Indonesia Wind Energy Market Outlook to 2030

Region:Asia

Author(s):Vijay Kumar

Product Code:KROD3607

October 2024

89

About the Report

Indonesia Wind Energy Market Overview

- The Indonesia Wind Energy market is valued at USD 400 million, based on a five-year historical analysis. This market is primarily driven by the governments commitment to increasing the share of renewable energy in its energy mix and the growing demand for sustainable energy sources in remote and rural areas. The governments policies, such as the National Energy Policy (KEN), are focused on reducing greenhouse gas emissions and promoting energy diversification, which has significantly contributed to the growth of wind energy projects in the country

- Java and Sumatra are the dominant regions in the Indonesia wind energy market, owing to favorable wind conditions and established infrastructure for energy projects. Java, being the most populous island, demands a substantial portion of the energy produced in Indonesia, making it a prime location for wind energy projects. Sumatra, with its large land area and coastal regions, offers extensive opportunities for both onshore and offshore wind projects, making these regions central to the markets development.

- Indonesia has simplified its licensing and environmental compliance regulations to encourage investment in renewable energy. These regulatory reforms include the establishment of a one-stop service for permit applications and reduced approval times for project proposals. In 2024, the average licensing period for renewable energy projects was reduced by 20%, enabling faster project development and reducing administrative costs for investors.

Indonesia Wind Energy Market Segmentation

By Location of Deployment: The market is segmented by location into onshore and offshore installations. Onshore wind energy projects currently dominate the market, driven by their relatively lower capital expenditure (CAPEX) compared to offshore projects. The established infrastructure in regions like Java and Sumatra supports onshore developments, with major projects such as the Sidrap Wind Farm in South Sulawesi becoming benchmarks in this segment.

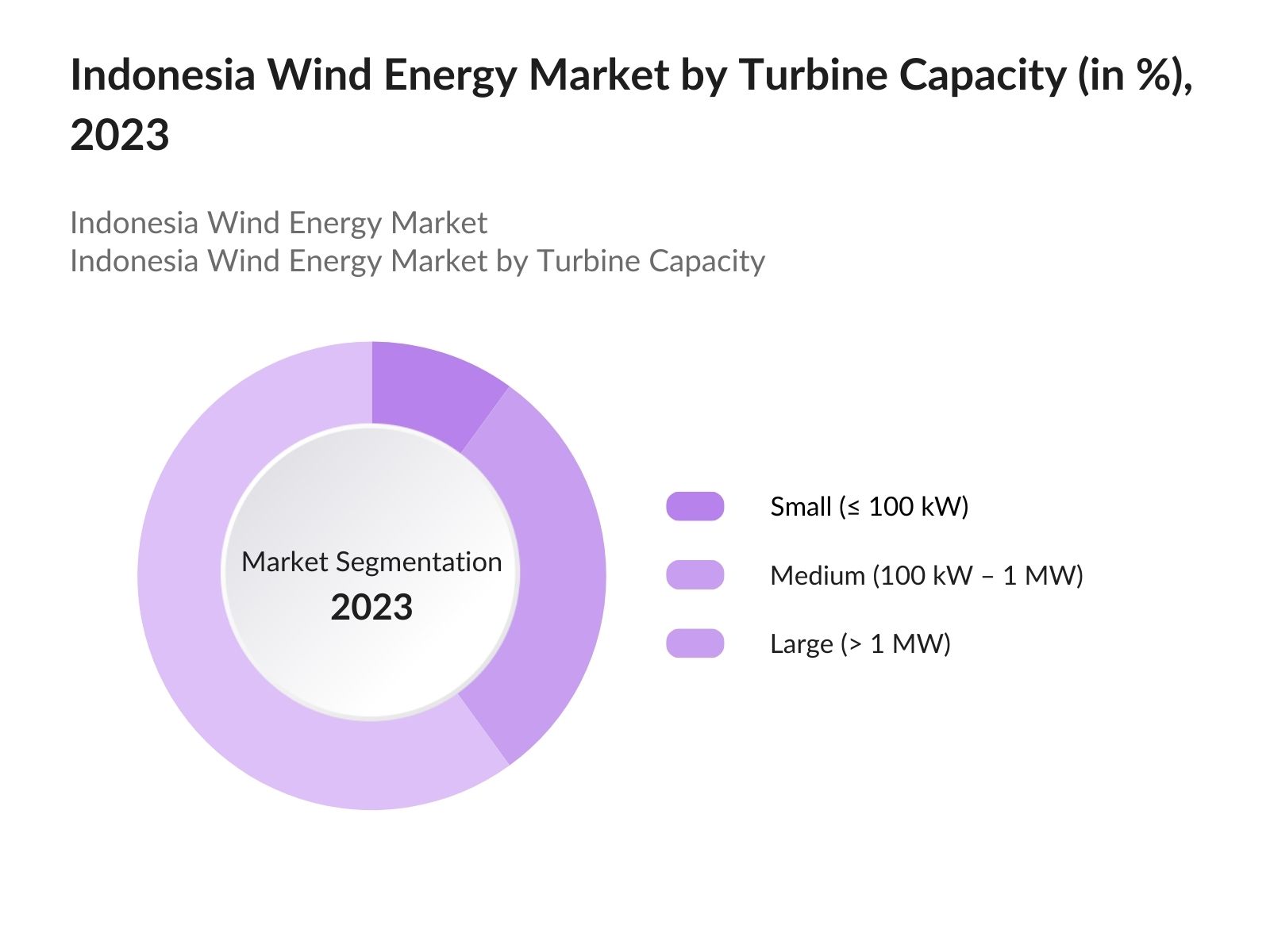

By Turbine Capacity: The market is also segmented based on turbine capacity, which includes small ( 100 kW), medium (100 kW 1 MW), and large (> 1 MW) turbines. Large capacity turbines dominate the market due to their higher energy output and efficiency, making them ideal for utility-scale projects. The adoption of large turbines has been driven by projects in regions with high wind speeds, such as South Sulawesi and parts of Sumatra. The increasing availability of financing options for large-scale projects further enhances this segments position.

Indonesia Wind Energy Market Competitive Landscape

The Indonesia wind energy market is dominated by a few key players that contribute significantly to its growth and development. The presence of both international and local companies indicates a competitive market landscape. The competitive landscape is characterized by collaborations and joint ventures between local players and international giants. The recent focus on advanced wind turbine technologies, such as larger rotor diameters and energy storage integration, is making key players more competitive.

Indonesia Wind Energy Industry Analysis

Growth Drivers

- Increase in Power Demand in Remote and Island Regions: Indonesias unique geography, comprising over 17,500 islands, creates a growing demand for reliable power supply, especially in remote and island regions. These areas often experience power shortages due to limited grid connectivity. The deployment of wind energy in such regions is a feasible solution. The government has identified these areas as critical targets for renewable energy projects. In 2024, approximately 30% of Indonesias population, particularly in these remote regions, experienced limited access to reliable electricity, making small and mid-sized wind projects highly viable.

- Decrease in Cost of Wind Turbines (CAPEX and OPEX Analysis): The decreasing capital expenditure (CAPEX) and operating expenditure (OPEX) for wind turbines has made wind energy more competitive in Indonesia. Over the past decade, the global cost of wind turbines has dropped by nearly 40%, with similar trends being observed in Southeast Asia. In 2024, the cost of installing wind energy systems in Indonesia was approximately $1,200 per kW, significantly lower than traditional fossil fuel plants.

- International Investment and Partnerships: Indonesia has seen an increase in foreign direct investment in the renewable energy sector, particularly from countries like Denmark, Germany, and South Korea. These investments have facilitated technology transfer, better financing options, and new project developments. For instance, in 2023, Indonesia secured a $380 million loan from the World Bank for its first pumped storage hydropower plant, which is expected to complement wind energy projects by providing additional capacity during peak demand times.

Market Challenges

- Complex Land Acquisition and Permitting Processes: The land acquisition and permitting process for renewable energy projects in Indonesia is time-consuming and complex, often taking several years to complete. This challenge is exacerbated by regulatory overlaps between central and regional authorities. In 2024, over 50% of planned wind projects were delayed due to unresolved land issues, highlighting the need for streamlined processes and better interagency coordination.

- High Initial Capital Costs: Although the cost of wind turbines has been decreasing, the initial capital costs for large-scale wind energy projects remain high, especially compared to other renewable sources like solar. In 2024, a large-scale wind project in Indonesia required an upfront investment of approximately $200 million, making it less accessible for smaller developers. The high initial capital cost often limits the involvement of local companies and investors.

Indonesia Wind Energy Market Future Outlook

Over the next five years, the Indonesia wind energy market is expected to grow significantly, driven by the governments ambitious renewable energy targets and technological advancements in wind turbine efficiency. The introduction of floating wind turbines, coupled with increased investments from both public and private sectors, is anticipated to further expand the market. The Indonesian governments efforts to decentralize energy production and ensure energy security in remote regions will also play a crucial role in driving growth.

Market Opportunities

- Offshore Wind Project Potential: Indonesia has significant potential for offshore wind energy development, particularly in regions like the Java Sea and the Sulawesi Sea, where wind speeds are optimal for power generation. Preliminary studies have indicated that the potential offshore wind capacity could exceed 60 GW, with the current installed wind capacity being less than 0.1 GW. The government is currently exploring partnerships with international developers to harness this potential and initiate pilot projects.

- Technological Innovations in Wind Energy (Blade Designs, Storage Integration): Advancements in wind blade design and energy storage solutions are opening new possibilities for wind energy projects in Indonesia. Newer blade technologies, designed to withstand harsh weather conditions and improve efficiency, have been introduced. Additionally, integrating wind energy with battery storage can help manage the intermittency issue, making wind a more stable power source. In 2024, Indonesia allocated $100 million to R&D for renewable energy technologies, focusing on wind and solar energy.

Scope of the Report

|

By Location |

Onshore Offshore |

|

By Application |

Utility-Scale Projects Community-Based Wind Projects Hybrid Systems |

|

By Turbine Capacity |

Small ( 100 kW), Medium (100 kW 1 MW) Large (> 1 MW) |

|

By Component |

Turbines Towers Blades Nacelles |

|

By Region |

Java Sumatra Sulawesi Kalimantan Papua |

Products

Key Target Audience

Government and Regulatory Bodies (e.g., Indonesian Ministry of Energy and Mineral Resources)

Energy Producers and Utility Companies

Equipment Manufacturers and Suppliers

Project Developers and EPC Contractors

Investments and Venture Capitalist Firms

Renewable Energy Associations (e.g., Indonesian Wind Energy Association)

Environmental and Sustainability Consultants

International Development Agencies

Companies

Players Mentioned in the Report

Vestas Wind Systems A/S

Siemens Gamesa Renewable Energy SA

General Electric Company

Nordex SE

Suzlon Energy Limited

Goldwind

PT Pertamina Geothermal Energy

PT Perusahaan Listrik Negara (PLN)

Canadian Solar Inc.

BCPG Public Company Limited

Table of Contents

1. Indonesia Wind Energy Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Indonesia Wind Energy Market Size (In USD Billion)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Indonesia Wind Energy Market Analysis

3.1. Growth Drivers

3.1.1. Government Initiatives and Renewable Energy Targets

3.1.2. Increase in Power Demand in Remote and Island Regions

3.1.3. Decrease in Cost of Wind Turbines (CAPEX and OPEX Analysis)

3.1.4. International Investment and Partnerships

3.2. Market Challenges

3.2.1. Complex Land Acquisition and Permitting Processes

3.2.2. High Initial Capital Costs

3.2.3. Dependence on Import of Wind Turbine Components

3.2.4. Grid Connectivity and Transmission Issues

3.3. Opportunities

3.3.1. Offshore Wind Project Potential

3.3.2. Technological Innovations in Wind Energy (Blade Designs, Storage Integration)

3.3.3. Development of Hybrid Systems (Wind-Solar or Wind-Biomass)

3.4. Trends

3.4.1. Hybrid Renewable Energy Projects

3.4.2. Floating Wind Turbine Projects

3.4.3. Rise in Corporate Power Purchase Agreements (PPAs)

3.5. Government Regulations

3.5.1. Indonesia's National Energy Policy (KEN)

3.5.2. Feed-In Tariff Policies for Renewable Energy

3.5.3. Licensing and Environmental Compliance Regulations

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porter’s Five Forces Analysis

3.9. Competitive Ecosystem Analysis

4. Indonesia Wind Energy Market Segmentation

4.1. By Location

4.1.1. Onshore

4.1.2. Offshore

4.2. By Application

4.2.1. Utility-Scale Projects

4.2.2. Community-Based Wind Projects

4.2.3. Hybrid Systems

4.3. By Turbine Capacity

4.3.1. Small (≤ 100 kW)

4.3.2. Medium (100 kW – 1 MW)

4.3.3. Large (> 1 MW)

4.4. By Component

4.4.1. Turbines

4.4.2. Towers

4.4.3. Blades

4.4.4. Nacelles

4.5. By Region

4.5.1. Java

4.5.2. Sumatra

4.5.3. Sulawesi

4.5.4. Kalimantan

4.5.5. Papua

5. Indonesia Wind Energy Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Vestas Wind Systems A/S

5.1.2. Siemens Gamesa Renewable Energy SA

5.1.3. General Electric Company

5.1.4. Nordex SE

5.1.5. Suzlon Energy Limited

5.1.6. Goldwind

5.1.7. PT Pertamina Geothermal Energy

5.1.8. PT Perusahaan Listrik Negara (PLN)

5.1.9. Canadian Solar Inc.

5.1.10. BCPG Public Company Limited

5.1.11. Sindicatum Renewable Energy Company Pte Ltd

5.1.12. PT PP Persero Tbk

5.1.13. Acciona Energia SA

5.1.14. Orsted A/S

5.1.15. EDF SA

5.2. Cross Comparison Parameters

5.2.1. Installed Capacity

5.2.2. Number of Projects

5.2.3. Revenue

5.2.4. CAPEX and OPEX

5.2.5. Market Share (%)

5.2.6. Employees

5.2.7. Operational Regions

5.2.8. Technological Innovations

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Indonesia Wind Energy Market Regulatory Framework

6.1. Environmental Standards

6.2. Compliance Requirements

6.3. Certification Processes

7. Indonesia Wind Energy Future Market Size (In USD Billion)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Indonesia Wind Energy Future Market Segmentation

8.1. By Location

8.2. By Application

8.3. By Capacity

8.4. By Component

8.5. By Region

9. Indonesia Wind Energy Market Analysts’ Recommendations

9.1. Total Addressable Market (TAM)/Serviceable Available Market (SAM)/Serviceable Obtainable Market (SOM) Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

This initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Indonesia Wind Energy Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the Indonesia Wind Energy Market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics is conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and subsequently validated through computer-assisted telephone interviews (CATIS) with industry experts representing a diverse array of companies. These consultations provide valuable operational and financial insights directly from industry practitioners, which are instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple wind energy companies to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction serves to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the Indonesia Wind Energy Market.

Frequently Asked Questions

01. How big is Indonesia Wind Energy Market?

The Indonesia Wind Energy market is valued at USD 400 million, based on a five-year historical analysis. This market is primarily driven by the governments commitment to increasing the share of renewable energy in its energy mix and the growing demand for sustainable energy sources in remote and rural areas.

02. What are the challenges in Indonesia Wind Energy Market?

Challenges include complex land acquisition processes, high initial capital costs, and dependence on imported wind turbine components, which affect project feasibility and implementation.

03. Who are the major players in the Indonesia Wind Energy Market?

Key players in the market include Vestas Wind Systems A/S, Siemens Gamesa Renewable Energy SA, General Electric Company, PT Pertamina Geothermal Energy, and PT Perusahaan Listrik Negara (PLN).

04. What are the growth drivers of Indonesia Wind Energy Market?

The market is propelled by government incentives, technological advancements, and increasing demand for renewable energy in remote and rural regions of Indonesia.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.