1. Overview of Financial Regulatory Bodies

3.5.2. Key Regulations Impacting Wealth Management

3.5.3. Taxation Policies Affecting Wealth Management Services

3.5.4. Consumer Protection Laws in Financial Services

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porter’s Five Forces

3.9. Competition Ecosystem

4. Indonesia Wealth Management Market Segmentation

4.1. By Service Type

4.1.1. Investment Management

4.1.2. Financial Planning

4.1.3. Estate Planning

4.2. By Client Type

4.2.1. High-Net-Worth Individuals (HNWIs)

4.2.2. Ultra-High-Net-Worth Individuals (UHNWIs)

4.2.3. Mass Affluent Clients

4.3. By Distribution Channel

4.3.1. Direct Sales

4.3.2. Online Platforms

4.3.3. Financial Advisors

4.4. By Geographic Region

4.4.1. Java

4.4.2. Bali

4.4.3. Sumatra

4.4.4. Kalimantan

4.5. By Investment Type

4.5.1. Mutual Funds

4.5.2. Stocks

4.5.3. Bonds

4.5.4. Real Estate

5. Indonesia Wealth Management Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Mandiri Investasi

5.1.2. Danareksa Investment Management

5.1.3. UBS Indonesia

5.1.4. BNI Asset Management

5.1.5. Schroders Indonesia

5.1.6. Nusantara Wealth Advisors

5.1.7. Archipelago Capital Management

5.1.8. Merah Putih Asset Strategies

5.1.9. Cendana Financial Group

5.1.10. Sinar Investasi Indonesia

5.2. Cross Comparison Parameters

5.2.1. Market Share of Key Players

5.2.2. Customer Satisfaction Ratings

5.2.3. Service Offerings Diversity

5.2.4. Digital Presence and Engagement

5.2.5. Fee Structures and Pricing Models

5.2.6. Investment Performance Metrics

5.2.7. Regulatory Compliance Track Record

5.2.8. Innovation and Technology Adoption

6. Indonesia Wealth Management Market Regulatory Framework

6.1. Environmental Standards

6.2. Compliance Requirements

6.3. Certification Processes

7. Indonesia Wealth Management Market Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Indonesia Wealth Management Market Future Market Segmentation

8.1. By Service Type

8.1.1. Investment Management

8.1.2. Financial Planning

8.1.3. Estate Planning

8.2. By Client Type

8.2.1. High-Net-Worth Individuals (HNWIs)

8.2.2. Ultra-High-Net-Worth Individuals (UHNWIs)

8.2.3. Mass Affluent Clients

8.3. By Distribution Channel

8.3.1. Direct Sales

8.3.2. Online Platforms

8.3.3. Financial Advisors

8.4. By Geographic Region

8.4.1. Java

8.4.2. Bali

8.4.3. Sumatra

8.4.4. Kalimantan

8.5. By Investment Type

8.5.1. Mutual Funds

8.5.2. Stocks

8.5.3. Bonds

8.5.4. Real Estate

9. Indonesia Wealth Management Market Analysts’ Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping the ecosystem of the Indonesia Wealth Management Market, identifying key stakeholders such as financial institutions, regulatory bodies, and consumers. This step relies on extensive desk research, utilizing secondary data sources and proprietary databases to gather relevant industry information. The primary goal is to pinpoint and define the critical variables that drive market dynamics.

Step 2: Market Analysis and Construction

In this phase, we will compile and analyze historical and current data related to the Indonesia Wealth Management Market. This includes evaluating market size, growth trends, and the competitive landscape. Additionally, we will assess service quality metrics to ensure the reliability of revenue estimates and market forecasts.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be formulated and validated through structured interviews with industry experts and stakeholders. These consultations will encompass a range of perspectives from financial advisors to regulatory authorities, providing critical insights that will help refine the market data and validate assumptions made during the analysis.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing the collected data and insights into a cohesive report. This will include direct engagement with key market players to gather detailed information on product offerings, consumer behavior, and market challenges. The synthesis will ensure a comprehensive and validated analysis of the Indonesia Wealth Management Market, ready for dissemination to stakeholders.

Frequently Asked Questions

01. How big is the Indonesia Wealth Management Market?

The Indonesia Wealth Management Market is valued at USD 156 billion, driven by factors such as increasing demand, technological advancements, and supportive government initiatives.

02. What are the key challenges in the Indonesia Wealth Management Market?

Key challenges in the Indonesia Wealth Management Market include intense competition, regulatory complexities, and infrastructure limitations affecting market dynamics.

03. Who are the major players in the Indonesia Wealth Management Market?

Major players in the Indonesia Wealth Management Market include Mandiri Investasi, Danareksa Investment Management, UBS Indonesia, BNI Asset Management, Schroders Indonesia, among others.

04. What are the growth drivers for the Indonesia Wealth Management Market?

The primary growth drivers for the Indonesia Wealth Management Market are increasing consumer demand, favorable policies, innovation, and substantial investment inflows.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.