Iran Automotive Market Outlook to 2029

Region:Middle East

Author(s):Rebecca Mary Reji

Product Code:KR1505

June 2025

90

About the Report

Iran Automotive Market Overview

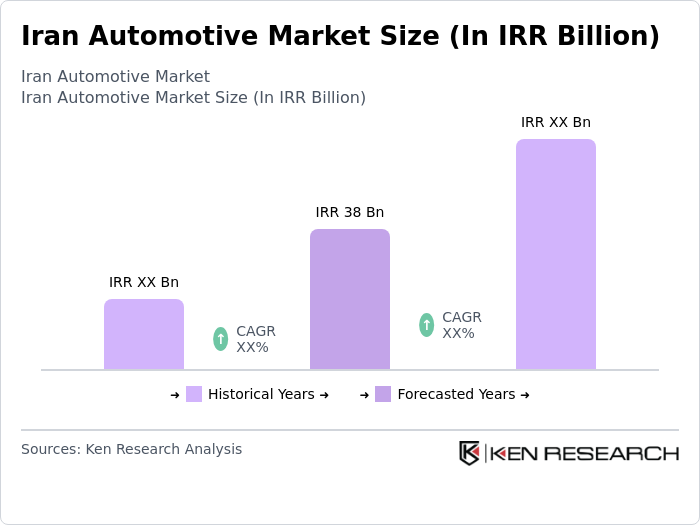

- The Iran Automotive Market is currently valued at IRR 38 billion, reflecting steady growth driven by strong domestic demand, government support for local manufacturing, and a rising middle class. The sector faces fluctuations from economic sanctions and currency instability, but ongoing demand for personal and commercial vehicles supports expansion. The automotive industry remains vital to Iran’s economy, accounting for about 10% of GDP and providing direct and indirect employment to around 700,000 people, or roughly 4% of the national workforce.

- Tehran, Isfahan, and Tabriz are primary hubs for Iran’s automotive market, benefiting from advanced industrial infrastructure and high population density. Tehran, as the capital, is the central node for automotive manufacturing and sales, hosting major companies like Iran Khodro and Saipa. Isfahan and Tabriz serve as key production centers, with Tabriz hosting a large auto parts cluster of over 450 firms. The concentration of manufacturers and suppliers in these cities strengthens their leadership in the market.

- The Iranian government has enacted policies to strengthen domestic manufacturing and reduce reliance on imports. Key regulations encourage joint ventures between foreign automakers and local firms to promote technology transfer and support local production. These initiatives aim to boost domestic industry competitiveness, generate employment, and foster technological advancement within the sector. While joint ventures are strongly promoted, they are not always strictly mandated but remain a preferred approach for foreign investment and collaboration.

Iran Automotive Market Segmentation

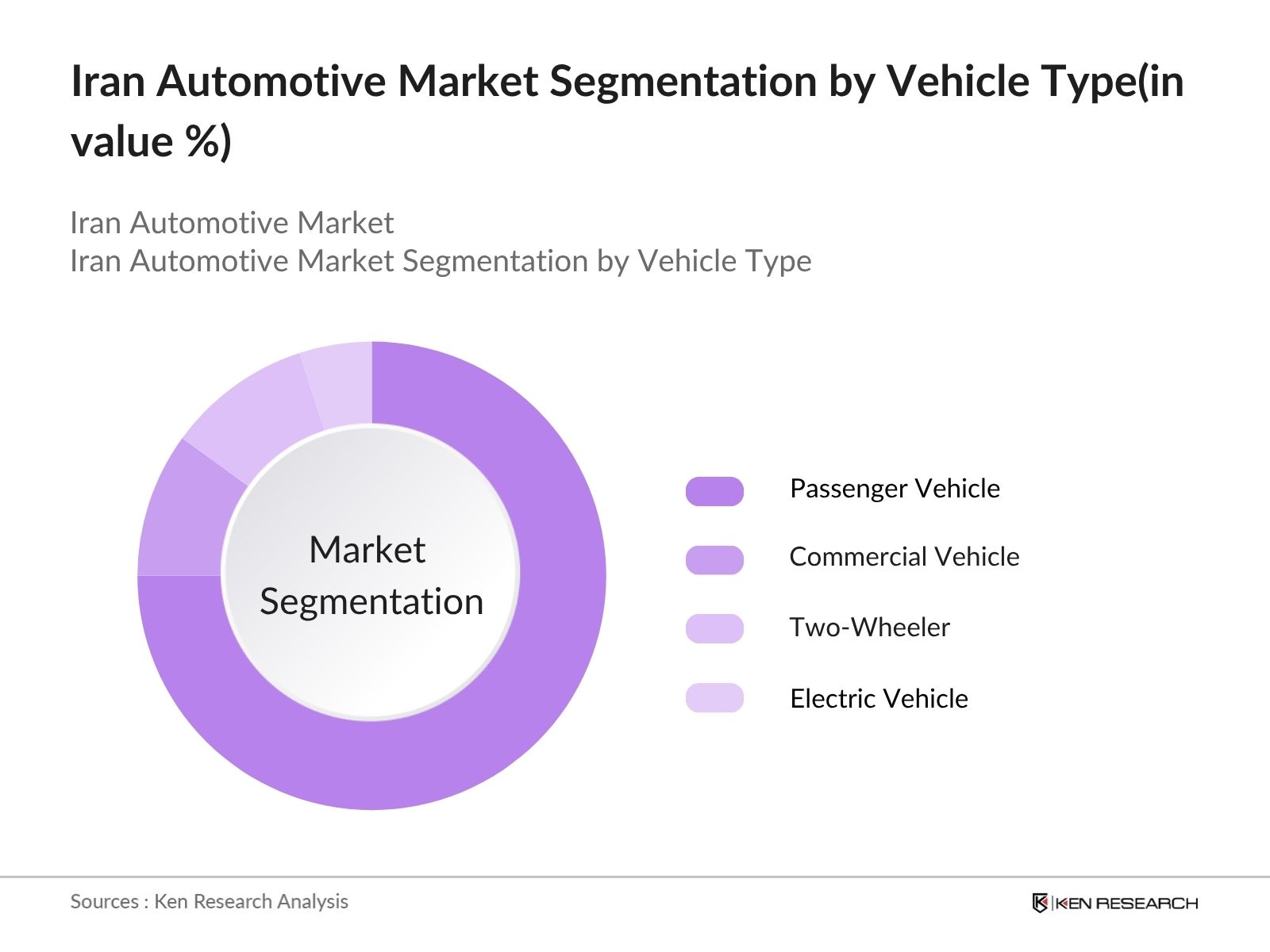

By Vehicle Type: The Iranian automotive market is segmented into passenger vehicles, commercial vehicles, two-wheelers, and electric vehicles. Passenger vehicles dominate the market, fueled by urbanization, rising disposable income, and demand for personal transport. Commercial vehicles play a critical role in trade and logistics, especially in industrial zones. Two-wheelers are favored in congested cities due to their low cost and maneuverability. Electric vehicles, though nascent, are witnessing early adoption amid growing environmental awareness and supportive government policies.

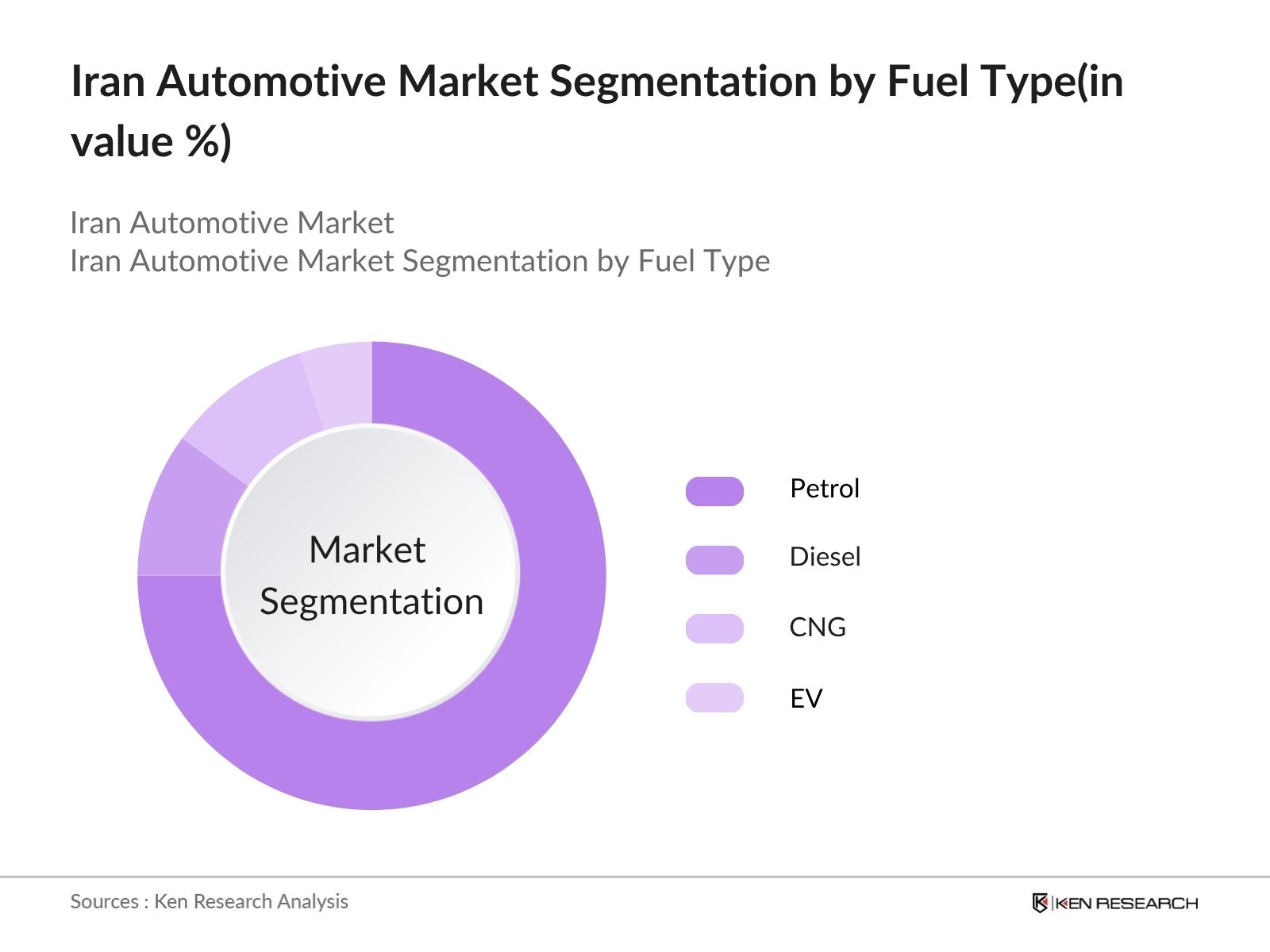

By Fuel Type: The market is segmented by fuel type into petrol, diesel, CNG, and electric vehicles (EVs). Petrol-powered vehicles lead the market due to their affordability and wide availability. Diesel vehicles are preferred for heavy-duty and commercial use owing to superior mileage. CNG vehicles are gaining traction in urban areas for being cost-effective and cleaner. EV adoption is rising gradually, supported by sustainability trends and government incentives, though limited charging infrastructure remains a challenge.

Iran Automotive Market Competitive Landscape

The Iran Automotive Market features a mix of established domestic players, with Iran Khodro, Saipa, Bahman Group, Zamyad, and Kerman Motor leading local operations. The competitive landscape is influenced by government policies, shifting consumer demand, and economic volatility. Key manufacturers are focused on expanding capacity, modernizing platforms, and introducing new models to meet changing market dynamics.

Iran Automotive Market Industry Analysis

Growth Drivers

- Increasing Urbanization and Population Growth: Iran's urban population is projected to reach 85% by 2024, up from 73% in 2020, according to the World Bank. This urbanization trend drives demand for personal and commercial vehicles, as urban residents typically require more transportation options. Additionally, the population is expected to grow to approximately 88 million by 2024, further increasing the need for vehicles. This demographic shift is a significant growth driver for the automotive market in Iran.

- Rising Disposable Income and Consumer Spending: The average disposable income in Iran is projected to increase over $5,000 per capita by 2024, representing a 15% rise from 2021 levels. As disposable income grows, consumer spending on automobiles is expected to increase, with more individuals able to afford new vehicles. This trend is supported by a growing middle class, which is projected to comprise 50% of the population by 2024, further stimulating demand in the automotive sector.

- Government Initiatives to Boost Domestic Production: The Iranian government has implemented policies aimed at increasing domestic vehicle production, with a target of achieving a production capacity of approx 1.5 million vehicles annually by 2024. This includes incentives for local manufacturers and restrictions on imports to encourage local assembly. Such initiatives are expected to enhance the competitiveness of Iranian automotive brands, reduce reliance on imports, and ultimately drive market growth as domestic production meets local demand.

Market Challenges

- Customs Rejection of Non-Compliant Imports: Imported vehicles that do not meet local environmental and technical standards face barriers to market entry, including outright rejection or mandatory modifications. This increases the burden on importers and delays vehicle availability. The added cost and complexity of compliance discourage international partnerships and limit the diversity of vehicle offerings in the Iranian automotive market.

- Fuel Quality Compromising Vehicle Performance: Iran's inflation rate is significantly eroding consumer purchasing power. This high inflation leads to increased vehicle prices, making it difficult for average consumers to afford new cars. As a result, demand for vehicles may stagnate, particularly in the economy segment, posing a significant challenge to the automotive market's growth trajectory.

Iran Automotive Market Future Outlook

The outlook for Iran’s automotive market remains optimistic, supported by CKD-led localization, rising EV adoption, and growing demand in both passenger and commercial segments. Urban expansion and middle-class mobility needs will drive future consumption. Meanwhile, government incentives and clean transport mandates will accelerate technological progress. However, geopolitical risks and regulatory volatility may require agile supply strategies and targeted partnerships to maintain momentum and market resilience.

Market Opportunities

- CKD Assembly Opportunities in Sedans and Hatchbacks: Iran offers strong growth potential in CKD assembly of compact sedans and entry-level hatchbacks, especially EV and CNG-ready models. Lower tariffs on CKD imports with local content make this route cost-effective. In the medium term, the opportunity expands to SUVs and hybrid sedans, targeting the growing middle class and public-sector demand.

- Rising Demand for Commercial EVs and Urban Mobility Solutions: CKD assembly of pickups, light vans, and cargo carriers presents immediate potential, driven by last-mile delivery and government fleet upgrades. Over the next three years, demand for electric LCVs and CNG buses via public tenders is expected to rise, supported by clean mobility policies and urban transit modernization plans.

Scope of the Report

| By Vehicle Type |

Passenger Cars Commercial Vehicles Two-Wheeler Electric Vehicle |

| By Fuel Type |

Petrol Diesel CNG EV |

| By Model of Vehicle |

Hatchback Sedan SUV Commercial |

Products

Key Target Audience

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., Ministry of Industry, Mine and Trade; Iran Automotive Industry Association)

Manufacturers and Producers

Distributors and Retailers

Automotive Component Suppliers

Technology Providers

Industry Associations

Financial Institutions

Companies

Players Mentioned in the Report:

Iran Khodro

Saipa

Bahman Group

ZAMYAD

Kerman Motor

Modiran Vehicle Manufacturing

Pars Khodro

Rakhsh Khodro

BMW Iran

Peugeot Iran

Table of Contents

1. Iran Automotive Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Iran Automotive Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Iran Automotive Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Urbanization and Population Growth

3.1.2. Rising Disposable Income and Consumer Spending

3.1.3. Government Initiatives to Boost Domestic Production

3.2. Market Challenges

3.2.1. Economic Sanctions Impacting Supply Chains

3.2.2. High Inflation Rates Affecting Consumer Purchasing Power

3.2.3. Limited Access to International Markets and Technologies

3.3. Opportunities

3.3.1. Growth in Electric Vehicle Adoption

3.3.2. Expansion of Automotive Aftermarket Services

3.3.3. Potential for Foreign Investment and Joint Ventures

3.4. Trends

3.4.1. Shift Towards Sustainable and Eco-friendly Vehicles

3.4.2. Increasing Popularity of Ride-sharing Services

3.4.3. Advancements in Automotive Technology and Connectivity

3.5. Government Regulation

3.5.1. Emission Standards and Environmental Regulations

3.5.2. Import Tariffs and Local Manufacturing Incentives

3.5.3. Safety Standards and Compliance Requirements

3.5.4. Policies Supporting Research and Development in the Automotive Sector

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porter’s Five Forces

3.9. Competition Ecosystem

4. Iran Automotive Market Segmentation

4.1. By Vehicle Type

4.1.1. Passenger Vehicle

4.1.2. Commercial Vehicle

4.1.3. Two-Wheeler

4.1.4. Electric Vehicle

4.2. By Fuel Type

4.2.1. Petrol

4.2.2. Diesel

4.2.3. CNG

4.2.4. EV

4.3. By Model of Vehicle

4.3.1. Hatchback

4.3.2. Sedan

4.3.3. SUV

4.3.4. Commercial

5. Iran Automotive Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Iran Khodro

5.1.2. Saipa

5.1.3. Bahman Group

5.1.4. ZAMYAD

5.1.5. Kerman Motor

5.1.6. Modiran Vehicle Manufacturing

5.1.7. Pars Khodro

5.1.8. Rakhsh Khodro

5.1.9. BMW Iran

5.1.10. Peugeot Iran

5.2. Cross-Comparison Parameters

5.2.1. Market Share by Company

5.2.2. Revenue Growth Rate

5.2.3. Product Portfolio Diversity

5.2.4. Geographic Presence

5.2.5. Customer Satisfaction Ratings

5.2.6. Innovation and R&D Investment

5.2.7. Supply Chain Efficiency

5.2.8. Brand Recognition and Loyalty

6. Iran Automotive Market Regulatory Framework

6.1. Environmental Standards

6.2. Compliance Requirements

6.3. Certification Processes

7. Iran Automotive Market Future Market Size (In IRR Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Iran Automotive Market Future Market Segmentation

8.1. By Vehicle Type

8.1.1. Passenger Vehicle

8.1.2. Commercial Vehicle

8.1.3. Two-Wheeler

8.1.4. Electric Vehicle

8.2. By Fuel Type

8.2.1. Petrol

8.2.2. Diesel

8.2.3. CNG

8.2.4. EV

8.3. By Model of Vehicle

8.3.1. Hatchback

8.3.2. Sedan

8.3.3. SUV

8.3.4. Commercial

9. Iran Automotive Market Analysts’ Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping out the key players and stakeholders in the Iran Automotive Market. This step relies on extensive desk research, utilizing secondary data sources such as industry reports, government publications, and market studies to gather relevant information. The primary goal is to pinpoint and define the essential variables that drive market behavior and trends.

Step 2: Market Analysis and Construction

In this phase, we will gather and analyze historical and current data related to the Iran Automotive Market. This includes evaluating market size, growth rates, and segmentation by vehicle type and consumer demographics. Additionally, we will assess competitive dynamics and market share distribution to provide a comprehensive overview of the market landscape.

Step 3: Hypothesis Validation and Expert Consultation

We will formulate market hypotheses based on preliminary findings and validate them through structured interviews with industry experts and stakeholders. These consultations will include representatives from automotive manufacturers, suppliers, and regulatory bodies, providing critical insights that will help refine our understanding of market conditions and validate our assumptions.

Step 4: Research Synthesis and Final Output

The final phase will involve synthesizing all collected data and insights into a cohesive report. This will include detailed analysis of product segments, sales trends, and consumer behavior. The output will be designed to provide actionable recommendations and strategic insights for stakeholders looking to navigate the Iran Automotive Market effectively.

Frequently Asked Questions

01. How big is the Iran Automotive Market?

The Iran Automotive Market is valued at IRR 38 billion, driven by factors such as increasing demand, technological advancements, and supportive government initiatives.

02. What are the key challenges in the Iran Automotive Market?

Key challenges in the Iran Automotive Market include intense competition, regulatory complexities, and infrastructure limitations affecting market dynamics.

03. Who are the major players in the Iran Automotive Market?

Major players in the Iran Automotive Market include Iran Khodro, Saipa, Pars Khodro, BMW Iran, Peugeot Iran, among others.

04. What are the growth drivers for the Iran Automotive Market?

The primary growth drivers for the Iran Automotive Market are increasing consumer demand, favorable policies, innovation, and substantial investment inflows.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.